What is the 5G Electromechanical RF Switch Market Size in 2026?

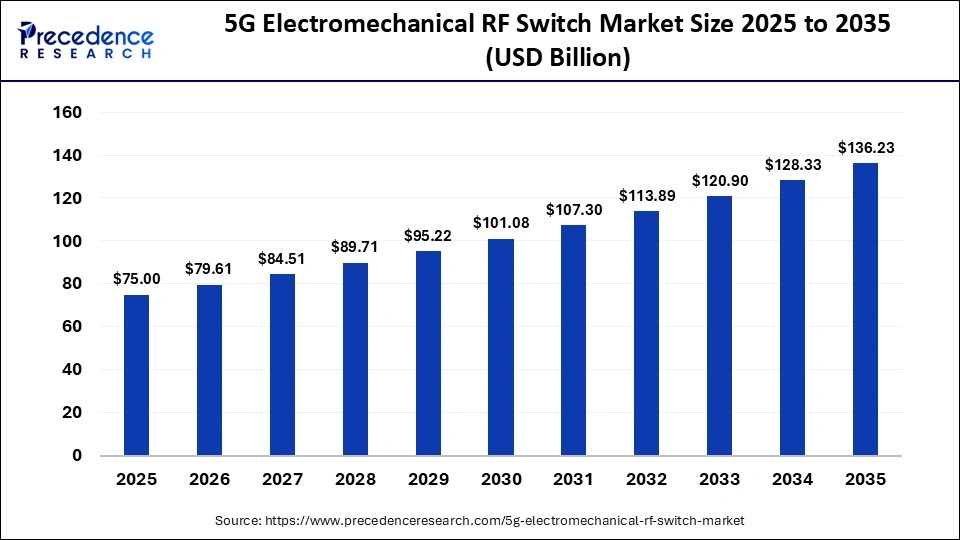

The global 5G electromechanical RF switch market size was calculated at USD 75.00 billion in 2025 and is predicted to increase from USD 79.61 billion in 2026 to approximately USD 136.23 billion by 2035, expanding at a CAGR of 6.15% from 2026 to 2035.The market is gaining momentum as telecom operators deploy advanced 5G networks and upgrade infrastructure. Demand is rising for high-reliability switching components used in base stations, communication systems, and aerospace applications. Manufacturers are focusing on improved performance, compact designs, and integration to support high-frequency signal management.

Key Takeaways

- Asia-Pacific led the 5G electromechanical RF switch market in 2025.

- Europe is expected to expand at the highest CAGR in the market between 2026 and 2035.

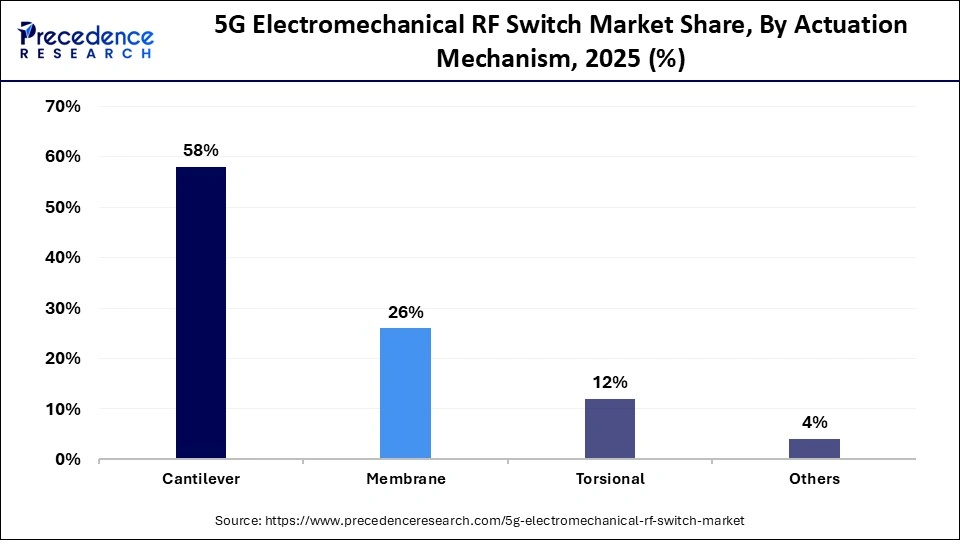

- By actuation mechanism, the cantilever segment held a dominant revenue share of the market in 2025.

- By actuation mechanism, the membrane segment is expected to grow at the highest CAGR between 2026 and 2035.

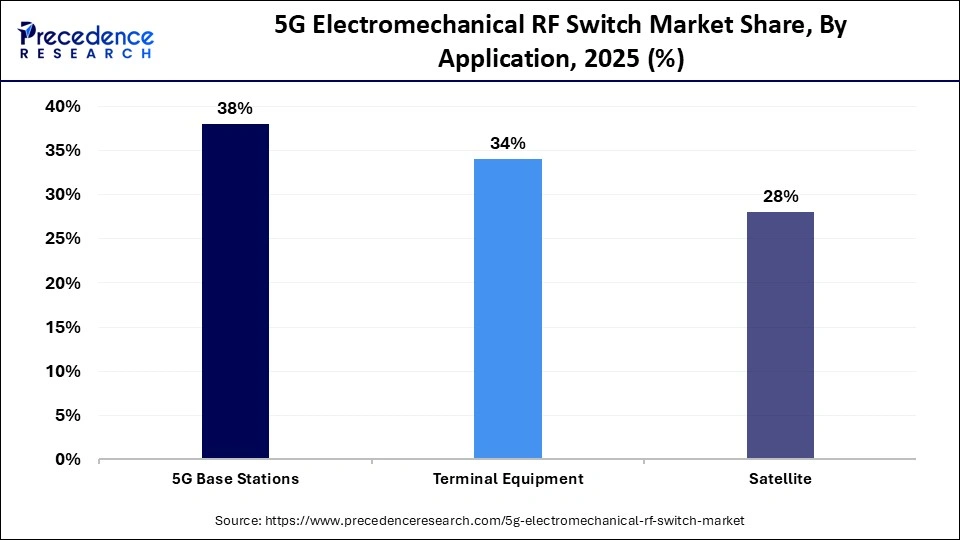

- By application, the 5G base station segment held the largest revenue share of the market in 2025.

- By application, the terminal equipment segment is expected to expand at the fastest CAGR from 2026 to 2035.

Why is the 5G Electromechanical RF Switch Market Gaining Strategic Importance?

A 5G electromechanical RF switch is a device that uses mechanical movement to open or close electrical paths, allowing radio-frequency (RF) signals to be routed between different circuits. In 5G systems, these switches are used in base stations, antennas, test equipment, and communication modules to handle high-frequency signals with low loss, high isolation, and strong reliability.

The market is driven by the rapid deployment of 5G networks across developed and emerging economies. Growing demand for high-speed data, expansion of telecom infrastructure, and increasing use of connected devices are boosting the need for efficient RF switching solutions. In addition, advancements in aerospace, defense, and satellite communications, along with the need for durable, high-performance components, are further supporting market growth.

How Can AI Integration Transform the 5G Electromechanical RF Switch Market?

AI integration can transform the global 5G electromechanical RF switch industry by improving design efficiency, predictive maintenance, and network optimization. AI-driven simulations help engineers develop switches with better performance, durability, and frequency handling while reducing development time. In manufacturing, AI enables quality control, defect detection, and process automation, leading to higher precision and lower production costs.

Within 5G networks, AI can analyze traffic patterns and automatically optimize signal routing, improving reliability and reducing downtime. Additionally, predictive analytics helps identify potential switch failures in advance, supporting proactive maintenance and extending component lifespan across telecom and aerospace applications.

Primary Trends Influencing the 5G Electromechanical RF Switch Market

- Rapid 5G Infrastructure Deployment: The ongoing global rollout of 5G networks is a core driver for RF switch demand. As carriers expand base stations and remote radio units to support high-speed, low-latency connectivity, the need for reliable electromechanical RF switches increases. These components help manage signal paths, maintain frequency integrity, and ensure seamless communication between hardware modules in complex 5G architectures. This infrastructure build-out spans both urban and rural regions, prompting steady production scale-up and innovation in switch design to match varied deployment conditions.

- Demand for High-Performance and Low-Loss Components: With 5G operating at higher frequencies compared to earlier generations, system components must handle these signals with minimal loss and distortion. Electromechanical RF switches are integral because they offer superior isolation and low insertion loss compared to some solid-state alternatives. Designers and network operators prioritize components that maintain signal quality under heavy traffic loads. This trend pushes manufacturers to enhance material quality, precision engineering, and performance testing, driving research into new contact technologies and improved mechanical tolerances that can support next-generation frequency bands, fostering 5G electromechanical RF switch market growth.

- Miniaturization and Integration Requirements: Modern 5G hardware demands compact and highly integrated solutions to fit into smaller, more efficient modules. Electromechanical RF switch manufacturers are under pressure to reduce the size and weight of their products without sacrificing performance. Miniaturization supports dense antenna arrays, multi-band systems, and distributed network nodes. This trend fosters innovation in packaging techniques, micro-mechanics, and integrated system design. As miniaturization proceeds, it enables broader adoption in consumer devices, remote units, and IoT gateways, widening the market beyond traditional base station equipment.

- Growth in Adjacent Sectors like Aerospace and Defense: Although telecommunications are the primary market, sectors such as aerospace, defense, and satellite communications increasingly rely on high-frequency RF switches for radar, secure communication links, and signal path routing. These industries demand rugged, highly reliable devices capable of withstanding extreme conditions. Their requirements influence broader market trends by encouraging enhanced durability, extended lifecycle performance, and stringent quality standards. As a result, innovation in electromechanical RF switch design also benefits 5G system applications, creating cross-industry technology improvements that support expanded market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 75.00 Billion |

| Market Size in 2026 | USD 79.61 Billion |

| Market Size by 2035 | USD 136.23 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.15% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Actuation Mechanism, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Actuation Mechanism Insights

Which Actuation Mechanism Segment Dominated the 5G Electromechanical RF Switch Market?

The cantilever segment dominated the market in 2025, due to its simple structure, reliable performance, and low actuation force, which enable faster switching and lower power consumption. Its design supports high isolation and low insertion loss at 5G frequencies, making it ideal for base stations and high-performance communication equipment where efficiency and durability are critical.

The membrane segment is expected to expand rapidly in the market in the coming years, as 5G hardware increasingly requires thinner, lighter, and more space-efficient switching solutions. Membrane-based designs support compact antenna modules, dense circuit layouts, and cost-optimized manufacturing. Their ability to maintain stable RF performance in tightly integrated 5G radio units and small-cell equipment is accelerating adoption across modern telecom deployments.

Application Insights

Which Application Segment Led the 5G Electromechanical RF Switch Market?

The 5G base station segment led the market in 2025, due to large-scale global deployment of telecom infrastructure and the high number of switches required per station. Advanced technologies such as massive MIMO, beamforming, and multi-band operation significantly increase switch usage, while rising mobile data traffic and network densification further boost demand for reliable switching components in base stations.

The terminal equipment segment is expected to show the fastest growth over the forecast period, due to the rapid expansion of 5G smartphones, routers, and customer-premises devices that require compact switches for multi-band signal routing. Modern 5G devices integrate multiple switches to support carrier aggregation, mmWave, and sub-6 GHz bands, and dynamic connectivity, increasing the number of switches per device. Additionally, rising adoption of IoT devices and fixed wireless access equipment is expanding the installed base of connected terminals, directly driving higher demand for reliable RF switching components across consumer and enterprise applications.

Regional Insights

Why Asia-Pacific Dominated the 5G Electromechanical RF Switch Market?

Asia-Pacific held a major revenue share of the market in 2025, due to rapid 5G network deployment across China, South Korea, and Japan, backed by strong government support and major telecom investments. High production capacity from local electronics manufacturers and robust supply chains for RF components further strengthen regional leadership. The increasing demand for advanced telecom equipment and widespread adoption of 5G-enabled devices also fuel market growth in the region.

China Market Trends

China's leadership in the market is driven by massive 5G infrastructure investment, extensive deployment of base stations, and strong domestic manufacturing capabilities. Key trends include rapid integration of RF switches in multi-band, high-frequency 5G equipment, local supply chain optimization, and growing demand from telecom operators and OEMs. Government support for indigenous technology, large-scale production of RF components, and increasing adoption of advanced telecom and IoT devices further reinforce China's dominant position in the Asia-Pacific market.

How is Europe Growing in the 5G Electromechanical RF Switch Market?

Europe is expected to witness the fastest growth during the predicted timeframe, due to accelerated deployment of 5G networks across key countries, strong telecom infrastructure upgrades, and growing investments in advanced communication technologies. Supportive regulatory frameworks, increasing demand for high-performance RF components from automotive, industrial, and aerospace sectors, and a rise in local R&D and manufacturing initiatives are driving rapid regional market expansion.

UK Market Trends

In the UK, growth in the 5G electromechanical RF switch industry is driven by the continued expansion of standalone 5G networks and the deployment of higher-frequency spectrum in dense urban areas. Increasing implementation of private 5G networks for manufacturing, logistics, and campus environments is strengthening demand for reliable RF switching components. Additionally, domestic research initiatives in advanced RF engineering and the country's strong aerospace and defense electronics base are supporting innovation and adoption of high-precision electromechanical switches.

How Big is the Opportunity for Market Growth in North America?

North America is expected to grow at a notable CAGR in the 5G electromechanical RF switch market in the coming years, due to rapid 5G network expansion across the U.S. and Canada, high adoption of 5G smartphones and IoT devices, and large-scale investments in advanced telecom infrastructure. The region's strong semiconductor ecosystem, defense and aerospace demand, private 5G network deployments, and early adoption of high-frequency technologies further accelerate the need for high-performance RF switching solutions.

Will Latin America Grow in the 5G Electromechanical RF Switch Market?

Latin America is expected to grow at a considerable CAGR in the upcoming period, as countries such as Brazil, Mexico, and Chile advance standalone 5G deployments and expand spectrum utilization. Increasing rollouts of fixed wireless access and enterprise connectivity solutions are raising demand for durable, high-frequency RF switches in base stations and backhaul systems. Partnerships between regional telecom operators and global equipment vendors, along with gradual infrastructure upgrades, are creating consistent growth opportunities across the region.

5G Electromechanical RF Switch Market Value Chain Analysis

- Raw Material Sourcing

This stage involves the procurement of high-conductivity metals, semiconductor substrates, and dielectric materials used in RF switch components. Critical materials include copper, gold, gallium, silicon, and advanced ceramics, which are selected for conductivity, durability, and high-frequency signal stability.

Key Players: Rio Tinto, Freeport-McMoRan, Sumitomo Metal Mining, Umicore, 3M, DuPont

- Component Fabrication and Machining

Manufacturers convert raw materials into precision RF components through micro-machining, semiconductor processing, plating, and assembly. This stage includes substrate preparation, metal contact formation, actuator integration, and packaging, ensuring compact designs and accurate tolerances for high-frequency switching performance.

Key Players: Qorvo, Skyworks Solutions, Murata Manufacturing, Teledyne Technologies, Menlo Micro, Amphenol

- Testing and Certification

Completed switches undergo electrical, mechanical, and environmental testing to verify insertion loss, isolation, switching speed, and durability. Certification processes include thermal cycling, humidity exposure, reliability trials, and compliance with telecom, aerospace, and industrial quality standards before commercial deployment.

Key Players: UL Solutions, Intertek Group, TÜV Rheinland, SGS, Keysight Technologies

- Product Lifecycle Management

After certification, RF switches are integrated into telecom infrastructure, satellite systems, and electronic modules. Distribution channels include direct OEM supply, telecom equipment providers, and global component distributors, followed by maintenance, replacement, and upgrade cycles throughout the product's operational life.

Key Players: Ericsson, Nokia, Huawei, Arrow Electronics, Avnet, CommScope

- After-Sales Support

This stage covers performance monitoring, predictive maintenance, spare-part supply, and technical support. Manufacturers analyze field data, manage product updates, and ensure long-term reliability through quality management systems, warranty programs, and end-of-life replacement strategies.

Key Players: Cisco Systems, HPE, Dell Technologies, IBM, Flex Ltd.

5G Electromechanical RF Switch Market Companies

- Infineon Technologies AG

- Teledyne Relays

- RF Lambda

- Mini Circuits

- Qotana

- Leader MW

- Pasternack

- Analog Devices, Inc.

- Qorvo, Inc.

- Menlo Micro

- Bright Toward Industrial Co., LTD.

- Guilin GLsun Science and Tech Group

- Microchip Technology Inc.

- Panasonic Corporation

- Omron Corporation

- TE Connectivity Ltd.

- Skyworks Solutions, Inc.

- Murata Manufacturing Co., Ltd.

- Texas Instruments Incorporated

- STMicroelectronics N.V.

Recent Developments

- In January 2025, Menlo Microsystems, Inc., launched the MM4250 cryogenic SP6T RF switch, designed for high-speed signal control with near-zero thermal footprint. The switch supports highly linear broadband performance at cryogenic temperatures, addressing demanding applications such as advanced communication and quantum-grade RF systems. This launch demonstrates progress toward ultra-low-power, high-reliability electromechanical switching technologies.(Source: https://menlomicro.com)

- In October 2025, Skyworks Solutions and Qorvo announced a major merger to create a US$22 billion RF semiconductor leader. The combination aims to accelerate the development of integrated RF solutions and address rising RF complexity across mobile, defense, IoT, and automotive markets. This strategic move reflects consolidation trends and increased R&D scale in advanced RF technologies.(Source: https://www.digitimes.com)

- In May 2024, Teledyne Relays announced the launch of its CCR-67V series, an advanced range of DC to 67 GHz SPDT coaxial switches, to meet the rigorous demands of 5G telecommunications, high-frequency automated test equipment, and millimeter-wave communication systems. The switch represents significant advancements in electromechanical switch technology, with both failsafe and latching models available.(Source: https://www.businesswire.com)

Segments Covered in the Report

By Actuation Mechanism

- Cantilever

- Membrane

- Torsional

- Others

By Application

- 5G Base Station

- Terminal Equipment

- Satellite

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting