What is the Whole Grain and High Fiber Foods Market Size?

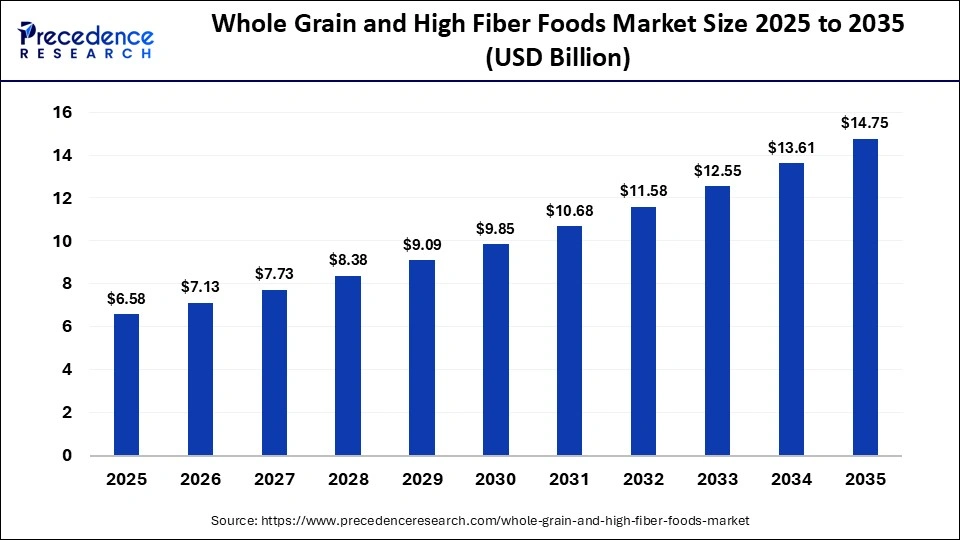

The global whole grain and high fiber foods market size accounted for USD 6.58 billion in 2025 and is predicted to increase from USD 7.13 billion in 2026 to approximately USD 14.75 billion by 2035, expanding at a CAGR of 7.80% from 2026 to 2035. The market is witnessing substantial growth due to a global push for preventive health, driven by increased awareness of fiber's role in managing chronic diseases and supporting gut health, which is fueling innovation in convenient, nutrient-dense products.

Market Highlights

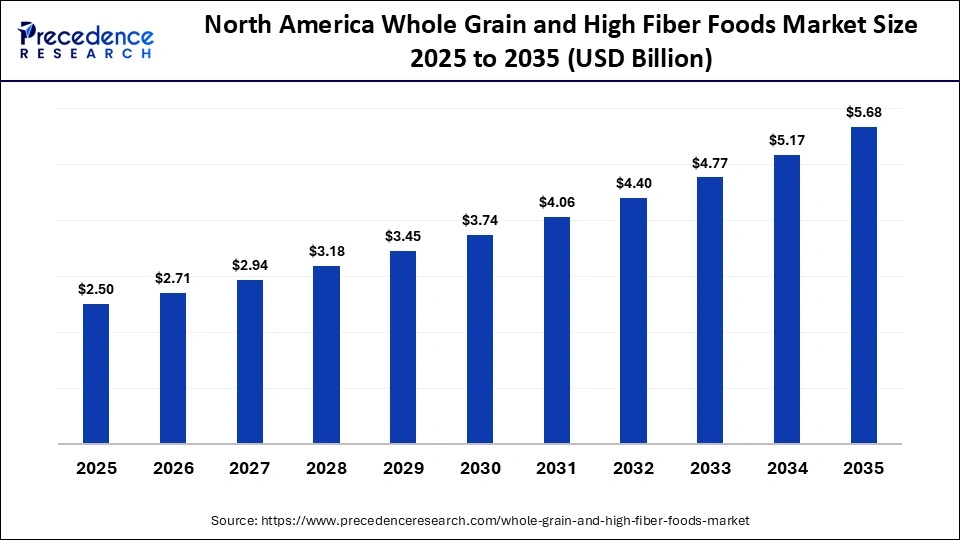

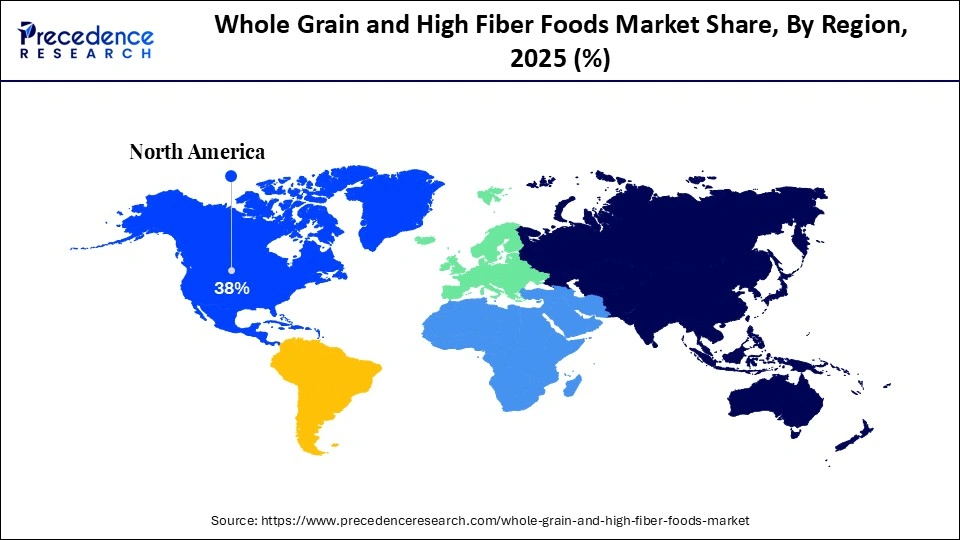

- North America dominated the market with a major market share of around 38% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 8.0% between 2026 and 2035.

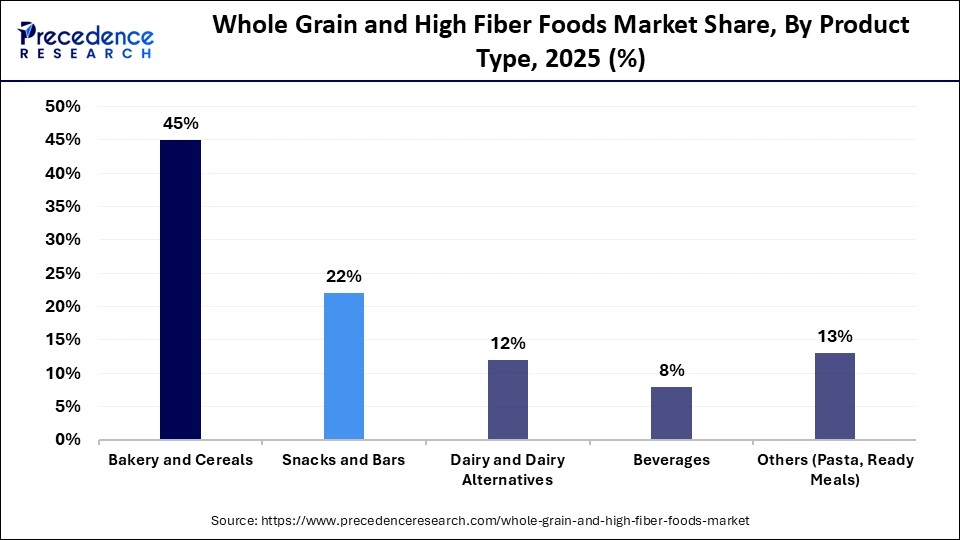

- By product type, the bakery and cereals segment generated the biggest market share of around 45% in 2025.

- By product type, the snacks and bars segment is expected to expand at the fastest CAGR of 6.6% between 2026 and 2035.

- By grain type, the wheat segment accounted for the largest market share of about 35% in 2025.

- By grain type, the quinoa and ancient grains segment is projected to grow at a solid CAGR of 6.7% between 2026 and 2035.

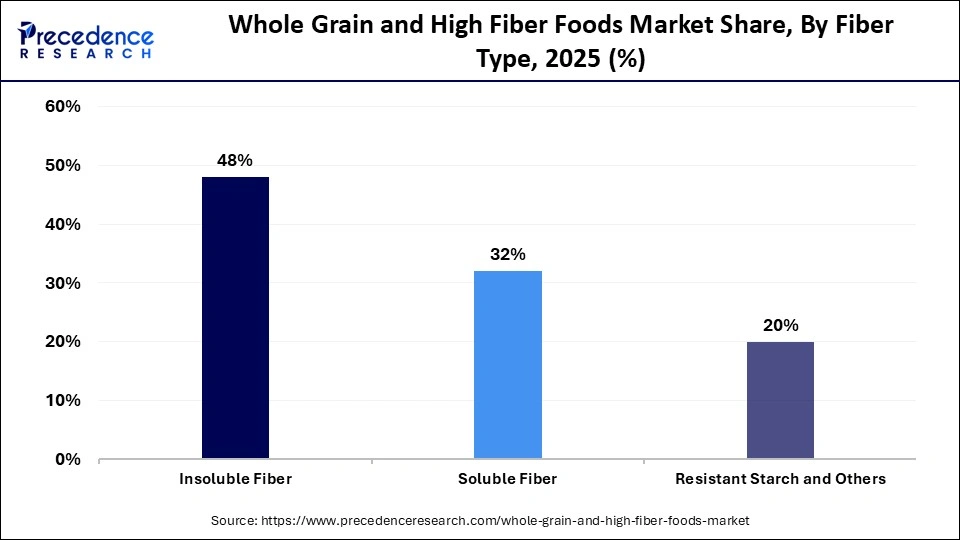

- By fiber type, the insoluble fiber segment contributed the highest market share of around 48% in 2025.

- By fiber type, the soluble fiber segment is growing at a strong CAGR of 6.8% between 2026 and 2035.

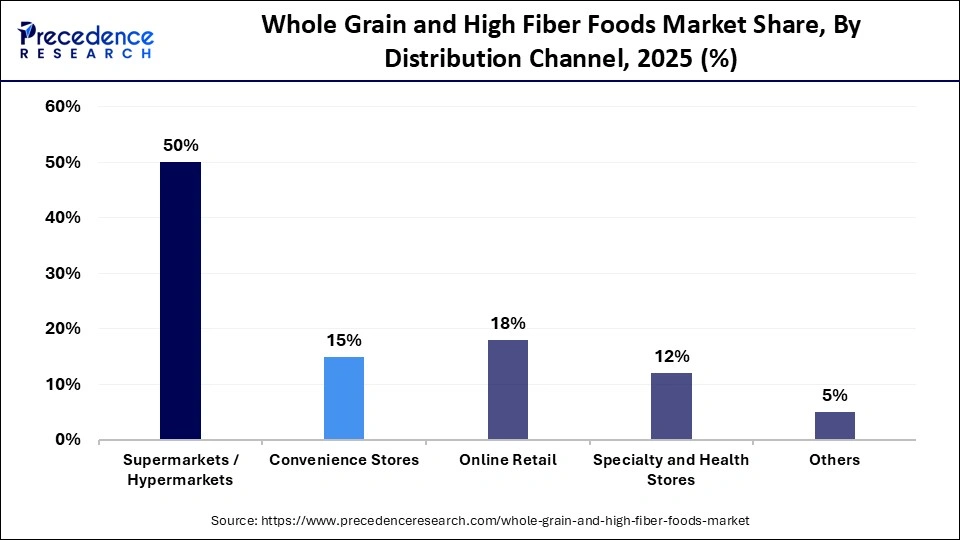

- By distribution channel, the supermarkets/hypermarkets segment held a major market share of around 50% in 2025.

- By distribution channel, the online retail segment is expected to expand at a notable CAGR of 7.2% from 2026 to 2035.

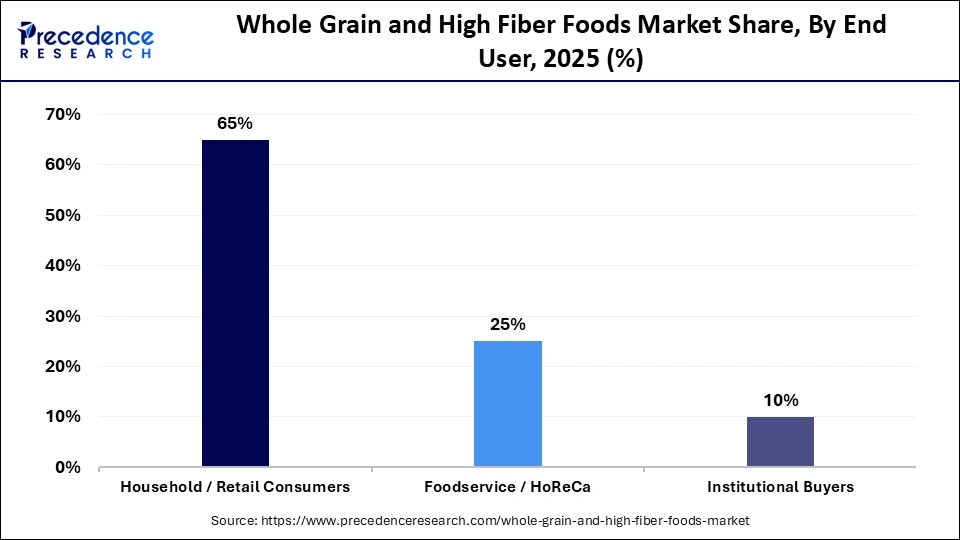

- By end user, the household/retail consumer segment contributed the highest market share of 65% in 2025.

- By end user, the foodservice/HoReCa segment is expected to grow at a strong CAGR of 7.0% between 2026 and 2035.

What is the Whole Grain and High Fiber Foods Market?

The whole grain and high fiber foods market comprises food and beverage products formulated with whole grains and fiber-rich ingredients that support digestive health, weight management, and chronic disease prevention. These products retain the bran, germ, and endosperm or are enriched with dietary fiber from sources such as oats, wheat, barley, and legumes. Market growth is driven by rising health awareness, the increasing prevalence of lifestyle diseases, clean-label demand, and government-backed nutrition guidelines promoting whole grain consumption.

How is AI Transforming the Whole Grain and High Fiber Foods Market?

Artificial intelligence (AI) is transforming the whole grain and high fiber foods market by optimizing RandD for new products, improving supply chains, enhancing processing for better quality, and personalizing consumer offerings. AI helps identify and develop novel high-fiber ingredients, including ancient grains like millet and amaranth, and enhances nutritional profiles. It also improves grain quality management, detects contaminants, and streamlines logistics from farm to shelf, ensuring higher-quality inputs. AI tailors food suggestions and product development to individual consumer preferences, dietary needs, and health goals.

Major Trends in the Whole Grain and High Fiber Foods Market

- Increased Health Awareness and Disease Prevention: Consumers are actively seeking whole grains and fiber to combat lifestyle diseases and improve digestive health, aligning with government guidelines and health influencer promotion.

- Plant-Based and Gluten-Free Innovation: The demand for plant-based and gluten-free options is fueling new product development, using diverse grains and ingredients to appeal to a wider audience with specific dietary needs.

- Clean Label and Sustainability Focus: There is a strong push for natural, minimally processed ingredients, transparency, and eco-friendly sourcing, with consumers favoring organic and responsibly sourced whole grains.

- Product Innovation and Convenience: Manufacturers are expanding beyond traditional products, offering convenient, high-fiber snacks and fiber-enriched beverages for busy lifestyles.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.58 Billion |

| Market Size in 2026 | USD 7.13 Billion |

| Market Size by 2035 | USD 14.75 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.80% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Grain Type, Fiber Type, Distribution Channel, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

How Did the Bakery and Cereals Segment Dominate the Whole Grain and High Fiber Foods Market?

The bakery and cereals segment dominated the market by holding the largest share of approximately 45% in 2025. This dominance is primarily driven by increased consumer health awareness, concerns about digestive health, and a growing demand for healthier alternatives to refined products. Ongoing innovations in flavors and clean labels are further boosting sales. Whole grain bread is a daily staple, making it a consistently high-volume product. Additionally, breakfast cereals and single-serve baked goods cater to the demand for quick, nutritious meals. Consumers perceive whole grain bakery items and cereals as healthier options that aid in weight management and reduce the risk of chronic diseases.

The snacks and bars segment is expected to grow at the fastest CAGR of 6.6% in the upcoming period. This growth is largely driven by the rising demand for convenience, increasing health consciousness, and portability. As consumers seek quick, ready-to-eat options for their busy lifestyles, bars emerge as ideal choices for work, school, or travel. These bars often contain fiber, protein, and complex carbohydrates, appealing to fitness enthusiasts and health-conscious individuals, and driving demand for fiber-rich snacks. Brands are responding by introducing diverse flavors, customizable profiles, and functional ingredients to cater to various needs.

Grain Type Insights

What Made Wheat the Leading Segment in the Whole Grain and High Fiber Foods Market?

The wheat segment led the market with a 35% share in 2025. This is primarily due to its widespread use in staple foods such as bread and pasta, its versatility in product development, affordability, and strong consumer recognition of its health benefits. Wheat-based items like bread, pasta, and cereals are foundational in many diets, ensuring consistent demand. Additionally, wheat is rich in fiber, B vitamins, minerals, and antioxidants, contributing to digestive and heart health. Its wide cultivation and processing make wheat a cost-effective option for mass production.

The quinoa and ancient grains segment is expected to grow at a robust CAGR of 6.7% over the forecast period. This growth is mostly driven by their superior nutritional profiles, versatility in various dishes, and increasing consumer demand for healthy, plant-based, and gluten-free alternatives. Quinoa, in particular, offers a complete amino acid profile, making it a valuable plant-based protein source that appeals to vegetarians, vegans, and health-conscious consumers. Additionally, its natural gluten-free status positions it as a nutritious substitute for conventional grains.

Fiber Type Insights

Why Did the Insoluble Fiber Segment Dominate the Whole Grain and High Fiber Foods Market?

The insoluble fiber segment accounted for 48% of the market share in 2025, driven by high consumer demand for digestive health, broad applications in staple foods, cost-effectiveness, and its ability to add bulk without altering taste. These fibers, especially cellulose, can easily be incorporated into everyday foods. Grains are staple crops that offer high availability, affordability, and strong yields, making them economical raw materials for manufacturers. The trend toward functional foods and beverages increasingly integrates insoluble fiber into convenient, health-boosting options.

The soluble fiber segment is expected to grow at a CAGR of 6.8% during the projection period. This is due to its proven health benefits, including lowering cholesterol, managing blood sugar levels, and aiding weight control. These attributes drive demand for fortified foods such as oats and fruits. Soluble fibers form a gel in the gut, slowing sugar absorption, reducing cholesterol, and promoting feelings of fullness, addressing key consumer concerns. Consumers actively seek foods with added health benefits, and soluble fibers like beta-glucan from oats, inulin, and pectin are ideal for creating these functional products.

Distribution Channel Insights

What Made Supermarkets/Hypermarkets the Leading Segment in the Whole Grain and High Fiber Foods Market?

The supermarkets/hypermarkets segment led the market by capturing a 50% share in 2025. The dominance of hypermarkets and supermarkets in the market is attributed to their extensive product selection, effective in-store promotions, strong physical presence for impulse purchases, and established trust among consumers seeking convenient access to healthy foods. They offer a wide variety of whole grain and high-fiber products, increasing product exposure and consumer choices in one location. Families and health-focused shoppers prefer these one-stop shops for their regular grocery needs, appreciating the reliable stock that builds consumer confidence.

The online retail segment is expected to grow at the fastest CAGR of 7.2% in the coming years. This growth is driven by unparalleled convenience, a diverse selection of products, easy price comparison, and access to personalized nutrition solutions. Online platforms enable tailored nutrition plans and allow consumers to easily find products that match their specific health goals. Shoppers can compare prices, read reviews, and access detailed nutritional information online, which builds trust and drives purchases as E-commerce platforms host numerous brands and specialized products.

End User Insights

How Did the Household/Retail Consumers Segment Dominate the Whole Grain and High Fiber Foods Market?

The household/retail consumers segment dominated the market with around 65% share in 2025. This is mainly due to surging global health consciousness, the increasing prevalence of lifestyle diseases, and a strong preference for convenient, ready-to-eat healthy options. Consumers are actively seeking foods that aid in managing obesity, diabetes, and cardiovascular conditions. Rising disposable incomes, urban lifestyles, and the influence of health-conscious trends have further driven the widespread adoption of these products at the retail level.

The foodservice/HoReCa segment is expected to expand at the fastest CAGR of 7.0% during the forecast period. The growth of this segment stems from rising demand from restaurants, hotels, and cafes to offer healthier menu options that cater to health-conscious consumers. Chain restaurants and quick-service outlets are increasingly incorporating whole grain breads, cereals, and snacks to meet consumer expectations for nutritious meals. Additionally, the growing trend of functional and clean-label foods in commercial kitchens is driving higher adoption of fiber-rich ingredients in the foodservice sector.

Regional Insights

How Big is the North America Whole Grain and High Fiber Foods Market Size?

The North America whole grain and high fiber foods market size is estimated at USD 2.50 billion in 2025 and is projected to reach approximately USD 5.68 billion by 2035, with a 8.55% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Whole Grain and High Fiber Foods Market?

North America dominated the market with around 38% share in 2025. This dominance is mainly driven by high consumer awareness regarding health, strong regulatory support, and extensive product innovation in the bakery and snack sectors. The Dietary Guidelines for Americans consistently emphasize the importance of whole grains, promoting their inclusion in school meals and public, which fosters widespread adoption. Increasing obesity rates and chronic diseases in the U.S. have spurred a significant shift toward preventive nutrition. Consumers are proactively seeking fiber-rich foods for improved digestion and satiety.

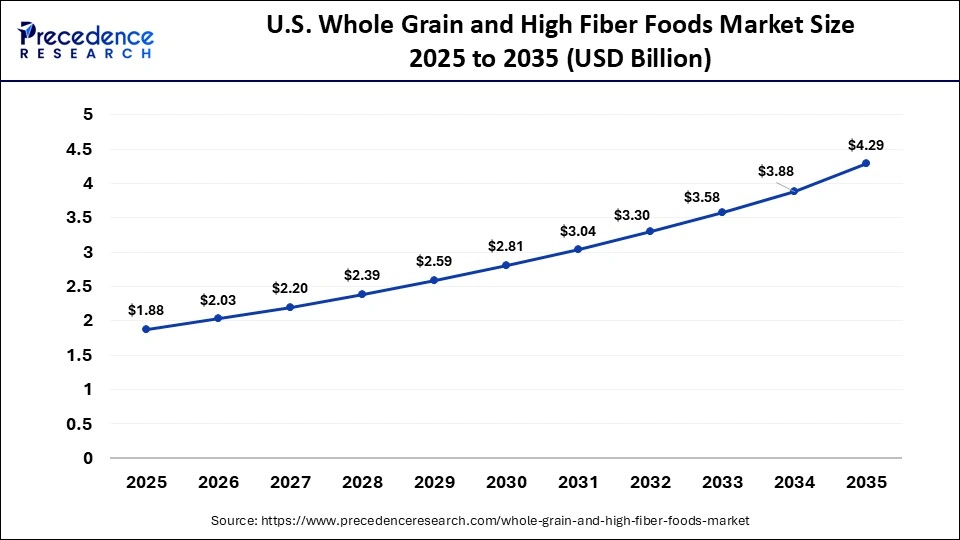

What is the Size of the U.S. Whole Grain and High Fiber Foods Market?

The U.S. whole grain and high fiber foods market size is calculated at USD 1.88 billion in 2025 and is expected to reach nearly USD 4.29 billion in 2035, accelerating at a strong CAGR of 8.60% between 2026 and 2035.

U.S. Whole Grain and High Fiber Foods Market Trends

The U.S. is a dominant player within the North American market, primarily due to high consumer awareness and an increasing focus on new product development, including organic, gluten-free, and non-GMO whole grain options, catering to evolving tastes. Well-developed retail infrastructure supports the widespread availability of whole grain products in bakeries, cereals, and snacks.

Why is Asia Pacific Considered the Fastest-Growing Region in the Whole Grain and High Fiber Foods Market?

Asia Pacific is expected to experience the fastest growth, growing at a CAGR of 8.0% CAGR throughout the forecast period. This growth is driven by rapid urbanization, increasing health consciousness among a growing middle class, and a shift toward convenient, functional nutrition in major economies like China, India, and Japan. The increasing prevalence of obesity, diabetes, and cardiovascular conditions in countries like India and China has pushed consumers toward fiber-rich diets. Rapid urbanization and hectic routines are driving demand for on-the-go, easy-to-prepare, yet nutritious options, such as instant oatmeal and cereal bars, for healthier, organic, and functional food products.

India Whole Grain and High Fiber Foods Market Trends

The market in India is primarily driven by intense urbanization and rising disposable incomes. There is a high availability of native grains like millets, brown rice, and quinoa, supported by government initiatives promoting them for nutrition. A growing middle class and Gen Z consumers are increasingly becoming health-conscious, seeking fiber for digestive and heart health, and increasing awareness of fiber's benefits is driving adoption.

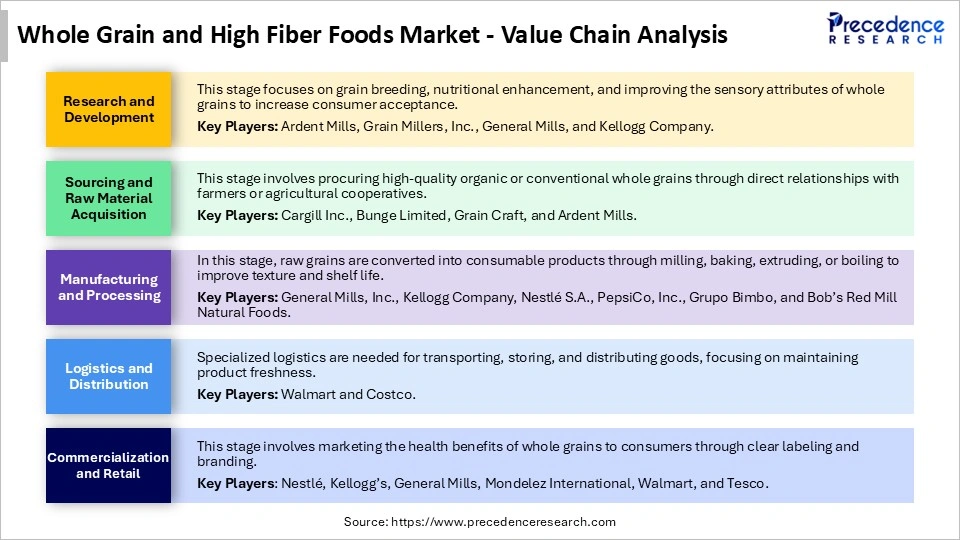

Whole Grain and High Fiber Foods Market Value Chain Analysis

Who are the Major Players in the Global Whole Grain and High Fiber Foods Market?

The major players in the whole grain and high fiber foods market include Nestle S.A., General Mills, Inc., Kellogg's Company, PepsiCo, Inc., Danone S.A., The Kraft Heinz Company, Unilever PLC, Archer Daniels Midland Company (ADM), Cargill, Incorporated, Associated British Foods plc, Grupo Bimbo S.A.B. de C.V., Post Holdings, Inc., Barilla Group, Hain Celestial Group, Inc., and ITC Limited.

Recent Developments

- In March 2025, Bob's Red Mill introduced Overnight Protein Oats in two flavors: Blueberries and Cream and Vanilla Almond, debuting at the Natural Products Expo West. These oats contain 10g of protein, 8g of sugar, and no fillers, made from a revolutionary hull-less variety that reduces carbon emissions. They are combined with milk and refrigerated overnight for a quick breakfast option.(Source: https://www.foodinfotech.com)

- In July 2025, Kellanova launched new whole grain products in June 2025, including Cheez-It Spicy Buffalo and Scooby Doo! Baked Graham Cracker Snacks, emphasizing minimal prep and great taste for students. Upcoming 2026-27 products include MorningStar Farms Whole Grain Breaded Chik'n Patties.(Source: https://newsroom.kellanova.com)

- In April 2024, Flowers Foods, Inc. announced 11 new products across brands like Nature's Own and Dave's Killer Bread. Innovations include protein bars, smaller loaves, flatbreads, and a keto bun, reflecting the company's commitment to meeting market trends and expanding consumer choice.(Source: https://investors.flowersfoods.com)

Segments covered in the Report

By Product Type

- Bakery and Cereals

- Snacks and Bars

- Dairy and Dairy Alternatives

- Beverages

- Others

By Grain Type

- Wheat

- Oats

- Barley

- Brown Rice

- Quinoa and Ancient Grains

- Others

By Fiber Type

- Insoluble Fiber

- Soluble Fiber

- Resistant Starch and Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty and Health Stores

- Others

By End User

- Household/Retail Consumers

- Foodservice/HoReCa

- Institutional Buyers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting