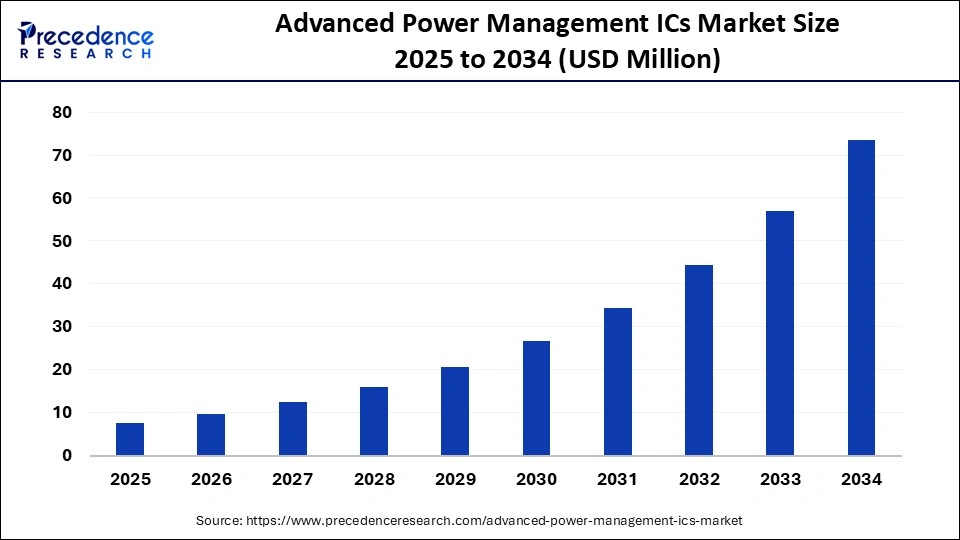

What is the Advanced Power Management ICs Market Size?

The advanced power management ICs market insights on market dynamics, challenges, and strategic outlook in advanced power management ICs. Rising demand for energy-efficient, high-performance electronics is driving growth in the market for advanced power management ICs.

Advanced Power Management ICs Market Key Takeaways

- North America dominated the advanced power management ICs market, holding the largest market share of 38.8% in 2024.

- The Asia Pacific is expected to expand at a notable CAGR of 7.2% between 2025 and 2034.

- By product type, the voltage regulators segment held the largest market share of 35.5% in 2024.

- By product type, battery management ICs is expected to grow at a remarkable CAGR of 6.8% between 2025 and 2034.

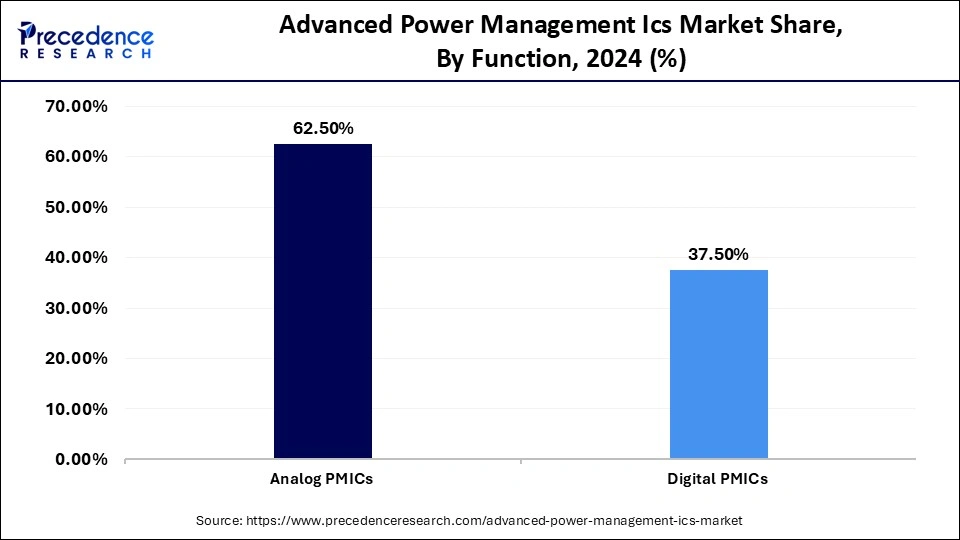

- By function type, the analog PMICs segment held the largest share of 62.5% in the advanced power management ICs market during 2024.

- By function type, digital PMICs is expected to grow at a remarkable CAGR of 6.7% between 2025 and 2034.

- By operating range type, the 1.1mA to 1A segment held the largest market share of 34.3% in 2024.

- The operating range type, 1A to 10A, is expected to grow at a remarkable CAGR of 6.8% in the advanced power management ICs market between 2025 and 2034.

- By application type, the consumer electronics segment held the largest market share of 38.3% in 2024.

- By application type, the automotive sector is expected to grow at a remarkable CAGR of 7.0% between 2025 and 2034.

What is the Advanced Power Management ICs Market?

Advanced power management integrated circuits (PMICs) are specialized semiconductor devices designed to manage and optimize the power requirements of electronic systems. They integrate multiple power management functions, such as voltage regulation, battery charging, power sequencing, and energy monitoring, into a single chip. PMICs are crucial in applications where space, efficiency, and performance are paramount, including smartphones, electric vehicles, industrial automation, and IoT devices.

Market growth in the advanced power management ICs market is being propelled by proliferating electrification across end markets, the insatiable demand for energy-efficient designs, and the imperative for longer battery life in mobile and edge devices. PMICs have migrated from auxiliary subsystems to central architects of power integrity, orchestrating complex multi-rail supplies, dynamic voltage scaling, and sophisticated power sequencing. The rise of 5G, AI accelerators, EVs, and IoT nodes has created heterogeneous power envelopes that only smart, programmable PMICs can manage with fine-grained efficiency. Suppliers are therefore racing to deliver higher integration, embedding power switches, regulators, battery management, and telemetry into ever-smaller footprints. Capital intensity, process-node sensitivity, and system co-design demands shape vendor selection and OEM partnerships. Consequently, PMICs have become a strategic lever for differentiation in performance, cost of ownership, and sustainability across modern electronics.

Advanced Power Management ICs Market Outlook:

- Industry Growth Overview: Industry growth is propelled by systemic drivers: proliferating electrified vehicle architectures, densification of data-centre compute, expansion of edge AI devices, and pervasive connectivity demanding stringent power budgets. Vendors are responding with domain-specific PMIC families, automotive-grade, telecom-grade, and ultra-low-power for wearables, each with tailored reliability and qualification regimes.

- Consolidation and strategic alliances are common as system OEMs prefer single-vendor power platforms for design simplicity and lifecycle support. Manufacturing and packaging innovations 3D integration, advanced substrates, and embedded passives, are shortening BOMs while improving thermal profiles. The industry's rhythm is defined by multi-year design cycles, close co-engineering with customers, and iterative firmware upgrades that extend product relevance. Overall, the sector grows by marrying semiconductor finesse with system-level power stewardship.

- Sustainability Trends: Sustainability considerations are increasingly central to PMIC design, optimising energy-per-operation, enabling energy-harvesting integration, and supporting power modes that drastically reduce idle consumption. Suppliers are designing for longevity: hot-swap capable rails, robust battery charging algorithms that extend cycle life, and firmware that adapts to environmental conditions to conserve energy.

- Packaging and process choices now consider lifecycle impact, favouring recyclable substrates and reduced use of hazardous materials where feasible. System-level power optimisation reduces data center cooling loads and extends vehicle range, aligning PMIC innovation with corporate ESG goals. Circularity is creeping into supply agreements, with OEMs demanding materials traceability and supplier carbon accounting. Thus, PMICs are an unsung enabler of greener electronics across the value chain.

- Major Investors: Capital flows into the PMIC domain are a blend of strategic corporate R&D funds from incumbent semiconductor houses, venture capital for novel analog and power-topology startups, and infrastructure investors backing advanced packaging fabs. Hyperscale and automotive OEMs occasionally take strategic stakes to secure supply and co-develop domain-specific power platforms.

- Private equity has also begun consolidating niche IP-rich analog specialists to create scale and broaden service offerings. Grant funding and government semiconductor initiatives in some regions underpin local capacity expansion and technology sovereignty efforts. Collectively, this investor mosaic reflects both financial opportunity and strategic industrial policy imperatives.

- Startup Economy: A sprightly startup ecosystem is innovating at the intersection of silicon, power topology, and firmware intelligence, delivering programmable PMIC fabrics, GaN/SiC power drivers, and adaptive battery-management IP. Many new entrants focus on software-defined power, offering modular PMIC platforms with cloud-connected telemetry for fleet optimisation. Startups often partner with OSATs and foundries for rapid prototyping and rely on strategic partnerships with Tier-1 OEMs for validation.

- At the same time, capital barriers for analog-heavy ventures are non-trivial; successful proof-points command premium M&A interest from established semiconductor players seeking to bolster product portfolios. In short, startups supply disruptive ideas and agile execution that invigorate the incumbents and accelerate market evolution.

Key Technological Shift in the Advanced Power Management ICs Market

The defining technological inflection is the convergence of highly integrated PMIC silicon with wide-bandgap power transistors (GaN/SiC), advanced packaging, and software-defined control loops to enable unprecedented power density and efficiency. GaN and SiC devices dramatically reduce conduction and switching losses, allowing PMICs to operate at higher frequencies and smaller passive footprints. Meanwhile, embedded telemetry and AI-driven control enable dynamic workload-aware power scaling and predictive thermal management. Heterogeneous integration co-packaging logic, analogy, and power dies minimizes parasitics and improves transient response. Additive manufacturing and 3D substrate technologies further compress the BOM and enhance heat dissipation. Together, these shifts recast PMICs as intelligent, co-designed system elements rather than passive power utilities.

Impact of AI in the Advanced Power Management ICs Market

AI is increasingly playing a pivotal role in advancing the advanced power management ICs market by pushing design optimization, operational efficiency, and adaptability to new power demands. In chip design, AI-assisted EDA (electronic design automation) tools are helping engineers explore vast design spaces more rapidly, finding optimal tradeoffs between power, performance, and area that would have been too complex to achieve through manual tuning. At runtime, AI and machine learning models embedded into PMICs enable real-time adaptive power management by dynamically adjusting voltage, frequency, and current in response to workload changes, thermal conditions, or battery state to maximize energy efficiency.

AI also enhances predictive maintenance and fault detection in power systems by analyzing telemetry and usage patterns to forecast component degradation or failures, allowing preventative intervention. AI helps optimize multi-rail systems (for example, in complex SoCs or multi-domain systems) by coordinating power sequencing across domains to avoid inefficiency or transient failures. In emerging domains like electric vehicles, data centers, and renewable energy, AI-integrated power management ICs help manage battery systems, DC-DC conversion, and energy routing in smart, responsive ways.

Market Key Trends in Advanced Power Management ICs Market

- Transition to software-configurable PMIC platforms with long-tail configurable rail maps.

- Rapid adoption of GaN/SiC drivers for high-efficiency power stages and fast charging.

- Emphasis on functional safety and ISO-compliant PMICs for automotive and industrial use.

- Movement to heterogeneous packaging (SiP, fan-out, embedded dies) for thermal and electrical gains.

- Telemetry and cloud-connected power analytics for fleet-level optimisation and predictive maintenance.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, byFunction,Operating Range,Applicationand Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics in Advanced Power Management ICs Market

Market Drivers

Power as a Platform

A primary driver of the advanced power management ICs market is the recognition that power management is no longer a commoditised afterthought but a strategic platform that shapes performance, battery life, cost, and emissions across end markets. PMICs that optimise energy use unlock higher computational throughput within tight thermal envelopes, prolong mobile device battery life, and extend EV driving range outcomes that end-users appreciate palpably. OEMs thus view advanced PMICs as differentiators that can justify premium positioning and brand loyalty. The drive toward electrification and pervasive intelligence in devices expands addressable markets for sophisticated PMIC solutions. Additionally, software-enabled PMICs open recurring revenue avenues through updates and optimisation services. Consequently, the market is propelled by the convergence of technical necessity and commercial leverage.

Market Restraint

Analog Complexity and Node Economics

A material restraint in the advanced power management ICs market is the intrinsic difficulty and cost of analog and power-device innovation. Design cycles are long, yields are sensitive to process variation, and qualification demands, especially for automotive and medical applications, are exacting. Wide-bandgap device integration and advanced packaging require substantial capital investment and specialised manufacturing ecosystems, limiting the pool of capable vendors. Moreover, the migration to advanced process nodes does not always yield proportional analogy performance gains, complicating cost-performance trade-offs. Supply-chain fragility for high-spec substrates and passives can delay production ramp-ups. Finally, systems OEMs often demand multi-year roadmaps and long-term supply commitments, which smaller vendors may struggle to guarantee. These factors collectively temper the pace of vendor proliferation and market commoditisation.

Market Opportunity

Embedded Intelligence, Embedded Value

The most promising opportunity lies in offering holistic PMIC platforms that combine silicon, firmware, packaging, and cloud analytics, thereby converting point products into strategic system enablers. Vendors that provide end-to-end solutions, reference designs, safety certifications, and OTA power-optimisation services will capture greater wallet share and cement long-term customer relationships. Verticalizing offerings for EV charging infrastructure, data-centre power racks, or edge-AI nodes can unlock higher-margin niches. Additionally, retrofittable intelligent drive modules and modular fast-charging PMICs for commercial fleets represent immediate commercial avenues. Partnerships with OSATs and test providers to offer turnkey validated kits will accelerate OEM adoption. In short, embedding intelligence across the power delivery chain creates sticky value propositions and recurring revenues.

Advanced Power Management ICs Market Value Chain Analysis

- Raw Material Sources: Critical inputs include specialized silicon wafers, epitaxial layers for GaN/SiC devices, high-reliability passives (MLCCs, inductors), copper and advanced substrate materials (copper-invar-copper, organic laminates), and thermal interface materials. Supply-chain resilience for these high-spec commodities is vital to avoid production disruptions and to maintain quality thresholds.

- Technology Used: Core technologies encompass GaN and SiC power transistors, switched-mode DC-DC converters, multi-phase buck regulators, wide-dynamic-range ADC telemetry, and advanced packaging SiP, embedded die, and fan-out. Complementary technologies include digital power controllers, model-based control firmware, and machine-learning-enabled power optimisation engines.

- Investment by Investors: Investors prioritise firms with differentiated mixed-signal IP, GaN/SiC integration capability, or modular PMIC platforms that serve fast-growing verticals like EVs and datacentres. Strategic corporate VC and infrastructure funds often co-invest to secure capacity and foster vertical integration across the value chain.

- AI Advancement: AI augments PMIC design and operation by predicting production yield anomalies, optimising control-loop parameters, and enabling adaptive power management that learns workload patterns to reduce energy consumption. Machine-learning models also accelerate layout verification for signal integrity and thermal modelling in complex multi-die packages.

Segmental Insights

Product Type Insights

Why Are Voltage Regulators Dominating the Advanced Power Management ICs Market?

The voltage regulators dominate the advanced power management ICs market, holding a 35.5% share and ensuring seamless voltage stability across a range of electronic subsystems. Their indispensability spans from smartphones and wearables to industrial controllers and EV powertrains, where precise voltage control is the sine qua non of reliability. Modern regulators, no longer mere passive stabilisers, integrate real-time telemetry, adaptive feedback, and thermal compensation to accommodate fluctuating loads. As system-on-chips (SoCs) proliferate in complexity, the number of discrete voltage domains has multiplied, reinforcing the dominance of regulators as indispensable enablers of functional integrity. Manufacturers are increasingly embedding these regulators into multi-function PMICs, providing configurable rails through software-defined voltage maps. This convergence of analogy precision and digital control cements voltage regulators as the fulcrum of the PMIC universe.

Voltage regulators also dominate due to their scalability across industries, from compact IoT sensors to high-wattage EV inverters. They embody the rare duality of ubiquity and customization, deployed universally yet meticulously tailored to each application's power persona. The market's preference for integrated linear and switching regulator architectures ensures lower noise, higher conversion efficiency, and greater compactness. Additionally, continuous refinements in topology, like low-dropout regulators and multi-phase buck converters, enhance transient performance and system resilience. As new semiconductor materials like GaN and SiC enter mainstream design, regulators evolve to handle higher voltages and switching frequencies with élan. In essence, voltage regulators remain the sentinels of electronic stability, quiet, efficient, and indispensable.

Battery management ICs (BMICs) represent the pulsating heart of portable and electric applications, orchestrating safe charging, cell balancing, and lifetime optimisation. Their demand is skyrocketing as electric vehicles, wearables, and IoT devices proliferate, each demanding nuanced energy orchestration. Modern BMICs no longer simply protect; they prognosticate, predict state-of-health, manage temperature gradients, and even learn user patterns via embedded AI logic. With lithium-ion cells advancing toward higher energy densities, precision management of charging cycles and fault detection becomes paramount. Startups and OEMs alike are investing in BMIC innovation as battery safety, efficiency, and lifespan evolve into crucial differentiators. Thus, the segment's growth mirrors a broader electrification ethos sweeping industries worldwide.

Modular architectures and universal compatibility with various chemistries from Li-ion to solid-state further undergird the acceleration of BMIC adoption. This adaptability allows BMICs to transcend traditional verticals, powering drones, medical devices, and autonomous robots with equal aplomb. Software-integrated diagnostics empower predictive maintenance and real-time system calibration, making these ICs not just protectors but intelligent custodians of stored energy. As the world embraces sustainability and mobility, BMICs stand poised at the confluence of safety, intelligence, and endurance. Their rapid growth embodies the transition from energy storage to energy intelligence, a quiet revolution encoded in silicon.

Function Insights

Why Are Analog PMICs Dominating the Advanced Power Management ICs Market?

The analog PMICs are dominating the advanced power management ICs market, holding a 62.5% share. They remain the bedrock of precision operating at the intersection of physics and finesse, where voltage margins are razor-thin and stability is sacrosanct. Analog architectures excel in low-latency responses, noise immunity, and thermal predictability, which are essential in automotive, industrial, and telecom environments. Their deterministic behaviour under dynamic load conditions offers a level of reliability that digital designs still aspire to match. Moreover, analogue PMICs are versatile across manufacturing nodes, preserving performance even in mature processes, thereby ensuring cost efficiency and longevity. Their ubiquity makes them both the workhorse and the watchguard of the power ecosystem.

The continued reign of analogue PMICs is also a testament to engineering craftsmanship, meticulous layout design, noise suppression, and thermal balancing. They deliver elegance through precision, performing feats of control invisible to the end-user but vital to the system's survival. In critical sectors such as medical devices, avionics, and energy infrastructure, analogue PMICs embody trust, performing tirelessly with minimal computational overhead. Even as the market tilts toward digital programmability, analogue remains indispensable for baseline regulation, current sensing, and transient management. It is this unassailable reliability that secures analogue PMICs their throne atop the market hierarchy, at least for the foreseeable epoch.

The digital PMICs are the fastest growing in the advanced power management ICs market, holding a share of 6.7%. Digital PMICs are the embodiment of modern convergence, melding precision hardware with intelligent firmware. Their rise stems from the need for programmability, adaptability, and telemetry in power-sensitive systems like AI accelerators and EV control modules. Unlike static analog counterparts, digital PMICs can dynamically configure voltage rails, monitor power metrics, and self-adjust to workload fluctuations. This agility makes them indispensable for next-generation systems-on-chip (SoCs) that require fine-grained control and energy reporting. Furthermore, integration with machine learning algorithms allows real-time optimisation for thermal limits, efficiency, and reliability. As power transitions from a static function to an adaptive service, digital PMICs are its most eloquent emissaries.

Operating Range Insights

Why Are 1.1mA to 1A Dominating the Advanced Power Management ICs Market?

The range from 1.1mA to 1A dominates the advanced power management ICs market, holding a 34.3% share and catering to the bulk of portable and embedded electronics that define modern life. This range supports smartphones, IoT nodes, wearables, and microcontroller applications where efficiency trumps brute strength. The emphasis here is on precision and leakage control, as even microamp fluctuations can translate into perceptible differences in battery endurance. PMICs in this range are paragons of miniaturisation, balancing thermal behaviour, switching speed, and integration density. Their architectures enable multi-rail support within space-constrained environments, an indispensable feature for modern SoCs. Consequently, the segment's dominance is both quantitative in terms of volume and qualitative in terms of design importance.

The 1A to 10A segment is the fastest growing in the advanced power management ICs market, holding a share of 6.8%, driven by burgeoning applications in electric mobility, industrial automation, and high-performance computing. These current ranges fuel processors, motors, and LED systems demanding both robustness and responsiveness. As data centres densify and electric powertrains diversify, PMICs capable of managing multi-ampere loads efficiently have become strategic assets. This range requires innovations in heat dissipation, current sensing, and low-loss switching, all critical for maintaining efficiency under stress. Additionally, the rise of GaN-based systems has enabled higher switching frequencies and smaller passive components, accelerating adoption. Thus, this segment epitomises power with purpose, high current, high intelligence, and high impact.

Application Insights

How Are Consumer Electronics Dominating the Advanced Power Management ICs Market?

Consumer electronics dominate the advanced power management ICs market, holding a 38.8% share and encompassing smartphones, tablets, wearables, and personal computing devices. These products demand impeccable power efficiency, compact form factors, and low heat generation, all hallmarks of modern PMIC design. The sector's relentless innovation cadence ensures continuous refresh cycles, fuelling sustained PMIC demand. As end-users expect longer battery life, faster charging, and seamless multitasking, PMICs have become strategic enablers of user experience. Their miniaturisation and programmability underpin the industry's ability to innovate rapidly without compromising energy integrity. In essence, the PMIC is the invisible hand orchestrating the harmony between performance and endurance in every digital device.

The automotive industry is the fastest-growing segment in the advanced power management ICs market, holding a 7.0% share, driven by the electrification wave and the digital cockpit revolution. Electric vehicles, ADAS modules, and infotainment systems demand efficient, reliable power conversion with functional safety compliance. PMICs are evolving to deliver precise voltage rails across noisy, high-temperature automotive environments, ensuring both safety and endurance. Moreover, the advent of EVs' fastest charging systems and autonomous driving computers has created multi-rail, high-current challenges tailor-made for advanced PMICs.

Regional Insights

Will North America Maintain Its Lead as the Power-Architecture Innovator?

North America dominates the advanced power management ICs market, holding a 38.8% share, driven by hyperscalers, premier automotive OEMs, and an ecosystem of analog design houses and fabless innovators. The region's concentration of cloud providers, AI chip designers, and electric-vehicle platforms creates voracious demand for high-performance power solutions that marry efficiency with safety and telemetry. The abundance of venture capital and a dense network of specialized foundries and OSAT partners facilitate rapid prototyping and scale-up of novel PMIC architectures. Moreover, stringent regulatory and functional-safety expectations drive vendors to mature robust verification and compliance practices that appeal to global OEMs. The market here prizes co-innovation, software-enabled features, and supplier reliability, which together sustain premium valuations for capable PMIC suppliers. In consequence, North America remains the epicentre of both demand sophistication and technological leadership.

Country Analysis U.S.

The United States continues to be the crucible of PMIC innovation, nurturing semiconductor IP, leading-edge EDA toolchains, and systems integrators that co-design power architectures with hyperscale and EV OEMs. Policy support for semiconductor R&D and robust capital markets further reinforce its strategic advantage. Yet, sustaining leadership demands continued investment in packaging, GaN/SiC fabrication, and resilient supply chains, areas where collaborative public–private initiatives can be decisive.

Can Asia Pacific Translate Scale into Leadership in High-Performance Power ICs?

The Asia Pacific is the fastest-growing region in the advanced power management ICs market, holding a share of 7.2%. This growth is propelled by large-scale consumer electronics manufacturing, accelerating EV adoption, and ambitious network infrastructure rollouts. The region's combination of cost-effective manufacturing, concentrated OSAT capacity, and rapidly maturing domestic semiconductor players makes it an attractive production and innovation hub for power management solutions. Governments are incentivising semiconductor ecosystems, and local OEMs are increasingly specifying advanced PMIC requirements for regional product lines, thereby stimulating demand.

Moreover, the presence of global foundries and packaging specialists accelerates time-to-volume for new PMIC families. The market's growth is both organically driven by domestic device demand and strategically driven by multinational suppliers as they regionalise capacity to mitigate geopolitical supply risks. Consequently, the Asia Pacific will continue to close the gap with established markets while carving out its own centres of power-technology excellence.

China's vast electronics ecosystem, coupled with targeted industrial policy, positions it to scale PMIC manufacturing and packaging capability rapidly; success will hinge on indigenous mastery of GaN/SiC epitaxy, advanced substrates, and robust IP development. Should domestic players achieve parity in these domains, China could both secure local supply and become a prominent exporter of advanced PMIC platforms.

Top Advanced Power Management ICs Market Companies

- Texas Instruments Incorporated: A global leader in analog and embedded semiconductors, Texas Instruments designs high-performance analog ICs and power management chips used in automotive, industrial, and consumer electronics.

- Analog Devices, Inc:Specializes in high-precision analog, mixed-signal, and digital signal processing (DSP) technologies, widely applied in healthcare, communications, and automation systems.

- Infineon Technologies AG: Focuses on power semiconductors, microcontrollers, and automotive ICs, driving innovation in energy efficiency, e-mobility, and smart IoT solutions.

- STMicroelectronics: Develops analog, power, and sensor ICs for applications in automotive, industrial, and consumer electronics, with strong expertise in MEMS and energy-efficient semiconductors.

- NXP Semiconductors: A leading provider of automotive and IoT semiconductors, NXP develops secure connectivity and power management chips for smart devices and EV platforms.

- Microchip Technology Inc.: Offers a broad portfolio of microcontrollers, analog, and mixed-signal ICs, supporting embedded solutions for automotive, aerospace, and industrial systems.

- Renesas Electronics Corporation:Specializes in microcontrollers and analog semiconductors, focusing on automotive, industrial, and IoT applications with advanced integration and reliability.

- ON Semiconductor Corporation:Provides intelligent power and sensing technologies, offering energy-efficient semiconductors for EVs, data centers, and renewable energy systems.

- Qualcomm Technologies, Inc.: A global leader in mobile and wireless chipsets, Qualcomm designs advanced SoCs integrating AI, connectivity, and power management for smartphones and IoT devices.

- MediaTek Inc.: Develops high-performance mobile, smart home, and connectivity chipsets, delivering cost-effective SoCs for 5G devices and consumer electronics.

- Maxim Integrated Products, Inc.: Known for low-power analog ICs and mixed-signal products, Maxim's technologies enhance efficiency in portable and automotive applications.

- Vishay Intertechnology, Inc.: Manufactures discrete semiconductors and passive components like diodes, resistors, and sensors for industrial and power management systems.

- Diodes Incorporated: Produces discrete and analog semiconductor components, including diodes, rectifiers, and voltage regulators, catering to the automotive and communication sectors.

- Monolithic Power Systems, Inc.: Designs power management ICs and analog semiconductors that enhance efficiency in cloud computing, automotive, and consumer electronics.

- Silicon Laboratories Inc.: Develops mixed-signal ICs and wireless connectivity solutions, focusing on low-power IoT, smart home, and industrial automation applications.

Recent Developments

- In October 2025, Empower Semiconductor, a power startup, secured over $140 million in new funding to expand production of its advanced power management ICs designed for GPUs and other high-power AI chips. The investment underscores a growing belief that the future of AI innovation hinges not only on breakthroughs in computing and networking but equally on advancements in power electronics.

Empower Secures $140 Million in Funding to Develop Voltage Regulator ICs for AI | Electronic Design

Segments Covered in the Report

By Product Type

- Voltage Regulators

- Linear Voltage Regulators

- Switching Regulators

- Battery Management ICs

- Battery Charging ICs

- Battery Protection ICs

- Fuel Gauge ICs

- Integrated ASSP PMICs

- Mobile Device PMICs

- Automotive PMICs

- Consumer Electronics PMICs

- Motor Control ICs

- AC Motor Control ICs

- DC Motor Control ICs

- Brushless DC Motor ICs

- Multi-Channel PMICs

- Other Products

- Power Monitoring ICs

- Power Distribution ICs

By Function

- Analog PMICs

- Digital PMICs

By Operating Range

- 1µA to 1mA

- 1.1mA to 1A

- 1A to 10A

- 10.1A to 25A

- 25.1A to 100A

- Above 100A

By Application

- Consumer Electronics

- Smartphones

- Tablets

- Wearables

- Automotive

- Electric Vehicles (EVs)

- Advanced Driver Assistance Systems (ADAS)

- Information Technology & Telecommunications

- Servers

- Networking Equipment

- Healthcare

- Medical Devices

- Diagnostic Equipment

- Industrial

- Robotics

- Automation Systems

- Power & Energy

- Renewable Energy Systems

- Smart Grids

- Aerospace & Defense

- Satellite Systems

- Avionics

- Other Applications

By Region

- North America (US, Canada)

- Europe (EU, UK, Rest)

- Asia-Pacific (China, Japan, South Korea, Australia)

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting