What is Combat Aircraft Swarm Radars Market Size?

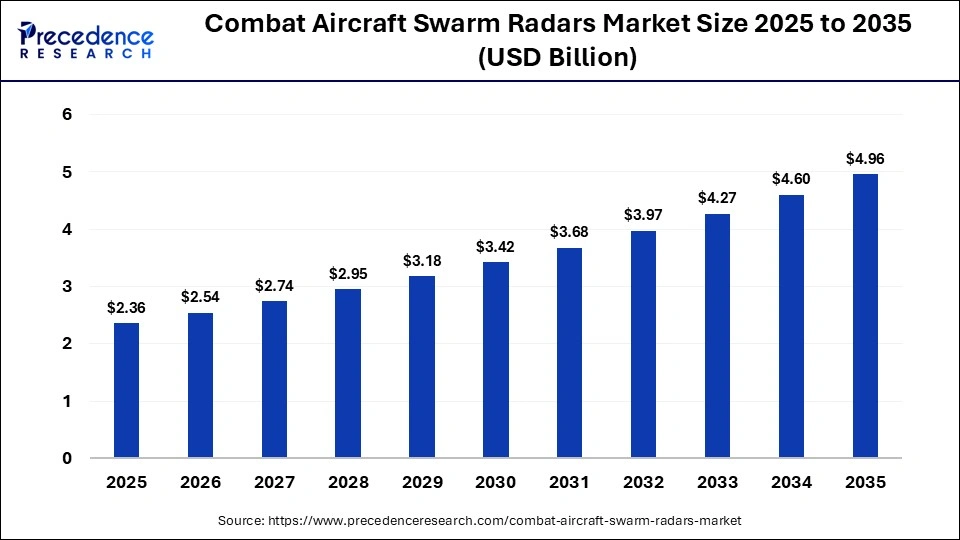

The global combat aircraft swarm radars market size was calculated at USD 2.36 billion in 2025 and is predicted to increase from USD 2.54 billion in 2026 to approximately USD 4.96 billion by 2035, expanding at a CAGR of 7.70% from 2026 to 2035. The market is driven by rising defense modernization, growing threats from drone swarms, and the adoption of advanced radar and sensor technologies for enhanced aerial surveillance and combat efficiency.

Market Highlights

- North America accounted for the largest market share in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By radar type, the AESA segment held a dominant share of the market in 2025.

- By radar type, the PESA segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

- By application, the swarm detection & counter-UAS segment accounted for a considerable revenue share in the market in 2025.

- By application, the air-to-air target tracking segment is expected to grow at the highest CAGR in the market during the studied years.

Market Overview

The combat aircraft swarm radars market encompasses advanced radar systems designed to detect, track, and neutralize large numbers of manned or unmanned aerial targets, including drone swarms, in complex combat scenarios. These radars provide high-resolution imaging, rapid data processing, and networked situational awareness, enabling militaries to improve threat detection, response times, and operational efficiency.

The market is expanding due to increasing demand for advanced defense systems capable of detecting, tracking, and neutralizing large numbers of unmanned and manned aerial threats. The rise of drone swarms and highly maneuverable aircraft has driven the development of intelligent, high-precision radar systems that outperform traditional technologies. Market expansion is further supported by defense modernization programs, rising military budgets, network-centric warfare strategies, and advancements in multi-role aircraft and electronic warfare radars with high-resolution and rapid data processing capabilities.

Combat Aircraft Swarm Radars Market Trends

- The combination of AI and machine learning is increasing target recognition, threat prioritization, adaptive beamforming, and autonomous decision-making, allowing swarm radars to operate with minimal human intervention in complex combat scenarios.

- Networked and distributed radar systems enable real-time sensor data sharing among multiple aircraft, improving detection range, tracking, redundancy, and resilience against electronic warfare threats.

- Miniaturized AESA radar modules support lightweight, low-power swarm radar systems for fighter jets and UCAVs without affecting aircraft performance or payload capacity.

- Advanced anti-jamming, frequency-agile, and stealth-detection capabilities are being developed to ensure stable operation in contested electromagnetic environments.

- Rising defense budgets in Asia-Pacific and the Middle East are driving investments in next-generation combat aircraft and swarm radar technologies, creating new opportunities for radar vendors and system integrators.

- There is a strong emphasis on improving radar resilience against electronic countermeasures and ensuring stable operation in electronic warfare-heavy scenarios.

How is AI Influencing the Combat Aircraft Swarm Radars Market?

Artificial Intelligenceis significantly transforming the market for combat aircraft swarm radars by enabling autonomous, coordinated, and intelligent operations across multiple platforms. Through AI-driven sensor fusion, data from multiple aircraft can be combined to create a comprehensive battlefield picture, enhancing situational awareness and accelerating decision-making. Predictive analytics allow early threat detection and optimal distribution of tasks and radar resources, while AI-enabled electronic counter-countermeasures modulate radar waveforms to resist jamming and deception. Additionally, reinforcement learning models optimize swarm behavior, flight coordination, and radar coverage, reducing operator workload and maximizing mission efficiency. Overall, AI is making swarm radars more adaptive, resilient, and effective in complex combat environments.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.36 Billion |

| Market Size in 2026 | USD 2.54 Billion |

| Market Size by 2035 | USD 4.96 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.70% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Radar Type,Application, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Radar Type Insights

Why Did the AESA Segment Lead the Combat Aircraft Swarm Radars Market?

The AESA segment led the market while holding a major share in 2025, as AESA radars have become more popular in the current combat environment because they offer high-resolution detection, fast beam steering, and multiple air targets at the same time. Such abilities make AESA radars very useful in the counteraction of advanced threats such as drone swarms, high-speed aircraft, and advanced electronic warfare conditions. They have high reliability, low possibility of interception, and can be integrated with other highly developed avionics and defense systems, which also enhances their market position. The militaries around the globe are emphasizing developing situational awareness, flexibility in operations, and automated threat evaluation, which are all made possible by AESA radars.

The PESA segment is expected to grow at the fastest CAGR in the market between 2026 and 2035, primarily due to its cost-effectiveness, simplicity, and adaptability. PESA radars are cheaper than AESA systems while still providing reliable detection and tracking of diverse aircraft targets, making them attractive for countries and programs with budget constraints. Their relatively uncomplicated design allows for easy maintenance, retrofitting, and deployment in tactical operations, which is especially valuable in markets with unstable defense spending. Additionally, the growing global defense programs in both developed and developing nations have accelerated the adoption of PESA radars in scenarios where high performance at a lower cost is essential, further strengthening their market leadership.

Application Insights

Why Did the Swarm Detection & Counter-UAS Segment Dominate the Market?

The swarm detection & counter-UAS segment dominated the combat aircraft swarm radars market with the largest share in 2025. This is mainly due to its ability to simultaneously detect, track, and assess multiple aerial threats, enabling rapid and automated countermeasures. The segment's prominence is driven by growing concerns over asymmetric warfare, border security challenges, and drone threats in both military and civilian contexts. Integration of electronic warfare capabilities and AI-based threat assessment enhances situational awareness, operational efficiency, and speed of response. As a result, swarm detection & counter-UAS have become a central focus of global defense modernization programs, underpinning the capabilities of next-generation fighter aircraft, unmanned combat systems, and layered air defense networks.

The air-to-air target tracking segment is expected to witness the fastest growth in the market over the forecast period. This growth is driven by the increasing need for precise monitoring of aerial threats in modern combat, where high-speed aircraft and complex maneuvers challenge conventional radar systems. By leveraging AI-enabled predictive algorithms and advanced signal processing, these radars achieve higher tracking accuracy and can prioritize and engage threats in real time. The segment is further supported by the modernization of fighter aircraft fleets, adoption of network-centric warfare strategies, and integration with long-range missile systems. Additionally, emerging markets and countries upgrading their air defense systems are seeking affordable, high-performance air-to-air tracking solutions, fueling further adoption.

Regional Insights

What Made North America the Leading Region in the Global Combat Aircraft Swarm Radars Market?

North America led the global combat aircraft swarm radars market by holding the largest share in 2025. This leadership is driven by high defense expenditures, early adoption of network-centric warfare doctrines, and ongoing modernization of air combat fleets. The region benefits from a strong defense technology base and major contractors specializing in AESA radars, AI-driven sensor fusion, and secure data-link solutions, which are critical for swarm operations. Additionally, the U.S. Department of Defense's emphasis on multi-domain operations and manned-unmanned teaming has accelerated the development and deployment of collaborative radar technologies. Continued investments in electronic warfare resilience, stealth detection, and autonomous mission systems have further reinforced the demand for high-capability swarm radars in North America.

U.S. Combat Aircraft Swarm Radars Market Analysis

The U.S. is a major player in the North American market, driven by large-scale procurement programs and long-term defense innovation strategies. The U.S. Air Force and Navy have prioritized distributed sensing, cooperative targeting, and real-time data exchange to maintain air superiority in contested environments, boosting the demand for AI-enabled radar processing, secure communication systems, and advanced electronic counter-countermeasures. Swarm coordination is further supported by domestic defense companies, leading the development of scalable AESA architectures and software-defined radar systems, ensuring advanced capabilities and adaptability for modern combat operations.

Why is Asia Pacific Considered the Fastest-Growing Region in the Combat Aircraft Swarm Radars Market?

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period, driven by ongoing military modernization and increasing security threats. Major countries, including China, India, Japan, and South Korea, are spending a lot on the next-generation fighter aircraft, unmanned combat aerial vehicles, and network-centric warfare capabilities. Governments around the region are prioritizing real-time monitoring, long-range capabilities, and electronic warfare resilience to strengthen air superiority. Additionally, the frequent combined military exercises and rising defense expenditures support the large-scale testing and deployment of cooperative radar technologies, accelerating their adoption and operational readiness.

China Combat Aircraft Swarm Radars Market Analysis

The market in China is expanding, as the country accelerates the modernization of its warfare capabilities. Key trends include the integration of AI for autonomous target detection, threat assessment, and coordinated mission execution across multiple aircraft platforms. To reduce reliance on foreign technologies, China is focusing on the domestic production of AESA radar modules and high-performance signal processors, strengthening its self-reliance in advanced radar systems.

How is the Opportunistic Rise of Europe in the Combat Aircraft Swarm Radars Market?

Europe is expected to grow at a significant CAGR in the foreseeable period as a result of increasing defense interoperability and modernization efforts. Programs such as Future Combat Air Systems and joint fighter upgrades are driving demand for networked radar technologies capable of supporting swarm operations. Rising geopolitical tensions and the need to strengthen air defense have prompted several European countries to increase defense budgets. The region also benefits from a strong aerospace and electronics industry, specializing in advanced radar systems, signal processing, and secure communication networks.

UK Combat Aircraft Swarm Radars Market Analysis

The market in the UK is growing due to a strong focus on next-generation air combat capabilities and active participation in multinational defense programs. A key trend is the integration of swarm-capable radar systems in future fighter designs, emphasizing cooperative sensing and shared battlespace awareness. The UK is investing in AI-enabled radar data processing to support faster decision-making and reduce pilot workload during complex missions. Additionally, the ongoing modernization of existing combat aircraft fleets continues to drive demand for advanced, interoperable swarm radar systems.

Who are the major players in the global combat aircraft swarm radars market?

The major players in the combat aircraft swarm radars market include Lockheed Martin Corporation, Northrop Grumman, Raytheon Technologies (RTX), BAE Systems, Thales Group.

Recent Developments

- Munich-based Hensoldt has inked a long-term framework agreement with Rheinmetall Air Defence to supply its Spexer 2000 compact ground-based radars for counter-UAS and Skyranger 30 air defense systems. The deal, running into the 2030s, could be worth high three-digit millions of euros.

- In November 2025, Indra and EDGE signed an MOU to increase the scope of PULSE NOVA in the development of advanced electronic warfare capabilities at the Dubai Airshow. This deal will consider combining radar and EW systems to add competitiveness to the emerging markets.

- In March 2025, Saab and ICEYE entered into an agreement called a Memorandum of Understanding to incorporate ICEYE space-based synthetic aperture radar data into Saab command and control systems to improve situational awareness and decision-making. Such a partnership will enhance long-range surveillance and multi-domain operation capacity for defense clients.

Segments Covered in the Report

By Radar Type

- AESA (Active Electronically Scanned Array)

- PESA (Passive Electronically Scanned Array)

- Hybrid AESA-PESA

- Phased Array with AI-Assisted Swarm Detection

- Others

By Application

- Swarm Detection & Counter-UAS

- Air-to-Air Target Tracking

- Terrain Following & Obstacle Avoidance

- Electronic Warfare Support

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting