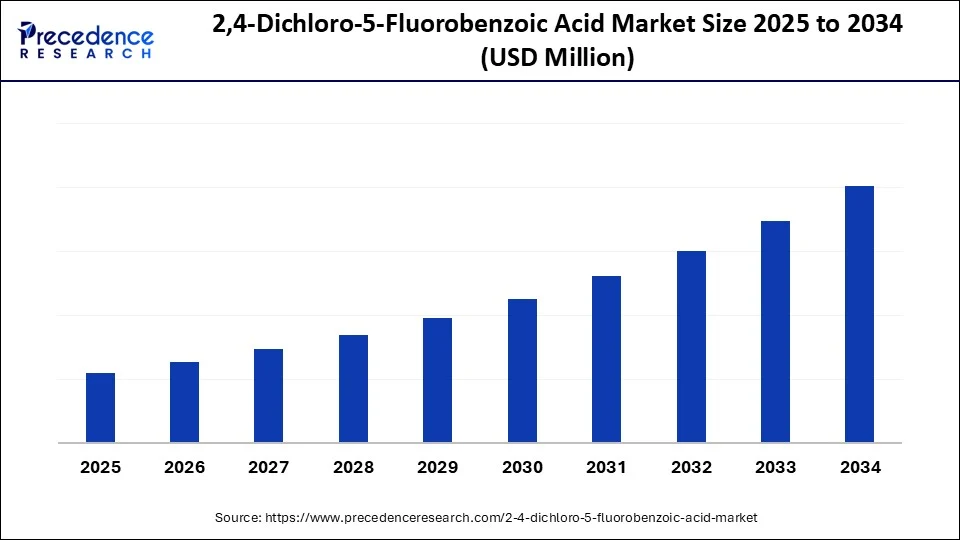

2,4-Dichloro-5-Fluorobenzoic Acid Market Size and Forecast 2025 to 2034

Explore key trends and opportunities shaping the 2,4-dichloro-5-fluorobenzoic acid market across global industries and applications. The market is witnessing rapid growth due to the increasing demand for agrochemicals and pharmaceutical precursors for drug discovery. The growth of the market is further bolstered by increased research and development in specialty chemicals.

2,4-Dichloro-5-Fluorobenzoic Acid MarketKey Takeaways

- Asia Pacific dominated the 2,4-dichloro-5-fluorobenzoic acid market with the highest share in 2024.

- North America is expected to expand at the fastest CAGR between 2025 and 2034.

- By purity, the ≥98% segment contributed the biggest market share in 2024.

- By purity, the 95–97% segment is anticipated to grow at a significant CAGR between 2025 and 2034.

- By form, the powder segment captured the highest market share in 2024.

- By form, the liquid segment is expected to expand at a notable CAGR over the projected period.

- By application, the pharmaceutical intermediates segment held the largest market share of 58% in 2024.

- By application, the agrochemical intermediates segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By end-use industry, the pharmaceutical industry segment accounted for significant market share in 2024.

- By end-use industry, the contract manufacturing organizations (CMOs) segment is expected to expand at a significant CAGR over the projected period.

- By distribution channel, the direct sales segment accounted for major market share in 2024.

- By distribution channel, the online platforms segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

Impact of AI on the 2,4-Dichloro-5-Fluorobenzoic Acid Market

Artificial Intelligenceis changing the way we produce and supply specialty chemicals such as 2,4-dichloro-5-fluorobenzoic acid. By leveraging AI tools in the production of specialty acids, manufacturers can reduce waste, improve yield, and enhance experimentation throughout the synthesis process. As the chemical industry drive toward sustainable practices, the demand for AI solutions increases. The solutions reduce waste generation by automating several tasks and optimizing the quality control process. Moreover, AI optimizes the production volume, making it easier for chemical manufacturers to meet the overall demand for specialty chemicals, including 2,4-dichloro-5-fluorobenzoic acid.

Market Overview

2,4-Dichloro-5-fluorobenzoic acid (CAS No. 394-42-5) is an intermediate chemical compound primarily used in the pharmaceutical and agrochemical sectors. It serves as a building block in the synthesis of various active pharmaceutical ingredients (APIs), particularly for anti-inflammatory and anticancer drugs, as well as in herbicide and pesticide formulations. It is valued for its halogenated structure, which enhances biological activity and chemical stability in end formulations.

The global market for 2,4-dichloro-5-fluorobenzoic acid is driven by its use as an advanced chemical intermediate, enabling high-performance synthesis for research and development, as well as industrial applications. Pharmaceutical companies use it for building active ingredients, while agrochemical manufacturers use it in the development of crop protection agents. In addition, the growing focus on custom synthesis and specialty chemical production is further increasing the use of 2,4-dichloro-5-fluoro-3-nitrobenzoic acid. While there is substantial potential for 2,4-dichloro-5-fluoro-3-nitrobenzoic acid, production and regulatory industry concerns related to nitro and halogenated compounds may limit its applicability, keeping it a niche and specialty compound within many high-value formulations.

2,4-Dichloro-5-Fluorobenzoic Acid MarketGrowth Factors

- Increased Demand for Pharmaceutical Intermediates: This compound is a key intermediate for a combination of complex drug molecules. The increase in drug discovery, especially for anti-cancer and anti-inflammatory medications, is driving demand for this compound as an intermediate.

- Increasing Production of Agrochemicals: This compound is also used as a building block in the formulation of herbicides and pesticides. The focus on crop protection and yield will continue to promote the use of this compound in synthesis within agrochemicals.

- Increase in Demand for CRO Services: The increase in outsourcing chemical synthesis to contract research organizations (CROs) has created intense demand growth for specialty intermediates like this compound, especially around APIs.

- Demand for Fluorinated Compounds: Fluorinated chemicals are becoming increasingly popular in pharmaceuticals and materials science due to their stability and bioactivity; thus, this fluorinated benzoic acid derivative is becoming more relevant.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Purity, Form, Application, End-Use Industry, Distribution Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Pharmaceutical Intermediate

The rising demand for pharmaceutical intermediates is a key factor driving the growth of the 2,4-dichloro-5-fluorobenzoic acid market. This acid is used as a pharmaceutical intermediate, specifically in the synthesis of fluoroquinolone antibiotics such as ciprofloxacin and norfloxacin, which are widely used to treat bacterial infections and are in high demand due to the increasing prevalence of antimicrobial resistance (AMR). 2,4-Dichloro-5-fluorobenzoic acid is a key building block used in the manufacture of carboxylic acid derivatives in these drug formulations. As well, R&D efforts to continuously develop and innovate in the area of synthesis (like, for example, continuous-flow nitric acid oxidation), have energized the production route into a more efficient, scalable, and safer approach.

A peer-reviewed publication in Reaction Chemistry & Engineering has shown that certain unique synthesis methods can introduce significant improvements in reaction control, exothermic risks, and production at the kilogram scale, resulting in high yield efficiencies. These advances align with modern state-of-the-art manufacturing expectations, which have had a significant impact on the supply chain position of 2,4-Dichloro-5-Fluorobenzoic Acid in the drug development continuum on a global scale.

Restraint

High Production Costs and Health and Safety Concerns

The 2,4-dichloro-5-fluorobenzoic acid market faces challenges due to stringent regulatory and safety frameworks enforced by organizations such as the U.S. Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA). These safety frameworks impose restrictions on 2,4-dichloro-5-fluorobenzoic acid and are governed by the Toxic Substances Control Act (TSCA), resulting in significant compliance with the TSCA rules, such as storage and transport, as well as disposal of 2,4-dichloro-5-fluorobenzoic acid, including 40 CFR §372.38(a).

Manufacturers are required to incinerate the 2,4-dichloro-5-fluorobenzoic acid waste in a permitted facility with an afterburner and scrubber to capture harmful emissions. These regulations increase the costs of production, limiting small producers from entering the market. Moreover, handling and using this acid pose health and safety risks, limiting its widespread use. Volatility in the prices of raw materials also increases production costs, which in turn affects the market.

Opportunity

How Can Continuous-Flow Technology Transform the 2,3-Dichloro-5-Flurobenzoic Acid Market?

The transition to continuous-flow manufacturing models presents a major opportunity for 2,4-dichloro-5-fluorobenzoic acid manufacturers. Traditional batch synthesis of this compound involves a variety of exothermic nitration processes, which raise safety and scale-up concerns. Continuous-flow processes also benefit from greater consistency of yields, real-time monitoring, and safer oxidation processes.

These technologies are gaining increasing recognition and support from government subsidies and individual innovations in industrial programs that promote sustainable and efficient chemical manufacturing. As regulators and pharmaceutical manufacturers demand greener, safer, and more automated production systems, we will quickly see that producers who adopt continuous-flow synthesis will have an opportunity to gain a competitive market advantage by increasing value chain efficiencies through reduced risk, better scalability and the opportunity to secure new long term supply contracts with pharmaceutical and fine chemical producer's organizations.

Purity Insights

Why did the ≥98% purity segment dominate the market in 2024?

The ≥98% purity segment dominated the 2,4-dichloro-5-fluorobenzoic acid market, accounting for approximately 63% of the revenue share in 2024. This purity is favored in pharmaceutical formulations, especially for drug intermediates, because it provides consistent quality and minimizes impurities. Due to its high-purity specifications, this form is also suitable for advanced therapeutic applications, which is why it's highly demanded in regulated manufacturing settings.

On the other hand, the 95–97% purity segment is expected to grow at the fastest rate in the coming years, as there is a more practical approach to quality versus cost. This grade is increasingly used in agrochemical synthesis processes because it does not require ultra-high-purity products. The combination of lower cost and good performance makes it an excellent product for the production of herbicides and insecticides, and it is especially attractive in emerging markets.

Form Insights

What made powder the dominant segment in the market in 2024?

The powder segment dominated the 2,4-dichloro-5-fluorobenzoic acid market with a 54% share in 2024. This is because it is a stable, easy-to-store, convenient form that is conducive to bulk handling for industrial production. It is the preferred choice for pharmaceutical and agrochemical manufacturers because of its ease of integration into synthesis workflows. Powder formulations can offer better stability and longer shelf life, which is beneficial for pharmaceuticals and agrochemicals.

On the other hand, the liquid segment is expected to expand at the highest CAGR in the upcoming period. Liquid formulation is easy to formulate and can be mixed with other chemicals, making them ideal for creating ready-to-use formulations. Liquid formulation is widely used in specialty applications because it offers better solubility. Unlike powder, liquid formulation eliminates the risk of dust inhalation during handling and application, improving worker safety.

Application Insights

How does the pharmaceutical intermediates segment dominate the market in 2024?

The pharmaceutical intermediates segment dominated the 2,4-dichloro-5-fluorobenzoic acid market, holding a 58% share in 2024. This is mainly due to the increased use of 2,4-dichloro-5-fluorobenzoic acid in the synthesis of certain pharmaceuticals. It is heavily used in the synthesis of anti-inflammatory drug APIs, which benefits from ongoing demand for effective treatment methods while maintaining consistent formulation standards in the pharma domain. There is also an opportunity for the pharmaceutical intermediate to further displace traditional solutions in synthesizing other drug APIs. Oncology drug APIs are the fastest-growing sub-segment, supported by the increasing burden of cancer globally and the increase in R&D for new targeted therapies.

Meanwhile, the agrochemical intermediates segment is expected to grow at a remarkable CAGR during the projected period. The growth of the segment is attributed to the increasing need to increase agricultural yields to feed a growing global population. 2,4-dichloro-5-fluorobenzoic acid is used as a key intermediate in the production of herbicides and pesticides. The rising demand for crop protection products significantly influences the growth of the segment.

End-Use Industry Insights

Why did the pharmaceutical industry segment dominate the 2,4-dichloro-5-fluorobenzoic acid market in 2024?

The pharmaceutical industry is the largest end-user, capturing about 60% share of the market in 2024. This is mainly due to the increased demand for high-purity pharmaceutical intermediates. The increasing investment in drug development, particularly anti-inflammatory pharmaceutical agents and antibiotics, ensures the long-term growth of the segment. Stringent regulations regarding the safety and efficacy of pharmaceuticals boosted the adoption of 2,4-dichloro-5-fluorobenzoic acid in the development of certain pharmaceuticals.

On the other hand, the contract manufacturing organizations (CMOs) segment is expected to grow at the fastest rate in the upcoming period as pharmaceutical companies increasingly outsource the production of APIs to reduce costs and more easily manage scalable production. The pharmaceutical intermediate chemicals' diverse usage in custom synthesis would fit well with the adaptable methods of production used by CMOs.

Distribution Channel Insights

What made direct sales the dominant segment in the market?

The direct sales segment dominated the 2,4-dichloro-5-fluorobenzoic acid market with a 62% share in 2024. This is mainly due to the increased volume of bulk orders. Direct sales allow manufacturers to ensure quality, compliance with regulatory conditions, and delivery times while also preventing other buyers from accessing the product once it is ordered. Further, manufacturers can control direct costs, maintain long-term contracts, and modify order specifications from individual buyer requirements. Direct sales facilitate stronger relationships with customers, allowing for a better understanding of their needs and providing tailored solutions.

On the other hand, the online platforms segment is experiencing the fastest growth. Online platforms enable manufacturers and suppliers to reach a broader consumer base, expanding their market reach. They allow for easier access to different purity grades of chemicals and various forms; therefore, buyers can procure chemicals for R&D and small chemical batch development immediately.

Regional Insights

Why did Asia Pacific dominate the 2,4-dichloro-5-fluorobenzoic acid market in 2024?

Asia Pacific dominated the market by capturing the largest revenue share in 2024. This is mainly due to its robust industrial base, rising downstream applications, and competitive manufacturing landscape. The market within the region is benefitting from developing chemical hubs on a larger scale, the availability of low-cost raw materials, and a trained workforce. There is a high demand for pharmaceutical formulations, agrochemicals, and specialty chemicals, resulting in rising uptake of this intermediate. Favorable government policies and subsidies have led to investment by domestic players and foreign companies in the fine chemicals sector. Furthermore, many Asian countries rely on agriculture. Thus, there is a high demand for crop protection agents, which drives the demand for 2,4-dichloro-5-fluorobenzoic acid.

China is a major player in the market due to the rising production of specialty chemicals. The availability of adequate raw materials is boosting the capabilities of the country to produce specialty chemicals. The market is also driven by investment in quality control aspects to improve product purity, while promoting green production and the development of an ecosystem for research and development.

European 2,4-Dichloro-5-Fluorobenzoic Acid Market Trends

Europe is expected to witness notable growth in the coming years. This is mainly due to the increasing demand for high-quality pharmaceuticals and rising production of specialty chemicals. Moreover, there is a strong emphasis on green chemistry and sustainable production, boosting the demand for high-purity intermediates (especially fluorinated materials used in drug synthesis and agrochemicals). EU regulations tend to favor fresh, clean, and safer alternatives when manufacturing chemicals, creating opportunities in the market. Germany is a major player in the European market due to its well-established chemical manufacturing industry, along with high demand for pharmaceuticals and agrochemicals. German pharmaceutical companies recognize that they need high-performance intermediates to meet stringent quality regulations.

North America 2,4-Dichloro-5-Fluorobenzoic Acid Market Trends

North America is expected to grow at the fastest CAGR during the forecast period due to continued pharmaceutical innovation and high demand for crop protection chemicals. Resilience in supply chain solutions encourages companies to manufacture and produce specialty chemicals locally and minimize dependence on imports, especially after global supply interruptions due to war and uncertainty in many regions. Additionally, many industries are being faced with stricter environmental and quality regulations, driving a shift toward the use of high-purity intermediates, such as the 2,4-dichloro-5-fluorobenzoic acid. The U.S. firms are allocating larger portions of their fund and resources toward specialty intermediates to support fundamental research in drug discovery and innovation in agrochemicals.

Recent Development

- In September 2024, American Chemical Society introduced a Nano-Cocrystal material composed of the herbicide clopyralid and coformer phenazine to address the critical challenges posed by the misuse and inefficiency of traditional pesticides. Developed through synergistic supramolecular self-assembly and mechanochemical nanotechnology, this Nano-Cocrystal significantly enhances pesticide performance. It exhibits a marked improvement in stability, with reductions in hygroscopicity and volatility by approximately 38%.

2,4-Dichloro-5-Fluorobenzoic Acid Market Companies

- Thermo Fisher Scientific

- Merck KGaA (Sigma-Aldrich)

- TCI Chemicals

- Toronto Research Chemicals (LGC Standards)

- Clearsynth

- Combi-Blocks Inc.

- Jubilant Ingrevia

- Beijing Chemsynlab Co., Ltd.

- Viva Pharmaceutical Co., Ltd.

- Shandong Xinhua Pharmaceutical

- ABCR GmbH

- Biosynth Carbosynth

- MolPort

- Alfa Aesar

- Accela ChemBio Inc.

- Hangzhou Trylead Chemical Technology

- Otto Chemie Pvt. Ltd.

- J&K Scientific Ltd.

- Loba Chemie

- Anvia Chemicals

- Other Players

Segments Covered in the Report

By Purity

- ≥98%

- 95–97%

- <95%

By Form

- Powder

- Crystalline

- Liquid

By Application

- Pharmaceutical Intermediates

- Anti-inflammatory Drug APIs

- Oncology Drug APIs

- Antibiotic Synthesis

- Agrochemical Intermediates

- Herbicide Intermediates

- Insecticide Intermediates

- Chemical Research

- Specialty Chemical Development

- R&D in Halogenated Compounds

By End-Use Industry

- Pharmaceutical Industry

- Agrochemical Industry

- Contract Manufacturing Organizations (CMOs)

- Academic & Industrial Research

By Distribution Channel

- Direct Sales

- Chemical Distributors

- Online Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting