Atomic Clock Market Size and Forecast 2025 to 2034

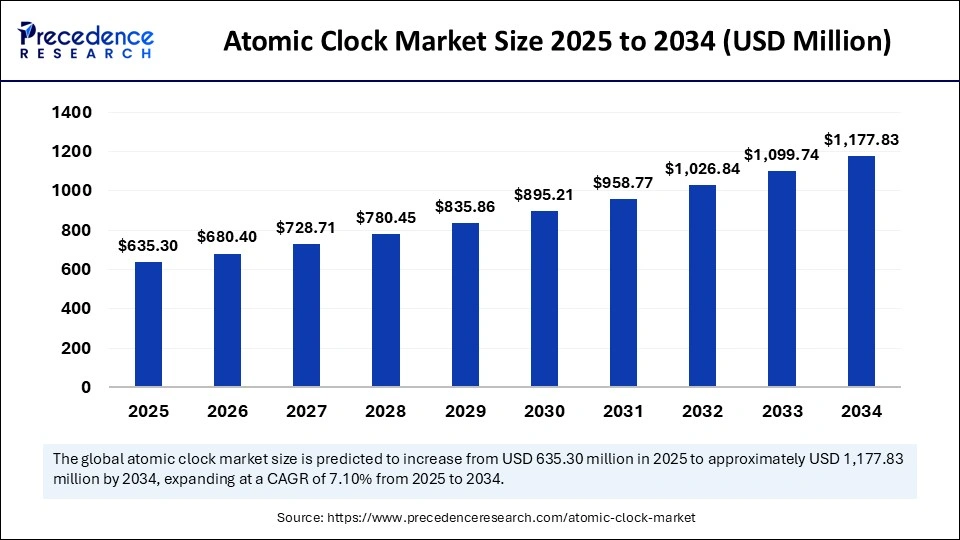

The global atomic clock market size accounted for USD 593.18 million in 2024 and is predicted to increase from USD 635.30 million in 2025 to approximately USD 1,177.83 million by 2034, expanding at a CAGR of 7.10% from 2025 to 2034. The growth of the market is attributed to the increasing demand for precision timing in telecommunications and navigation systems. Moreover, advancements in quantum technology and miniaturization support market expansion.

Atomic Clock Market Key Takeaways

- In terms of revenue, the atomic clock market is valued at $ 635.30 million in 2025.

- It is projected to reach $ 1,177.83 million by 2034.

- The market is expected to grow at a CAGR of 7.10% from 2025 to 2034.

- North America led the atomic clock market with the highest revenue share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By type, the Rubidium (Rb) atomic clock segment held the largest revenue share in 2024.

- By type, the Hydrogen (H) maser atomic clock segment is anticipated to grow at a remarkable CAGR during the forecast period from 2025 to 2034.

- By application, the aerospace and military segment captured the largest revenue share in 2024.

- By application, the scientific and metrology research segment is expected to expand at a significant CAGR over the projected period from 2025 to 2034.

Can AI-Powered Innovation Redefine the Future of Atomic Clocks?

The atomic clock industry is changing with the advent of artificial intelligence (AI). Precision, performance, and versatility will continue to improve through AI. AI algorithms support frequency stability, anticipate environmental changes, automate calibrations, and reduce human error and maintenance time. For instance, AI-assisted cesium and optical-lattice clocks can increasingly self-adjust through instability. In uses, such as satellite GPS routines and deep space, real-time adjustments made by AI improved drift, timing, and performance. Research institutes are harnessing machine learning to develop long-term forecasts for drift in atomic frequencies. The future of atomic clocks is bright because of AI, enabling them to be smarter, more compact, and more cost-effective.

Market Overview

An atomic clock is an extremely precise timekeeping device that measures time based on the vibrations of atoms, typically cesium or rubidium. Atomic clocks are essential in applications that require the highest precision. The atomic clock market is witnessing rapid growth, driven by the increasing demand from various applications in aerospace, defense, telecommunications, and scientific research, where precise timing is required. The development of portable atomic clocks and smaller atomic clocks will expand the commercial applications of atomic clocks. Atomic clocks are increasingly critical to synchronized systems, including 5g systems and space missions. This contributes to the steady growth of the market throughout the future.

Atomic Clock MarketGrowth Factors

- The Demand for Telecom Synchronization: The implementation of advanced telecom networks such as 5G and the forthcoming 6G specifications leads to a demand for highly accurate timing solutions. Atomic clocks provide the accuracy needed to achieve synchronization across extensive telecom networks.

- GNSS Growth: Globally navigated systems such as GPS, Galileo, and BeiDou utilize atomic clocks to provide positional performance. The continuous evolution and rollout of global navigated systems drive demand for advanced timekeeping technologies.

- Rising Demand from the Defense & Aerospace Sectors: Atomic clocks play a pivotal role in defense and aerospace applications, including secure communications, missile guidance, and satellite propulsion. The increased funding in defense and aerospace sectors aids the growth of atomic clock technologies.

- Miniaturized Atomic Clocks (MACs): Technological progress has produced a class of compact, available, and highly energy-efficient atomic clocks. The MAC's small size and power efficiency encourage their application in a wider variety of platforms involving mobile, Internet of Things, and autonomous systems.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,177.83 Million |

| Market Size in 2025 | USD 635.30 Million |

| Market Size in 2024 | USD 593.18 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.10% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Precision Timing in Atomic Clocks Energizes Growth in Satellite Navigation

The development of atomic clocks for satellite navigation systems drives the growth of the market. Global Positioning Systems, or GPS, modernization programs in the U.S., Europe's Galileo, and India's NavIC use atomic timing to ensure the integrity and accuracy of satellite-based global positioning. For example, Galileo satellites use two rubidium and two hydrogen maser atomic clocks that allow timing accuracy to one billionth of a second. The demand for ultra-precise timing systems has also been prompted by the increasing use of satellite services for international and domestic air transport, marine navigation, agriculture, and autonomous vehicles. Underlying these systems is a growing proliferation of positioning and navigation information that is vital to defense, commercial logistics, and space exploration. Hence, atomic clock systems are a vital infrastructure in these sectors.

Restraint

High Costs Slows Widespread Adoption

The high costs of developing and maintaining atomic clocks, even though they outperform lesser technology, remain a significant factor that restrains the growth of the atomic clock market. Advanced atomic clocks, such as hydrogen masers and optical lattice clocks, require highly complex setups, vacuum systems, and controlled environments that are expensive and impractical for widespread commercial use. The production of high-performance atomic clocks can cost hundreds of thousands of dollars, not including the installation and calibration of the atomic clock. The cost barriers limit applications mostly to government, aerospace, and science, which are highly specialized areas with low penetration in consumer products or local industries. Removing skilled labor requirements would further increase installation and operational costs, creating an even larger hurdle to the uptake of advanced timing technology for developing regions and small businesses.

Opportunity

Expanding 5G and Quantum Tech

The growth of 5G communication networks and quantum technologies creates new possibilities for the atomic clock market. Telecom companies and research organizations have begun to introduce chip-scale atomic clocks (CSAC) to enable ultra-low latency timing and precision synchronization in the next-gen networks. CSACs are smaller, more efficient, and cheaper than atomic clocks and provide a suitable alternative for use in telecom base stations and military-grade communications. On this trajectory, growing interest in quantum computing and quantum sensing means there is a high demand for stable timing sources - atomic clocks are irreplaceable in terms of stability. These emerging applications will be the foundation for future commercial uptake and technology.

Type Insights

Why Did Rubidium Atomic Clocks Lead the Market in 2024?

The rubidium (Rb) atomic clock segment held the largest share of the atomic clock market in 2024. This is mainly due to the increased popularity of Rb atomic clocks for their compact size, low power consumption, and low cost. They are popularly used in the telecommunications industry, GPS systems, and network synchronization. In the defense sector, they exist in a variety of applications. They're favored for their high performance and affordability and suit a lot of applications.

The Hydrogen (H) maser atomic clock segment is anticipated to grow at a remarkable CAGR during the forecast period, driven by the rising demand for ultra-precise timekeeping for scientific research and deep-space navigation. Although these clocks are expensive and complex, their frequency and stability are unrivaled and make them suitable for high-end applications such as radio astronomy and advanced metrology. Increasing investment in scientific research, space exploration, and advanced research facilities are driving the growth of the segment.

Application Insights

Why Did the Aerospace and Military Segment Dominate the Atomic Clock Market in 2024?

The aerospace and military segment dominated the atomic clock market with the largest share in 2024 because of the heightened need for precision timing in satellite operations, secure communications, and missile guidance. Atomic clocks are found in the heart of defense-grade GPS and navigation systems to deliver critical strategic capabilities. Increasing government funding for the modernization of defense infrastructure continues to boost the demand for atomic clocks in various applications.

The scientific and metrology research segment is expected to expand at a significant CAGR over the projected period as measures of urgency are significantly placed on high-precision measurements and fundamental physics experiments. Atomic clocks support global time standards and perform quantum research. With a growing shift in the global research docket, the landscape is changing, especially as national laboratories replace and upgrade timing infrastructure, addressing climate change and sustainable development.

Why is North America Dominating the Atomic Clock Market?

North America registered dominance in the market by capturing the largest share in 2024. This is mainly due to the region's high investments in space exploration and defense technologies. The adoption rate of satellite communication systems and the need for high-precision timekeeping systems continue to rise across both government and commercial sectors. The Federal Government of the U.S., in particular, continues to procure high-precision timekeeping systems to support navigation and surveillance systems and perform precise scientific research. The growing use of atomic clocks in GPS satellites and aerospace continues to drive steady demand for atomic clocks.

The U.S. leads the North American atomic clock market with the rising use of atomic clocks in both commercial and government sectors. In March 2024, the United States Air Force further invested in upgrading the Global Positioning System (GPS) by adding the newest generation of atomic clocks. In addition, U.S. institutions such as NIST (National Institute of Standards and Technology) are making efforts to develop new optical lattice clocks, which further exemplifies the country's position in the market.

- In April 2025, NASA, in collaboration with the European Space Agency (ESA), launched two state-of-the-art atomic clocks to the International Space Station (ISS) as part of the Atomic Clock Ensemble in Space (ACES) mission. The atomic clocks were launched aboard the SpaceX Dragon spacecraft to the ISS.(Source:https://www.indiatoday.in)

What are the Key Trends in the Atomic Clock Market within Asia Pacific?

Asia Pacific is poised to witness the fastest growth during the forecast period. This is mainly due to the increasing satellite deployments, defense modernization, and scientific research. Many countries in the Asia Pacific are developing satellite navigation programs, which require ultra-precise timing solutions. The rapid digitization of infrastructure coupled with increased investments into national space programs has further increased the region's appetite for atomic clocks, especially in countries entering the aerospace sector.

China is the largest contributor to regional market growth, driven by the increased investment by the government in the BeiDou Navigation Satellite System (BDS). Recently, China sent several satellites with atomic clocks aboard to enhance navigation accuracy. The China Aerospace Science and Technology Corporation (CASC) continually pursues technological advancements to build on space-grade timekeeping technology. Along with government investment, national research on cesium and rubidium clock precision will make China an innovation hub for the atomic clock market in APAC.

- In January 2025, Chinese researchers have developed the most precise portable atomic clock ever. China's new atomic clock, the NIM-TF3, can work autonomously over long periods with minimal maintenance and supervision. This makes it ideal for military applications. These developments underscore China's ambition to reduce reliance on U.S.-led systems and establish technological independence.

Which Opportunities Exist in the European Atomic Clock Market?

Europe is expected to witness significant growth in the coming years, owing to its leadership in the area of high-precision satellite navigation and scientific research. The European Space Agency (ESA), as well as European national space agencies, are exploring the applications of atomic clocks as part of Galileo and other significant missions. In fact, Europe has access to a number of collaborative scientific programs being funded through the ESA and member states that are focused on R&D for next generation optical clocks.

The UK is a significant player in the European atomic clock market, with its emphasis on quantum technologies and precision timing. Institutions across the UK, such as the National Physical Laboratory (NPL), are developing technologies such as optical and chip-scale atomic clocks. The UK's involvement in satellite navigation projects and the evidence of its quantum technologies program insist the UK is a significant contributor to the area of atomic technology.

- In January 2025, the UK Defence Science and Technology Laboratory developed a quantum atomic clock to refine military operations through precise and resilient timing, reducing reliance on GPS systems that are vulnerable to disruption.

Atomic Clock Market Companies

- AccuBeat ltd.

- Excelitas Technologies Corp.,

- IQD Frequency Products Ltd.

- Leonardo

- Microchip Technology Inc.

- Orolia

- Oscilloquartz

- Stanford Research Systems

- Tekron

- VREMYA-CH JSC

Recent Developments

- In April 2025, QuantX Labs, an Australian developer of high-precision quantum timing systems, launch a key component of its TEMPO optical atomic clock into space aboard Exotrail's spacevan on a SpaceX mission in late 2025. The payload, an optical frequency comb, serves as the enabling subsystem for space-based optical clocks and has completed space-readiness validation, including thermal, vacuum, vibration, and radiation testing.

(Source:https://quantumcomputingreport.com) - In January 2025, Microchip launched its second generation Low-Noise Chip-Scale Atomic Clock (LN-CSAC), model SA65-LN, in a lower profile height and designed to operate in a wider temperature range, enabling low phase noise and atomic clock stability in demanding conditions. The Low-Noise Chip-Scale Atomic Clock, model SA65-LN, enables frequency mixing for battery-powered devices. Together, the LN-CSAC can save board space, design time and overall power consumption compared to designs that feature two oscillators.

(Source: https://www.globenewswire.com) - In January 2024, the Academy for Precision Measurement Science and Technology (APM) has developed a new rubidium atomic clock, setting a new international record for stability. This technological breakthrough further expands China's leading advantage in rubidium atomic clock technology and is of great significance for the development of high-quality microwave oscillator technology and the development of a new generation of Beidou system satellite-borne atomic clocks.

(Source: http://english.apm.cas.cn)

Segments Covered in the Report

By Type

- Rubidium (Rb) Atomic Clock

- Cesium (Cs) Atomic Clock

- Hydrogen (H) Maser Atomic Clock

By Application

- Aerospace and Military

- Scientific and Metrology Research

- Telecom and Broadcasting

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting