What is the Airport Operation Market Size?

The global airport operation market size was calculated at USD 6.46 billion in 2025 and is predicted to increase from USD 7.88 billion in 2026 to approximately USD 47.10 billion by 2035, expanding at a CAGR of 21.97% from 2026 to 2035.One key driver of the market is the increasing global demand for air travel, which is fueled by rising disposable incomes and a growing middle class in emerging economies. This trend encourages airlines to expand their fleets and networks, thereby increasing the need for enhanced airport facilities and services.

Market Highlights

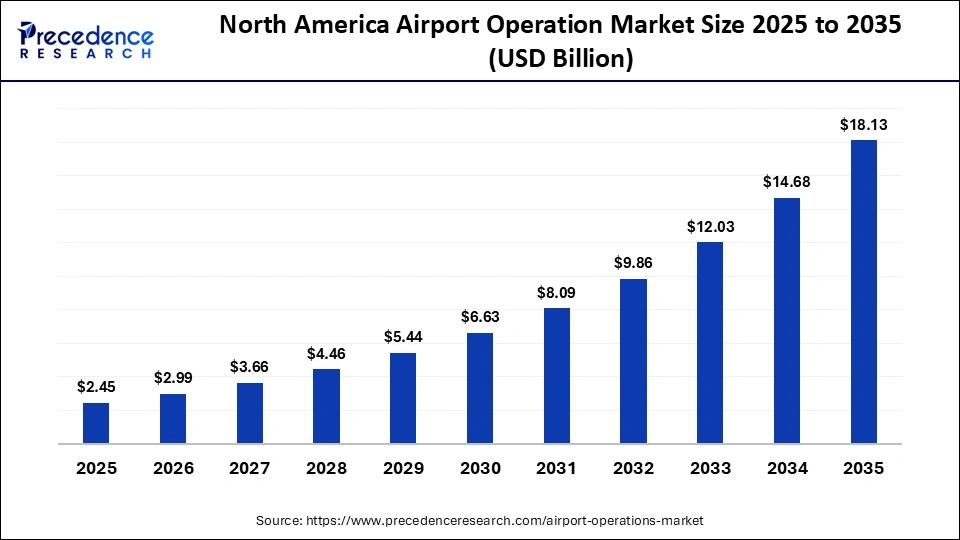

- North America dominated the global airport operation market with the largest share of approximately 38% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By operation type, the airside operations segment held a dominant position in the market with the largest share of approximately 42% in 2025.

- By operation type, the landside operations segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

- By service/platform, the baggage handling & screening segment accounted for a considerable revenue share of approximately 28% in the market in 2025.

- By service/platform, the passenger processing segment is expected to grow with the highest CAGR in the market during the studied years.

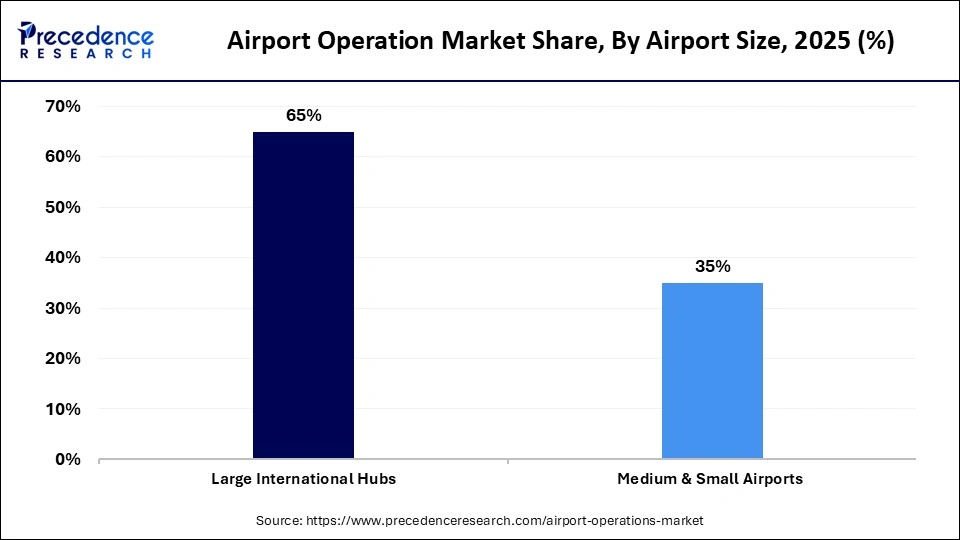

- By airport size, the large international hubs segment led the global market with a share of approximately 65% in 2025

- By airport size, the medium & small airports segment is expected to expand rapidly in the market in the coming years.

Air Operations: The Brain Behind Seamless Air Travel

The airport operation market is an invisible engine that keeps global air travel running smoothly, efficiently, and safely. It encompasses a wide range of systems managing airside operations, terminal activities, passenger flow, baggage handling, and ground support. Rising air passenger traffic, airport modernization programs, and the push for operational efficiency are driving steady market growth. As airports evolve into smart mobility hubs, investments in digital and automated operations are becoming mission-critical rather than optional.

AI development: From Control Towers to Intelligent Ecosystems

Artificial intelligence (AI) is rapidly transforming airport operations from reactive systems into predictive, self-optimizing ecosystems. AI-driven platforms are being deployed for passenger flow forecasting, queue management, predictive maintenance of runways and equipment, and real-time disruption management. Machine learning algorithms analyze historical and live data to optimize gate allocation, turnaround times, and workforce scheduling. Additionally, computer vision and AI-powered surveillance enhance security screening, apron safety, and baggage tracking, significantly reducing delays and operational bottlenecks.

Airport Operation Market Trends

- Shift Towards Smart Airports: Integrated digital platforms unify airside, landside, and terminal operations.

- Rising Adoption of Predictive Analytics: Predictive analytics is enhancing and encouraging delay reduction, asset utilization, and preventive maintenance.

- Automation: Automation of handling and baggage systems is set up to improve turnaround efficiency. It enhances accuracy and reduces manual errors.

- Passenger Experience Management: The increased focus on passenger experience management facilitates real-time crowd control and journey optimization.

- Cloud-based Operations: The cloud-based airport operational database is replacing the legacy on-premise systems. Encouraging bot or online operations for the operation staff present on-job. Making things easy and ensuring every operation is on time.

- Sustainability-driven Operations: This system is leveraging AI to reduce the fuel burn, emissions, and energy consumption.

Market scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.46Billion |

| Market Size in 2026 | USD 7.88 Billion |

| Market Size by 2035 | USD 47.10Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 21.97% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Operation Type, Service/Platform, Airport Size, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Operation Type Insights

Why the Airside Operations Segment Dominated the Airport Operation Market?

The airside operations segment dominated the market by holding a share of approximately 42% in 2025, because of services that comprise runway operations, air traffic operations, aircraft parking, and ground handling operations. The large number of passengers and heavy flight schedules at major airports require continuous optimization of airside efficiency. This segment is further strengthened by investments in high-level surface movement systems and safety. High capital intensity in airside operations is maintained by regulatory compliance and stringent safety measures.

The landside operations segment is expected to show the fastest growth over the forecast period, driven by terminal control, ground transportation, parking, and passenger flow. Air travel is putting strains on terminal infrastructure, as it drives the intelligent landside investment. Airports are embracing the concept of digital wayfinding, real-time crowd management, and mobility integration platforms. Non-aeronautical revenues are also increasing, compelling airports to improve their landside efficiency. All in all, landside operations are becoming a business priority of customer satisfaction and revenue growth.

Service/Platform Insights

Which Service/Platform Segment Dominated the Airport Operation Market?

The baggage handling & screening segment held a major revenue share of approximately 28% in the market in 2025, due to the need for high security, operational performance, and passenger satisfaction. Airports are still spending heavily on automated baggage handling systems to minimize delays and mishandling rates. High security laws demand the use of sophisticated screening devices and constant upgrading of the system. Reliability and speed are required due to the high level of passenger throughput in major hubs. It is further enhanced by integration with the airport operations control centers.

The passenger processing segment is expected to gain the highest share of the market between 2026 and 2035, which is powered by the push towards touchless and digital airport experiences. Airports are implementing self-service check-in, biometric check-in, and mobile check-in. These technologies minimize time in queues and streamline manpower needs. The increase in passenger traffic and safety expectations after the pandemic is increasing adoption. Airports and airlines are also working together to standardize digital identity solutions.

Airport Size Insights

How the Large International Hubs Segment Dominated the Airport Operation Market?

The large international hubs segment held the largest revenue share of approximately 65% in the market in 2025, because of the large traffic volumes and complicated operational needs. Many international passengers and cargo are processed in these airports and need sophisticated operation systems. They are enhanced by investments in runway capacity, expansion of terminals, and automation. They are also the first to embrace AI-powered airport management systems. Huge hubs have access to strong financial resources, which facilitate investments in next-generation technologies. Their strategic significance is increasing as the world gets more connected.

The medium & small airports segment is expected to expand rapidly in the market in the coming years, due to regional connectivity policies and decentralization of air travel. Governments are also investing in developing regional airports to ease congestion at the major airports. There is a rapid adoption of scalable and cloud-based operational solutions at these airports. Traffic is being boosted by growth in domestic tourism and regional business travel. Low-cost automation is enhancing the efficiency of operations in small facilities.

Regional Insights

How Big is the North America Airport Operation Market Size?

The North America airport operation market size is estimated at USD 2.45 billion in 2025 and is projected to reach approximately USD 18.13 billion by 2035, with a 22.16% CAGR from 2026 to 2035.

Why North America Dominated the Airport Operation Market?

North America dominated the market by holding a share of approximately 38% in 2025, driven by the strong demand for air travel and extensive investments in infrastructure modernization. Regulatory frameworks in this region further support the growth of smart airports, ensuring safety and efficiency in operations. As a region, North America is poised to leverage innovative solutions, such as AI and automation, to maintain its competitive edge in the global airport operations landscape. The region witnesses the highest amount of passenger flow rates traveling to and from North American countries.

What is the Size of the U.S. Airport Operation Market?

The U.S. airport operation market size is calculated at USD 1.84 billion in 2025 and is expected to reach nearly USD 13.69 billion in 2035, accelerating at a strong CAGR of 22.22% between 2026 and 2035.

Country Level Analysis

The U.S., as the largest aviation market in the region, boasts a vast network of airports that continuously undergo upgrades to enhance efficiency and passenger experience. Canada and Mexico are also expanding their airport capacities to accommodate rising air traffic, with a focus on integrating advanced technologies and sustainable practices.In 2024, approximately 72.4 million tourists visited the U.S., representing an increase of 9% from 2023.

- In October 2025, about 549,000 overseas residents travelled to Canada, of whom 81.5% travelled by air. Mexico witnessed approximately 38.4 million international tourists from January 2025 to October 2025, an increase of 5.8% compared to 2024.

How is Asia-Pacific Growing in the Airport Operation Market?

Asia-Pacific is expected to host the fastest-growing market in the coming years, propelled by booming air travel and blistering growth of aviation infrastructure. The growth of low-cost carriers, the middle-class population, and improved connectivity through air travel boost the pace of modernization in airports. The governments of the region are investing in new airports, terminal developments, and smart airport technologies. The market development of the region is also growing with the push to digitalization and automation.

Country Level Analysis

China is on top of the region in terms of massive airport construction projects and the modern use of smart airport systems in large hubs. The Indian airport's privatization and schemes to connect all regions are becoming a high-growth market, coupled with the modernization process of tier-2 and tier-3 airports. Japan and South Korea prioritize operational efficiency and passenger experience through highly advanced automation and biometric solutions.

Emerging markets in Southeast Asia, such as Indonesia, Vietnam, and Thailand, are undergoing a boom in the upgrade of their airports so as to benefit the growth of tourism. Australia is still working on its airport development and airside optimization to accommodate the increasing global and domestic traffic.China is home to over 552 airports, India has a total of 487 airports, and there are 98 airports in Japan. The rising demand for air travel and the increasing population potentiate the need for more number of operational airports.

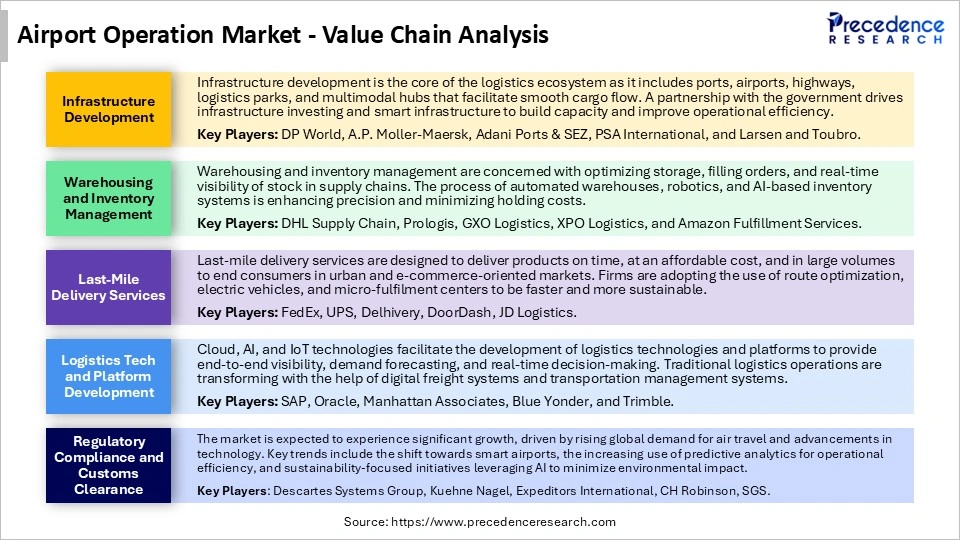

Airport Operation Market Value Chain Analysis

Who are the Major Players in the Global Airport Operation Market?

The major players in the airport operation market include SITA, Amadeus IT Group, Honeywell International Inc., Siemens AG, Thales Group, Collins Aerospace (RTX), TAV Airports Holding, Vanderlande Industries, Menzies Aviation, Fraport AG, S.A.S. Services Group, IBM Corporation, Cisco Systems, Inc., Daifuku Co., Ltd., ADB SAFEGATE

Recent Developments

- In January 2026, Atlanta's Hartsfield-Jackson International Airport announced an investment of $3 million in new equipment to enhance passenger movement during winter storms, following past disruptions. The airport is acquiring specialized snow and ice removal machinery to ensure runways and taxiways remain clear, minimizing delays and improving overall efficiency.

- In January 2026, the Irish Air Corps started operations with its newly acquired Dassault Aviation Falcon 6X, delivering enhanced capability in airlift, medical evacuation, and government transport. The French-built aircraft aimed to support Irish citizens and defense forces personnel across the globe with high speed, safety, and flexibility.(Source: https://www.flightglobal.com)

- In December 2025, Riyadh Air launched the world's first AI-native airline in collaboration with IBM Consulting to transform guest and employee experiences and set a benchmark for the aviation industry. IBM Consulting served as the orchestrator and brought together 59 workstreams and 60 partners, including Adobe, Apple, FLYR, and Microsoft. (Source: https://newsroom.ibm.com)

Segments Covered in the Report

By Operation Type

- Airside Operations

- Landside Operations

- Financial & Information Management

By Service/Platform

- Baggage Handling & Screening

- Passenger Processing

- Smart Technologies

By Airport Size

- Large International Hubs

- Medium & Small Airports

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting