What is the Automated Endoscope Reprocessors Market Size?

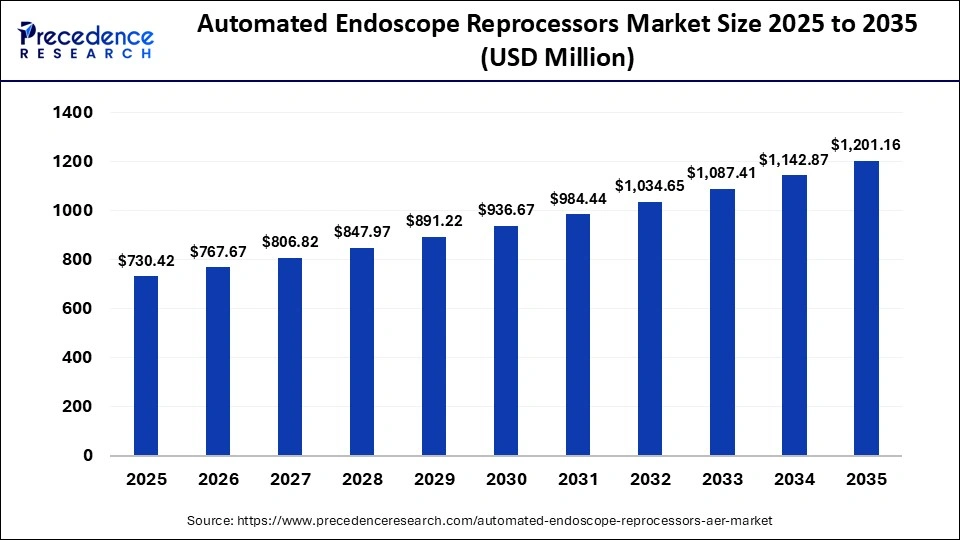

The global automated endoscope reprocessors market size was calculated at USD 730.42 million in 2025 and is predicted to increase from USD 767.67 million in 2026 to approximately USD 1,201.16 million by 2035, expanding at a CAGR of 5.10% from 2026 to 2035. This market is growing due to the rising demand for effective infection control and standardized endoscope reprocessing in hospitals and diagnostic centers.

Market Highlights

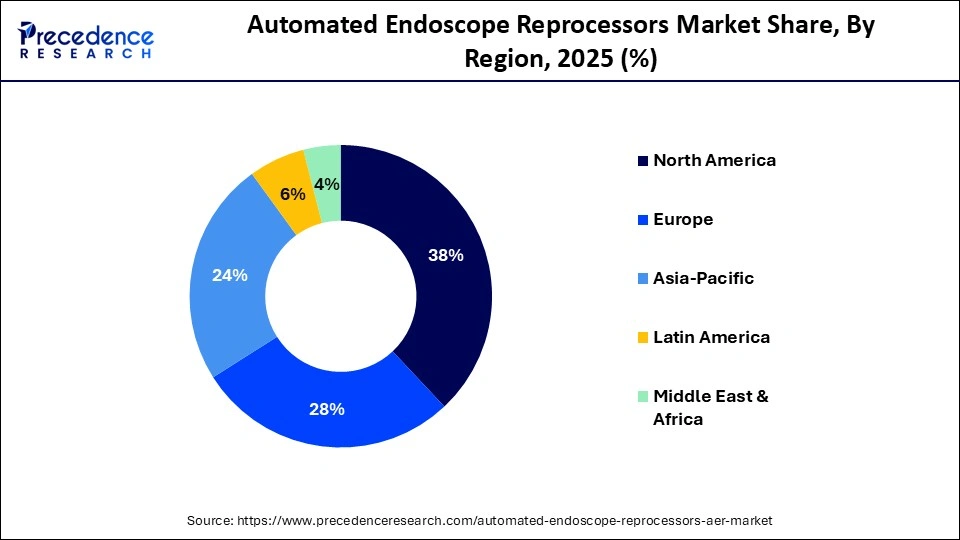

- North America dominated the global automated endoscope reprocessors market with approximately 38% share in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

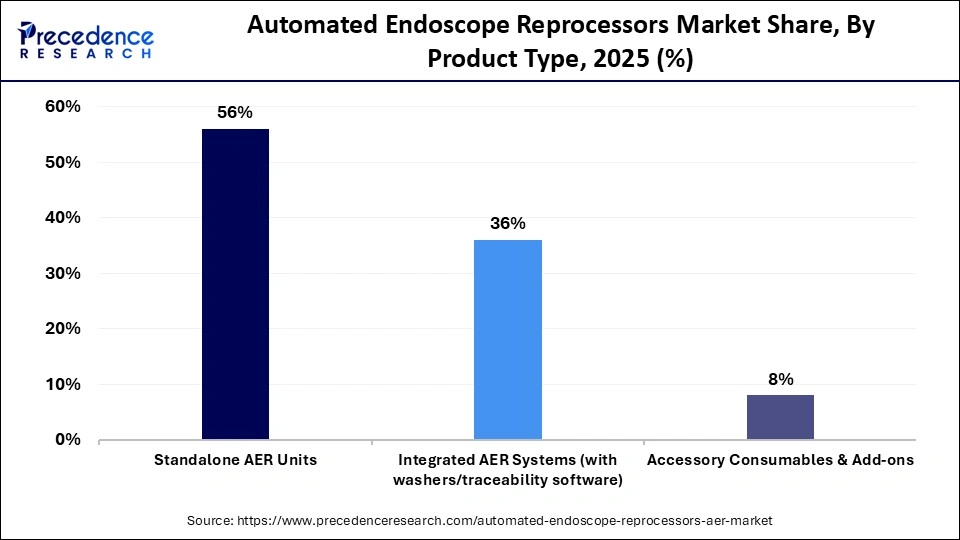

- By product type, the standalone AER units segment held the biggest market share of approximately 56% in 2025.

- By product type, the integrated AER systems segment is expected to expand at the fastest CAGR between 2026 and 2035.

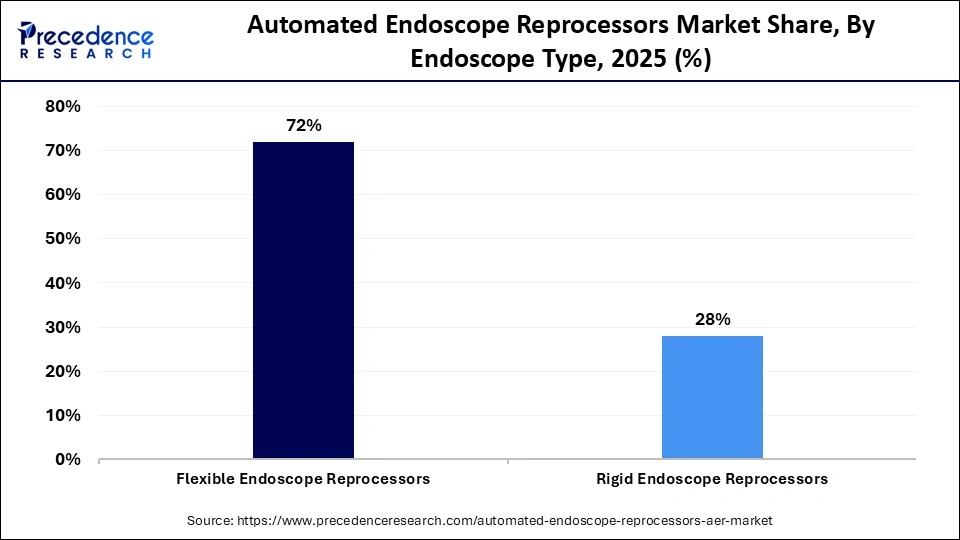

- By endoscope type, the flexibility endoscope reprocessors segment contributed the highest market share of approximately 72% in 2025.

- By endoscope type, the rigid endoscope reprocessors segment is expected to grow at a strong CAGR between 2026 and 2035.

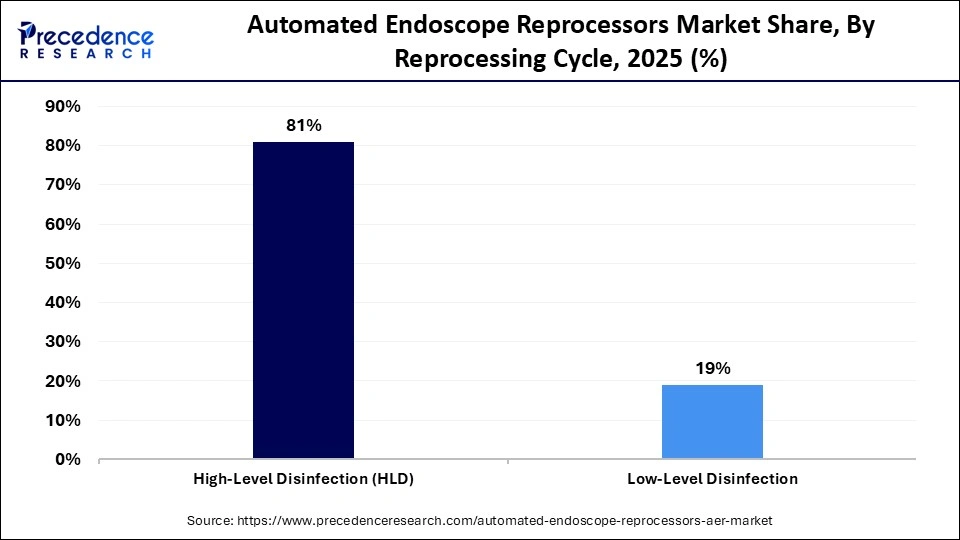

- By reprocessing cycle, the high-level disinfection segment held a major market share of approximately 81% in 2025.

- By reprocessing cycle, the low-level disinfection segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By technology/feature, the automated disinfection & wash cycles segment generated the biggest market share of approximately 49% in 2025.

- By technology/feature, the remote monitoring & IoT-enabled features segment is expected to grow at the fastest CAGR between 2026 and 2035.

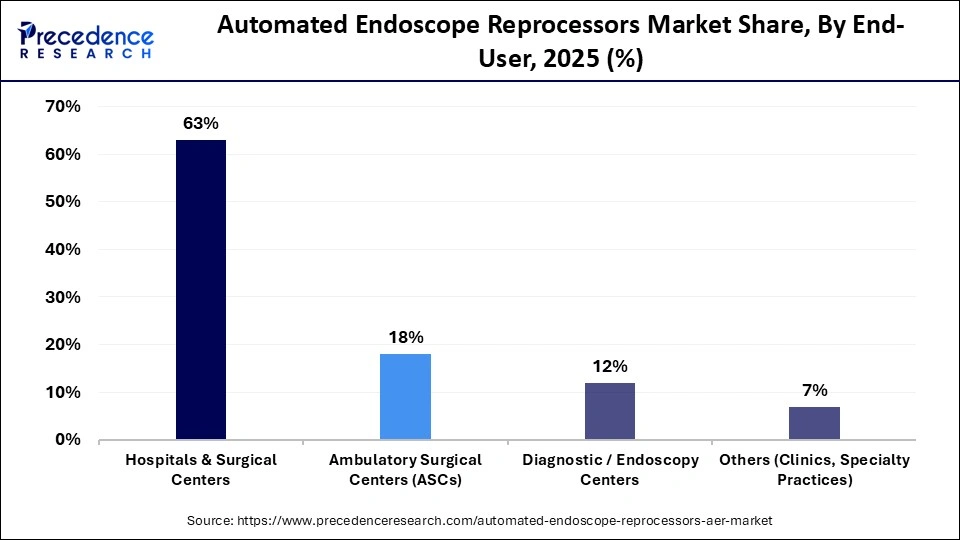

- By end user, the hospitals & surgical centers segment contributed the highest market share of approximately 63% in 2025.

- By end user, the ambulatory surgical centers (ASCs) segment is growing at a strong CAGR between 2026 and 2035.

What Drives the Growth of the Automated Endoscope Reprocessors Market?

The automated endoscope reprocessors market is experiencing steady growth due to the increasing recognition of hospital-acquired infections and the need for reliable, standardized endoscope disinfection procedures. To decrease human error, enhance patient safety, and adhere to stringent regulatory and accreditation requirements, healthcare facilities are implementing automated reprocessing systems. Market growth is further supported by the rising number of endoscopic procedures, technological advancements in reprocessing equipment, and increasing investments in healthcare infrastructure.

How is Artificial Intelligence Influencing the Automated Endoscope Reprocessors Market?

Artificial intelligence is increasingly being integrated into automated endoscope reprocessors to increase operational effectiveness, process accuracy, and compliance. AI-enabled systems lower the risk of insufficient disinfection by supporting automated error detection, predictive maintenance, and real-time reprocessing cycle monitoring. AI helps healthcare facilities improve patient safety, comply with regulations, and maximize workflow efficiency in endoscope reprocessing units by enabling data-driven insights, traceability, and intelligent alerts. Additionally, AI-powered digital documentation simplifies regulatory compliance and traceability, making AER systems more attractive to hospitals and endoscopy centers.

Major Market Trends

- Increasing adoption of fully automated and standardized reprocessing systems to reduce human error and improve patient safety.

- Growing focus on infection prevention and control, driven by rising cases of hospital-acquired infections.

- Rising demand for regulatory-compliant and traceable reprocessing solutions to meet strict healthcare guidelines.

- Technological advancements enable shorter cycle times and higher throughput in endoscope reprocessing. Integration of digital monitoring, data logging, and connectivity features for better documentation and audits.

- Expanding use of automated reprocessors in ambulatory surgical centers and diagnostic clinics.

- Increasing preference for low-chemical and environmentally friendly reprocessing solutions.

Future Growth Outlook

- Growing demand for advanced infection control solutions in hospitals and outpatient facilities creates strong adoption opportunities.

- Expansion of ambulatory surgical centers and diagnostic clinics increases the need for compact and efficient reprocessing systems.

- Rising emphasis on regulatory compliance and traceability opens opportunities for digitally enabled and data-integrated reprocessors.

- Technological innovations focused on faster cycle times and reduced chemical usage offer differentiation for manufacturers.

- Increasing healthcare investments in emerging economies present untapped growth potential.

- Demand for eco-friendly and low-toxicity disinfectants supports the development of sustainable reprocessing solutions.

- Growth in service, maintenance, and training programs creates recurring revenue opportunities for solution providers.

How Are Government Initiatives Supporting the Automated Endoscope Reprocessors Market?

The market for automated endoscope reprocessors is positively impacted by government programs designed to improve patient safety, infection prevention, and healthcare quality. Stricter regulations for endoscope reprocessing are being issued by health authorities and regulatory bodies, which also require standardized disinfection procedures and frequent compliance audits in healthcare facilities. Additionally, hospitals and diagnostic facilities are being encouraged to implement automated reprocessing systems that guarantee consistency, traceability, and regulatory compliance by increased public funding for hospital infrastructure upgrades, accreditation programs, and quality assurance frameworks.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 730.42 Million |

| Market Size in 2026 | USD 767.67 Million |

| Market Size by 2035 | USD 1,201.16 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.10% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Endoscope Type, Reprocessing Cycle, Technology/Feature, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

What made standalone AER units the dominant segment in the automated endoscope reprocessors market?

The standalone AER units segment dominated the market with a 56% share in 2025 because hospitals and diagnostic facilities looking for dependable independent reprocessing solutions have widely adopted them. These units are easier to install, operate, and maintain without requiring integration into complex hospital IT or workflow systems. Their cost-effectiveness, flexibility across different endoscope brands, and proven compliance with infection control standards have made them the preferred choice, especially in high-volume healthcare settings

The integrated AER systems segment is expected to grow at the fastest CAGR in the coming years, driven by hospitals implementing fully connected, fully automated reprocessing workflows. By integrating with hospital information systems, these systems decrease manual handling, increase traceability, and boost workflow efficiency. Rising demand for centralized reprocessing units improved infection control, and digital documentation is accelerating adoption, particularly in advanced healthcare facilities.

Endoscope Type Insights

Why did the flexibility endoscope reprocessors segment dominate the market?

The flexibility endoscope reprocessors segment dominated the automated endoscope reprocessors market with a 72% share in 2025 because flexible endoscopes are widely used in urology, pulmonary, and gastrointestinal procedures worldwide. Automated reprocessing is crucial because the intricate internal channels of these endoscopes necessitate careful cleaning. Segment dominance is further supported by the rising number of minimally invasive procedures and stringent regulations about flexible endoscope reprocessing.

The rigid endoscope reprocessors segment is expected to grow at the fastest rate over the forecast period, fueled by increasing surgical procedures in orthopedics, ENT, and laparoscopy. Advances in rigid endoscope design and rising adoption in ambulatory and specialty clinics are boosting demand. Rigid endoscope reprocessors are appealing in high-turnover surgical settings because of their simpler structure, which enables quicker reprocessing cycles.

Reprocessing Cycle Insights

Why did the high-level disinfection segment lead the automated endoscope reprocessors market?

The high-level disinfection segment led the market with the largest share of 81% in 2025. This is mainly due to its critical role in eliminating bacteria, viruses, and mycobacteria from reusable endoscopes. Regulatory bodies mandate high-level disinfection for most semi-critical devices, making it the standard across hospitals. Its dominance is further reinforced by rising awareness of patient safety issues and hospital-acquired infections (HAIs).

The low-level disinfection segment is expected to expand at the fastest CAGR during the projection period, driven by its widespread use in non-critical devices and pre-cleaning applications. Smaller healthcare facilities find it appealing due to its shorter cycle times, reduced chemical usage, and lower operating costs. Where high-level disinfection is not always necessary, adoption is supported by the expansion of outpatient and diagnostic facilities.

Technology/Feature Insights

How does the automated disinfection & wash cycles segment dominate the automated endoscope reprocessors market?

The automated disinfection & wash cycles segment dominated the market with a 49% share in 2025 because they significantly reduce human error and ensure consistent validated cleaning outcomes. These systems improve operational efficiency, lower staff workload, and enhance compliance with infection prevention protocols. They are now the mainstay of endoscope reprocessing workflows due to their extensive availability and demonstrated dependability. Adoption is further aided by healthcare facilities standardizing their reprocessing procedures. Segment dominance is being strengthened by ongoing product improvements that prioritize speed and safety.

The remote monitoring & IoT-enabled features segment is expected to expand at the fastest rate in the coming years, driven by the shift toward smart healthcare infrastructure. These technologies enable real-time monitoring, digital documentation, predictive maintenance, and regulatory compliance tracking. Hospitals that prioritize operational transparency and data-driven infection control are accelerating adoption. Growth is being accelerated by the growing need for centralized supervision across multi-site hospital networks. Long-term operational planning is being enhanced by integration with analytics platforms.

End User Insights

What made hospitals & surgical centers the dominant segment in the automated endoscope reprocessors market?

The hospitals & surgical centers segment dominated the market by holding a major revenue share of 63% in 2025 because of the high volume of procedures and stringent infection-control requirements. To manage daily endoscope usage efficiently, these facilities require reliable, large-capacity reprocessing systems. Widespread adoption in hospital settings is further driven by strong regulatory oversight, the availability of trained personnel, and the ability to invest in advanced AER technologies supported by large capital budgets. Continuous demand is also reinforced by ongoing accreditation and compliance requirements.

The ambulatory surgical centers (ASCs) segment is expected to grow at the fastest CAGR over the forecast period, driven by the trend toward same-day and outpatient surgery. In order to facilitate quick patient turnover, ASCs place a high priority on small, effective, and affordable AER systems. Growing investments in outpatient infrastructure are accelerating demand. Lower operating costs and favorable reimbursement models are strengthening ASC expansion. AERs designed especially for ASC environments are also being developed by manufacturers.

Regional Insights

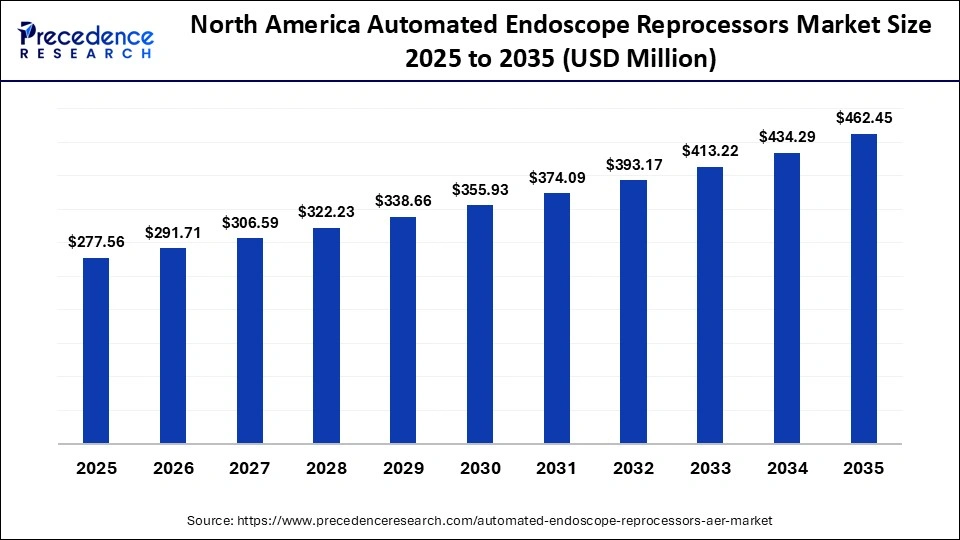

How Big is the North America Automated Endoscope Reprocessors Market Size?

The North America automated endoscope reprocessors market size is estimated at USD 277.56 million in 2025 and is projected to reach approximately USD 462.45 million by 2035, with a 5.24% CAGR from 2026 to 2035.

What made North America the dominant region in the automated endoscope reprocessors market?

North America dominated the automated endoscope reprocessors market by capturing a 38% share in 2025. This is because of the high uptake of automated medical technologies, stringent infection control laws, and sophisticated healthcare infrastructure. The region benefits from strong reimbursement systems, frequent technology upgrades, and high awareness of HAIs. Regional dominance is further reinforced by the existence of top AER manufacturers. Regular regulatory inspections and reporting requirements support continuous system upgrades. Consistent demand across healthcare facilities is also maintained by high procedure volumes.

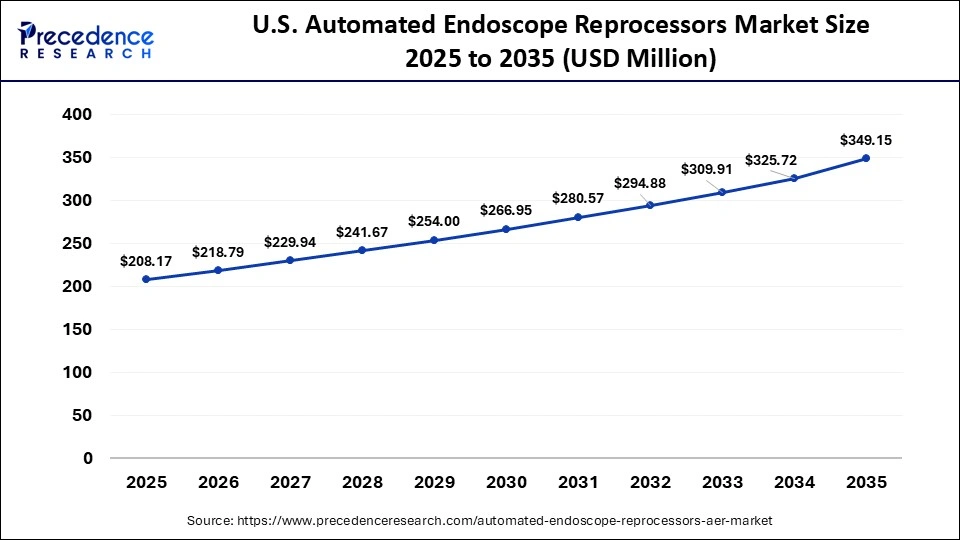

What is the Size of the U.S. Automated Endoscope Reprocessors Market?

The U.S. automated endoscope reprocessors market size is calculated at USD 208.17 million in 2025 and is expected to reach nearly USD 349.15 million in 2035, accelerating at a strong CAGR of 5.31% between 2026 and 2035.

U.S. Automated Endoscope Reprocessors Market Trends

U.S. dominates the North American market, driven by high procedural volumes in hospitals and surgical centers and stringent infection prevention regulations. Strong enforcement by regulatory bodies such as the FDA and CDC has pushed healthcare facilities to adopt validated and automated reprocessing solutions. High awareness of hospital-acquired infections and frequent audits further support consistent demand.

Why is Asia Pacific considered the fastest-growing area in the market?

Asia Pacific is considered the fastest-growing region in the market, driven by expanding healthcare infrastructure and rising endoscopic procedure volumes. Adoption is being accelerated by rising government healthcare spending, expanding medical travel, and raising infection control standards. Rapid hospital expansion in emerging economies is further accelerating market growth. Purchase decisions are being influenced by growing patient safety and infection prevention awareness. Local manufacturing and cost-effective solutions are also improving market accessibility.

India Automated Endoscope Reprocessors Market Trends

India is leading the market due to rising endoscopic procedure volumes and the quick development of hospital infrastructure. Adoption of automated reprocessing solutions is being driven by the expansion of private hospitals, increased awareness of infection control, and improved accreditation standards. Medical tourism and increasing diagnostic procedures are also contributing to demand growth. Moreover, government initiatives to strengthen healthcare quality and investments in tertiary care hospitals are supporting market expansion. The availability of affordable AER systems designed for mid-sized and large healthcare facilities increases adoption even more.

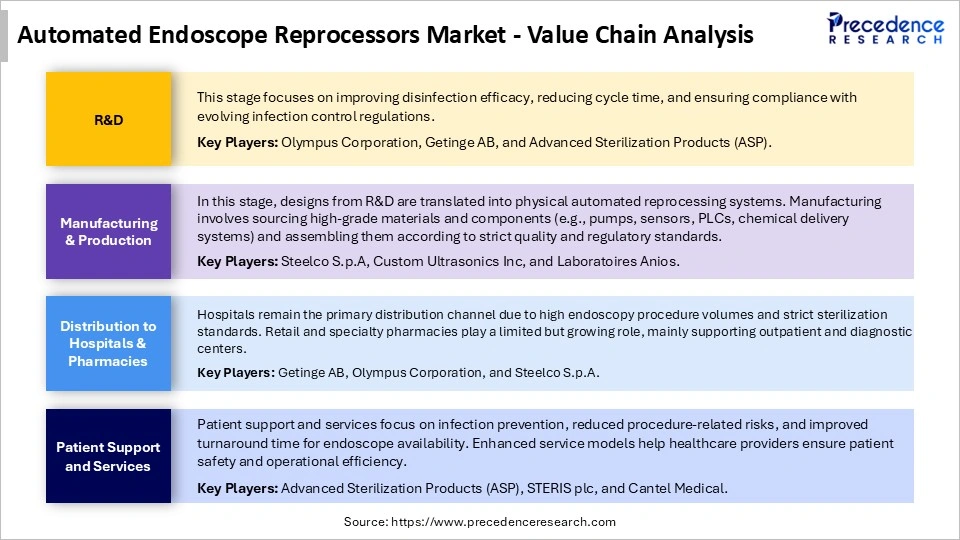

Automated Endoscope Reprocessors Market Value Chain Analysis

Who are the Major Players in the Global Automated Endoscope Reprocessors Market?

The major players in the automated endoscope reprocessors market include STERIS plc, Olympus Corporation, Advanced Sterilization Products (ASP) (Fortive Corporation), Getinge AB, Cantel Medical Corp. (now part of STERIS), Steelco S.p.A. (Miele Group), Wassenburg Medical B.V. (HOYA Corporation), Belimed AG (Metall Zug AG), Ecolab Inc., Custom Ultrasonics, Inc., Shinva Medical Instrument Co., Ltd., Laboratoires Anios (Ecolab), Soluscope S.A.S., ARC Healthcare Solutions Inc., Choyang Medical Industry Ltd., Metrex Research, LLC (Envista Holdings), Ottomed Endoscopy, and Biorad Medisys Pvt. Ltd.

Recent Developments

- In May 2024, Olympus Corporation announced the launch of ScopeLocker Air, a specialized drying and storage cabinet designed to improve infection prevention for flexible endoscopes. The system features a high-capacity vertical storage design that can accommodate up to 10 endoscopes, optimizing clinical workflow and space. Developed in partnership with Capsa Healthcare, the cabinet ensures thorough channel drying to mitigate the risk of microbial growth after reprocessing.(Source: https://www.prnewswire.com)

- In September 2024, Soluscope (An Ecolab Company) announced that its automated endoscope reprocessing portfolio and manufacturing site achieved EU Medical Device Regulation (MDR) certification. This milestone includes the launch of the Serie XS, a compact and rapid automated endoscope reprocessor designed to meet the highest safety standards. The certification ensures continued access to the European market with validated high-level disinfection technology.(Source: https://en-be.ecolab.com)

Segments Covered in the Report

By Product Type

- Standalone AER Units

- Integrated AER Systems (with washers/traceability software)

- Accessory Consumables & Add-ons

By Endoscope Type

- Flexible Endoscope Reprocessors

- GI endoscopes

- Bronchoscopes

- Urological scopes

- Rigid Endoscope Reprocessors

- Laparoscopes

- Arthroscopes

By Reprocessing Cycle

- High-Level Disinfection (HLD)

- Low-Level Disinfection

By Technology/Feature

- Automated Disinfection & Wash Cycles

- Traceability & Documentation Software

- Integrated Leak Detection & Safety Systems

- Remote Monitoring & IoT-enabled Features

By End-User

- Hospitals & Surgical Centers

- Ambulatory Surgical Centers (ASCs)

- Diagnostic/Endoscopy Centers

- Others (Clinics, Specialty Practices)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting