What is the Airline Fraud Detection Market Size?

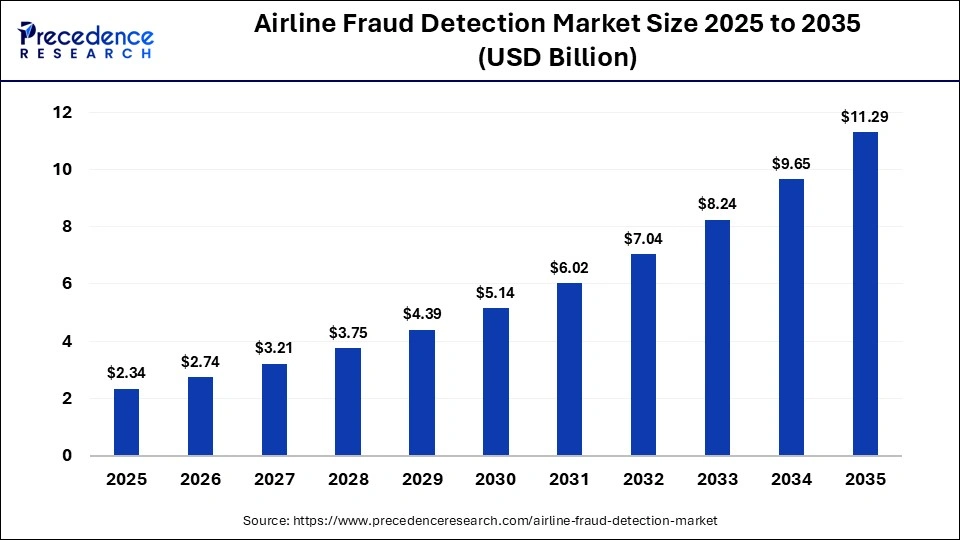

The global airline fraud detection market size was calculated at USD 2.34 billion in 2025 and is predicted to increase from USD 2.74 billion in 2026 to approximately USD 11.29 billion by 2035, expanding at a CAGR of 17.04% from 2026 to 2035. The global airline fraud detection market is witnessing substantial growth due to increasing payment fraud and regulatory demands, pushing rapid adoption of AI, ML, and biometrics for real-time risk management and seamless passenger experiences.

Market Highlights

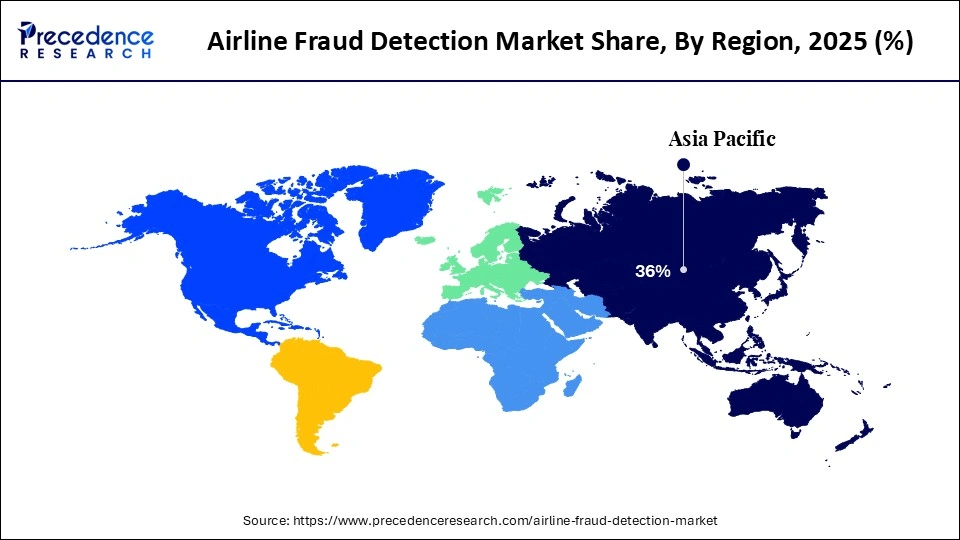

- North America dominated the market with a major market share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR in the market between 2026 and 2035.

- By component, the software segment accounted for the largest revenue share in the airline fraud detection market in 2025.

- By component, the services segment is poised to grow at a solid CAGR between 2026 and 2035.

- By deployment mode, the on-premises segment generated the biggest market share in 2025.

- By deployment mode, the cloud segment is expected to expand at a notable CAGR between 2026 and 2035.

- By application, the payment fraud detection segment captured the highest market share in 2025.

- By application, the ticketing fraud detection segment is growing at a healthy CAGR between 2026 and 2035.

- By end-user, the airlines segment contributed the highest market share in 2025.

- By end-user, the travel agencies segment is expected to expand rapidly in the market between 2026 and 2035.

What is the Airline Fraud Detection Market?

The market refers to solutions and services designed to safeguard airlines from various forms of fraud that rely on deception to achieve illicit gain. It involves the use of specialized systems and technologies, such as artificial intelligence (AI) and machine learning (ML), to identify and prevent fraudulent activities targeting the aviation industry. The systems analyze vast amounts of data, including flight, passenger, cardholder, payment, and auxiliary data, to detect suspicious patterns and anomalies indicative of fraudulent behavior with a focus on mitigating significant financial losses.

How is AI Transforming the Airline Fraud Detection Market?

Artificial intelligence (AI) is transforming the market by using ML and predictive analytics to analyze vast data in real time, spotting anomalies faster and more accurately than traditional methods, tracking deviations, and identifying novel fraud schemes. AI algorithms analyze booking patterns, payment data, and user behavior to flag suspicious transactions instantly, preventing fraud before it occurs. AI learns from historical fraud data to predict and prevent future attempts, improving accuracy over time. AI systems process massive datasets from various sources to build comprehensive risk profiles.

Major Trends in the Airline Fraud Detection Market

- Moving Beyond Rule-Based Systems: AI and ML algorithms learn from vast historical data and identify subtle, non-linear patterns, enabling authorities to predict fraudulent transactions with high accuracy.

- Shift towards Real-Time Processing: The demand for immediate transaction approval, especially in online and mobile booking channels, necessitates real-time fraud monitoring, enabling immediate responses to emerging threats and reducing the window of opportunity for fraud to succeed.

- Leveraging Big Data and Behavioral Analytics: This profile-based approach helps establish historical connections for each transaction, which is crucial for identifying anomalies and distinguishing legitimate users from fraudsters.

- Addressing New Fraud Types: AI and ML are essential for combating evolving threats such as sophisticated account takeovers, loyalty program fraud, and the use of synthetic identities or generative AI in scams.

- Balancing Security and Customer Experience: A key goal of implementing advanced technology is to minimize false positives. AI-driven systems provide frictionless security, adjusting the level of scrutiny to ensure a smooth experience for trusted customers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.34 Billion |

| Market Size in 2026 | USD 2.74 Billion |

| Market Size by 2035 | USD 11.29 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 17.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment Mode, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

How Did the Software Segment Dominate the Airline Fraud Detection Market?

The software segment dominated the global market in 2025, primarily due to its essential role in deploying advanced automated technologies that effectively combat increasingly sophisticated and high-volume digital fraud. Airlines can implement and customize fraud detection software to meet their specific operational needs and business rules, giving them greater control over their fraud screening processes to fine-tune their rules and policies to address their unique risks. Software-based platforms offer high scalability and efficiency to process large transaction volumes and adapt to digital operations.

The services segment is expected to experience the fastest growth in the market, due to the increasing demand for expert support in the successful implementation, customization, and management of complex fraud prevention systems. By relying on managed service providers, clients can focus on their core operations while these providers manage the complexities of fraud prevention infrastructure. Service providers also help organizations maintain compliance with various stringent data protection and security regulations, allowing them to effectively understand and mitigate fraud risks.

Deployment Mode Insights

What Made the On-Premises Segment Lead the Airline Fraud Detection Market?

The on-premises segment led the market in 2025, primarily due to the strict requirements for data security, governance, and regulatory compliance within the aviation industry. Many large and established airlines operate complex legacy IT systems, and on-premises deployments often facilitate smoother and more customized integration with this existing core infrastructure compared to cloud-based alternatives. Additionally, on-premises solutions offer higher levels of customization to meet specific operational requirements and performance needs for real-time transaction processing, crucial for fraud detection.

The cloud segment is expected to witness the fastest growth during the forecast period, primarily due to its unmatched scalability for big data, cost-efficiency, rapid deployment, and easier integration of advanced AI and ML technologies to adapt to evolving fraud tactics. Cloud platforms readily integrate cutting-edge AI for behavioral analytics and predictive modeling, outpacing legacy systems when it comes to countering sophisticated fraud. This enables real-time analysis of flight, passenger, and transaction data, which is essential for proactive fraud prevention while maintaining private cloud control.

Application Insights

Which Application Segment Dominated the Airline Fraud Detection Market?

The payment fraud detection segment held the largest revenue share of the market in 2025, as the vast majority of airline transactions are electronic payments, which are highly susceptible to fraud, particularly chargebacks. The rapid issuance of airline tickets and service utilization necessitate real-time fraud detection systems that can identify and prevent fraudulent transactions before services are utilized to recover losses. The development of advanced fraud detection systems using AI, ML, and behavioral analytics focuses on securing payment transactions and analyzing high-volume transaction data in real time.

The ticketing fraud detection segment is expected to grow with the highest CAGR in the market, primarily driven by the high volume and value of online ticket transactions and the rapid adoption of advanced AI and ML solutions to combat these threats. Fraudsters constantly adapt their tactics, shifting from simple stolen credit card usage to complex schemes like loyalty program fraud and ticket scams. The dynamic nature of these threats requires evolving and adaptive detection technologies, emphasizing real-time monitoring to promptly identify and void suspicious tickets.

End-User Insights

How the Airlines Segment Led the Airline Fraud Detection Market?

The airlines segment led the market in 2025, largely because airlines are the primary victims of significant financial losses from fraudulent activities, such as stolen credit card transactions, chargeback abuse, and loyalty program fraud. The shift toward direct online and mobile bookings means airlines must take on greater responsibility for fraud management. Furthermore, airlines must invest in fraud prevention solutions to safeguard their loyalty programs from account takeovers and mileage fraud to prevent substantial losses, making them prime targets for fraud.

The travel agencies segment is expected to grow at the fastest CAGR because online travel agencies handle vast amounts of diverse customer data, making them attractive targets for fraudsters. The convenience of online booking also exposes OTAs to various types of fraud, including fake bookings, stolen payment information, loyalty program abuse, and account takeovers. Travel agencies are rapidly adopting AI-driven tools to personalize customer experiences and are crucial for real-time fraud detection, enabling them to score transactions and identify suspicious patterns.

Regional Insights

How Big is the North America Airline Fraud Detection Market Size?

The North America airline fraud detection market size is estimated at USD 842.40 million in 2025 and is projected to reach approximately USD 4,120.85 million by 2035, with a 17.21% CAGR from 2026 to 2035.

How Did North America Dominate the Airline Fraud Detection Market?

North America dominated the market in 2025, due to advanced technological infrastructure, the high volume of digital transactions, a strict regulatory environment, and the presence of major technology players, creating significant demand for sophisticated fraud prevention solutions. The region is home to major companies and innovators in the fraud detection space, such as IBM Corp., Microsoft, Oracle, FICO, and ACI Worldwide, fostering innovation in the development of sophisticated solutions. It is also forced to prioritize and invest heavily in robust fraud prevention measures to combat evolving fraud tactics.

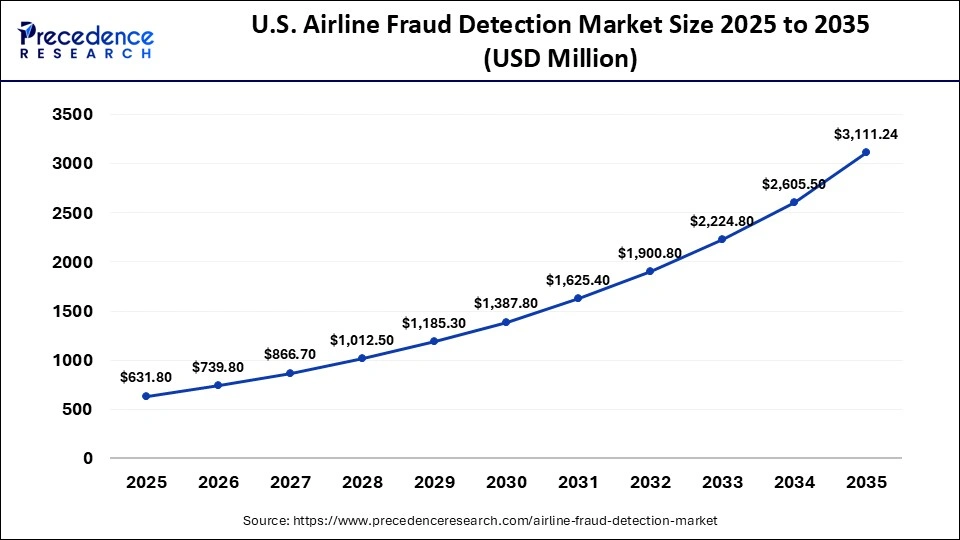

What is the Size of the U.S. Airline Fraud Detection Market?

The U.S. airline fraud detection market size is calculated at USD 631.80 million in 2025 and is expected to reach nearly USD 3,111.24 million in 2035, accelerating at a strong CAGR of 17.28% between 2026 and 2035.

The U.S. Airline Fraud Detection Market Trends

The U.S. plays a primary role within the region, driven by a high volume of digital payments and significant e-commerce activities. Strict U.S. regulations, issued by the Transportation Security Administration on cybersecurity and identity management, compel organizations to invest heavily in robust FDP systems to ensure compliance. U.S.-based technology providers are prominent, with companies like Accertify serving a majority of leading airlines and developing platforms to detect fraud patterns.

Will Asia Pacific Grow in the Airline Fraud Detection Market?

Asia Pacific is expected to witness the fastest growth during the forecast period, due to rapid digitization, a booming e-commerce and mobile payment sector, increasing sophistication of cybercrime and financial fraud, and evolving regulatory compliance requirements. Countries like India, China, Indonesia, and Vietnam are mobile-first economies that have spurred the growth of e-wallets and instant payment systems, requiring robust fraud prevention measures. Governments across the region are implementing stricter data protection laws and cybersecurity mandates to adopt advanced fraud detection systems.

India Airline Fraud Detection Market Trends

India is an emerging player in the region, mainly characterized by its position as a global IT and BPO powerhouse and its rapidly expanding domestic aviation market. Indian firms are developing innovative solutions, such as hybrid models that blend technology platforms with human expertise to manage fraud end-to-end, covering everything from online sales to loyalty program fraud and chargeback disputes, while encouraging the adoption of forensic technology to deal with financial crimes.

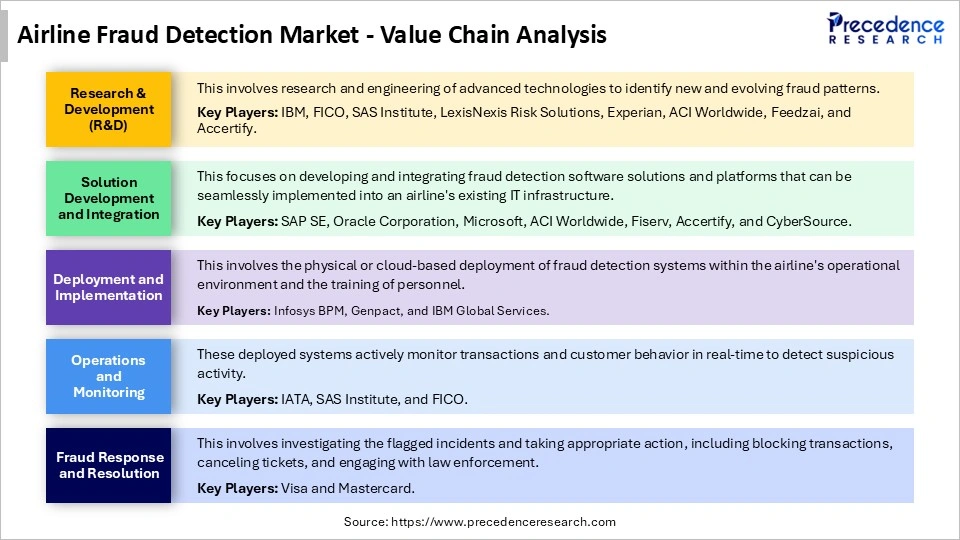

Airline Fraud Detection Market Value Chain Analysis

Who are the Major Players in the Global Airline Fraud Detection Market?

The major players in the airline fraud detection market include Accertify, SAS Institute, Sift, LexisNexis Risk Solutions, Kount An Equifax company, Feedzai, ACI Worldwide, Cybersource, Amadeus, and Forter.

Recent Developments

- In December 2025, Etraveli Group announced a partnership with Sabre Corporation to integrate its travel-specific fraud prevention solution, PRECISION, into Sabre Direct Pay. This collaboration aims to enhance fraud prevention in the travel industry, leveraging Etraveli's 25 years of expertise for better security in airline and agency operations.

- In October 2025, WNS worked with a major European airline to enhance its baggage claims operations with AI-powered automation, enabling faster resolutions and improving fraud detection accuracy to over 85%. The solution processes 100% of claims in real-time.

- In October 2024, Worldline announced a collaboration with Visa Acceptance Solutions to launch an optimized fraud management solution. The collaboration was made to leverage the extensive transactional data and expertise of both companies to offer fraud detection services across various industries.

Segments Covered in the Report

By Component

- Software

- Services

By Deployment Mode

- On-Premises

- Cloud

By Application

- Payment Fraud Detection

- Ticketing Fraud Detection

- Loyalty Program Fraud

- Identity Fraud

- Others

By End-User

- Airlines

- Travel Agencies

- Airports

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting