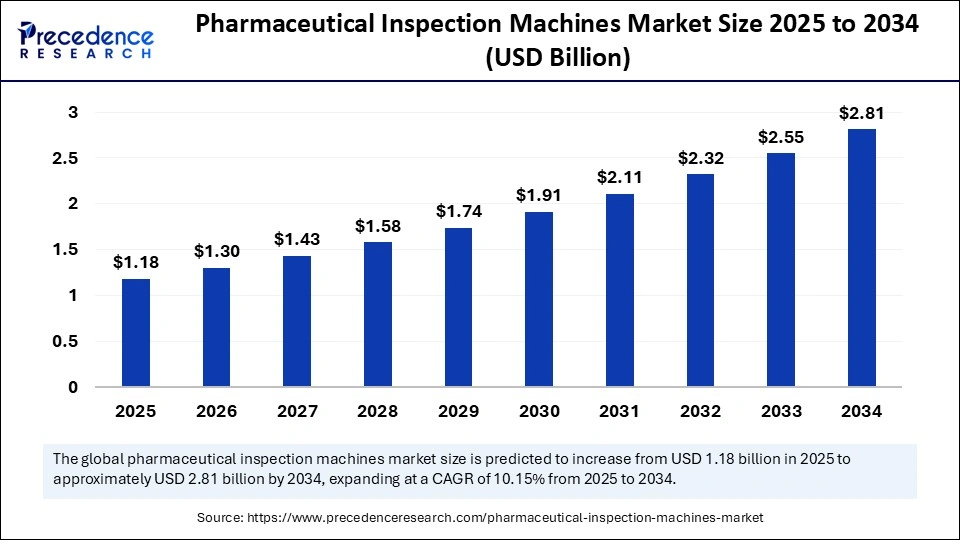

What is the Pharmaceutical Inspection Machines Market Size?

The global pharmaceutical inspection machines market size accounted for USD 1.18 billion in 2025 and is predicted to increase from USD 1.30 billion in 2026 to approximately USD 2.81 billion by 2034, expanding at a CAGR of 10.15% from 2025 to 2034. This market is growing as demand for automated quality control increases to ensure product safety, accuracy, and compliance with strict regulatory standards.

Market Highlights

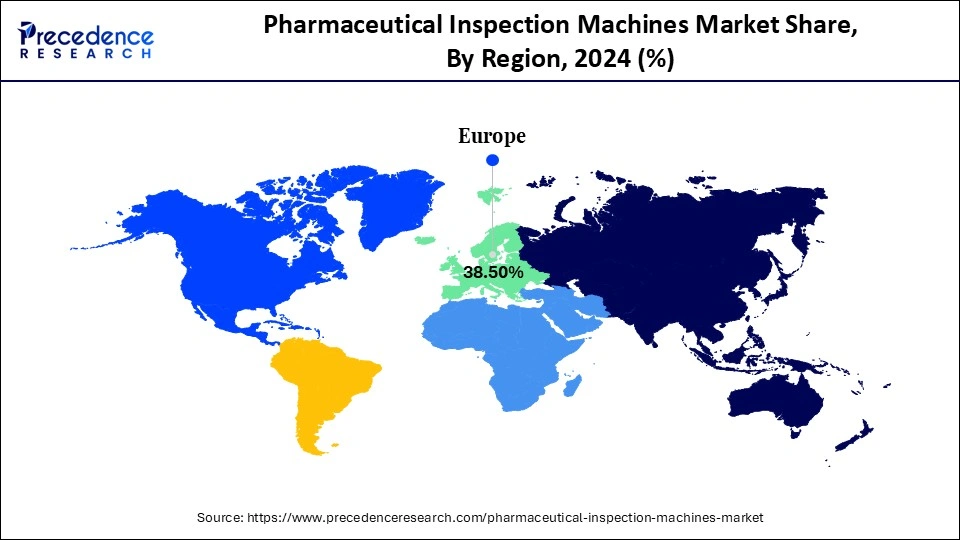

- Europe dominated the market, holding the largest market share of 38.50% in 2024.

- The Asia Pacific is expected to expand at the fastest CAGR of 8% between 2025 and 2034.

- By product type, the vial inspection machines segment held the major market share of 37.8% in 2024.

- By product type, the syringe inspection machines segment is expected to grow at a remarkable CAGR of 6.9% from 2025 to 2034.

- By technology, the automated vision inspection segment captured the biggest market share of 40.4% in 2024.

- By technology, the X-ray inspection segment is growing at a notable CAGR of 7.1% between 2025 and 2034.

- By application, the injectable product segment contributed the highest market share of 45.3% in 2024.

- By application, the lyophilized products are set to grow at a remarkable share of 7.4% CAGR between 2025 and 2034.

- By operation mode, the automatic segment accounted for the biggest market share of 58.4% in 2024.

- By operation mode, the manuals segment is expected to expand at a strong CAGR of 7.1% between 2025 and 2034.

Market Overview

Ensuring Perfection: The Rise of Pharmaceutical Inspection Machines

The pharmaceutical inspection machines market is witnessing steady growth, driven by the growing demand for high-quality, pure pharmaceutical products. Stricter regulatory compliance requirements and increased automation in pharmaceutical manufacturing are driving market adoption. Further driving market expansion are developments in vision inspection technology and the increasing emphasis on lowering human error.

Case Study: Syntegon Technology Advances AI-Based Inspection

In 2025, Syntegon Technology launched an AI-powered visual inspection system that improved defect-detection accuracy and reduced human error. By using deep learning, the system quickly identified micro-defects and contaminants, improving quality control and compliance. This innovation set a new benchmark for automation and reliability in the pharmaceutical inspection machines market.

Pharmaceutical Inspection Machines Market Outlook

As businesses prioritize accuracy, safety, and compliance in drug manufacturing, the market for pharmaceutical inspection machines is expanding quickly. Automated inspection systems have become more popular due to stringent regulations and the growing demand for high-quality medications. To maintain product integrity and patient safety, these devices help identify flaws, contamination, and labelling errors. Additionally, the industry is becoming more efficient and reliable as AI and vision-based systems become increasingly widespread.

To lessen their impact on the environment, manufacturers are concentrating on eco-friendly designs and energy-efficient inspection equipment. Using recyclable materials to reduce production waste and maximize power usage are examples of sustainable practices. Additionally, businesses are adopting smart technologies for predictive maintenance, reducing resource waste and machine downtime. This green change aligns with the global movement to produce pharmaceuticals in a more responsible, cleaner manner.

With new companies bringing AI robotics and data analytics-based innovations to the pharmaceutical inspection machines market, the startup ecosystem is expanding. Startups are developing compact, reasonably priced, and intelligent inspection systems for small- and mid-sized pharmaceutical companies. For quicker scalability and technology integration, many are also working with well-known manufacturers. Through automation, customization, and digital intelligence, these new businesses are bringing new life to the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.18 Billion |

| Market Size in 2026 | USD 1.30 Billion |

| Market Size by 2034 | USD 2.81 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.15% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Technology, Application, Operation Mode, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Emerging Opportunities in the Pharmaceutical Inspection Machines Market

| Opportunities | Description | Drivers & Market Impact |

| Advanced AI & ML Integration | Vision systems powered by AI and ML for enhanced, real-time defect detection and measurement, surpassing human capabilities | Higher precision, reduced false rejections, and efficiency in inspecting complex drug formulations. |

| Full Automation Adoption | Shift towards fully automated, high-throughput systems that minimize human intervention and contamination risks. | Optimized production, lower operational costs, compliance with strict regulations, and superior throughput |

| Biopharma & Injectable Room | The expanding market for biologics, vaccines, and prefilled syringes requires specialized inspection and advanced leak detection systems. | Vital for ensuring the integrity of high-value, sensitive, and patient-friendly injectable formats. |

| Serialization & Track and Trace | Growing government mandates for serialization and end-to-end traceability of drugs to combat counterfeiting | Ensures supply chain integrity, builds patient trust, and ensures regulatory compliance. |

| Advanced Vision Technology | Investment in state-of-the-art 3D vision and high-resolution imaging to detect minute, intricate defects in products and packaging | Guarantees with the highest quality standards for high-value products, ensuring that defects invisible to the human eye are identified. |

Pharmaceutical Inspection Machines Market Segmental Insights

Product Type Insights

The vial inspection machines segment dominated the pharmaceutical inspection machines market in 2024, with a 37.8% share, driven by increased manufacturing of biologics, vaccines, and injectable medications, all of which require precise packaging and contamination-free processing. The use of advanced automated vial inspection systems with AI-based defect detection abilities by pharmaceutical manufacturers has been reinforced by increased regulatory scrutiny.

Syringe inspection machines are the fastest-growing segment of the pharmaceutical inspection machines industry, with a 6.9% CAGR, driven by the growing use of prefilled syringes for convenient, safe medication administration. The use of automated inspection technologies that can detect fill-level irregularities, particulate matter, and glass cracks has grown in popularity, enhancing syringe manufacturing quality assurance.

Ampoule inspection machines are a notable segment of the pharmaceutical inspection machines market, driven by the rising production of ampoule-based injectables in developing nations and the growing need for accurate visual and leak-detection solutions for small-volume glass containers.

Technology Insights

The automated vision inspection segment is dominating the pharmaceutical inspection machines market, with a 40.4% share, driven by its ability to detect defects quickly and precisely. Manufacturers are replacing manual processes with automated visual inspection solutions because these AI- and machine-vision-powered systems ensure superior product quality and compliance with strict pharmaceutical standards.

X-ray inspection is the fastest-growing segment of the pharmaceutical inspection machines industry, with a 7.1% CAGR, driven by internal flaws, foreign particles, and fill inconsistencies that optical systems cannot detect. High-value biologics and complex drug formulations that require deep, precise inspection are increasingly being used with technology.

Leak detection is a notable segment of the pharmaceutical inspection machines sector, driven by the increasing demand for sterile, airtight packaging of injectable drugs and parenteral formulations. This demand is rising because manufacturers must ensure that every container maintains its integrity throughout storage, transport, and administration. Leak detection systems help identify micro leaks, seal weaknesses, and packaging defects that could compromise sterility or reduce product safety. These systems are especially important for high-value biologics, vaccines, and sensitive formulations that require strict control to prevent contamination.

Application Insights

The injectable products segment is dominating the pharmaceutical inspection machines market, with a 45.3% share, driven by the growing need for sterile injectable vaccines and biologics. Automated injectable inspection systems support regulatory compliance and manufacturing efficiency by ensuring production is free of contamination and defects.

Lyophilized products are the fastest-growing in the pharmaceutical inspection machines sector, with a 7.4% CAGR, driven by inspection equipment that can identify particulate matter and seal flaws in intricate formulations, ensuring products are free of contamination and defects.

Tablets & capsules are a notable segment of the pharmaceutical inspection machines market, supported by the ongoing need for solid dosage inspection to ensure product safety, uniformity, and consistency. In tablet manufacturing facilities, the use of optical and weight-based inspection equipment has been steadily increasing. Furthermore, the use of advanced vision systems is being encouraged by the increasing demand for high-speed inspection lines.

Operation Mode Insights

Automatic segment is dominating the pharmaceutical inspection machines market by holding a share of 58.4% as pharmaceutical companies are increasingly using automation to increase production speed, reduce human error, and maintain uniform quality control across large-scale operations. Inspection accuracy and throughput are being streamlined by the combination of robotics, AI, and machine learning. Additionally, the adoption of fully automated systems is being driven by rising investments in predictive maintenance and smart factory infrastructure.

Manuals are the fastest-growing segment in the pharmaceutical inspection machines sector, with a 7.1% CAGR, driven by their continued use in specialized products where flexibility and visual inspection are still required, as well as in small-scale pharmaceutical setups. Lower setup costs and greater flexibility for specialized or brief production runs are advantages for this segment. Additionally, training initiatives and the application of assistive AI tools are enhancing the accuracy of manual inspections.

The semi-automatic is a notable segment in the pharmaceutical inspection machines market. Serving mid-sized producers looking to strike a balance between cost containment and automation effectiveness. These systems are perfect for transitioning businesses because they are scalable. Because they offer flexibility and operational efficiency, the demand for semi-automated solutions is anticipated to stay steady.

Pharmaceutical Inspection Machines MarketRegional Insights

The Europe pharmaceutical inspection machines market size has grown strongly in recent years. It will grow from USD 454.30 million in 2025 to USD 1,083.26 million in 2034, expanding at a compound annual growth rate (CAGR) of 8.41% between 2025 and 2034.

What Made Europe Dominate the Pharmaceutical Inspection Machines Industry in 2024?

Europe is dominating the pharmaceutical inspection machines market, holding a 38.5% share, driven by strict legal requirements, cutting-edge production facilities, and the widespread use of automated inspection systems to meet quality and safety standards. The regions continued market leadership is supported by its emphasis on innovation and compliance. Europe dominance has also been cemented by the presence of top pharmaceutical manufacturers and R&D investments.

How is Germany Transforming the Pharmaceutical Inspection Machines Market?

Germany leads the market with its early adoption of AI-driven inspection technologies and robust pharmaceutical manufacturing base. The country benefits from strong industrial capabilities, well-established production facilities, and a skilled workforce that supports rapid integration of advanced inspection tools. German manufacturers have been early users of machine learning and computer vision systems that improve detection speed, reduce manual errors, and enhance overall product consistency across high-volume operations. Inspection procedures are being transformed by the nations emphasis on automation and precision engineering, which is improving accuracy efforts with technology providers and supportive government initiatives.

Asia Pacific is the fastest-growing region in the pharmaceutical inspection machines market, with a CAGR of 8.0%, driven by early adoption of AI-driven inspection technologies and a robust pharmaceutical manufacturing base. Inspection procedures are being transformed by the nation emphasis on automation and precision engineering, which is improving accuracy and productivity throughout production lines. Innovation is being fueled by cooperative efforts with technology providers and supportive government initiatives.

India Market Trends

India is experiencing growth driven by programs such as the Ayushman Bharat Digital Mission and the rapid adoption of telemedicine. Hospitals are using AI to improve accessibility and efficiency through robotic surgery, remote care, and diagnostics. Partnerships between tech companies, hospitals, and startups are revolutionizing patient care and individualized treatment. The nations healthcare disparity is also being addressed by the expanding use of AI in smaller cities.

The Middle East is rapidly emerging as a leader in improving patient outcomes; governments are investing in smart health infrastructure, predictive analytics, and digital hospitals. AI is being used in hospitals for virtual consultations, efficient resource management, and precision medicine. The area is developing into a center for cutting-edge medical technology thanks to strong national visions that prioritize innovation.

UAE Pharmaceutical Inspection Machines Market Trends

The UAE is becoming a regional leader in line with its objective of becoming a world leader in digital health. AI is being used for data-driven decision-making, robotic surgery, and diagnostics in smart hospitals in Dubai and Abu Dhabi. The nation is redefining medical innovation through international collaborations and national AI initiatives. The UAE is setting new benchmarks for intelligent healthcare delivery thanks to ongoing investments in technology and research.

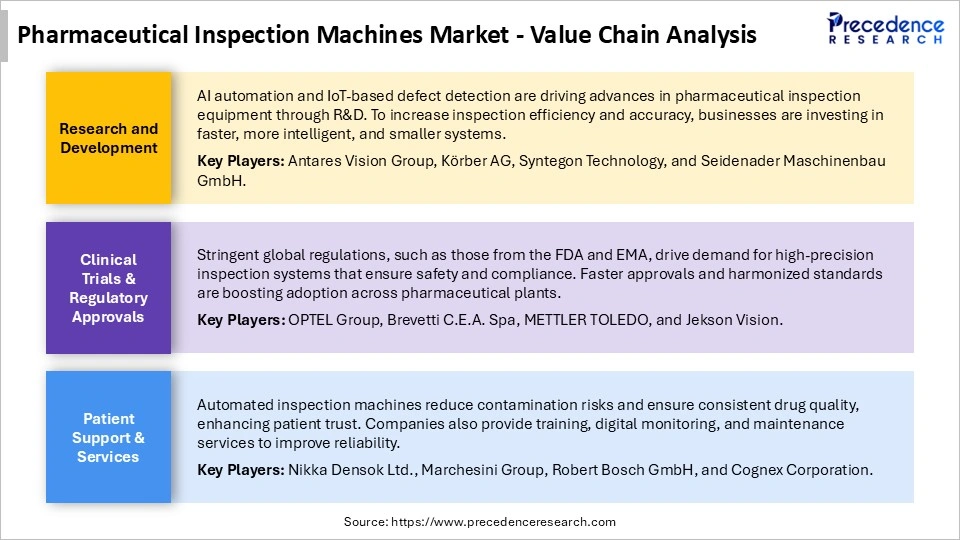

Pharmaceutical Inspection Machines Market Value Chain

Pharmaceutical Inspection Machines Market Companies

A global provider of integrated pharmaceutical manufacturing solutions, offering equipment for capsules, solid dosage production, and inspection. The company recently expanded its U.S. capsule manufacturing footprint to strengthen supply reliability and regional capacity.

Specialists in high-precision pharmaceutical inspection systems for vials, ampoules, and syringes. The company increasingly integrates AI and deep learning algorithms to enhance defect-detection accuracy and regulatory compliance.

A global leader in machine vision systems used to automate inspection, identification, and quality checks in pharmaceutical production lines. Its AI-powered vision tools detect defects, verify packaging, and support serialization processes.

Provides end-to-end product traceability and quality-inspection solutions across the pharmaceutical supply chain. Its platforms integrate AI, data management, and vision technology for serialization, aggregation, and regulatory compliance.

A major provider of analytical instruments, laboratory equipment, and inspection technologies that support drug development and pharmaceutical quality assurance. Its systems are widely used for purity testing, contaminant detection, and process analytics.

Manufactures precision instruments, including checkweighers, metal detectors, and vision inspection systems for industrial and laboratory settings. The company plays a key role in ensuring packaging integrity and measurement accuracy.

A global automation leader offering sensing, control, and machine vision technologies used to enhance pharmaceutical inspection and production efficiency. Its systems support defect detection, labeling verification, and high-speed automation.

Develops automated visual inspection machines for tablets, capsules, softgels, and similar solid dosage forms. Sensum systems provide 360-degree imaging for detecting shape, surface, and color defects at high throughput.

The inspection machinery division of Eisai focuses on advanced visual inspection systems for injectable products. Its solutions emphasize reliability, precision, and compliance with global quality standards.

A major Chinese supplier of pharmaceutical manufacturing equipment, offering freeze-drying systems, filling lines, and inspection solutions. The company provides integrated engineering and automation support for sterile drug production.

Recent Developments

- In December 2024, ACG Inspection launched its Life Science Cloud and AI-powered inspection solutions, enabling pharmaceutical manufacturers to gain deeper insights, traceability, and quality control access to their production lines.(Source: https://www.business-standard.com)

- In September 2025, ACG Engineering announced it would showcase its AI-powered vision inspection systems and next-generation serialization/inspection machine at Pharma Pro & Pack 2025 in Hyderabad.(Source: https://whattheythink.com)

- In May 2025, Jekson Vision unveiled its next-generation vision inspection, track & trace, and IoT solutions for pharmaceutical compliance at the Pharm Intech/Ip+ Ma exhibition.(Source: https://jeksonvision.com)

Pharmaceutical Inspection Machines MarketSegments Covered in the Report

By Product Type

- Ampoule Inspection Machines

- Vial Inspection Machines

- Syringe Inspection Machines

- Bottle Inspection Machines

- Blister Pack Inspection Machines

- Others (Cartridges, IV Bags)

By Technology

- Visual Inspection

- Automated Vision Inspection

- X-ray Inspection

- Leak Detection

- High Voltage Leak Detection (HVLD)

By Application

- Injectable Products

- Liquid Dosage Forms

- Lyophilized Products

- Tablets & Capsules

By Operation Mode

- Automatic

- Semi-automatic

- Manual

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting