What is the Automotive Cybersecurity Market Size?

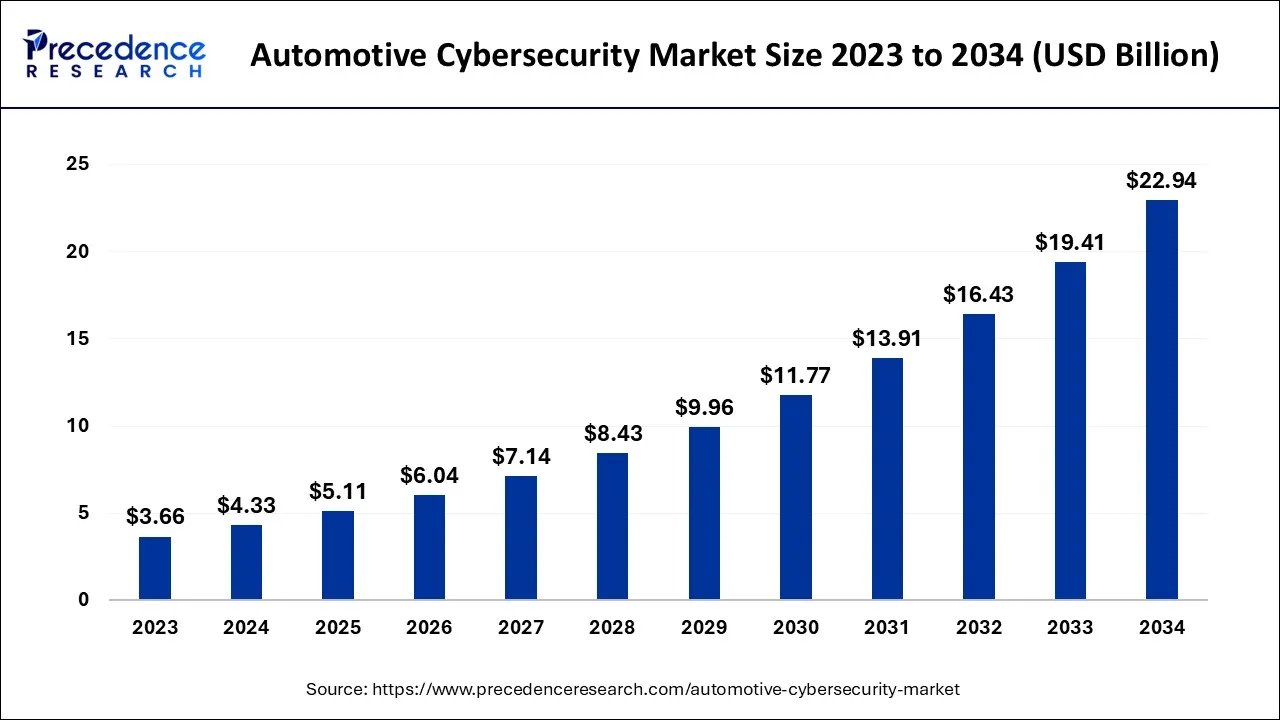

The global automotive cybersecurity market size was estimated at USD 5.24 billion in 2025 and is predicted to increase from USD6.04 billion in 2026 to approximately USD21.11 billion by 2035, expanding at a CAGR of 14.95% from 2026 to 2035.

Automotive Cybersecurity Market Key Takeaways

- In terms of revenue, the market is valued at $5.24 billion in 2025.

- It is projected to reach $21.11 billion by 2035.

- The market is expected to grow at a CAGR of 14.95% from 2026 to 2035.

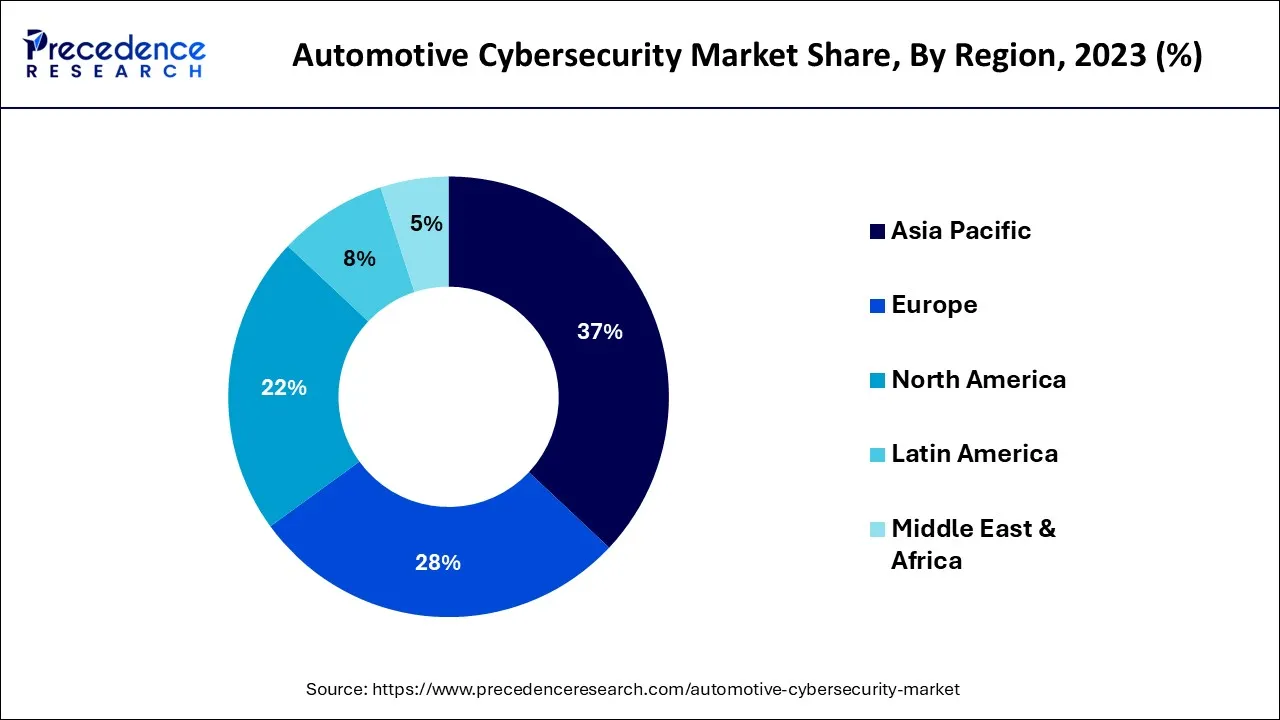

- North America dominated the global market with the largest market share of 36.80% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 16.4% during the period.

- By security type, the network security segment captured a significant market share of 26.39% in 2025.

- By security type, the application security segment is expected to grow at a solid CAGR of 15.9% during the forecast period.

- By application, the advanced driver assistance systems (ADAS) segment accounted for the highest market share of 25.10% in 2025.

- By application, the powertrain systems segment is expected to grow at a notable CAGR of 15.7% during the forecast period.

- By offering, the services segment has held a major market share of 54.08% in 2025.

- By offering, the software segment is expected to grow at a notable CAGR of 15.1% during the forecast period.

- By vehicle type, the passenger cars segment generated the major market share of 43.18% in 2025.

- By vehicle type, the electric vehicles (EVs) segment is expected to expand at a solid CAGR of 16.2% during the forecast period.

- By security layer, the in-Vehicle network security segment contributed the highest market share of 40.43% in 2025.

- By deployment, the Embedded segment captured the biggest market share of 63.51% in 2025.

- By deployment, the cloud-based segments are expected to grow at a notable CAGR of 15% during the forecast period.

- By communication channel, the vehicle-to-vehicle (V2V) segment generated the major market share of 31.61% in 2025.

- By communication channel, the In-Vehicle Communication (CAN, LIN, Ethernet, etc.) segments are expected to grow at a notable CAGR of 15.8% during the forecast period.

- By end-user, the automotive OEMs segment has held the largest market share of 49.62% in 2025.

- By end-user, the tire 1 and tire 2 suppliers' segment is expected to grow at a notable CAGR of 15.1% during the forecast period.

Market Overview

Automotive cybersecurity is a programme that guards against unauthorized access, damage, assaults, and other wrongdoing on internet-connected automobiles, automotive communication systems, users, and data. Today's cars can connect to the internet, giving them increased independence, improved communication capabilities, and mobility sharing capabilities. Cars can now transmit data to both their makers and consumers, despite the fact that this better connection has left them more susceptible to hacks.

All contemporary vehicles include electronic brake, accelerator, control, engine, steering, and security system controls, making it easy for hackers to remotely commandeer the vehicle. Also, there can be a security issue with connected intelligent security systems for cars. Moreover, cybersecurity solutions for data protection are required by a number of governmental rules and regulatory frameworks. The need for automotive cybersecurity has grown as a result of the industry's increasing demand for cybersecurity.

Automotive Cybersecurity Market Growth Factors

The market for automotive cybersecurity is expanding as a result of rising demand for automotive cybersecurity solutions brought on by a rise in cyberattacks on the car industry. Cybercrime is on the rise, and it is anticipated that customer comprehension of information security will result in lucrative business opportunities. As a result, owners and organisations are urged to put automotive cybersecurity safeguards in place, which is what propels the sector.

The development of connected cars and the enforcement of vehicle data security regulations by regulatory bodies are expected to fuel further market expansion.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 21.11 Billion |

| Market Size in 2025 | USD 5.24 Billion |

| Market Size in 2026 | USD 6.04 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 14.95% |

| Largest Market | North America |

| Fastest Growing | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Security Type, Vehicle Type, Application, Form and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increased use of electronics per vehicle and growing number of connected cars

The weight of a car has been decreased because to electrification. As a result, the need for electronics in the automotive industry has dramatically increased. The increasing use of electronics has made vehicles more vulnerable to cyberattacks.

The electronic components used in telematics, infotainment, engine, body, communication, and advanced driver assistance systems (ADAS) systems, among other purposes, might be the subject of cyberattacks. As a result, parties with an interest in providing trustworthy electronic platforms for autos have started to invest in cybersecurity technology.

Due to the increase in car connectivity, a vehicle is becoming increasingly susceptible to hackers. The complexity of in-vehicle applications is growing as more ECUs and software with 30 to 40 million lines of code are used. Each line of software code needs to be secure.

By 2024, a sizable majority of new cars, according to industry estimates, will be network connected. Several OEMs and security solution providers are acting to mitigate cyber dangers. Yet, no guarded architecture will ever offer unwavering security over the long run. Security codes must be used regularly in connected vehicles as a result. Manufacturers are focusing on lowering the possibility of security flaws and strengthening software updates as a result. As a result, the market for automotive cybersecurity is anticipated to grow in the next years as the number of connected cars increases.

- In January 2025, NVIDIA announced that its autonomous vehicle (AV) platform, NVIDIA DRIVE AGX™ Hyperion, has passed industry-safety assessments by TÜV SÜD and TÜV Rheinland, two of the industry's foremost authorities for automotive-grade safety and cybersecurity. This achievement raises the bar for AV safety, innovation, and performance.

Restraint

Growing complexity in vehicle electronic system

Due to the increased demand for vehicle safety in terms of accident avoidance, driver safety, and sophisticated communication & data safety, electronic driver aid systems are becoming more and more necessary (parking, speed regulation, lane assist, blind spot detection, pre-collision warning, etc.). Because of this, automotive electronic designs are now more complicated, which makes it simpler for hackers to attack a car. Also, there is a desire for modern infotainment systems and comfort features like automatic cooling, memory-assisted seat adjustment, automated tailgate opening, and performance control.

The software in a modern, high-end car currently has 100 million lines of code (greater than Windows 7 and Boeing 787). There are several lines of code because of the potential for a Man in the Middle attack during an over-the-air software upgrade. As a result of the physical hardening of the hardware and more intricate software solutions needed to solve these problems, OEM implementation costs will rise, slowing the market's growth momentum.

Opportunity

Introduction of electric vehicle wireless battery management system

For OEMs worldwide, the introduction of wireless battery management systems (wBMS) has opened a sizable Return on Investment (ROI) possibility. For the next generation of EVs, wBMS can reduce the volume of battery packs by up to 15% and up to 90% of the wiring. In addition, the battery life span is extended with this new system.

As a result, it is essential that the wireless power pack management system maintain a strict security procedure. General Motors and Analog Devices, Inc. (Analog) partnered to deploy Analog's wBMS in its Ultium battery platform once the company debuted its wBMS in 2020.

By integrating all integrated circuits, hardware, and software for power, battery management, RF communication, and system functions into a single system-level product that supports ASIL-D safety and module-level security, the new wBMS expands on the company's well-established, leading-industry BMS battery cell measurement technology. As a result of the expanding use of wBMS, it is projected that the demand for cybersecurity solutions in the global automotive industry would rise.

In August 2024, FPT Software and VinCSS partnered to offer automotive security solutions to OEMs and Tier 1 suppliers, combining resources, expertise, and networks to meet global industry standards.FPT Software will integrate VinCSS's solutions into its existing products and services to enhance its cybersecurity capabilities, according to an MoU between the companies.

Segment Insights

Security Type Insights

How did the Network Security Segment Dominate the Market in 2025?

The network security segment held the largest share of the market in 2025, due to its properties, such as the ability to protect the communication between two electronic components in the vehicle. By ensuring that hackers cannot access and control vehicles' systems through any devices, the network security segment gained immense industry attention in recent years.

The application security segment is expected to grow at a notable rate during the forecasted timeframe due to the increasing number of vehicles equipped with software-based systems, such as remote diagnostics, infotainment, and others. These apps can rise as the entry point for hackers in the coming years, which is likely to lead to application security segment growth in the coming years.

Automotive Cybersecurity Market Revenue, By Security Type, 2022-2024 (USD Million)

| By Security Type | 2022 | 2023 | 2024 |

| Network Security | 911.2 | 1,044.5 | 1,202.8 |

| Endpoint Security | 711.7 | 808.7 | 923.1 |

| Application Security | 543.5 | 621.9 | 714.8 |

| Wireless Security | 423.4 | 480.0 | 546.5 |

| Cloud Security | 327.2 | 370.1 | 420.5 |

| Hardware Security | 252.3 | 285.2 | 323.7 |

| Data Security | 189.2 | 213.8 | 242.7 |

| Others | 145.2 | 163.1 | 184.0 |

Application Insights

Why does the Advanced Driver Assistance Systems (ADAS) Segment Dominate the Market by Application?

The advanced driver assistance systems segment held the largest share of the automotive cybersecurity in 2025, owing to its unique properties such as they are directly linked to driving security, which includes sensors, cameras, and others. Also, these systems are essential for reducing accidents and securing them is the top priority for automakers these days.

On the other hand, the powertrain systems segment is expected to grow at a notable rate due to a sudden increase in the adoption of electric vehicles in recent years. As the powertrain is a highly digital system, which includes all the information such as the battery management, motor control, and others. As these systems are very crucial for vehicle performance, the security of these systems is expected to become the top priority in the coming years.

Automotive Cybersecurity Market Revenue, By Application, 2022-2024 (USD Million)

| By Application | 2022 | 2023 | 2024 |

| Telematics | 434.1 | 491.7 | 559.6 |

| Infotainment | 342.4 | 387.4 | 440.3 |

| Powertrain Systems | 683.5 | 780.4 | 895.2 |

| Advanced Driver Assistance Systems (ADAS) | 868.8 | 994.8 | 1,144.2 |

| Body Control and Comfort Systems | 206.3 | 233.4 | 265.3 |

| Communication Systems (V2X, V2V, V2I, etc.) | 495.3 | 565.3 | 647.9 |

| Battery Management Systems (BMS) | 259.9 | 293.8 | 333.6 |

| Over-the-Air (OTA) Updates | 213.3 | 240.4 | 272.2 |

Offering Insights

Why Did the Services Segment Dominate the Market in 2025?

The services segment dominated the market with the largest share in 2025, owing to several automakers are seen in depending on external experts for cybersecurity solutions in recent years. Moreover, these services can include risk assessment, software updates, and others. Also, the software and cybersecurity are becoming complex and rapidly updating; several companies are actively seeking professionals in the past few years.

On the other hand, the software segment is expected to grow at a notable rate, akin to the several vehicles being produced with the in-built software systems in recent years. Moreover, this software is seen as under the heavy need for a stronger cybersecurity system that secures all the systems in the coming years, as per the recent observation.

Automotive Cybersecurity Market Revenue, By Offering, 2022-2024 (USD Million)

| By Offering | 2022 | 2023 | 2024 |

| Hardware | 530.6 | 600.8 | 683.4 |

| Software | 1,214.3 | 1,380.1 | 1,575.6 |

| Services | 1,758.8 | 2,006.3 | 2,299.3 |

Vehicle Type Insights

The passenger cars segment held the largest share of the automotive cybersecurity market in 2025, akin to the greater adoption and the adoption smart features in recent years. Furthermore, these vehicles have advanced systems such as infotainment, ADAS, and internet connectivity, where cybersecurity has played a major role in the past few years.

The electric vehicles segments are expected to grow at a notable rate owing to the increasing demand in developed regions and the increasing sustainability initiatives globally. Also, having very advanced software systems which control the whole car, requires a stronger and reliable cybersecurity system in the coming years, as per recent industry observations.

Automotive Cybersecurity Market Revenue, By Vehicle Type, 2022-2024 (USD Million)

| By Vehicle Type | 2022 | 2023 | 2024 |

| Passenger Cars | 1,515.7 | 1,723.3 | 1,968.0 |

| Light Commercial Vehicles (LCVs) | 855.2 | 970.8 | 1,107.1 |

| Heavy Commercial Vehicles (HCVs) | 397.0 | 449.2 | 510.5 |

| Electric Vehicles (EVs) | 735.7 | 843.9 | 972.6 |

Security Layer Insights

The in-vehicle network security segment held the largest share of the market in 2025, due to its ability to secure the internal data flow between the various car systems, such as braking strengthening, engine control, and others. Moreover, modern vehicles have various control units, and the need for in-vehicle network systems can be increased.

The sensors' level security segment is expected to grow at a notable rate during the predicted timeframe due to increasing adoption of vehicles such as electric vehicles and others, where all the control comes from the sensors. For the security of these sensors, the sensors' level security segment can gain immense industry attention in the coming years, as per industry expectations.

Automotive Cybersecurity Market Revenue, By Security Layer, 2022-2024 (USD Million)

| By Security Layer | 2022 | 2023 | 2024 |

| On-Board Security | 270.1 | 304.5 | 344.9 |

| External Cloud/Network Security | 343.6 | 388.3 | 440.9 |

| Gateway Security | 465.0 | 526.3 | 598.4 |

| In-Vehicle Network Security | 1,401.3 | 1,603.3 | 1,842.8 |

| Sensor-Level Security | 868.7 | 991.3 | 1,136.3 |

| Application-Level Security | 155.0 | 173.5 | 195.0 |

Deployment Insights

The embedded segment held the largest share of the automotive cybersecurity market in 2025, primarily due to the widespread integration of hardware-based security solutions directly into vehicle systems. Embedded cybersecurity involves built-in hardware components such as secure gateways, trusted platform modules (TPMs), and electronic control units (ECUs), which are essential for real-time protection of critical vehicle functions.

The cloud-based segment is projected to grow at the fastest rate during the forecast period, driven by the increasing adoption of connected and autonomous vehicles that rely heavily on remote data access and over-the-air (OTA) updates. Cloud platforms enable centralized threat detection, real-time monitoring, and scalable security management across vehicle fleets. They also support rapid response to emerging vulnerabilities without requiring physical recalls or dealership visits.

Communication Channel Insights

The vehicle-to-vehicle (V2V) segment dominated the market with the largest share in 2025, because it enables cars to exchange safety data like speed, position, and road conditions. This helps prevent accidents and improve traffic flow. However, since this data is shared wirelessly, it's vulnerable to hacking or tampering. Ensuring the security of V2V communication has been a major focus for automakers and regulators.

On the other hand, the vehicle-to-infrastructure (V2I) segments are expected to grow at a notable rate as smart cities and intelligent transport systems develop. V21 allows vehicles to connect with traffic lights, road signs, and parking systems. This helps manage traffic, reduce congestion, and improve road safety. However, this communication also creates cybersecurity risks. Hackers could manipulate signals or access vehicle data.

End-User Insights

The automotive OEM's segment held the largest share of the automotive cybersecurity market in 2025, because they are responsible for designing and building the vehicle, including its digital systems. To ensure the safety and reliability of their vehicles, OEMs invest heavily in cybersecurity solutions during the development phase. Many governments also require OEMs to meet strict cybersecurity standards.

On the other hand, the tire 1 and tire 2 suppliers' segment is expected to grow at a notable rate because they provide the core components, sensors, and software that make up the vehicle's digital systems. As vehicles become more complex and modular, automakers are relying more on suppliers to deliver pre-secured and tested systems. Cybersecurity is being built directly into hardware and software at the supplier level.

Regional Insights

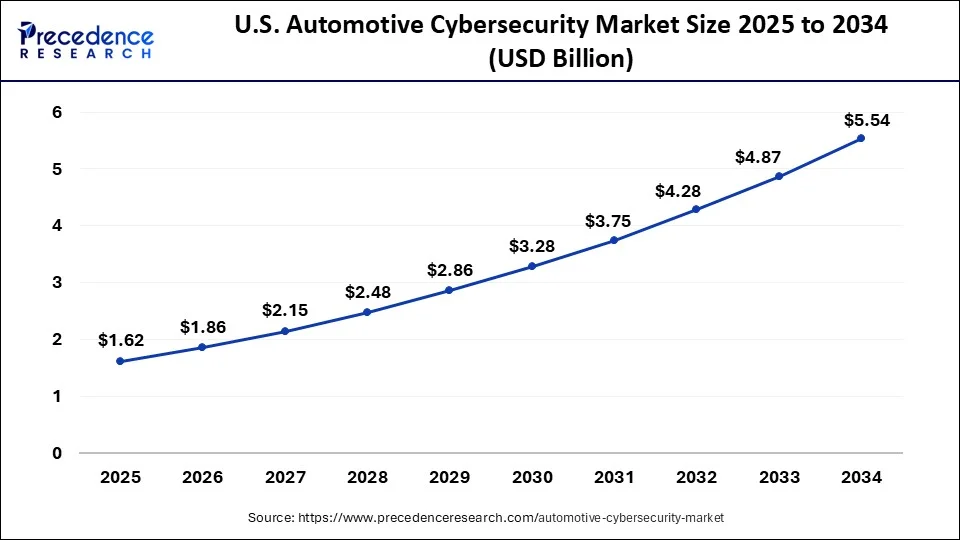

What is the U.S. Automotive Cybersecurity Market Size?

The U.S. automotive cybersecurity market size is exhibited at USD 1.62 billion in 2025 and is projected to be worth around USD 6.16 billion by 2035, growing at a CAGR of14.29% from 2026 to 2035.

North America dominated the global market. The market for automotive cybersecurity in North America will expand due to the widespread use of automatedpassenger vehicles. Due to the increased focus on reducing vehicle emissions, the automobile industry's focus has switched to hybrid vehicles, which are currently dominating the market.

In response to expanding environmental concerns, governmental organisations and environmental agencies are enforcing emission standards, regulations, and laws. This could push up the price of delivering electrical drivetrain components and energy diesel engines during the projection period.

In January 2025, VicOne, an automotive cybersecurity solutions leader, announced that it co-hosted with Trend Micro the world's largest zero-day vulnerability discovery contest in Tokyo. Top-tier security researchers performed real-world testing on innovative automotive technologies, all within Trend Micro's proven Zero Day Initiative (ZDI) platform, the world's largest vendor-agnostic bug bounty program.

Asia Pacific is anticipated to continue expanding over the course of the projection. The number of cyberattacks has been rising steadily across APAC. Yet, a lack of security measures and the rising popularity of work-from-home policies have led to a rapid increase in cyberattacks. The two most prevalent kinds of cyberattacks are malware and ransomware assaults.

The number of malware and ransomware attacks in APAC nations is still 1.6 times greater than worldwide. During 2018, ransomware assaults have increased in frequency across the globe. Cyberattacks on the auto industry have become more frequent as connected cars and digitization have proliferated. These attacks target the car and compromise crucial vehicle data, causing owners to incur significant losses.

Europe: Regulation-Led Automotive Cybersecurity Adoption

Europe continues to be the most important destination for cybersecurity solutions due to the high number of regulatory requirements placed on manufacturers, in addition to the presence of world-class automotive manufacturers, along with an early adopter environment for secure-by-design vehicles.

Germany continues to experience the highest levels of growth in cybersecurity as it has a strong original equipment manufacturer (OEM) presence in addition to a rapidly growing requirement for the integration of cybersecurity across all premium and electric vehicle platforms.

Latin America: An Emerging Market for Connected Vehicle Protection

As connected vehicles, telematics systems, and the growing number of companies utilizing digital fleet management are increasing cybersecurity awareness in the Latin American market, automotive manufacturers and government organizations are slowly beginning to incorporate cyber resilience strategies and develop policies related to protecting data from vehicles.

Brazil continues to see some of the hottest growth in the connected mobility industry as connected mobility services are being introduced in both passenger and commercial vehicle segments.

Middle East & Africa: Growing Momentum for Smart Mobility Security

With the advancement of many smart city initiatives, advancements in connected infrastructure, and the increasing demand for luxurious and electric vehicles that utilize complex cybersecurity solutions, the Middle East and Africa region is becoming increasingly competitive.

The United Arab Emirates (UAE) is emerging as one of the more dominant growth areas due to its commitment to developing Intelligent mobility and digital transportation ecosystems.

Value Chain Analysis of the Automotive Cybersecurity Market

- Secure Automotive Hardware Enablement: This phase concentrates on integrating cybersecurity at the chip and hardware level, including secure microcontrollers, in-car GWs, and trusted execution environments.

Key Players: NXP Semiconductors, Infineon Technologies, and Renesas Electronics. - Automotive Cybersecurity Software Development & Testing: Software-based solutions for security, including intrusion detection systems, secure boot, encrypted OTA updates, and threat modelling platforms, are an important component in securing vehicles.

Key Players: Argus Cyber Security, GuardKnox, and Upstream Security. - Managed Security Services & Post-Deployment Monitoring: This area provides vehicle threat monitoring and incident response in real-time, compliance management, and fleet-wide cybersecurity analytics.

Key Players: Bosch, Harman International, and Continental AG.

Automotive Cybersecurity Market Companies

- Sheelds: Focuses on cloud-based cybersecurity and monitoring specifically tailored for heavy commercial vehicle fleets and buses.

- Vector Informatik GmbH: Provides a comprehensive suite of embedded security modules (MICROSAR HSM), testing tools, and consulting services for automotive software architectures.

- NXP Semiconductors N.V.: Delivers security at the chip level through dedicated hardware security modules (HSM) and secure enclaves integrated into automotive microcontrollers and processors.

- Harman International: Features the HARMAN SHIELD platform, which provides multi-layered protection including intrusion detection (IDPS) and a dedicated cybersecurity analysis center.

- Broadcom Inc.: Supplies secure automotive Ethernet switches and communication hardware designed to protect high-speed vehicle data networks from unauthorized access.

- Denso Corporation: Develops holistic defense-in-depth systems that focus on secure gateways and robust authentication for external vehicle connections.

- Honeywell International, Inc.: Offers security software that monitors vehicle communication networks for anomalies and prevents the execution of unauthorized commands.

- Continental AG: Provides end-to-end security solutions through its subsidiaries, focusing on intrusion detection systems and secure over-the-air (OTA) update management.

- Guard Knox Cyber-Technologies Ltd.: Utilizes a deterministic "Communication Lockdown" methodology derived from aviation tech to protect vehicle ECUs without requiring constant signature updates.

- Robert Bosch GmbH: Offers a full lifecycle security portfolio through its subsidiary ETAS (ESCRYPT), ranging from embedded security middleware to specialized security operations centers.

Recent Developments

- In March 2025, NXP Semiconductors announced a collaboration with Clavister to explore AI-driven cybersecurity applications in the automotive industry. This collaboration coincides with new UN regulations, highlighting the need for advanced cybersecurity in vehicles.

- In March 2024, the University of Windsor's SHIELD Automotive Cybersecurity Centre of Excellence and Block Harbor, an automotive cybersecurity firm, announced that they are collaborating to offer students hands-on learning opportunities with real-world test cases.

- In February 2024, AutoCrypt, a company specializing in automotive cybersecurity and smart mobility technology, unveiled AutoCrypt CSTP, a comprehensive cybersecurity testing platform. This platform is specifically designed to facilitate integrated cybersecurity testing for vehicle type approval, in alignment with UNECE's Regulations 155/156 and SAC's GB and GB/T standards.

- In October 2022,Denso Company and NTT Communications Corporation announced the creation of the vehicle security operation centre (VSOC) in response to the growing cyber risks against automobiles.

- The next generation of vehicles will have powerful network management systems due to the launch of the EB zoneo SwithCore Shield pre-integrated solution in September 2022 from Argus Cyber Security Ltd. and Elektrobit.

Segments Covered in the Report

By Security Type

- Network Security

- Endpoint Security

- Application Security

- Wireless Security

- Cloud Security

- Hardware Security

- Data Security

- Others

By Application

- Telematics

- Infotainment

- Powertrain Systems

- Advanced Driver Assistance Systems (ADAS)

- Body Control and Comfort Systems

- Communication Systems (V2X, V2V, V2I, etc.)

- Battery Management Systems (BMS)

- Over-the-Air (OTA) Updates

By Offering

- Hardware

- Secure Control Units

- Hardware Security Modules (HSM)

- Trusted Platform Modules (TPM)

- Software

- Intrusion Detection Systems (IDS)

- Intrusion Prevention Systems (IPS)

- Firewall & Antivirus Software

- Encryption/Decryption Tools

- PKI & Certificate Management

- Post-Quantum Cryptographic Libraries

- Services

- Professional Services

- Consulting

- Integration & Deployment

- Training & Education

- Managed Security Services

- Security Monitoring & Operations

- Managed Threat Detection & Response (MDR)

- Incident Response & Forensics

- Threat Intelligence Management

- Compliance Management

- Patch & Vulnerability Management

- Identity & Access Management (IAM) as a Service

- Secure Configuration & Policy Management

- Professional Services

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Vehicles (EVs)

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

By Security Layer

- On-Board Security

- External Cloud/Network Security

- Gateway Security

- In-Vehicle Network Security

- Sensor-Level Security

- Application-Level Security

By Deployment

- On-Premises

- Cloud-Based

- Embedded

By Communication Channel

- Vehicle-to-Vehicle (V2V)

- Vehicle-to-Infrastructure (V2I)

- Vehicle-to-Everything (V2X)

- In-Vehicle Communication (CAN, LIN, Ethernet, etc.)

- Cellular & Satellite

By End-User

- Automotive OEMs

- Tier 1 and Tier 2 Suppliers

- Mobility Service Providers

- Fleet Operators

- Regulatory & Standards Organizations

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting