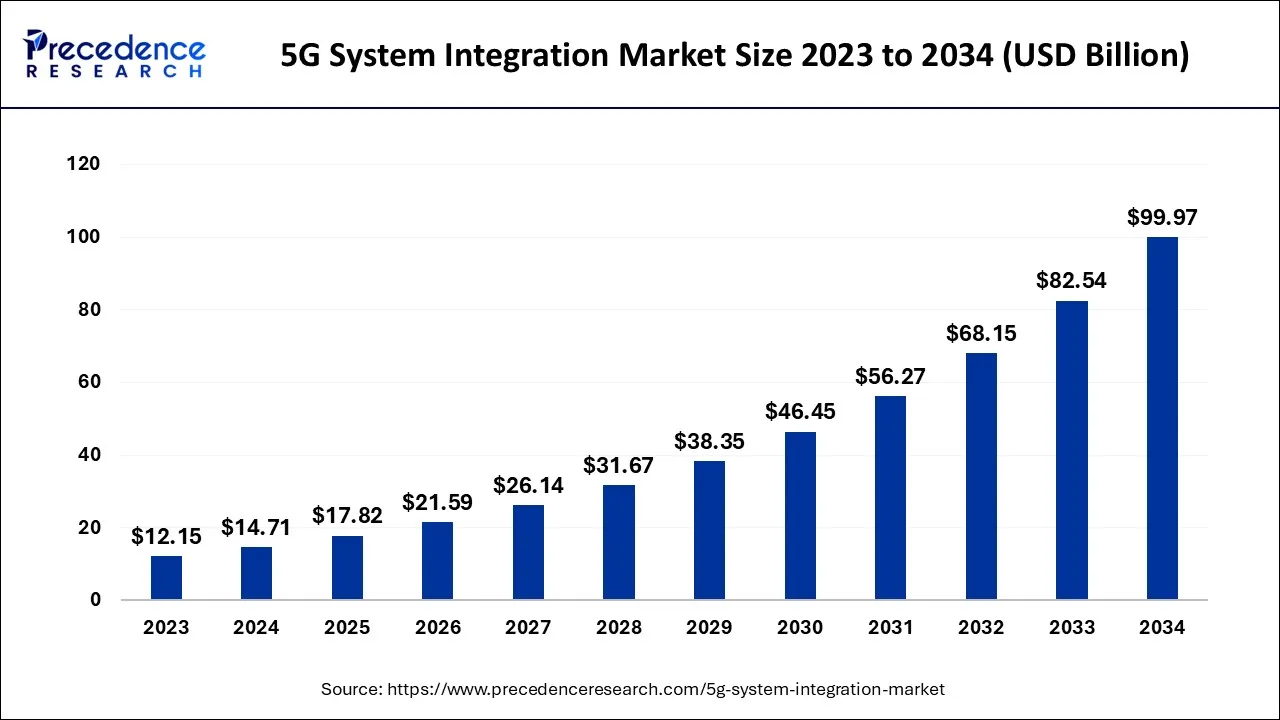

What is the 5G System Integration Market Size?

The global 5G system integration market size is accounted at USD 17.82 billion in 2025 and predicted to increase from USD 21.59 billion in 2026 to approximately USD 117.40 billion by 2035, representing a CAGR of 14.36% from 2026 to 2035.

5G System Integration Market Key Takeaways

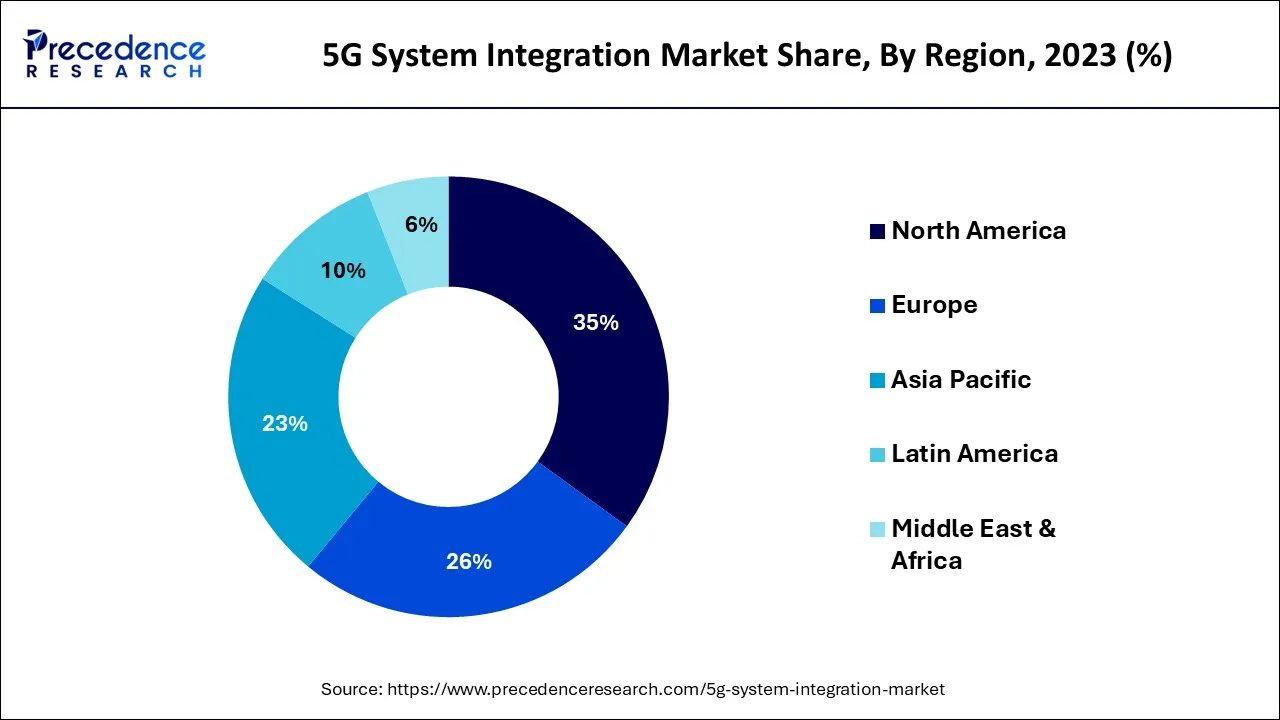

- North America captured more than 35% of the revenue share in 2025.

- By services, the infrastructure integration segment generated more than 39% of revenue share in 2025.

- By services, the consulting segment is predicted to grow at a CAGR of 31.40% from 2026 to 2035.

- By vertical, the IT and telecom segment dominated the market and accounted for more than 26% of revenue share in 2025.

- By application, the home and office broadband segment held the largest market share of around 24% in 2025.

Strategic Overview of the Global 5G System Integration Industry

Integrating physical and virtual aspects of any enterprise with new, improved applications or systems so they can operate over the brand-new 5G network is known as 5G system integration. Due to the increasing requirement for high-speed bandwidth capacity, businesses can now install updated network infrastructure to increase operational efficiency and decrease overall process expenses.

Therefore, it is predicted that the requirement for 5G system integration services will be driven by the aggressive deployment of improved network infrastructure all over enterprises to deliver enhanced services to consumers.

Major international manufacturers want to accelerate their business processes by utilizing cutting-edge digital technologies to fuel the fourth industrial revolution (Industry 4.0). Manufacturing facilities can make a significant step toward innovative and data-driven flexible operations success can be attributed to technologies like industrial wireless cameras, big data analytics, and collaborative robots.

Additionally, several manufacturers have created and implemented the abovementioned technologies to succeed in a highly competitive market. To give these 5G technologies truly united communication, manufacturers must integrate them with next-generation networks. Supplying constant remote monitoring and connectivity also assists in reducing operational expenses and downtime.

Therefore, over the forecast period, the popularity of 5G system integration services will increase due to the widespread deployment of the industrial internet of things (IIoT) and the increasing preference for 5G services to provide genuinely united connectivity.

One of the key factors anticipated to propel the market for 5G system integration is the rising acceptance of Software-Defined Networking and Network Function Visualization among businesses. Businesses can use NFV to deploy multiple firewalls and virtual machines to achieve an effective economy of scale. On the other hand, the smart network architecture offered by SDN aims to decrease hardware limitations on the business's premises.

Additionally, SDN enables these businesses to effectively manage the utilization of their interactions through an Application Programming Interface (API). Thus, the market growth is expected to be further boosted by the rapid adoption of SDN and NFV technologies to reduce overall network infrastructure prices.

Moreover, as the amount of data being stored in the cloud proliferates and the demand for cloud-based application integration rises, customers are becoming more concerned about security, which could limit the growth of the 5G system integration market in the future.

Artificial Intelligence: The Next Growth Catalyst in 5G System Integration

AI has become the "central nervous system" of the 5G system integration industry. AI fundamentally transforms these networks into autonomous, self-healing systems by automating complex tasks like real-time traffic management, load balancing, and predictive maintenance. Integration services now heavily feature AI-driven network slicing, which allows for up to 40% better resource utilization and the creation of highly customized virtual networks for industries like healthcare and smart manufacturing.

Market Outlook

- Market Growth Overview: The 5G system integration market is expected to grow significantly between 2025 and 2034, driven by the rapid adoption of 5G networks, industrial automation & industry 4.0, and proliferation of connected devices & IoT.

- Sustainability Trends: Sustainability trends involve AI-driven energy efficiency, renewable energy integration, and circular economy principles.

- Major Investors: Major investors in the market include Lightspeed Venture Partners, Sequoia Capital, Qualcomm Ventures, Cisco Investments, Singtel Innov8, and Verizon.

- Startup Economy: The startup economy is focused on open RAN solutions, private 5G networks for industry, edge computing and cloud integration, and AI and analytics for network management.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 17.82 Billion |

| Market Size by 2035 | USD 117.40 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 21.12% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Services, By Vertical, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for network infrastructure and increasing industrial automation

The 5G system integration market has expanded due to the growing use of industrial automation technologies, especially in advanced nations. There are now more battery manufacturing facilities due to the rising demand for hybrid and electric vehicles. Therefore, growing industrial automation demand is anticipated to drive the 5G system integration market forward.

Industries have substantially reduced process expenses and enhanced efficiency and productivity by upgrading their network infrastructure due to the rising need for high-speed bandwidth capacity. By implementing a robust, updated network infrastructure, companies can offer better customer service, which will spur market expansion.

Restraint

The market for 5G system integration may be affected by various restraints, including:

- High Cost: Investment in 5G infrastructure is necessary, which can be a significant barrier to entry for many businesses. Especially for small and medium-sized companies, integrating 5G networks and devices can be relatively inexpensive.

- Limited coverage: Although 5G networks have been widely deployed, coverage still needs to be improved in many places. As a result, businesses might be reluctant to invest in a system that does not have widespread coverage, which could limit the adoption of 5G technologies.

- Security concerns: The complexity of 5G networks and devices may increase their susceptibility to security flaws. Businesses might be willing to implement 5G technologies once the security risks are better understood and reduced.

- Lack of standardization: Since there currently needs to be a global standard for 5G networks, businesses may find it challenging to integrate the technology across various systems and devices. This lack of standardization may hamper the interoperability of 5G systems with current infrastructure.

- Regulatory barriers: There may be legal limitations on deploying 5G networks in some areas or nations. For instance, some governments might demand that businesses obtain licenses or permits before deploying 5G infrastructure, which can increase the overall cost and duration of the technology's implementation.

Opportunity

The market for 5G system integration may present several opportunities, including:

- Enhanced connectivity:5G networks offer faster speeds, greater bandwidth, and lower latency than earlier wireless network generations. New use cases and applications, like smart cities, autonomous vehicles, and remote healthcare services, may be possible.

- Increased productivity:Businesses may operate more effectively thanks to 5G networks' high-speed connectivity, which lowers latency and speeds up data transfer. This may result in more productive workers and more efficiently run businesses.

- New revenue streams:Businesses, particularly those in sectors like healthcare, manufacturing, and logistics, may find new sources of income due to the adoption of 5G technologies. This includes new services and applications that are made possible by 5G networks' increased speed and bandwidth.

- Improved customer experience:By enabling faster and more dependable connectivity, 5G networks can improve the customer experience, particularly for applications like online gaming, video streaming, and virtual reality.

- Innovation:New products and services may be developed due to innovation made possible by 5G networks in several industries. This may involve the creation of new Internet of Things gadgets, smart home technologies, and augmented reality software.

Services Type Insights

The infrastructure integration segment, which had a market share of more than 39% in 2025 in revenue, held the largest market share for 5G system integration. From 2024 to 2034, this segment is anticipated to grow at the fastest CAGR. The rapid growth of the fusion of current and next-generation network infrastructure is to blame.

Therefore, integrating legacy infrastructure allows customers to utilize the same hardware with improved features, decreasing the hardware price. Additionally, building management, network integration, and data center infrastructure management are included in the infrastructure system integration services.

During the forecast period, the consulting segment is anticipated to grow at a CAGR of 31.40%. Business enterprises first turn to system integrators to create updated network architecture for their organizations due to the rapidly increasing demand for 5G technologies, such as networking devices. These businesses will be able to expand business output overall in less time compared to this architecture. Additionally, it is anticipated that the requirement for application integration services will increase throughout the projected timeframe due to the spiraling demand for multi-vendor cloud-based applications all over enterprises.

Vertical Insights

The IT and telecom segment dominated the 5G system integration market in terms of value in 2023, with a share of 26%; from 2024 to 2034, a significant CAGR is expected to be recorded. This is explained by the rising demand for 5G integration services from IT and telecom firms to support New Radio (NR) waves. The requirement for 5G system integration facilities in the IT and telecom sector is expected to increase due to increasing preference for incorporating enterprise network infrastructure and data center network hardware. In addition, 5G network services are anticipated to experience significant enterprise implementation over the forecast period due to increased emphasis on delivering seamless connectivity during a virtual meeting to cut down on a consultant or specialist's overall travel time.

Manufacturing companies continuously automate their production lines to increase overall production efficiency as digitalization gains popularity in the industry. This has led to the requirement for seamless wireless communication among industrial robots, sensors, actuators, and other devices mounted in production facilities. Due to the increasing demand for system integration facilities to integrate the entire facility with 5G carriers' supporting network, the manufacturing sector is predicted to expand faster throughout the projected period.

Application Insights

The home and office broadband segment held the largest market share in revenue in 2025, with a market share of 24%; from 2026 to 2035, it is anticipated to grow at a significant CAGR. This is due to the increasing demand for 5G system integration facilities to connect customers and businesses to improved mobile broadband. The requirement for 5G system integration services to create such systems adaptable with next-generation network services is also anticipated to increase due to the significant rise in IoT devices across fast-developing smart cities worldwide. From 2024 to 2034, it is predicted that this factor will further accelerate the expansion of the smart city segment during the forecast period.

Globally, there has been a significant increase in the use of connected sensors and collaborative robots in industry applications. Establishing seamless connectivity is anticipated to increase the requirement for next-generation data services, fuelling the segment's expansion during the forecast period. A flawless communication setup among smart grids to automate and monitor power distribution and storage operations is another factor expected to contribute to the intelligent power distribution processes market segment experiencing a significant rise.

Regional Insights

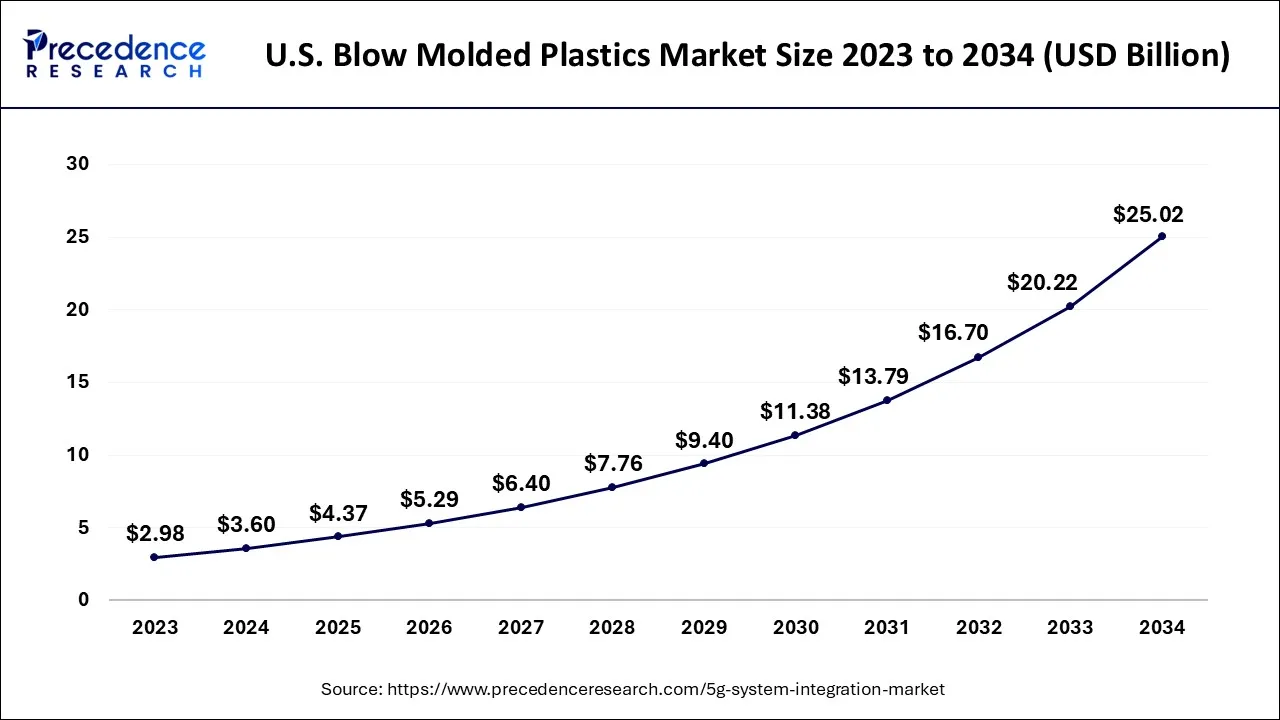

U.S. 5G System Integration Market Size and Growth 2026 to 2035

The U.S. 5G system integration market size is exhibited at USD 4.37 billion in 2025 and is projected to be worth around USD 25.02 billion by 29.82, growing at a CAGR of 21.17% from 2026 to 2035.

Throughout the forecast period, North America will dominate the 5G system integration market and generate for more than 35% of the revenue share in 2025. This results from increasing government spending on implementing cutting-edge solutions across numerous departments, rising industrial automation using the internet of things (IoT), growing use of energy-efficient production techniques, and rising demand for affordable products in this geographical area.

During the projected period of 2026–2035, Asia–Pacific is anticipated to experience the fastest growth because of the region's increasing internet of things (IoT) adoption in industrial automation as well as the sector's technological improvements and investment in utilized information technology systems.

Individual business variables and modifications to market regulation are also provided in the country section of the report, which affects both the market's current and future developments. Data points like technical trends, case studies, porter's five forces analysis, and downstream and upstream supply chain analyses are just a limited number of the indicators used to predict the market condition for particular countries. When supplying a forecast review of the country data, it also considers the presence and visibility of major brands, the problems they face because of significant or inadequate competition from national and local brands, the effect of domestic tariff barriers, and trade routes.

U.S. 5G System Integration Market Trends

U.S. rapid expansion of private 5G networks to ensure secure, low-latency communication for industrial applications. This growth is heavily reliant on the seamless integration of AI and edge computing, which enables autonomous network management and real-time data processing for critical sectors like manufacturing and healthcare.

China 5G System Integration Market Trend

China's massive infrastructure rollout and strong government support. Deploying cloud-native architectures and leveraging AI for network automation. A major focus is on developing private 5G networks for industrial applications (Industry 4.0), smart cities, and healthcare.

How Did Europe Notably Grow in the 5G System Integration Market?

Europe is shifting from prototyping to large-scale industrial production, particularly in the automotive and aerospace sectors. Regional leaders like Germany and the Netherlands pioneered "distributed manufacturing," using cloud-based printer farms to localize spare part production. The market integrated AI-driven generative design and advanced metal powders to meet strict sustainability and carbon-neutrality mandates.

Germany 5G System Integration Market Trend

Germaine's strong manufacturing, automotive, and logistics sectors, global leader in the proliferation of private 5G networks, and government support and privacy. The need to integrate legacy systems with next-generation network infrastructure often utilizes technologies like network function virtualization and software-defined networking.

Value Chain Analysis of the 5G System Integration Market

- Component & Chipset Manufacturing:

This foundational stage involves the design and production of high-performance 5G modems, RF transceivers, and specialized semiconductor technologies like Gallium Nitride (GaN) for signal amplification.

Key Players: Qualcomm, Intel, Samsung Electronics, MediaTek. - Network Equipment & Infrastructure Supply:

Providers at this stage manufacture the physical hardware of the network, including Massive MIMO antennas, small cells, and base stations (gNodeB), as well as the 5G core network software.

Key Players: Ericsson, Huawei Technologies, Nokia Corporation, ZTE Corporation, Samsung Electronics. - System Integration & Consulting Services:

System integrators bridge the gap between hardware vendors and end-users by designing network architectures, managing multi-vendor interoperability, and deploying software-defined networks (SDN).

Key Players: Accenture, IBM Corporation, Capgemini, Tata Consultancy Services (TCS), Wipro, Tech Mahindra, Infosys. - Network Operation & Connectivity (TSPs):

Telecom Service Providers (TSPs) own the spectrum and operate the 5G networks, offering high-speed connectivity to both individual consumers and industrial enterprises.

Key Players: Verizon, AT&T, T-Mobile, China Mobile, Vodafone, Bharti Airtel, Deutsche Telekom. - End-User Application & Industry Verticals:

The final stage represents the realization of 5G value through specific use cases like smart manufacturing (Industry 4.0), autonomous vehicles, and remote healthcare.

Key Sectors: Manufacturing, Healthcare, Automotive, Energy & Utilities, Smart Cities.

Top Companies in the 5G System Integration Market & Their Offerings:

- Accenture Inc.

Accenture provides high-level strategic consulting and complex multi-vendor orchestration to help enterprises integrate 5G with existing IT infrastructures. - ECI Telecom (Ribbon Communications)

ECI Telecom offers packet-optical transport solutions and elastic network architectures that facilitate the backhaul and midhaul requirements of 5G networks. - Huawei Technologies Co., Ltd.

Huawei is a leading end-to-end provider of 5G infrastructure, offering everything from radio access network (RAN) hardware to core network software and cloud services. - Keysight Technologies

Keysight provides essential testing, measurement, and optimization solutions that allow integrators to validate 5G network performance and device interoperability. - Cisco Systems, Inc.

Cisco focuses on the software-defined networking (SDN) and cybersecurity aspects of 5G integration, providing the IP-based transport and mobile core architectures. - Samsung Electronics Co., Ltd.

Samsung provides advanced 5G RAN and Core equipment, leveraging its expertise in chipsets and virtualization to offer high-performance network solutions. They are a key partner for operators looking to integrate Open RAN architectures and massive MIMO technology into their 5G rollouts. - Infosys Limited

Infosys leverages its "Living Labs" and engineering services to design and deploy 5G-enabled digital solutions for industries like retail and energy. They act as a system integrator by building software layers that connect 5G connectivity to enterprise applications and AI-driven analytics. - Ericsson

Ericsson is a primary provider of 5G hardware and software, offering a robust portfolio of radio systems and cloud-native core solutions. They facilitate system integration by partnering with global enterprises to deploy private 5G networks and manage complex network migrations. - Wipro Limited

Wipro provides 5G engineering and edge computing services, focusing on the integration of IoT devices with high-speed network architectures. They help clients monetize 5G by developing custom application programming interfaces (APIs) and managing cross-platform network orchestration. - Tata Consultancy Services Limited (TCS)

TCS offers its "Network Solutions Group" expertise to help telecommunications firms and enterprises modernize their stacks for 5G readiness. They specialize in integrating 5G with cognitive business operations and providing managed services for complex network ecosystems. - Hansen Technologies

Hansen focuses on the monetization and billing integration of 5G services, providing specialized BSS (Business Support Systems) software. They help service providers integrate complex 5G data usage and network slicing metrics into streamlined customer management and billing platforms. - Radisys Corporation

Radisys provides open-source-based 5G software modules and disaggregated RAN solutions that are vital for the shift toward Open RAN (O-RAN). - HPE (Hewlett Packard Enterprise)

HPE offers a cloud-native 5G core and edge computing platforms that allow for the seamless integration of telco and enterprise IT environments. Their "GreenLake" model provides an as-a-service approach for companies looking to integrate and manage 5G infrastructure without heavy upfront capital. - IBM Corporation

IBM utilizes its "Cloud for Telecommunications" and Red Hat OpenShift platform to provide the hybrid cloud foundation necessary for 5G system integration. They specialize in using AI and automation to orchestrate network functions across complex, distributed edge environments. - Oracle Corporation

Oracle provides 5G core network signaling, policy control, and security solutions designed for highly scalable, cloud-native environments. - ALTRAN (Capgemini Engineering)

Now part of Capgemini, Altran provides deep R&D and engineering services for 5G product development and network deployment. - HCL Technologies Limited

HCL provides 5G lab-as-a-service and system integration frameworks that focus on accelerating the adoption of O-RAN and edge computing. They help enterprises integrate 5G into their digital foundations by providing end-to-end engineering and infrastructure management services. - CA Technologies (Broadcom)

As part of Broadcom, CA Technologies provides software solutions for monitoring and managing the performance of 5G network infrastructures. - AMDOCS

Amdocs is a leader in software and services for communications and media companies, specializing in the orchestration and automation of 5G network slices.

5G System Integration Market Companies

- Accenture Inc.

- ECI TELECOM

- Huawei Technologies Co., Ltd.

- Keysight Technologies

- Cisco Systems, Inc.

- Samsung Electronics Co., Ltd.

- Infosys Limited

- Ericsson

- Wipro Limited

- Ericsson

- Tata Consultancy Services Limited

- Hansen Technologies

- Radisys Corporation

- HPE

- IBM Corporation

- Oracle Corporation

- ALTRAN

- HCL Technologies Limited

- CA Technologies

- AMDOCS

Recent Developments

- 2021-The largest supplier of communications solutions in India, Bharti Airtel Limited and Qualcomm Technologies, Inc., will work together to hasten the rollout of 5G in that country. To implement virtualized and Open RAN-based 5G networks, Airtel will work with device partners, and network vendors using Qualcomm 5G RAN Platforms.

- In February 2024, Wipro and Nokia designed to integrate operational infrastructure with secure 5G private networks for enhanced reliability and real-time data access in various industries. The collaboration offered enterprises with a more secure 5G private wireless network solution integration with operation infrastructure. (https://www.nokia.com)

- In November 2024, Huawei and China Unicom introduced a large-scale integrated 5G-Advanced intelligent network in Beijing, featuring AI-driven optimization and faster speeds for applications like Extended Reality (XR) and IoT. The new network is designed to optimize network operations and energy efficiency. (https://technologymagazine.com)

Segments Covered in the Report

By Services

- Infrastructure Integration

- Consulting

- Application Integration

By Vertical

- Energy & Utility

- Retail

- Manufacturing

- Healthcare

- Media & Entertainment

- Transportation & Logistics

- IT & Telecom

- BFSI

- Others

By Application

- Collaborate Robot /Cloud Robot

- Smart City

- Industrial Sensors

- Wireless Industry Camera

- Logistics & Inventory Monitoring

- Drone

- Vehicle-to-everything (V2X)

- Home and Office Broadband

- Gaming and Mobile Media

- Intelligent Power Distribution Systems

- Remote Patient & Diagnosis Management

- P2P Transfers /mCommerce

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting