Architectural Coatings Market Size and Forecast 2025 to 2034

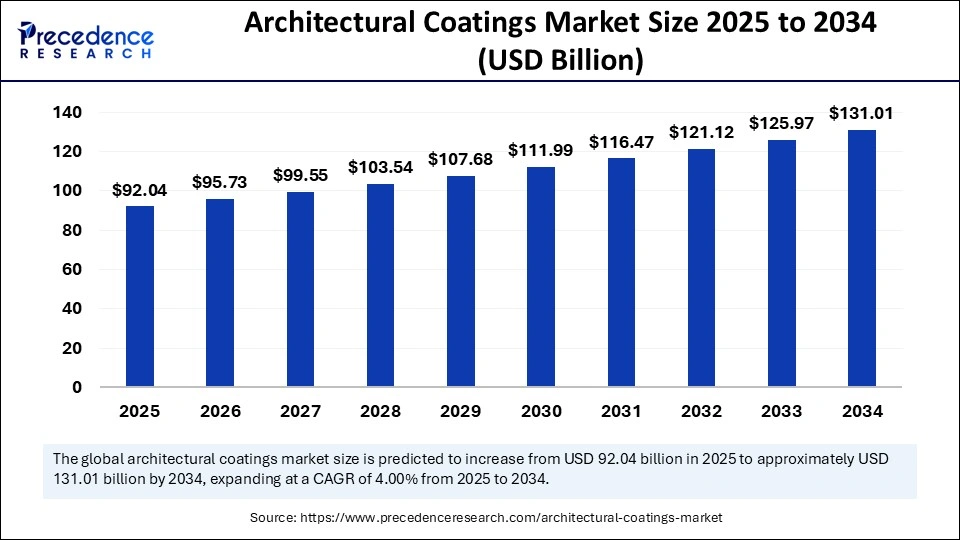

The global architectural coatings market size accounted for USD 88.50 billion in 2024 and is predicted to increase from USD 92.04 billion in 2025 to approximately USD 131.01 billion by 2034, expanding at a CAGR of 4.00% from 2025 to 2034. The well-established infrastructure, a growing shift towards renovation, and the expansion of urbanization foster the development of the market.

Architectural Coatings Market Key Takeaways

- Asia Pacific dominated the architectural coatings market in 2024.

- North America is expected to grow rapidly during the forecast period.

- By resin type, the acrylic segment led the market in 2024.

- By resin type, the vinyl segment is anticipated to expand rapidly in the coming year

- By technology, the waterborne segment dominated the market in 2024.

- By technology, the solvent-borne segment is expected to grow rapidly during the forecast period.

- By coating type, the interior segment led the market in 2024.

- By coating type, the exterior segment is anticipated to witness the fastest growth in the coming years.

- By application, the residential segment dominated the market in 2024.

- By application, the non-residential segment is expected to grow notably over the forecast period.

- By user type, the professional segment dominated the market in 2024.

- By user type, the DIY segment is expected to grow rapidly during the forecast period.

How is Artificial Intelligence (AI) Changing Architectural Coatings?

Artificial intelligence and machine learning platforms can guide instruments for specific measurements in research and development and quality control operations. AI and ML also aid in process optimization and predictive maintenance. AI plays a vital role in product manufacturing and knowledge-based performance. AI and ML can give a higher level of insight into desired concepts and can guide through continuous learning from new data. AI aids in tuning the formulations to obtain certain performance characteristics.

Market Overview

The architectural coatings market revolves around the decorative or protective applications of various types of protective materials, such as sealants, paints, and specialty coatings that are used for walls, roofs, surfaces, etc. The BASF conducts a study on testing exterior coating mechanics to adjust to environmental elements. Research, quantification, and modeling of DIY architectural paint applications are favored by consumers with a high interest. The exclusive demand and supply of latex polymers, formulations, performance additives, primers, etc., drive the growth of the market globally. The interior coatings balance aesthetics and durability, while exterior coatings offer a performance adaptable to different elements. The wide applications of primers and specialty coatings in every constructive layer raise their significance.

Architectural Coatings Market Growth Factors

- The increased demand for interior and exterior wall paints to apply on ceilings and interior walls raised the importance of decorative finishes, colors, and textures in home living spaces.

- Expanding industrialization, a growing population, and rising disposable incomes are fostering the growth of the architectural coatings market.

- The developments in new and existing infrastructures and the need for improved aesthetics of buildings surge the market's expansion.

- The growing environmental awareness and the rising shift of consumers toward sustainable products uplift the market's portfolio.

- The presence of major global manufacturers of coatings across Germany, France, Europe, Canada, Saudi Arabia, the U.S., etc., drives the huge expansive reach of this market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 131.01 Billion |

| Market Size in 2025 | USD 92.04 Billion |

| Market Size in 2024 | USD 88.50 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.00% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Resin Type, Technology, Coating Type, Application, End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

R&D investments and sustainable product manufacturing

With the increasing investments in R&D, product manufacturing, etc., the supply of promising products is also increasing in the global market. The huge focus of builders on constructing new buildings or renovating existing ones is supporting the investors and the businesses. The environmentally sustainable nature of various materials draws their significance without showcasing any toxicity or harm to health and the environment. The excellent demand for different types of materials, such as thermosetting acrylic resins and other materials offering aesthetic appearance and durability, accelerates their sales revenue in the market.

Restraint

Unmet needs and burnishing-related issues

The industries face challenges associated with improving the application properties of coatings, interior trim paints, etc. There can arise some problems when dealing with water-based coatings. Moreover, burnishing is one of the major issues for wall paints in heavy traffic areas. The unmet needs of regions, including green technologies, improved aesthetics, and durability, must be addressed to promote the growth of the architectural coatings market.

Opportunity

Strategic collaborations for technological advancements

The industries are developing new technologies to solve problems associated with water-based coatings. These technologies enable filling the gaps between waterborne and solvent-borne technologies and coatings. The leading players like Clariant have developed 100% biobased additives that are improved solutions to use in antiburnish on wall paints. The paint producers are capable of differentiating their products due to ideal properties like burnish resistance and scuff resistance, which deliver long-term performance. The recent developments in technologies are becoming more crucial for interior wall and trim coatings. The collaborations between suppliers and manufacturers promote the development and formulation of new technologies.

Resin Type Insights

The acrylic segment led the architectural coatings market in 2024 due to its ideal nature in terms of aqueous forms, reasonable pricing, and easy applicability. Their cohesive strength makes them capable of adhering to most roof surfaces. With the expanding infrastructure development in the Asia Pacific region, the demand for acrylic architectural resins is also rising notably. The huge expansion of the construction sector also raises the demand and need for these ideal resins. The noticeable efforts of the government in developing the infrastructure and construction services raise the importance of acrylic resins.

The implementation of various government policies, such as open FDI, large budget allocations, the Smart Cities Mission, and the Make in India initiative, upholds the significance of acrylic resins. Moreover, the excellent durability, weathering resistance, color retention properties, and wide uses in exterior paints drive the rising adoption of acrylic forms of resins for commercial purposes. The excellent protection of buildings from UV radiation, temperature, and moisture offered by acrylic forms surges their preference among people.

The vinyl segment is anticipated to expand rapidly in the coming years. This segmental growth is attributed to the superior UV resistance, chemical stability, hardness, and transparency offered by vinyl ethers to make FEVE resins more compatible. Moreover, they provide hard gloss, flexibility, adhesion, and pigment compatibility to the FEVE polymers to make them usable as resins for powder coatings. Vinyl resins also allow functional groups like hydroxyl groups to be inserted into the structure for cross-linkability. The nonstick and anticorrosion applications of vinyl ether copolymers are driving their exclusive growth in the market. The preferred choice of end users for fluoroethylene vinyl ether (FEVE) resins for powder coatings is driven by their unique chemical structure with vinyl ether groups.

Technology Insights

The waterborne segment dominated the architectural coatings market in 2024 due to the availability of water-based coatings involving water as the primary solvent to spread the resin. The minimum addition of other solvents like glycol ethers and the maximum inclusion of water make them a better choice for end users. The high usage of water-based paints for many residential and non-residential infrastructure developments drives their commercial significance. The elimination of harmful volatile organic compounds (VOCs) from getting released into the air is favored by these water-based coatings. The ecologically friendly nature of waterborne technologies boosts their expansive reach in the market.

The solvent-borne segment is expected to grow rapidly during the forecast period. The outstanding durability, excellent performance, and wide uses in architectural coating drive the growth of solvent-borne technologies. Moreover, the huge adoption of these technologies in commercial and industrial sectors also raises their importance. The adaptability of these coatings to chemical exposure, abrasion, and heavy foot traffic drives their wide growth in the market. Moreover, the reduced sensitivity to atmospheric humidity and the ease of handling upsurge the adoption of solvent-borne technologies.

Coating Type Insights

The interior segment led the architectural coatings market in 2024 due to the excellent properties of interior paint coatings, such as high durability, stain repellency, better-concealing properties, and long-lasting performance. They allow experts to paint in inhabited areas by preventing any kind of disturbance to the operations carried out by end users. The emerging demand for high-quality paints to modify home interiors raises segmental growth. The demand for standard and premium paints by end users is rising their cost-effectiveness. The enhanced performance of these materials introduces competitiveness in the global market.

The exterior segment is anticipated to witness the fastest growth in the coming years. This growth is driven by the huge shift toward building renovation with paints and other protective materials. The demand for people to make roofs, walls, surfaces, and other structures more attractive and eye-catching improves the adoption of exterior architectural coatings. The exclusive protection of constructions from corrosion is offered by exterior coatings through waterproofing and resistance to weather conditions. The wide usage of primers, sustainable coatings, colors, finishes, etc., accelerates segmental progress. They ensure eco-friendly service delivery and environmental sustainability.

Application Insights

The residential segment dominated the architectural coatings market in 2024 due to the strong economies of several countries, which is associated with the success of various sectors. The emerging need for residential construction and renovation of existing buildings surges the growth of this segment. The residential construction applications include new paints and repainting, which drive the significance of this segment. The extensive usage of architectural coatings in both interior and exterior home applications boosts their expansion. The trending needs to obtain a fresh new look to the home interior and exterior through repainting also raises segmental growth in the market.

The non-residential segment is expected to grow notably over the forecast period due to its assistance in protecting buildings from environmental conditions. Moreover, they provide decorative finishes for ceilings, floors, interior and exterior walls, woodwork, metal structures, etc. The heavy usage of architectural coatings in non-residential buildings, including institutional, commercial, and industrial sectors, raises their success in the market. They protect these buildings with waterproofing, UV resistance, and abrasion resistance, and fight against other stress factors.

End User Insights

The professional segment dominated the architectural coatings market in 2024 due to the increased employment opportunities for painters and painting contractors. The professionals ensure a high-quality finish and try to prevent any damage to the flooring and furniture. The less time needed to complete these painting tasks makes end users feel supportive and reliable. The assistance of professionals for elderly people and young generations opens favorable doors to do various tasks promptly. The skilled and experienced professionals ensure accountability, reliability, and improved performance.

The DIY segment is expected to grow rapidly during the forecast period. The increased shift of consumers toward home renovation and personalization drives the demand for paints and stains. The available DIY materials ensure great affordability, user-friendly nature, and versatility for several purposes. The rising demand for low-volatile organic compounds, including coatings and paints, showcases the emergence of environmentally friendly green technologies. The high preference of people for renovations rather than new construction drives the expansion of the DIY segment globally.

Regional Insights

Asia Pacific dominated the architectural coatings market in 2024, due to the presence of various industries dedicated to manufacturing operations. The availability of cheap production costs, low-cost raw materials, and the desire to deliver better services to consumers drive the regional market's growth. The emerging demand for luxury goods serves to improve facilities for the rising global population. The expansion and growth of the construction industry and other commercial buildings are driven by various supportive measures of the government.

- In September 2025, the Asia Pacific Coatings Show will be conducted to connect the global coating industries, suppliers, and buyers of Asia Pacific. This trade show aims to meet new and existing customers from the APAC region, collect insights on the latest technologies, and have face-to-face business interactions.

Furthermore, the Asia Pacific Coatings Conference and Business Presentations Hub aims to offer the ideal platform to learn about innovations, trends, the latest industry products, etc. This event also looks forward to building strong networks in the region by exchanging ideas with industry leaders.

Singapore Government Upholding the Building and Construction Authority

The Singapore Institute of Architects holds a significant position as a professional organization aiming to promote the architectural profession and infrastructure development in Singapore. It holds a strong vision to see ‘Singapore as an Architecture Capital.' The Building and Construction Authority of Singapore provides e-commerce services such as the construction workforce registration system (CWRS), the overseas testing management system (OTMS), and the lifts and escalators application (LEAP) portal. The presence of various government departments, statutory boards, professional architectural institutions, educational institutions, regulatory bodies, regulations, etc.

- In November 2024, Akzo Nobel Paints Pvt. Ltd. in Singapore announced the launch of an innovative paint named the new flagship Dulux Ambiance All AirClean, which is formulated with PureAir technology to deliver clean air in an indoor environment.

The North American architectural coatings market is expected to grow rapidly during the forecast period. The American Coatings Association (ACA) focuses on the regulatory, legislative, and judicial issues faced by the U.S. Paint and Coating industries at the federal, state, and local levels. The World Coatings Council represents Australia, Brazil, France, Canada, China, Germany, Japan, the European Union, New Zealand, Turkey, South Africa, the U.S., and the UK. It highlights over 90% of paint and coatings global sales and volume.

- In March 2025, the American Coatings Association (ACA) announced a global initiative that was planned to launch across social media channels. The ACA planned to unite with the World Coatings Council and Paint and Coatings Associations, and companies from all over the world, through this initiative. Moreover, the World Coatings Council focuses on exchanging and cooperating with international issues and priorities faced by the global coatings industry.

Promising Activities by the Government Regulatory Agencies in the U.S.

The Environmental Protection Agency (EPA) makes efforts to submit an information collection request (ICR) and the National Volatile Organic Compound Emission Standards for Architectural Coatings to the Office of Management and Budget (OMB). These efforts are made for review and approval based on the Paperwork Reduction Act. The United Nations Economic and Social Council granted the World Coatings Council as a non-governmental organization (NGO). This NGO status is empowering the World Coatings Council to collaborate with and highlight international industrial issues before the United Nations and its officially connected organizations.

- In April 2024, Arkema announced the expansion of a wide range of solutions and technologies with sustainable offers by showcasing a strong commitment of customers toward decarbonization and sustainability goals at the American Coatings Show.

Europe is considered to be a notably growing architectural coatings market in the upcoming period. In March 2025, the 2025 European Coating Show (ECS) was organized in Nuremberg, Germany, and it aims to introduce various products from coatings and allied industries. The products that are planned to be introduced through the 2025 ECS include renewable energy-based polymer resin binder, fumed silica for wood and leather, a coating system with circular content, etc.

The products to be highlighted in the 2025 ECS continue as coating stabilizers, universal titanium dioxide grade, pigments for motorcycle coatings, water-reducible polyester polyol resin modifiers, wetting and dispersing agents, and polyurethane-based low shear thickener. A wide range of product offerings and industrial efforts showcase the dedication and commitment of European industries toward sustainable product manufacturing and promising service delivery.

Global Footprint of the Coatings Associations in Europe

The World Coatings Council is comprised of 14 industry member associations. These industry members include the European Council of the Paint, Printing Ink, and Artists' Colours Industry (CEPE), the French Paints, Printing Inks, Artists Colours, and Adhesives Association (FIPEC). Moreover, the German Paint and Printing Ink Industry Association also comprises the World Coatings Council. These European industries are represented by the WCC on their major international issues. These European industries are monitored and communicated regarding their issues of importance. These initiatives by the WCC aim to promote product stewardship and environmental sustainability through implementing eco-friendly practices and principles by coating companies and associations globally.

- In June 2024, PPG Industries announced the launch of a new concept entitled ‘Tomorrow Included,' a sustainability or marketing concept specifically designed for the Architectural Coatings (AC) sector expanding in Europe, the Middle East, and Africa (EMEA).

Architectural Coatings Market Companies

- PPG Industries

- Nippon Paint Holding Co. Ltd.

- BASF

- Masco Corporation

- The Sherwin-Williams Company

- RPM International Inc.

- Hempel

- Axalta Coating Systems

- Asian Paints Limited

- ICP Group

- Kansai Paint Co. Ltd.

Latest Announcements by Leaders

- In December 2024, Tim Knavish, chairman and CEO of PPG Industries, reported that the industry was delighted to complete the transaction with American Industrial Partners, and he wanted to express his gratitude to the architectural coatings U.S. and Canada employees for their dedicated and committed efforts toward business and PPG customers.

Recent Developments

- In October 2024, PPG Industries announced that it had reached a definitive agreement to sell 100% of its architectural coatings business in the United States and Canada. It had planned a transaction value of USD 550 million to American Industrial Partners (AIP).

- In July 2024, RPM International Inc. announced the acquisition of subsidiaries that hold strong positions in building materials, specialty coatings, sealants, and related services in the world.

Segments Covered in the Report

By Resin Type

- Acrylic

- Alkyd

- Vinyl

- Polyurethane

- Others

By Technology

- Waterborne

- Solventborne

- Powder coatings

By Coating Type

- Interior

- Exterior

By Application

- Residential

- New Construction

- Remodel and repaint

- Non-residential

- Commercial

- Industrial

- Infrastructure

By End User

- DIY

- Professional

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting