What is the AI-RAN Market Size?

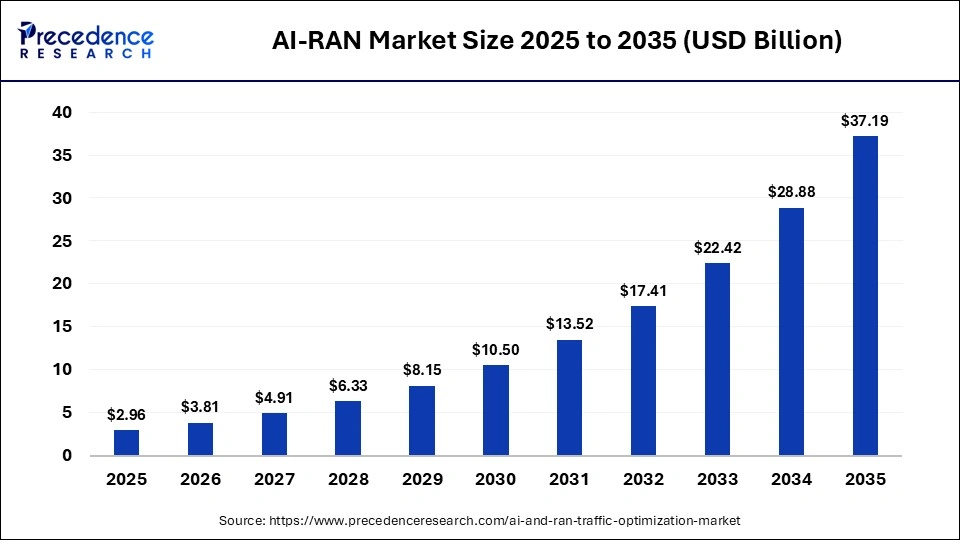

The global ai-ran market size was calculated at USD 2.96 billion in 2025 and is predicted to increase from USD 3.81 billion in 2026 to approximately USD 37.19 billion by 2035, expanding at a CAGR of 28.79% from 2026 to 2035. The market is witnessing substantial growth due to the adoption of advanced AI technologies in traditional telecommunications infrastructure to improve efficiency, optimize energy usage, and provide connectivity in remote regions.

Market Highlights

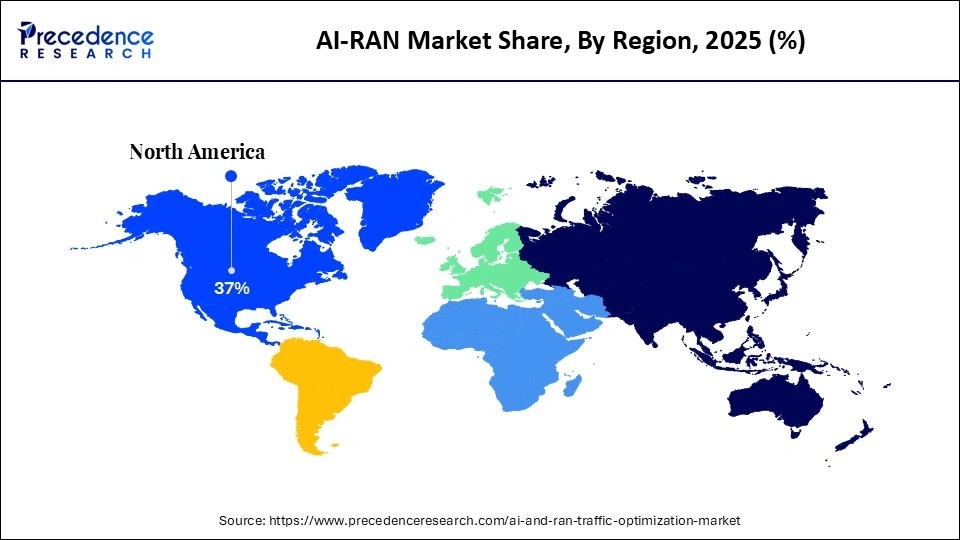

- North America dominated the AI-RAN market with the largest share of approximately 37% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR of 25.5% from 2026 to 2035.

- By component type, the software segment dominated the market while holding the largest share of approximately 40% in 2025.

- By component type, the hardware segment is expected to grow at the highest CAGR between 2026 and 2035.

- By technology type, the open-RAN segment led the market while holding the largest share of approximately 45% in 2025.

- By technology type, the hybrid RAN segment is expected to grow at the fastest CAGR between 2026 and 2035.

- By deployment mode, the on-premises segment contributed the largest AI-RAN market share of approximately 55% in 2025.

- By deployment mode, the cloud-based segment is expected to grow at the fastest CAGR from 2026 to 2035.

- By end user industry, the telecom operators segment dominated the market while holding the largest share of approximately 70% in 2025.

- By end user industry, the government segment is poised to grow at the highest CAGR between 2026 and 2035.

What is the Landscape of the AI-RAN Market?

AI-RAN refers to Radio Access Networks enhanced with artificial intelligence and machine learning to automate, optimize, and adapt wireless network operations - improving performance, spectrum efficiency, fault management, resource allocation, and energy use in 4G/5G/6G networks. It integrates AI models, analytics, and closed-loop control within RAN elements, enabling predictive decision-making, real-time optimization, and autonomous network management across Open RAN (O-RAN), vRAN, and hybrid architectures for telecom operators and enterprise applications.

Technology Shifts in the AI-RAN Market

The AI-based radio access network market is transitioning from rule-based optimization to predictive real-time control. Operators of RANs are increasingly adopting the use of AI to manage data traffic effectively and minimize latency. Cloud native and virtualization technologies are being integrated with RAN. The adoption of AI in existing RAN infrastructure optimizes the usage of energy and boosts productivity in its operations.

AI-RAN Market Trends

- Collaborations & Partnerships: Telecom and network equipment providers are collaborating with AI and cloud solutions companies to integrate intelligent technologies in RAN. These collaborations are accelerating the commercialization of intelligent and self-optimizing RAN infrastructures. For instance, Ericsson is partnering with NVIDIA to develop advanced AI-powered RAN solutions.

- Government Initiatives: Governments are actively supporting the integration of AI technologies in existing RAN infrastructure. They are promoting open-RAN support policies and intelligent telecom infrastructures. Governments are providing incentives to companies to develop and integrate advanced AI algorithms with RAN technology. For instance, the U.S. government is promoting the schemes for enhancing 5G infrastructure by integrating AI-based solutions in RAN technology.

- Business Expansions: Key players are scaling up their cloud-native RAN platforms and investing in cutting-edge AI technologies. These technologies boost their presence in high-growth regions, thereby expanding their AI in RAN capabilities. Integration of AI solutions in RAN helps telecommunication operators manage a surge in data traffic, reduce operating costs, and improve network quality. For instance, companies like Ericsson and Samsung Electronics are expanding their AI-driven RAN deployments across Asia-Pacific and Europe.

Segment Insights

Component Type Insights

Why Did Software Segment Dominate the AI-RAN Market?

The software segment dominated the market with a market share of approximately 40% in 2025. Technological advancements in RAN are mainly delivered through AI algorithms, analytics platforms, and automation layers, which fall under software upgrades. AI-driven software facilitates real-time network optimization, data traffic prediction, energy management, and predictive maintenance capabilities across RAN infrastructure. Software solutions have comparatively easier deployment, scaling, and upgradation than hardware, which allows operators to rapidly enhance their network and minimize operational costs.

The hardware segment is poised to grow at the highest CAGR between 2026 and 2035. The market growth of this segment can be attributed to increasing investment in AI-powered RAN infrastructure for supporting advanced network intelligence. The deployment of 5G and open-RAN networks is improving the demand for high-performance baseband units, edge servers, GPUs, and AI accelerators that can process data in real time. AI-based networks operate on low-latency computing and require high processing capacity, which makes it mandatory for operators to upgrade their existing infrastructure. The market growth of this segment is further driven by increasing emphasis on energy optimization, network expansion, and reliable connectivity.

Technology Type Insights

Why Did the Open-RAN Segment Dominate the AI-RAN Market?

The open-RAN segment led the market while holding the largest share of approximately 45% in 2025. Open-RAN architecture facilitates the deployment of various AI solutions across centralized, distributed, and edge layers. This helps the real-time optimization of communication as well as the performance of the network. AI-based open-RAN solutions are being widely adopted in 5G networks. This technology offers straightforward integration with AI-based software architecture.

The hybrid RAN segment is growing at the fastest CAGR between 2026 and 2035. The market growth of this segment can be attributed to the requirement of diverse infrastructure for telecommunications operator while upgrading their existing network. This segment facilitates operators to operate their traditional network while incorporating AI-based solutions in their operations. The hybrid RAN segment has lower upfront costs than open-RAN due to its ability to easily integrate with traditional communication networks.

Deployment Mode Insights

Why Did On-Premises Deployment Mode Dominate the AI-RAN Market?

The on-premises segment contributed the largest market share of approximately 55% in 2025. This deployment mode facilitates telecommunication operators' low latency, high reliability, and control over critical network operations. Companies prefer this deployment because it offers data security by having an AI-based RAN in proximity to cell towers rather than a purely cloud-based model. The market growth of this segment is further driven by the growing emphasis on cybersecurity.

The cloud-based segment is growing at the fastest CAGR from 2026 to 2035. The market growth of this segment is due to the transition of telecommunication organizations to cloud native and virtualized RAN. This deployment mode facilitates large-scale AI processing, rapid AI model upgrades, and centralized intelligence in the networks. The market adoption of this segment is due to its ability to reduce operational complexity and long-term infrastructure costs.

End User Insights

Why Did the Telecom Operators Segment Dominate the AI-RAN Market?

The telecom operators segment dominated the market with a market share of 70% in 2025. Telecom operators are the main owners and managers of radio access networks, making them the largest adopters of AI-driven RAN solutions. The deployment of AI for improved network performance, management of rising data traffic, energy consumption, and automation of network operations at the scale of vast 4G and 5G infrastructures. The market growth in this segment is further driven by investments in 5G networks, modernization, and AI adoption.

The government segment is poised to grow at the highest CAGR between 2026 and 2035. The market growth of this segment is attributed to public sector investments in AI-based RAN to support the national 5G programs. Governments are also promoting smart cities and secure digital infrastructures, which drive the market growth. They are promoting the deployment of an artificial intelligence-powered RAN for the reliability of the network. The integration of machine learning algorithms in RAN facilitates remote network solutions, defense communications, and public safety.

Regional Insights

How Big is the North America AI-RAN Market Size?

The North America ai-ran market size is estimated at USD 1.10 billion in 2025 and is projected to reach approximately USD 13.95 billion by 2035, with a 28.92% CAGR from 2026 to 2035.

Why Did North America Dominate the AI-RAN Market?

North America dominated the market with the largest share of approximately 37% in 2025. This region has widespread adoption of 5G technology and significant investment in AI technologies. There is a presence of prominent telecommunications companies, including network equipment providers, hyperscalers, and AI technology players. Telecom operators have adopted AI-based 5G technologies, aiming to maximize their network performance while optimizing costs. The market growth is further driven by government investments in 5G infrastructure development and open-RAN integration.

What is the Size of the U.S. AI-RAN Market?

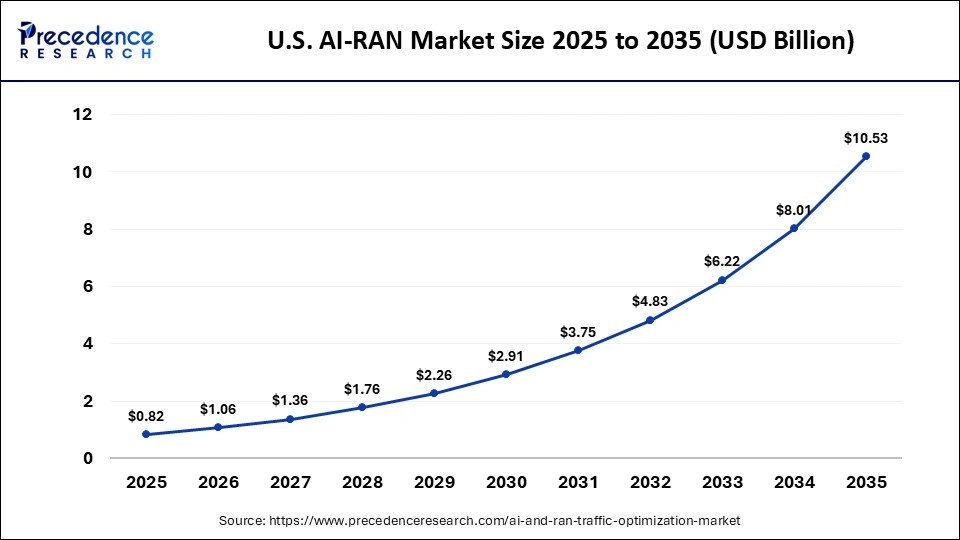

The U.S. ai-ran market size is calculated at USD 0.82 billion in 2025 and is expected to reach nearly USD 10.53 billion in 2035, accelerating at a strong CAGR of 29.08% between 2026 and 2035.

U.S AI-RAN Market Analysis

The U.S. leads the market growth in the region due to widespread 5G deployments and significant investments in AI-driven network automation. There is a significant presence of mobile and technology operators who have adopted advanced network technologies. The adoption of artificial intelligence-driven RAN facilitates better network efficiency and energy control. The market growth is further driven by government promotion for 5G and secure telecommunication architecture.

Why is Asia-Pacific the Fastest-Growing Region in the AI-RAN Market?

Asia-Pacific is expected to grow at the fastest CAGR of 25.5% from 2026 to 2035. This region has a rapid increase in the number of mobile users and demand for high-speed network connectivity. The telecommunication operators are adopting advanced machine learning and deep learning models in RAN to enhance energy efficiency and improve network performance in congestion areas. Government investment in traditional network infrastructure modernization is further driving the market growth in the region.

China AI-RAN Market Trends

China leads the market in the region due to significant adoption of advanced 5G network architecture. The country has a significant presence of telecommunication companies with widespread AI-adoption in RAN to optimize traffic control efficiency. The market growth is further boosted by collaborations between the government and telecommunication operators to modernize traditional RAN on a significant scale. Government investments facilitate the integration of advanced technologies in traditional telecommunication architecture.

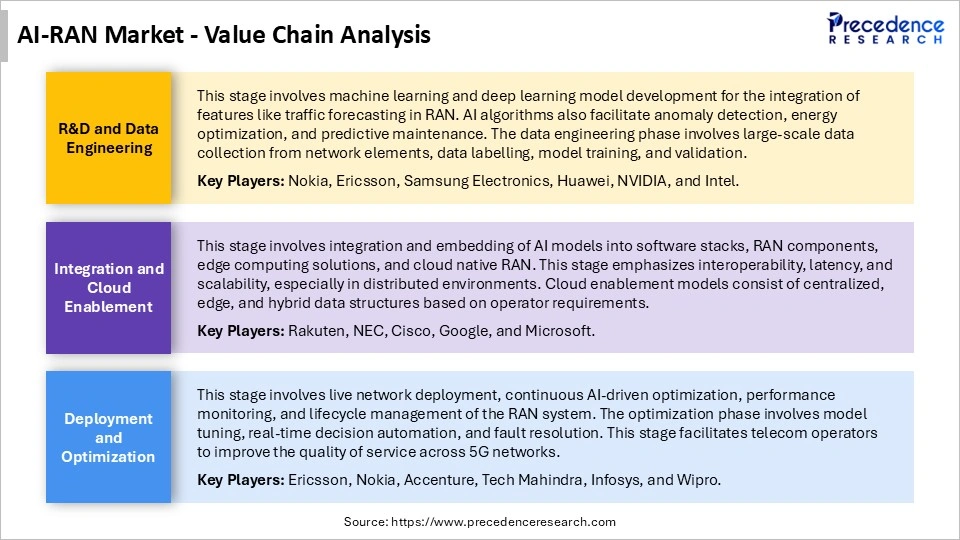

AI-RAN MarketValue Chain Analysis

Who are the Major Players in the Global AI-RAN Market?

The major players in the ai-ran market include Nokia, Ericsson, Huawei, Samsung Electronics, Qualcomm, NVIDIA, Intel, Cisco Systems, NEC Corporation, ZTE Corporation, Mavenir, Rakuten Symphony, VIAVI Solutions, Fujitsu, Altiostar (part of Rakuten Symphony ecosystem)

AI-RAN Market Recent Developments

- In March 2025, Nokia launched MantaRay AutoPilot, which is an artificial intelligence-powered, fully autonomous solution to boost network performance and resource usage. This product is being widely adopted in cloud-based 5G networks to improve signal tracing and emitting capacity of electronic devices.(Source: https://www.nokia.com)

- In October 2025, NVIDIA launched the AI-Native Wireless Stack, which offers integration of advanced AI technologies in the wireless network architecture. This product facilitates AI-enabled spectrum flexibility and integrated communication and sensing to facilitate the deployment of 6G networks.(Source: https://nvidianews.nvidia.com)

- In October 2025, AsiaInfo Technologies and China Mobile Research Institute launched AI Native RAN Base Station, which can integrate RAN, computing, sensing, and AI to dynamically allocate CPU and GPU resources. This product also incorporates edge computing AI capabilities.(Source: https://www.asiainfo.com)

Segments Covered in This Report

By Component

- Software

- Hardware

- Services

By RAN Architecture / Technology

- Open RAN (O-RAN)

- vRAN (Virtual RAN)

- Hybrid RAN

By Deployment

- On-Premises

- Cloud

By End-User

- Telecom Operators

- Enterprises

- Government/Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content