What is the Lubricants Market Size?

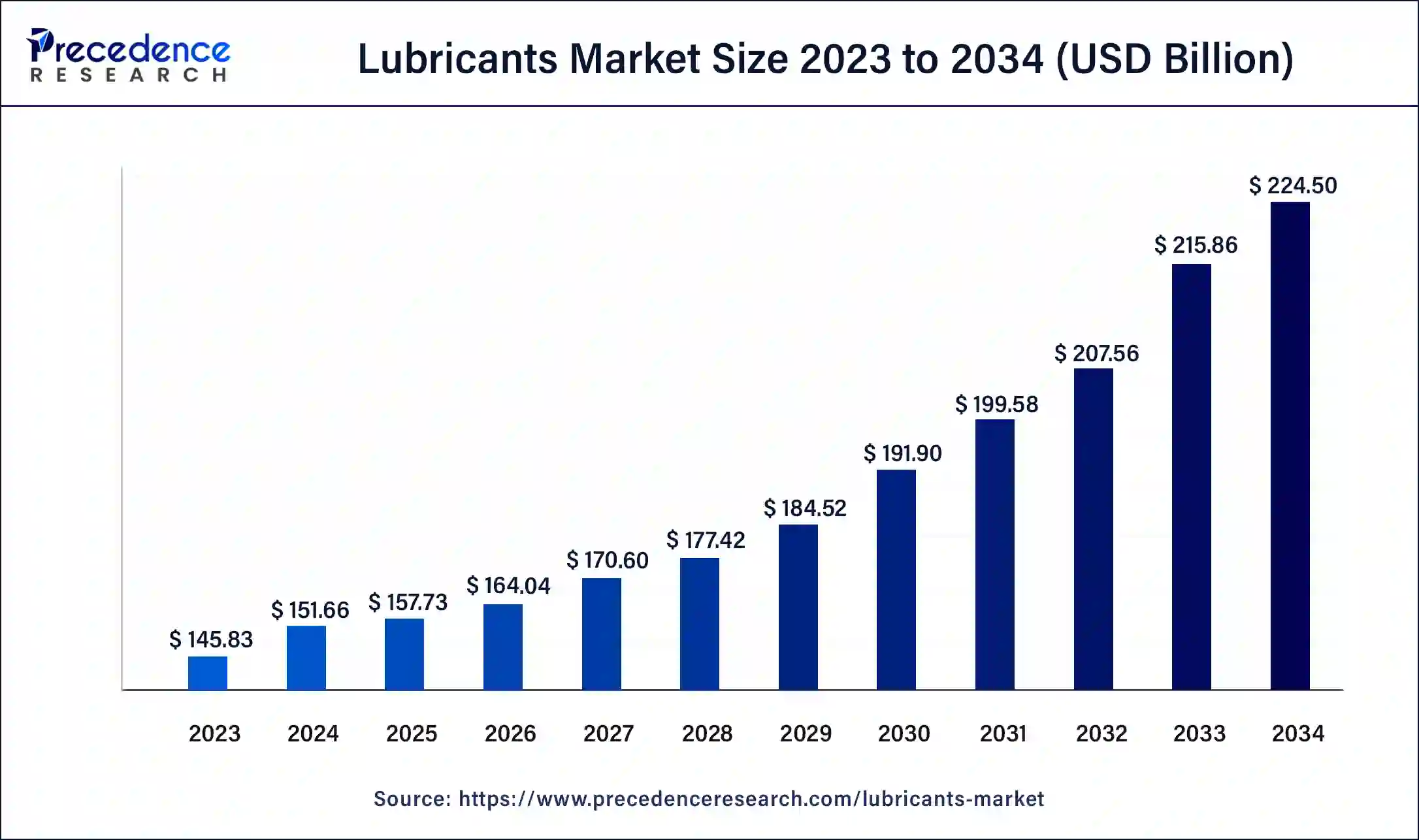

The global lubricants market size is calculated at USD 157.73 billion in 2025 and is predicted to increase from USD 164.04 billion in 2026 to approximately USD 232.91 billion by 2035, expanding at a CAGR of 3.97% from 2026 to 2035.

Market Highlights

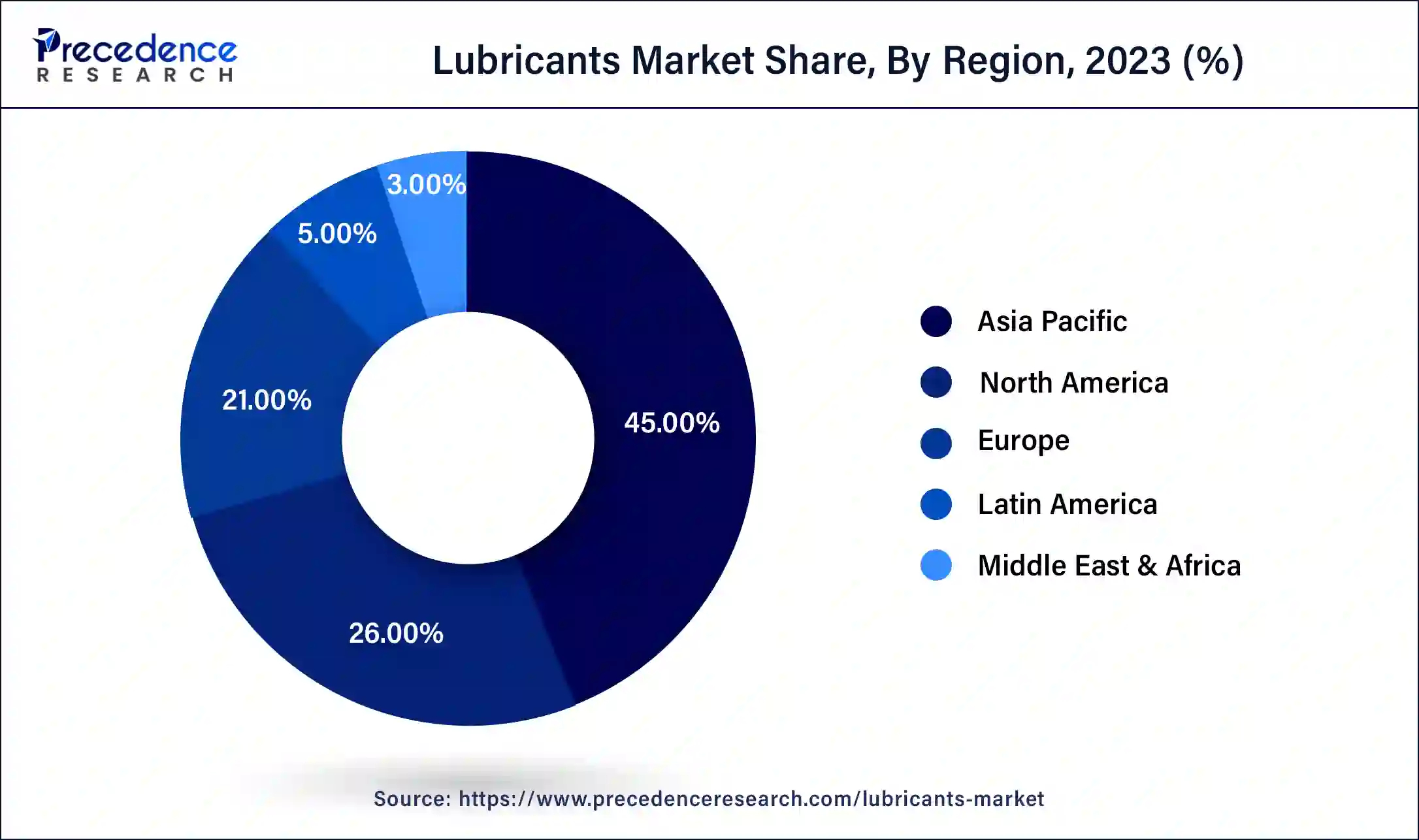

- Asia Pacific has contributed more than 45% of market share in 2025.

- Europe is expected to experience significant growth during the forecast period.

- By application, the automotive segment accounted for more than 54% market share in 2025.

- By application, the industrial segment is expected to grow significantly during the forecast period.

- By base oil, the synthetic lubricants segment dominated the market with the largest share in 2025.

- By base oil, the bio-based oil segment is observed to be the fastest growing during the forecast period.

Market Overview

The lubricants market refers to the industry involved in the production, distribution, and sale of lubricating oils and greases. Lubricants are substances used to reduce friction, heat, and wear between moving parts in machinery and equipment, thereby extending their lifespan and improving efficiency. The lubricants market encompasses a wide range of applications across various industries, including automotive, industrial, marine, aerospace, construction, and agriculture. Depending on their application, Lubricants can transmit power, protect against damage, and eliminate wear and heat debris.

Liquid lubricants, categorized as mineral, synthetic, or semi-synthetic oils based on their base oil, typically contain additives to enhance performance. The effectiveness of lubricants relies on critical characteristics, with viscosity and density being the most significant attributes in lubrication theory. The primary goal of lubrication strategies is to create a lubricant layer that separates rubbing surfaces, preventing direct contact between the bodies involved.

Market Trends

- In July 2025, a Manufacturing and Marketing Agreement was signed between GP Petroleums Limited and Delta Fuel and Lubricants Nigeria Limited. Delta is well known lubricant manufacturer, blending and marketing premium quality industrial lubricants, engine oils, greases, gear oils, marine oils, and transmission engine oils supplied to various industries across the Middle East and Africa. Moreover, as per this agreement, the product will be manufactured or blended, supplied, and commercialized by the "IPOL" brand name across Nigeria and other West-African markets by Delta. Furthermore, enhancing its local market presence and expanding the international footprint in the West African region will be the main goal of the collaboration (Source:https://www.equitybulls.com)

- In April 2025, a collaboration between Mangali Industries Limited and Daewoo, which is a South Korean automotive firm, was formed, which helped Daewoo enter the Indian automotive lubricant sector. Thus, the wide range of vehicles in India, such as agricultural vehicles, passenger cars, two-wheelers, and commercial vehicles, will be provided with a premium range of high-performance lubricants by Daewoo through this collaboration. Moreover, it is famous for its innovations and engineering excellence (Source:https://auto.economictimes.indiatimes.com)

Lubricants Market Growth Factors

- The growing trade of piston engine lubricants, in terms of imports and exports, is fueling market expansion. Consumer interest in improving vehicle performance and introducing innovative and premium product options drives the demand for lubricants.

- The rise in middle-class incomes, leading to higher demands for two-wheelers and four-wheelers, is a crucial factor contributing to the growth of the lubricants market.

- Global seaborne trade growth and the increasing prevalence of tourism and recreational sports are expected to drive the demand for marine lubricants.

- The rapid increase in power generation from wind energy is driving the demand for gear oils, mainly due to the growing installation of wind turbines. This trend is contributing to the growth of the lubricants market.

- The widespread use of various power generation sources, such as wind, solar, thermal, and hydro turbines, increases lubricant demand. This, in turn, is driving the lubricants market.

- The growing preference for bio-based grease requires more effective additives to remain compatible with oxygen-containing oil esters. There is an increasing demand for oils derived from algae, incorporating a blend of mineral, synthetic, or plant-based oil in new feedstocks within the lubricants market.

Market Scope

| Report Coverage | Details |

| Global Market Size in 2025 | USD 157.73 Billion |

| Global Market Size in 2026 | USD 164.04 Billion |

| Global Market Size by 2035 | USD 232.91Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.97% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, Base oil and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

expansion of application in various sectors

In various industries, including construction, automotive, aerospace, agriculture, automotive, construction, marine, mining, oil drilling, steel and cement, and wind energy, lubricants play a crucial role. In construction, lubricants are crucial for their resistance to corrosion and anti-wear properties, which aid equipment like excavators and loaders.

The demand for lubricants is rising due to their unique qualities, primarily dependent on. Properties such as high boiling point, thermal stability, hydraulic stability, a high viscosity index, and oxidation resistance help reduce friction in various applications, increasing the global lubricant demand. The growing utilization of lubricants, driven by their superior properties, is expected to boost the market's growth rate.

Growing demand for lubricants in the automotive sector

Lubricants play a vital role in diverse industries, including automotive and industrial manufacturing, where their use has grown significantly. With the rapid expansion of industrial activities in many developing nations, companies employ machinery to meet their daily production needs. The rising demand for consumer goods necessitates increased raw material supply. Lubricants effectively blend with oil and act as a protective barrier, preventing impurities from causing damage to surfaces. This makes lubricants essential in meeting the demands of different end-user sectors, including the automotive industry and industrial manufacturing.

- In October 2022, TotalEnergies partnered with MG Motor to create a new line of lubricants in Chile. The upcoming product, anticipated to be MG Oil, is poised to be MG Motor's first specially formulated oil for automobiles. This innovative product will be produced entirely in Chile and is expected to enhance TotalEnergies' footprint in the region.

Restraint

Rising demand for hybrid vehicles or battery-operated vehicles

The increasing adoption of battery-operated and hybrid vehicles is gradually reducing the demand for internal combustion engines (IC) in the automotive sector, significantly impacting lubricant demand in the forecast period. Strict vehicle emission standards and regional initiatives to ban diesel engines are substantial factors impeding the growth of the lubricants market in the forecast period.

Additionally, fluctuations in crude oil prices pose a significant challenge as the production of lubricants heavily relies on the fractioning process of crude oil. Mineral oil-based lubricants, a substantial part of the global market, are particularly affected by raw material fluctuations from the oil and gas industry, impacting the cost of marine lubricants.

Opportunities

Increasing research and development in the automotive sector

The global automotive industry has witnessed substantial growth driven by factors like increased market openness, the introduction of new vehicle models, easy access to low-interest financing, and price reductions by dealers and manufacturers. The past decade has seen a nearly twofold increase in passenger vehicle sales due to pent-up demand and expanded market access. The surge in demand for personal mobility, including traditional and advanced electric vehicles, has driven the need for improved components, leading to a heightened demand for lubricants.

- In July 2022, ExxonMobil Lubricants Pvt. Ltd. launched an advanced range of lubricants for passenger vehicles in New Delhi, featuring cutting-edge technology and compliance with Indian government BS-VI specifications. These lubricants offer notable fuel economy benefits, enhanced wear protection, and improved engine cleanliness through their Mobil Super All-In-One Protection and Mobil Super Friction Fighter series.

Surging demand for bio-based lubricants

One of the recent trends in the global market is the increasing adoption of bio-based lubricants by end-users and manufacturers. These greener lubricants offer improved safety with more elevated flashpoints, even viscosity, and reduced vapor emissions and oil mist. Many vendors are emphasizing bioaccumulation and eco-toxicity to minimize adverse environmental impacts. Bio-based lubricants can help reduce pollution in stormwater from the engine, hydraulic systems, and brake line leaks.

Several European countries now mandate using bio-based lubricants in specific environmentally sensitive applications. Companies like RSC Bio Solutions, with their FUTERRA brand, offer plant-based lubricants. Castrol and FUCHS are also manufacturing eco-friendly lubricants. Bio-based lubricants degrade gradually, leaving minimal environmental traces, contributing to increased adoption and market focus during the forecast period.

Segment Insights

Application Insights

In 2025, the automotive sector took the lead in the global lubricants market. This dominance results from increased sales of consumer vehicles, including buses and trucks. The surge in automobile production and demand, especially in developing nations like China, India, Brazil, and Indonesia, has propelled the lubricants market. The growing preference for passenger cars, particularly in the mentioned countries, is set to expand the automotive industry, subsequently boosting the demand for lubricants.

The industrial sector is expected to grow significantly during the forecast period, primarily driven by robust industrial production in emerging markets. Moreover, automotive lubricants play a critical role in enhancing fuel efficiency, reducing friction and wear, and extending the lifespan of automotive components. They also prevent component seizures and severe damage. Additionally, lubricants exhibit high resistance to oil degradation and minimize evaporation, contributing to improved fuel efficiency. The increasing use of automotive lubricants in new applications, including battery cooling and noise reduction, further drives market demand.

Base Oil Insights

The synthetic lubricants segment contributed to the largest share of the lubricants market in 2024. The increasing demand for synthetic lubricants serving as base oils is fueled by their compatibility with automotive components, reduced vehicle emissions, and cost-effectiveness. Specifically, lubricants derived from Group IV synthetic base oils, such as polyalphaolefins, demonstrate a broad temperature tolerance, making them ideal for lubricating automotive parts exposed to extreme temperatures. Synthetic oils showcase enhanced chemical and shear stability and an improved viscosity index, driving the demand for synthetic oils in lubricant production. The segment is expected to experience growth.

During the forecast period, the bio-based oil segment emerges as the fastest-growing segment. Bio-based lubricants, sourced from renewable materials like vegetable oils, animal fats, and other natural sources, are characterized by their biodegradability, although only sometimes. The aim is to reduce environmental impact by decreasing reliance on non-renewable petroleum-based lubricants.

Regional Insights

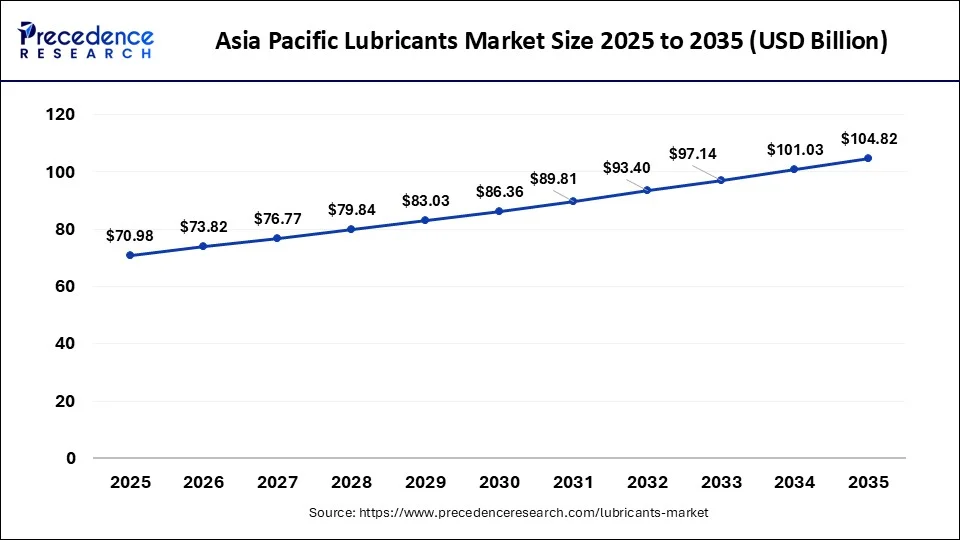

Asia Pacific Lubricants Market Size and Growth 2026 to 2035

The Asia Pacific lubricants market size is estimated at USD 70.98 billion in 2025 and is predicted to be worth around USD 10482 billion by 2035, at a CAGR of 3.98% from 2026 to 2035.

Asia-Pacific led the market with the biggest market share of 45% in 2025, capturing a significant revenue share. This growth is driven by the rapid expansion of the automotive industry, industrial development, and automotive manufacturing hubs in countries like Japan, India, and China. Predominantly used lubricants in the Asian market include automotive engine oils, greases, and hydraulic fluids. Major countries such as China, India, Japan, and South Korea contribute to demand. The market exhibits diversity due to swift industrialization, business sector expansion, and local vendors' presence.

- In 2022, Chevron Corporation partnered with PT Pertamina to explore business opportunities related to lower carbon initiatives in Indonesia. The collaboration aims to investigate technologies such as geothermal energy and carbon offsets, utilizing nature-based solutions.

China Market Trends

China dominates the Asia Pacific lubricants market due to its massive automotive fleet, extensive industrial base, and large-scale infrastructure projects. The market growth is also supported by rising demand for high-performance engine oils, hydraulic fluids, and industrial lubricants, along with increasing adoption of synthetic and environmentally compliant lubricant formulations.

What Makes Europe the Second-Largest Region in the Market?

Europe held a substantial revenue share in the lubricants market and is expected to experience a significant compound annual growth rate (CAGR) in the forecast period. The European Union (EU) automotive industry is one of the largest globally, playing a vital role in the region's economy. During the first three quarters of 2023, the EU produced over 9 million cars, marking a 14% increase compared to the previous year.

Germany Market Trends

Germany plays a pivotal role in the European lubricants market due to its strong automotive manufacturing sector and advanced industrial machinery base. Demand is concentrated on premium engine oils, metalworking fluids, and specialty lubricants designed to support high-performance vehicles, automation systems, and Industry 4.0 manufacturing processes.

What Potentiates the Market in North America?

North America is expected to grow significantly in the lubricants market during the forecast period. The advancing automotive sector of North America is increasing the demand for lubricants for various purposes. At the same time, the expanding aerospace and construction sectors are also increasing their use. Moreover, the use of biodegradable lubricants is being encouraged by the regulatory bodies as well as the government. While in the U.S., the expanding oil and gas sectors are increasing the demand for lubricant, the automotive sector in Germany is also contributing to the same. Thus, this promotes the market growth.

The North American market is driven by steady demand from the automotive, manufacturing, construction, and transportation sectors. Advanced technological capabilities, high-quality standards, and widespread adoption of high-performance lubricants further support growth. Ongoing infrastructure development, rising investments in industrial automation, and the increasing need for energy-efficient and environmentally friendly lubricants are also driving the market.

U.S. Market Trends

The U.S. leads the North American lubricants market, supported by a large vehicle parc, advanced industrial operations, and increased oil & gas production activities. There is a rising demand for high-performance synthetic lubricants, bio-based oils, and specialty industrial lubricants to improve equipment efficiency and meet emission standards, contributing to the market.

How is the Opportunistic Rise of Latin America in the Market?

Latin America is witnessing a substantial growth in the market. This growth is driven by the rising demand for high-performance lubricants from the construction, automotive servicing, manufacturing, and transportation industries. Brazil is considered a leading player in the region due to factors like increasing urbanization, growth in consumer goods production, and the expansion of industrial and commercial vehicles. The region is carrying out several initiatives for strengthening manufacturing capabilities, and this is expected to create long-term opportunities for the market.

What Drives the Market in the Middle East & Africa (MEA)?

The lubricants market in the Middle East & Africa (MEA) is primarily driven by rising construction activities, increasing investments in infrastructure development, and growing demand from industrial machinery, transportation fleets, and energy sector operations. The region's market growth is also driven by large-scale development projects and economic diversification initiatives in countries such as Saudi Arabia, the UAE, and South Africa. The rapid expansion of the industrial sector is also likely to contribute to market growth.

Value Chain Analysis

- Raw Material Selection

This process involves carefully assessing and choosing base oils, additives, and other ingredients that will be used to formulate lubricants.

Key Players: Chevron, Shell, Neste - Manufacturing Process

This process involves precisely blending base oils and additives to generate oils with tailor-made qualities.

Key Players: Shell, Exxon Mobil, Castrol - Quality Checking

After achieving a perfect blend, manufacturers conduct rigorous testing and quality checks to validate the product's performance characteristics.

Key Players: Petronas, Shell, Fuchs

Top Companies Operating in the Lubricants Market & Their Offerings:

- Shell plc: Shell is a leading global supplier of lubricants covering automotive, industrial, marine, and specialty applications. Its portfolio includes engine oils, gear oils, hydraulic fluids, greases, and high-performance synthetic lubricants designed for fuel efficiency, extreme conditions, and extended service life.

- ExxonMobil Corporation: ExxonMobil provides a broad range of lubricant products, including Mobil 1 synthetic engine oils, industrial lubricants, turbine oils, and metalworking fluids. The company emphasizes performance enhancements, extended drain intervals, and reduced environmental impact.

- BP plc (through Castrol): BP's Castrol brand offers automotive and industrial lubricants such as motor oils, transmission fluids, and specialty greases. Castrol focuses on advanced formulations for modern engines, motorsport, and heavy-duty industrial machinery.

- Chevron Corporation: Chevron markets lubricants under brands such as Texaco and Havoline, supplying passenger car motor oils, heavy-duty diesel engine oils, and industrial greases. Its products support enhanced protection, oxidation stability, and wear resistance across sectors.

- Fuchs Petrolub SE: Fuchs is a major independent global lubricant manufacturer with a wide product portfolio including automotive and industrial lubricants, metalworking fluids, and specialty products tailored for specific equipment and performance needs.

- Lubrizol Corporation: Lubrizol is a leading additive supplier whose technologies enhance the performance of finished lubricants. Its additive packages improve viscosity index, oxidation stability, and protection against wear and deposits for engine and industrial lubricants.

Other Lubricants Market Companies

- Royal Dutch Shell Co..

- Fuchs

- Castrol India Ltd.

- Amsoil Inc.

- JX Nippon Oil & Gas Exploration Corp.

- Philips 66 Company

- Valvoline LLC

- PetroChina Company Ltd.

- China Petrochemical Corp.

- Idemitsu Kosan Co. Ltd.

- Lukoil

- Petrobras

- Petronas Lubricant International

- Quaker Chemical Corp.

- PetroFer Chemie

- Buhmwoo Chemical Co. Ltd.

- Zeller Gmelin Gmbh & Co. KG

- Blaser Swisslube Inc.

Recent Developments

- In August 2025, ExxonMobil announced a significant investment in a new lubricant blending facility in Texas, aimed at enhancing its production capacity for high-performance synthetic lubricants. This strategic move is likely to bolster ExxonMobil's position in the premium lubricants segment, catering to the growing demand from automotive and industrial sectors for advanced lubrication solutions. The investment underscores the company's commitment to innovation and its response to evolving market needs.(Source: https://www.bing.com )

- In September 2025, Royal Dutch Shell launched a new line of biodegradable lubricants designed for use in environmentally sensitive applications. This initiative reflects Shell's strategic focus on sustainability and its efforts to meet the increasing regulatory pressures for eco-friendly products. By expanding its product portfolio to include biodegradable options, Shell positions itself as a leader in sustainable lubrication solutions, potentially attracting environmentally conscious consumers and businesses.(Source: https://www.bing.com )

- In January 2024, Shell U.K. Limited acquired MIDEL and MIVOLT from M&I Materials Ltd. The products of the latter two will be produced and distributed as part of Shell's Lubricants portfolio. This acquisition enhances Shell's position in Transformer Oils, which is utilized in offshore wind parks, utility companies, and power distribution.

- Starting September 2023, Total Energies Lubrifiants accelerated the incorporation of recycled plastics (50% PCR high-density polyethylene) in its lubricants bottles, following a pilot project launched in 2021 called Quartz Xtra bottles. This initiative aims to contribute to a circular economy and reduce the use of virgin plastic.

Segments Covered in the Report

By Application

- Industrial

- Process Oils

- General Industrial Oils

- Metalworking Oils

- Industrial Engine Oils

- Greases

- Others

- Automotive

- Engine oil

- 0W-20

- 0W-30

- 0W-40

- 5W-20

- 5W-30

- 5W-40

- 10W-60

- 10W-40

- 15W-40

- Others

- Gear oil

- Transmission fluids

- Brake fluids

- Coolants

- Greases

- Engine oil

- Marine

- Engine oil

- Hydraulic oil

- Gear oil

- Turbine oil

- Greases

- Others

- Aerospace

- Gas turbine oil

- Piston engine oil

- Hydraulic fluids

- Others

By Base Oil

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting