What is the X-Ray Inspection System Market Size?

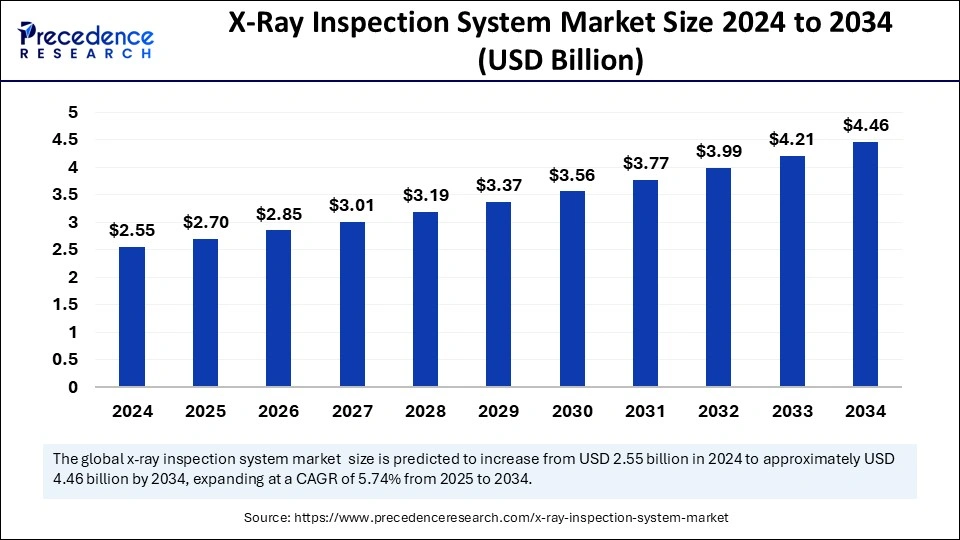

The global X-ray inspection system market size is accounted at USD 2.70 billion in 2025 and predicted to increase from USD 2.85 billion in 2026 to approximately USD 4.69 billion by 2035, expanding at a CAGR of 5.68% from 2026 to 2035. The market is predominantly fueled by growing security concerns, prompting airports, transportation hubs, and critical infrastructure facilities to make substantial investments in advanced X-ray technologies aimed at strengthening them.

X-Ray Inspection System Market Key Takeaways

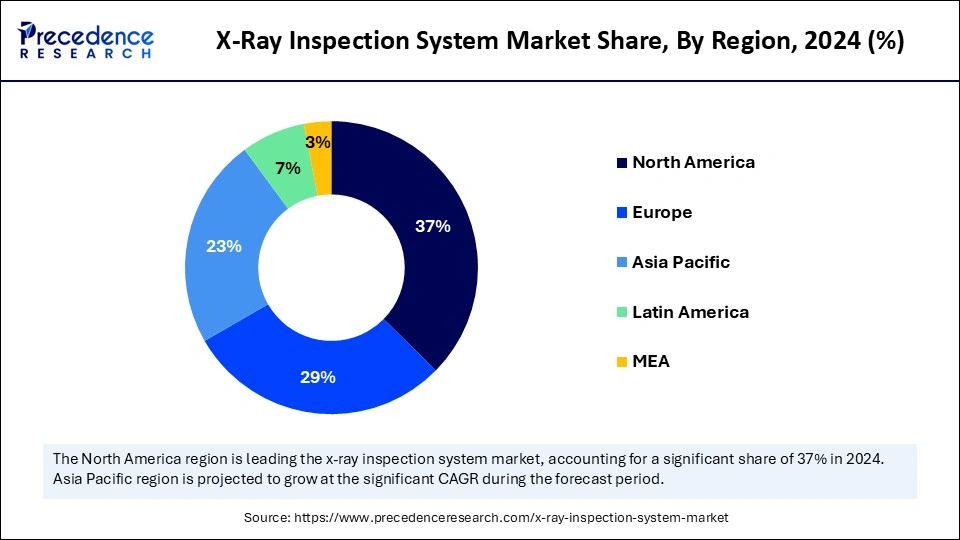

- North America dominated the global market with the largest market share of 37% 2025.

- Asia Pacific is estimated to expand the fastest CAGR in the market between 2026 to 2035.

- Europe has been witnessing notable growth in the global market.

- By technology, the digital imaging segment held the largest market share in 2025.

- By technology, the film-based imaging segment is anticipated to grow at a remarkable CAGR between 2026 to 2035.

- By dimension, the 2D X-ray segment contribute the biggest market share in 2025.

- By dimension, the 3D X-ray segment is anticipated to grow at a remarkable CAGR between 2026 to 2035.

- By end-user, the manufacturing segment captured the highest market share in 2025.

- By end-user, the aerospace segment is anticipated to grow at a remarkable CAGR between 2026 to 2035.

Artificial Intelligence: The Next Growth Catalyst in the X-Ray Inspection System Market

The integration of artificial intelligence (AI) is revolutionizing the X-ray inspection system market, enhancing precision, efficiency, and automation in security screening and quality control to evolve. The need for advanced inspection solutions surged, promoting industries such as aviation, manufacturing, and healthcare to embrace smart technology.

Computerized systems leverage machine learning algorithms and deep learning techniques to improve image recognition, anomaly detection, and decision-making processes. These systems can rapidly analyze vast amounts of data, identifying hidden threats, defects, or inconsistencies with greater accuracy than traditional methods. In security applications, AI enhances baggage screening at airports by reducing false alarms and improving the detection rates of prohibited items.

Additionally, the synergy between AI and radiograph inspection is poised to redefine security and quality assurance industries. As digital models become more sophisticated, they will further improve threat detection, reduce operational costs, and enhance overall system reliability.

- In October 2024, the UK's National Health Service approved the use of an AI tool to assist in detecting bone fractures from X-rays. Platform like Techcare Alert and Boneview helps reduce missed diagnoses in the emergency department.

Strategic Overview of the Global X-Ray Inspection System Industry

The global X-ray inspection system market has emerged as a cornerstone in the quality control, security, and diagnostics sectors, driven by the rapid advancement of imaging technologies and growing integration of smart devices. These systems are widely used across industries, including healthcare, food and beverages, aerospace, electronics, and security, offering non-destructive, real-time analysis for defect detection. This capability not only streamlines production processes but also upholds regulatory compliance, minimizes risk, and enhances product reliability on a global scale.

High-tech use of products in the industry has led to the rise of digital radiography, which offers superior image quality, faster processing, and reduced radiation exposure compared to traditional film-based methods. With unmatched versatility and ability to enhance operational integrity, the market continues to expand its footprints across the globe, emerging not merely as tools but as strategic assets in achieving excellence, safety, and trust.

X-Ray Inspection System Market Growth Factors

- Increasing security threats: Rising global threats in transportation and public places are compelling government and private sectors to enhance their security infrastructure with advanced X-ray systems.

- Demand for non-destructive testing: Industries such as automotive, aerospace, and electronics require precise and non-invasive testing solutions to maintain quality standards.

- Computerized advancements: The integration of AI improves image analysis, speeds up threat detection, and reduces false positives, driving faster adoption.

Stringent regulatory compliance: Regulatory mandates in food, pharmaceuticals, and healthcare industries demand automated inspection systems. - Rise in air travel and global trade: Increased passenger traffic and cargo shipments necessities robust and reliable security screening systems, further fueling the X-ray inspection system market growth.

Major Trends

- Miniaturization and Portability: The demand for portable, compact X-ray systems is increasing due to the rise of inspections, enabling remote and on-site applications.

- Combination Inspection Capabilities: Modern X-ray systems are increasingly integrating multiple inspection functions, such as defect detection, shape identification, product weighing, and contamination detection, reducing the need for multiple standalone systems and cutting operational costs.

- 3D and Tomographic Imaging Adoption: The use of 3D Computed Tomography (CT) imaging is rising in the aerospace, automotive, and semiconductor industries because of its ability to offer in-depth analysis of detected defects, allowing engineers to make better-informed decisions regarding the manufacturing of their products.

- Increasingly Stringent Quality and Food Safety Standards: Regulatory requirements in food, pharmaceuticals, and manufacturing are pushing companies to adopt X-ray technology for contaminant and foreign object detection, ensuring adherence to quality assurance and safety standards.

Market Outlook:

- Market Growth Overview: The X-Ray Inspection System market is expected to grow significantly between 2025 and 2034, driven by the rising quality control requirements, innovation in digital radiography, AI-driven defect detection, and 3D imaging are enhancing system efficiency and reliability, propelling market expansion.

- Sustainability Trends: Sustainability trends involve waste reduction and resource conservation, eco-friendly manufacturing and materials, and product safety and brand integrity.

- Major Investors: Major investors in the market include State Street Corporation, Fidelity (FMR LLC), T. Rowe Price Associates, and Capital Group.

- Startup Economy: The startup economy is focused on nanotechnology for X-ray components, additive manufacturing inspection, and AI and automation software.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 4.69 Billion |

| Market Size in 2025 | USD 2.70 Billion |

| Market Size in 2026 | USD 2.85 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.68% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Dimension, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

High-end security needs

The growing need for high-end security solutions across airports, border controls, and public spaces is a major driver of the X-ray inspection system market. With rising global security threats and an increase in contraband smuggling, governments and private sectors are investing in advanced X-ray systems to enhance security screening. The aviation industry has seen a surge in the adoption of digitally hi-tech scanners, with the U.S. Transportation Security Administration and European civil aviation conference implementing stricter regulations.

Restraints

High investment costs and maintenance challenges

Despite the growing demand, the market faces challenges due to the high upfront costs associated with purchasing and installing advanced X-ray inspection systems. Additionally, the cost of regular maintenance, software updates, and skilled personnel for system operation can be a significant financial burden, especially for developing economies. Moreover, industries like food and pharmaceuticals require stringent compliance with safety regulations, further increasing operational costs.

Opportunity

The machine sector is witnessing rapid growth, driven by technological advancements and increasing adoption in industrial and medical applications. The integration of AI-powered automated detection has significantly improved accuracy and reduced manual screening efforts, making X-ray inspection more efficient.

Technology Type Insights

The digital imaging segment held the largest X-ray inspection system market share in 2024. It is witnessing growth due to its high resolution, faster processing time, and ease of data storage and sharing. Industries such as aerospace, automotive, and healthcare have rapidly shifted towards digital solutions for real-time, precise inspection. Recently, next-gen digital flat-panel detectors have been introduced in the market, offering improved image clarity and higher inspection speeds, gaining traction in industrial applications. Precision and speed are the key factors that are keeping this segment in supremacy.

On the other hand, the film-based imaging segment is anticipated to grow at a remarkable CAGR between 2025 and 2034 due to its remaining relevance in regions with limited digital infrastructure and for specific legacy applications. The key factors contributing to constant market growth include cost-effectiveness, simplicity, and continued demand in emerging economies and traditional applications. Recently, some oil and gas companies in remote areas continue to utilize film-based systems, although they are gradually transitioning to alphanumeric substitutes.

Dimension Type Insights

The 2D X-ray segment held the largest X-ray inspection system market share in 2024. It is witnessing growth due to proven reliability, faster processing capabilities, and cost-effective deployment. Widely adopted across industries such as automotive, electronics, food processing, and manufacturing systems. This segment offers efficient defect detection and quality control with minimal complexity. Their ability to deliver high-resolution flat images in real time without requiring advanced computational infrastructure makes them a preferable choice for routine inspection.

However, the 3D X-ray segment is anticipated to grow at a remarkable CAGR between 2025 and 2034 due to demand for in-depth inspections in aerospace, electronics, and medical applications. It provides comprehensive visualization, improving fault detection and quality assurance. This segment offers depth perception and layered visualization, which significantly enhances accuracy in identifying hidden defects, voids, or misalignments, especially in critical applications such as aerospace, automotive, and electronics manufacturing. As industries increasingly adopt advanced quality assurance standards and advanced devices, the demand for 3D imaging systems is increasing.

End-Use Insights

The manufacturing segment held the largest X-ray inspection system market share in 2024. It is witnessing growth due to its extensive reliance on non-destructive testing for quality assurance, defect detection, and process optimization. Industries such as automotive, electronics, and food and beverages heavily rely on tomographic solutions to maintain production standards and regulatory compliance, solidifying manufacturing's dominate market position. For instance, GE measurement and control introduced advanced X-ray systems for robotic inspection on manufacturing lines, improving quality control in 2024.

Meanwhile, the aerospace segment is anticipated to grow at a remarkable CAGR between 2025 and 2034 due to the increasing need for the precision inspection of high-value components, complex assemblies, and composite materials. As global aviation demand rises and safety regulations become more stringent, the adoption of advanced inspection technologies in aerospace is accelerating rapidly, marking it as a key growth frontier in the market. For instance, in 2024, Nikon Metrology unveiled its latest CT scan system, optimized for inspecting turbine blades and aerospace composites, boosting safety and performance standards.

Regional Insights

What is the U.S. X-Ray Inspection System Market Size?

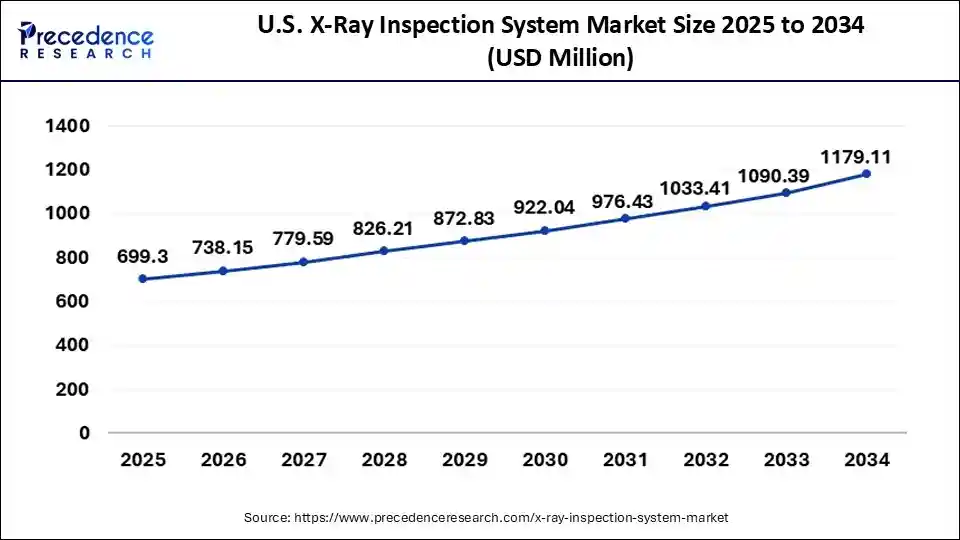

The U.S. X-ray inspection system market size is exhibited at USD 699.3 million in 2025 and is projected to be worth around USD 1,246.67 million by 2035, growing at a CAGR of 5.95% from 2026 to 2035.

North America: U.S. X-Ray Inspection System Market Trends

North America dominated the X-ray inspection system market in the year 2024. The growth of the region is due to a strong industrial base, advanced healthcare infrastructure, and consistent technological innovation. The region benefits from the early adoption of cutting-edge inspection technologies, stringent regulatory standards, and a high concentration of key market players across sectors such as defense, electronics, and medical imaging. The key market player in this region U.S., remains the primary contributor, backed by its advanced industrial infrastructure and strong focus on technological innovation.

- In August 2024, Varex Imaging Corporation expanded its range of digital X-ray detectors with AI-powered capabilities, enhancing image quality and speeding up defect recognition in manufacturing processes.

The U.S. stringent quality control regulations and increasing security needs, several technological advancements, and the widespread adoption of digital X-ray technology over older film-based methods. The integration of AI and machine learning is enhancing inspection accuracy and automation, while the rising demand for 3D imaging addresses the need for comprehensive quality control of complex parts.

Asia Pacific: India X-Ray Inspection System Market Trends

Asia Pacific is estimated to expand the fastest CAGR in the X-ray inspection system market between 2025 and 2034, driven by rapid industrialization, expanding manufacturing capabilities, and increasing investment in quality control and safety standards. Countries like China, Japan, South Korea, and India are at the forefront of this growth, leveraging inspection systems across self-propelled, electronics, food processing, and pharmaceutical industries. It has been recently observed that some strong government initiatives made in China policy were booming the electronics sector and further accelerating the growth of the market.

- In March 2024, Omron Corporation developed three modules of CT scan automated X-ray inspection systems that enable industry-leading high-speed 3D inspection.

The Indian X-ray inspection system market is driven by increased focus on quality control and rising consumer awareness of product safety. The shift towards advanced digital X-ray technologies, with AI and 3D imaging gaining traction across sectors like ‘'Make in India'' and stricter regulatory standards, is further propelling market adoption.

- In July 2024, Siemens Healthineers local production launched the local production of the Multix Impact E Digital X-ray machine in India. The floor-mounted system, manufactured in Bengaluru, aims to increase access to patient care and supports the government's "Make in India" initiative. (https://www.siemens-healthineers.com)

Europe Growing at a Notable Pace

Europe has been witnessing notable growth in the global X-ray inspection system market but is considered a developing region compared to North America and Asia-Pacific. Germany, France, and the UK are key contributors, with an emphasis on automotive, aerospace, and food safety applications. Europe is also actively investing in sustainability and energy-efficient technologies, impacting the development of innovative x-ray systems. Emphasis on automation, sustainability, and quality assurance, combined with supportive government policies and a focus on research and development, continues to propel the region's market forward. Some leading companies in this region are leading companies include Bosello High Technology srl, YXLON International, and Smiths Detection.

Europe: Germany X-Ray Inspection System Market Trends

Germany's steady growth is driven by the Industry 4.0 initiative, strict quality standards, and advanced industrial sectors. The integration of AI for automation and enhanced defect detection, and the growing demand for 3D X-ray CT systems for complex components in the automotive and electronics industries.

How is the Opportunistic Rise of Latin America in the X-Ray Inspection System Market?

Latin America is witnessing an opportunistic rise in the market due to increasing industrial automation, expanding food and pharmaceutical manufacturing, and growing logistics and e-commerce activities. Companies are investing in advanced X-ray systems for quality control, contaminant detection, and regulatory compliance, particularly in emerging markets like Brazil. Additionally, the adoption of portable and integrated inspection solutions is creating new opportunities for vendors to expand their presence across the region.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) presents immense opportunities for the X-ray inspection systems market due to rapid industrialization, growth in food and pharmaceutical manufacturing, and expanding logistics and e-commerce sectors. Increasing focus on regulatory compliance, quality assurance, and adoption of portable and integrated inspection technologies is creating strong demand for advanced X-ray solutions, offering growth potential for both global and regional vendors.

Worldwide Product Highlights

| Country | Company | Product |

| United Kingdom | Smith's Detection | Unveiled their latest HI-SCAN 6040 CTX with AI-powered threat recognition in 2024 |

| America | Varex Imaging | Launched an AI-integrated digital X-ray flat-panel detector for industrial inspection in 2023 |

| China | Nuctech | Deployed enhanced cargo inspection systems at Sanghai port in 2023. |

| Germany | YXLON international | Introduced the cheetah EVO plus for semiconductors in 2024 |

| Japan | Canon Medical | Released a next-generation 3D imagining on healthcare and precision diagnostics in 2024 |

Value Chain Analysis of the X-Ray Inspection System Market

- Research & Development (R&D) and Design

This foundational stage involves intensive research to develop new X-ray technologies, improve imaging resolution, integrate AI for automation, and design systems for specific industrial or medical applications.

Key players: Siemens Healthineers, Canon, Nikon, and Qure.ai (for medical applications). - Raw Material Sourcing & Component Manufacturing

This stage focuses on procuring high-quality raw materials and specialized components, such as X-ray tubes, detectors, sensors, control units, and robust housing materials.

Key players: Varian Medical Systems, Hamamatsu Photonics - System Assembly & Integration

System manufacturers integrate the various components, software, and housing into the final X-ray inspection machine.

Key contributors: Eagle Product Inspection, Mettler-Toledo, Bosch Packaging Technology, General Electric (GE) Inspection Technologies, Anritsu, and Nikon Metrology. - Distribution & Sales

The completed systems are sold through direct sales teams or a network of authorized distributors, resellers, and system integrators. - Installation, Training & Support Services

After the sale, specialized technicians install the systems at the client's facility and provide training to operators and maintenance personnel. - End-User Application & Operations

This final stage involves the actual use of the X-ray inspection systems by the end-users across various industries, including food processing, pharmaceuticals, automotive manufacturing, aerospace, electronics, and medical diagnostics.

Key contributors: Tyson Foods, TSMC

X-Ray Inspection System Market Companies

- North Star Imaging Inc.: North Star Imaging develops and manufactures a wide range of industrial X-ray inspection systems, including both 2D digital radiography and 3D computed tomography (CT).

- Nikon Metrology, Inc.: Nikon Metrology provides advanced industrial metrology and imaging solutions, including high-precision X-ray and CT inspection systems for a variety of sectors.

- Nordson Corporation: Nordson is a major supplier of inspection technology, offering X-ray inspection systems that emphasize higher defect detection.

- YXLON International GmbH: YXLON specializes in high-quality industrial X-ray and CT inspection systems, offering solutions for non-destructive testing and quality control across multiple industries.

- VJ Group, Inc.: VJ Group offers advanced X-ray inspection systems and services, with a focus on non-destructive testing and quality assurance solutions.

- Mettler Tledo International Inc.: Mettler Toledo contributes significantly to the food and pharmaceutical sectors of the X-ray inspection market with its product inspection solutions.

- Ametek, Inc.: Ametek's contribution comes from its vast portfolio of advanced electromechanical devices and analytical instruments, which includes components and systems used in X-ray technology.

- Viscom AG: Viscom AG is a German-based company that provides a comprehensive range of automated optical and X-ray inspection systems, primarily for the electronics manufacturing industry.

- ViTrox Corporation Berhad: ViTrox is a key player in the electronics inspection market, providing a range of automated vision inspection systems, including advanced X-ray inspection solutions.

- Test Research, Inc. (TRI): TRI develops and manufactures automated test and inspection systems for the electronics manufacturing industry, including advanced 3D X-ray inspection.

Recent Developments

- In February 2025, Nordson announced plans to demonstrate state of the art optical, X-ray, and acoustic inspection systems at the IPC APEX Expo, featuring its Nordson Intelligence ecosystem with advanced machine learning and AI capabilities. The demonstration will include integrated SPC solutions that support machine and factory-level quality reporting and analytics.(Source- https://www.nordson.com/)

- In March 2025, the X-ray inspection system market is projected to grow at a very high rate due to the adoption of high-end technologies.

In February 2024, Metler Toledo designed for food and pharmaceutical industries; this system can inspect up to 300 products per minute and detect contaminations.

Segments Covered in the Report

By Technology

- Digital Imaging

- Film-based imaging

By Dimension

- 2D

- 3D

By End Use

- Manufacturing

- Oil and Gas

- Aerospace

- Automotive

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting