Workforce Management Market Size and Forecast 2025 to 2034

The global workforce management market size was calculated at USD 10.53 billion in 2024 and is expected to reach around USD 31.44 billion by 2034, expanding at a CAGR of 11.56% from 2025 to 2034.

Workforce Management Market Key Takeaways

- The global workforce management market was valued at USD 10.53 billion in 2024.

- It is projected to reach USD 31.44 billion by 2034.

- The workforce management market is expected to grow at a CAGR of 11.56% from 2025 to 2034.

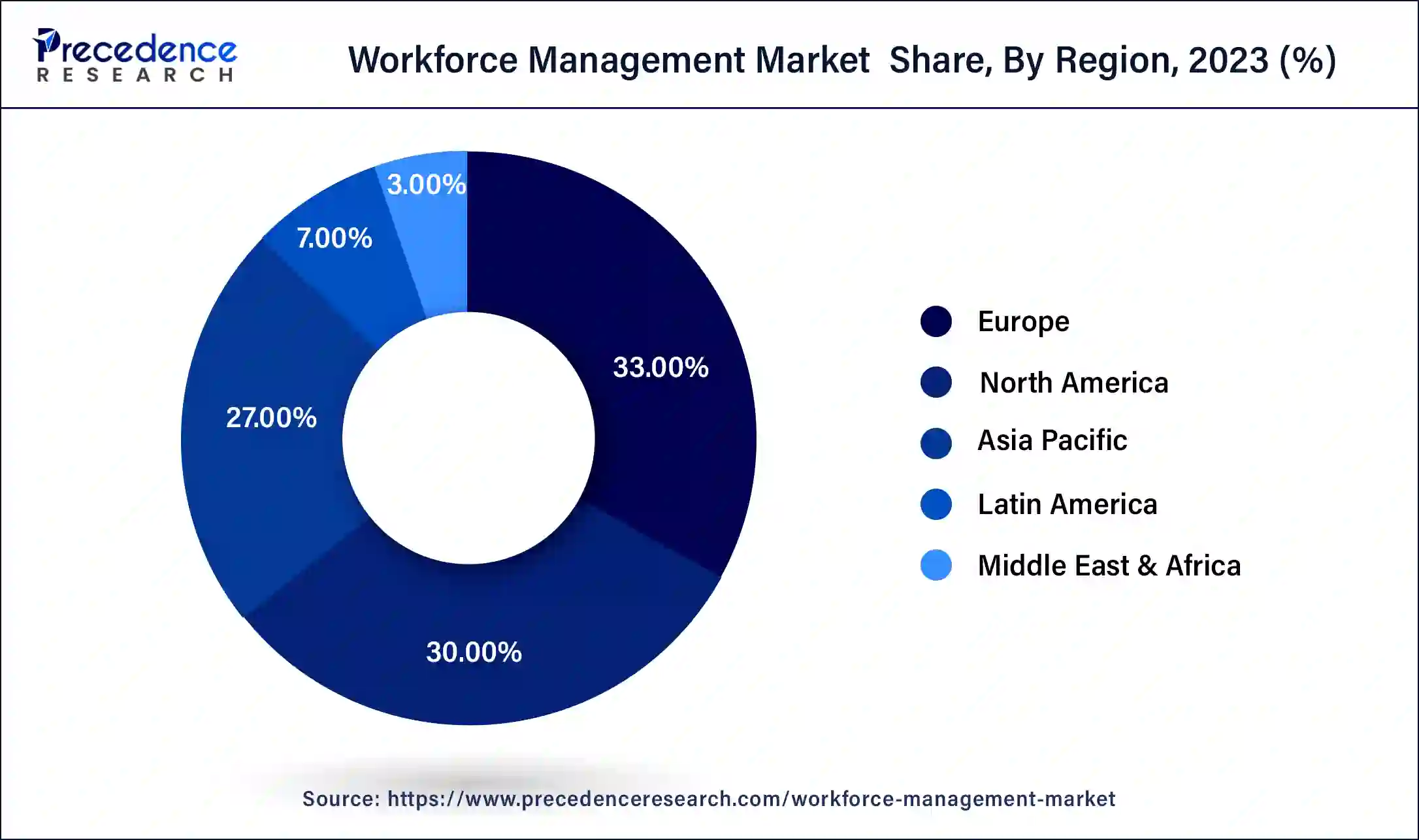

- Europe has held the largest market share of 33% in 2024.

- By solution, the time & attendance management segment has accounted more than 37% of market share in 2024.

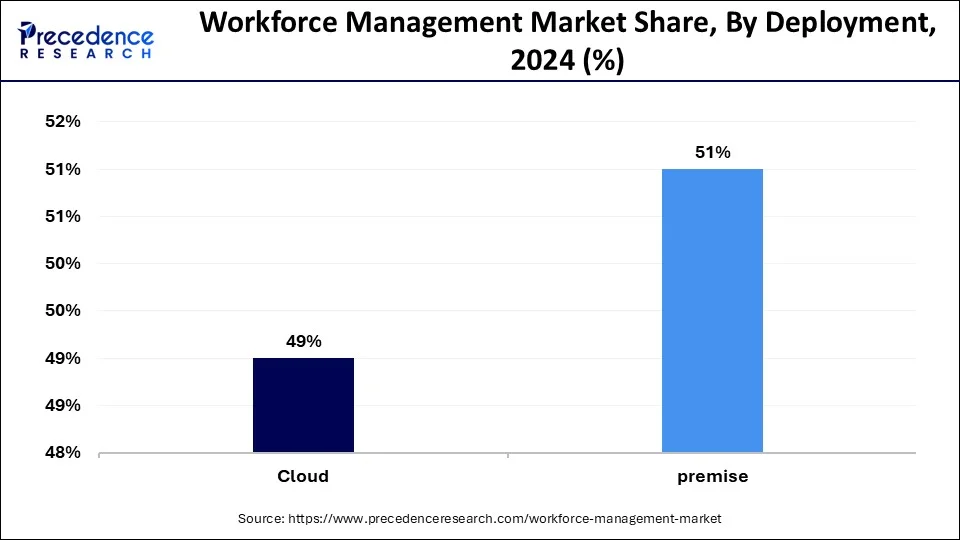

- By deployment, the on-premise segment has held the major market share of 51% in 2024.

- By application, the BFSI segment has contributed the largest market share of 23% in 2024.

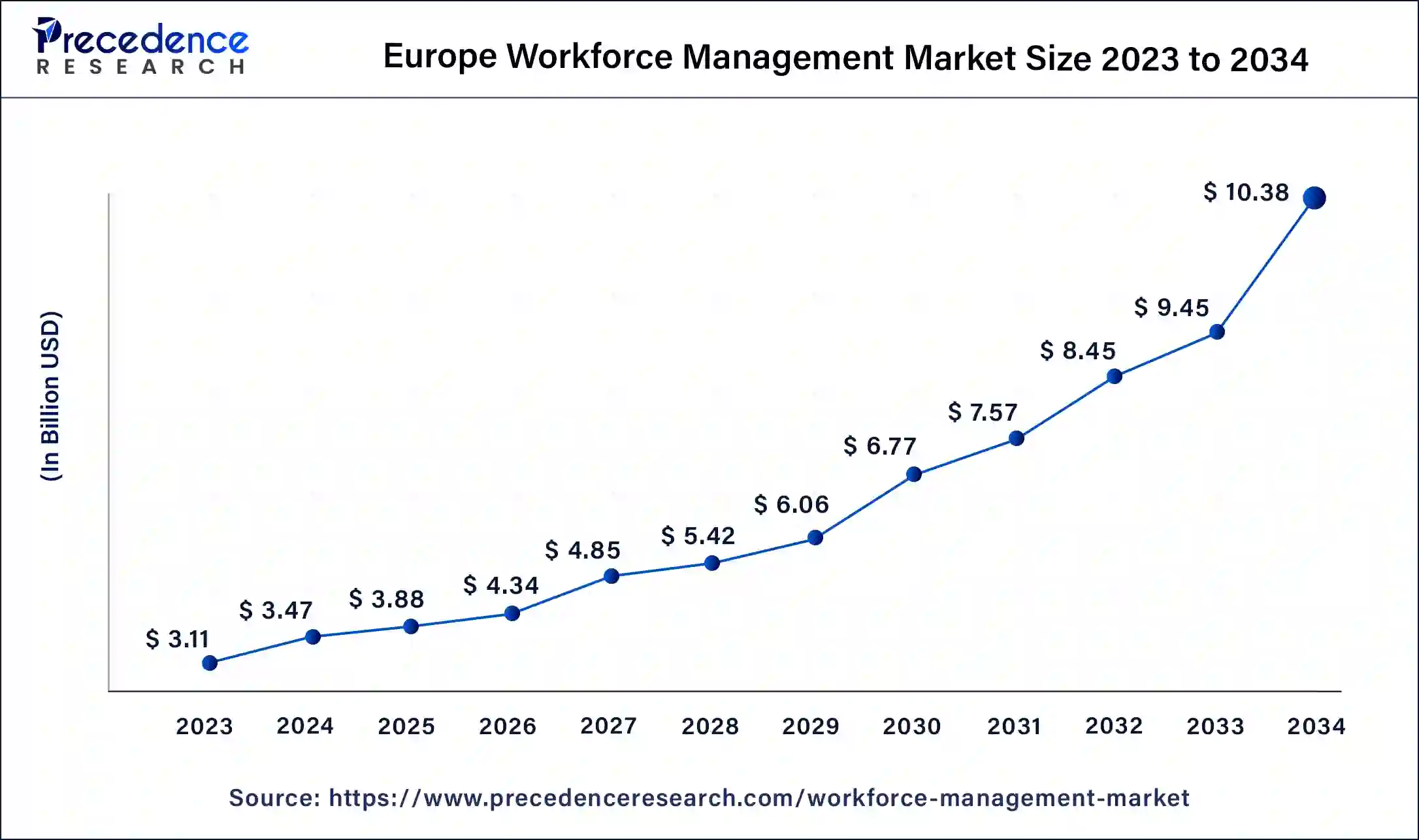

Europe Workforce Management Market Size and Growth 2025 to 2034

The Europe workforce management market size was reached at USD 3.47 billion in 2024 and is predicted to be worth around USD 10.38 billion by 2034 at a CAGR of 11.58% from 2025 to 2034.

Europe dominated the market while carrying 33% of the market share in 2024. European businesses often prioritize employee engagement and satisfaction as critical factors for organizational success. Workforce management systems that offer features such as self-service portals, mobile access, and communication tools can help enhance employee experience and satisfaction, driving their adoption. European countries often prioritize work-life balance, leading to a greater need for tools that help manage schedules efficiently, offer flexible working arrangements, and accommodate employee preferences. Workforce management systems that can handle complex scheduling requirements are in high demand in such environments.

North America held a significant share of the workforce management market, with the United States witnessing approximately $8.5 billion annually in lost productivity among workers. The imperative for workforce management software companies in this region is to optimize personnel allocation, ensuring the deployment of the most qualified individuals with the appropriate skills at the right time and place.

Achieving excellence in service delivery to the American populace necessitates a federal workforce that is not only talented and well-trained but also actively engaged in the workplace. Effective leadership, inspiring and motivating executives, and a workforce reflecting the rich diversity of the nation are vital components in this endeavor.

Amidst this landscape, WorkHub emerges as a rising workforce management software company specializing in superior employee management services. With a focus on developing solutions that drive organizational success, WorkHub enhances communication and collaboration efficiency across different organizational departments. By ensuring employees remain focused on meeting the needs of valued customers, WorkHub contributes to improved productivity and operational effectiveness within organizations operating in North America.

- In December 2023, Upwork launched partnerships to enhance workforce management capabilities.

- In March 2023, UJET collaborates with Google Cloud to introduce Intelligent Workforce Management, aiming to shape the future of both employee and customer experience.

- In July 2022, Procore introduces Workforce Management, a comprehensive solution tailored for the construction industry.

Market Overview

Workforce management (WFM) is a strategic framework comprising a series of processes and procedures designed to ensure the optimal allocation of staffing resources within a business. Its primary objective is to efficiently deploy the right number of employees possessing the requisite skill sets to the appropriate roles precisely when they are needed. This framework underscores performance and competency, aiming to maximize employee productivity.

The implementation of workforce management processes yields several benefits for businesses. Firstly, it enhances planning and awareness by providing a comprehensive understanding of the organization's staffing requirements. This heightened insight enables companies to make informed decisions regarding workforce deployment, thereby aligning resources more effectively with business objectives.

WFM fosters flexibility within the organization, enabling it to adapt swiftly to evolving challenges without resorting to costly alterations in business or hiring strategies. This agility is crucial in today's dynamic business landscape, where unforeseen disruptions and market shifts necessitate rapid responses.

- In December 2023, RLDatix announced an agreement to acquire Breitenbach Software Engineering GmbH, further strengthening its connected healthcare operations software and services.

- In June 2023, Zendesk made a significant move into the workforce management market with the acquisition of Tymeshift.

- In November 2022, UKG acquired a workforce planning startup, Quorbit, to enhance its workforce management solutions suite.

Workforce Management Market Growth Factors

- Implementing a workforce management solution leveraging state-of-the-art technologies can efficiently optimize scheduling procedures, addressing common pain points within the organization. This optimization leads to an increase in the size of the available labor pool and enhances talent acquisition and retention strategies, thereby driving growth in the workforce management market.

- Workforce management solutions assist in addressing the root causes of absenteeism while also enabling proactive planning and long-term solutions to manage its effects. By effectively managing absenteeism, businesses experience improved productivity and operational efficiency, contributing to the growth of the workforce management market.

- Workforce management solutions bring in the necessary expertise to identify and rectify operational inefficiencies. This outsider's perspective enables better allocation of resources and labor, ultimately driving growth in the market through improved operational efficiency and resource utilization.

- Comprehensive workforce management solutions streamline retention efforts by managing recruitment, selection, onboarding, induction, shift planning, and forecasting processes. Improving retention rates, decreasing turnover, and saving costs while increasing productivity are solutions that contribute significantly to the growth of the market.

- Workforce management solutions facilitate easier compliance with union regulations and local labor laws, as well as streamline human resource management processes. This leads to more efficient resource management and better profit margins, driving growth in the workforce management market.

- Workforce management is a critical aspect of modern business operations, with successful implementation resulting in cost savings, productivity gains, and improvements in employee and customer satisfaction. Conversely, businesses that neglect workforce management often experience negative impacts on resource planning, operational efficiency, productivity, and overall performance, underscoring the importance of workforce management solutions and driving growth in the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 31.44 Billion |

| Market Size in 2025 | USD 11.77 Billion |

| Market Size in 2024 | USD 10.53 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.56% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution, Application, Deployment, Company Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Enhanced data access

Implementation of workforce management strategies, businesses gain easier access to rich data and insights about their operations. This information serves as a crucial driver for growth in the workforce management market by enabling more effective staff scheduling, improved resource allocation, and better alignment with customer demands. With enhanced data, businesses can make informed decisions, leading to improved customer communication, higher satisfaction levels, and increased revenue.

The workforce management market provides solutions for better hiring decisions based on available staff skills, enhancing workforce efficiency and productivity. Improved worker satisfaction, streamlined performance management, and enhanced team communication contribute to market growth as businesses recognize the value of comprehensive workforce management solutions in optimizing operations and fostering organizational success.

- In March 2022, Magnit (formerly PRO Unlimited) announced plans to acquire Geometric Results, Inc., a leading managed services provider.

- In November 2023, Hunter and goBetter join forces, heralding a new era in blue-collar workforce management.

Strategic evolution and increased adoption

The transformation of workforce management from a compliance-driven and automation-focused approach to a strategic enterprise-wide solution presents both challenges and opportunities. Decision-makers are now prioritizing the utilization of workforce management to align with broader organizational goals and elevate HR's role as a strategic business partner. Despite the widespread adoption of time and attendance applications, there are hurdles to overcome, such as ensuring compliance with regional labor laws and reporting standards.

The shift towards strategic HR practices necessitates a holistic approach to workforce management, encompassing automated time tracking, absence management, and optimized project staffing. Overcoming these challenges is vital for sustaining the growth trajectory of the workforce management market as businesses increasingly recognize the significance of enhancing workforce productivity and efficiency to achieve their strategic objectives.

- In July 2023, Humanforce partnered with Datacom, offering customers increased choice and flexibility in unifying workforce management and payroll.

- In July 2023, ATOSS and Delaware collaborated to provide a comprehensive HR solution.

- In April 2023, Workday and Alight expand their partnership to deliver a global, unified HCM and payroll experience.

Restraint

Diverse stakeholder needs

The multifaceted nature of workforce management, encompassing the interests of front-line staff, middle management, C-suite executives, and external contractors, presents a significant restraint on market growth. Meeting the diverse information needs of these stakeholders requires tailored reporting, resulting in varied key performance indicators (KPIs) and metrics.

Customization, while essential for addressing specific contexts, poses a challenge in standardizing workforce management solutions, thereby limiting scalability and hindering the broader adoption of such systems across organizations. Overcoming this restraint necessitates innovative approaches to balancing stakeholder interests while maintaining the efficiency and effectiveness of workforce management processes.

Communication and collaboration challenges

Small and medium-sized businesses (SMBs) encounter various obstacles in fostering effective communication and collaboration within their organizations. Factors such as limited resources, outdated technology, inadequate training, cultural differences, and departmental silos contribute to miscommunication and conflicts. These challenges jeopardize productivity, lead to missed deadlines, and result in diminished employee morale.

In the management of global, cross-cultural teams, understanding diverse customs, values, and social norms is essential. Failure to address cultural barriers can impede communication and collaboration, hindering the growth potential of the workforce management market. Overcoming these restraints demands proactive measures to promote inclusive communication practices and bridge cultural divides within SMBs.

Opportunities

Digital transformation trends

The proliferation of digital technologies is revolutionizing workforce management and profoundly impacting all facets of organizations. The imperative for digital transformation (DT) underscores the need to develop digital capabilities in alignment with workforce requirements. DT encompasses the integration of evolving digital tools and technologies, including mobile apps, software solutions, big data analytics, social media platforms, cloud computing, artificial intelligence, and machine learning algorithms, along with emerging embedded services.

Innovations streamline business operations, enhance user experiences for diverse stakeholders, and ensure business continuity and growth. The integration of digital technologies presents significant opportunities for the workforce management market as businesses seek to optimize efficiency, agility, and productivity in the evolving digital landscape.

- In June 2023, Zendesk acquired Tymeshift, integrating AI-powered workforce management capabilities into its offerings.

Artificial intelligence (AI) integration

The integration of AI in workforce management presents a myriad of opportunities for organizations to enhance their operations and drive productivity. AI-powered solutions offer advanced capabilities that can revolutionize how businesses address staffing challenges, enabling them to make data-driven decisions, streamline processes, and gain a competitive edge in today's dynamic business landscape. By leveraging AI, organizations can accurately forecast and plan their workforce needs, utilizing algorithms to predict future demand, identify skill gaps, and recommend appropriate workforce adjustments based on historical data, market trends, and business objectives.

The predictive analytics capability enables proactive resolution of workforce challenges, such as fluctuating demand or changing skill requirements, thereby minimizing risks associated with over or understaffing and optimizing resource allocation. The integration of AI in workforce management presents a significant opportunity for businesses to enhance operational efficiency and stay ahead in an ever-evolving market.

- In October 2023, EY and IBM teamed up to launch an Artificial Intelligence Solution aimed at boosting productivity and driving efficiencies within HR operations.

Solution Insight

The time & attendance management segment held the largest market share within the workforce management market. Workforce management software plays a pivotal role in automating attendance tracking, leading to enhanced data accuracy and reduced payroll errors. Through the implementation of a comprehensive workforce management solution, organizations can provide various worker types with an intuitive platform to accurately report hours worked and absences in real time.

Time & attendance management systems not only improves operational efficiency but also offers visibility and control over the organization's most valuable resource, its people. Moreover, a time management system ensures compliance with labor laws and labor union agreements, mitigating risks associated with non-compliance. In essence, the time & attendance management segment offers businesses a holistic solution to optimize workforce productivity, ensure accuracy in payroll processes, and maintain regulatory compliance.

Deployment Insight

The on-premise segment is emerging as the dominant force within the workforce management market, yet it comes with inherent deployment challenges. Implementation of on-premise solutions is notably more difficult and time-consuming compared to cloud-based alternatives. The cost implications are significant, with the initial software expenses typically far exceeding those of monthly subscription models by $10-20,000 or more, alongside additional charges for administrators, users, and implementation services. This creates a substantial burden on IT support, diverting technical staff from other critical projects and tasks.

The deployment timeline stretches over months, requiring meticulous planning and a significant workforce to implement the software across various locations and conduct on-site training sessions, often disrupting existing workflows. In essence, while on-premise solutions offer control and security, their deployment complexities and associated costs present considerable challenges for businesses seeking workforce management solutions.

Company Size Insight

The large enterprises segment is emerging as the dominant force within the workforce management market, driven by the need for comprehensive tools and processes to manage staffing levels efficiently. Workforce management (WFM) solutions enable companies to streamline time-off requests and approvals digitally, leveraging automation and data analysis to optimize various aspects such as leave balances, paid time off (PTO), absences, and schedule conflicts. Industries with time-sensitive tasks and hourly employee pay structures, including retail, insurance, banking, healthcare, distribution, and transportation, increasingly rely on WFM software to enhance overall productivity.

By utilizing workforce management tools, employers gain valuable insights into worker engagement, attendance, and productivity levels, empowering them to tailor training, coaching, and processes for maximum performance. The automation capabilities, coupled with instant accessibility and simplified reporting for workforce-related data, further enhance HR productivity while reducing administrative costs. As large enterprises recognize the strategic importance of workforce management in driving operational efficiency and maintaining a competitive edge, the adoption of advanced WFM solutions is expected to continue its upward trajectory.

Application Insights

The banking, financial services, and insurance (BFSI) segment has emerged as the dominant force fueling growth within the workforce management market. Within this sector, both branch networks and contact centers remain pivotal in delivering personalized customer service, representing significant people-intensive channels. Enterprise Workforce Management (WFM) solutions play a crucial role in enhancing profitability, employee retention, and customer satisfaction by optimizing operations across these people-intensive areas.

By leveraging WFM solutions, financial institutions can effectively manage staff, forecast demand, automate scheduling processes, and generate insightful reports. This resource planning functionality enables organizations to improve service quality while simultaneously controlling costs, leading to enhanced operational efficiency and customer experience. As the BFSI sector continues to prioritize workforce optimization to meet evolving customer expectations, the adoption of advanced WFM solutions is expected to drive significant advancements in operational effectiveness and competitive positioning within the industry.

Workforce Management Market Companies

- UKG Inc.

- SAP SE

- Oracle Corporation

- WorkForce Software, LLC

- NICE

- ActiveOps PLC

- Infor

- Ceridian HCM, Inc

- EG Solutions

- Blue Yonder Group, Inc

- Reflexis Systems, Inc

- Replicon

- SISQUAL Workforce Management, Lda.

Recent Developments

- In September 2023, Beeline unveiled two new products targeting previously unmet challenges in the extended workforce sector.

- In February 2024, Brittman enhances its growth strategy through a strategic stake acquisition in Workex.

- In July 2023, Workforce Management Platform When I Work expanded its portfolio with the acquisition of Fintech Startup Lean Financial.

- In February 2024, Volaris Group proudly announced its acquisition of Zeit AG, further solidifying its position as a global leader in vertical market software.

Segments Covered in the Report

By Solution

- Workforce Scheduling

- Time & Attendance Management

- Embedded Analytics

- Absence Management

- Others

By Application

- Academia

- Automotive & Manufacturing

- BFSI

- Government

- Healthcare

- Retail

- Others

By Deployment

- Cloud

- On-premise

By Company Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting