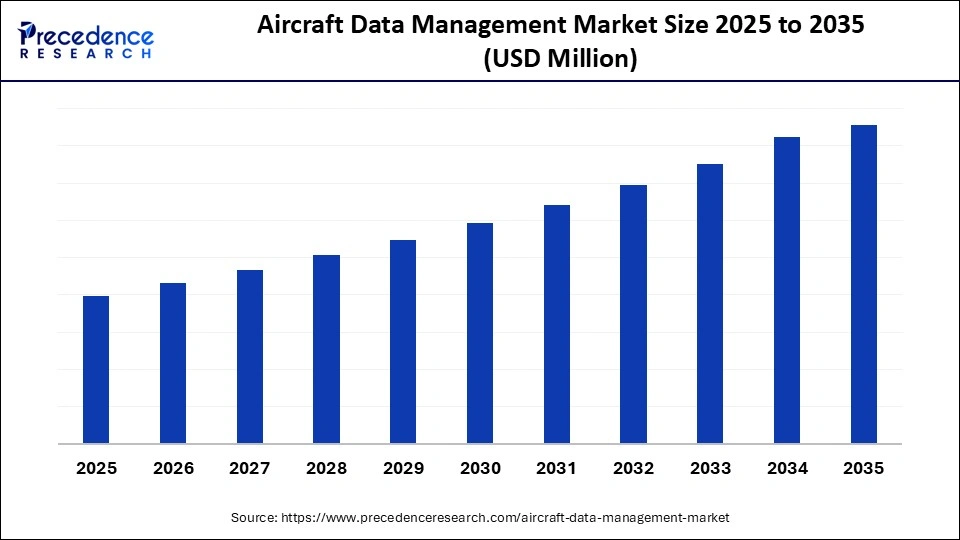

What is Aircraft Data Management Market Size?

The global aircraft data management market is evolving with cloud-based platforms and AI technologies that streamline aircraft performance and compliance reporting. This market is growing due to rising adoption of connected aircraft technologies, increasing air traffic, and the need for real-time data analytics to improve operational efficiency, safety, and predictive maintenance.

Market Highlights

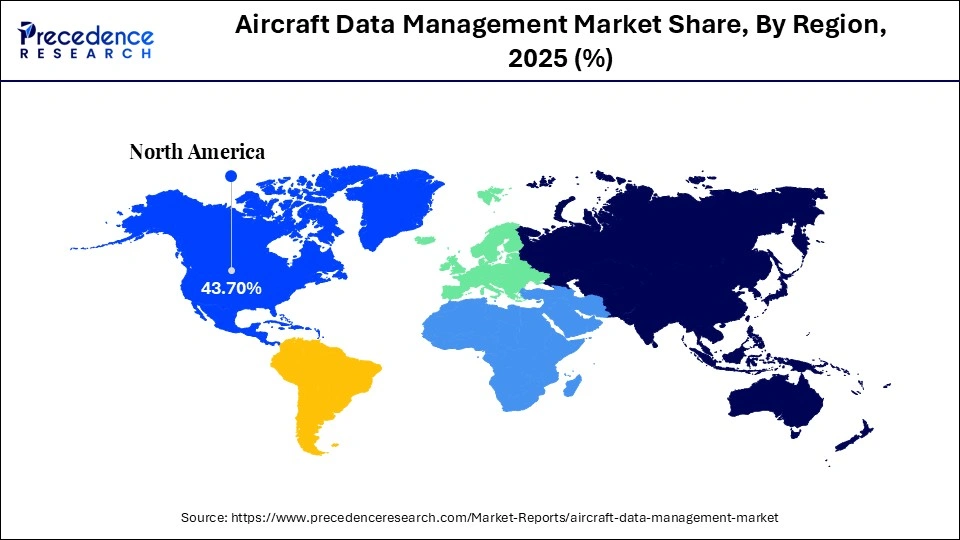

- North America dominated the aircraft data management market with 43.7% of the market share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 8.5% between 2026 and 2035.

- By component, the software segment contributed the highest market share of 62.3% in 2025.

- By component, the services segment is growing at a strong CAGR of 7.4% between 2026 and 2035.

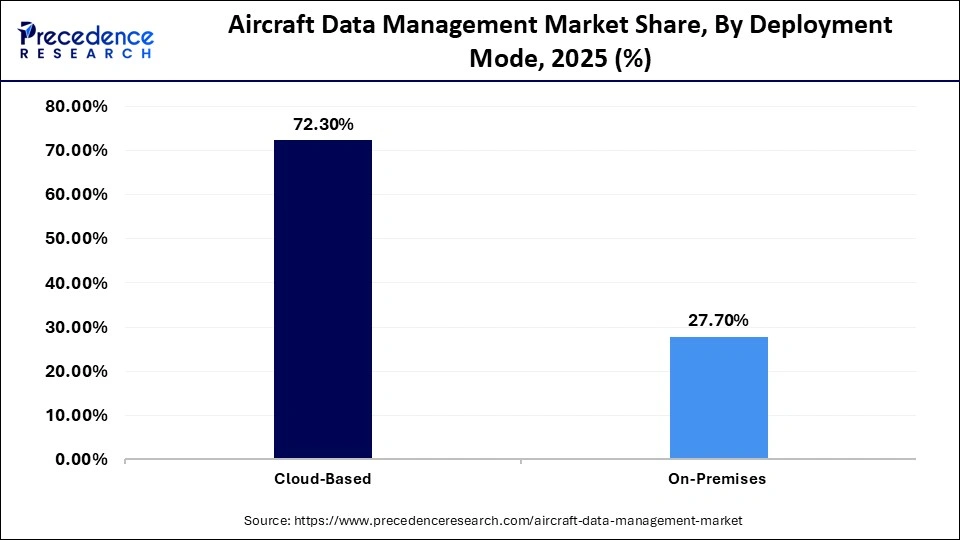

- By deployment mode, the cloud-based segment held a major market share of 72.3% in 2025.

- By deployment mode, the on-premises segment is expected to expand at a notable CAGR of 7.6% from 2026 to 2035.

- By application, the flight operations & analytics segment captured the highest market share of 38.6% in 2025.

- By application, the predictive maintenance segment is poised to grow at a healthy CAGR of 7.4% between 2026 and 2035.

- By end-user, the airlines segment generated the biggest market share of 43.7% in 2025.

- By end-user, the airports/MROs segment is expanding at the fastest CAGR of 7.5% between 2026 and 2035.

Why Is Aircraft Data Management Gaining Rapid Momentum?

The aircraft data management market is witnessing rapid growth, emphasizing gathering, storing, combining, and evaluating data produced by aircraft operations and systems. Through real-time insights, it is essential to improve flight safety, operational effectiveness, and maintenance planning. Demand is rising due to the aviation industry's digitalization and the use of connected and intelligent aircraft. To cut expenses and boost performance, airlines and MRO providers are depending more on data-driven decision-making.

Airlines are standardizing data architectures to consolidate information from flight operations, maintenance logs, and crew reports into unified analytics platforms. Advanced algorithms correlate aircraft usage patterns with environmental and operational conditions such as hot-and-high airports, short-haul cycles, and harsh weather exposure. This enables more accurate life-cycle tracking of critical components like engines, landing gear, and avionics line-replaceable units. Aircraft lessors are also using managed data platforms to assess asset health and residual value across fleets. Together, these use cases are turning aircraft data into a strategic asset that directly influences safety, cost control, and fleet planning decisions.

How Are Airlines Investing in Aircraft Data Management?

- Airlines are investing in cloud-based data platforms to centralize flight, maintenance, and operational data for faster access and analysis.

- Growing adoption of AI- and machine learning–based analytics helps airlines predict component failures and reduce unplanned maintenance events.

- Airlines are deploying real-time aircraft health monitoring systems to track performance and detect anomalies during flight operations.

- Increased spending on predictive maintenance tools enables airlines to shift from reactive to condition-based maintenance strategies.

- Airlines are investing in digital twin technologies to simulate aircraft performance and optimize maintenance and operational planning.

- Strategic partnerships with OEMs, MROs, and technology providers are expanding airlines' access to advanced data analytics capabilities.

- Airlines are using aircraft data platforms to optimize fuel consumption and reduce emissions, supporting sustainability and regulatory goals.

- Investment in cybersecurity and data governance solutions is rising to protect sensitive flight and operational data.

Market Trends

- Industry Growth Overview: The market is growing due to rising aircraft deliveries, digital transformation in aviation, and increasing use of data analytics for operational efficiency and maintenance optimization. New-generation aircraft generate continuous data from avionics, engines, and health monitoring systems, increasing the need for structured data ingestion and analysis. Airlines are deploying aircraft data platforms to transition from time-based to condition-based maintenance models. This shift is reducing unscheduled groundings, maintenance delays, and aircraft-on-ground events.

- Sustainability Trends: Aircraft data management helps reduce fuel consumption and emissions through route optimization, performance monitoring, and predictive maintenance. Detailed analysis of fuel burn, engine efficiency, and flight profiles allows airlines to adjust climb, cruise, and descent parameters. Data-driven maintenance prevents efficiency losses caused by component degradation such as engine fouling or sensor drift. These measures directly support airline carbon reduction targets and regulatory reporting requirements.

- Startup Ecosystem: Startups are introducing AI and cloud-based platforms for real-time aircraft monitoring, predictive analytics, and cost-efficient fleet management. These platforms aggregate data from ACARS, flight data recorders, and onboard sensors into unified dashboards. Machine learning models detect anomaly patterns linked to component wear, operational misuse, or environmental stress. Startups are also enabling faster deployment through software-as-a-service models that reduce upfront infrastructure costs for airlines and MRO providers.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Technology, Application, End User, Configuration, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Opportunities in the Aircraft Data Management Market

|

Opportunity area |

What is driving |

Market impact |

|

AI-based predictive maintenance |

Need to reduce aircraft downtime and maintenance costs |

Improves fleet availability and lowers unexpected repair expenses |

|

Digital twin technology |

Demand for real-time aircraft performance simulation |

Enables proactive fault detection and lifecycle optimization |

|

Cloud-based data platforms |

Shift toward scalable and centralized data management |

Enhances data accessibility, integration, and cost efficiency |

|

Fuel & emissions optimization |

Stricter environmental regulations and sustainability goals |

Supports fuel savings and carbon footprint reduction |

|

Connected aircraft ecosystems |

Rising adoption of IoT and real-time data exchange |

Enables seamless collaboration between airlines, OEMs, and mros |

|

Real-time flight analytics |

Focus on safety, efficiency, and operational visibility |

Improves decision-making and flight performance monitoring |

What Will Drive Future Demand in the Aircraft Data Management Market?

|

Future demand area |

Why will increase |

Market outlook |

|

Connected & smart aircraft |

Growing adoption of digitally enabled aircraft systems |

Drives continuous demand for advanced data management platforms |

|

Ai-driven analytics |

Airlines seeking smarter decision-making and cost efficiency |

Accelerates operational optimization and safety improvements |

|

Predictive maintenance solutions |

Need to minimize unscheduled maintenance and downtime |

Enhances aircraft reliability and reduces lifecycle costs |

|

Cloud-based data infrastructure |

Shift toward scalable and secure data storage solutions |

Enables faster development and global data accessibility |

|

Fuel efficiency & emissions monitoring |

Rising sustainability and regulatory requirements |

Supports long-term environmental and cost benefits |

|

Real-time flight & operations data |

Demand for enhanced situational awareness |

Improves safety, punctuality, and passenger experience |

Segmental insights

Component Insights

What Made the Software Segment Dominate the Aircraft Data Management Market in 2025?

The software segment dominates the aircraft data management market with 62.3% market share, driven by extensive use of integrated data processing solutions, flight data monitoring systems, and advanced analytics platforms. To analyze a massive amount of real-time aircraft data, enhance operational visibility, and facilitate data-driven decision-making across flight operations and maintenance tasks, airlines and operators are depending more on software. These platforms ingest data from avionics buses, engine health monitoring systems, and flight data recorders into centralized dashboards. Advanced analytics support functions such as anomaly detection, fuel efficiency tracking, and predictive fault identification. Software-based solutions also enable seamless integration with airline operations control centers and MRO planning systems, improving response times and coordination.

The services segment is growing rapidly, with 7.4% CAGR bolstered by the growing need for system deployment, data integration, cloud migration, and continuing technical assistance. Airlines and MROs are increasingly outsourcing data management services to ensure smooth operations and regulatory compliance as aircraft data ecosystems grow more complex. Service providers support secure data architecture design, compliance with aviation safety regulations, and continuous platform optimization. Managed services also help airlines handle software updates, cybersecurity risks, and interoperability across multiple aircraft types. This reliance on external expertise is reducing internal IT burden while improving scalability and system reliability.

Deployment Mode Insights

Why Did the Cloud-Based Segment Dominate the Aircraft Data Management Market in 2025?

The cloud-based segment dominates the market with 72.3% market share because of its affordability, real-time accessibility, and scalability. Cloud platforms are the preferred option for contemporary aviation data management because they facilitate centralized data storage, quicker analytics, and smooth cooperation between airlines, OEMs, and MROs. These platforms support continuous data ingestion from connected aircraft through satellite and air-to-ground links. Cloud-native analytics enable rapid processing of large datasets for fuel optimization, fault detection, and fleet performance benchmarking. In addition, role-based access and shared data environments improve coordination across distributed operational teams.

The on-premises segment is growing rapidly with 7.6% CAGR, motivated by the need for improved data security control over sensitive flight and operational data and regulatory compliance. To comply with stringent data governance regulations, legacy airlines and defense operators are still using on-premises solutions. On-premises deployments allow full control over data residency, cybersecurity policies, and system access. These solutions are often integrated with legacy IT and maintenance systems that are not cloud-compatible. Defense and government aviation operators also prefer on-premises architectures to meet national security and classified data handling requirements.

Application Insights

What Made the Flight Operations & Analytics Segment Dominate the Aircraft Data Management Market in 2025?

The flight operations and analytics segment dominates the aircraft data management market with 38.6% market share, backed by its increasing demand for operational effectiveness, fuel optimization, and real-time flight monitoring. Airlines can increase overall operational reliability, safety performance, and punctuality with data-driven flight analytics. These solutions analyze parameters such as flight trajectories, weather conditions, aircraft weight, and fuel burn in real time. Insights are used to optimize climb, cruise, and descent profiles while improving on-time performance. Integration with operations control centers enables faster response to disruptions and safety events.

The predictive maintenance segment is growing rapidly, with 7.4% CAGR, motivated by a growing emphasis on lowering aircraft downtime and unplanned maintenance. Early fault detection, which reduces maintenance costs and increases fleet availability, is made possible by advanced data analytics and AI-based monitoring. Predictive models monitor engine vibrations, temperature trends, and system fault codes to identify degradation patterns. Maintenance teams can schedule interventions before failures occur, reducing aircraft-on-ground events. This approach improves spare parts planning and extends component service life across fleets.

End User Insights

What Made Airlines Segment Dominate the Aircraft Data Management Market in 2025?

The airlines segment dominates the aircraft data management market with 43.7% market share as they increasingly invest in digital platforms to manage fleet performance, optimize routes, and enhance passenger experience. Large commercial fleets generate massive volumes of data, making airlines the primary adopters of data management solutions. Airlines analyze flight data to monitor fuel efficiency, engine health, and operational deviations across different aircraft types. Integrated data platforms support dynamic route planning, delay mitigation, and crew scheduling decisions. These systems also feed performance insights into customer-facing applications, improving punctuality and service consistency.

The airports and MROs segment is growing rapidly in the aircraft data management market, with 7.5% CAGR supported by rising aircraft maintenance activities and digital transformation initiatives. These stakeholders use aircraft data to improve turnaround times, maintenance efficiency, and infrastructure planning. Real-time aircraft health data allows MROs to preposition tools, spare parts, and technicians before aircraft arrival. Airports use operational data to optimize gate allocation, ground handling workflows, and resource utilization. Data-driven coordination between airlines, airports, and MROs is reducing delays and improving overall operational throughput.

Regional Insights

What Made North America Dominate the Aircraft Data Management Market in 2025?

The North America region dominates the aircraft data management market with 43.7% market share, propelled by early adoption of digital and connected aircraft technologies, the presence of large airline operators, and highly developed aviation infrastructure. Strong investment in cloud computing, artificial intelligence, and aviation analytics is reinforcing regional leadership.

Airlines in the United States and Canada are deploying enterprise-wide data platforms to integrate flight operations, maintenance, and fleet performance analytics. High penetration of next-generation aircraft equipped with advanced avionics is increasing real-time data availability. Close collaboration between airlines, OEMs, and MRO providers supports rapid implementation of predictive maintenance and fuel optimization programs. Regulatory emphasis on safety reporting and performance monitoring is accelerating structured data adoption. Presence of major cloud and analytics providers is further enabling scalable and secure data management solutions across the region.

U.S. Aircraft Data Management Market Trends

The U.S. plays a leading role in the aircraft data management market, propelled by a sizable fleet of commercial aircraft, the presence of significant airlines, and cutting-edge aviation infrastructure. Widespread adoption of data-driven solutions is facilitated by early adoption of cloud computing, AI-based analytics, and connected aircraft technologies. Market leadership is further strengthened by ongoing investments in safety systems, predictive maintenance, and digital aviation.

Why Is Asia Pacific the Fastest-Growing Region in the Aircraft Data Management Market in 2025?

Asia Pacific is the fastest growing, with 8.5% CAGR, driven by the swift increase in airline passenger numbers, expanding airline fleets, and rising investments in smart aviation technologies. The regional market is expanding more quickly due to the growing use of data-driven solutions by new airlines and airports.

Airlines across China, India, and Japan are adopting aircraft data platforms to support rapid fleet scaling and operational standardization. Newly built airports and greenfield aviation hubs are integrating digital data systems from the design stage to improve airside efficiency and asset utilization. Increased deployment of narrow-body aircraft for regional routes is generating high-frequency operational data that requires centralized management. Government-backed aviation modernization programs are encouraging adoption of cloud-based analytics and predictive maintenance tools. Together, these factors are accelerating structured aircraft data management adoption across Asia Pacific.

India Aircraft Data Management Market Trends

India's aircraft data management market is expanding rapidly because domestic airlines are aggressively expanding their fleets, and air passenger traffic is growing quickly. Aircraft data analytics platform adoption is accelerating due to growing emphasis on fuel optimization, digital transformation, and operational efficiency. The development of smart airports and government support for aviation infrastructure both accelerate market expansion.

Why Is Latin America Emerging in the Market for Aircraft Data Management?

Latin America is growing consistently, backed by a slow recovery in air travel and a growing emphasis on operational efficiency by regional airlines. Carriers are lowering operating costs and optimizing fleet utilization through the use of cloud-based platforms and data analytics. Increased spending on digital maintenance tools and fleet modernization is bolstering data-driven decision-making. Market adoption is accelerated by expanding alliances between airlines and technology companies.

Airlines in Brazil and Mexico are deploying aircraft data systems to monitor fuel burn, dispatch reliability, and maintenance intervals across mixed fleets. Cloud-hosted analytics are enabling faster rollout without heavy upfront IT investment. Predictive maintenance adoption is reducing aircraft-on-ground events and improving schedule reliability. Partnerships with global MRO providers are improving access to advanced diagnostics and benchmarking. These developments are steadily increasing penetration of aircraft data management platforms across the region.

Brazil Aircraft Data Management Market Trends

Brazil is leading the market because major airlines are present, and there is a vast domestic aviation network. Aircraft data management system demand is being driven by rising investments in digital aviation solutions and fleet modernization. The need for data generation and analytics is rising as low-cost carriers expand. Digital transformation in aviation is also being aided by government-led airport modernization initiatives.

Why Is Europe Considered a Mature Market Region for Aircraft Data Management Implementation?

Europe represents a mature market with a strong emphasis on regulatory compliance, flight safety, and sustainability. Airlines and airports across the region are adopting advanced data management solutions to support emissions monitoring and fuel efficiency. Compliance with frameworks such as the European Union Emissions Trading System requires precise tracking of fuel burn and flight performance data. Operators use integrated platforms to automate safety reporting and meet oversight requirements set by the European Union Aviation Safety Agency.

High fleet standardization across European carriers enables faster rollout of analytics across operations and maintenance. Airports leverage data to optimize ground handling and reduce turnaround emissions. Long-standing collaboration between airlines, OEMs, and MROs supports continuous optimization and stable platform maturity across the region.

Germany Aircraft Data Management Market Trends

Germany stands out as a leading European country in the aircraft data management market, fueled by its adoption of smart aviation technologies and solid foundations in aerospace engineering. The nations emphasize that Industry 4.0 facilitates the application of advanced data analytics. Innovation in data platforms is strengthened when top aerospace manufacturers are present. Adoption of AI-driven aviation analytics is boosted by increased R&D investments.

Who are the Major Players in the Global Aircraft Data Management Market?

The major players in the aircraft data management market include Honeywell International Inc., RTX Corporation (Collins Aerospace), Thales Group, GE Aerospace, Lufthansa Technik, IBM Corporation, SAP SE, Oracle Corporation, Viasat Inc., Gogo Inc., and Ramco Systems

Recent Developments

- In January 2025, Flydocs announced A five-year partnership with Avianca to digitize aircraft records and enhance data-driven asset management across the airline's fleet. (Source:Https://flydocs.Aero)

- In April 2025, Trax and Rolls-Royce launched an integrated digital interface connecting Trax Emro with Rolls-Royce's blue data thread platform to improve engine health monitoring and predictive maintenance.(Source:Https://www.Aarcorp.Com)

- In August 2025, Collins Aerospace launched FlightAware foresight predictive analytics technology for JetBlue to enhance real-time operational visibility and airline performance management. (Source:Https://www.Rtx.Com)

- In December 2025, Embraer announced the development of an AI-powered aircraft data analytics solution in collaboration with Aquarela Analytics to improve operational efficiency and data-driven decision-making. (Source:https://www.Asdnews.Com)

- In November 2025, Informatica announced A partnership with Emirates Flight Catering to deploy AI-driven cloud data management solutions for improved operational transparency and sustainability. (Source:Https://www.Businesswire.Com)

Segments Covered in the Report

By Component

- Software

- Services

- Hardware

By Deployment Mode

- Cloud-Based

- On-Premises

By Application

- Flight Operations & Analytics

- Fleet Management

- Predictive Maintenance

- Safety & Compliance

- Revenue Management

- Others

By End-User

- Airlines

- Airports

- Mros (Maintenance, Repair & Overhaul)

- Oems

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting