Automated Microbiology Market Size and Forecast 2025 to 2034

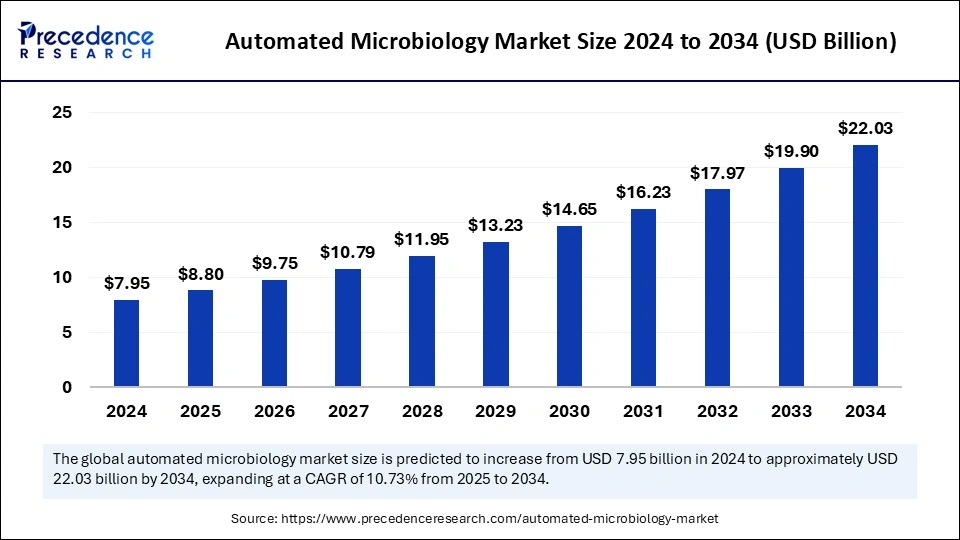

The global automated microbiology market size accounted for USD 7.95 billion in 2024 and is predicted to increase from USD 8.80 billion in 2025 to approximately USD 22.03 billion by 2034, expanding at a CAGR of 10.73% from 2025 to 2034. The growing incidence of infectious diseases across the globe is the key factor driving market growth. Also, increasing demand for precise and rapid microbial identification coupled with technological advancements in microbiology can fuel market growth further.Market Key Takeaways

Automated Microbiology Market Key Takeaways

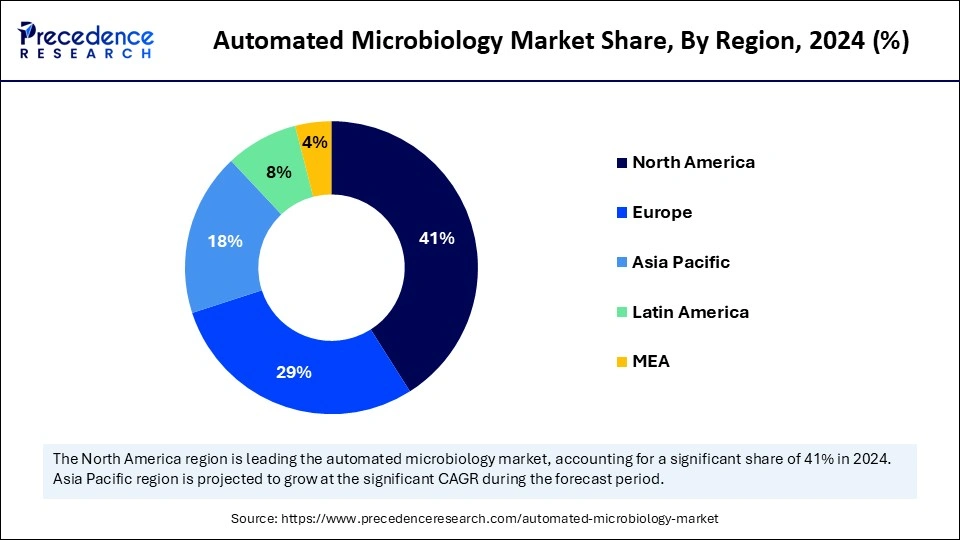

- North America led the market by holding more than 41% of the market share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR over the studied period.

- By product, the reagents and kits segment held the biggest market share of 49% in 2024.

- By product, the instruments segment is anticipated to grow at the fastest CAGR over the forecast period.

- By automation type, the fully automated segment led the market in 2024.

- By application, the clinical diagnostics segment dominated the market in 2024.

- By application, the biopharmaceutical production segment is anticipated to grow at the fastest CAGR over the forecast period.

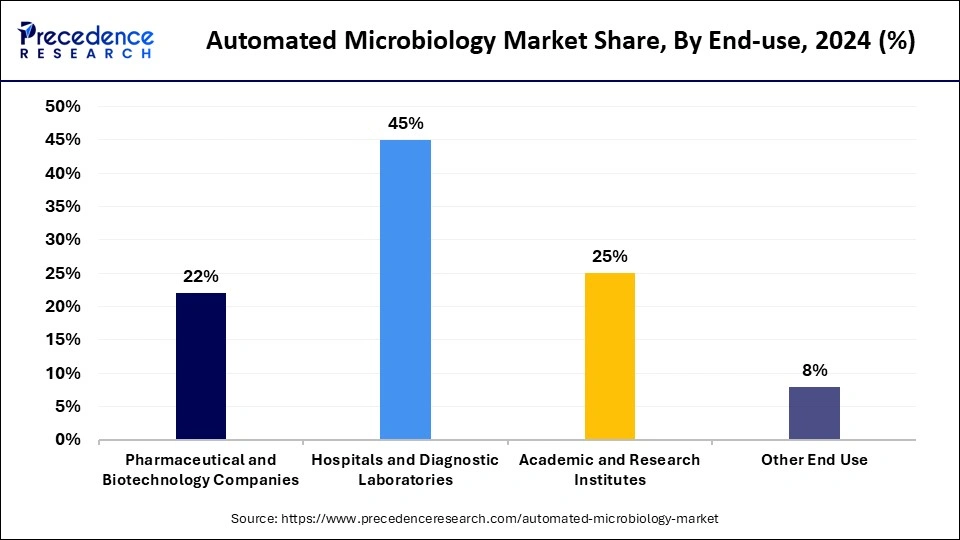

- By end use, the hospitals and diagnostic laboratories segment held the biggest market share of 45% in 2024.

- By end use, the pharmaceutical and biotechnology companies segment is anticipated to grow at the fastest rate during the projected period.

Role of Artificial Intelligence (AI) in the Automated Microbiology Market

Artificial intelligence plays a significant role in the automated microbiology market by improving the precision and speed of pathogen detection, enabling rapid diagnosis of infectious diseases, optimizing drug discovery, forecasting antibiotic resistance, and facilitating better surveillance of disease through innovative data analysis. Furthermore, AI systems can process microscopic images to identify viruses, bacteria, and parasites with high precision.

U.S. Automated Microbiology Market Size and Growth 2025 to 2034

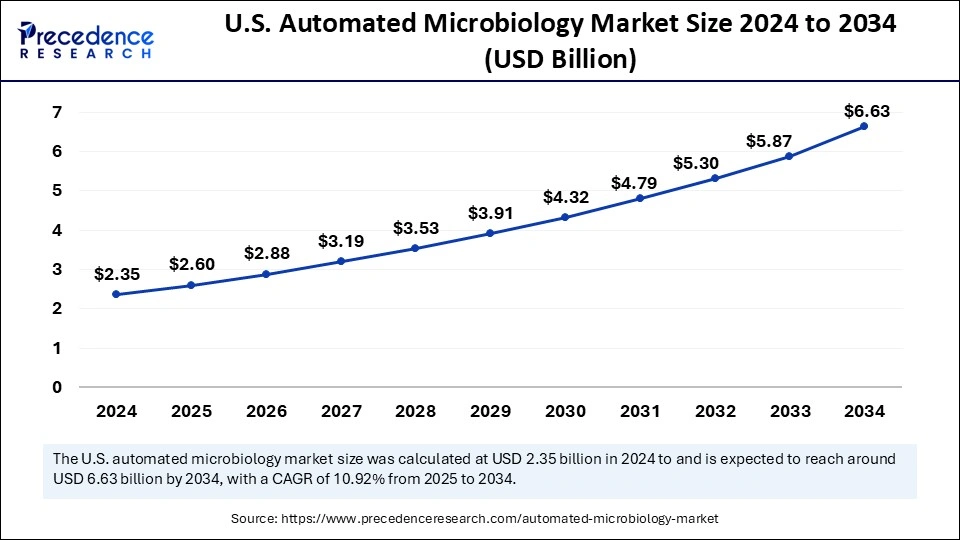

The U.S. automated microbiology market size was exhibited at USD 2.35 billion in 2024 and is projected to be worth around USD 6.63 billion by 2034, growing at a CAGR of 10.92% from 2025 to 2034.

North America dominated the automated microbiology market in 2024. The dominance of the region can be attributed to the rising incidence of infectious diseases, developed healthcare infrastructure, and strong regulatory framework in the region. Moreover, advancements in a testament to the increasing demand for automated microbiology analyzers and tools can support regional growth further.

U.S. Automated Microbiology Market Trends

In North America, the U.S. led the market. The dominance of the region is owing to the growing incidence of infectious diseases and well-established healthcare facilities in the country. Also, substantial R&D investments and the strong presence of key market players in the region is impacting the country's growth positively.

Asia Pacific is expected to grow at the fastest rate in the automated microbiology market over the studied period. The growth of the region can be credited to the surge in healthcare expenditure, the growing pharmaceutical and biotechnology sector, and increasing infectious disease cases. Furthermore, the increasing utilization of f AI-powered automation and growing awareness of antimicrobial resistance can propel market growth soon.

China Automated Microbiology Market Trends

In Asia Pacific, China is witnessing the fastest growth, driven by a rise in government investments in diagnostics, a rapidly growing healthcare sector, and the need for strict microbial quality control in food safety and pharmaceuticals. Also, innovation in AI-based automation and diagnostics is making automated solutions more prevalent in the country.

- In January 2024, Samsung Biologics selected Rapid Micro Biosystems' Growth Direct platform to automate crucial microbiology quality control tests. Rapid Micro Biosystems, Inc., is an innovative life sciences technology company that provides mission-critical automation solutions to facilitate the efficient manufacturing and fast, safe release of healthcare products.

Market Overview

The automated microbiology market encompasses systems and technologies created to automate the processes involved in the testing and analysis of microbiological essays. These also involve automated equipment for microbial detection, susceptibility testing, and processing of culture. Automation in microbiology improves accuracy and efficiency while decreasing human error and potential manual labor. The deployment of automated systems like BD Kiestra TLA has shown significant operational efficiencies.

Automated Microbiology Market Growth Factors

- The increasing need for innovative diagnostic tools to manage and control outbreaks is expected to boost automated microbiology market growth soon.

- The ongoing integration of automation into laboratory workflows can propel market growth shortly.

- Strategic collaborations between healthcare providers and vendors will likely help in the market expansion further.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 22.03 Billion |

| Market Size in 2025 | USD 8.80 Billion |

| Market Size in 2024 | USD 7.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.73% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Automation Type, Application, End use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East |

Market Dynamics

Drivers

Increasing need for rapid diagnostic techniques

The demand for fast diagnostic techniques is increasing due to the requirement for precise and rapid detection of diseases. These systems substantially decrease the time needed for diagnostic processes as compared to conventional methods, offering results in a few hours. In addition, healthcare professionals are striving for accurate patient outcomes.

In January 2023, Becton Dickinson and Company (BD) launched the new third-generation BD Kiestra Total Lab Automation System for microbiology laboratories. The robotic track system is suitable for use with the BD Kiestra microbiology laboratory solution, which automates lab specimen processing and is designed to meet the evolving requirements of labs.

Restraint

Slow automation adoption

The adoption of automated microbiology systems by diagnostic laboratories is much slower than the traditional systems. Many factors contribute to this, such as high initial costs, lack of skilled labor, and integration difficulties with legacy systems. Moreover, comfort with current manual workflows can pose a hurdle to change.

Opportunity

Growing focus on infection control

The increasing focus on infection prevention and control can present substantial opportunities in the market in the near future. Automated microbiology systems play a crucial role in controlling infection by offering precise and timely identification of microorganisms. Furthermore, Automated systems also improve the safety of laboratory assistance by decreasing their exposure to harmful microorganisms.

- In June 2024, Sysmex and Inpeco announced to join forces for a one-of-a-kind launch later in the year. By combining Sysmex's long history and extensive knowledge in automated urinalysis over the last 25+ years and market leadership in sediment analysis with Inpeco's unparalleled authority and global leadership in Total Laboratory Automation, the solution innovation will be a game-changer in the field of urinalysis.

Product Insights

The reagents and kits segment held the largest automated microbiology market share in 2024. The dominance of the segment can be attributed to the growing demand for accurate and rapid microbial identification along with the increasing incidence of infectious diseases. Additionally, technological innovations in reagent formulations, such as molecular diagnostic kits and ready-to-use culture media, can improve overall laboratory efficiency.

The instruments segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the growing demand for high-throughput microbial testing and innovations in automation. Laboratories are increasingly using automated instruments like blood culture analyzers, microbial identification systems, and antibiotic susceptibility testing (AST) systems to decrease manual errors and improve accuracy.

Automation Type Insights

The fully automated segment led the automated microbiology market in 2024 and is expected to grow at the fastest rate over the forecast period. The dominance of the segment can be linked to the rising demand for accurate, high-throughput, and rapid microbial diagnostics in pharmaceutical, clinical, and food safety laboratories. Also, this system reduces errors by reducing human intervention and enhancing efficiency.

Application Insights

The clinical diagnostics segment dominated the automated microbiology market in 2024. The dominance of the segment can be driven by the growing prevalence of infectious disease diagnosis coupled with the increasing dependency on automation to speed up diagnostic results. Moreover, technological innovations such as molecular diagnostics, AI-driven data analysis, and integrated automation platforms can boost its adoption in clinical laboratories.

The biopharmaceutical production segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment is owing to the increasing adoption of innovative technologies, including AI-driven analytics, real-time monitoring systems, and high-throughput microbial detection platforms, which decrease human intervention and optimize workflows by reducing errors.

- In August 2024, Burkina Faso built its first pharmaceutical production plant, specializing in the production of generic drugs, which was visited on Tuesday by Prime Minister Albert Ouédraogo. Built by actors of the Burkinabe private sector and named Propharm, this factory was erected on 1.5 hectares in the commune of Komsilga, on the outskirts of the capital Ouagadougou.

End-Use Insights

In 2024, the hospitals and diagnostic laboratories segment led the automated microbiology market by holding the largest share. The dominance of the segment is due to the increasing concerns over antimicrobial resistance and the growing prevalence of infectious diseases. Furthermore, automation improves efficiency by reducing errors, minimizing manual workload, and enhancing turnaround times for important tests.

The pharmaceutical and biotechnology companies segment is anticipated to grow at the fastest rate during the projected period. The growth of the segment can be linked to the increasing need for strict microbial quality control, regulatory compliance in drug manufacturing and development, and contamination detection. Also, automation improves testing precision, decreases human errors, and fuels microbial identification.

Automated Microbiology Market Companies

- BD

- QIAGEN

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Danaher

- Merck KGaA

- bioMérieux

- Abbott

- DiaSorin S.p.A.

- BioRad Laboratories, Inc.

Latest Announcement by Market Leaders

- In February 2025, QIAGEN announced the official opening of a new data center in Melbourne, Australia, designed to strengthen its global bioinformatics leadership position in this region of the world. This latest addition reflects QIAGEN's ongoing commitment to enhance its bioinformatics data infrastructure.

- In January 2025, Diatech Pharmacogenetics announced an expansion of its collaboration with Merck Serono Middle East Ltd., affiliates of Merck KGaA ("Merck"). The collaboration aims to improve patient access to RAS biomarker testing in Middle East and Africa. Targeted therapy against cancer may be used in combination with chemotherapy for patients with specific genetic mutations, such as KRAS, BRAF, and NRAS mutations.

Recent Developments

- In January 2024, Rapid Micro Biosystems, Inc. announced that Samsung Biologics has chosen the Growth Direct platform to automate its microbial quality control processes, enhancing efficiency, strengthening data integrity, and enabling scalable quality control operations.

- In November 2023, London Health Sciences Centre (LHSC) and St. Joseph's Heath Care London (St. Joseph's) unveiled the installation of a Total Laboratory Automation (TLA) system within the clinical microbiology laboratory. The TLA system is the first of its kind to be installed in the world, making London an international flagship site for innovation in clinical microbiology.

- In January 2023, BD (Becton, Dickinson, and Company) launched a robotic track system for its BD Kiestra microbiology laboratory solution, designed to automate specimen processing, potentially minimizing manual effort and reducing result turnaround time.

Segments Covered in the Report

By Product

- Instruments

- Automated Microbial Identification Systems

- Automated Blood Culture Systems

- Automated Colony Counters

- Automated Sample Preparation Systems

- Automated Antibiotic Susceptibility Testing (AST) Systems

- Other Instruments

- Reagents and Kits

- Culture Media

- Stains and Dyes

- Assay Kits and Panels

- Others

- Software

By Automation Type

- Fully Automated

- Semi-Automated

By Application

- Biopharmaceutical Production

- Clinical Diagnostics

- Environmental and Water Testing

- Food and Beverage Testing

- Other Applications

By End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Academic and Research Institutes

- Other End Use

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting