U.S. Precision Medicine Market Size and Growth 2025 to 2034

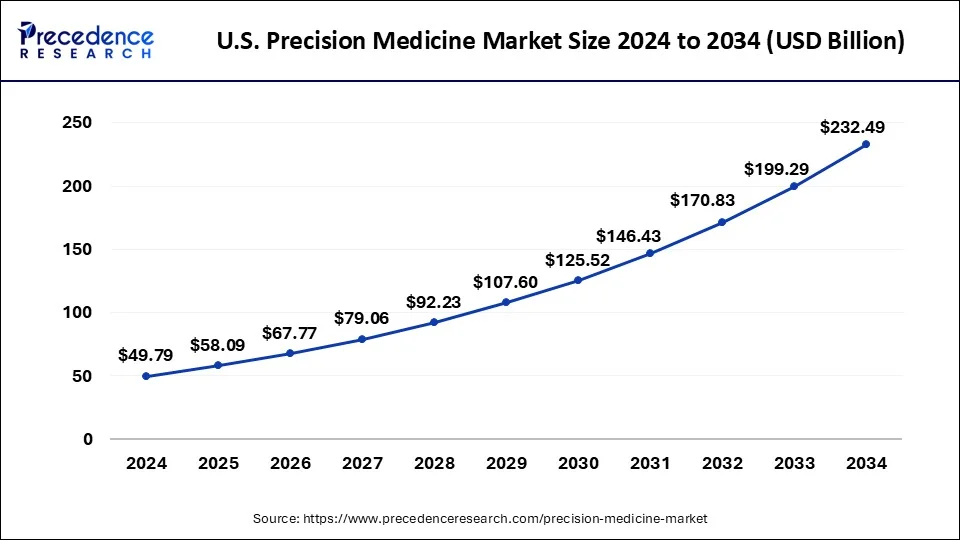

The U.S. precision medicine market size was estimated at USD 49.79 billion in 2024 and is predicted to increase from USD 58.09 billion in 2025 to approximately USD 232.49 billion by 2034, expanding at a CAGR of 16.66% from 2025 to 2034.

U.S. Precision Medicine Market Key Takeaways

- By technology, the drug discovery segment held the dominating share of the market in 2024.

- By application, the oncology segment dominated the U.S. precision medicine market in 2024.

- By end-use, the pharmaceutical company segment held the largest share of the market in 2024.

- By sequencing technology, the single molecule real-time sequencing segment is expected to dominate the market over the forecast period.

- By product, the consumables segment held the largest share of the market in 2024.

- By route of administration, the oral segment held the largest share of the market in 2024.

- By drugs, the Mepolizumab segment is observed to witness significant growth during the forecast period.

Market Overview

Precision medicine, which is often referred to as personalized medicine, is a cutting-edge approach to healthcare and medical treatment that considers the unique genetic, environmental, and lifestyle variations of each patient. Rather than taking a one-size-fits-all strategy, precision medicine aims to customize medical care and treatment plans to each patient's specific needs.

The U.S. precision medicine market has grown significantly with advancements in genomics, molecular biology, and computational technologies. It holds the promise of revolutionizing healthcare by moving away from a one-size-fits-all approach and towards more tailored and effective medical interventions. This approach has been particularly successful in certain cancer treatments, where identifying specific genetic mutations can lead to targeted therapies that are more successful and less toxic than traditional treatments.

- According to the American Cancer Society reports published in 2022, in the United States, there will be 609,360 cancer-related deaths and an estimated 1.9 million new cancer cases diagnosed in 2022.

As per the data published by the Population Reference Bureau (PRB), over the last century, the number of Americans 65 and older has gradually climbed; since 2011, when baby boomers began to reach retirement age, this development has accelerated. The population of older adults is expected to rise from 56.0 million to 94.7 million, a 69 percent increase, between 2020 and 2060. The population 85 years of age and older is expected to almost quadruple from 6.7 million in 2020 to 19.0 million by 2060.

U.S. Precision Medicine Market Growth Factors

- The growing prevalence of chronic diseases such as chronic obstructive pulmonary disease, arthritis, asthma, ulcerative colitis, and irritable bowel syndrome (IBD) in the US has been a major factor driving the growth of the U.S. precision medicine market.

- Rising incidences of cancer and growing disparity in the medical community have inspired several developments and discoveries in the overall market.

- The expanding geriatric population gives rise to additional revenue in the form of several age-related conditions such as arthritis and dementia.

- Given the deteriorating health status of the US population, both the government and private entities are channeling substantial resources into the healthcare and pharmaceutical sectors, indicating a promising market potential.

- The U.S. precision medicine market has seen increasing collaboration among the key players in response to growing monetary grants and other initiatives.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 16.66% |

| U.S. Market Size in 2024 | USD 49.79 Billion |

| U.S. Market Size in 2025 | USD 58.09 Billion |

| U.S. Market Size by 2034 | USD 232.49 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Technology, By Application, By End-Use, By Sequencing Technology, By Product, By Route of Administration, and By Drugs |

Market Dynamics

Driver

Rising government initiatives and funding

One major factor propelling the U.S. precision medicine market is funding from governments. The research and development (R&D) sector is moving more quickly due to financial support from the public and commercial sectors, opening up new possibilities for customized healthcare. Extensive research endeavors, sometimes including worldwide partnerships, are underway to identify the fundamental genetic and environmental components of many medical conditions. Research institutes and businesses that concentrate on creating precision medical techniques or technology can apply for grants and subsidies. The commercialization of new goods and services is accelerating due to this capital inflow, which is propelling the market upward.

Restraint

Data privacy concerns and regulatory challenges

A significant quantity of sensitive patient data, including genetic data, must be gathered and analyzed to practice precision medicine. Patients and healthcare professionals may become hesitant due to worries about data privacy, security breaches, and the abuse of genetic information, which present moral and legal issues. Such factors hamper the overall growth of the U.S. precision medicine market. Furthermore, the regulatory environment around precision medicine is changing, and creating coherent and uniform regulatory frameworks may provide difficulties. Market access and acceptance may be impacted by the approval and reimbursement procedures for personalized medicines, which may be more complicated than those for conventional treatments.

Opportunity

The expanding applications of machine learning (ML) and artificial intelligence (AI) in precision medicine

Utilizing these technologies makes it possible to quickly evaluate enormous volumes of patient data to provide individualized and focused therapies. Several precision medicine applications utilize AI and ML based on patient-specific genetic and molecular profiles. This incorporation of AI/ML algorithms with precision medicine facilitates the resolution of complex problems in personalized medical care by physicians, researchers, and practitioners. The drug development process may be sped up by using AI and ML to forecast novel medication effectiveness and identify possible therapeutic targets.

Assisting in the identification of individuals who are most likely to benefit from a certain medication, these technologies can help increase the effectiveness and success of clinical studies. They can identify patterns and connections that human researchers would miss, which can result in more precise diagnoses and potent therapies. Therefore, throughout the projected period, the U.S. precision medicine market is anticipated to rise in tandem with the increasing use of AI and ML in precision medicine.

- In January 2024, PYC Therapeutics, a clinical-stage biotechnology business, announced a partnership plan that would enable it to work with Google Cloud and other specialist partners to use artificial intelligence to support the development of novel pharmaceuticals. PYC, a pioneer in the use of cutting-edge medical technologies like RNA treatment, is integrating Google Cloud's AI platform with its machine learning models.

Technology Insights

The market is segmented into bioinformatics, big data analytics, drug discovery, gene sequencing, companion diagnostics, and others. The drug discovery segment dominated the U.S. precision medicine market. Precision medicine relies heavily on biomarkers that are measurable indicators of biological processes. Biomarkers play a crucial role in patient stratification, allowing researchers to identify subpopulations that are more likely to respond to a particular treatment. This approach facilitates the development of drugs with higher efficacy and fewer side effects.

Precision medicine enables the stratification of patients in clinical trials based on their genetic and molecular profiles. This approach helps identify patient subgroups that are more likely to benefit from the experimental treatment, improving the efficiency of clinical trials and increasing the chances of success. Thus, this is expected to drive the segment growth.

Application Insights

The market is bifurcated into CNS, immunology, oncology, respiratory, and others. The oncology segment held the largest share of the U.S. precision medicine market in 2024 due to the rise in cancer incidence and advancements in technology. Applications of precision medicine are mostly focused on improving the treatment of cancer diseases, and throughout the projected period, there is anticipated to be a notable increase in growth. The rising incidence of cancer and the increasing number of treatment options undergoing clinical trials are the primary drivers of the segment's notable rise.

The U.S. precision medicine market is expanding as a result of cancer patients using precision oncology more frequently. According to a Nature Medicine journal article from April 2022, the usage of precision medicine in cancer patients has expanded due to the growing use of genetic profiling for diagnosis and therapeutic recommendations in various tumor types. Precision medicine is reportedly utilized for patients who have a higher chance of acquiring specific cancers, especially those with a family history of the disease. Therefore, the expansion of this market is being driven by the rising incidence of cancer patients and the growing effectiveness of precision medicine.

End-Use Insights

Based on the end-user, the market is segmented into diagnostic companies, pharmaceutical companies, healthcare IT companies, and others. The pharmaceutical companies segment held the dominating share of the U.S. precision medicine market. Pharmaceutical companies invest in the development of companion diagnostics, which are essential tools for identifying patients who are most likely to benefit from specific therapies. These diagnostics help personalize treatment decisions by matching patients with the most suitable drugs based on their genetic and molecular profiles.

Moreover, collaboration is a key trend in the precision medicine landscape. Pharmaceutical companies often collaborate with diagnostic companies, research institutions, and technology firms to leverage expertise and resources. These collaborations enhance the understanding of disease mechanisms, identify relevant biomarkers, and accelerate drug development.

Sequencing Technology Insights

The market is segmented into pyrosequencing, sequencing by synthesis, sequencing by ligation, single-molecule real-time sequencing, ion semiconductor sequencing, chain termination sequencing, and nanopore sequencing. The single molecule real-time sequencing (SMRT) segment is expected to dominate the U.S. precision medicine market over the forecast period.

SMRT provides longer reads compared to traditional short-read sequencing technologies. This capability is crucial for accurately characterizing complex genomic regions, such as repetitive sequences, structural variations, and genomic rearrangements. The long reads generated by SMRT sequencing enhance the resolution of genomic information, aiding in the identification of disease-causing mutations. Thus, these properties drive the market growth.

Product Insights

The market is segmented into consumables, instruments, and services. The consumables segment led the U.S. precision medicine market in 2023. Precision medicine involves tailoring medical treatment to individual characteristics, such as genetic makeup. Consumables in this context often include genetic testing kits, diagnostic reagents, and other materials used in molecular diagnostics. The market is being driven by advancements in genomics, increased awareness of personalized healthcare, and a growing emphasis on targeted therapies.

Route of Administration Insights

The market can be segmented into injectable and oral. The oral segment held the largest share of the U.S. precision medicine market in 2024 owing to its therapeutic and dosing advantages. Oral drugs provide a convenient method of drug delivery, allowing patients to take their medication at home or on the go without the need for medical supervision. This convenience promotes better adherence to treatment plans. In addition, compared to some other routes of administration (such as injections or intravenous infusions), taking medications orally is generally less invasive and more comfortable for patients. Thus, these advantages drive the segment expansion.

Drugs Insights

The market can be segmented into Alectinib, Osimertinib, Mepolizumab, Aripiprazole Lauroxil, and Others. The Mepolizumab segment is anticipated to grow significantly in the U.S. precision medicine market during the forecast period due to the rising prevalence of asthma because this drug is used to treat severe respiratory conditions. The increasing prevalence of asthma is one of the important variables that propels the segment expansion.

U.S. Precision Medicine Market Companies

- Biocrates Life Sciences

- Quest Diagnostics

- NanoString Technologies

- Pfizer

- AbbVie Inc.

- AstraZeneca

- Johnson & Johnson Services, Inc

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- ARIEL Precision Medicine, Inc.

Recent Developments

- In March 2023, the global biotechnology company Seagen, which finds, develops, and markets revolutionary cancer medicines, was acquired by Pfizer for $229 in cash per Seagen share, amounting to a $43 billion enterprise value. Pfizer and Seagen Inc. announced that they have entered into a definitive merger agreement.

- In January 2024, the US state of California will see the establishment of a precision medicine center due to cooperation established by BIOS Health, the Kern Venture Group, and the city of Bakersfield. The facility will function as a central location for brain clinical trials and research and development (R&D) that makes use of the adaptive dosage technology from BIOS.

Segments Covered in the Report

By Technology

- Bioinformatics

- Big Data Analytics

- Drug Discovery

- Gene Sequencing

- Companion Diagnostics

- Others

By Application

- CNS

- Immunology

- Oncology

- Respiratory

- Others

By End-Use

- Diagnostic Companies

- Pharmaceutical Companies

- Healthcare IT companies

- Others

By Sequencing Technology

- Sequencing by Synthesis

- Ion Semiconductor Sequencing

- Sequencing by Ligation

- Pyrosequencing

- Single Molecule Real Time Sequencing

- Chain Termination Sequencing

- Nanopore Sequencing

By Product

- Consumables

- Instruments

- Services

By Route of Administration

- Oral

- Injectable

By Drugs

- Alectinib

- Osimertinib

- Mepolizumab

- Aripiprazole Lauroxil

- Others

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting