What is the Smart Airports Market Size?

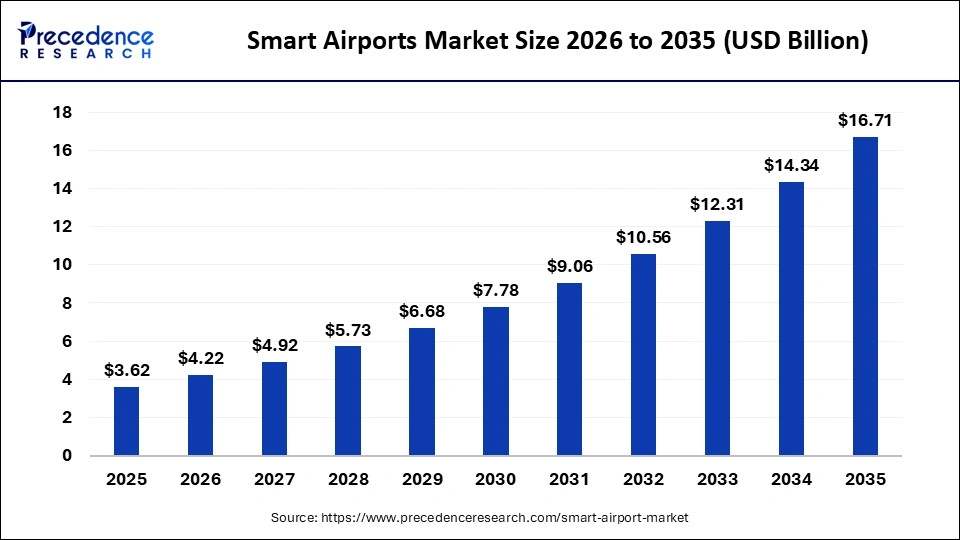

The global smart airports market size accounted for USD 3.62 billion in 2025 and is predicted to increase from USD 4.22 billion in 2026 to approximately USD 16.71 billion by 2035, expanding at a CAGR of 16.53% from 2026 to 2035. The market is driven by the rising need for automated, efficient, and technology-enabled airport operations to enhance passenger experience, security, and operational performance.

Market Highlights

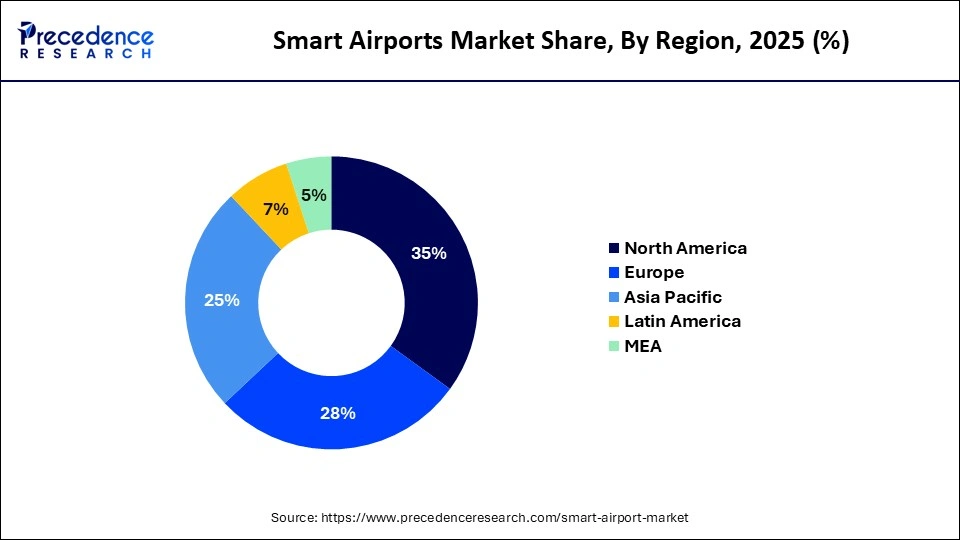

- North America dominated the market, holding the largest market share of 35% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By solution/offering type, the passenger processing & self-service segment held the major market share of 28% in 2025.

- By solution/offering type, the airport operations platforms segment is growing at the highest CAGR between 2026 and 2035.

- By application/use case, the passenger flow & processing segment contributed the biggest market share of 30% in 2025.

- By application/use case, the airport operations / predictive maintenance & analytics segment is expanding at the fastest CAGR between 2026 and 2035.

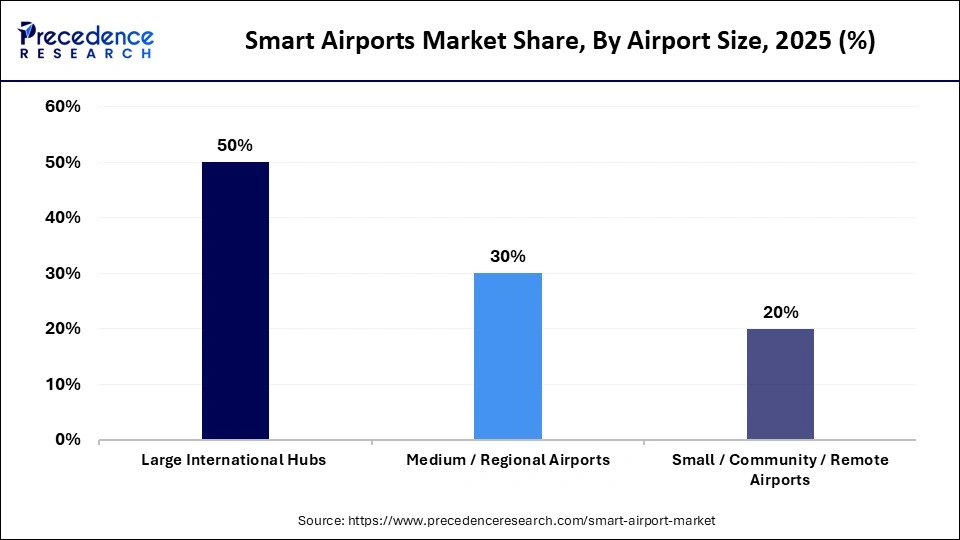

- By airport size, the large international hubs segment captured the highest market share of 50% in 2024.

- By airport size, the small / community / remote airports segment is poised to grow at a significant CAGR between 2026 and 2035.

What is Smart Airports Market?

The smart airports market covers hardware, software, and services that digitize and automate airport operations to improve passenger experience, safety, throughput, and cost-efficiency. Solutions include IoT sensors and connectivity, passenger-and-baggage self-service and tracking systems, biometric identity and access control, AI/analytics for operational decisioning (flight/stand/queue/turnaround), automated baggage handling and robotics, energy/building management, predictive maintenance for airport assets, and integrated airport-operation platforms that tie airline, ground-handling, and air-traffic functions together. The market spans system integrators, airport IT/platform vendors, security and surveillance suppliers, and specialist automation companies that deliver both on-premise and cloud-native offerings to airports, ground handlers, and air navigation service providers.

The market is expanding due to multiple converging factors, including the increasing demand for smooth passenger travel and higher airport security levels. Growing traffic at large hubs is leading airports to adopt automated passenger flows, predictive maintenance tools, and AI-based operational decision-making to reduce turnaround times. Rising focus on security and compliance with rules and regulations is increasing the adoption of biometric identity control and advanced surveillance solutions. Additionally, the use of cloud-native airport platforms and digital twins is enabling scalable real-time operations management.

How is the Emergence of AI Transforming the Smart Airports Market?

AI is revolutionizing the smart airports market by enhancing efficiency, accuracy, and safety across all airport operations. Through biometric identification, automated check-ins, and intelligent queue management, AI improves passenger handling and predicts congestion, while in airside operations, AI optimizes aircraft scheduling, turnaround times, and weather impact predictions. AI-driven technologies like computer vision and machine learning enhance surveillance, baggage tracking, and runway monitoring, while predictive maintenance reduces downtime and costs for critical airport assets such as baggage conveyors and airfield lighting.

Smart Airports Market Outlook

The smart airports market is growing rapidly due to the growth in passenger traffic and the desire to pursue contactless and efficient operation, which are boosting the adoption of smart airport systems. There is a growing presence of AI analytics and IoT-enabled solutions to streamline airport operations, which contributes to market growth.

The market is expanding worldwide, driven by increasing demand for seamless, contactless passenger experiences, enhanced security, and operational efficiency through IoT, AI, and automation technologies. Emerging regions, particularly in Asia-Pacific, the Middle East, and Africa, present significant opportunities as investments in airport infrastructure, digital transformation, and air travel volume rise, creating a need for advanced technologies to improve airport operations and passenger services.

Major investors in the market include technology giants like Cisco, IBM, Siemens, and Honeywell, along with large infrastructure firms and airport authorities. These investors contribute by providing advanced IoT solutions, AI-driven systems, and automation technologies that enhance airport operations, improve security, streamline passenger experiences, and support the digital transformation of airport infrastructure worldwide.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.62 Billion |

| Market Size in 2026 | USD 4.22 Billion |

| Market Size by 2035 | USD 16.71 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 16.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Solution/Offering Type, Application/Use Case, Airport Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Smart Airports Market Segment Insights

Solution/Offering Type Insights

The passenger processing & self-service segment led the market with a 28% share in 2025, as airports increasingly focus on faster, contactless, and automated passenger handling. Biometric identity verification, e-gates, self-boarding, and mobile check-in provided significant opportunities to reduce dependence on manual processes and boost terminal traffic. Growing passenger numbers prompted airports to adopt automated bag-drop systems, online identification platforms, and queueing systems to reduce congestion and improve efficiency. Increased demand for seamless travel experiences, enhanced security checks, and unobstructed movement within terminals further bolstered segmental growth.

The airport operations platforms segment is expected to grow at the fastest rate over the projection period, as airports increasingly require centralized, data-driven systems to manage complex airside and landside operations. Combining AODB, AOC, gate/stand allocation, resource management, and AI-based turnaround optimization, these platforms provide real-time situational awareness and support critical operational decisions. With rising pressures to improve on-time aircraft operations and reduce delays, airports are adopting integrated digital platforms that facilitate seamless communication between airlines, ground handlers, and air traffic controllers.

The security & surveillance segment is expected to grow at a notable rate in the upcoming period, driven by rising global security threats, stringent regulations, and demand for advanced safety systems. Airports are adopting next-generation CT scanners, automated screening lanes, AI-powered CCTV, and real-time threat detection systems to enhance security at both perimeters and terminals. The growing number of passengers leads airports to adopt screening and biometric access control solutions to maintain high safety standards without compromising efficiency.

Application/Use Case Insights

The passenger flow & processing segment led the market with a 30% share in 2025, driven by the growing demand for faster, smarter passenger processing. Airports are focusing on self-service check-ins, biometric identity verification, online boarding, and real-time queue management to handle increasing traveler volumes and reduce waiting times. Touchless processing and AI-driven e-gates have become key for improving efficiency and passenger experience, while investments in workflow automation, crowd analytics, and passenger management systems help streamline throughput and minimize bottlenecks.

The airport operations / predictive maintenance & analytics segment is expected to expand at the highest CAGR over the forecast period due to the rising demand for AI-driven operational intelligence. The integration of predictive analytics, digital twins, and IoT-based monitoring has improved resource allocation, turnaround time management, and equipment failure prediction. Real-time dashboards have enhanced coordination between airside and landside operations, optimizing gate distribution, baggage routing, and incident response. As operational reliability and efficiency become key to cost reduction, AI-based maintenance and decision-support systems are increasingly being developed to improve airport performance further.

Airport Size Insights

The large international hubs segment dominated the smart airports market with a 50% share in 2025 due to their high passenger traffic, complex operations, and greater need for advanced technologies to manage these demands efficiently. These airports have the financial resources and infrastructure to implement cutting-edge solutions, such as AI-driven security systems, automated check-ins, biometric screening, and predictive maintenance platforms, thereby enhancing operational efficiency, improving the passenger experience, and streamlining coordination among stakeholders. Their central role in global air travel, coupled with growing demands for better security, faster processing, and operational resilience, has made them early adopters and leaders in smart airport technologies.

The small/community/remote airports segment is expected to grow at the fastest CAGR during the projection period as they gradually embrace scalable, affordable smart airport technologies. These airports are adopting smart solutions like automated check-ins, biometric identification, and IoT-based systems to streamline operations, reduce labor costs, and maintain high security and service standards despite limited staff and infrastructure. Additionally, as air travel becomes more accessible in remote areas, these airports are modernizing to meet growing passenger demand while ensuring smooth and efficient operations.

The medium / regional airports segment is expected to grow at a significant rate in the coming years due to increasing passenger traffic, ongoing infrastructure developments, and the need to enhance service quality. These airports are adopting technologies such as self-service check-ins, queue analytics, integrated operations systems, and predictive maintenance to reduce congestion and streamline operations. Their crucial role in facilitating national and regional connectivity has attracted steady investments from both aviation authorities and private stakeholders, supporting their transformation into more efficient, technology-driven hubs.

Smart Airports Market Regional Insights

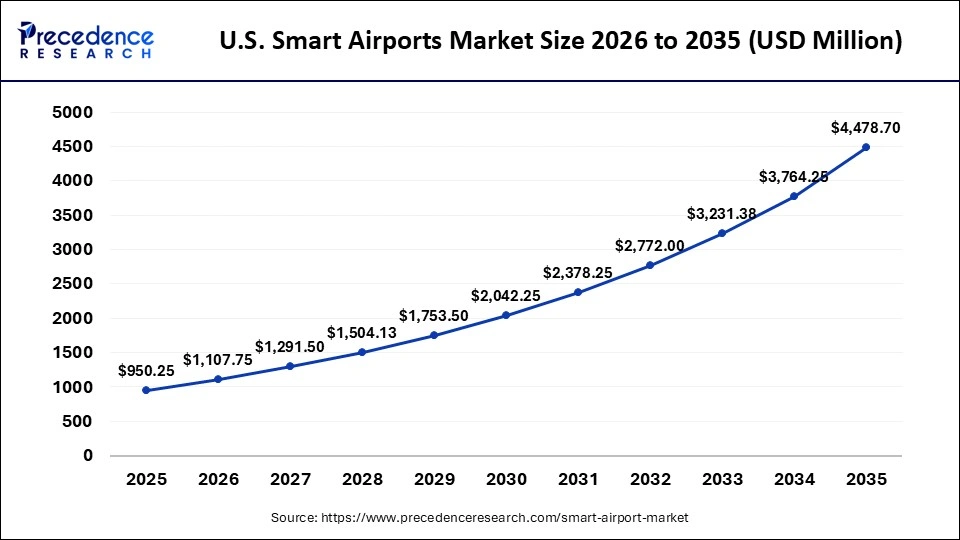

The North America smart airports market size is estimated at USD 1.27 billion in 2025 and is projected to reach approximately USD 5.93 billion by 2035, with a 16.66% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Smart Airports Market in 2025?

In 2025, North America dominated the smart airports market with a 35% share due to its advanced aviation sector, extensive adoption of technology, and large network of international airports. The region benefits from high passenger traffic, robust regulatory frameworks, and significant investments in modernizing airport infrastructure. U.S. and Canadian airports are leveraging biometrics, AI-driven analytics, smart security, and automated passenger processing to enhance operational efficiency and reduce congestion. Additionally, the presence of leading international suppliers and strong government support for next-generation airport facilities has driven the region's market leadership.

The U.S. smart airports market size is calculated at USD 950.25 million in 2025 and is expected to reach nearly USD 4,478.70 million in 2035, accelerating at a strong CAGR of 16.77% between 2026 and 2035.

U.S. Smart Airports Market Analysis

The U.S. is a major contributor to the Market in North America. The country boasts world's busiest airports like Hartsfield-Jackson Atlanta International and Dallas-Fort Worth International. They consistently rank among the world's busiest travel hubs. The need to manage heavy passenger volumes efficiently has led to the adoption of advanced technologies, including automated screening, real-time resource monitoring, and smart queue management. Additionally, the Transportation Security Administration (TSA) is accelerating market growth by promoting infrastructure modernization and the implementation of advanced security and identity technologies at key airports.

The Asia Pacific smart airports market size is expected to be worth USD 4,261.05 million by 2035, increasing from USD 905.00 million by 2025, growing at a CAGR of 16.76% from 2026 to 2035.

Why is Asia Pacific Considered the Fastest-Growing Region in the Smart Airports Market?

Asia Pacific is projected to grow at the fastest CAGR during the forecast period, driven by rapid urbanization, increasing disposable income, and significant growth in air passenger traffic, particularly in China, India, Japan, and Southeast Asia. The region's adoption of smart technologies such as biometrics, automated resource planning, AI-based maintenance, and energy-efficient infrastructure is streamlining operations and alleviating bottlenecks, making airport functions more efficient. With heavy government investments in new mega-airports and modernization projects, Asia Pacific is emerging as the next hub for innovation and growth in aviation technology.

India Smart Airports Market Trends

The market in India is expanding, driven by the surge in both domestic and international passenger traffic and the government's aggressive digitalization initiatives. Airport management is integrating advanced technologies to streamline passenger flow, enhance security, and reduce congestion across terminals. A key success is the Digi Yatra program, which uses facial recognition for seamless, paperless access to checkpoints, security gates, and boarding areas, eliminating repeated identity checks. Additionally, the system integrates with self-bag drop and automated check-in, significantly boosting operational efficiency.

The Europe smart airports market size has grown strongly in recent years. It will grow from USD 1.01 billion in 2025 to USD 4.76 billion in 2035, expanding at a compound annual growth rate (CAGR) of 16.77% between 2026 and 2035.

What Makes Europe a Notably Growing Area in the Smart Airports Market?

Europe is experiencing notable growth in the market, driven by a widespread airport modernization initiative and rising air traffic in key countries. Many European airports are replacing outdated infrastructure with advanced biometric systems, automated baggage management, AI-powered operations, and efficient management systems. The emphasis on green technology has prompted airports to adopt eco-friendly, energy-efficient solutions, aligning with sustainability goals. As aviation regulations become stricter, passenger expectations rise, and digital transformation accelerates, European airports are quickly deploying integrated smart solutions to reduce delays, optimize capacity management, and enhance the overall traveler experience.

UK Smart Airports Market Trends

The UK is one of the leading adopters of smart airport technologies, which is supported by the presence of several major high-traffic airports like Heathrow Airport that are under constant pressure to improve their performance. Airports in the country are implementing AI, automation, and predictive analytics to manage the growing number of passengers and limited resources more efficiently. A significant event took place in April 2024 when the Manchester Airports Group (MAG) switched to the Veovo platform, an AI-based system that uses real-time and historical data to plan operations more effectively. The platform helps improve aircraft turnaround times, optimize gate assignments, provide accurate off-block forecasts, and enhance revenue performance.

Top Companies in the Smart Airports Market & Their Offerings

- SITA

- Amadeus IT Group

- Thales Group

- Siemens AG

- Honeywell International

- IBM Corporation

- Cisco Systems

- Collins Aerospace (RTX Corporation)

- ADB SAFEGATE

- Vanderlande Industries

- Indra Sistemas

- NEC Corporation

- Leidos

- L3Harris Technologies

- Daifuku Co., Ltd.

- BEUMER Group

- RESA Systems

- Damarel Systems

- TK Elevator

- Huawei Technologies

Recent Developments

- In May 2025, Mumbai Airport opened its new next-generation Airport Operations Control Centre, which is set to improve real-time decision-making and operational coordination. This Aviio-powered digital platform enables faster response times, better cooperation among stakeholders, and a much-improved passenger experience.(Source: https://www.internationalairportreview.com)

- In March 2024, Amadeus announced its acquisition of Voxel, a leading provider of B2B payment and electronic invoicing solutions for the travel industry. The acquisition simplifies payment processes among airlines, hotels, and travel sellers, enhancing digitalization and operational efficiency in air travel worldwide.(Source: https://amadeus.com)

- In November 2023, Honolulu Airport announced its plan to implement SITA Smart Path to enable biometric U.S. exit processes. The solution offers a touchless, secure, and faster departure experience for international passengers, improving operational efficiency and passenger convenience.(Source: https://amadeus.com)

Smart Airports MarketSegments Covered in the Report

By Solution/Offering Type

- Passenger processing & self-service (kiosks, biometrics, e-gates)

- Security & surveillance (screening, CCTV, threat detection)

- Airport operations platforms (AODB, AOC, resource/turnaround mgmt, AI/analytics)

- Baggage handling & tracking (automated sorting, RFID)

By Application/Use Case

- Passenger flow & processing (check-in, security, boarding

- Security screening & surveillance

- Ground handling & turnaround optimization

- Baggage automation & tracking

- Airport operations/predictive maintenance & analytics

- Retail, concessions & advertising

By Airport Size

- Large international hubs (major metros)

- Medium/regional airports

- Small/community/remote airports

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content