Alternative Protein Market Size and Forecast 2025 to 2034

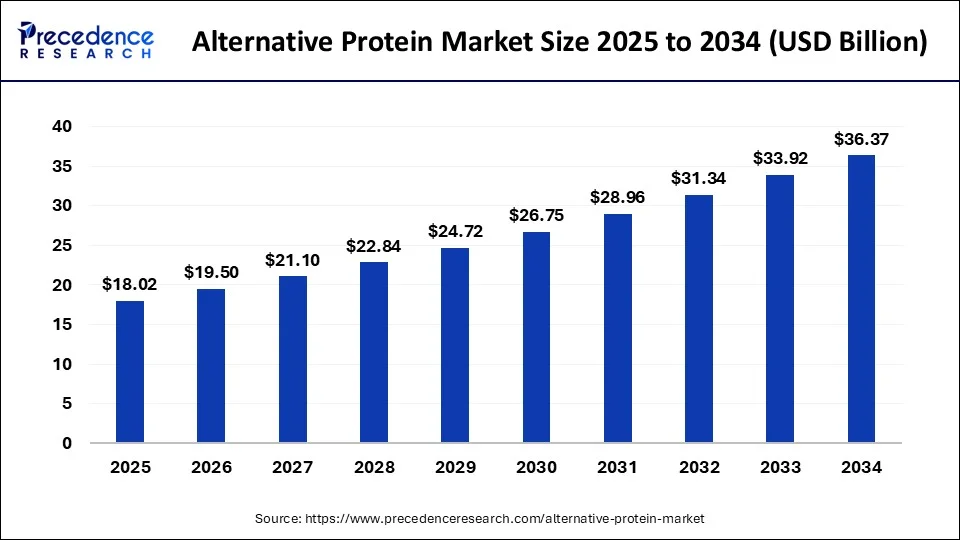

The global alternative protein market size was calculated at USD 16.65 billion in 2024 and is expected to reach around USD 36.37 billion by 2034, expanding at a CAGR of 8.23% from 2025 to 2034. Rising awareness about the benefits of plant-based protein can increase the alternative protein market.

Alternative Protein Market Key Takeaways

- In terms of revenue, the alternative protein market is valued at USD 18.02 billion in 2025.

- It is projected to reach USD 36.37 billion by 2034.

- The alternative protein market is expected to grow at a CAGR of 8.23% from 2025 to 2034.

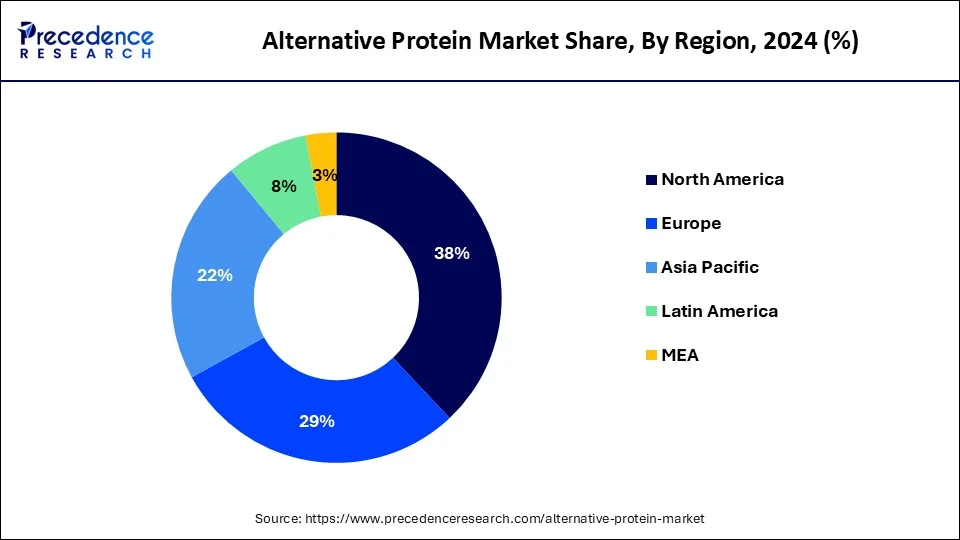

- North America dominated the alternative protein market with the largest revenue share of 38% in 2024.

- Asia Pacific is expected to grow at a highest CAGR of 9.23% during the forecast period.

- By product, the plant protein segment has contributed more than 90% of revenue share in 2024.

- By product, the insect protein segment is expected to grow at the highest CAGR in the market during the forecast period.

- By application, the food & beverages segment has held a major revenue share of 60% in 2024.

- By application, the animal feed segment is expected to grow at a notable CAGR of 8.03% during the forecast period.

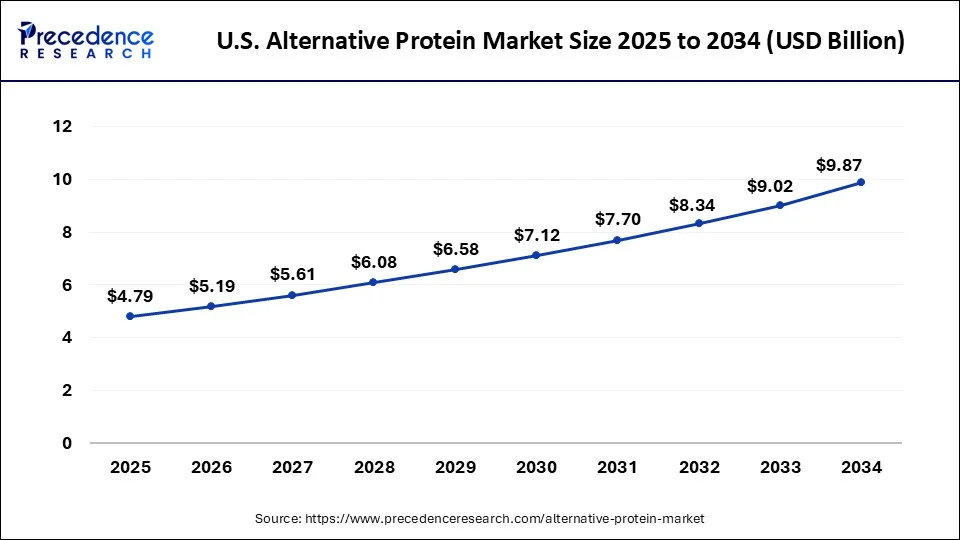

U.S. Alternative Protein Market Size and Growth 2025 to 2034

The U.S. alternative protein market size was exhibited at USD 4.43 billion in 2024 and is projected to be worth around USD 9.87 billion by 2034, poised to grow at a CAGR of 8.34% from 2025 to 2034.

North America dominated the alternative protein market in 2024. The demand for alternative protein products from consumers has increased significantly in North America because of trends including flexitarianism, veganism, vegetarianism, and health-conscious eating. As alternatives to conventional animal-based goods, consumers in this region are actively looking for plant-based, insect-based, and cell-based protein sources.

North America gains from a thriving market infrastructure that facilitates the manufacturing, distributing, and advertising of substitute protein goods. These include wide-ranging food service channels, strong retail networks, and internet platforms that serve a variety of customer demographics. In the field of alternative proteins, innovation and product development are concentrated in North America. In the region, a large number of start-ups, food firms, and research institutes are actively engaged in creating new protein sources and enhancing current goods.

Asia Pacific is expected to grow at the highest CAGR in the alternative protein market during the forecast period. There is a sizable and quickly expanding population in Asia Pacific, especially in metropolitan areas. The demand for alternate protein sources, greater consumer knowledge, and shifting dietary habits are all linked to urbanization. The growing middle-class size and increased discretionary income are the results of the economic expansion seen by several of the region's countries.

The dietary tastes in Asia Pacific are shifting in favor of healthier and more sustainable sources of protein as a result of these demographic changes. The growing worries about environmental sustainability and food security have led to a surge in interest in alternative proteins, which, when compared to traditional animal-based proteins, promise reduced environmental impact and effective resource utilization. Insect and plant-based protein eating are part of the cultural traditions of many Asia Pacific nations. The adoption of different protein sources in the community is facilitated by this cultural acceptability.

Market Overview

The alternative protein market refers to protein sources that are not obtained from conventional animal sources, such as cattle, chicken, pig, or fish, which are referred to as alternative proteins. Rather, they include a wide variety of protein-rich substitutes that may be obtained from algae, fungus, plants, insects, and even animal cells that have been cultivated or developed in a lab.

Many factors, including health advantages, environmental sustainability, ethical issues, and technical breakthroughs in food production, are contributing to the growing popularity of these proteins. Because they may lessen their environmental effect, fulfill a range of consumer dietary demands and tastes, and solve global food sustainability concerns, alternative proteins are becoming more and more popular as viable substitutes for traditional animal-based proteins.

Alternative Protein Market Growth Factors

- Rising consumer preference towards non-meat-based protein can boost the alternative protein market.

- The growing popularity of a vegan diet can boost the alternative protein market.

Technological Advancement

The technology provides a whole new way of making superior products that match animal protein in terms of flavor, texture, and nutritional value. Through casein or whey, there are non-animal processes for synthesizing protein with precision fermentation. Furthermore, these technologies are enhancing the organoleptic attributes and functional properties of plant-based proteins, making the replacement of meat, milk, and eggs increasingly competitive with traditional animal protein-based products. Through new technologies and advancements, production barriers will continue to be addressed, offering consumers healthier, more ethical, and environmentally friendly food options.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 36.37 Billion |

| Market Size in 2025 | USD 18.02 Billion |

| Market Size in 2024 | USD 16.65 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.13% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising adoption of plant-based protein

The rising adoption of plant-based protein can grow the alternative protein market. The health advantages of plant-based diets, such as lowered risks of diabetes, heart disease, and several malignancies, are becoming more well-known to consumers. The plant-based protein products are in high demand due to this shift in customer preferences.

Restraint

Possibility of side effects in allergic people

The possibilities of side effect in allergic people may slowdown the alternative protein market. The plant-based proteins are frequently produced from common allergens such as soy, almonds, and legumes. Customers may be discouraged from trying or consistently drinking these items due to their concern about allergic responses.

Opportunity

Innovation in food technology

The innovation in food technology may be the opportunity to boost the alternative protein market. Plant-based proteins that closely resemble the flavor, texture, and nutritional makeup of animal-based proteins may now be produced because of developments in food technology. This increases the attractiveness of these alternatives to a wider range of consumers, including non-vegans and vegetarians.

Product Insights

The plant protein segment dominated the alternative protein market in 2024. The growing consciousness among consumers regarding the potential health advantages of plant-based diets, such as lowered cholesterol, decreased heart disease risk, and improved weight control, has stimulated the market for plant-based proteins. Customers are looking for more sustainable options, such as plant-based proteins, as a result of growing worries about the negative environmental effects of animal agriculture, such as greenhouse gas emissions, deforestation, and water consumption.

Choosing plant-based proteins over those obtained from animals has become more popular among consumers due to ethical concerns regarding animal welfare. With a large range of products that imitate the flavor, texture, and appearance of animal-based proteins, the market for plant-based proteins has experienced substantial innovation. The products like plant-based sausages, burgers, dairy substitutes, and more fall under this category.

The insect protein segment is expected to grow at the highest CAGR in the alternative protein market during the forecast period. Because of their high protein content, vitamin, mineral, and essential fatty acid content, insects offer a nutrient-dense substitute for conventional animal-based proteins. Compared to conventional animal farming, insect farming uses less space, water, and feed, making it a more sustainable source of protein.

This is consistent with the growing emphasis on environmental sustainability among consumers & businesses. Compared to conventional cattle, insects may generate a substantial quantity of protein per unit of meal intake due to their high feed conversion efficiency. Because it produces less greenhouse gas emissions than traditional cattle farming, insect farming is becoming more and more popular as a sustainable source of protein. Since many cultures already include insects in their regular meals, the acceptance and adoption of insect-based protein products are facilitated in those areas.

Application Insights

The food & beverages segment dominated the alternative protein market in 2024. The alternative proteins are adaptable components that may be utilized to make a range of food and drink items. Examples of these include proteins derived from plants, insects, and cells. This covers plant-based dairy alternatives (like yogurt and plant-based milk), meat replacements (like burgers and sausages), baked products, snacks, and more. Concerns about the effects of food choices on health and the environmental impact of food production are growing among consumers.

When opposed to traditional animal-based proteins, alternative proteins frequently provide perceived health benefits (such as lower cholesterol and saturated fats) and environmental advantages (such as fewer greenhouse gas emissions and reduced water consumption). The wider range of consumers may now obtain alternative protein products as they become more generally available in stores, supermarkets, and online. Increased availability fuels demand and propels the food & beverages segment to the alternative protein market supremacy.

The animal feed segment is expected to grow at the highest CAGR in the alternative protein market during the forecast period. The need for animal feed high in protein rises in tandem with the worldwide demand for meat, dairy, and aquaculture products. Alternative proteins can be effective and sustainable sources of protein for the aquaculture and cattle sectors. Traditional animal feed sources like fish meal and soybean meal have issues with availability, cost, and sustainability.

These conventional feed components can be supplemented or replaced with alternative proteins, such as those derived from insects, microorganisms, or even plants. Comparing alternative proteins to traditional feed components, animal feed frequently has a lesser environmental impact. For instance, compared to animal farming or conventional feed crops, insect farming uses less land and water and produces less carbon emissions.

Alternative Protein Market Companies

- ADM

- Cargill Inc.

- Lightlife Foods, Inc.

- Impossible Foods Inc.

- International Flavors & Fragrances, Inc.

- Ingredion Inc.

- Kerry Group

- Glanbia plc

- Bunge Limited

- Axiom Foods Inc.

- Tate & Lyle PLC

- SunOpta Inc.

- Glanbia plc

- AGT Food and Ingredients

- Emsland Group

Recent Developments

- In February 2025, Rockwell Automation collaborated with E Tech to help the producers of alternative protein scale their business. With advanced automation, Rockwell enabled producers of commercial goods, who were previously just small-scale testers, to ensure quality, sustainability, and cost management in their operations.

- In January 2025, Cargill introduced innovation in the manufacturing of products by putting capital in 3D printing and also in mycoprotein fermentation technology. These improvements resolved the issues regarding the taste and texture, which contributed to Cargill's evolution in the constantly developing category of alternative proteins, according to R&D head Megan Swartz.

- In August 2024, Corbion acquired the bread improver business from Novotech Food Ingredients in India to extend its reach in the Asia Pacific market. This acquisition is expected to add to Corbion's range of functional solutions to meet local market needs and deepen collaboration with global customers located in India.

- In June 2024, the Bezos Centre for Sustainable Protein at Imperial was established with the goal of creating and implementing evidence-based and creative solutions via the development, production, and marketing of healthy, reasonably priced, and palatable alternative food items.

- In April 2024, Wamame Foods, a firm well-known for its plant-based product line Waygu, introduced Outlier Protein, a novel protein substitute. With just seven components, this product has a protein value that is 64% more than cooked ground beef, according to the manufacturer.

- In January 2024, The Robert Mondavi Center for Wine and Food Science at UC Davis hosted an Innovation Day to celebrate the introduction of iCAMP. To promote food innovation in alternative meat and protein sources, scientists, program directors, and partners will exchange research and collaborative efforts. According to Center Director David Block, there will be a 50% to 100% growth in the global demand for beef over the next 25 years. The production of meat is a significant contributor to global greenhouse gas emissions, which in turn affects climate change.

- Leading FMCG company Nestle India is expected to introduce plant-based protein products in the nation in November 2023. Suresh Narayanan, chairman and managing director of Nestle India, told Business Standard on the fringes of the Birla Institute of Management Technology's third annual Pritam Singh Memorial Conference that the business will launch these goods in the upcoming quarters.

Government Announcement

- In September 2024, the Indian government launched the Biotechnology for Economy, Environment, and Employment policy, where smart protein manufacturing is also highlighted as one of the main directions. New additions included eight more insects that were approved as fit for human consumption as protein sources.

Segment Covered in the Report

By Product

- Plant Proteins

- Cereals

- Wheat

- Wheat Protein Concentrates

- Wheat Protein Isolates

- Textured Wheat Protein

- Hydrolyzed Wheat Protein

- Hmec/Hmma Wheat Protein

- Rice

- Rice Protein Isolates

- Rice Protein Concentrates

- Hydrolyzed Rice Protein

- Others

- Oats

- Oat Protein Concentrates

- Oat Protein Isolates

- Hydrolyzed Oat Protein

- Others

- Wheat

- Cereals

- Legumes

- Soy

- Soy Protein Concentrates

- Soy Protein Isolates

- Textured Soy Protein

- Hydrolyzed Soy Protein

- Hmec/Hmma Soy Protein

- Pea

- Pea Protein Concentrates

- Pea Protein Isolates

- Textured Pea Protein

- Hydrolyzed Pea Protein

- Hmec/Hmma Pea Protein

- Lupine

- Chickpea

- Others

- Soy

- Roots

- Potato

- Potato Protein Concentrate

- Potato Protein Isolate

- Maca

- Others

- Potato

- Ancient Grains

- Ancient Wheat

- Quinoa

- Sorghum

- Amaranth

- Chia

- Millet

- Others

- Nuts & Seeds

- Canola

- Canola Protein Isolates

- Hydrolyzed Canola Protein

- Others

- Almond

- Flaxseeds

- Others

- Canola

- Microbe-Based Protein

- Algae

- Bacteria

- Yeast

- Fungi

- Insect Protein

- Coleoptera

- Lepidoptera

- Hymenoptera

- Orthoptera

- Hemiptera

- Diptera

- Others

By Application

- Food & Beverages

- Bakery & Confectionary

- Beverages

- Breakfast Cereals

- Dairy Alternatives (Cheese, Desserts, Snacks, Others)

- Dietary Supplements/Weight Management

- Meat Alternatives & Extenders

- Snacks

- Sports Nutrition

- Others

- Infant Formulations

- Clinical Nutrition

- Animal Feed

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content