What is the Cough Assist Devices Market Size?

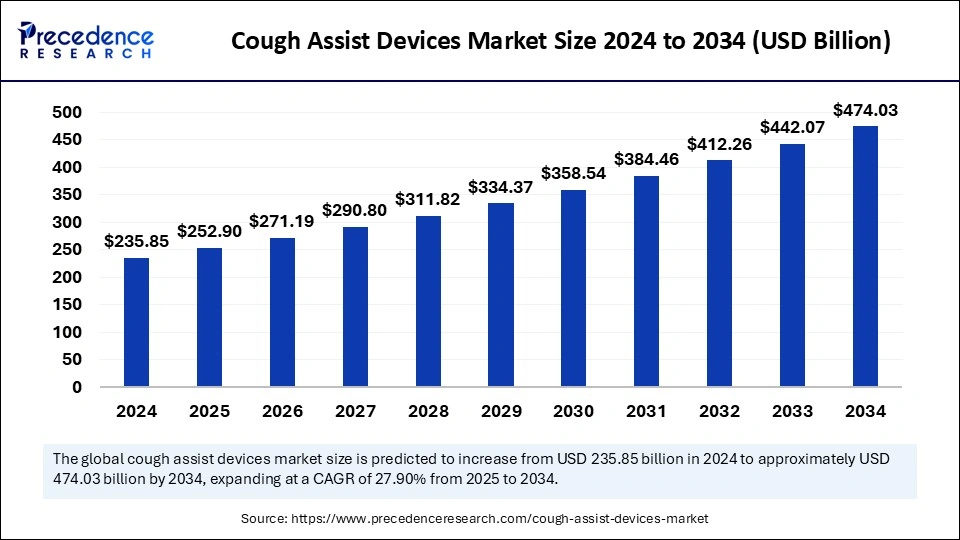

The global cough assist devices market size is calculated at USD 252.90 billion in 2025 and is predicted to increase from USD 271.19 billion in 2026 to approximately USD 74.03 billion by 2034, expanding at a CAGR of 7.23% from 2025 to 2034.

Cough Assist Devices Market Key Takeaways

- North America dominated the global cough assist devices market in 2024.

- Asia Pacific is expected to grow rapidly in the market during the forecast period.

- By product type, the automatic segment led the global market in 2024.

- By product type, the manual segment is anticipated to expand rapidly in the coming years.

- By choice of delivery, the mouthpiece segment contributed the highest market share in 2024.

- By choice of delivery, the face mask segment is expected to grow at the fastest CAGR throughout the forecast period.

- By end user, the hospital segment generated the major market share in 2024.

- By end user, the home care settings segment is expected to grow rapidly in the coming years.

Artificial Intelligence (AI) Contribution to the Cough Assist Devices Market

Artificial intelligence cough tools enable patients to become more aware of their health, and AI helps in cough sound detection and diagnosis. AI-based solutions help to identify characteristics of diseases and their symptoms through cough sounds. They can also identify several respiratory diseases by using cough sounds. AI helps in data analysis and the prediction of results. AI algorithms can identify several diseases, such as asthma, pulmonary edema, pneumonia, TB, etc.

Why Cough Assist Devices Are Becoming Essential in Respiratory Care?

The cough assist devices refer to the equipment used in hospitals and home care settings to give relief to people from respiratory or chest secretions. They are also known as mechanical insufflators or exsufflators, which provide positive airway pressure through a turbine. The air is provided through a mouthpiece and a close-fitting mask. The growing success of the cough assist devices market is driven by the increasing use of these devices among patients with spinal cord injuries or severe fatigue related to lung diseases. The reduced costs associated with hospital visits and increased patient comfort to access medical care in home-based settings accelerate the adoption of these devices in healthcare systems.

- In May 2024, the Global Allergy and Asthma Patient Platform (GAAPP) joined Esperity and announced the launch of its state-of-the-art portal to deliver patient care related to chronic cough and refractory chronic cough.

The Vest Advanced Pulmonary Experienced (APX) System, launched by Baxter International Inc., is potentially useful in supporting daily therapies for adults and children dealing with chronic lung disorders and retained secretions.

Market Outlook

- Market Growth Overview: The cough assist devices market is expanding rapidly, driven by the rising prevalence of neuromuscular and respiratory disorders that impair natural cough reflexes. Technological advancements, home care adoption, and increasing awareness of non-invasive respiratory support solutions are further boosting market growth. Partnerships between home-health agencies, durable medical equipment suppliers, and telehealth platforms are also likely to contribute to market growth.

- Investment Theme: Major investors in the market include medical device companies, healthcare-focused private equity firms, and venture capital investors specializing in respiratory care technologies. Their investments support R&D for innovative, user-friendly devices, expand manufacturing and distribution capabilities, and promote adoption in hospitals, clinics, and home care settings, accelerating overall market growth. Investors are targeting miniaturization and battery tech for portable devices, integrated sensor suites for therapy-adherence monitoring, AI-enabled therapy optimization, and software platforms that aggregate device data for clinical decision support.

- Global Expansion: The market is expanding worldwide due to the increasing prevalence of neuromuscular and chronic respiratory disorders, rising geriatric populations, and growing adoption of home care respiratory support solutions. Emerging regions, particularly in Asia-Pacific and Latin America, offer significant opportunities driven by improving healthcare infrastructure, rising awareness of respiratory therapies, and expanding access to medical devices in hospitals and home care settings.

Cough Assist Devices Market Growth Factors

- The increasing rate of pulmonary diseases also increases the growth rate of respiratory medical devices.

- The reduction of rehospitalization and the period of hospital stay increased the adoption of cough-assist medical devices.

- The increasing preferences for therapies due to the effectiveness of these portable medical equipment surged their growth in the market.

- Advancements in the Internet of Medical Things (IoMT) and wearable smart devices raised the need to replace and supplement conventional physiotherapies.

- The effectiveness of these medical appliances to enhance breathing in patients who are dealing with asthma, cystic fibrosis, much-obstructive pulmonary diseases, chronic obstructive pulmonary diseases, etc., accelerated the growth of the cough assist devices market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 474.03 Billion |

| Market Size in 2025 | USD 252.90 Billion |

| Market Size in 2026 | USD 271.19 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.23% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Choice of Delivery, End User, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Market Dynamic

Drivers

Growing health conditions

The increasing incidence of respiratory diseases and spinal cord injuries causes a rising demand for advanced medical devices in cough assistance, cough detection, and cough diagnosis. The efforts of the WHO and the CDC in the monitoring of several respiratory conditions lead to increased healthcare awareness among the majority of the population. The prevalence of several respiratory illnesses is caused by the seasonal rise of respiratory pathogens, leading to the need for improved patient care with advanced medical equipment.

With the large global population, the global incidence of people living with disability due to spinal cord injuries, including cervical conditions, is increased, which needs effective measures to manage them precisely. Advancements in medical device technologies, such as health acoustic representations (HeAR) like the bioacoustic foundation model, enable researchers to build models that can listen to human sounds and give early signs of diseases.

- In December 2024, electronics announced the launch of a cardiopulmonary assessment application named purpleDx to enable patients dealing with chronic respiratory disease (CRD) to deal with and monitor digital biomarkers of lung function at home.

Restraint

High costs

The high costs of these medical devices can limit their access to the population. By eliminating the need for hospitalization, patients may face issues in getting proper home-based medical care settings due to the high standards required for maintenance, regulation, etc. The lengthy period for regulatory approvals of medical devices and stringent regulations needed for their maintenance may limit their growth in the market. The limited awareness about the health benefits of these medical equipment can limit their expansive reach in the patient population.

Opportunity

New initiatives and reimbursement policies

Considering the high costs associated with medicines to treat respiratory conditions, companies like AstraZeneca took initiatives for better healthcare accessibility. The expansion of savings programs for patients increases the affordability of medicines used to treat conditions like asthma and chronic obstructive pulmonary disease (COPD). Both uninsured and underinsured people can afford and access related treatments, medicines, and therapies with the help of cost-reduction initiatives by companies.

Favorable reimbursement and insurance coverage in the U.S. boosts the adoption of cough-assist medical devices among the patient population. The susceptibility of the elderly population to impaired lung functions and several kinds of lung infections raises the need for advanced cough detection and diagnosis devices.

- In March 2024, AstraZeneca announced the expansion of its savings programs for the entire U.S. inhaled respiratory portfolio to help patients pay no more than USD 35 per month for their medicines.

Segment Insights

Product Type Insights

The automatic segment dominated the cough assist devices market due to the improved effectiveness, monitoring, data recording capabilities, home care settings, and ease of usage. They offer user-friendly and convenient solutions for people with impaired cough functions, which drives their adoption among the population. The useful features, such as adjustable pressure and timing settings, boost their importance in the market. The adaptability of these products enables healthcare professionals to recommend their uses to meet the specific needs of people.

The manual cough assist device segment is expected to grow at a significant rate in the cough assist devices market during the forecast period due to its importance in treating patients with neuromuscular disorders and spinal cord injuries with weak breathing muscles. The usefulness of these devices in the clearance of high amounts of cough and giving relief to the lungs from maximum air volume drives their demand and need in the market. The use of manual cough assist medical devices and lung volume recruitment (LVR) techniques in managing lung infections and maximum air volumes in lungs boost their increasing adoption in healthcare systems. The implementation of lung volume recruitment techniques such as the LVR bag (breath stacking bag), a breathing machine (ventilator), and the mechanical coughing machine with a mouthpiece or glossopharyngeal breathing (frog breathing) accelerates the segmental growth in the market.

Choice of Delivery Insights

The mouthpiece segment dominated the cough assist devices market due to the simplicity and easy usage of mouthpiece cough assist devices. They enable people to hold the mouthpiece in their mouth and achieve control over their breath during the therapy. The designed features of these devices allow their increased accessibility and availability without the need for masks or external equipment. The other major rationales behind this segmental growth are improved patient comfort, the portability of devices, and better hygienic initiatives.

The face mask segment is expected to grow at the fastest rate in the cough assist devices market over the forecast period due to its potential to clear secretions from the lungs. This non-invasive treatment provides air pressure through a tube and mask interface and raises the increased use of cough assist face masks. The latex-free nature of some face masks and their adaptable use with cough assist units boost their adoption in healthcare. The availability of face masks in various sizes for pediatric and adult patients surges the expansive reach of these products in the market.

End User Insights

The home care settings segment is anticipated to be the fastest-growing in the cough assist devices market during the forecast period due to the preferences for better quality of life, personalized care, decreased risk of infections, and cost-effectiveness. The potential advantages of home care cough assist devices as cost-effective alternatives to hospital-based care drive their importance in the market. People can get comfortable respiratory care by achieving familiarity in their own homes.

The hospital segment dominated the cough assist devices market due to the increased preferences for proper treatment monitoring by healthcare professionals and healthcare facilities available in hospitals. The adaptability of several high-performance medical devices in hospital infrastructure raises the quality of medical treatments in hospitals. The proper maintenance and strict regulations required for medical appliances and related facilities, followed by well-equipped hospital infrastructure, raise the expansion of hospitals in the market. The presence of responsible and accountable medical staff, along with experienced healthcare professionals, causes the increased shift of people toward hospitals for improved patient care.

Regional Insights

Why Did North America Dominate the Market?

North America dominated the cough assist devices market due to the rising incidence of chronic respiratory conditions such as cystic fibrosis, chronic obstructive pulmonary disease (COPD), etc. The increased rate of lung infections, difficulties in coughing up, and other health complications raise the need for cough-assist medical devices to deliver improved patient care. The efficiency of these devices in clearing mucus, providing positive airway pressure, and delivering airway clearance drives the growth of the market.

The rising healthcare access and improved affordability of healthcare services surge the adoption of advanced medical devices in hospitals and home-based medical care settings. The presence of well-equipped healthcare infrastructure, the availability of advanced medical technologies, and the accessibility to reimbursement policies boost the shift of people toward healthcare.

- In September 2024, the U.S. Food and Drug Administration (USFDA) approved Dupixent as the first biologic medicine approved in the U.S. to treat adults with chronic obstructive pulmonary disease.

What Makes Asia Pacific the Fastest-Growing Region in the Cough Assist Devices Market?

Asia Pacific is expected to grow rapidly in the market during the forecast period due to increasing healthcare access, increasing investments in healthcare infrastructure, and economic developments in China and India. The easy accessibility to medical treatments and technologies drives the regional market's growth significantly.

The major efforts of several leading companies in research and development activities to drive exciting innovations accelerate the growth of the market in this region. The guide, like the PIC/S, offers international standards to promote the elimination of trade barriers, ensure the quality of active ingredients and drug products, and promote equality in licensing decisions.

China's extensive hospital network generates significant procurement volumes for acute respiratory support and rehabilitation centers, while Japan and South Korea focus on advanced integrated systems and miniaturized device designs. Australia and New Zealand benefit from high home-care adoption combined with strong reimbursement frameworks for chronic-care respiratory devices. Local manufacturing and regional service hubs further help reduce costs and improve device availability across large and diverse populations.

- In January 2024, the Indian Health Minister announced the inauguration of a sub-zonal office of the Central Drugs Standard Control Organization (CDSCO) and a Central Drug Testing Laboratory (CDTL) in Indore, Madhya Pradesh, which aims to empower nearby cities to offer regulatory services and monitor medicine quality.

- In June 2024, the Therapeutic Goods Administration (TGA) of Australia established a transition period for the new version of the Pharmaceutical Inspection Co-operation Scheme (PIC/S) document to Good Manufacturing Practice (GMP).

U.S. Cough Assisted Devices Market Analysis

The U.S. is a major contributor to the market in North America due to a broad network of pulmonologists and a well-developed home health ecosystem. Clear reimbursement policies for cough-assist therapies in chronic disease management and post-ICU care are driving higher prescription rates and supporting device retention programs. This financial clarity encourages both healthcare providers and patients to adopt these therapies, improving continuity of care.

The growing use of telehealth enables remote titration and adherence monitoring, enhancing patient outcomes while reinforcing payer confidence in coverage. Meanwhile, the presence of leading medical device manufacturers in the country contributes to market growth.

What Opportunities Exist in the Middle East & Africa for Cough Assist Devices Market?

The Middle East & Africa present significant opportunities, as wealthier Gulf states and South African tertiary hospitals and specialized rehabilitation centers purchase advanced cough-assist devices, while many other countries in the region emphasize urgent respiratory support and infection control. Investments in public health infrastructure and the rising burden of non-communicable diseases are steadily increasing demand for airway-clearance tools.

The UAE invests in high-quality tertiary care and rehabilitation centers that use cough-assist technologies for respiratory and post-ICU patients. Government-supported health infrastructure projects and medical tourism initiatives facilitate the acquisition of advanced devices. Training programs for respiratory therapists ensure proper device use and patient education. Additionally, the UAE functions as a regional distribution hub for multinational medical device companies.

What Potentiates the Market in Europe?

Europe combines a strong clinical evidence base with organized healthcare systems that support the systematic use of cough-assist devices in pulmonology clinics and home-health programs. National health services and insurance programs in many European countries cover devices for eligible patients, especially children and adults with respiratory disease, or severe COPD with sputum retention risk. The region favors devices that demonstrate proven effectiveness, low noise, portability, and ease of use for caregivers.

Value Chain Analysis

- Component & Technology Suppliers

This stage includes manufacturers of core components, such as compressors, sensors, tubing, and microprocessors, that form the backbone of cough-assist devices. High-quality components ensure device reliability, accuracy, and patient safety.

Key Players: Nidek Medical, Parker Hannifin, Smiths Medical, Honeywell, and Sensirion. - Device Manufacturing

Original equipment manufacturers design, assemble, and test cough assist devices, focusing on user-friendly features, portability, and integration with respiratory support platforms for hospitals and homecare use.

Key Players: Philips Respironics, ResMed, Hill-Rom, Invacare Corporation, and NuvoAir. - Distribution & Logistics

Distributors and logistics partners manage the delivery of cough assist devices and consumables to hospitals, clinics, home care providers, and patients, ensuring timely availability and compliance with regulatory standards.

Key Players: McKesson Medical-Surgical, Henry Schein Medical, Cardinal Health, Medline Industries, and regional distributors.

Cough Assist Devices Market Companies

- Baxter International Inc.

- ICU Medical Inc.

- Ventec Life Systems

- West Care Medical

- Triumph Medical Services

- Koninklijke Philips N.V.

- Air Liquide Medical Systems

- Hill-Rom Holdings Inc.

- Breas Medical Ltd.

- Inogen Inc.

Latest Announcements by Leaders

- In September 2024, Jim O'Connell, the President of Front Line Care at Baxter International Inc., reported that the company aimed to design a seamless, portable, next-level comfortable, and easy-to-use solution like the Vest APX System for patients going through certain therapies related to chronic lung conditions and retained secretions.

- In March 2024, Pascal Soriot, the CEO of AstraZeneca, announced that the expansion of the savings programs by AstraZeneca is established on its strong commitment to addressing barriers in accessibility and affordability for patients dealing with respiratory diseases and helping them to live healthy lives.

- In October 2024, Christian Tucat, the CEO of Sciensus, said that the company is dedicated to helping patients achieve improved healthcare outcomes through its strong partnerships with healthcare and pharmaceutical provider organizations and aims to prove a significant impact on patient care.

Recent Developments

- In September 2024, Baxter International Inc. announced the launch of the next-generation airway clearance system named the Vest Advanced Pulmonary Experience (APX) System at the North American Cystic Fibrosis Conference.

- In December 2024, Inogen Inc. announced the U.S. FDA 510(k) clearance for the SIMEOX 200 airway clearance device to meet the treatment needs of patients associated with chronic respiratory diseases in the U.S.

Segments Covered in the Report

By Product Type

- Automatic Cough Assist Device

- Manual Cough Assist Device

By Choice of Delivery

- Face Mask

- Mouthpiece

- Adapter

By End-Use

- Hospitals

- Home Care Settings

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting