What is the Air Cooled Condenser Market Size?

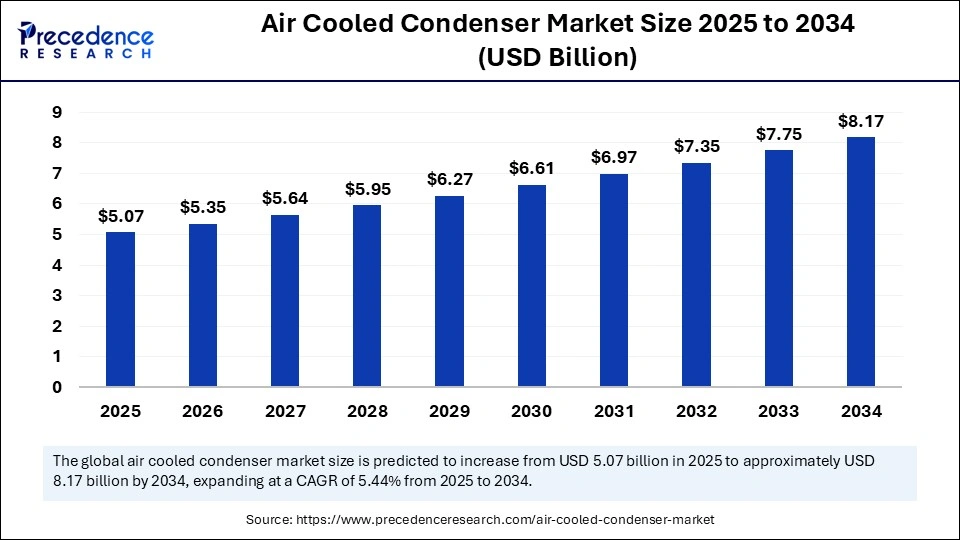

The global air cooled condenser market size is calculated at USD 5.07 billion in 2025 and is predicted to increase from USD 5.35 billion in 2026 to approximately USD 8.17 billion by 2034, expanding at a CAGR of 5.44% from 2025 to 2034. The global air-cooled condenser market is witnessing robust growth driven by the increasing need for water conservation, stringent energy-efficiency regulations, demand for sustainable solutions, and rapid advancements in air-cooled condenser technology. This report covers market trends, production volumes, technological developments, and competitive dynamics across North America, Europe, and APAC between 2025 and 2030.

Market Highlights

- Asia Pacific held the largest share in the air-cooled condenser market in 2024.

- North America is anticipated to grow at the fastest rate in the market during the forecast period.

- By type, the A-frame air-cooled condensers segment accounted for the dominant share of the market in 2024.

- By type, the V-frame air-cooled condensers segment is expected to witness a significant share during the forecast period.

- By application, the industrial segment held the major share of the air-cooled condenser market in 2024.

- By application, the commercial segment is projected to grow at a CAGR between 2025 and 2034.

What Is an Air Cooled Condenser?

The market is experiencing significant demand from thermal power plants, natural gas power plants, and other energy generation plants. An air-cooled condenser (ACC) is a type of direct dry cooling system that condenses steam inside air-cooled finned tubes, which are most commonly used to remove heat from steam condensation or the cooling of working fluids. ACCs play a vital role in maintaining the efficiency and performance of thermal power plants. Effective cooling with ACCs allows the thermal power plant to operate at lower condenser temperatures, resulting in higher efficiency, enhanced power generation, and no reliance on traditional wet cooling methods. Air-cooled condensers (ACCs) allow greater flexibility to operators in choosing plant locations. Air-cooled condensers require no water for their operation, which makes them crucial in water-scarce regions or where water resources are limited.

Technological Shifts in the Air-Cooled Condenser Market

- In the rapidly evolving technological landscape, rapid technological innovation emerges as a game-changer and holds potential for growth in the air-cooled condenser market by driving innovations in variable speed drives, advanced heat exchanger designs, and microchannel coil technology. The integration of Artificial Intelligence and automation for predictive maintenance significantly optimizes operations, while the increasing development of eco-friendly solutions and materials enhances sustainability.

- Artificial Intelligence can predict any potential failures, optimize fan speed, and minimize energy losses by offering data-driven insights. AI can enhance heat exchanger design, leading to higher efficiency in extracting latent heat and improving overall performance. These technological shifts aim to enhance reliability, lower operational costs, and meet stringent environmental regulations, which align with global sustainability goals.

Air-Cooled Condenser Market Outlook

Between 2025 and 2030, the industry is expected to see accelerated growth due to the increasing demand for efficient and reliable cooling solutions, rapid industrialization, a rising focus on sustainability and water conservation, and supportive government initiatives and regulations. As the emerging market continues to develop, the market is experiencing substantial demand for air-cooled condensers in the power generation sector.

The market is experiencing a push for sustainable and eco-friendly solutions. Air-cooled condensers offer numerous sustainability benefits by reducing water and energy usage, owing to EC motor technology. Dry cooling systems do not release heated water into the environment, which can adversely impact local ecosystems. Dry cooling improves overall system efficiency, and it can help building projects earn credits in schemes like the Leadership and Environmental Design (LEED) certification program from the US Green Building Council.

Leading players are expanding their geographical presence. For instance, in July 2025, SPG Dry Cooling announced that they are opening a new office in Dubai, covering all activities in the MEA region. With this new location, SPG Dry Cooling and Paharpur Cooling Towers now have over 23 offices worldwide. Consequently, they cover all regions in dry cooling systems, traditional and innovative wet cooling installations, and hybrid technologies.

Major Investment and Government Initiatives in the Air-Cooled Condenser Market

According to the article published by the Press Information Bureau in March 2024, Prime Minister of India Shri Narendra Modi will dedicate to the nation and lay the foundation for a series of NTPC projects on 4th March, 2024, signaling a significant leap towards sustainable development and economic growth. Unit-2 (800 MW) of NTPC's Telangana Super Thermal Power Project (Stage-I), located in the Peddapalli district of Telangana.

With an investment of Rs. 8,007 Crores, this project utilizes Ultra-Supercritical Technology, ensuring optimal power generation efficiency while significantly reducing carbon dioxide emissions. The project will supply 85% power to Telangana and will have the highest power generation efficiency among all power stations of NTPC in India, of approximately 42%.

In March 2023, NTPC commissioned India's first air-cooled condenser installed supercritical plant to demonstrate its commitment to water conservation through the reduction, reuse, and recycling of water. NTPC, the country's largest integrated energy utility, has started commercial operation of the 1st Unit of 660 MW at North Karanpura (3*660 MW), in Jharkhand. This project has been envisioned with an Air-Cooled Condenser (ACC), which has approximately one-third the water footprint compared to a conventional Water-Cooled Condenser (WCC).

In January 2022, Birla Corporation Limited, the flagship Company of the MP Birla Group with business interests in cement and jute, announced the inauguration of an integrated cement plant at Mukutban. For setting up this plant, the company invested Rs 2,744 crore. It will be the fourth integrated cement unit of the Group and the biggest single-line/kiln cement plant in Maharashtra, by capacity. Moreover, it will be powered by a 2 x 20 MW Thermal Captive Power Plant, which is based on Air-Cooled Condenser (ACC) technology. This shall bring down the water consumption by 90 percent.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.07 Billion |

| Market Size in 2026 | USD 5.35 Billion |

| Market Size by 2034 | USD 8.17 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.44% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Major Benefits Offered by the Air-Cooled Condenser Market

| Top Feature | Benefits |

| Energy Efficiency | Air-cooled condensers primarily rely on the natural airflow to dissipate heat, significantly reducing energy consumption compared to water-cooled systems, which require energy to pump water. Air cooled condenser is a cost-effective option for cooling systems, especially in areas where water resources are limited or costly. |

| Environmental Benefits | Air-cooling eliminates the usage of water, conserves resources, and significantly reduces environmental impact compared to water-cooled systems. Air cooled condensers are considered a more sustainable choice for cooling systems, particularly in water-scarce areas. |

| Space-Saving Design | Air-cooled condenser has a compact and space-efficient design, making it ideal for smaller spaces. Its design eliminates the need for complex piping systems, allows for simpler installation, and more flexible system configurations. |

| Low Maintenance | Air-cooled condensers are easier to maintain compared to their water-cooled counterparts. The absence of water-related issues, such as corrosion and scaling, reduces the need for frequent maintenance, which makes air-cooled condensers a low-maintenance solution that saves money and time in the long run. |

Air-Cooled Condenser MarketSegmental Insights

The A-frame air-cooled condensers segment dominated the global air-cooled condenser market in 2024, reflecting its superior design efficiency and broad industrial applicability. A-frame air-cooled condensers are specifically designed to maximize heat transfer efficiency, making them ideal for use in power generation plants, chemical processing facilities, and large-scale manufacturing operations. Their sloped “A” structure enhances airflow and optimizes thermal performance, allowing for better heat dissipation even under high ambient temperature conditions. On the other hand, the V-frame air-cooled condensers segment is expected to witness remarkable growth during the forecast period. V-frame air-cooled condensers are a significant innovation in the field of industrial cooling systems. V-frame air-cooled condensers are widely used in dry cooling systems, which are critical for power plants and industrial facilities in arid regions. The V-shaped air-cooled condensers facilitate better airflow distribution and increased surface area for heat dissipation, which leads to improved cooling performance.

The industrial segment held a dominant presence in the air-cooled condenser market in 2024, driven by the growing demand for dry cooling solutions across multiple heavy industries. ACCs are increasingly being adopted in sectors where efficient process cooling and heat removal are essential, including power generation, chemical and petrochemical processing, and metal manufacturing. Their ability to operate effectively in high-temperature environments and minimize water usage has made them an ideal solution for regions facing water scarcity challenges. On the other hand, the commercial segment is expected to grow at a notable rate during the forecasted period. For commercial usage, air-cooled condensers offer water-free, lower-maintenance cooling for HVAC and refrigeration. Commercial buildings, including supermarkets, data centers, and others, are driven by sustainable trends and regulations. Such factors are boosting the segment's expansion in the coming years.Type Insights

Application Insights

Air-Cooled Condenser Market Regional Insights

Asia-Pacific dominated the global air-cooled condenser market in 2024. This region's dominance is primarily due to the water scarcity concerns, rising environmental regulations, increasing investment in power generation projects, and rising efforts of key players to improve the efficiency of air-cooled condensers. Moreover, government support and increasing demand for sustainable practices are anticipated to propel the market's growth during the forecast period. The rising innovations in microchannel coils are improving energy savings and reducing noise. Furthermore, rapid industrialization and rising infrastructure development, particularly in emerging economies, are likely to accelerate the growth of the air-cooled condenser market in the region. Several market players are planning to expand their geographical presence, with major manufacturing companies setting foot in the Asia-Pacific region. These factors are expected to boost the growth of the air-cooled condenser market in the region. On the other hand, North America is anticipated to grow at the fastest CAGR. North America has a well-developed industrial and energy sector, including power generation, the chemicals sector, manufacturing, and HVAC, all of which are major users of air-cooled condensers. Air-cooled condensers (ACCs) are widely used in these sectors for cooling applications, especially in power plants, refineries, and industrial facilities. Sustainability trends and environmental regulations, such as restrictions on water usage and emissions, have significantly increased the adoption of ACCs. ACCs are highly favored over water-cooled systems in areas with water scarcity, poor water quality, and limited access to high-quality water for cooling purposes. India Air-Cooled Condenser Market The India air-cooled condenser market is witnessing steady growth, driven by the country's expanding power generation capacity and the increasing shift toward sustainable cooling technologies. With rising environmental concerns and limited water resources, industries are actively adopting air-cooled condensers (ACCs) as an efficient alternative to traditional water-based cooling systems. These systems are particularly suitable for thermal power plants, petrochemical facilities, and manufacturing industries operating in water-scarce regions. Government initiatives such as ‘Make in India' and ‘Atmanirbhar Bharat' are also supporting domestic manufacturing and technological advancements in industrial cooling equipment. Additionally, the push for renewable energy projects, particularly solar and wind power, is creating new opportunities for air-cooled condenser integration in hybrid and auxiliary power systems. Rapid industrialization, combined with growing demand for reliable and energy-efficient cooling solutions, continues to strengthen market adoption. In January 2025, Holtec Asia, an autonomous subsidiary of Holtec International and a globally recognized supplier of state-of-the-art Air-Cooled Condensers (ACCs), announced a significant expansion of its manufacturing facility in Dahej, Gujarat (India) to meet the rising demand for condensing of low-pressure steam produced by power-generating and industrial plants without reliance on a cooling water source. Holtec Asia's cutting-edge manufacturing plant is widely recognized for producing high-reliability Air-Cooled Condensers (ACC). These condensers are essential for enabling power plants to operate in areas with limited water supply and are desirable for preventing thermal pollution of water sources, even in locales that are not water-challenged. In March 2024, Modi launched development projects worth Rs 56,000 crore in Telangana. Prime Minister Narendra Modi addressed the nation and laid the foundation stone for multiple development projects in the power, rail, and road sectors in Telangana, worth more than Rs 56,000 crore.

Air-Cooled Condenser Market Value Chain

The value chain begins with the sourcing of aluminum, galvanized steel, copper tubes, fans, and fin materials, key components that determine heat transfer efficiency and corrosion resistance. Material quality, pricing, and supplier reliability are crucial since metals account for a major share of total system cost. Many manufacturers develop long-term partnerships with metal fabricators and component suppliers to ensure cost stability and supply continuity. Upstream value is captured by suppliers offering lightweight alloys and anti-corrosive materials that enhance system performance and lifespan.

This is the core value-creation stage, where engineering firms design and assemble condensers tailored for power plants, refineries, and industrial cooling systems. Advanced manufacturing involves tube-fin assembly, structural frame fabrication, fan integration, and thermal performance testing. Companies invest in CFD simulation, modular construction, and noise/vibration control to optimize efficiency and compliance with environmental norms. Value capture is highest among OEMs and engineering firms that combine in-house design, fabrication, and performance customization, such as SPX Cooling Technologies, Enexio, and EVAPCO.

Finished ACC systems are supplied to power generation companies, petrochemical plants, and industrial facilities through EPC (Engineering, Procurement & Construction) contractors or direct sales. Installation, commissioning, and after-sales services, including maintenance, retrofitting, and spare parts, are crucial for long-term client retention. Digital monitoring (IoT sensors, performance analytics) adds additional value for operational optimization. Downstream value capture comes from service contracts, system upgrades, and lifecycle management, which provide recurring revenue beyond initial equipment sales.

Air-Cooled Condenser Market Companies

SPG Dry Cooling is a global leader in air-cooled condensers and coolers, with equipment installed worldwide. They provide a range of dry cooling solutions protected by multiple international patents. With over 700 professionals on their team, SPG Dry Cooling operates successfully in all climates and challenging conditions around the globe.

Longhua Technology Group (Luoyang) Co., Ltd is China's leading manufacturer of air-cooled condensers with the largest production capacity. They specialize in air heat exchangers, evaporative condensers, and hybrid coolers. They also design heat exchange systems tailored to your specific industrial needs.

Thermax Group is a Pune-based company in India. Its business portfolio includes products for heating, cooling, water and waste management, and specialty chemicals. The company also designs, builds, and commissions large boilers for steam and power generation, turnkey power plants, industrial and municipal wastewater treatment plants, waste heat recovery systems, and air pollution control projects. They operate globally through 29 international offices and 14 manufacturing facilities, with 10 located in India and 4 overseas.

John Cockerill is a mechanical engineering group headquartered in Seraing, Belgium. Over the last 20 years, dry cooling systems for power plants have gained increasing interest as an alternative to wet cooling systems. Each section of Air-Cooled Condensers (ACC) is designed by its engineers to enhance performance while respecting cost and constructability.

Holtec International is an American supplier of equipment and systems for the energy industry. Holtec is one of a few companies worldwide that design and supply water-cooled and air-cooled condensers. Holtec’s Air-Cooled Condenser systems (ACCs) feature transformative air-cooling technology that ends reliance on large quantities of cooling water by rejecting waste heat.

SPX Cooling Technologies designs and manufactures cooling systems, including wet, dry, and hybrid cooling towers under brands such as Marley. The company’s engineered solutions improve thermal performance, reduce emissions, and optimize energy efficiency across power, HVAC, and industrial sectors.

Enexio is a global leader in heat exchange and cooling technologies, offering advanced air-cooled condensers and hybrid cooling systems. Its products are widely used in power generation, industrial processes, and renewable energy plants. Enexio’s innovations in dry cooling solutions enhance water conservation and operational efficiency in large-scale thermal systems.

Shouhang High-Tech Energy Technology specializes in energy-saving and environmental protection equipment, with a strong focus on air-cooled condenser systems. The company serves the power, chemical, and renewable energy industries, emphasizing sustainable and high-efficiency cooling solutions.

Shuangliang Group provides energy-efficient heat exchange and cooling equipment, including air-cooled condensers and absorption chillers. Its products support clean energy and industrial applications by enhancing heat recovery and reducing environmental impact.

EVAPCO Inc. manufactures high-performance evaporative cooling and heat transfer systems for commercial, industrial, and power generation applications. Its advanced thermal management technologies ensure reliable performance, energy efficiency, and minimal environmental footprint.

Recent Developments

- In February 2025, B.Grimm Technologies Company Limited, a leader in engineering and energy-efficient solutions in Thailand, signed a Licensee Agreement with John Cockerill Hamon, a renowned expert in industrial cooling solutions, to become the distributor of HAMON cooling towers. The collaboration aims to expand the customer base across key industries in Thailand, such as power plants, oil and gas plants, chemical processing factories, oil refineries, and data centers.(Source: https://www.kaohooninternational.com)

- In June 2025, John Cockerill Hamon was awarded a contract by Aksa Energy Company Ghana to supply a 3-module Air-Cooled Condenser for the 350 MW Kumasi Power Plant in Anwomaso, Ghana. This marks an important milestone as they expand into a new country, further reinforcing their presence in Africa. By contributing to this strategic project, enhance power reliability and stability in Ghana's middle belt, strengthening the region's energy infrastructure. (Source: https://johncockerill.com)

Air-Cooled Condenser MarketSegments Covered in the Report

By Types

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting