Agricultural Lubricant Market Size and Forecast 2025 to 2034

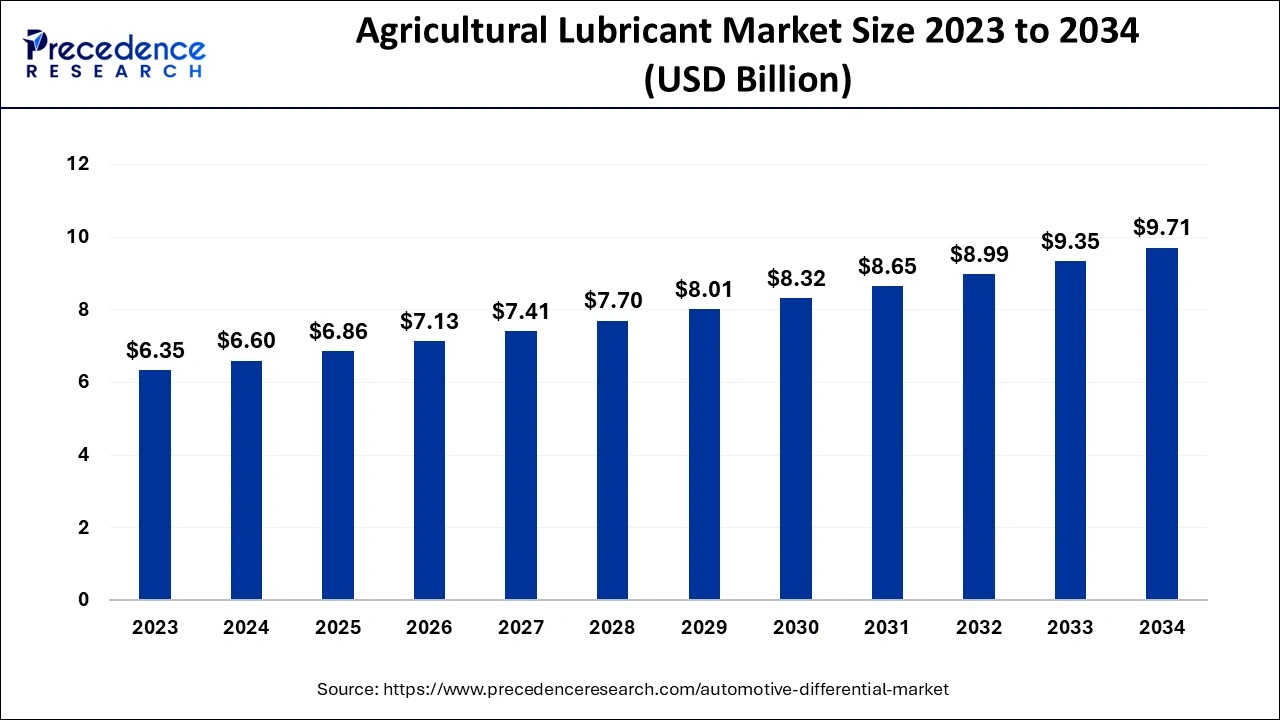

The global agricultural lubricant market size was calculated at USD 6.60 billion in 2024, and is anticipated to hit around USD 6.86 billion by 2025, and is predicted to reach around USD 9.71 billion by 2034, expanding at a CAGR of 3.93% from 2025 to 2034. The agricultural lubricant market is growing because of frequently rising levels of mechanization and constant innovation in farming equipment technology.

Agricultural Lubricant Market Key Takeaways

- In terms of revenue, the agricultural lubricant market is valued at $6.86 billion in 2025.

- It is projected to reach $9.71 billion by 2034.

- The agricultural lubricant market is expected to grow at a CAGR of 3.93% from 2025 to 2034.

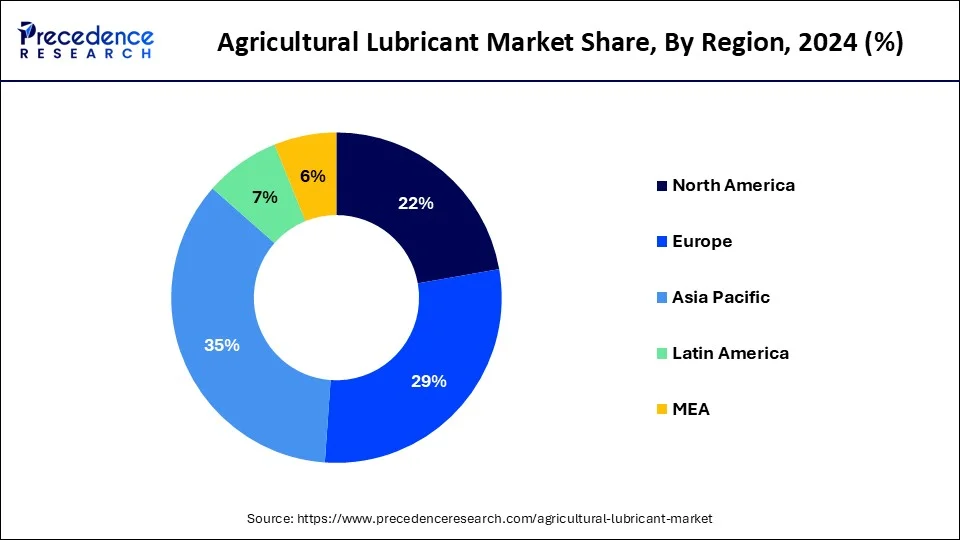

- Asia Pacific dominated the agricultural lubricant market in 2024.

- North America is expected to witness the fastest growth during the forecast period.

- By product type, the engine oil segment accounted for the highest market share in 2024.

- By product type, the UTTO segment is projected to grow at a solid CAGR during the forecast period.

- By sales channel, the aftermarket segment led the market in 2024.

- By category type, the bio-based lubricant segment contributed the largest market share in 2024.

How is Artificial Intelligence (AI) Changing the Agricultural Lubricant Market?

As global forces such as increasing costs, scarcity of labor, and the effect of climate change increase,farmers are adopting innovative technologies like artificial intelligence, robotics, andInternet of Things(IoT) T to keep production and gains per acre high. The use of AI and automation technology is widely affecting the lubricants market in agriculture and farming. Advanced techniques of real-time datasets driven by AI/ML have allowed farmers to track the condition of machinery and lubricants to improve overall utilization. There's better control of lubricants; this has made the systems cut on wastage and even reduce costs, making the operations efficient. These developments are not only revolutionizing lubricant handling but also positively impacting this market by promoting innovation and enhancing equipment's reliability in agriculture.

Asia Pacific Agricultural Lubricant Market Size and Growth 2025 to 2034

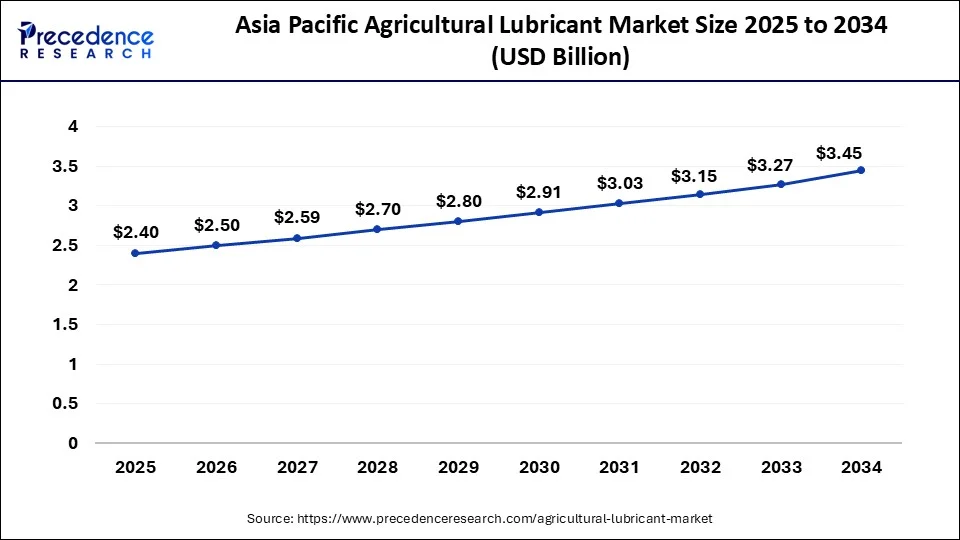

The Asia Pacific agricultural lubricant market size is exhibited at USD 2.40 billion in 2025 and is projected to be worth around USD 3.45 billion by 2034, growing at a CAGR of 4.09% from 2025 to 2034.

Asia Pacific led the agricultural lubricant market in 2024. Regions such as China and India are expected to enhance their capability to produce agricultural lubricants to lessen import dependence on oils. The region is the largest producer of various crops like rice, cotton, potato, etc. The size of agricultural production in the country and the need for agricultural machinery in the future will remain high. This will stimulate the demand for agricultural lubricants so that it becomes the leading market segment. India is one of the world's most agriculture-based economies.

- About 50% of India's total population depends on agriculture. There is an increasing concern for the environment and policies set up by regional governments to support farmers and increase the rate of localization of products.

- The tractor exports from India rose 6% in the year 2022 to 131,850 units. It is the highest recorded annual export for the Indian auto industry, marginally ahead of 124,901 units exported in 2021. Currently, India owns approximately 2.1% of the market share for tractors around the world.

- The Japanese strategic plan is to boost the agricultural output to 54 million metric tonnes by 2025 from 50 million metric tonnes in the year 2013. Furthermore, the government of the country intends to grow the producer income to USD 35 billion from USD 29 billion by at least 21% over the same time in relation to agricultural quality yield and revenue and reducing costs of production.

Asia-Pacific holds the largest share in the global agricultural lubricant market, owing to rapid agricultural mechanisation, expansive rural economies, and supportive government frameworks. Key contributing countries include China, India, Japan, Australia, and Indonesia. These nations are investing heavily in agricultural reforms, digital farming infrastructure, and subsidy-based procurement of modern machinery like tractors, combine harvesters, and irrigation systems.

India's government has promoted PM-KUSUM and Sub-Mission on Agricultural Mechanization (SMAM) to support farmers in upgrading their equipment, which directly contributes to higher lubricant usage. In China, the push toward smart agriculture has seen the introduction of AI-powered tractors and drones, further requiring advanced lubricants for smooth operations. Japan and South Korea, with their advanced farming technologies, demand precision-grade, synthetic, and biodegradable lubricants for high-end machinery.

North America is anticipated to grow notably in the agricultural lubricant market during the forecast period. This growth is attributed to the change that has occurred in the agriculture sector through the use of high-performance machinery that needs specialized oil to enable efficiency and durability. Also, the growing concerns for sustainability and environment-conscious products in the region are promoting the evolution of lubricants with less detrimental effects on the environment due to demanding legislation. The changing agricultural trend, especially in North American countries such as the U.S. and Canada, is augmenting the use of agricultural machinery such as tractors and sprinklers, hence driving the sales of lubricants.

North America is witnessing a surge in demand for agricultural lubricants, making it the fastest-growing region in this sector. The presence of technologically advanced machinery, along with a growing trend towards sustainable agriculture, is pushing farmers to choose premium, synthetic, and long-drain interval lubricants. The U.S. and Canada are spearheading innovation in precision farming and agro-robotics, which rely on high-performance lubricants to maintain system efficiency and uptime. Recent trends include partnerships between lubricant giants and OEM manufacturers to create equipment-specific solutions that enhance productivity and reduce environmental impact.

Market Overview

The agricultural lubricants are used for machinery engine oil. Lubricants on which performance, longevity, and the safety of deployment rely are developed to address issues such as high-temperature usage, longer periods between servicing, and greater power densities to support more effective equipment. They also protect the machinery against end damage to the engine part. Agricultural lubricants have become important for the agricultural machinery industry through the improvement of farm equipment. Better performance lubricants are needed, which can also increase efficiency and reduce wastage.

Fuelling the Future of Sustainable Farming

The global agricultural lubricant market is witnessing a robust transformation driven by sustainability concerns, technological innovations in farming equipment, and rising mechanization in both developed and developing nations. One of the key trends is the increasing adoption of biodegradable and eco-friendly lubricants, replacing traditional petroleum-based solutions. Farmers and agricultural businesses are leaning towards bio-based lubricants derived from vegetable oils due to their lower environmental impact and improved lubrication properties.

Precision agriculture and smart farming machinery have created the need for high-performance lubricants that can operate efficiently in extreme temperatures, resist corrosion, and extend machinery life cycles. Equipment-specific lubricants that ensure reduced wear and tear while maintaining energy efficiency are gaining traction, especially as climate-resilient farming becomes the norm. Furthermore, government incentives promoting environmentally responsible practices are helping the bio-lubricant segment flourish. Across Southeast Asia, increased food security initiatives have led to stronger demand for lubricant-supported farm equipment, especially in rice and palm oil production hubs.

Agricultural Lubricant Market Growth Factors

- Growth in Global Agricultural Production: The growing population has changed, forcing farmers to produce large grains. Therefore, they use efficient methods such as modern machinery.

- Increasing Mechanization in Agriculture: The enhanced application of modern equipment in agricultural practices in tractors, harvesters, and irrigation systems for high-performing lubricants so as to reduce maintenance costs.

- Focus on Sustainability and Eco-friendly Products: Green biodegradable lubricants are in demand.

- Technological Advancements in Equipment: The machinery used in current agriculture was designed to operate at better efficiency under unfavorable circumstances. This has led to the development of high-performance lubricants to enhance the effectiveness and longevity of equipment.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 9.71 Billion |

| Market Size in 2025 | USD 6.86 Billion |

| Market Size in 2024 | USD 6.60 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.94% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Category Type, Sales Channel, Farm Equipment, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Market Dynamics

Drivers

Rising Automation in Farming Practices

As the use of machinery and equipment in agricultural operations to improve diagnosis, decision making or performing, reducing the labor of agricultural work and improving the timeliness and possibly precision agriculture, this market is expected to grow because of growing automation in farming practices as well as the increase in food production and new farmlands. This will create massive demand for engine oil in the agricultural lubricant market around the globe since it extends the life of the equipment.

- As per Progressive Dairy, the used farm equipment market of Canada was expected to stay robust for most of 2024 and into 2025 due to the escalating interest rates. The trends of using aging engines as reflected to propel the demand for engine oil.

Restraint

Price fluctuations

The fluctuations in raw material prices are one of the biggest restraints for the global agricultural lubricant market. Lubricants are manufactured from a variety of raw materials, which include the base stock, additives, and special chemicals. These materials are very sensitive to changes in affected prices and, hence, can greatly affect the costs of producing Lubricants. As natural disasters, logistic problems, or a pandemic can result in a shortage of raw materials, their prices rise.

Opportunity

Rising demand for eco-friendly agricultural lubricants

The importance of sustainability progresses the demand for bio-based lubricants. The increasing concern accelerates the growth of the bio-based lubricant market for the consumer, especially regarding the positive impact on the environment. Bio-based lubricants are chemically synthesized organic products developed from renewable resources, including vegetable oil, animal fats, natural esters, and special adjuvants. Further, the higher price of petrochemicals and the global diminishing of crude oil reserves also boost the bio-based lubricant market. The growing focus on economic development and enhancing sustainability to minimize carbon emissions, as well as the emerging automotive, mining, and industrial businesses, are fueling market growth in the global bio-based lubricants sector. The government's regulatory policies toward ‘green' and ‘environmentally friendly' products are also pushing the industry for such products.

Product Insights

The engine oil segment accounted for the biggest agricultural lubricant market share in 2024. Automobile engines, or motor oil, are commonly used to reduce friction in internal combustion engines. In addition, to prevent the engines from corrosion, keep them cool during use. In the agricultural sector, engine oils are used in tractors, harvesters, and forage equipment to reduce the maintenance period, wear and corrosion protection, improve the reliability of the engine, and improve fuel consumption. The major uses of engine oils are to lubricate and safeguard the engine against the effects of high temperature and pressure.

The UTTO segment is expected to witness significant growth in the agricultural lubricant market during the forecast period. Universal Tractor Transmission Oil (UTTO) is a category of agricultural oil used in the transmissions, hydraulics, and wet brakes of agricultural equipment. UTTO oils are among the most important products currently used in modern agriculture throughout the world. Such oils are used for the first assembly of agricultural and industrial machinery and vehicles in the tractors' design. UTTO is a universal reducing and increasing friction and cleaning, keeping the seals of mechanisms and hydraulic systems.

Sales Channel Insights

The aftermarket segment dominated the agricultural lubricant market in 2024 due to the continuous requirement for lubricants for the replacement and maintenance of agricultural equipment. Modern farming equipment is characterized by specialization and high cost. The operators are more concerned with keeping their machines for long periods before replacement. The increasing demand for better quality lubricating oils enhances the efficiency of engines, hydraulics, and many others. Further, the aging of agricultural machines and threats of frequent downtime have also propelled the sales of lubricants in the aftermarket. This segment relies on repeat purchases because the end consumer recognizes the need to use the appropriate lubricant on agricultural machinery.

Category Type Insights

The bio-based lubricant segment dominated the agricultural lubricant market in 2024. Bio-lubricants are non-hazardous to human health; they are carbon neutral, renewable, and environmentally friendly, thus increasing the demand for them. Increased usage of agriculture lubricants for higher products, including biodegradable products with high flash points, constant viscosity, and low emission levels. The availability of crude oil resources worldwide and the growing costs of crude oil have helped to create a higher need for bio-based products. Other drivers, including the need to carry out research and development, technology advancement, increasing awareness of the environment, and government policies, will influence the bio-based lubricant market.

Agricultural Lubricant Market Companies

- ExxonMobil Corporation

- Quaker Chemical Corporation

- Fuchs Petrolub SE

- BP plc

- TotalEnergies SE

- Apar Industries Ltd.

- Calumet Specialty Products Partners, L.P.

- Chevron Corporation

- China Petroleum and Chemical Corp (Sinopec Corporation)

- Repsol SA

- Philips 66

- Raj Petro Specialities Pvt. Ltd

- Nynas AB

- Valvoline, Inc

- Shell plc.

- Savita Oil Technologies Ltd.

Recent updates on Agricultural Lubricant

Technological advancements transforming agricultural lubricants

- On 15 March 2025, considerable technological progress is being made in the agricultural lubricants sector with an emphasis on creating high-performance lubricants that are compatible with contemporary farming machinery. These developments seek to increase equipment longevity, lower maintenance requirements, and improve machinery efficiency to make maintenance easier for farmers. Manufacturers are launching multipurpose lubricants that work with a variety of machinery parts, including engines, transmissions, and hydraulic systems.

Emerging trends emphasize sustainability and efficiency

- On 5 April 2025, lubricant solutions that are efficient and sustainable are becoming more and more popular because of their favorable environmental effects and regulatory backing bio based lubricants which are made from renewable resources are becoming more and more popular in addition lubricants that provide extended service intervals and enhanced performance in harsh operating environments are becoming more and more popular which supports the industry's drives for operational effectiveness and decreased downtime.

Latest Key Player Announcement

- In September 2024, Jeff Rowe, the CEO of Syngenta Group, called on the Indian government to accelerate regulatory approvals for new agricultural products to assist farmers. Rowe underscored the effects of climate change on farming, stressing the necessity for quicker access to innovative solutions. Syngenta is making significant investments in digital technology and crop modeling to assist farmers in adapting, intending to introduce 40 new crop protection products in the upcoming years.

Recent Developments

- On 10 January 2025, Shell introduced a new line of bio-based agricultural lubricants designed to meet the performance requirements of modern farming equipment while reducing environmental impact. This launch reflects the company's commitment to sustainability and innovation in the agricultural sector.

- On 21 February 2025, ExxonMobil announced the expansion of its mobile Agri range featuring advanced synthetic lubricants that provide enhanced protection for high-load agricultural machinery. The new products aim to improve fuel efficiency and extend service life.

- On 25 March 2025, TotalEnergies unveiled its latest Agri fluid series, a range of multipurpose lubricants sustainable for engines, transmissions, and hydraulic systems. This development addresses the need for versatile lubricant solutions in increasingly complex agricultural machinery.

- In September 2024, Maxol Lubricants, a division of the Maxol Group, unveiled the new Agri-Max Plus Grease range of greases to address the growing complexity of the farmer's world.

- In March 2023, Exxon Mobil Corporation revealed that it had spent about USD 110 million to establish a Lubricant manufacturing plant at the Maharashtra Industrial Development Corporation in the Isambe industrial area in Raigad, India.

- In March 2022, Morris Lubricants unveiled a new generation product range of multifunctional hi-performance lubricants that are capable to cater almost all agricultural needs. These lubricants were used for engines, gearboxes, and hydraulic and oil-immersed brake systems in a variety of agricultural machinery.

Segments Covered in the Report

By Product Type

- Engine Oil

- UTTO (Transmission and Hydraulic Oil)

- Coolant

- Grease

By Category Type

- Mineral Oil-Based Lubricants

- Synthetic Oil-Based Lubricants

- Bio Oil-Based Lubricants

By Sales Channel

- Aftermarket

- OEM's

By Farm Equipment

- Tractors

- Combines

- Implements

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting