What is the AI PC Market Size?

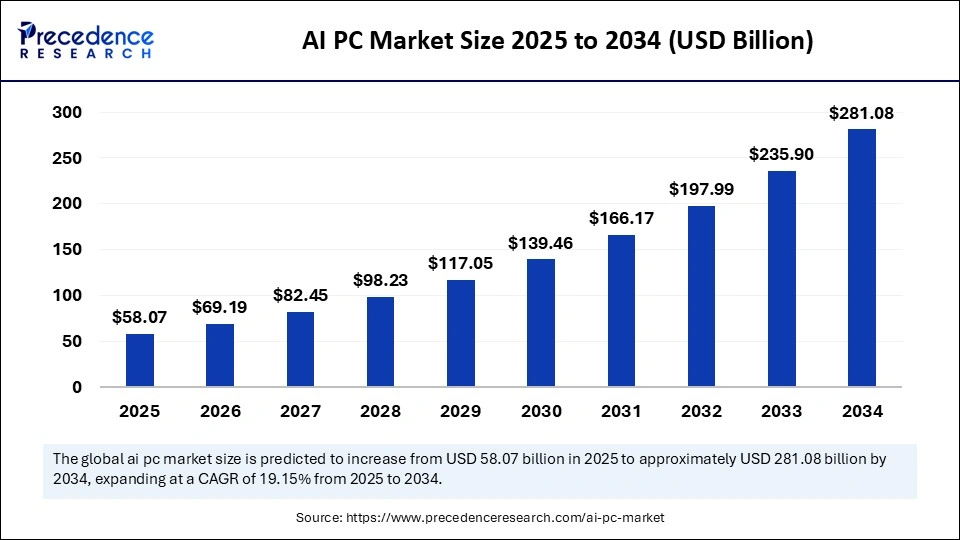

The global AI PC market size is calculated at USD 58.07 billion in 2025 and is predicted to increase from USD 69.19 billion in 2026 to approximately USD 281.08 billion by 2034, expanding at a CAGR of 19.15% from 2025 to 2034. The increasing adoption of AI-powered technologies across various sectors, emergence of generative AI, and strategic partnerships among key players are boosting the growth of the market.

Market Highlights

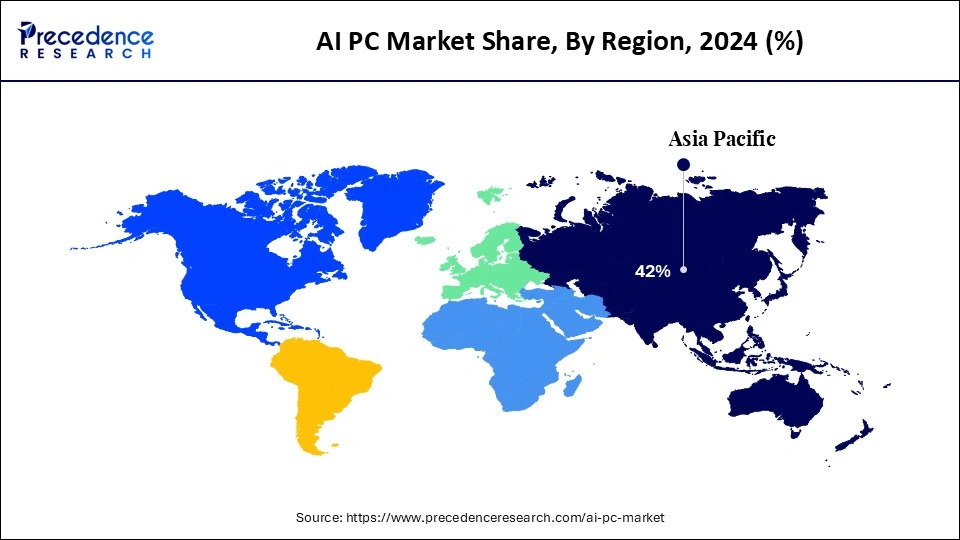

- By region, Asia Pacific held the largest market share of nearly 42% in 2024.

- By region, North America is expected to witness the fastest growth during the foreseeable period of 2025-2034.

- By component, the hardware segment held the largest market share of nearly 45% in 2024.

- By component, the software segment is expected to expand at the fastest CAGR during the forecast period.

- By device type, the laptops/notebooks segment held the largest market share of nearly 50% in 2024.

- By device type, the workstations segment is expected to witness the fastest CAGR during the foreseeable period.

- By technology, the on-device AI processing segment held the largest market share of nearly 40% in 2024.

- By technology, the hybrid AI segment is expected to grow at the fastest CAGR during the forecast period.

- By end user, the enterprises segment held the largest market share of nearly 35% in 2024.

- By distribution, the OEM direct sales segment held the largest market share of nearly 55% in 2024.

- By distribution, the online retail segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034.

Market Size and Forecast

- Market Size in 2026: USD 69.19 Billion

- Market Size in 2025: USD 58.07 Billion

- Forecasted Market Size by 2034: USD 281.08 Billion

- CAGR (2025-2034): 19.15%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

How is AI PC Industry Evolving?

The AI PC industry is evolving rapidly with ongoing advancements in AI algorithms and a rapid shift of industries toward AI technologies. The AI PC market refers to personal computers equipped with built-in artificial intelligence acceleration capabilities, enabling on-device AI processing for tasks such as natural language interaction, generative AI, predictive modelling, and advanced graphics rendering. Unlike traditional PCs that rely heavily on cloud-based AI, AI PCs incorporate neural processing units (NPUs), GPUs, and optimized CPUs to deliver real-time AI functions with enhanced efficiency, security, and energy savings.

Key applications include productivity enhancement, creative workflows, gaming, enterprise analytics, and personalized digital experiences. The demand for AI PCs is being fuelled by enterprise digital transformation, consumer adoption of AI-driven applications, and OEM partnerships with chipmakers. North America and Asia Pacific dominate adoption, while Europe is steadily expanding through enterprise AI integration initiatives.

What are the Key Trends in the AI PC Market?

- Hybrid Computing: A significant market trend includes the adoption of hybrid computing designs for AI PCs, which offer the integration of CPUs, GPUs, and NPUs to optimize the performance of various AI workloads while also supporting power efficiency. Additionally, the adoption of AI-powered software, such as Microsoft Copilot, is further fueling the growth of the market.

- Advanced Chip Technology: The increasing demand for highly advanced and smaller chips for AI applications is a leading trend in the AI PC market. A small chip offers highly powerful and efficient processing for huge datasets, facilitating the adoption of advanced chip technology to build robust AI PC ecosystems.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 69.19 Billion |

| Market Size in 2025 | USD 58.07 Billion |

| Market Size by 2034 | USD 281.08 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 19.15% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Device Type, Technology Integration, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Emergence of Gen AI

The significant driving factor for the expansion of the AI PC market is the increasing acceptance of AI tools to enhance work productivity, as well as the rise of generative AI, which is rapidly adopted due to its unprecedented benefits. AI tools like ChatGPT, Microsoft Copilot, and many others are redefining how consumers interact with content and offering them real-time insights to generate complex documents, texts, and images, and create related presentations efficiently.

Generative AI is incorporated into operating systems and productivity applications, supporting innovative features such as smart ways to summarize long paragraphs, suggestions based on context, and voice-to-text dictation. These features hugely support ideal workflows with unique capabilities, further translating into OEMs shifting to in-built AI systems within PCs to stay competitive.

Restraint

Dependency on Cloud-Based Services

A notable restraining factor for the AI PC Market is reliance on cloud-based services for many sophisticated AI capabilities. However, AI PCs are designed to operate through built-in NPUs or AI-powered CPUs. Various AI workloads, such as large language models, sophisticated image creation, and real-time multi-language translation, have remained highly reliant on cloud infrastructure due to the significant computational resources involved. This dependency can pose a significant challenge for consumers residing in under-connected regions or those who prioritize data privacy over other features.

Opportunity

Increasing Software Optimization

A significant opportunity that the AI PC Market holds includes the increasing software optimization for AI workloads, creating an opportunity for market players to present advanced hardware upgrades. Many applications are increasingly adopting AI-based capabilities, such as real-time transcription, intelligent content creation and editing, and predictive suggestions. These operations require high computing resources that can handle them efficiently.

This shift has prompted users to upgrade to AI PCs equipped with purpose-built hardware, including AI-powered graphics processing units, next-generation CPUs, and Neural Processing Units. All these are built to offer excellent speed to AI operations locally, reducing reliance on cloud services and providing faster, highly secure, and efficient performance.

Segments Insights

Component Insights

Why Did the Hardware Segment Dominated the AI PC Market in 2024?

The hardware segment dominated the market while holding a 45%, under which the NPU integrated systems sub-segment hold a stronghold in 2024. This is because these systems are the backbone of AI PCs. NPUs are generally designed to handle AI models at their interface stage that offer real-time solutions based on huge datasets. NPUs can further simplify complex queries by breaking them down into smaller parts and allow multitasking with parallel processing, which is essential for AI workloads such as deep learning and neural networks. NPUs can support an enhanced user experience due to their unique features, along with power efficiency and improved system speed.

The software segment is expected to grow at the fastest CAGR in the upcoming period, with the AI productivity applications sub-segment leading the charge. This is because AI-driven software enhances the overall functionality and user experience of AI PCs by enabling advanced features such as on-device AI processing, intelligent virtual assistants, and optimized productivity tools. Software innovations, such as AI-powered operating systems and applications, enable the seamless integration of AI capabilities with hardware, driving demand for AI-powered PCs across enterprises and consumers alike.

Device Type Insights

What Made Laptops/Notebooks the Dominant Segment in the AI PC Market?

The laptops/notebooks segment dominated the market by holding the largest share of about 50% in 2024. Laptops and notebooks are highly popular among people of all ages due to their versatility and lightweight design, which makes them convenient to carry anywhere, particularly for educational institutions and small to medium-sized businesses. They facilitate the seamless integration of AI capabilities for various needs. They can work with different AI software and peripherals, making them the ideal choice in almost every sector.

The workstations segment is expected to experience the fastest growth during the foreseeable period. A major reason behind the segment's growth is the increasing adoption of workstations by several industries for their high-performance and specialized hardware, which are required for complex AI tasks, including data analytics and simulations. Workstations provide tailored and locally supported computing power to manage demanding workloads while enhancing R&D in various critical sectors, including healthcare, engineering, and banking.

Technology Insights

How Does the On-Device AI Processing Segment Lead the AI PC Market?

The on-device AI processing segment led the market by holding the largest market share of nearly 40% in 2024. This is mainly due to its ability to provide a balance of cost-effective solutions, versatility, and increased privacy and security. Additionally, processing AI problems on a device only is more convenient than processing data in the cloud, which further reduces privacy issues and helps preserve confidential data about organizations. Additionally, on-device AI processing further supports real-time applications, such as NLP and image recognition, fueling the segment's growth.

The hybrid AI PCs segment is expected to expand at the fastest CAGR during the projection period. Hybrid AI devices help divide the workload between the dedicated hardware of PCs and the cloud. It offers faster processing of AI tasks on a local level, further reducing latency and enhancing overall performance compared to relying completely on cloud platforms.

End User Insights

Why Did Enterprises contribute the Largest Market Share in 2024?

The enterprises segment held a 35% share of the AI PC market in 2024, under which the IT & software sub-segment maintained a stronghold. AI PCs provide the core AI capabilities that drive innovation in hardware systems and support broad user adoption. Additionally, software companies are seeking to adopt AI models and various applications that require specialized hardware, such as NPUs and powerful GPUs. IT service providers integrate these AI-enhanced PCs into business workflows, while developers support OS systems like Windows to fuel the segment's demand.

The healthcare sub-segment is expected to expand at the fastest CAGR during the foreseeable period because AI-powered PCs enable faster and more accurate data analysis, medical imaging, and patient monitoring, which are critical for improving diagnostics and treatment outcomes. AI-powered devices help address the industry's crucial needs by enhancing automation, personalization, and efficiency. Additionally, AI-powered PCs assist healthcare professionals in creating customized treatment plans by easily analyzing vast datasets, including patients' histories, genomic data, and other key lifestyle factors.

Distribution Channel Insights

Why Did the OEM Direct Sales Segment Lead the AI PC Market?

The OEM direct sales segment led the market with the largest market share of nearly 55% in 2024. This is because it allows manufacturers to sell AI-powered PCs directly to large enterprises and organizations, ensuring customized solutions tailored to specific business needs. This direct channel streamlines procurement, reduces costs by eliminating intermediaries, and enables closer collaboration between OEMs and end-users for the faster integration of the latest AI technologies. OEMs can optimize device performance by integrating AI hardware that supports specific features, such as NPUs, which drive better user experiences and highlight the benefits of AI PCs compared to conventional ones.

The online retail segment is expected to expand at the fastest CAGR in the upcoming period, as it offers consumers easy access to a wide range of AI-powered PCs, along with the convenience of quick comparison, reviews, and doorstep delivery. The online retail channel also offers various benefits, such as discounts and after-sales support, attracting more consumers. Additionally, the expansion of e-commerce channels supports the rapid expansion of technological devices by evaluating consumers' purchasing habits.

Regional Insights

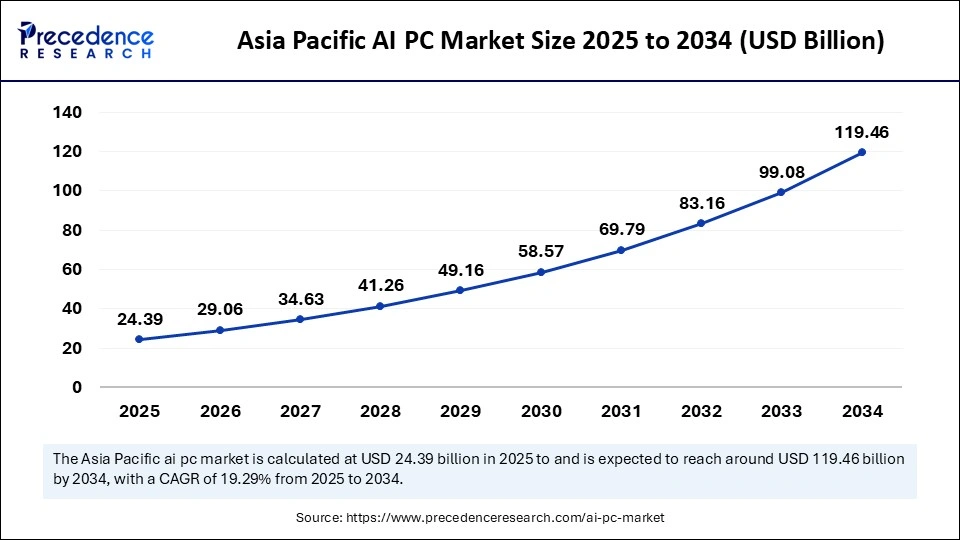

Asia Pacific AI PC Market Size and Growth 2025 to 2034

The Asia Pacific AI PC market size is evaluated at USD 24.39 billion in 2025 and is projected to be worth around USD 119.46 billion by 2034, growing at a CAGR of 19.29% from 2025 to 2034.

What Made Asia Pacific a Global Leader in the AI PC Market?

Asia Pacific dominated the AI PC market by capturing about 42% share in 2024. The major reasons behind the dominance of the Asia Pacific market include rapid technological evolution and the adoption of emerging technologies, such as AI, across various industries. Strong economic growth and strategic investments and collaboration by leading market players in the AI PC domain also supported the region's dominance. Additionally, the region boasts the world's most advanced and largest electronics manufacturing capabilities, with countries such as Taiwan, Japan, and China further supporting its growth.

Additionally, governments across the region are actively promoting the adoption of AI to develop a robust AI ecosystem, along with compute clusters, large-scale data centers, and the adoption of 5G networks, which are foundational for AI systems. The fast-paced digitalization across various industries, such as banking, manufacturing, and healthcare, further drives an increasing demand for high-performance AI PCs.

What Factors Contribute to North America's Fastest Growth in the AI PC Market?

North America is expected to experience the fastest growth in the market during the foreseeable period. North America is a leading hub for technological revolutions, such as AI adoption, due to the presence of prominent players like NVIDIA, Google, and Microsoft. This facilitates technological innovation, supporting the development of advanced hardware compatible with AI PCs. Additionally, the integration of AI with cloud computing is a major driving factor that enables businesses and various consumers to utilize cloud-based AI tools seamlessly.

The presence of leading semiconductor manufacturers and PC vendors creates strong competition between leading AI PCs marketers to come up with continues upgrades and innovations like powerful NPUs and AI-powered CPUs that can integrate with mainstream devices. Moreover, the region is an early adopter of AI technologies. All these factors collectively drive regional market growth.

Is Europe at the Forefront of the AI PC Movement?

Europe is becoming an important center for AI programming, fueled by the region's emphasis on digital sovereignty, privacy of data, and automation for enterprise and consumers. Government efforts to support AI infrastructure and expand the chips to support innovation are improving soft infrastructure for domestic manufacturing and increasing smart device integration. Further expanding Europe's growth trajectory is the coming-together of sustainable computing and increasing productivity from AI-assisted workflows.

Germany AI PC Market Trend

Germany is leading the region's growth, taking advantage of the country's robust industrial base and R&D ecosystem. Germany's commitment to Industry 4.0 and increasing rollout of AI-enabled computing in manufacturing, health, education, etc., increases the momentum for AI PCs. At the same time, Germany's investment from domestic tech companies and startups in intelligent edge computing, and hardware optimization for AI workloads, also speaks to the growth rate from public funding to digital transformation.

Middle East & Africa Keep Pace in AI PC Adoption?

The Middle East and Africa (MEA) region is a new market for AI PCs focusing on growing investment into smart infrastructure, education, and digital advancement programs. Many governments across the Gulf states and African nations are looking at technology-led diversification of their economy, and this will help advance the market around AI PC's. The region has a young population, with access to affordable technology, and is accelerating internet penetration which will contribute to growing demand for AI-enabled computing within schools, start up, and government applications.

UAE AI PC Market Trend

The United Arab Emirates is an early adopter of AI-driven digital adoption as it is a national objective under their national strategy for AI, focused on investment into smart government infrastructure. The UAE vision for AI encompasses; education, health care, and the enterprise ecosystem, providing an environment ripe for the ecosystem of advanced computing. Policies around technology, incubators focused on AI, and collaborations with global manufacturers all support establishing a great environment for AI PC market advancement.

Value Chain Analysis

- Component & AI Model Development

It is a foundational stage that involves building, training, and validating AI and ML models. This process involves specific problem-solving related to the AI lifecycle, such as automating tasks, making predictions, and extracting insights.

Key players: OpenAI, Google, Intel, Samsung, Apple, and Anthropic

- Platform & System Integration

This stage involves shifting the AI model from the development phase into a production system, which requires the provision of infrastructure, tools, and workflows to turn pre-trained models into scalable services.

Key players: Microsoft, AWS, HP, Lenovo, and Qualcomm

- Distribution

This is the final stage, where AI capabilities are incorporated into various end-user applications across multiple business units to enhance performance.

Key players: Intel, AMD, Apple, and Asus

AI PC Market Companies

- Acer Inc.

- Apple Inc.

- ASUSTeK Computer Inc.

- BOXX

- Corsair Gaming Inc.

- Dell Technologies Inc.

- Fujitsu Ltd.

- Gigabyte Technology Co. Ltd.

- HP Inc.

- Huawei Technologies Co. Ltd.

- Intel Corp.

- Lambda Inc.

- Lenovo Group Ltd.

- Microsoft Corp.

- Micro Star International Co. Ltd.

- NVIDIA Corp.

- Puget Sound Systems Inc.

- Qualcomm Inc.

- Razer Inc.

Recent Developments

- In January 2025, Dell Technologies introduced a new AI PC portfolio designed for personal and professional use. Their new line up empowers users to collaborate and enhance productivity from any location.(Source: https://www.dell.com)

- In September 2024, Lenovo and SentinelOne joined forces to protect Lenovo PCs with integrated AI security. Lenovo will leverage singularity platform and Gen AI capabilities of SentinelOne in new PC models and provide upgradation to existing users.(Source: https://news.lenovo.com)

Segments Covered in the Report

By Component

- Hardware

- CPU with Integrated AI Accelerators

- GPU (Discrete & Integrated)

- Neural Processing Unit (NPU)

- Memory & Storage Optimized for AI

- Software

- AI Productivity Applications (Office, Analytics)

- Creative & Design Applications

- Security & System Optimization Software

- Services

- Deployment & Integration

- Support & Maintenance

- Training & Consulting

By Device Type

- Desktops

- Laptops / Notebooks

- Workstations

- All-in-One PCs

By Technology Integration

- On-Device AI Processing

- Hybrid AI (On-Device + Cloud)

- Cloud-Only Augmented AI PCs

By End User

- Individual Consumers

- Enterprises

- IT & Software

- BFSI

- Healthcare

- Education & Research

- Media & Entertainment

- Government & Public Sector

By Distribution Channel

- OEM Direct Sales

- Online Retail

- Offline Retail / Distributors

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting