Deoxycholic Acid Obesity Drugs Market Size and Forecast 2025 to 2034

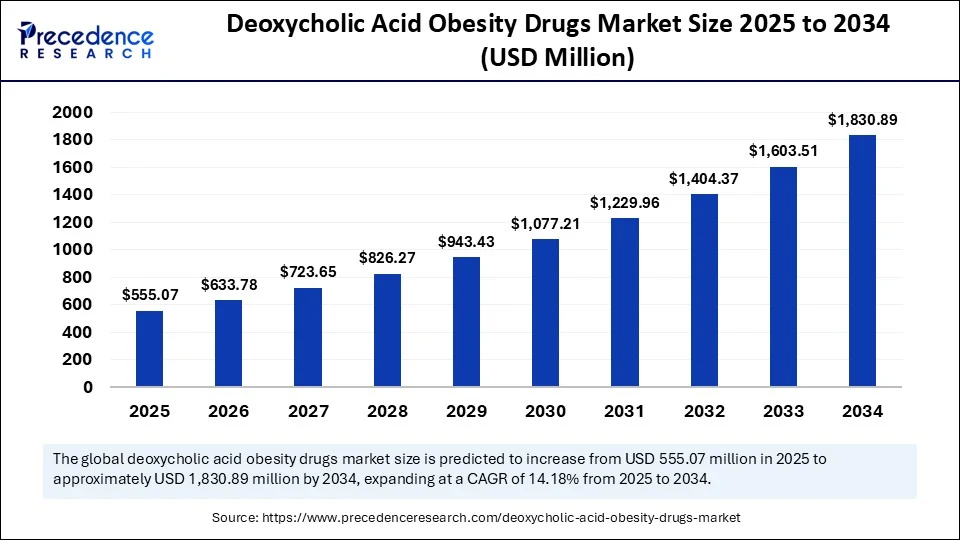

The global deoxycholic acid obesity drugs market size accounted for USD 486.14 million in 2024 and is predicted to increase from USD 555.07 million in 2025 to approximately USD 1,830.89 million by 2034, expanding at a CAGR of 14.18% from 2025 to 2034. The deoxycholic acid obesity treatment market is driven by growing demand for non invasive fat-reduction methods, growing body contouring awareness, and increasing associated clinic practice worldwide, all of which are working together to support a strong upward trajectory of the identified market overall.

Deoxycholic Acid Obesity Drugs MarketKey Takeaways

- In terms of revenue, the global deoxycholic acid obesity drugs market was valued at USD 486.14 million in 2024.

- It is projected to reach USD 1,830.89 million by 2034.

- The market is expected to grow at a CAGR of 14.18% from 2025 to 2034.

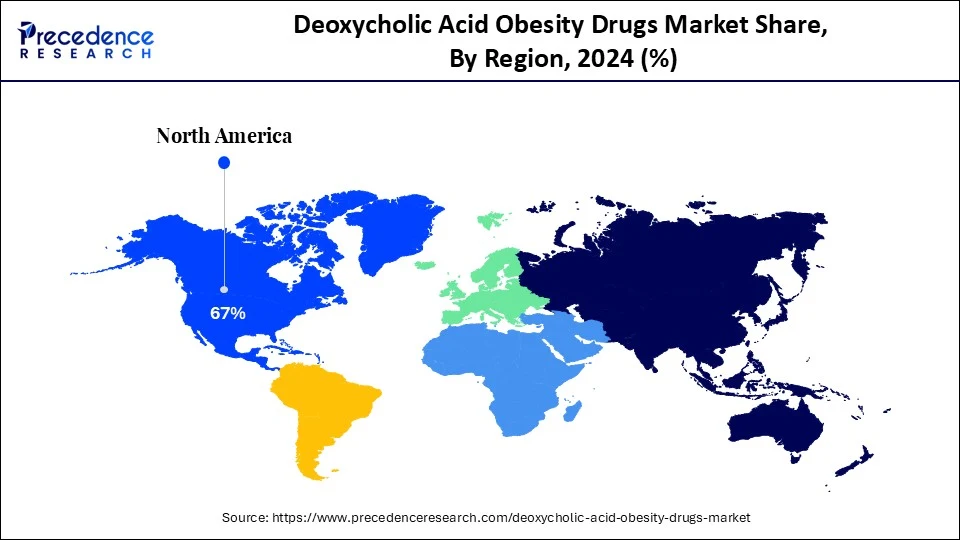

- North America led the global deoxycholic acid obesity drugs market with the largest market share of 67% in 2024.

- Asia Pacific is estimated to expand at the fastest CAGR between 2025 and 2034.

- By drug type, the ATX-101 (Deoxycholic Acid Injection / Kybella / Belkyra) segment held the biggest market share of 94% in 2024.

- By drug type, the experimental / compounded deoxycholic acid formulations segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By application, the submental fat reduction (double chin) segment captured the highest 88% of market share in 2024.

- By application, the abdominal fat reduction (off-label) segment is expected to expand at a notable CAGR over the projected period.

- By end user, the aesthetic clinics & medspas segment contributed the major market share of 61% in 2024.

- By end user, the plastic surgery centers segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By distribution channel, the physician-dispensed / in-clinic administration segment generated the largest market share of 84% share in 2024.

- By patient demographic, the adults aged 25–45 years segment accounted for the significant market share of 38.1% in 2024.

- By patient demographic, the 46–60 Years segment is expected to expand at a notable CAGR over the projected period.

AI Advances Development of Deoxycholic Acid-Driven Obesity Drugs

Artificial intelligence is rising as a strong player in the development of novel deoxycholic acid (DCA) treatments for obesity. At the same time, AI has been increasingly applied to advancements in the deoxycholic acid obesity drugs market, particularly with peptide-based drugs, which are being developed for DCA applications. A 2025 patent has broadly described the development of a deoxycholic acid-peptide product that aims to restrict fat cell formation and enhance lipolysis, ultimately taking a targeted approach to treating obesity.

New evidence has also demonstrated that DCA enhances insulin resistance and increases thermogenesis by stimulating fat breakdown and mitochondrial function in mouse models. These are new mechanisms that could be fine-tuned with artificial intelligence and developed through molecular modeling. Overall, taking both of these advances together, the potential for artificial intelligence to better and faster identify the next generation of deoxycholic acid-based treatments for obesity is available.

U.S. Deoxycholic Acid Obesity Drugs Market Size and Growth 2025 to 2034

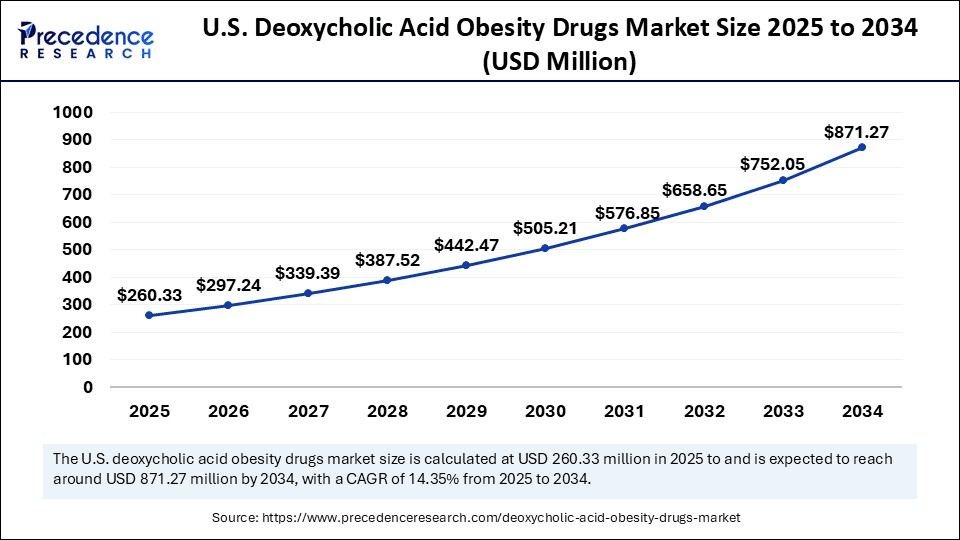

The U.S. deoxycholic acid obesity drugs market size was exhibited at USD 228.00 million in 2024 and is projected to be worth around USD 871.27 million by 2034, growing at a CAGR of 14.35% from 2025 to 2034.

Why North America is dominating the Lead in the Deoxycholic Acid Obesity Drugs Market?

North America dominated the deoxycholic acid obesity drugs market in 2024, which is primarily attributable to rising demand for fat reduction using non-surgical methods, along with a large concentration of aesthetic clinics also providing injectable options. Consumer awareness regarding cosmetic aesthetic surgical procedures is also increasing, along with the prevalence of obesity, and favorable regulatory approvals have fueled the market. Moreover, body contouring is increasingly promoted by healthcare providers across the region, and overall consumer preferences are shifting to outpatient options with minimal time in recovery and less risk.

Due to high awareness among patients and access to Board-Certified dermatologists and other aesthetic professionals, the U.S. heavily drives North America's dominance. Growing attention about body image, along with the surge in adult obesity prevalence, is creating momentum to adopt deoxycholic acid-based treatments. Interest in injectable fat reduction options has also risen after the FDA approved Kybella injectable, largely for the treatment of submental fullness. The US market benefits from a strong aesthetic brand marketing initiative, general insurance reimbursement for consultation visits, and a large number of medspas and aesthetic centers providing customized, personalized non-surgical obesity interventions.

Why Is Asia-Pacific the Fastest-Growing Region for the Deoxycholic Acid Obesity Drugs Market?

The Asia Pacific region is the fastest-growing area in this market, as it is a region with increasing awareness of body aesthetics, rapid urbanization, and growing disposable income. Demand for non-invasive fat reduction procedures is driven by changing lifestyles, increasing urban obesity, and the cultural push towards beauty and wellness. The region is experiencing a high quantity of cosmetic dermatology clinics and international aesthetic brands beginning to sell to the region. The government support for expanding cosmetic services and licensed products also impacts this demand, especially in the area of expanding medical tourism for countries with the highest volume of cosmetic procedures.

India is the main growth contributor for the Asia Pacific region due to the growing middle class, interest in aesthetic medicine, and increased urban population body weight. Demand for non-invasive fat reduction procedures is increasing since more people are looking for affordable and quick alternatives to liposuction. This market in India is expanding with dermatology and aesthetic clinics opening in metro cities and performing deoxycholic acid-based injections offered under global protocols. Medical tourism and competitive pricing are totaling encouraging patients to obtain injectable treatments to help with the management of localized fat accumulation, with the addition of influence from social media.

Market Overview

What is the Deoxycholic Acid Obesity Drugs Market?

The deoxycholic acid obesity drugs market consists of pharmaceutical products formulated with deoxycholic acid, a naturally occurring bile acid that helps break down and absorb dietary fat. In drug form (notably injectable formulations), deoxycholic acid is used as a minimally invasive treatment for localized subcutaneous fat reduction, particularly in aesthetic medicine for chin (submental) fat and emerging off-label uses in body contouring. While not a systemic anti-obesity drug, it plays a role in targeted fat loss treatments and is gaining popularity due to the growing demand for non-surgical aesthetic solutions.

What Are the Main Growth Factors Driving the Deoxycholic Acid Obesity Drugs Market?

- Increasing Rates of Obesity: The increase in obesity rates across the globe (driven by sedentary lifestyles and poor dietary practices) is creating a demand for localized fat reduction options such as deoxycholic acid and their associated fat loss in areas that are resistant to diet and exercise habits.

- Preference for Non-Surgical Solutions: Patients are opting for less-risky minimally invasive procedures that increase the recovery rate and decrease the financial costs. Therefore, injectable fat treatment such as deoxycholic acid is preferred over surgical means such as liposuction.

- Enhancements in Aesthetic Information: The increased amount of time spent on social media creates a heightened focus on our physical appearance, and there is an elevated demand for body contouring treatments that encourage and embrace injectable fat reductions in patients.

- Additional Clinical Support and Regulatory Approvals: With each regulatory approval and favorable clinical trial results, the safety and efficacy of deoxycholic acid are making it more convincing for physicians and patients to accept the new treatment.

- Increased Medical Tourism: With low costs of cosmetic procedures in emerging markets and an increase in professionals becoming trained, there is an increase in patients traveling internationally to pursue deoxycholic acid-based fat reduction.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,830.89 Million |

| Market Size in 2025 | USD 555.07 Million |

| Market Size in 2024 | USD 486.14 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.18% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type,Distribution Channel,End User, Application, Patient Demographics, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Global Obesity Trends Increase Demand for Deoxycholic Acid Treatments

The global rise in obesity has become a sociological concern, and the demand for non-invasive methods of fat reduction, such as deoxycholic acid, has increased, leading to significant growth in the deoxycholic acid obesity drugs market. According to the World Heart Federation, over 2.3 billion people currently live with overweight or obesity, and it is projected that this number will exceed 2.7 billion by 2025. This increase has generated increased interest in fat treatment in body areas, specifically for submental fullness, commonly referred to as the "double chin," where traditional weight loss efforts may fall short.

Deoxycholic acid also provides a non-invasive injectable option designed solely to target and harm fat cells of specific areas of the body, including the chin, jawline, and flanks. The growth and awareness of deoxycholic acid are largely due to the non-surgical aspects of treatment, minimized downtime for recovery, and obvious results. The body awareness/reducing fat in any area/facial contouring, etc., is growing leaps and bounds worldwide, leading deoxycholic acid to gain popularity and acceptance within people's aesthetic goals, particularly those desiring a subtle improvement.

Restraint

Side Effects and Nerve Injury Concerns Are Inhibiting the U.S. Adoption of Deoxycholic Acid Obesity Drugs

A constraining factor for the deoxycholic acid obesity drugs market resides with the growing concern over side effects, specifically nerve injury and duration of swelling. According to the U.S. FDA and clinical updates, adverse events like swelling, pain, bruising, numbness, and even temporary facial muscle weakness after injection treatments with deoxycholic acid (i.e., Kybella) are common.

While the side effects of deoxycholic acid treatment are typically transient, they can cause significant issues for several weeks by distorting the patient's facial movements or symmetry, which are important factors for patient satisfaction. In addition, as more and more real-world patient reviews and dermatologists in 2023 raised cautions of the variability in fat-reduction efficacy, the injectable deoxycholic acid treatments are approached more carefully by both providers and patients than they would be when compared to other non-invasive obesity and body contouring alternatives.

Opportunity

Is the Surge in Male Medical Aesthetics Attracting New Demand for Deoxycholic Acid Treatments?

There is a burgeoning opportunity in the deoxycholic acid obesity drug market from the expanding male patient demand for aesthetic procedures, particularly non-surgical fat reduction. For example, the American Society of Plastic Surgeons' 2024 report noted that men underwent over 1,585,878 cosmetic procedures, especially 34,260 facial fat grafting procedures. A key opportunity with Kybella and deoxycholic acid products in the market includes expanded labels beyond submental (double-chin) fat to create demand for more localized body contouring across regions.

Clinics are directing marketing and treatment plans toward male aesthetics, notably in the chin, abdomen, and flanks. This is reflective of changing beauty ideals and the normalization of aesthetic care for men. As the male-focused trends of gender-neutral wellness and aesthetics gain traction around the world, deoxycholic acid-based therapies have the opportunity to enter a new, previously untapped space, all while supporting future growth in the deoxycholic acid obesity drugs market.

Drug Type Insights

Why Are ATX-101 (Deoxycholic Acid Injection / Kybella / Belkyra) Dominating the GI Stool Testing Market?

The Kybella/Belkyra (deoxycholic acid injection) dominated the market in 2024, based on a combination of FDA approval, brand recognition, and safety profile. Its application in a clinic by a trained provider, together with increasing demand for non-surgical fat reduction, has allowed it to establish itself as the dominant deoxycholic acid injection in North America, Europe, and parts of Asia in aesthetic treatment centers and dermatology clinics.

An experimental and compounded formulation of deoxycholic acid is the fastest-growing drug type segment. There has been interest in their potential ESG and flexibility for consideration in local fat treatment applications, i.e., not solely the submental area. The use is presently off-label and not well regulated, but expanding, particularly through smaller clinics that are interested in custom formulations, as there is usually less stringent regulation in the deoxycholic acid obesity drugs market where the treatment is in use. This has the potential to open new pathways for development with effects that may drive growth even further.

Application Insights

Why Did the Submental Fat Reduction (Double Chin) Segment Dominate the Deoxycholic Acid Obesity Drugs Market?

Submental Fat Reduction (Double Chin) segment remains the dominating application for deoxycholic acid obesity drugs. This popularity has grown at least in part from the consumer demand for non-invasive facial contouring in aesthetic-focused markets such as the U.S. and South Korea. The proven efficacy of ATX-101 in dissolving fat under the chin and its FDA approval for this application have established it and the associated diagnosis codes as a standard of care for dermatologists and other aesthetic leaders.

The abdominal fat reduction is likely to be the fastest-growing segment by application during the forecast period. While still considered an off-label use, it is developing appeal among aesthetic clinics providing focused body contouring. The added interest in minimally invasive methods for abdominal and flank fat reduction is driving demand, particularly as patients look for a subtle yet noticeable fat reduction without invasive surgery or prolonged downtime.

End User Insights

Which End User Segment Dominates the Market in 2024?

The aesthetic clinics and medspas will continue to dominate the deoxycholic acid obesity drugs market. These facilities have become the go-to for non-surgical fat reduction treatments, and especially for the submental fat contouring procedures with ATX-101. Their appeal comes from providing low-cost and minimally invasive outpatient procedures, with little downtime, satisfying individuals who are worried about their appearance and looking to do subtle body sculpting. Additionally, they are taking advantage of the ethic of the singular customer decision maker, creating clinical rationale to mix treatment paths into a single visit, motivating increasingly footfall and repeat treatments to bracket size concerns.

Plastic surgery centers are expected to be the fastest-growing end-user segment over the forecast period. As demand for a broader range of body contouring procedures expands beyond the chin area, these facilities are expanding their services to include the off-label applications of intravenous deoxycholic acid procedures to treat abdominal fat. Surgeons in these settings are adopting more deoxycholic acid-based options to provide patients with less invasive alternatives to liposuction, especially for patients who are reluctant to undergo surgery but desire targeted reductions in accumulated fat.

Distribution Channel Insights

What Makes Physician-Dispensed / In-Clinic Administration the Prominent Distribution Channel?

Physician-dispensed or in-clinic administration was the dominant and fastest-growing distribution channel for deoxycholic acid obesity drugs in 2024. Due to the injectable nature of deoxycholic acid formulations like ATX-101 (Kybella/Belkyra), these treatments require professional medical oversight and precision, making in-clinic administration the most suitable approach. Clinics ensure proper dosage, minimize complications, and provide post-treatment care, all of which contribute to patient safety and treatment effectiveness. The growing number of certified providers and rising patient trust in professionally administered aesthetic procedures are further accelerating the growth of this segment across global markets.

Patient Demographic Insights

Which Patient Demographic Segments Dominated the Market in 2024?

The dominant demographic for deoxycholic acid obesity drug treatments in 2024 was adults ages 25–45 years, who are typically driven by appearance and are generally seeking non-invasive cosmetic procedures to manage submental or local fat. This age group has more disposable income and has interacted with cosmetic procedures in one form or another, making them the target demographic reaching for deoxycholic acid injections offered by clinics and MedSpas

Adults aged 46–60 years will be the fastest-growing segment based on the opportunities available to them and current trends in older adults increasing their desire to achieve or maintain their appearance in an age-conscious world without the use of surgery. With growing acceptance of cosmetic injectables in older populations, profiting from deoxycholic acid utilization will be advantageous.

Deoxycholic Acid Obesity Drugs Market Companies

- AbbVie Inc.

- Revance Therapeutics, Inc.

- Ipsen

- Hugel, Inc. (South Korea)

- Medytox, Inc.

- Daewoong Pharmaceutical Co., Ltd.

- Endo International plc

- Venus Remedies

- Allergan Aesthetics (subsidiary of AbbVie)

- Revexia Life Sciences

- Contura International Ltd.

- OBE Pharma

- NovaBay Pharmaceuticals

- Laboratoires VIVACY (France)

- Sinclair Pharma

- Hyundae Meditech (Korea)

- DermaSculpt

- SinoPharm Group

- Croma Pharma

- Anika Therapeutics

Segments Covered in the Report

By Drug Type

- ATX-101 (Deoxycholic Acid Injection / Kybella / Belkyra)

- Experimental / Compounded Deoxycholic Acid Formulations

- Combination Therapies (under development)

- Oral Deoxycholic Acid Products (limited and non-FDA approved)

By Application

- Submental Fat Reduction (Double Chin)

- Abdominal Fat Reduction (off-label)

- Thighs, Arms, and Flanks (off-label aesthetic uses)

- Lipomas and Localized Fat Deposits

- Cellulite Management (experimental)

By End User

- Aesthetic Clinics & MedSpas

- Dermatology Clinics

- Plastic Surgery Centers

- Hospitals

- Home Administration (emerging, under supervision)

By Distribution Channel

- Physician-Dispensed / In-Clinic Administration

- Retail Pharmacies (in regions where approved for direct sales)

- Online Pharmacies (regulated channels only)

By Patient Demographics

- Adults Aged 25–45 Years

- 46–60 Years

- Millennials Seeking Non-Surgical Aesthetic Procedures

- Men

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting