Women's Health Devices Market Size and Forecast 2025 to 2034

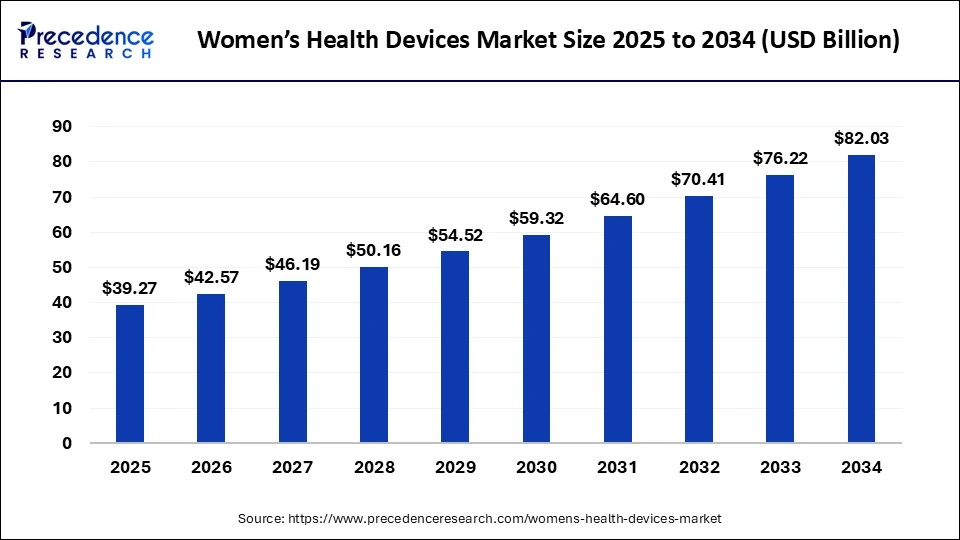

The global women's health devices market size was valued at USD 36.26 billion in 2024 and is expected to reach over USD 82.03 billion by 2034 with a registered CAGR of 8.51% from 2025 to 2034.

Women's Health Devices Market Key Takeaways

- The global women's health devices market was valued at USD 36.26 billion in 2024.

- It is projected to reach USD 82.03 billion by 2034.

- The market is expected to grow at a CAGR of 8.51% from 2025 to 2034.

- By type, the devices segment held a significant share in 2024.

- By type, the consumables segment is anticipated to show considerable growth in the market over the forecast period.

- By product, the diagnostic segment held a significant share in 2024.

U.S.Women's Health Devices Market Size and Growth in the 2025 To 2034

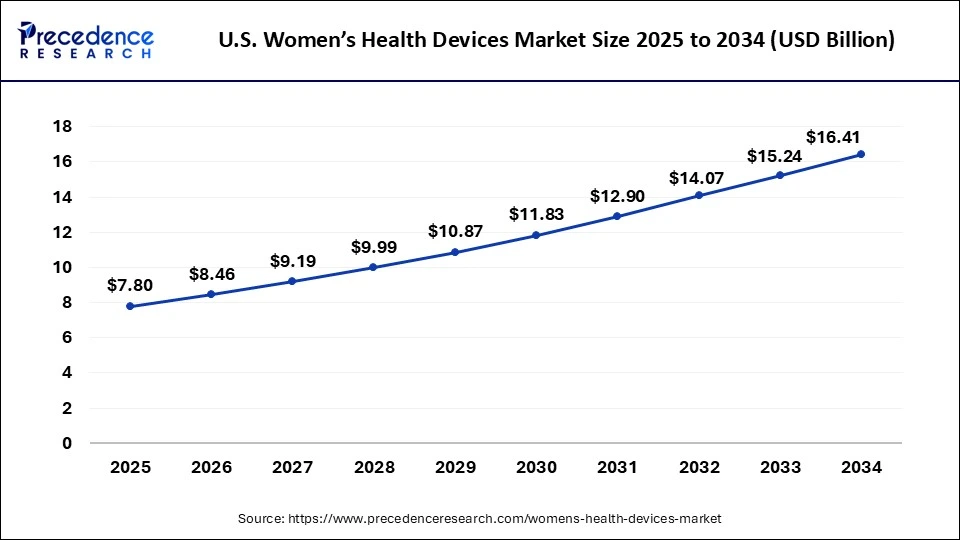

The U.S. women's health devices market size was estimated at USD 7.19 billion in 2024 and is projected to grow around USD 16.41 billion by 2034 with a CAGR of 8.60% between 2025 to 2034.

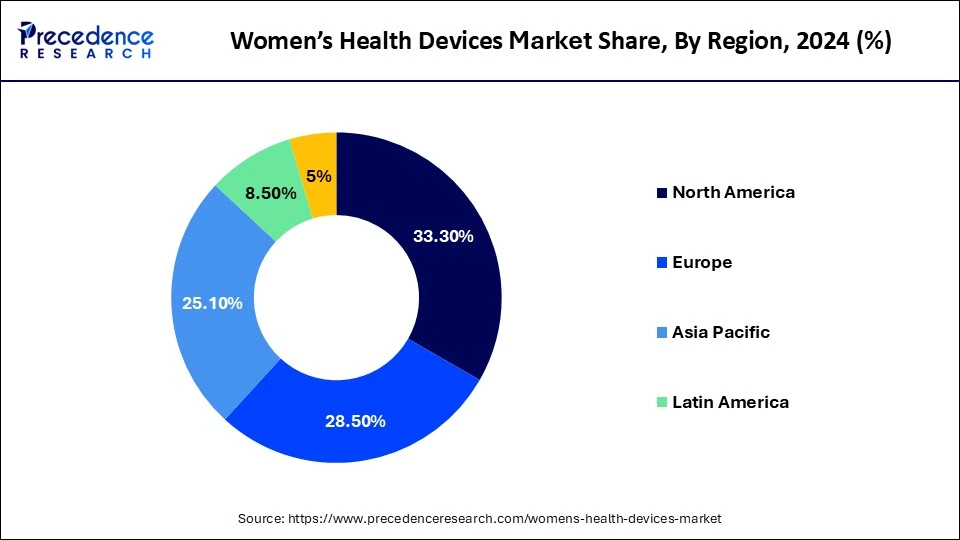

North America was the dominant women's health devices market in 2024. The high healthcare expenditure on women's health and higher adoption of the advanced healthcare devices among the women population in North America has driven the market growth in this region. Moreover, the presence of huge female population in the region along with the favorable reimbursement policies of the government has fostered the market growth in this region in the past few years. Moreover, around 60% of the US population is suffering from one or more chronic diseases and this is a major factors that has contributed towards the growth of the women's health devices market. The growing investments in the research & development, clinical trials, and marketing of new health devices by the top market players in the region is expected to further boost the demand for the women's health devices across US and Canada.

The Asia Pacific is estimated to be the most opportunistic market during the forecast period. The increased government initiatives to promote gender equality in the nation like India and China have resulted in a surge in the women population. Moreover, the rising participation of women in the workforce is resulting in the increased disposable income of the women. Apart from this, the improving access to healthcare infrastructure is boosting the growth of the women's health devices market in Asia Pacific. The rising prevalence of various chronic diseases such as cancer, diabetes, cardiovascular diseases, and respiratory disorders among the women population is expected to augment the growth of the Asia Pacific women's health devices market.

Women's Health Devices MarketGrowth Factors

A strong growth in the women's healthcare expenditure has been witnessed across the globe. The growing focus on the women's healthcare coupled with the increased personal disposable income of the women has fostered the growth of the women's health devices market across the globe. The rising participation of the women in the workforce especially in the developed nations has significantly contributed towards the growth of the market. Moreover, the rising prevalence of chronic diseases like cancer, cardiovascular diseases, and diabetes among the women population is fueling the growth of the global women's health devices market. According to the International Agency for Research on Cancer, the female breast cancer has become the most diagnosed type of cancer by surpassing the lungs cancer. Around 2.3 million new cases of breast cancer were reported in 2020. Around 9.2 million new cases of cancer and 4.4 million cancer deaths in female were reported in 2020. These numbers are boosting the healthcare expenditure in the women's health devices.

The lack of awareness regarding the female genital health and sanitization along with the underdeveloped healthcare infrastructure in the developing and the underdeveloped markets is presenting a huge growth opportunity to the market players. Furthermore, the rapidly growing geriatric population is expected to drive the market growth in the foreseeable future. According to the World Health Organization, the global geriatric population is expected to reach at 2 billion by 2050. Moreover, improving gender ratio in the developing nations owing to the government initiatives is expected to foster the growth of the women's health devices market in the forthcoming years. Further, the rising complications related to the women's fertility owing to the delayed marriage and pregnancy is fostering the demand for the women's health devices across the globe. Rising government initiatives regarding the women empowerment and women health especially in the developing countries like India is resulting in growth of the women's health devices market. The rising expenditure of the medical devices manufacturing companies for the development of the women focused health and medical devices is significantly fostering the growth of the market across the globe.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 82.03 Billion |

| Market Size in 2025 | USD 39.27 Billion |

| Market Size in 2024 | USD 36.26 Billion |

| Growth Rate | CAGR of 8.51% from 2025 to 2034 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, Application, Region |

Market Dynamics

Driver

Increasing Awareness and Health Education

Increasing awareness and education among women about their health is also a key driver that is driving the women's health devices market. The problem of female health is becoming a greater concern of governments and non-governmental organizations all around the world as the introduction of campaigns and publications aimed at raising awareness about female health concerns in such fields as reproductive health, menstrual hygiene, pregnant care, menopause, osteoporosis, and breast cancer draws attention to the problem.

As information becomes more widely available due to digital health programs, social media, and mobile applications, an increasing number of women are taking an active responsibility when it comes to managing their health, which boosts the demand for diagnostic and therapeutic devices.

Restraint

High Cost and Regulatory Complexity Limit Accessibility

High-tech diagnostic and therapeutic equipment may be made with expensive materials and need to exploit very advanced technologies, as well as undergo demanding testing procedures, and thus they tend to be expensive to the manufacturer and even to their users. Such a high cost becomes a barrier to access, especially among women in low-income and rural regions where healthcare infrastructure may be poor. Also, most developing nations do not have favorable insurance reimbursement policies, and this, too, limits access by patients to these vital medical devices. At the regulatory level, there exist different levels of approvals, elaborate licensing procedures, and long clearance delays that block the introduction of new products to such markets.

Opportunity

Robust Investment Initiatives by Key Players

The women's health device market has huge market growth opportunities in the form of robust funding programs by the key market players. Larger firms and investors are investing huge funds in research and development, strategic partnerships, and product development in response to the changing healthcare demands among women. The investments are contributing to the development of more sophisticated, easier-to-use, and cheaper devices, hence enhancing the accessibility and uptake by different income categories. Furthermore, more funds help to advance new technologies, including wearable health sensors, minimally invasive diagnostics, and artificial intelligence pregnancy and fertility tracking. Such efforts also tend to increase the manufacturing capacities and international distribution, particularly in the developing world.

Type Insights

The devices contributed the most revenue in 2024 and are expected to dominate throughout the projected period. They are pregnancy and ovulation test kits, mammography systems, breast and pelvic ultrasound machines, colposcopes, and bone densitometers. An increase in incidences of breast cancer, cervical cancer, osteoporosis, and reproductive health disorders causes the demand for these devices. Their application is additionally spread by the increased utilization of point-of-care diagnostic devices and the incorporation of these with online technologies, such as AI and telemedicine. In addition, government screening programs and health educational campaigns can keep supporting their use in both city and provincial healthcare systems, guaranteeing that the segment continues thriving in the market.

The consumables segment is expected to grow substantially in the women's health devices market. Consumables cover test kits, reagents, catheters, imaging agents, swabs, and other items that are used once and not reusable during diagnostic and therapeutic interventions. Raising frequency of diagnostic testing, emerging awareness about women's health illnesses, as well as the emerging need to have more home-based or point-of-care testing, is also posing a big contributing significantly to the growth of the segment. Test strips used in pregnancy and fertility tests, cervical screening kits, and breast biopsy consumables are all giving rise to higher usage, especially in areas where healthcare and diagnostic support are more readily available.

Product Insights

The diagnostic sector dominated the women's health devices market in 2024. These devices assist in identifying and handling a wide range of women-related illnesses in their initial phases. The rising consciousness regarding the need for preventive healthcare, governmental efforts to raise awareness on periodic healthcare checks, and plans to increase awareness and routine health checkups among women are also contributing factors in the rise of this segment. Further, the increasing number of older women who are more vulnerable to diseases like osteoporosis and cancer is increasing the demand for effective diagnostic technologies.

Region Insights

What Are the Key Trends Driving the Europe Women's health devices market?

The European women's health devices market is expected to account for a substantial market share in 2024, influenced by positive government initiatives, a wide reimbursement policy, along high investments in the healthcare infrastructure. The market covers several diagnostic, treatment, and monitoring systems, bridging the reproductive health disorder, osteoporosis, and cancer challenges affecting women. The development of more public health initiatives that encourage early detection, regular screenings, and preventive care is also spurring the widespread use of devices within the region. Furthermore, within a rising consciousness, expanding disposable income, and a friendly telemedicine policy, a wider reach to maternal health and wellness solutions is being accommodated.

Germany is one of the key countries in its contribution to the increase of the European women's health devices market with its developed healthcare system, well-established regulation, and extensive awareness of the population about the health of women. A good relationship between public health organizations and other businesses in the private sector is also stimulating research and development efforts in the same.

Application Insights

Based on the application, the global women's health devices market was dominated by chronic diseases segment. The various chronic diseases such as cancer, diabetes, cardiovascular diseases, and various others is rising at an alarming rate among the women owing to changing lifestyle, physical inactivity, and changing food habits. Cancer is the most dominant chronic disease among the female population. The rising burden of breast cancer, colorectum cancer, ovarian cancer, and lungs cancer among the women population has significantly contributed towards the growth of this segment across the globe.

The pelvic & uterine health is estimated to be the most opportunistic segment during the forecast period. According to the UCLA Health, one in three women are affected with the pelvic floor disorders once in their lifetime. The rising prevalence of the pelvic floor disorder, rising awareness regarding the vaginal disorders, and increasing prevalence of the urinary and fecal incontinence among the women population are the major factors that are expected to drive the growth of this segment during the forecast period.

End User Insights

The hospitals & clinics segment dominated the global women's health devices market in 2024. This is simply attributable to the increased preference for the hospital services among the population for receiving treatment for majority of the diseases. The increased penetration of public and private hospitals, rising number of private clinics, strong and developed infrastructure for treatment and diagnosis at hospitals, and availability of special wards for serving women at hospitals are the major factors that has fostered the growth of the hospitals & clinics segment.

The home healthcare is estimated to be the fastest-growing segment during the forecast period. The rising disposable income, rising healthcare expenditure, growing awareness regarding the hospital acquired infections, and easy availability of the home healthcare services are the prominent factors that are expected to augment the demand for the home healthcare segment in the forthcoming years.

Recent Developments

- In January 2025, GE HealthCare declared that it had secured 510(k) clearance from the United States Food and Drug Administration clearance upon the remodeled portfolio of the Voluson Expert Series ultrasound systems. The Voluson Expert Series offers the combination of artificial intelligence (AI)-based capabilities and automation systems to enable reinforced behavior in imaging performance and efficiencies in women's healthcare.

- In October 2024, Hologic, Inc., a global leader in women's health, reported that it has entered into a definitive agreement to acquire Gynesonics, Inc., a privately-owned company engaged in development of minimally invasive devices used in women health for about 350 million dollars subject to customary working capital and other closing adjustments.

- In January 2024, the U.S. Dept of Health and Human Services will increase its focus on the HIPAA protection of reproductive health data, shifting the regulatory environment of women and healthcare and causing an outpouring of companies to enhance the privacy of their digital health apps.

Women's Health Devices Market Companies

- GE Healthcare

- Hologic

- F. Hoffmann-La Roche

- Koninklijke Philips

- Siemens AG

- Prestige Consumer Healthcare, Inc.

- Abbott Laboratories

- Caldera Medical

- MedGyn Products

- Medline Industries

- Carestream Health

Segments Covered in the Report

By Type

- Devices

- Consumables

By Product

- Surgical

- Diagnostics

- Contraceptives

- Labor & Delivery

- Critical Care

- Others

By Application

- Chronic Diseases

- General Health

- Reproductive Health

- Pelvic and Uterine Health

- Cancer

- Infectious Disease

- Uterine Fibroids

- Others

By End User

- Hospitals & Clinics

- Home Healthcare

- Obstetrics & Gynecology Clinics

- Diagnostic Laboratories

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting