What is the AI-based Data Observability Software Market Size?

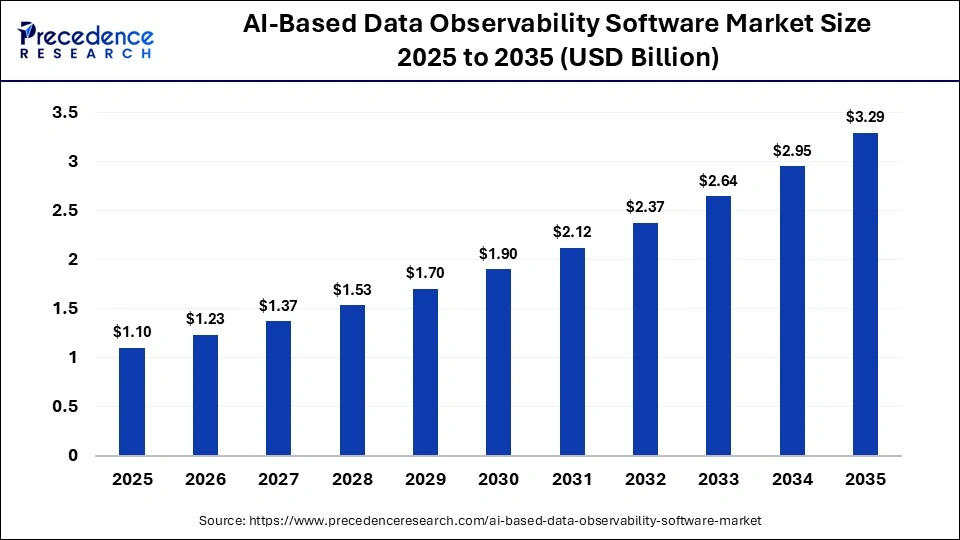

The global AI-based data observability software market size was calculated at USD 1.10 billion in 2025 and is predicted to increase from USD 1.23 billion in 2026 to approximately USD 3.29 billion by 2035, expanding at a CAGR of 11.57% from 2026 to 2035. The AI-based data observability software market is experiencing robust growth, driven by rapid digital transformation, increasing data volumes, and the need for real-time insights. The market growth is also driven by expanding cloud data ecosystems, rising complexity of data pipelines, increased regulatory need for trusted data, and growing adoption of GenAI/ML systems requiring high-quality inputs.

Market Highlights

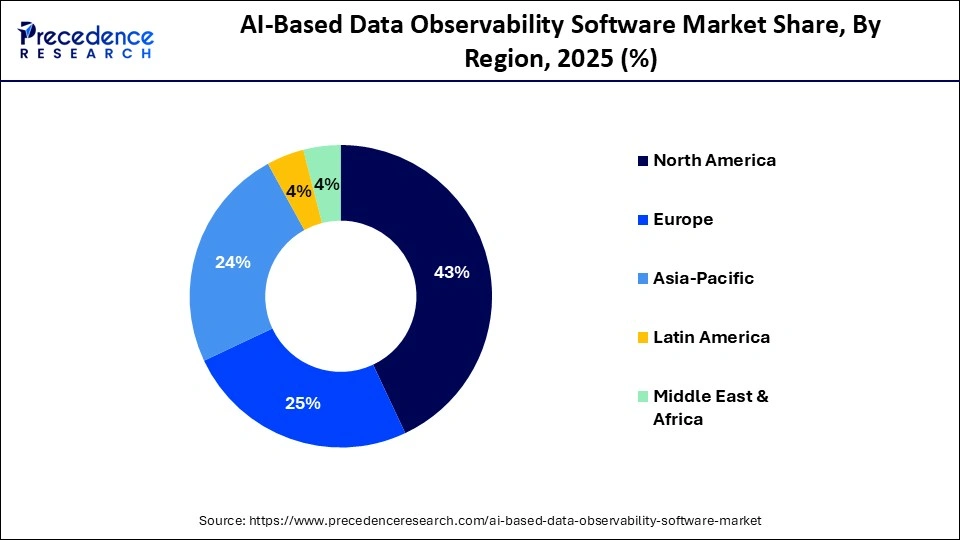

- North America dominated the market, holding the largest market share of approximately 43% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

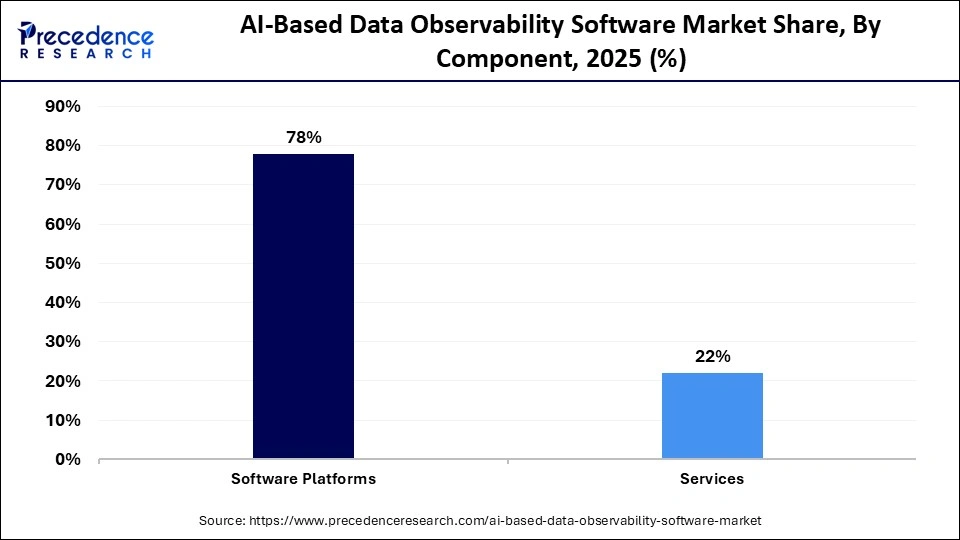

- By component type, the software platforms segment held the largest revenue share of approximately 78% in 2025.

- By component type, the services segment is expected to grow with the highest CAGR in the market during the studied years.

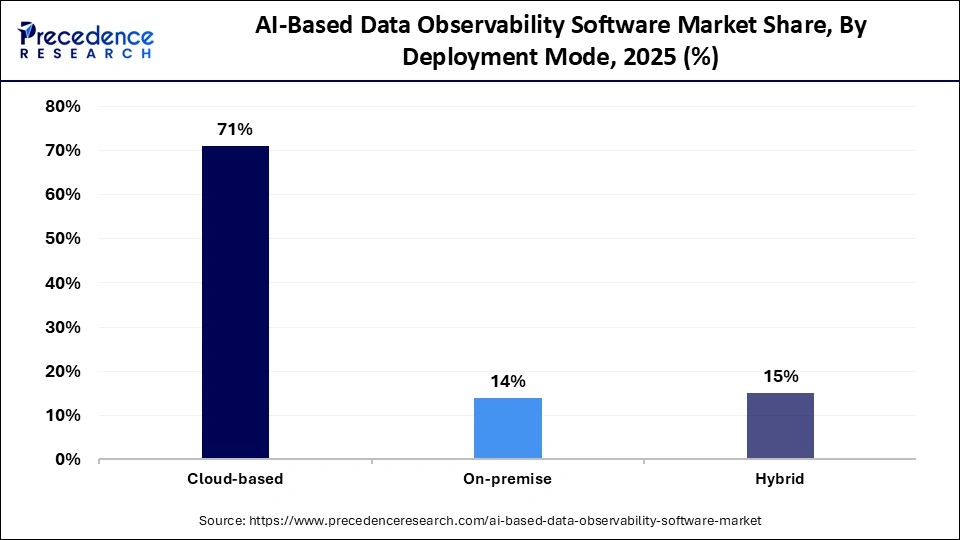

- By deployment mode, the cloud-based segment held a dominant position in the market with a share of approximately 71% in 2025.

- By deployment mode, the hybrid segment is expected to expand rapidly in the market in the coming years.

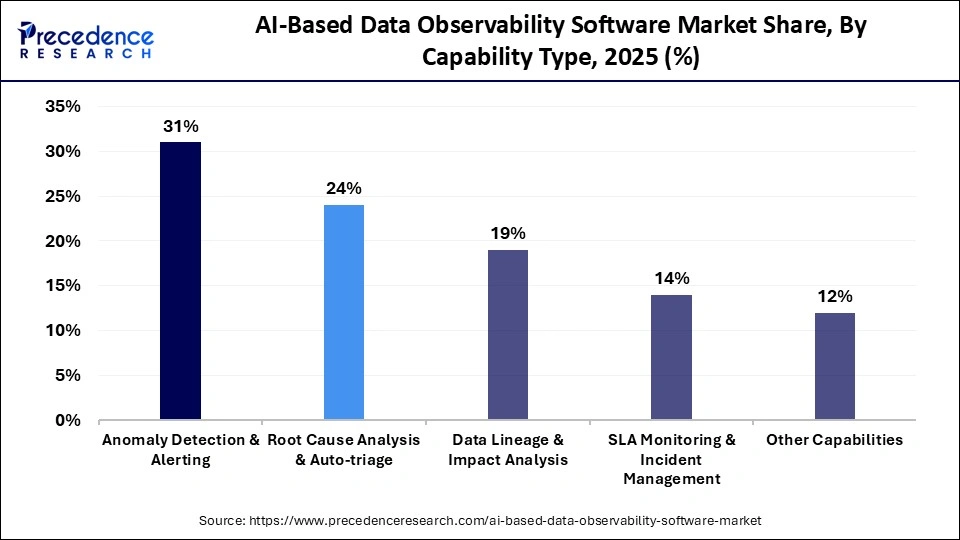

- By capability type, the anomaly detection & alerting segment contributed the biggest revenue share of approximately 31% in 2025

- By capability type, the root cause analysis & auto-triage segment is expected to witness the fastest growth over the forecast period.

- By end user industry type, the BFSI segment held a major revenue share of approximately 17% in the market in 2025.

- By end user industry type, the retail & e-commerce segment is expected to gain the highest share of the market between 2026 and 2035.

What is AI-based Data Observability Software?

The global AI-based data observability software market encompasses platforms that utilize AI/ML-driven monitoring, anomaly detection, root-cause analysis, and automated alerting to ensure the reliability, accuracy, and performance of data pipelines, data warehouses/lakes, and analytics systems. These solutions provide end-to-end visibility across the modern data stack, tracking freshness, schema changes, data quality issues, lineage, and SLA compliance, while supporting enterprise analytics, BI, and AI initiatives.

Technology Shifts in the AI-based Data Observability Software Market

The market is shifting from rule-based monitoring to fully autonomous AI-driven observability platforms. It assists in machine learning (ML) model detection of anomalies, schema drifts, and pipeline failures in real-time with minimal human intervention. Generative AI (GenAI) is being integrated to help in problem explanation and root cause analysis. There is an evolving market from one-time to usage-based pricing of the SaaS model to appeal to medium-sized businesses. Natural language processing is being incorporated to cater to business users beyond data teams. AI-driven data observability is emerging as an important technology in the reliability infrastructure sector.

AI-based Data Observability Software Market Trends

- Collaborations: AI-based data observation tools manufacturing vendors are collaborating to accelerate AI innovation and to improve shared data visibility across platforms. This collaboration aims to enable rapid data lineage and impact analysis for sophisticated data stacks. In March 2025, Acceldata partnered with Google Cloud for the AI-driven anomaly detection and root cause analysis for data pipelines based on BigQuery and Dataproc.

- Government Initiatives: Various public sector organizations are encouraging data reliability through the use of AI to ensure digital governance and data-driven decision-making. These steps are intended to improve data infrastructure resilience and confidence in data analysis platforms. In February 2025, U.S department of commerce provided funding for platforms that enhance data observability and quality to support public sector organizations through their AI and data resilience program.

- Business Expansion: Information technology companies are scaling up to meet the rising demand for automated data monitoring solutions in enterprises. The companies are focusing on new regions and industry-specific solutions. In June 2025, Monte Carlo Data announced significant investments in Europe to meet the growing demand for its use of AI for data observability solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.10 Billion |

| Market Size in 2026 | USD 1.23 Billion |

| Market Size by 2035 | USD 3.29 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.57% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment Mode, Capability Type, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Component Type Insights

Which Component Type Segment Dominated the Market?

The software platforms segment held a dominant position in the AI-based data observability software market with a share of approximately 78% in 2025, because they play a pivotal role in facilitating AI-based monitoring and analysis. They provide real-time anomaly alerts, automated root cause analysis, and continuous data quality validation. They seamlessly integrate with cloud data warehouses, ETL solutions, and streaming solutions. Businesses are increasingly adopting software solutions owing to their shorter deployment time and ease of scalability. Upgrades and subscription-based models drive the demand for software solutions.

The services segment is expected to grow at the highest CAGR between 2026 and 2035. Implementation and integration, managed observability services, and training and support are witnessing the fastest growth as organizations target complex data analysis. Organizations require expert support in implementing AI observability in their cross-cloud and hybrid infrastructure. Managed services help organizations with the operations of their data observation systems. Services are relatively cost-effective, and they eliminate the need for organizations to purchase annual subscriptions.

Deployment Mode Insights

Why Did the Cloud-Based Segment Dominate the Market?

The cloud-based segment held a major revenue share of approximately 71% in the AI-based data observability software market in 2025, due to its flexibility and scalability. It allows real-time data observation. Companies adopt cloud-based solutions due to quick setup and lower upfront costs. Integration with cloud data warehouses and cloud-based SaaS applications improves data efficiency management infrastructure. Development of advanced AI algorithms is further accelerating the market adoption of data observability solutions.

The hybrid segment is expected to show the fastest growth over the forecast period, due to the balanced adoption of cloud data solutions by organizations, along with their on-premises data requirements. Most organizations have data observability requirements for cloud infrastructure along with their existing systems. Hybrid systems offer organizations flexibility to maintain security for their sensitive data by allowing AI-driven data observation.

Capability Type Insights

How the Anomaly Detection & Alerting Segment Dominated the Market?

The anomaly detection & alerting segment held a dominant position in the AI-based data observability software market with a share of approximately 31% in 2025, due to its advantage in predictive identification of discrepancies in data. AI algorithms continuously monitor data volume and schema changes in real-time. Automated alerts reduce downtime and prevent downstream analytics failure. Enterprises benefit from this capability to protect business-critical dashboards and AI models. This segment is being increasingly adopted due to its direct influence on data reliability.

The root cause analysis & auto-triage segment is expected to witness the fastest growth in the market over the forecast period, because organizations look for quicker solutions to system issues. AI algorithms correlate signals effortlessly in pipelines, metadata, and data lineage. Auto-triage ranks system problems according to their respective business impact. The increasing data maturity levels are driving the need for intelligent solutions in root cause analysis.

End-User Industry Insights

Which End-User Industry Segment Dominated the Market?

The BFSI segment contributed the biggest revenue share of approximately 17% in the AI-based data observability software market in 2025. Banking, insurance, and financial institutions generate and process an enormous amount of sensitive data daily. These sectors require data processing accuracy and anomaly detection, along with compliance with the law. AI-driven data observability tools can monitor and prevent fraud in real time. Advanced AI algorithms facilitate rapid and accurate decision-making. The software ensures reliable data in the BFSI sector for regulatory compliance and financial reporting.

The retail & e-commerce segment is expected to expand rapidly in the market in the coming years. The retail industry receives an enormous amount of data from its customers, transactions, and supply chain inventory. These companies require real-time data to maintain their market position. AI-driven data monitoring tools help them monitor data quality, which leads to an accelerated pace of software operations with optimized accuracy. They enable an easy-to-use, connected, and trusted environment to manage consumer, product, and supply chain data.

Regional Insights

How Big is the North America AI-based Data Observability Software Market Size?

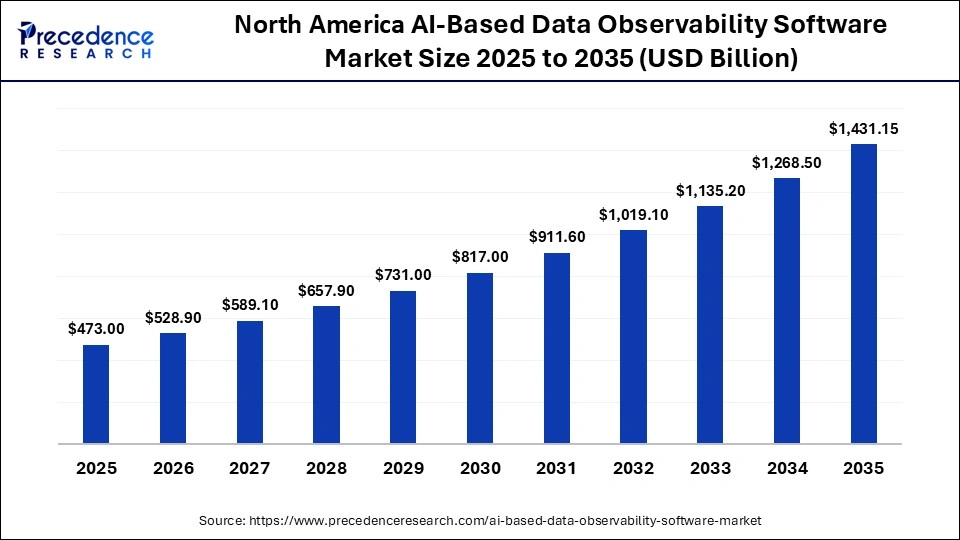

The North America AI-based data observability software market size is estimated at USD 473.00 billion in 2025 and is projected to reach approximately USD 1,431.15 billion by 2035, with a 11.71% CAGR from 2026 to 2035.

Why did North America Dominate the Market in 2025?

North America dominated the AI-based data observability software market in 2025, holding the largest market share of approximately 43%. The regional growth is attributed to the presence of a mature technological infrastructure and accelerated adoption of AI-based solutions. The region has leading technology giants and startups that are investing in AI and data management solutions. North America has a robust digital infrastructure and strict regulations to ensure quality and adherence to norms

What is the Size of the U.S. AI-based Data Observability Software Market?

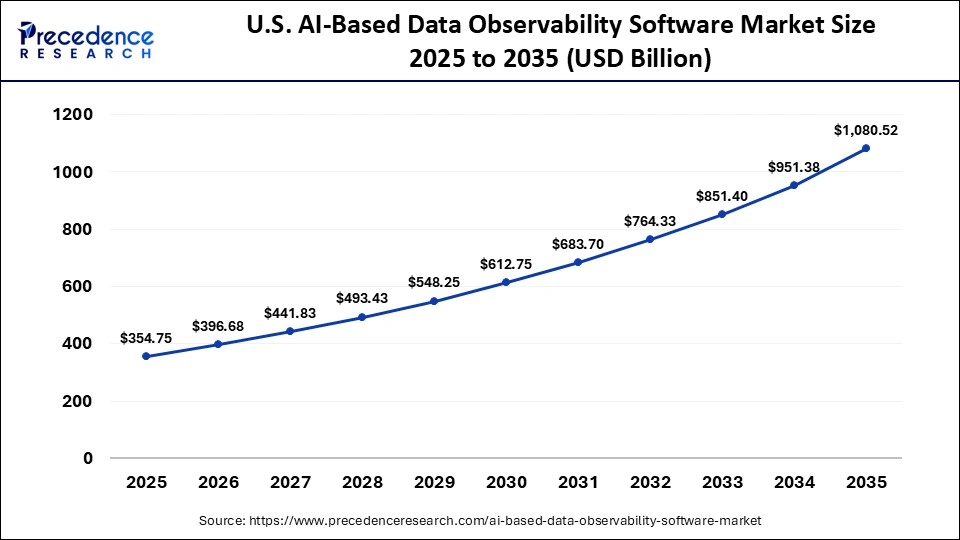

The U.S. AI-based data observability software market size is calculated at USD 354.75 billion in 2025 and is expected to reach nearly USD 1,080.52 billion in 2035, accelerating at a strong CAGR of 11.78% between 2026 and 2035.

U.S. Market Trends

The U.S leads the market in North America due to its data scalability and innovation. It has advanced technology ecosystems, steady research and development, and advanced cloud infrastructure, which drive market growth. It is home to numerous key players, such as Grafana, Snowflake, and Telmai, that offer proprietary software solutions. Enterprises are increasingly adopting AI-based solutions to process large amounts of complex data with optimized accuracy.

For instance, According to “The State of Observability 2025” report by Dynatrace, 70% of organizations in the U.S. increased their observability budgets in 2025, and 75% plan to increase them next year. In addition, 29% of leaders prioritize AI capabilities while selecting an observability platform.

Which Factors Drive Market Growth in Asia-Pacific?

Asia Pacific is expected to witness the fastest growth in the AI-based data observability software market during the predicted timeframe. This region is experiencing accelerated digital adoption due to the increasing number of digital businesses. These businesses benefit from the integration of cloud and AI-based solutions. Emerging markets in this region in the retail, BFSI, and information technology sectors generate large amounts of data. Investments in AI infrastructure, government policies, and a rising number of startups contribute to the accelerated adoption of AI-based data monitoring solutions.

China Market Trends

China holds a major share in the Asia-Pacific region due to its mature digital ecosystem and data generation in finance, e-commerce, and information technology industries. Organizations are adopting AI algorithms to ensure real-time data processing accuracy. Government support in the form of emphasis on AI and big data analysis, and investment in cloud infrastructure and smart technologies.

- For instance, China is actively involved in cross-border e-commerce business. The cross-border import and export volume reached CNY 2.38 trillion (USD 331 billion) in 2023, representing 15.6% year-on-year growth.

AI-based Data Observability Software MarketValue Chain Analysis

- Research and Development

At the research and development stage, there is an emphasis on AI-powered observability platforms leveraging ML techniques and anomaly analysis. Development involves cloud native architecture, integration of GenAI solutions, and compatibility in a modern data stack.

Key Players: Acceldata, Monte Carlo, Databand(IBM), and Bigeye.

- Deployment and Integration

Deployment solutions are delivered across enterprise data pipelines, warehousing, and streaming architectures by vendors. Data quality and schema are monitored by GenAI algorithms. The integration of advanced AI algorithms helps to improve business performance by optimizing data observation technology.

Key Players: Acceldata, Monte Carlo, Dynatrace, Datadog, and New Relic.

- Support and Optimization

The support and optimization stage involves customer support, incident resolution, and platform refinement. Vendors provide optimization services to improve adoption by technical and business organizations that include managed observability. This continuous model improves the accuracy of data anomaly detection.

Key Players: IBM, Splunk, Acceldata, Datadog, and Grafana Labs.

Who are the Major Players in the Global AI-based Data Observability Software Market?

The major players in the AI-based data observability software market include Monte Carlo, Acceldata, Telmai, Sifflet, Arize AI, Logz.io, WhyLabs, Decube, Splunk, Informatica, and Bigeye.

Recent Developments

- In November 2025, Chronosphere launched AI-guided troubleshooting, an observability platform that integrates contextually aware AI analysis with a temporal knowledge graph. This technology facilitates faster and more precise root cause determination. It offers natural query capabilities and investigation notebooks for diagnosing and saving knowledge about troubleshooting operations.(Source: https://www.prnewswire.com)

- In August 2025, Riverbed announced the launch of its AI-powered intelligent network observability solutions to enhance network visibility for enterprise IT teams. The platform can proactively identify and resolve problems in real-time before they escalate into business challenges.

(Source: https://www.businesswire.com) - In May 2025, Datadog AI research launched Toto, an open weights observability time series focused foundation model. Toto offers zero-shot forecasting and advanced anomaly detection without the need for series-specific hyperparameter tuning. This product has significant benefits in monitoring accuracy and scalability.(Source: https://www.datadoghq.com)

Segments Covered in the Report

By Component

- Software Platforms

- Data quality monitoring

- Anomaly detection engines

- Lineage & impact analysis

- Services

- Implementation & integration

- Managed observability services

- Training & support

By Deployment Mode

- Cloud-based

- On-premise

- Hybrid

By Capability Type

- Anomaly Detection & Alerting

- Root Cause Analysis & Auto-triage

- Data Lineage & Impact Analysis

- SLA Monitoring & Incident Management

- Other Capabilities

By End-User Industry

- BFSI

- IT & Telecom

- Retail & E-commerce

- Healthcare & Life Sciences

- Media & Entertainment

- Manufacturing

- Government & Public Sector

- Energy & Utilities

- Other Industries

By Region

Get a Sample

Get a Sample

Table Of Content

Table Of Content