What is the Precision Medicine Market Size?

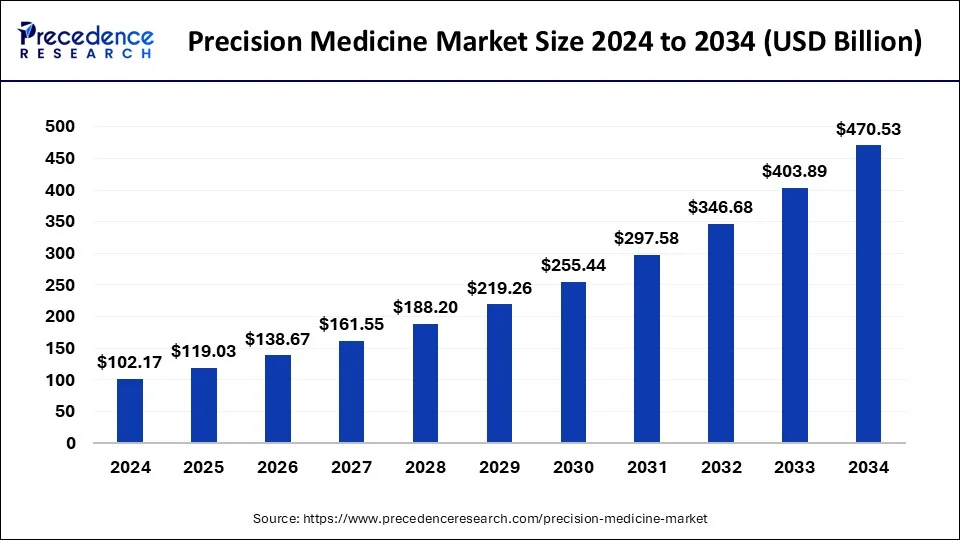

The global precision medicine market size is estimated at USD 119.03 billion in 2025 and is predicted to increase from USD 138.67 billion in 2026 to approximately USD 537.17 billion by 2035, expanding at a CAGR of 16.26% from 2026 to 2035.

Precision Medicine Market Key Takeaways

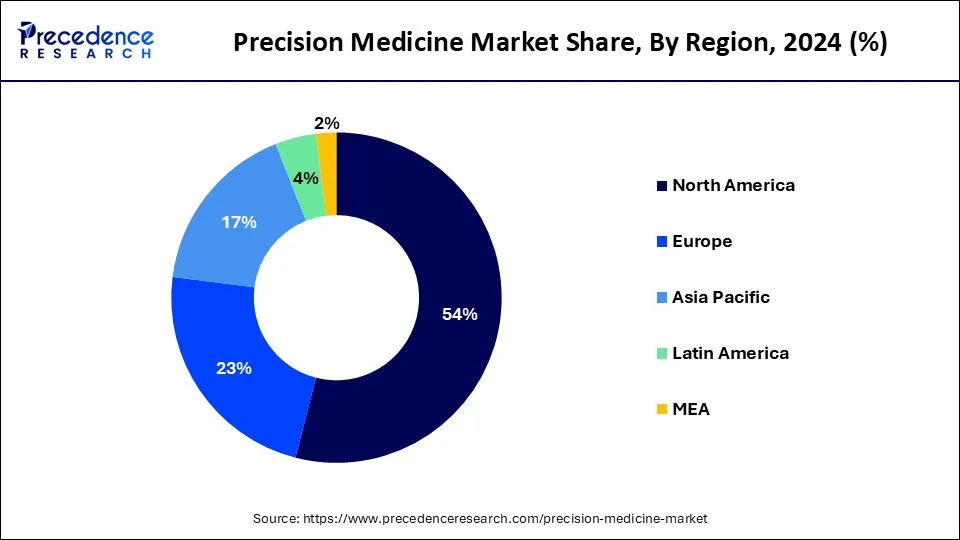

- North America dominated the market in 2025.

- By region, the market in Asia Pacific is anticipated to grow rapidly in during the forecast period.

- By technology, the genomics segment led the market in 2025.

- By application, the therapeutics segment held a large share of the market in 2025.

- By indication, the oncology segment dominated the market in 2025.

- By end-use, the hospitals segment dominated the market in 2025.

Unlocking the Future: A Comprehensive Overview of the Precision Medicine Market

Precision medicine, also known as personalized medicine, is an innovative healthcare approach to disease treatment that tailored treatments and interventions according to the individual characteristics such as lifestyle, genetics, and environment. This personalized approach has the potential to revolutionize healthcare and enhance treatment efficacy, thereby improving patient outcomes. The market witnessed significant growth over the years due to rising demand for personalized healthcare saolutions. Moreover, the market is expected to expand rapidly during the forecast period owing to the increasing advancements in genomics and the rising instances of chronic conditions. Precision medicine leads to effective chronic disease management, improving patient quality of life. For instance,

- According to the National Library of Medicine, about one in three adults worldwide suffer from multiple chronic conditions (MCCs).

Key Technological Shift in the Precision Medicine Market

The key technological shift in the precision medicine market revolves around the integration of advanced technologies such as genomics, artificial intelligence, and big data analytics. These innovations enable personalized treatment plans based on individual genetic profiles and other biomarkers, leading to more effective therapies with fewer side effects.

Additionally, the development of wearable health devices and mobile health applications facilitates continuous monitoring and data collection, allowing for real-time insights into patient health and treatment responses. This shift is transforming the healthcare landscape, making it more proactive and tailored to the unique needs of each patients

Market Outlook in the Precision Medicine Market

- Industry Overview: Precision medicine is powered by an interconnected ecosystem of diagnostics companies, biopharma innovators, digital health platforms, clinical laboratories, and healthcare delivery networks. Diagnostics form the backbone of the industry, spanning next-generation sequencing panels, liquid biopsy technologies, pharmacogenetic tests, and multi-omics assays. On the therapeutic front, targeted small molecules, monoclonal antibodies, cell therapies, and gene therapies are increasingly being designed for biomarker-defined patient groups.

- Sustainability Trend: Sustainability in precision medicine reflects a broader commitment to environmental responsibility, economic viability, and social equity. Laboratories are moving towards greener workflows that reduce reagent waste, optimize energy use, and digitize logistics to limit environmental impact.

- Major Investment Themes: Investment in precision medicine is heavily concentrated around multi-omics platforms, AI-enabled analytics, liquid biopsy technologies, and targeted therapeutics paired with companion diagnostics. Investors are attracted to companies that can integrate sequencing, analytics, and clinical reporting into unified platforms. Single-cell technologies, spatial biology, real-world evidence generation tools, decentralized trial solutions, and data-governance innovations such as federated learning platforms are emerging as major themes.

- Sustainable Ecosystem and Startups: The precision medicine landscape is being strengthened by sustainable ecosystems that integrate academic research, government initiatives, clinical networks, and startup innovation. Many countries are establishing national genomic programs, ethical data-sharing infrastructures, and public-private partnerships that create stable environments for precision medicine expansion. Startups play a crucial role by offering agile innovation in areas like affordable genomics, AI-based variant interpretation, cloud-native bioinformatics, liquid biopsy development, and decentralized trial enablement.

Precision Medicine Market Growth Factors

Advancements in Genomics and Rising Investments for Developing Novel Therapies

Precision medicine analyzes the genes and proteins present in the patient' body to accordingly design the personalized treatment to cure the particular disease. With key discoveries such as single nucleotide polymorphism and microarray/biochips in the field of precision medicine, the market expected to experience a boom in the coming years. Research on human genome is the future of precision medicine and has significant potential to upend the medical treatment on individual patients by understanding their genetics, molecular profiles, and clinical characteristics and evolving proper treatment to cure the disease. The aforementioned factors projected to flourish the demand for precision medicine in the near future. Moreover, the rising prevalence of cancer is expected to boost the demand for precision medicine for personalized therapeutics and diagnostics, which boost the market growth. For instance,

- According to WHO, about 1 in 5 people develop cancer in their lifetime, and about 1 in 12 women and 1 in 9 men die from cancer every year.

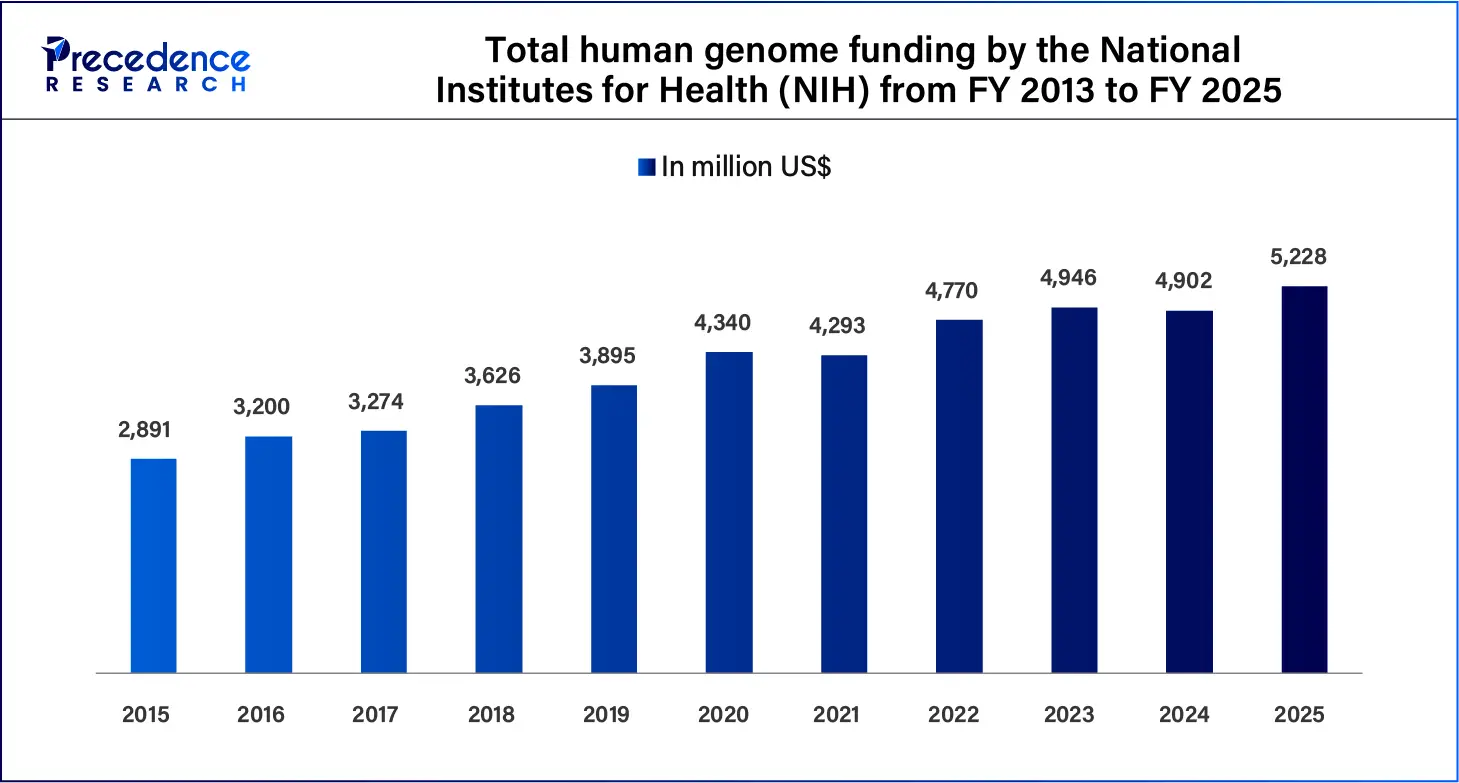

Advancements in genomics have transformed clinical diagnosis & personalized medicine. Advancements such as next-generation sequencing (NGS) and high-density microarray allow for rapid analysis of extensive genomic data, enabling quick exploration of disease genetics. NGS is effective in identifying disease-causing variations, facilitating early detection of genetic disorders accurately. Additionally, the rising investments in human genome for developing targeted therapies are anticipated to drive the market in the coming years. For instance, human genome funding by the National Institutes for Health (NIH) was about US$ five million in fiscal year 2023 and is expected to increase in the coming years. Funding helps companies to generate genomic data from bio-samples that is a critical component of precision medicine discoveries.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 119.03 Billion |

| Market Size in 2026 | USD 119.03 Billion |

| Market Size by 2035 | USD 537.17 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 16.26% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Application, End User, Sequencing Technology, Product, Route of Administration, Drugs, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Restraining Factors

High Cost and Lack of Reimbursement Policies

High cost of precision medicine along with challenges in reimbursement policies are expected to hinder the market growth. The application of high-end calculation methodology and advanced computational techniques add various types of cost to the treatment procedure, making precision medicine expensive. Apart from this, on-going advancement in the computational tools and innovation in the genetic technology helps to examine the functional effects of genetic changes that finally cause cancer development. Thus, genetic diagnosis approach predicted to fuel the growth of precision medicine exponentially especially in the field of cancer treatment.

Emerging Opportunities

Targeted Gene Therapy

The gene therapy creates immense opportunities for companies engage in precision medicine. Since genome sequencing is an unavoidable phase of gene therapy, the substantial investments that are being made in this field would propel the growth of the precision medicine market. Globally, rising cancer prevalence is likely to increase the demand for gene therapy as an effective personalized treatment choice. According to WHO, cancer incidence is projected to rise by 50% to reach more than 20 million by the end of this decade. This alarming increase in the number of patients necessitates gene therapy as a potential treatment approach addressing the growing global burden of the disease.

As the number of gene therapy clinical trials reporting positive results increases, it is becoming clear that the gene therapy is moving toward commercialization. Being a part of the portfolio mixes for many of the biggest companies in the biopharmaceutical arena, gene therapy is suddenly a hot investment sector. Spark Therapeutics (ONCE) and GlaxoSmithKline (GSK) priced the world's first approved gene therapies at figures approaching $1.0 million apiece. Spark's Luxturna treats a rare eye disease that causes blindness. Glaxo's drug, Strimvelis, is approved in Europe to treat an immunodeficiency disease, often referred to as "bubble-boy disease" in children. It costs about $714,000.

Expansion into the Emerging Markets

Most of the companies providing precision medicine solutions have limited their operations to the developed markets, leaving the immense potential of the emerging markets untapped. The countries, such as China, India, Australia, and countries of the Middle East and Africa, possess population with a high risk of diseases (whose treatment requires gene sequencing) in high numbers and offer a great opportunity for the expansion of the precision medicine market.

Although the field of genetics and genomics are well-established in developed countries, significant progress has also been made by the developing countries for genetics and precision medicine in the past ten years, in terms of regulations, product approvals, and implementation of novel methods and procedures in healthcare. A critical issue faced by the emerging countries is the reimbursement of genetic testing by the health insurance companies. In the recent years, healthcare insurance companies that are recognized in the developing economies are agreeing to cover the costs of genetic diagnostic testing of their clients, and thus offer this new technology to patients and their at-risk relatives.

Funding programs by the public healthcare systems in the emerging countries are probably based initially on searching for mendelian germline genetic mutations, such as those occurring in cancer genetics. This increases the affordability and accessibility of screening for mendelian diseases among the population of the developing economies. In addition, funding by the private healthcare systems play a major role in supporting small innovative players in the emerging regions that are focused on new and informative genetic tests.

Proper regulation of guidelines and policies for genetic testing is another factor supporting the growth of precision medicine in emerging economies. For instance, proper and easy approval of the Genetic Information Nondiscrimination Act (GINA) law by many developing countries helped to prohibit genetic discrimination in health insurance and also genetic discrimination in employment. This forms the bases for a modern and humanized genomic medicine environment in the country.

Collaboration and Partnerships across Value Chain to Accelerate the Market Entry

Only 15 to 20% of biopharmaceutical companies, such as Roche, Abbott, and Novartis, have meaningful capabilities and presence in the commercial market. For most of the other companies, the development of commercial diagnostics is not a core competency, and they need to rely on diagnostic and biotech and Life sciences companies to successfully launch companion diagnostics. For instance, in the last five years, more than 60 deals have been finalized between biopharmaceutical and diagnostic/Life sciences companies to market companion diagnostics. In the future, the precision medicine market offers a lot more opportunities for mutual benefits for all the players in the value chain.

Segment Insights

Technology Insights

The genomics segment held a large market share in 2025 due to the growing advancements in sequencing technology. Genomics play a key role in identifying genetic variations associated with disease. Furthermore, the increasing area of applications of genomics, including oncology, neurology, cardiology, and rare genetic diseases, contribute to segmental growth.

The pharmacogenomics segment is expected to grow significantly in the coming years due to the growing adoption of pharmacogenomics testing in clinical practices. Advancements in pharmacogenomics expected to pave the way for drug discovery. Pharmacogenomics predict the efficacy of drugs and helps in understanding the differences in pharmacokinetics and pharmacodynamics using individual's genetic information.

Application Insights

The therapeutics segment accounted for major market share in 2025 and is projected to register a substantial growth rate during the assessment period. The growth of the segment is attributed to the increasing focus on targeted therapies for specific genetic mutation. Additionally, the rising instances of chronic diseases boost the segment, as chronic diseases required tailored therapeutic approach for effective management of disease.

Indication Insights

The oncology segment led the global precision medicine market with significant revenue share in 2025 and is anticipated to grow at a substantial rate during the forecast period. Increasing prevalence of cancer across the globe is likely boost the demand for precision medicine for effective therapeutic approach. Precision medicine helps to examine the patient's genes and the root cause of the cancer disease. It also helps in designing personalized medicine for the patient to cure them in less time as compared to conventional treatment methods.

- According to the World Health Organization (WHO), nearly 20 million new cancer cases and 9.7 million cancer deaths were recorded worldwide in 2022.

End-useInsights

The hospitals segment captured a large share of the market in 2025 owing to the high adoption rate of targeted therapeutics among hospitals & clinics. Healthcare providers are increasingly embracing precision medicine due to the rising awareness about the benefits of targeted therapies. Additionally, the easy availability and accessibility of advanced healthcare technologies in hospital settings boost the segment.

Regional Insights

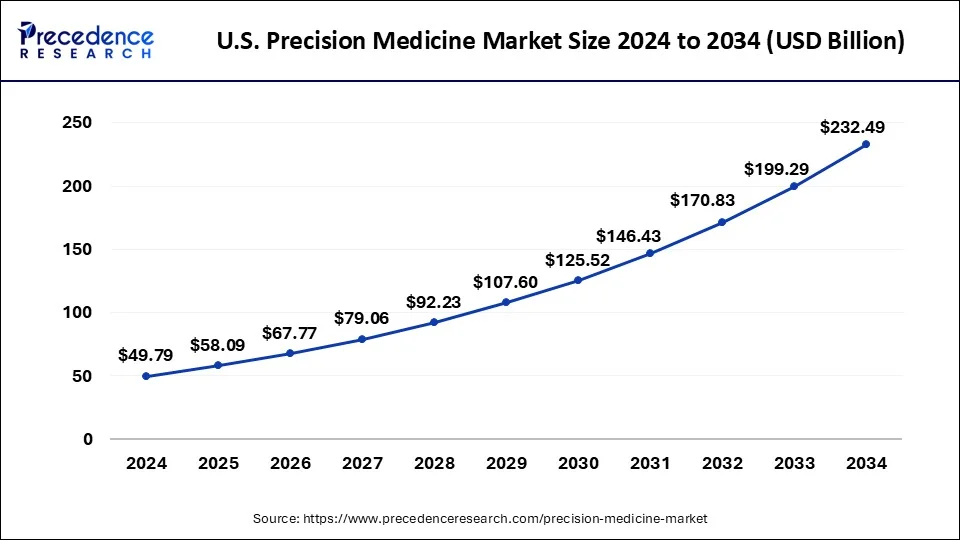

U.S. Precision Medicine Market Size and Growth 2026 to 2035

The U.S. precision medicine market size was estimated at USD 58.09 billion in 2025 and is predicted to surpass USD 265.69 billion by 2035, at a CAGR of 16.42% from 2026 to 2035.

Why is North America leading the League?

North America is the largest precision medicine market by revenue and depth of clinical adoption. Strengths: strong venture/VC funding ecosystem, mature regulatory pathways (adaptive approvals and CDx), broad clinical genetics infrastructure, established payer dialogues on value. Challenges: fragmented payers, variable coverage policies, high therapy prices and access inequities.

U.S. Precision Medicine Market Trends

Leader in clinical trials, biotech R&D, and commercialization of both diagnostics and targeted therapies. Robust private investment and established genomic labs; active development of companion diagnostics and liquid biopsies. Reimbursement complexities exist, but there is a growing willingness for outcomes-based contracts and pilot programs for high-value interventions.

In terms of revenue, North America captured the largest share of the market in 2024 and is projected to maintain its dominance in the coming years. The market growth in the region is primarily attributed to the increasing prevalence of cancer and the rising approval of personalized medicines. The demand for precision medicine in North America is mainly driven by favorable government initiatives and rising investments for developing novel solutions for effective disease management.

How Asia Pacific is Growing Ahead?

Asia Pacific is fast-growing with large patient populations, increasing sequencing capacity, and government interest in genomics. Market heterogeneity is high: some countries move quickly China, Japan, South Korea, Singapore, Australia while others are in early-stage adoption. Key themes: cost-sensitive adoption, public initiatives to build genomic capacity, and partnerships between global firms and local players.

The market in Asia Pacific is anticipated to expand at the fastest growth rate during forecast period due to the increasing disease burden. The rising disposable income and rising economy in the developing nations such as India and China expected to boost the demand for precision medicines in the region. The region offers several aspect of growth in the medical sector owing to on-going research and significant investment on health care facilities and techniques. Furthermore, increasing government initiatives to increase health awareness boosts the market. For instance,

- The government of India started “Jan Aushidhi program” to educate people and make generic medicines available at affordable prices.

China Precision Medicine Market Trends

China is swiftly ascending as a dominant force in the Asia Pacific, characterized by an expansive scale-up in sequencing capacity and diagnostics, offering a vast potential sample base for scholarly studies. The nation's robust domestic biotech and diagnostics firms flourish within an evolving regulatory environment that increasingly supports pioneering diagnostics and therapies.

| Drug | Company | Indication | Estimated Sales |

|

Vanza triple

|

Vertex Pharmaceuticals | Cystic fibrosis | $8.3 billion |

| Datopotamab deruxtecan | Daiichi Sankyo/AstraZeneca | Lung and breast cancers | $5.9 billion |

| Suzetrigine | Vertex Pharmaceuticals | Acute and neuropathic pain | $2.9 billion |

| Aficamten | Cytokinetics | Hypertrophic cardiomyopathy | $2.8 billion |

(Source: https://www.biochempeg.com)

Precision Medicine Market Top Companies

- Novartis (A major pharmaceutical company that has been a leader in the development of targeted therapies, particularly in oncology. Novartis focuses on developing breakthrough medicines that target specific molecular pathways of diseases, moving beyond the one-size-fits-all approach.)

- Qiagen (They collaborate extensively with pharmaceutical companies to co-develop diagnostic tests that identify patients most likely to benefit from specific targeted therapies.)

- Quest Diagnostics (This company specializes in rare cell technologies for advanced diagnostics, particularly in the field of liquid biopsy. Their key technologies,

- CELLSEARCH (for capturing and enumerating circulating tumor cells or CTCs) and DEPArray (for isolating single pure cells for molecular characterization), provide unparalleled precision in cancer diagnostics and research.)

- Menarini Silicon Biosystems (The company operates at the intersection of computational biology and data science, focusing on the analysis of complex biological data, especially the microbiome.)

- NanoString Technologies (A major pharmaceutical corporation with a significant stake in precision medicine, particularly in developing targeted cancer therapies. Pfizer's efforts involve using genetic and molecular insights to identify specific patient populations that will respond best to certain treatments, aiming for more effective and less toxic therapeutic outcomes across various diseases.)

- Eagle Genomics (The company operates at the intersection of computational biology and data science, focusing on the analysis of complex biological data, especially the microbiome.)

- Pfizer (A major pharmaceutical corporation with a significant stake in precision medicine, particularly in developing targeted cancer therapies. Pfizer's efforts involve using genetic and molecular insights to identify specific patient populations that will respond best to certain treatments, aiming for more effective and less toxic therapeutic outcomes across various diseases.)

Recent Developments

- In January 2024, BIOS Health entered into partnership with the Kern Venture Group to establish a hub for precision medicine in Bakersfield, California, U.S.

Segments Covered in the Report

By Technology

- Bioinformatics

- Big Data Analytics

- Drug Discovery

- Gene Sequencing

- Companion Diagnostics

- Others

By Application

- CNS

- Immunology

- Oncology

- Respiratory

- Others

By End-Use

- Diagnostic Companies

- Pharmaceutical Companies

- Healthcare IT companies

- Others

By Sequencing Technology

- Sequencing by Synthesis

- Ion Semiconductor Sequencing

- Sequencing by Ligation

- Pyrosequencing

- Single Molecule Real Time Sequencing

- Chain Termination Sequencing

- Nanopore Sequencing

By Product

- Consumables

- Instruments

- Services

By Route of Administration

- Oral

- Injectable

By Drugs

- Alectinib

- Osimertinib

- Mepolizumab

- Aripiprazole Lauroxil

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting