Nucleic Acid Aptamers Market Size and Forecast 2025 to 2034

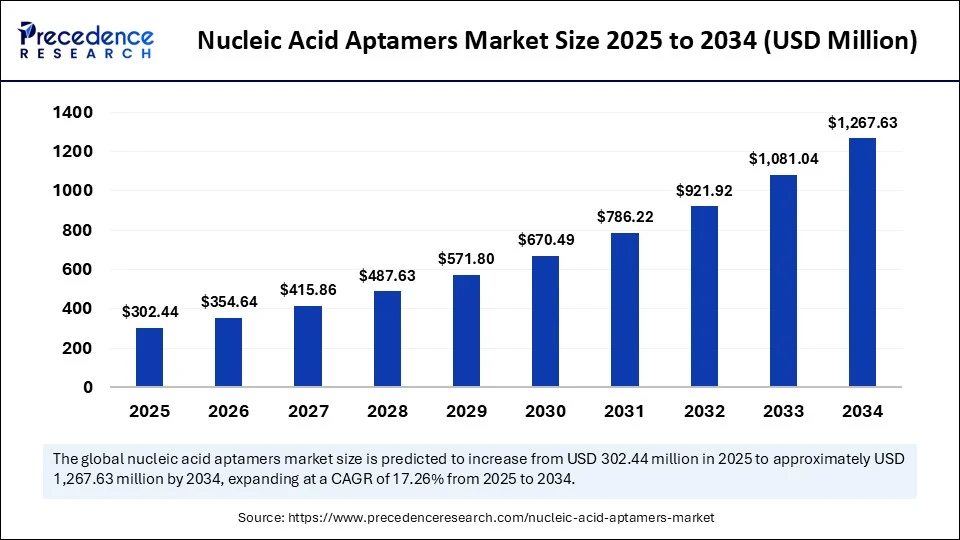

The global nucleic acid aptamers market size was calculated at USD 257.93 million in 2024 and is predicted to increase from USD 302.44 million in 2025 to approximately USD 1,267.63 million by 2034, expanding at a CAGR of 17.26% from 2025 to 2034. The increasing investments in research and development activities related to aptamers are driving the growth of the market. The demand for targeted therapies has been increasing, driving innovation and development of nucleic acid aptamers, fueling the market growth.

Nucleic Acid Aptamers Market Key Takeaways

- In terms of revenue, the global nucleic acid aptamers market was valued at USD 257.93 million in 2024.

- It is projected to reach USD 1,267.63 million by 2034.

- The market is expected to grow at a CAGR of 17.26% from 2025 to 2034.

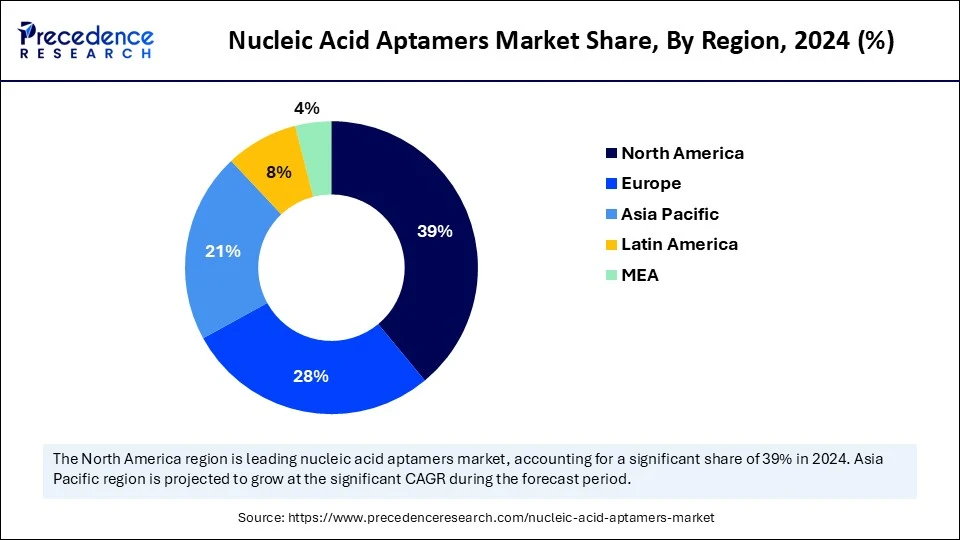

- North America dominated the nucleic acid aptamers market with the largest share of 39% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By type, the DNA aptamers segment held the highest market share of 45% in 2024.

- By type, the RNA aptamers segment will expand at a significant CAGR between 2025 and 2034.

- By application, the therapeutics segment contributed the biggest market share of 28% in 2024.

- By application, the diagnostics segment will expand at the highest CAGR between 2025 and 2034.

- By synthesis method, the SELEX (systematic evolution of ligands by exponential enrichment) segment led the market, under which the conventional SELEX segment held a significant share as a sub-segment in 2024.

- By synthesis method, the non-SELEX-based methods segment will grow at a significant CAGR between 2025 and 2034.

- By delivery method, the conjugated delivery segment captured the major market share of 41% in 2024.

- By delivery method, the carrier-mediated delivery segment will grow at the highest CAGR between 2025 and 2034.

- By end-user, the pharmaceutical & biotech companies segment generated the major market share of 36% in 2024.

- By end-user, the contract research organizations (CROs) segment will expand at a significant CAGR between 2025 and 2034.

Impact of AI on the Nucleic Acid Aptamers Market

Artificial intelligence is transforming the nucleic acid aptamers market by accelerating the discovery process, improving designs, and performance. AI's role in analyzing vast amounts of data from high-throughput sequencing, optimizing aptamer sequences, improving binding affinity, and personalized medicine approaches is leading to fast, more efficient, and effective nucleic acid aptamers for applications like therapeutics, diagnostics, and biosensing. AI-based silico streamlining designs and optimization of aptamer sequences to improve stability, affinity, and specificity of nucleic acid aptamers for targeted molecular research. AI-based SELEX technology streamlines the selection process of aptamers, leading to fast identification of high-affinity aptamers.

- In December 2024, the National Institutes of Health unveiled a study highlighting the potential of the computational tool, DeepAptamer, for identifying high-affinity aptamers from early SELEX rounds. The tool integrated deep learning to accelerate the discovery process of aptamers by predicting aptamer sequences and creating capabilities from initial selection rounds, thereby reducing the need for large and time-consuming later rounds.(Source: https://pubmed.ncbi.nlm.nih.gov)

U.S. Nucleic Acid Aptamers Market Size and Growth 2025 to 2034

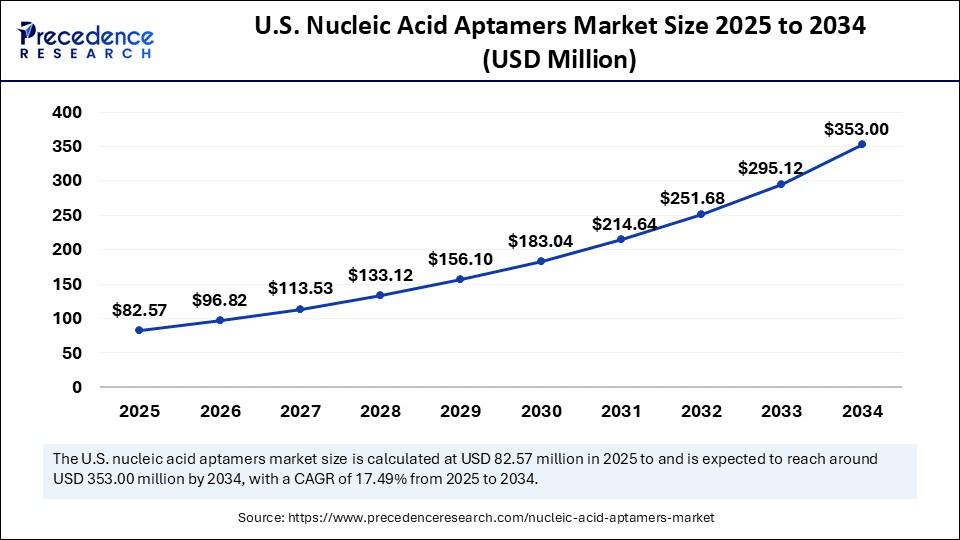

The U.S. nucleic acid aptamers market size was exhibited at USD 70.41 million in 2024 and is projected to be worth around USD 353.00 million by 2034, growing at a CAGR of 17.49% from 2025 to 2034.

What Made North America the Dominant Region in the Nucleic Acid Aptamers Market in 2024?

North America dominated the nucleic acid aptamers market while holding the largest share in 2024. This is mainly due to its advanced biotechnology infrastructure, increased chronic disease prevalence, and robust regulatory framework. North America has experienced rapid growth in chronic disease prevalence, like cancer and cardiovascular disease, driving significant innovations in diagnostic and therapeutic solutions. The region's state-of-the-art research and development infrastructure contributes to market growth. Additionally, the increased demand for targeted therapies and personalized medicines further contributes to rising innovation and developments of novel outcomes like nucleic acid aptamers for diagnostics and therapeutics.

The U.S. is a major player in the market, contributing to regional market growth due to its significant investments in research and development. There is a high demand for personalized medicines, creating opportunities for nucleic acid aptamers. The U.S. has increased its funding for biotechnology R&D in the last few years, driving innovative and extensive approaches in nucleic acid aptamers. Additionally, the strong existence of regulatory bodies for approvals and adoption of aptamers is fueling the market.

Asia Pacific Nucleic Acid Aptamers Market Trends

Asia Pacific is the fastest-growing region in the market, driven by increased awareness and adoption of aptamers in diagnostics and therapeutics. The expanding biotechnology industry in emerging countries, such as China, India, and Japan, is driving investments in research and development. The growing prevalence of chronic diseases, demand for personalized medicines, government and pharmaceutical companies' investments and support for the research and development industry, and the need for novel diagnostic processes are transforming the Asian market. Innovative approaches by key market players, including Aptamer Sciences, SomaLogic, and TriLink Bio Technologies, are fostering the market growth.

China is a major player in the regional market, contributing to the growth due to its significant investments in biotechnology and government funding for improving research infrastructure. The large population of China and the high incidence of chronic disease have boosted research and investment areas.

India and Japan are notable players in the regional market due to rising innovations and developments of novel diagnostic systems and processes. Expanding pharmaceutical and biotechnology companies and government funding for research institutions are supporting market expansion in India. Similarly, robust research capabilities and cutting-edge medical technologies of Japan are contributing to the growing research and development of nucleic acid aptamers.

Europe Nucleic Acid Aptamers Market Trends

Europe is expected to experience notable growth in the upcoming years, driven by its robust healthcare infrastructure, strong emphasis on scientific research, increased awareness about aptamer technologies, and demand for personalized medicines. The well-established research facilities and demand for aptamer-based therapies are driving innovations in nucleic acid aptamers in the region. Additionally, the strong pharmaceutical and academic institutions in Germany, the UK, and France are fostering market expansion.

Germany is leading the charge due to the presence of some of the leading pharmaceutical companies and research institutes. The focus of German research institutions on the development of new diagnostic solutions is contributing to innovations in nucleic acid aptamers. The UK is projected to grow fastest over the forecast period due to innovations in SELEX technologies and targeted therapies.

Market Overview

The nucleic acid aptamers market refers to the global landscape of research, development, manufacturing, and commercialization of short, single-stranded DNA or RNA molecules, termed aptamers, that bind specifically to a target molecule. These aptamers serve as alternatives to antibodies and are used extensively in therapeutics, diagnostics, targeted drug delivery, biomarker discovery, biosensing, and research applications. Owing to their high specificity, ease of synthesis, modifiability, and low immunogenicity, nucleic acid aptamers are increasingly gaining traction in biomedical and pharmaceutical applications.

Nucleic acid aptamers have superior stability, specificity, and are easy to synthesize, driving their use in drug discovery and development. The growing prevalence of chronic disease, increased demand for precision therapy and personalized medicines, and growing investments in research laboratories are enabling significant innovations in nucleic acid aptamers.

What are the Key Trends in the Nucleic Acid Aptamers Market?

- Increased Prevalence of Chronic Disease: The demand for aptamer-based diagnostic and therapeutic products has increased due to the increased prevalence of chronic diseases like cancer and cardiovascular disease globally.

- Increase Demand for Targeted Therapies: The demand for targeted therapies has increased, driving the need for nucleic acid aptamers as an alternative to traditional antibodies.

- Biotechnology Advances: The advancements in biotechnology for enhancing aptamer selection and stability are driving the use of nucleic acid aptamers in diagnostics and therapeutics.

- Personalized Medicine Demands: The growing demand for personalized medicines is driving the need for precise and efficient diagnostic tools, increasing the adoption of nucleic acid aptamers.

- Application Versatility: The ongoing research for utilizing the nucleic acid aptamers in various applications like biosensing, drug discovery, and diagnostics due to their unique properties is fostering the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,267.63 Million |

| Market Size in 2025 | USD 302.44 Million |

| Market Size in 2024 | USD 257.93 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.26% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Synthesis Method, Delivery Method, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing R&D Activities

Increasing research & development (R&D) activities are the major drivers of the global nucleic acid aptamers market. The increased prevalence of chronic disease globally has led to the demand for personalized medicines and targeted therapies, driving the need for novel and innovative diagnostics and therapeutic solutions like nucleic acid aptamers. These aptamers are the best alternative for traditional antibiotics due to their high flexibility & modifiability, easy chemical synthesis process, high specificity in targeted model and affinity, and lower immunogenicity. Ongoing collaboration between research & academic institutions, government, and pharmaceutical & biotechnology companies is further contributing to increased R&D activities. Additionally, the increasing government funding for nucleic acid aptamers-based research supports market growth.

Restraint

Limited Acceptance

Nucleic acid aptamers are less accepted due to their competition with already existing technologies like small molecules and antibiotics. The limited universal regulatory guidelines for aptamers and a lack of awareness among several healthcare professionals and researchers about the benefits of aptamers are creating a barrier to their acceptance. Additionally, the technical challenges associated with aptamer development and optimization drive the need for specialized equipment and expertise, affecting their adoption. The regulatory landscape for aptamer-based products is still evolving, creating challenges in the market.

Market Opportunity

Technological Advances in Aptamer Development

Ongoing technological advancements in SELEX (systematic evolution of ligands by exponential enrichment) to enhance selection and stability of the aptamers are creating significant opportunities for the easier development and adoption of nucleic acid aptamers in diagnostics and therapeutics. The innovations in delivery systems, like conjugation techniques and nanoparticles, are further enhancing targeted delivery of aptamers, enhancing efficiency, and reducing side effects. Furthermore, the advancements in amplification techniques, sequencing technologies, and oligonucleotide library designs are further adding to improving the efficiency and affordability of aptamer developments, leading to expanding their acceptance in healthcare infrastructure.

Type Insights

Why Did the DNA Aptamers Segment Dominate the Nucleic Acid Aptamers Market in 2024?

The DNA aptamers segment dominated the market in 2024. This is mainly due to their superior stability compared to other nuclide acid aptamers. DNA aptamers require less production cost, making them suitable for researchers and several companies. The wide availability of DNA aptamers has facilitated their advancements in DNA synthesis technologies. There is a strong emphasis on modifying and synthesizing DNA sequences, which further contributes to the segment's growth. Additionally, the wide adoption of DNA aptamers in applications like biosensors, diagnostics, and pharmaceuticals is contributing to their increased demand.

The RNA aptamers segment is expected to grow at the fastest CAGR during the forecast period due to their increased use in applications like diagnostics and therapeutics. RNA aptamers offer high binding affinity, specificity, and complex structure, making them ideal for targeted therapies and biosensing. Ongoing advancements in mRNA-lipid nanoparticle co-formulations are further driving the adoption of RNA aptamers.

Application Insights

What Made Therapeutics the Leading Application?

The therapeutics segment led the nucleic acid aptamers market in 2024 due to increased use of nucleic acid aptamers in personalized medicines and targeted drug delivery. Substantial investments in research & development led to the development of aptamer-based therapeutics. The cancer therapy sub-segment held the maximum market share in 2024. This is due to the increased demand for targeted therapies and personalized medicines for cancer. Nucleic acid aptamers offer high specificity, low immunogenicity, and easy modification, making them ideal for cancer therapies.

The diagnostics segment is expected to grow at the fastest rate over the projection period due to its crucial role in detecting biomarkers. The high sensitivity and specificity of nucleic acid aptamers have increased their integration with biosensors to improve diagnostic capabilities. The diagnostics application includes pathogen detection, biomarker discovery, imaging agents, and point-of-care testing, where the point-of-care testing sub-segment is leading the charge, due to increased integration of aptamers in these devices. The nucleic acid aptamers enhance the specificity, portability, and sensitivity of the point-of-care testing devices.

Synthesis Method Insights

How Does the SELEX (Systematic Evolution of Ligands by Exponential Enrichment) Segment Dominate the Nucleic Acid Aptamers Market in 2024?

The SELEX (systematic evolution of ligands by exponential enrichment) segment dominated the market in 2024 due to its crucial role in the selection and development of nucleic acid aptamers. The SELEX generates aptamers with various applications, such as biosensors, targeted therapies, and diagnostics. The SELEX method includes cell-SELEX, conventional SELEX, microfluidic SELEX, and capillary electrophoresis-SELEX, where the conventional SELEX sub-segment held the maximum market share in 2024. This is primarily due to its ability to identify high-affinity aptamers for diverse targets. The growing technological advancements, like the development of AI-powered optimization and in vivo SELEX methods, are further contributing to the segment's growth.

The non-SELEX-based methods segment is expected to expand at the highest CAGR in the upcoming period, driven by the rising adoption of non-SELEX-based methods for enhancing aptamer selection specificity and efficiency. The ability of non-SELEX-based methods to provide fast and affordable aptamer discovery is driving their use in various research institutions and companies. Technological advancements like non-equilibrium capillary electrophoresis of equilibrium mixtures (NECEEM) are enabling the selection of aptamers.

Delivery Method Insights

Which Delivery Method Dominated the Nucleic Acid Aptamers Market in 2024?

The conjugated delivery segment dominated the market in 2024 due to its crucial role in enhancing the therapeutic potential of aptamers. The conjugated delivery method enables aptamers to explore targeted drug delivery more efficiently. Conjugated aptamers with different carriers like liposomes, biomolecules, and nanoparticles improve drug delivery, targeting, as well as therapeutic efficacy. The advancements in conjugated delivery technologies are enhancing the building affinity and therapeutic potential.

The carrier-mediated delivery segment is expected to grow at the fastest rate over the forecast period due to its key role in enhancing the effectiveness of nucleic acid aptamers. This delivery method enhances therapeutic efficacy and reduces the side effects associated with aptamers. The carrier-mediated delivery includes liposomes, nanoparticles, and some other biomolecules that protect aptamers with high stability.

End-User Insights

Why Did the Pharmaceutical & Biotech Companies Segment Dominate the Nucleic Acid Aptamers Market in 2024?

The pharmaceutical & biotech companies segment led the market in 2024. This is mainly due to the high adoption rates of nucleic acid aptamers among pharmaceutical and biotech companies for drug discovery and therapeutic developments. The rising R&D expenditure and strategic collaborations within research institutions and pharmaceutical & biotech companies are driving innovations and developments of nucleic acid aptamers. Additionally, the pharmaceutical & biotech companies offering custom aptamers for therapeutic developments are contributing to segment growth.

The contract research organizations (CROs) segment is likely to grow at the fastest CAGR in the coming years, driven by their key role in aptamer-based therapeutics. The contract research organizations (CROs) outsource preclinical and clinical research of aptamer-based therapeutics. The expertise of contract research organizations (CROs) in trail management, regulatory compliance, and data analysis makes them crucial for nucleic acid aptamers.

Nucleic Acid Aptamers Market Companies

- SomaLogic Inc.

- Aptamer Group PLC

- NOXXON Pharma AG

- Base Pair Biotechnologies Inc.

- Aptamer Sciences Inc.

- AM Biotechnologies LLC

- NeoVentures Biotechnology Inc.

- TriLink BioTechnologies LLC

- Aptus Biotech S.L.

- Aptagen LLC

- Vivonics Inc.

- Aptamer Solutions Ltd.

- AuramerBio Ltd.

- Bio-Techne Corporation

- Novaptech

- IBA GmbH

- ATDBio Ltd.

- Raptamer Discovery Group

- LC Sciences LLC

- Integrated DNA Technologies (IDT)

Recent Developments

- In June 2025, ACS publications reported achieving a detection limit of 60 and 70 nM in spiked artificial saliva by developing a biosensor using two MPD aptamers. This biosensor also exhibits a linear detection range from 100 to 1000 nM. (Source:https://pubs.acs.org)

- In April 2025, the International Society on Aptamers hosted the 12th annual aptamers conference in Oxford, UK, as a ‘virtual-in-person' hybrid mode. This conference brings emerging aptamer researchers and students to submit their abstracts for oral and poster presentations. (Source: http://aptamersociety.org)

- In May 2025, Ajinomoto Co., Inc. collaborated with RIBOMIC Inc., a drug discovery startup focused on the development and production of aptamer pharmaceuticals, to develop technology to control the pharmacokinetics of nucleic acid aptamers by using the antibody-drug conjugated (ADC) manufacturing technology “AJICAP”. The innovation has resulted in extending the half-life of a nucleic acid aptamer conjugate. (Source: https://ajibio-pharma.ajinomoto.com)

Segment Covered in the Report

By Type

- DNA Aptamers

- RNA Aptamers

- XNA Aptamers (Synthetic analogs)

- Others (e.g., Spiegelmers)

By Application

- Therapeutics

- Cancer Therapy

- Ocular Diseases

- Cardiovascular Diseases

- Infectious Diseases

- Others

- Diagnostics

- Biomarker Discovery

- Pathogen Detection

- Point-of-Care Testing

- Imaging Agents

- Research & Development

- Target Validation

- Molecular Probes

- Biosensors / Analytical Devices

- Others (e.g., Food Testing, Environmental Monitoring)

By Synthesis Method

- SELEX (Systematic Evolution of Ligands by Exponential Enrichment)

- Conventional SELEX

- Cell-SELEX

- Capillary Electrophoresis-SELEX

- Microfluidic SELEX

- Non-SELEX-Based Methods

By Delivery Method (for therapeutic aptamers)

- Conjugated Delivery (e.g., PEGylated, Nanoparticle-conjugated)

- Unmodified Free Aptamers

- Carrier-mediated Delivery

- Others

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations (CROs)

- Diagnostic Laboratories

- Others (Hospitals, Government Labs)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting