What is the Fossil Fuels Market Size?

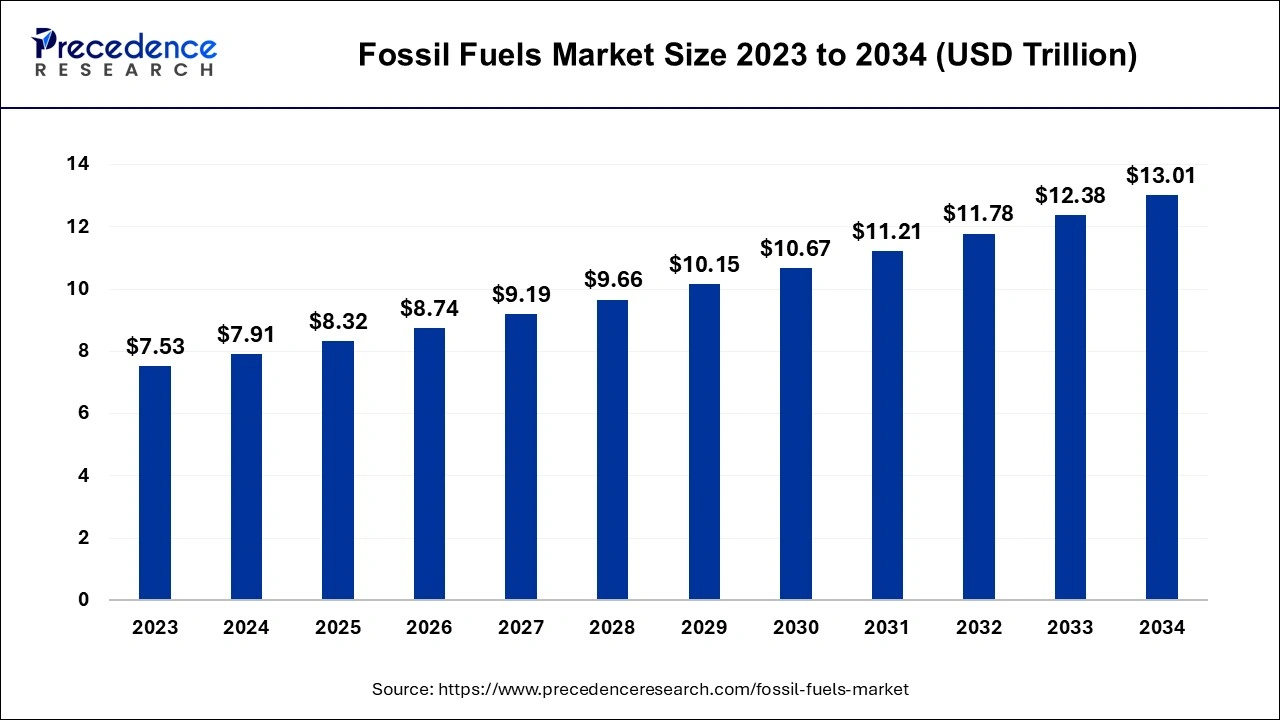

The global fossil fuels market size is estimated at USD 8.32 trillion in 2025 and is predicted to increase from USD 8.74 tillion in 2026 to approximately USD 13.62 trillion by 2035, growing at a CAGR of 5.05% between 2026 and 2035.

Fossil Fuels Market Key Takeaways

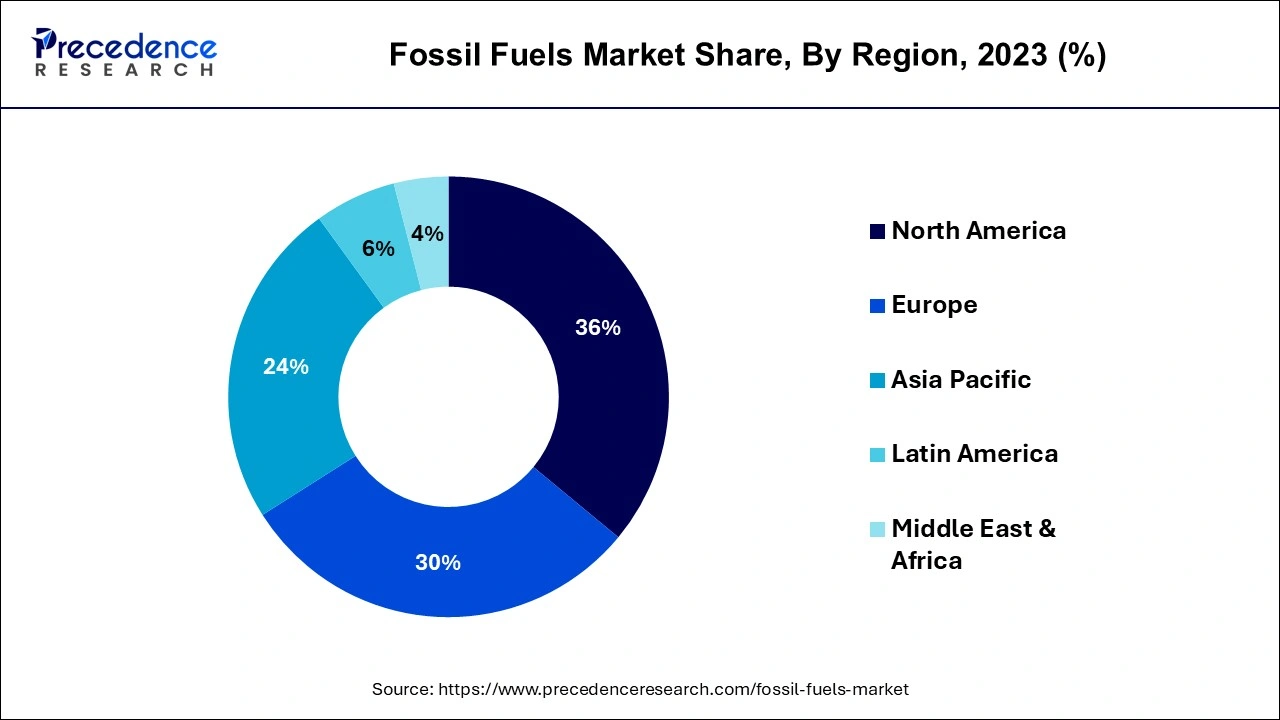

- North America contributed more than 36% of revenue share in 2025.

- Asia Pacific is estimated to expand the fastest CAGR between 2026 to 2035.

- By type, the crude oil segment has held the largest market share of 41% in 2025.

- By type, the natural gas segment is anticipated to grow at a remarkable CAGR of 7.4% between 2026 and 2035.

- By application, the industrial processes segment generated over 38% of revenue share in 2025.

- By application, the transportation segment is expected to expand at the fastest CAGR over the projected period.

- By end-user, the industrial segment had the largest market share of 49% in 2025.

- By end-user, the commercial segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Fossil fuels encompass hydrocarbon-based energy sources originating from ancient organic materials, such as plants and microorganisms, subjected to geological processes over eons. The primary fossil fuels include coal, crude oil, and natural gas, integral for electricity generation, transportation, industrial operations, and heating. Yet, the combustion of fossil fuels emits greenhouse gases, contributing to climate change, motivating a global transition towards cleaner, sustainable energy alternatives. These fuels are linked to environmental concerns, with applications spanning electricity generation, transportation, and industry, serving a diverse range of end users from households to commercial and transportation sectors.

Fossil Fuels Market Growth Factors

- Gasoline and diesel continue to dominate as the primary fuels for the majority of vehicles, with sustained demand driven by the transportation sector.

- Fossil fuels remain a fundamental energy source in fulfilling the increasing global energy demand.

- Power plants heavily depend on fossil fuels, notably coal, for the generation of electricity.

- A shift toward natural gas, a cleaner-burning fossil fuel, is witnessed for power generation.

- The growing emphasis on carbon offset programs and emissions trading creates opportunities for businesses to engage in carbon credit trading and develop carbon reduction projects.

- Firms specializing in advising organizations on transitioning from fossil fuels to cleaner energy sources can play a pivotal role in guiding the shift toward sustainability.

- Companies involved in repurposing waste products from fossil fuel industries, such as converting plastics to fuel, can tap into the circular economy concept and contribute to sustainability efforts.

- Adoption of energy-efficient technologies and practices to reduce consumption.

- Businesses can provide energy-efficient products and services.

- The development of a hydrogen economy presents business prospects in fuel cells and hydrogen production.

- Fossil fuels play an essential role in the industrial sector, particularly in manufacturing and chemical processes.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.32 Trillion |

| Market Size in 2026 | USD 8.74 Trillion |

| Market Size by 2035 | USD 13.62 Trillion |

| Growth Rate from 2026 to 2035 | CAGR of 5.05% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Global energy demand and transportation sector

Global energy demand is a paramount driver for the fossil fuels market. With the global population expanding and economies growing, there's an ever-increasing need for energy. Fossil fuels, being highly energy-dense, are sought-after sources to fulfill this escalating demand. They power electricity generation, heating, and various industrial processes. Emerging economies rely on fossil fuels to meet their energy needs, contributing significantly to market growth.

The transportation sector is another crucial factor propelling fossil fuel demand. Gasoline and diesel fuels power the majority of the world's vehicles, from automobiles to freight trucks and airplanes. As urbanization spreads and personal mobility becomes more accessible, the transportation industry continues to expand. Moreover, maritime and aviation sectors primarily rely on fossil fuels. The continued growth of the transportation sector, especially in emerging markets, ensures a steady demand for fossil fuels, further driving the market.

Restraint

Geopolitical instability and volatility in prices

Geopolitical tensions and instability can significantly hinder the fossil fuels market. Conflicts in major oil-producing regions, trade disputes, and sanctions can disrupt the supply chain, causing uncertainty in the market. Political instability in regions like the Middle East can lead to sudden supply disruptions or constraints, affecting global energy prices.

Moreover, geopolitical factors can influence energy policies and trade agreements, leading to fluctuations in supply and demand. Businesses and investors often face challenges when geopolitical events lead to uncertainty in energy markets, making long-term planning and investment in fossil fuel projects risky.

Price volatility is another critical restraint in the fossil fuels market. This inherent volatility can introduce uncertainty into energy markets, making it challenging for businesses, investors, and consumers to plan effectively and adapt to shifting economic and geopolitical conditions. Price volatility can deter investments in fossil fuel projects, making it challenging for the industry to plan for the long term and maintain stability. Additionally, as the world transitions toward cleaner energy sources, the fossil fuels market faces uncertainties in terms of future demand, which can exacerbate price instability.

Opportunity

Hydrogen economy and carbon capture & storage (CCS)

The hydrogen economy and carbon capture and storage (CCS) initiatives are paradoxically surging the demand for the fossil fuels market even as the world transitions toward cleaner energy sources. Firstly, the hydrogen economy relies on various types of hydrogen, including blue and green hydrogen. Blue hydrogen is produced from natural gas using CCS technologies to capture and store carbon emissions. As this process still involves natural gas, the demand for fossil fuel remains intact.

Similarly, green hydrogen, produced through renewable energy sources, necessitates significant energy input, often from conventional power sources, including fossil fuels. This dual demand for hydrogen has created a unique synergy with fossil fuels.

Moreover, CCS technologies are critical for reducing carbon emissions from industries heavily reliant on fossil fuels, such as power generation and heavy manufacturing. As governments and industries seek to meet carbon reduction targets, CCS projects present a compelling solution, resulting in sustained demand for fossil fuels. This unique interplay between cleaner energy initiatives and the fossil fuels market highlights the complex transition to a more sustainable energy landscape.

Impact of COVID-19

- The COVID-19 pandemic had a profound impact on the fossil fuels market. Lockdowns, travel restrictions, and economic slowdowns led to an unprecedented drop in global energy demand. With reduced industrial activity and transportation, oil consumption plummeted, causing oil prices to hit historic lows. This, in turn, disrupted investment in new oil projects and exploration.

- Natural gas demand also declined, particularly in the commercial and industrial sectors. Coal faced a similar decline in demand due to reduced electricity consumption and a shift towards cleaner energy sources.

- The pandemic further accelerated the transition towards renewable energy sources, as governments and businesses sought to build more resilient and sustainable energy systems. The fossil fuels industry faced challenges in terms of reduced investment, workforce disruptions, and lower profitability. However, the industry also adapted by implementing cost-saving measures and exploring opportunities in cleaner technologies, such as carbon capture and storage, to mitigate the long-term impact of the pandemic.

Segment Insights

Type Insights

According to the type, the crude oil segment has held 41% revenue share in 2023. Crude oil, a vital component of the fossil fuels market, is unrefined petroleum extracted from underground reservoirs. Despite the growing focus on renewable energy, crude oil maintains its significance. Recent trends show a shift toward cleaner extraction methods, like fracking and offshore drilling, and an increased emphasis on optimizing oil's energy efficiency. The market is also witnessing innovations in crude oil processing to reduce environmental impact and emissions, aligning with global efforts to combat climate change.

The natural gas segment is anticipated to expand at a significant CAGR of 7.4% during the projected period. Natural gas, primarily methane-based, holds a crucial role in the energy sector for its environmentally friendly combustion. Recent market trends reveal an increasing dependence on liquefied natural gas (LNG) for international trade, extending its global presence.

Additionally, natural gas applications have seen a surge, particularly in electricity generation, serving as a transitional fuel in the global transition towards cleaner and sustainable energy sources. Advancements in natural gas infrastructure and extraction methods continue to bolster its prominence in the ever-evolving fossil fuels market. Advancements in natural gas infrastructure and extraction techniques are contributing to its increasing prominence in the dynamic fossil fuels market.

Application Insights

Based on the application, the industrial processes segment held largest market share of 38% in 2023. In the fossil fuels market, industrial processes refer to the extensive use of these energy sources in manufacturing, chemicals, and heavy industries. These sectors rely on fossil fuels as a primary energy input, facilitating high-temperature heat generation, chemical reactions, and mechanical work. A prominent trend in industrial processes is the growing emphasis on energy efficiency and emissions reduction, pushing industries to explore cleaner technologies and sustainable practices while optimizing fossil fuel utilization.

On the other hand, the transportation segment is projected to grow at the fastest rate over the projected period. Within the fossil fuels market, the term "transportation" pertains to the application of gasoline and diesel fuels in diverse modes of conveyance, spanning automobiles, maritime vessels, and aircraft. Shift towards cleaner, more fuel-efficient vehicles, catalyzed by evolving regulations and changing consumer preferences. The adoption of electric and hybrid vehicles, in conjunction with the exploration of renewable fuels, is steadily growing. This transition presents a dual landscape for the fossil fuels industry, encompassing both challenges and opportunities as it adapts to these changing dynamics and the demand for greener alternatives.

End-user Insights

In 2023, the Industrial segment had the highest market share of 49% on the basis of the end user. Industrial end users in the fossil fuels market comprise diverse sectors like manufacturing, chemicals, and heavy industries. They heavily depend on fossil fuels, particularly natural gas and coal, to fuel operations, provide essential heat, and facilitate various industrial processes.

A prominent trend within this category is the increasing push towards cleaner and more efficient technologies. Industries are actively investing in measures aimed at enhancing energy efficiency, with a growing exploration of solutions like combined heat and power (CHP) systems, aimed at reducing carbon emissions and operational costs.

The commercial is anticipated to expand fastest over the projected period. The commercial sector encompasses businesses and institutions that rely on fossil fuels for heating, electricity, and transportation. A notable trend within this sector revolves around a shift towards heightened energy efficiency and sustainability. Commercial establishments are progressively embracing energy-efficient technologies and strategies, incorporating high-efficiency HVAC systems and lighting. Furthermore, there is a growing emphasis on transitioning to cleaner energy sources, aiming to reduce their dependence on fossil fuels to align with environmental objectives and drive down operational expenses.

Regional Insights

What is the U.S. Fossil Fuels Market Size?

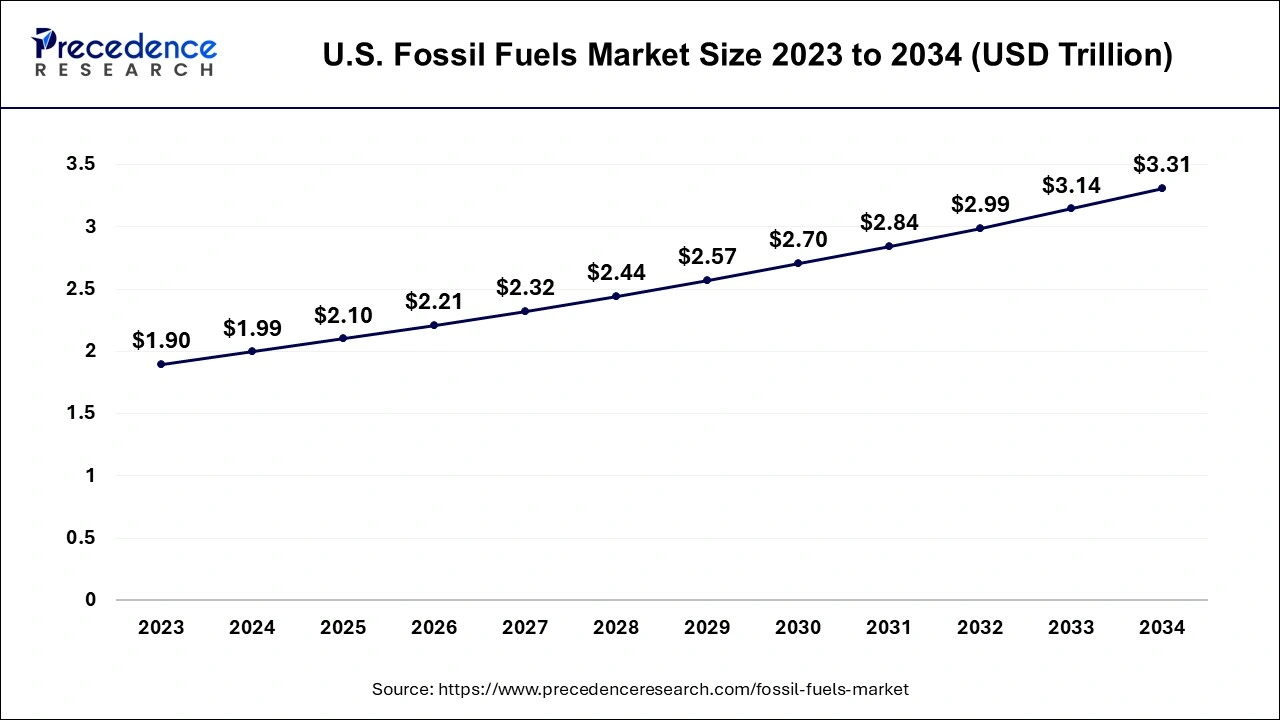

The U.S. fossil fuels market size is estimated at USD 2.10 trillion in 2025 and is expected to be worth around USD 3.47 trillion by 2035, at a CAGR of 5.15% from 2026 to 2035.

North America has held the largest revenue share of 36% in 2023. Many U.S. states are adopting ambitious renewable energy targets and gradually phasing out coal-fired power plants. This transition is motivated by dual factors, growing environmental concerns and the economic viability of renewable alternatives. In addition to this, the region is proactively directing investments into carbon capture and storage (CCS) technologies, aimed at mitigating emissions from pre-existing fossil fuel infrastructure. These initiatives underscore a collective commitment to bolster sustainability measures and reduce the environmental footprint within the North American fossil fuels industry.

U.S. Fossil Fuels Market Trends

The U.S. market is growing due to abundant domestic oil and natural gas reserves, advanced extraction technologies, and strong infrastructure. Rising energy demand from the industrial sector, coupled with supportive government policies and investments in carbon capture and efficiency improvements, further drives market expansion despite increasing adoption of renewable energy sources.

What Makes Asia Pacific the Fastest-Growing Region?

Asia Pacific is estimated to observe the fastest expansion. In Asia Pacific, the fossil fuels market is undergoing a significant upswing in energy demand, driven by the robust expansion of emerging economies in the area. Although there's a rising inclination towards renewable energy sources, coal retains its dominant position as a primary energy source, notably in nations such as China and India.

The region's energy security is notably impacted by geopolitical factors, largely attributable to its reliance on energy imports. Consequently, several countries are proactively exploring energy source diversification and investing in cleaner technologies to address environmental concerns and minimize their ecological impact.

India Fossil Fuels Market Trends

India's market is expanding due to rapid industrialization, growing energy demand, and reliance on coal and oil for power generation and transportation. Investments in exploration, infrastructure development, and domestic production, along with government initiatives to ensure energy security, are driving market growth, even as the country gradually explores cleaner technologies and renewable energy alternatives.

Europe: A Notably Growing Region

Europe is expected to grow at a notable rate over the forecast period due to ongoing energy transition strategies, investments in cleaner fossil technologies, and efforts to ensure energy security amid geopolitical uncertainties. Rising demand for natural gas, modernization of power infrastructure, and adoption of carbon capture and storage (CCS) solutions are also driving market expansion.

UK Fossil Fuels Market Trends

The market in the UK is expected to grow due to rising energy demand, investments in natural gas infrastructure, and efforts to balance energy security with the transition to cleaner sources. Government support for carbon capture technologies, modernization of power plants, and ongoing industrial and transportation energy needs further drive market growth.

Value Chain Analysis

- Resource Extraction

Fossil fuel extraction uses mining, drilling, offshore operations, and fracking to meet energy needs, impacting the environment.

Key players: ExxonMobil, Chevron, BP, and Shell. - Power Generation

Fossil fuel power plants convert coal, oil, or gas into steam or heat to drive turbines and generate electricity.

Key players: Duke Energy, RWE, Engie, and NTPC. - Distribution Network Management

Fossil fuel distribution optimizes delivery via pipelines, transport, and storage using monitoring and forecasting tools.

Key players: Kinder Morgan, Enbridge, TransCanada, and TotalEnergies.

Fossil Fuels Market Companies

- Chevron Corporation: Produces and distributes crude oil, natural gas, and refined petroleum products globally, serving energy, industrial, and transportation sectors with integrated upstream and downstream operations.

- BP PLC: Engages in oil and gas exploration, production, refining, and marketing, along with renewable energy initiatives, providing fuels, lubricants, and petrochemical products worldwide.

- TotalEnergies SE: Operates in oil, natural gas, and low-carbon energy sectors, offering fuels, lubricants, and electricity solutions while investing in sustainable energy transitions.

- Saudi Arabian Oil Company: World-leading oil producer, supplying crude oil, refined products, and natural gas, with integrated upstream, downstream, and chemicals operations.

- Gazprom: Focuses on natural gas exploration, production, and export, alongside oil and energy services, supplying Europe and Asia with fuel and energy solutions.

- ConocoPhillips: Global energy company producing crude oil, natural gas, and natural gas liquids, serving industrial, transportation, and power generation sectors.

- China National Petroleum Corporation: Engages in oil and gas exploration, refining, and marketing, offering fuels, petrochemicals, and energy solutions domestically and internationally.

Other Major Key Players

- ExxonMobil Corporation

- Royal Dutch Shell PLC

- Rosneft

- PetroChina Company Limited

- Petrobras (Petroleo Brasileiro S.A.)

- Eni S.p.A.

- Equinor ASA

- Phillips 66

Recent Developments

- In June 2025, the Shell-led consortium, comprising Petronas, PetroChina, Mitsubishi, and Kogas, successfully produced its first LNG at the LNG Canada terminal in Kitimat, British Columbia, marking a key milestone in Canada's LNG development.(Source: https://www.shell.com/ )

- In January 2025, hedge fund Engine No. 1, known for pushing ExxonMobil on climate issues, partnered with Chevron to develop new fossil fuel power plants in the U.S.(Source: https://www.chevron.com/)

- In 2022, Mexico's state-owned electric utility, Comisión Federal de Electricidad (CFE), awarded contracts for five gas-based power generation projects, aiming to add 2.26 GW of capacity. Wartsila secured contracts for two internal combustion engine plants, while Mitsubishi Power, TSK, and Siemens Energy were awarded contracts for three combined cycle plants.

- In 2022, Germany reactivated the Heyden coal-fired reserve power plant, located in Petershagen near Hanover. With an impressive capacity of 875 megawatts, Heyden stands as one of Germany's most potent coal-fired power facilities.

Segments Covered in the Report

By Type

- Crude Oil

- Natural Gas

- Coal, Petroleum Products

- Others

By Application

- Electricity Generation

- Transportation

- Industrial Processes

- Residential Heating

- Others

By End User

- Residential

- Commercial

- Industrial

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting