What is the U.S. AI-RAN (Artificial Intelligence-Powered Radio Access Network) Market Size?

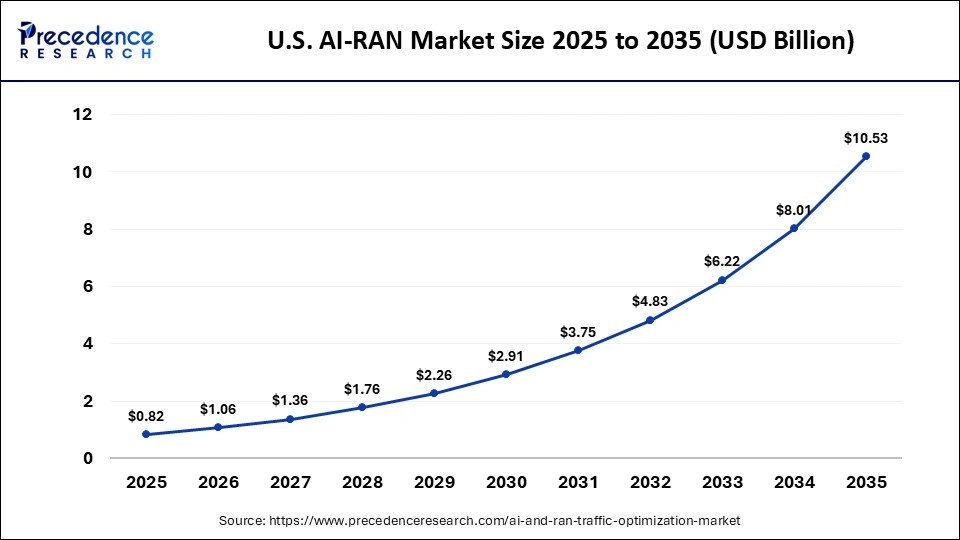

The U.S. AI-RAN (artificial intelligence-powered radio access network) market size accounted for USD 0.82 billion in 2025 and is predicted to increase from USD 1.06 billion in 2026 to approximately USD 10.53 billion by 2035, expanding at a CAGR of 29.08% from 2026 to 2035. The market is rapidly growing due to the surge in data traffic that requires advanced 5G and emerging 6G network optimization, increasing focus on reducing energy consumption, and rapid integration of AI to improve spectral efficiency.

Market Highlights

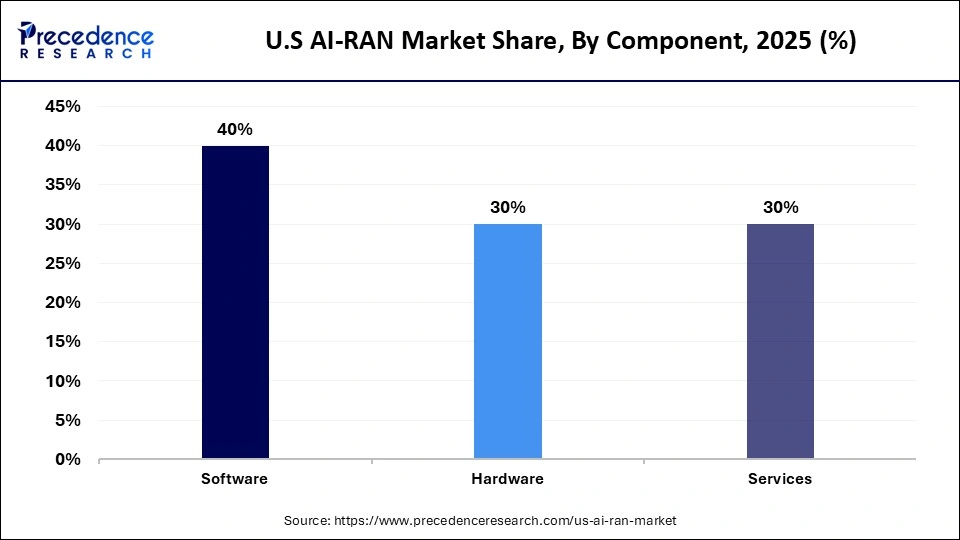

- By component, the software segment held the largest market share of nearly 40% in 2025 and is expected to grow at the fastest CAGR during the foreseeable period.

- By component, the hardware segment is expected to grow at a notable rate in the coming years.

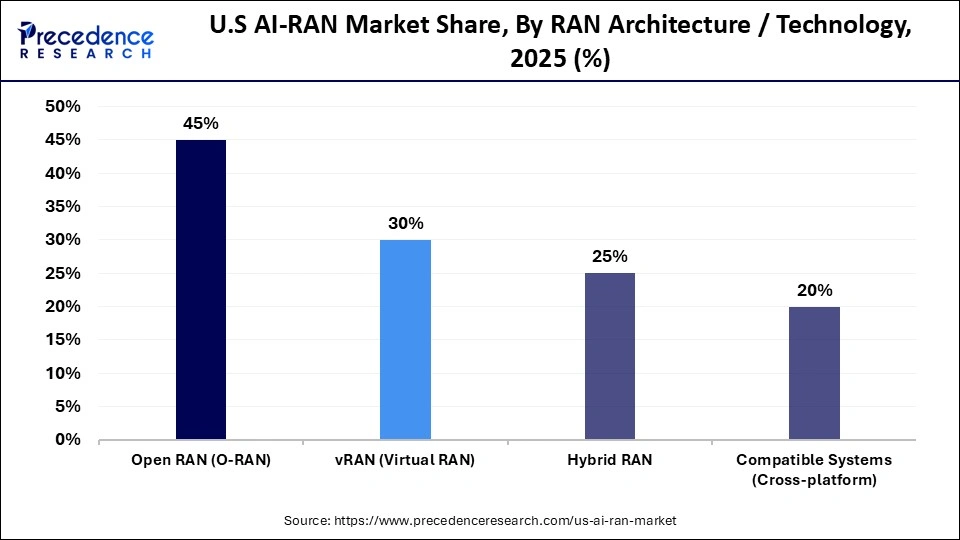

- By RAN architecture / technology, the Open RAN segment held the largest market share of nearly 45% in 2025.

- By RAN architecture / technology, the hybrid RAN segment is expected to grow at the fastest CAGR during the forecast period.

- By deployment, the on-premises segment led the U.S. AI-RAN (artificial intelligence-powered radio access network) market, holding the largest share of nearly 55% in 2025.

- By deployment type, the cloud segment is expected to grow at the fastest CAGR during the foreseeable period.

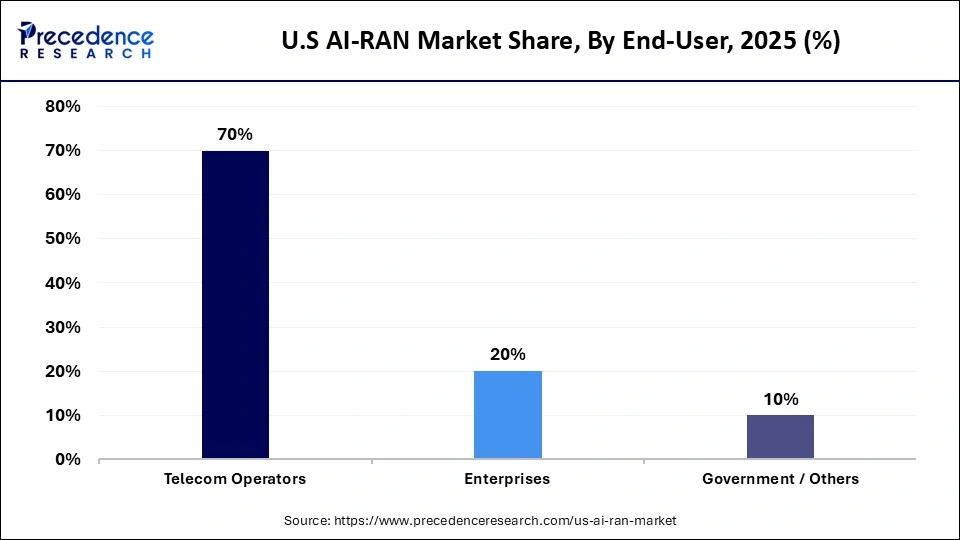

- By end user, the telecom operators segment held the largest market share of nearly 70% in 2025.

- By end user, the government / others segment is expected to grow at the fastest CAGR during the foreseeable period.

Market Overview

The U.S. AI‑RAN industry deals with the deployment of artificial intelligence technologies within radio access networks to enable self‑optimizing, adaptive, and efficient management of wireless traffic and resources. By leveraging AI for tasks such as predictive traffic balancing, dynamic spectrum allocation, and energy‑efficient operations, AI‑RAN enhances network performance, capacity, and quality of service while lowering operational costs. Key benefits include improved spectral efficiency, reduced latency, and smarter handling of complex 5G/6G workloads, which are critical for supporting data‑intensive applications.

The market is being driven by the explosive growth in mobile data usage, the rollout of advanced 5G services and future 6G research, and increasing pressure on operators to reduce energy consumption and operational complexity. Additionally, investments in AI algorithms, edge computing, and telecom infrastructure modernization are further accelerating adoption across U.S. service providers.

U.S. AI-RAN (Artificial Intelligence-Powered Radio Access Network) Market Trends

- There is a strong emphasis on energy and cost savings, where AI-powered RAN is highly crucial for initial deployments and shows nearly 15-20% energy reduction, further supporting the sustainability goals as well.

- Emergence of 6G networks significantly contributes to the market. AI-RAN is critical for the expansion of 6G networks in the foreseeable period, which allows self-optimizing networks, real-time edge computing, and AI-driven services.

- There is a rapid shift from traditional manual operating systems to open RAN and vRAN architectures, which provide greater flexibility and seamless AI integration at the network edge.

- AI-RAN is being increasingly applied in security and specialized use cases, such as safeguarding radio signals, detecting anomalies, and supporting applications like autonomous vehicles.

How partnerships/Collaborations Influence the U.S. AI-RAN (Artificial Intelligence-Powered Radio Access Network) Market?

The momentum of AI-RAN is largely driven by the supercycle of compute demand, which necessitates strategic partnerships to keep pace with rapid market developments and integrate emerging technologies into existing systems. Partnerships and collaborations allow telecom operators, equipment vendors, and AI solution providers to combine expertise, share resources, and accelerate innovation.

Strategic alliances help in the integration of AI algorithms, edge computing, and open RAN/vRAN architectures into existing networks, reducing deployment risks and costs. Collaborations also foster faster standardization, testing, and commercialization of AI-RAN solutions, enabling operators to meet growing 5G/6G data demands, enhance spectral efficiency, and support advanced applications such as autonomous vehicles and real-time edge services.

For instance, in October 2025, NVIDIA announced a $1 billion investment in Nokia, marking the first time an AI company directly backed telecom infrastructure to transform mobile networks into AI-driven platforms. Supported by T-Mobile U.S. and Dell Technologies, the partnership integrates NVIDIA GPUs into Nokia's anyRAN architecture, replacing traditional ASIC-only designs and enabling 5G/6G RAN software to run on a programmable, COTS Aerial RAN Computer Pro (ARC-Pro) platform, combining accelerated computing with telecom-scale operations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 0.82 Billion |

| Market Size in 2026 | USD 1.06 Billion |

| Market Size by 2035 | USD 10.53 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 29.08% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, RAN Architecture/Technology, Deployment, and End-User |

Segment Insights

Component Insights

How Does the Software Segment Lead the Market?

The software segment led the U.S. AI-RAN (artificial intelligence-powered radio access network) market with a major share of nearly 40% in 2025 and is expected to continue its growth trajectory during the foreseeable period. This is mainly due to the increased need to manage complex 5G/6G networks automatically with intelligence. AI-RAN software helps in optimization of network performance, allows self-healing mechanisms during outages, and manages the load of traffic effectively, thereby reducing overall operational costs.

AI-powered software solutions support real-time traffic prediction, dynamic spectrum allocation, energy savings, and edge computing applications, delivering higher network performance and lower operational costs. Its dominance is reinforced by the growing shift toward open RAN and virtualized RAN architectures, which rely heavily on software for flexibility, scalability, and seamless AI integration.

The hardware segment is expected to grow at a notable rate in the upcoming period, owing to the increasing need for advanced hardware to process AI-powered tasks such as spectral efficiency optimization, real-time analytics, and radio-resource management. Hardware solutions are the foundation of any RAN system. Operators are replacing conventional hardware with open, flexible infrastructure to support the deployment of future 6G networks, further fueling the segment's growth.

RAN Architecture/Technology Insights

Why Did the Open RAN Segment Dominate the Market?

The open RAN segment dominated the U.S. AI-RAN (artificial intelligence-powered radio access network) market, holding the largest share of nearly 45% in 2025. This is because of its ability to offer superior network optimization, high-level energy savings, and bypassing vendor needs through intelligent controllers with faster innovation. The open interface by open RAN allows AI/ML integration into the existing network to automate management tasks and enhance user experiences with better performance. Also, the open RAN enables operators to manage, control, and optimize the radio access network dynamically.

The hybrid RAN segment is expected to grow at the fastest CAGR during the foreseeable period due to its unmatched benefits, like the integration of existing infrastructure with the AI-powered software that offers cost-effective solutions for 5G/6G networks. Hybrid solutions offer immediate and tangible financial solutions, like significant energy savings by automatically powering down components during low-demand time.

Deployment Insights

What Made On-Premises the Leading Segment in the Market?

The on-premises segment led the U.S. AI-RAN (artificial intelligence-powered radio access network) market while holding nearly 55% share in 2025. This is because it provides in-house control over sensitive data and network management, which is critical for telecom operations. Unlike public cloud solutions, on-premises deployment ensures highly reliable performance, low latency for 5G/6G networks, and immediate data processing. Key industries such as logistics, manufacturing, and healthcare prefer this model, further driving segmental growth.

The cloud segment is expected to grow at the fastest CAGR during the foreseeable period, as it enables scalable, cost-efficient deployment of AI workloads without the need for expensive, dedicated hardware. Cloud-based RAN solutions allow operators to rapidly implement virtualized network functions, microservices, and continuous deployment pipelines, supporting faster innovation, real-time optimization, and greater operational flexibility for 5G and emerging 6G networks.

End-User Insights

Why Did the Telecom Operators Segment Dominate the Market?

The telecom operators segment dominated the U.S. AI-RAN (artificial intelligence-powered radio access network) market by capturing the highest share of 70% in 2025. This is due to the rapid expansion of 5G traffic that requires immediate data management by optimizing network performance and reducing overall operational expenditures. Operators are rapidly leveraging AI to automate RAN, aiming to manage complex and heterogeneous environments more effectively than conventional methods. Also, leading telecom operators in the U.S. are heavily investing in AI-powered technologies like GPU integration and edge computing to improve network capabilities, supporting segmental growth.

The government/others segment is expected to grow at the fastest CAGR during the foreseeable period due to the strategic initiatives by the U.S. government to modernize its communication network with AI for improving national security. This significantly creates the need for AI-RAN. For example, the U.S. Department of Defense (DoD) is actively using AI-RAN as a modern-day arms by focusing on AI integration to stay competitive and highly aware in battlefield areas.

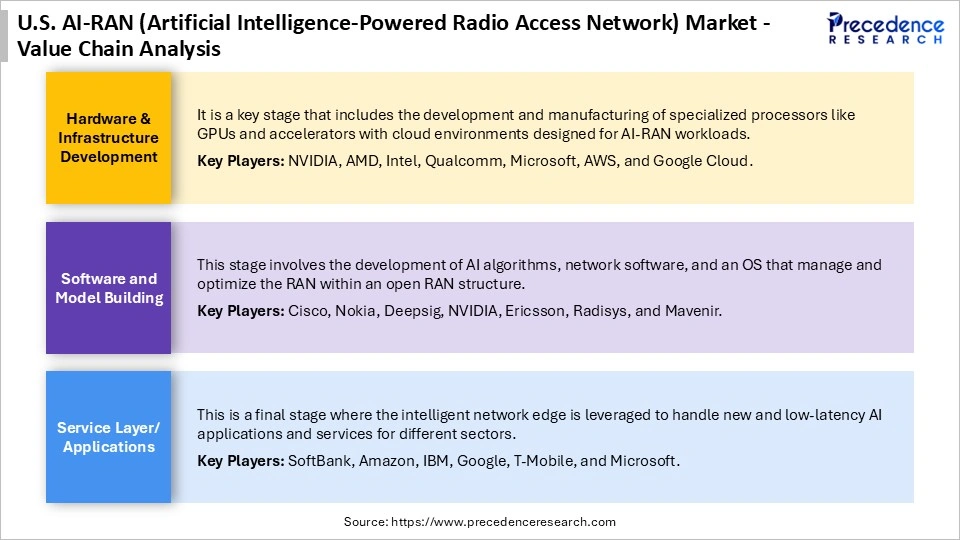

U.S. AI-RAN (Artificial Intelligence-Powered Radio Access Network) Market Value Chain Analysis

Recent Developments

- In November 2025, a leading tech giant, NVIDIA, announced its strategic move with America's first AI-native wireless stack for 6G, along with the new applications to advanced next-generation wireless technology, and collaborated with the leading marketers like Cisco, MITRE, ODC, Booz Allen, and T-Mobile.

(Source: https://uktin.net) - In November 2025, Open RAN Development Company (ODC) integrated its AI-RAN software with NVIDIA's AI Aerial platform under the chipmaker's all-American 6G initiative. Demonstrated at NVIDIA's GTC DC event, the solution combines accelerated computing, software, and services to manage wireless networks, delivering 40 faster L1 signal processing, 7 higher cell capacity, and 3.5 greater power efficiency compared to traditional CPU-based vRAN architectures.(Source: https://www.sdxcentral.com)

Who are the Major Players in the U.S. AI-RAN (Artificial Intelligence-Powered Radio Access Network) Market?

The major players in the U.S. AI-RAN (artificial intelligence-powered radio access network) market include Nokia, Ericsson, Huawei, Samsung Electronics, Qualcomm, NVIDIA, Intel, Cisco Systems, NEC Corporation, ZTE Corporation, Mavenir, Rakuten Symphony, VIAVI Solutions, Fujitsu, and Altiostar.

Segments Covered in the Report

By Component

- Software

- Hardware

- Services

By RAN Architecture/Technology

- Open RAN (O-RAN)

- vRAN (Virtual RAN)

- Hybrid RAN

- O-RAN deployments

By Deployment

- On-Premises

- Cloud

- cloud-native AI-RAN due to edge/cloud integration

By End-User

- Telecom Operators

- Enterprises

- Government/Others

Get a Sample

Get a Sample

Table Of Content

Table Of Content