What is Diagnostic Testing Market Size?

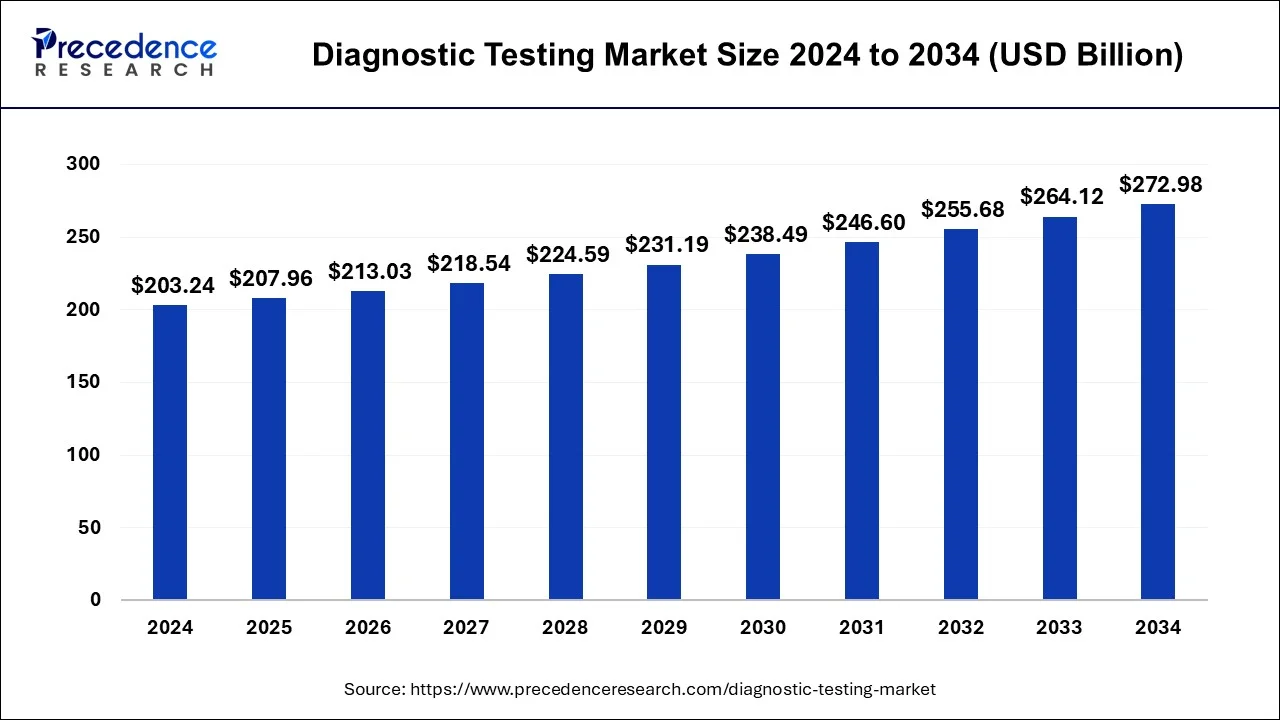

The global diagnostic testing market size was calculated at USD 207.96 billion in 2025, grew to USD 213.03 billion in 2026, and is predicted to surpass around USD 281.56 billion by 2035, poised to grow at a CAGR of 3.08% between 2026 and 2035.

Market Highlights

- North America led the global market with the highest market share in 2025.

- By approach, the in-vitro diagnostic instrument segment has held the highest market share in 2025.

- By application, the cardiology segment captured the biggest market share in 2025.

- By end user, the hospitals segment registered the maximum market share in 2025.

What is the Role of AI in the Diagnostic Testing Market?

By identifying patterns and correlations within the data, artificial intelligence (AI) improves diagnostic accuracy and allows personalized treatment planning. This is perfect example of how AI predicts patient outcomes and guides clinicians to enhance patient care quality. Application of AI across many human machine interfaces, addressing areas like focal & non-focal disorders, Alzheimer's disease, seizures, emotions, human attention, leukemia, abnormal heartbeats, and electrocardiogram rhythms.

AI algorithms can analyze a high amount of data to assist medical professionals in making more informed decisions about care. AI is transforming disease diagnosis in burn and wound management, significantly speeding up the process and improving accuracy.

Market Overview

Diagnostic tests are the kinds of medical examinations carried out to assist in the recognition or diagnosis of any illness. These tests are essential for the management, monitoring, and prevention of any disease. These tests help to improve patient treatment, consumer safety, and healthcare costs. According to the Non-communicable Illnesses Key Facts report from the World Health Organization (WHO), chronic diseases would account for about 41 million deaths annually by April 2021, or 71 percent of all fatalities globally. As a result, diagnostic tests have demonstrated value in the management of chronic illness conditions as well as in the prevention, identification, and diagnosis of disease. Clinical diagnostics open up new possibilities for early prevention and intervention by identifying individual risk factors and early warning indications. As a result, it is anticipated that the entire market would continue to grow as the frequency of chronic illnesses rises.

Due to the COVID-19 pandemic, lab testing has increased, which has caused the demand to rise even faster to keep up with the suspected COVID-19 cases. The COVID-19 test count increased dramatically worldwide, from 760,441 tests in September 2020 to 964,792 new tests in October 2020, according to the Atlantic Monthly Group. As a result, the increasing number of tests due to the ongoing increase in patients and government financing are the factors that are anticipated to increase demand for COVID-19 test kits and fuel the overall market's exponential expansion.

Diagnostic Testing Market Growth Factors

Use of Point of Care Diagnostic Products

The market is anticipated to be driven by the rising popularity of decentralised health systems. Additionally, it is anticipated that the market would grow during the forecast period due to the adoption of new breakthroughs and technical improvements in the sector by major market players. In the upcoming years, growth in the point of care diagnostics market is anticipated as a result of these factors.

Globally, the ageing population is increasing the chance of developing a wide range of illnesses, including diabetes, cancer, cardiovascular disease, obesity, and neurological problems. A UN research estimates that 727 million people worldwide will be 65 years of age or older in 2020. Additionally, it is anticipated that by 2050, there will be twice as many people aged 80 and older than there are today, or more than 1.5 billion people. The forecasted increase in the worldwide geriatric population over the course of the projected period is likely to have a significant influence on the market.

Market Trends

- Regulatory support and government initiatives

- Emergence of point-of-care testing

- Rising awareness among patients about early diagnosis and preventive healthcare

- Growing healthcare expenditure

- Technological advancements

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 207.96 Billion |

| Market Size in 2026 | USD 213.03 Billion |

| Market Size by 2035 | USD 281.56 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.08% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, Application, Approach, Solution, Technology, Mode of Testing, Sample Type, Testing Type, Age, Distribution Channel, End User and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Technological innovation in molecular diagnostics:

Molecular diagnostics also known as molecular pathology, involves taking DNA or RNA, the unique genetic code found in our cells, and analyzing the sequences for red flags that can pinpoint the potential emergence of a specific disease. A range of methods like electron microscopy, culture, and pathogen genome detection by polymerase chain reaction (PCR) are used. Molecular diagnostics are increasingly used to guide patient management, from diagnosis to treatment, mainly in the field of cancer, infectious disease, and congenital abnormalities.

Restraint

High cost of advanced diagnostic tests:

The result of diagnostic tests may include additional testing or frequent follow up, and the patient may incur significant cost, risk, and discomfort at the time of follow up procedures. Higher costs are may unrelated to health outcomes in the other words, healthcare resources are may spent inefficiently.

Opportunity

Integration of digital health technologies:

The benefits of digital health technologies include increased operation efficiency at health facilities, like hospitals, enhanced patient health outcomes through personalized treatment plans, decreased healthcare costs for both patients and providers, and expanded access to health care to historically marginalized communities.

Segment Insights

Type Insights

Clinical diagnostic segment held a dominant presence in the diagnostic testing market in 2024.

- In December 2024, cobas Mass Spec solution, bringing mass spectrometry to the routine clinical lab was launched by Roche. Clinical mass spectrometry testing offers unparalleled sensitivity and specificity, providing clinicians with additional diagnostic insights.

Roche transforms mass spectrometry diagnostics with launch of cobas Mass Spec solution

Home diagnostic segment is expected to grow at the fastest rate in the market during the forecast period of 2026 to 2035

Application Insights

The cardiology segment accounted for a considerable share of the market in 2024.

- In July 2025, the launch of the Philips ECG AI Marketplace, a platform that give cardiac care teams access to multiple vendor offerings all in one central location to help clinicians manage and implement AI powered diagnostic tools more easily was announced by Royal Philips, a global leader in health technology.

Philips Launches ECG AI Marketplace to Enhance Early

The neurology segment is projected to experience the highest growth rate in the market between 2026 to 2035

Approach Insights

The molecular diagnostic instrument segment led the diagnostic testing market.

The point of care testing instrument segment is set to experience the fastest rate of the market growth from 2026 to 2035

- In January 2023, the launch of Cippoint, a point of care testing for multiple health conditions was announced by Mumbai based pharma firm Cipla.

Cipla launches point-of-care testing device for multiple health conditions

Solution Insights

The products segment registered its dominance over the market in 2024. The benefits of clinical diagnostic products include these products are used in advancing medical research and development, play an important role in monitoring the progress and effectiveness of treatments, ability to improve personalized medicines by using human samples, can offer disease screening methods, and accurate and early diagnosis.

The services segment is anticipated to grow with the highest CAGR in the market during the studied years. Importance of diagnostic services include the tools empower the health workforce in the identification of diseases or health conditions. They allow initiation of treatments in order to avoid further complications and costly treatments for patients.

Technology Insights

The immunoassay-based segment dominated the diagnostic testing market. Immunoassay is a highly selective bioanalytical method that measures the presence or concentration of analytes in a solution using an antibody or an antigen as a biorecognition agent. Immunoassays are highly used in various important areas of pharmaceutical analysis like diagnosis of disease, therapeutic drug monitoring, and clinical pharmacokinetic and bioequivalence studies in drug discovery and pharmaceutical industries.

The next generation sequencing segment is projected to expand rapidly in the market in the coming years. Next generation sequencing (NGS) provides a higher level of data resolution. Researchers can detect genetic variations, structural rearrangements, and mutations at a finer scale.

Mode of Testing Insights

The prescription-based testing segment maintained a leading position in the diagnostic testing market in 2024. Prescription based testing benefits include confirming that the prescription complies with current medical guidelines and laws, identifying potential drug interactions that may be harmful, and checking accuracy of dosages and medication instructions.

The OTC-testing segment is predicted to witness significant growth in the market over the forecast period. OTC medications help people to relieve many symptoms and to cure some simple diseases easily and without seeing a doctor. Safe and effective use of these medications needs responsibility, knowledge, and common sense.

Sample Type Insights

The blood segment captured a significant portion of the diagnostic testing market in 2024. A blood test is one of the most common tests healthcare providers use to monitor overall health or help diagnose medical conditions. Blood tests are used for preventive screening to assess patient's risk for conditions, diagnose disease and infection, and evaluate health status.

The saliva segment will gain a significant share of the market over the studied period of 2025 to 2034. Saliva is clinically informative, biological fluid, which is useful for prognosis, laboratory or clinical diagnosis, monitoring and management of patients with both oral and systemic diseases.

Testing Type Insights

The biochemistry segment enjoyed a prominent position in the market during 2024. Clinical biochemistry services are particularly critical for diagnosing, monitoring, anticipating, and employing many serious and life-threatening infections like liver, heart, kidney, and other.

The microbiology segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The benefits of microbiology tests in early diagnosis include rapid results, targeted treatment, and improved patient outcomes.

Age Insights

The adult & geriatric segment underwent notable growth in the market during 2024. The emergence of laboratory testing effectively used at primary healthcare level significantly improves diagnosis and treatment outcomes.

The pediatric segment is projected to experience the highest growth rate in the market between 2025 and 2034. Pediatric testing can help to reduce parent's anxiety by excluding a disease or can lead to a diagnostic label, thereby also facilitating acceptance of nonmedical treatments.

Distribution Channel Insights

The direct tenders segment held a dominant presence in the diagnostic testing market in 2024. The benefits of direct tenders include competitive pricing, innovation among bidders, selective & negotiated tendors improve the work and materials, and competitive bidding leads to cost effective solutions for projects, and structured & regulated procurement process.

The online sales segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Online sales benefits include global accessibility, feasibility to operate from anywhere, faster buying process, direct to consumer, data insights, customer convenience, create return customers, content marketing strategy, competitors, affordable, and more.

End-user Insights

The hospitals, diagnostic centers segment accounted for a considerable share of the market in 2024.

The homecare segment is projected to experience the highest growth rate in the market between 2025 and 2034.

- In July 2025, the benchmark for in-home medical care in the UAE with the launch of its advanced homecare services was redefined by Medicare Hospitals and Medical Centers, a premium healthcare provider under Aster DM Healthcare.

Medcare Launches UAE's Most Advanced Home Care Services - Biz Today

Regional Insights

The market for diagnostic tests is dominated by North America due to the region's growing elderly population. According to the Centers for Condition Control and Prevention (CDC), six out of ten individuals in the United States have at least one chronic disease, and four out of ten persons have two or more. The top causes of mortality and disability in the United States are chronic illnesses like cancer, heart disease, and diabetes, which also account for the majority of the USD 3.8 trillion in yearly health care expenses. As a result, there is now a greater need in the United States for better care that is managed effectively. Therefore, it is anticipated that the rising incidence of infectious and chronic illnesses as well as increased recognition of the importance of laboratory testing will drive market expansion in the nation.

Due to the availability of affordable diagnostic tests for chronic illnesses in the area, Asia-Pacific (APAC) is anticipated to have considerable growth during the forecast period of 2025 to 2034.

North America dominated the global diagnostic testing market in 2024.

- In December 2024, an expansion of fingertip blood collection and testing technologies for use by U.S. health systems and other large provider networks in settings like urgent cares, doctor offices, and other ambulatory care settings was announced by BD (Becton, Dickinson and Company), a leading global medical technology company.

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period. Rising awareness about early diagnosis and treatment, technological innovations in molecular diagnostics contributing the growth of the market in the Asia Pacific region.

- In April 2025, the two diagnostic tools the Gut Microbiome Test (GMT) and the Food Intolerance Test (FIT) as part of its move towards science-based digestive health management was launched by Sova Health, positioned as India's first full stack gut health company.

Diagnostic Testing Market Companies

- F-Hoffman La-Rcohe Ltd. (Switzerland)

- Danaher (US)

- BD (US)

- Thermo Fisher Scientific Inc. (US)

- ACON Laboratories Inc. (US)

- Hemosure, Inc. (US)

- MicroGen Diagnostics (US)

- Grifols, S.A (Spain)

- BODITECH MED INC. (South Korea)

- Chembio Diagnostic Systems, Inc. (US)

- Nanoentek (South Korea)

- DiaSorin S.p.A. (Italy)

- Bio-Rad Laboratories, Inc. (US)

- BIOMEDOMICS INC (US)

- EKF Diagnostics Holdings plc (UK)

- Siemens Healthcare GmbH (Germany)

- PerkinElmer Inc. (US)

- bioMérieux SA (France)

- ARKRAY USA, Inc. (US)

- Biohit Oyj (Finland)

- Quidel Corporation (US)

- Illumina, Inc. (US)

- Lamdagen Corporation (US)

- LifeSign LLC. (US)

- Medixbiochemica (Finaland)

- Nova Biomedical (US)

- Ortho Clinical Diagnostics (US)

- Sannuo Biosensing Co., Ltd. (US)

- STRECK (US)

- Sysmex Corporation (Japan)

Recent Developments

- In June 2025, Amazon Diagnostics, a new at home diagnostics service that allows customers to book lab tests, schedule, and track appointments, and access digital reports instantly from the Amazon app was launched by Amazon India. Amazon Diagnostics offers home sample collection in under 60 minutes and lab results in as less as 6 hours across 6 cities.

- In July 2025, the Anti-MCV (anti-mutated citrullinated vimentin) antibody test in India was launched by Agilus Diagnostics. Developed by Sebia, this advanced diagnostic tool significantly improves the early detection of rheumatoid arthritis (RA), especially in patients who test negative for conventional markers like anti-CCP and rheumatoid factor (RF). (Source: https://www.pharmabiz.com)

Segments Covered in the Report

By Type

- Clinical Diagnostic

- Home Diagnostic

By Application

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Gastroenterology

- Gynecology

- Odontology

- Others

By Approach

- Molecular Diagnostic Instrument

- In-Vitro Diagnostic Instrument

- Point Of Care Testing Instrument

By Solution

- Services

- Products

By Technology

- Immunoassay-Based

- PCR-Based

- Next-generation Sequencing

- Spectroscopy-Based

- Chromatography-Based

- Microfluidics

- Substrate Technology

- Others

By Mode of Testing

- Prescription Based Testing

- OTC Testing

By Sample Type

- Urine

- Saliva

- Blood

- Hair

- Sweat

- Others

By Testing Type

- Biochemistry

- Hematology

- Microbiology

- Histopathology

- Others

By Age

- Pediatric

- Adult & Geriatric

By Distribution Channel

- Direct Tenders

- Retail Sales

- Online Sales

By End User

- Hospitals, Diagnostic Center

- Research Labs and Institutes

- Research Institute

- Homecare

- Blood Banks

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting