What is Automotive Software Market Size?

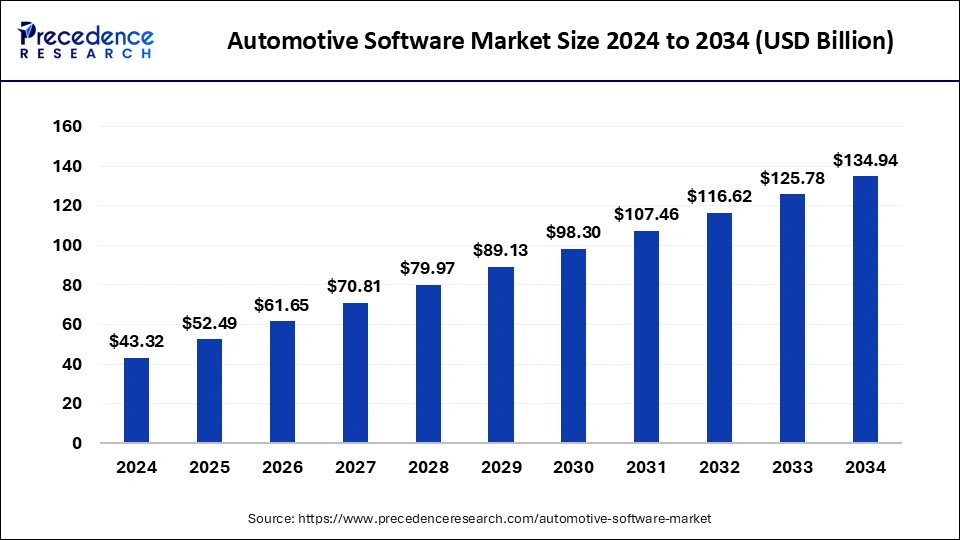

The global automotive software market size was calculated at USD 52.49 billion in 2025 and is predicted to increase from USD 61.65 billion in 2026 to approximately USD 144.1 billion by 2035, expanding at a CAGR of 10.63% from 2026 to 2035

Market Highlights

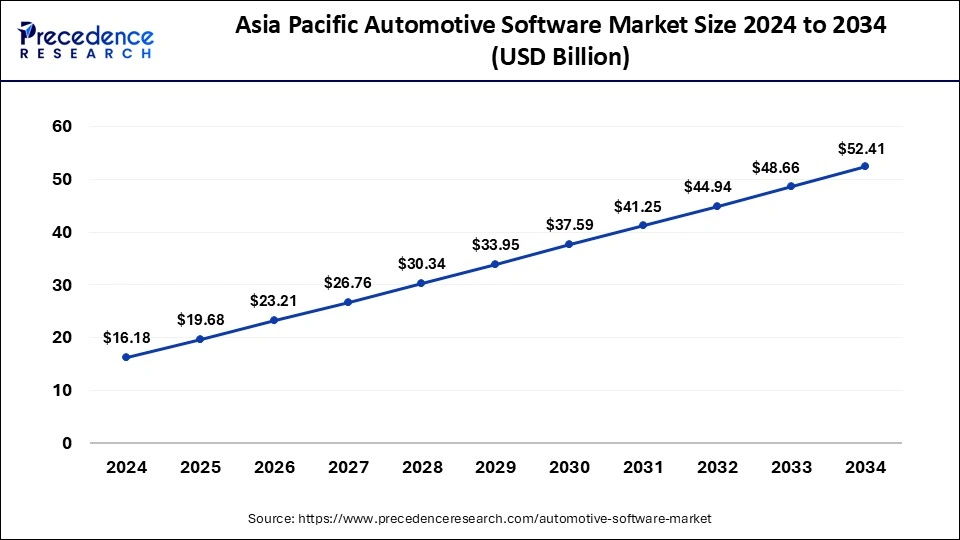

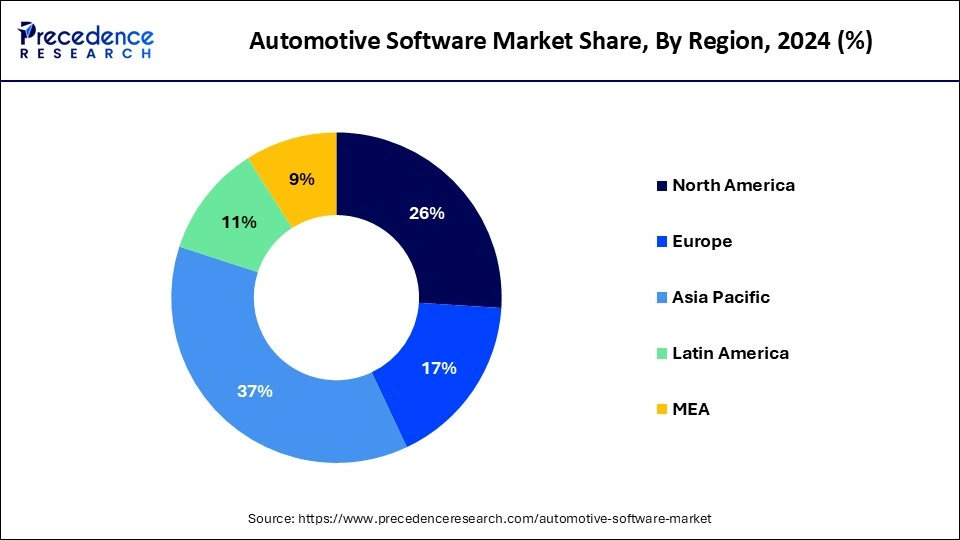

- Asia Pacific region has reached a revenue share of around 37.35% in 2025.

- The North America region is growing at a CAGR of 13.46% over the forecast period.

- By software, the autonomous driving segment is projected to experience the highest growth rate in the market between 2026 to 2035

- By vehicle type, the passenger cars segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By application, the infotainment and instrument cluster segment is set to experience the fastest rate of market growth from 2026 to 2035

- By deployment, the on board (edge) segment maintained a leading position in the market in 2025.

- By deployment, the cloud based segment is projected to expand rapidly in the market in the coming years.

How AI will stimulate the Growth of the Automotive Software Sector?

In the automotive software market, artificial intelligence plays a central role transforming how vehicles operate, interact with drivers, and evolve over time. AI is the backbone of autonomous driving their surroundings through sensor fusion, interpret complex traffic situations, and make split second driving decisions. It processes massive streams of data from cameras, LiDAR, radar, and ultrasonic sensors, applying deep learning models to detect objects, predict their movements, and plan safe navigation routes. Beyond self-driving, AI revolutionizing predictive maintenance by analysing vehicle performance data in real time to detect early signs of component wear or failure, reducing downtime and improving safety.

In infotainment and personalization, AI algorithms tailor navigation routers, recommended entertainment options, and adapt climate and seat settings to user preferences, creating and sear setting to user preferences, creating a more engaging and customized driving experience. In the manufacturing and software update cycle, AI also supports automated testing and quality assurance, drastically reducing the time required to identify bugs, optimize code, and push over the air updates. Additionally, in connected and software-defined vehicles, AI facilitates voice assistants that understand natural language, enabling drivers to interact with vehicle systems more intuitively.

What is the Automotive Software Industry Capable of?

A collection of programmable instructions which are used in performing various operations of the in-vehicle applications, which are computer based are known as the automotive software. These softwares are used for the embedded systems of the vehicles. Infotainment, body control, comfort and telematics are some of the applications that make use of the software. Advanced Driver Assistance Systems (ADAS), safety and communication, or other applications that make use of the automotive software. The growing need for communication between the cars is expected to boost the automotive software market in the coming years and the popularity of such applications has increased in the recent years.

The manufacturers of the automotive's are constantly engaged in incorporating the automotive softwares which help in providing more convenience and utility to the customers. The demand for advanced technologies has grown to a great extent in the recent years. The increasing demand for autonomous vehicles among the people has emerged as a major growth factor for the automotive software as it provides the necessary integration which helps to connect the entire vehicle to a single system that is able to manage the functioning and balance of the vehicle.

The use of telematics in the automotive software has enabled the companies to track the current status of the vehicles which helps to provide a better service to the consumers and also takes care of the current condition of the vehicle. This has proved to be a beneficial factor for the automotive industry as it reduces the maintenance cost of the vehicle. Skilled professionals are required in the automotive industry to manage the functioning of these softwares that helps to maintain the smooth functioning of the industry.

Introduction of many new market players in the automotive industry after the emergence of the electronic vehicle segment has proved to be a major driving force for the automotive software market as these vehicles use a single integrated system to connect the entire vehicle with the real time data of weather and road conditions that assists the vehicle to function smoothly and hence provides the potential consumers with a premium experience.

Automotive Software Market Growth Factors

Increased use of the innovative technologies and the introduction of innovative technologies that provide advanced user interface are expected to help in the growth of the market in the coming years. The increased use of the ADAS feature will also help in the growth of this software market in the coming years. The increased use of artificial intelligence will prove to be a boon for the growth of the market during the forecast period. The introduction of the 5G technology is expected to provide greater potential for the growth of the market in the coming years.

Artificial intelligence is used in the autonomous as well as the semi-autonomous vehicles. The revenue in the automotive sector has grown to a great extent as many opportunities are provided to the stakeholders due to the increased use of softwares in the automotive's. The demand for connected cars has also increased in the recent years and provided major opportunities for growth. Autonomous driving is another feature that is in great demand and this will also provide major opportunities for the growth of the market in the coming years and provide larger revenues to the market players.

- Recent innovations that have taken place in the field of technology

- Increasing demand for ADAS feature

- Increasing demand for artificial intelligence

- Introduction of 5G technology

- Demand for connected cars

- Demand for autonomous driving system

Market Outlook

- Start-up Ecosystem: The start-ups in automotive software are growing mainly in the software-defined Vehicles (SDVs) domain, specifically aiming at user interfaces, cybersecurity, and OTA updates. The most popular startups, such as May Mobility and Applied Intuition defines the demand for ADAS. This ecosystem is also blooming in charging infrastructure and Battery Management Systems (BMS). The valid and significant investment has accelerated the R&D process for automotive software, paving more workforce and projects in line.

- Industry Growth Overview: Industry growth is at its peak with the growing electric vehicle force and demand for spectacular and supportive software. For a better car experience, the vehicle industries are equipping digital cockpits and infotainment, which accelerated the demand for advanced and impressive features associated with automotive software to support AR-inspired navigation and AI-sponsored voice assistant features.

With the computerized vehicles, the industry is speeding up and investing more in the software line to compete in the long run. The regulatory framework is the security for the industry giants and a guidance to automotive software. The industries are also investing largely in autonomous technology.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 52.49 Billion |

| Market Size in 2026 | USD 61.65 Billion |

| Market Size by 2035 | USD 144.1 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.63% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Application, Vehicle Type, Software Layer, EV Application, Offering, Organization Size and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

- Increasing demand for connected cars - The segment of connected cars has observed a huge demand from the global market which makes use of advanced software systems that manage the entire functioning and handling of the car along with the assistance provided by artificial intelligence. This has emerged as a major driving force for the growth of the automotive software market when is expected to most the economy further.

- Emergence of new market players - Various new market players have emerged in in the automotive sector after the introduction of from the electric segment which has seen a tremendous demand from the recent market. A huge number of people who are opting for the technologically advanced options available in the automobile segment has boosted the demand for smoother and better softwares which are user friendly and provide a great experience to the consumer.

Key Market Challenges

- Lack of infrastructural advancements - The development in the field of infrastructure is considerably on a slower side as compared to read once made by the automotive industry. This is creating a gap between the two sectors which or supposed to walk hand in hand with a view to obtain maximum benefits from the current market. The usage of smart technology and systems demands a better infrastructure which connects intelligently with the system and provides a seamless service to the end user. lack of advanced facilities hinders the growth of the market to a great extent.

- Lack of connectivity - Avanced navigation systems and applications have been introduced by the key market players according to the increasing demand experience from the market. These advancements need to be supported by a proper Internet connection which helps the system to function seamlessly. lack of development in the field of Internet connectivity has hampered the growth of the automotive software market to great extent. These reasons have emerged as the challenging factors for the growth of the market.

Restraints

As vehicles become more connected through cloud services, over the air updates, and vehicle to everything (V2X) communication, the attack surface for potential cyber threats grows substantially. Hackers targeting vehicle software could exploit Vulnerabilities to gain unauthorized access top safety critical systems, such as braking or steering, posing severe safety hazards. Automakers and software developers must invest heavily in advanced encryption, intrusion detection., and continuous monitoring systems to counter these risks. however, the cost and complexity of implementing robust cybersecurity measures specially across global supply chains can delay product rollouts and limit the speed of innovation. This ongoing security challenges not only increases development expanses but also raises concerns among regulators and consumers, slowing the pace of software adoption in vehicles.

Many automotive manufacturers still rely on legacy electronic control units (ECUs) and software often requires extensive reengineering, compatibility testing, and hardware upgrades. This process can be both time consuming and costly, particularly for established automakers with large back catalogues of models still in production. The fragmentation in software standards across different supplier further compounds the challenge, leading to integration bottlenecks and delayed features deployment. In some cases, the need to maintain backward compatibility limits the scope of software innovation, preventing manufacturers from fully leveraging modern, scalable architectures.

Opportunities

- Introduction of 5G - The introduction of 5G technology has emerged as a major development for the automotive software industry. Increasing demand for faster network connectivity with a view to provide maximum benefits to the end user as emerged as a major opportunity for the growth of the market. Advanced wireless connectivity options that are provided with the automotive software have provided a very premium experience to the consumers which is foreseen to emerge as a major opportunity for the market.

- Modern designs- A rapid evolution has taken place as far as the design of the software is concerned, which has attracted potential consumers on the basis of its aesthetic value. The younger generations are attracted to the modern designs that have been launched by the key market players which emerges as a major opportunity for the growth of the market. An increasing number of new market players in society has also boosted the growth of the market to a great extent.

Segment Insights

Application Insights

The infotainment and instrument cluster software segment is expanding quickly as vehicles transform into digital experience platforms. Touchscreen interfaces, voice-controlled assistants, seamless smartphone integration, and high-resolution digital displays are becoming standard expectations for drivers and passengers. Automakers are focusing on creating intuitive, customizable, and connected interfaces that integrate navigation, entertainment, and vehicle diagnostics. With increasing competition, brands are using infotainment systems as a key differentiator, incorporating app ecosystems, streaming services, and AI-powered recommendations to deliver a more engaging and personalized in car experience.

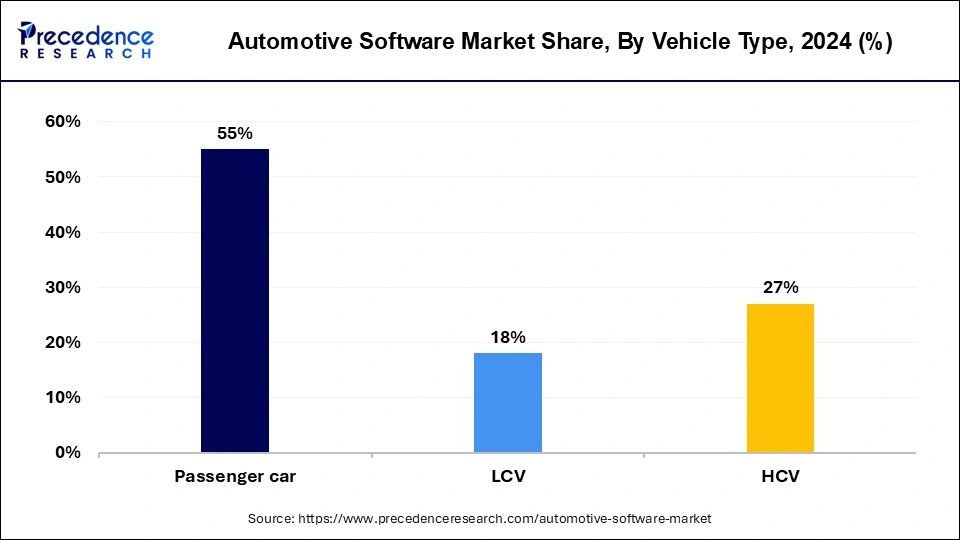

Vehicle Type Insights

Passenger cars are emerging as the fastest growing category for automotive software adoption due to the rapid integration of digital features and connected technologies. Modern consumers are seeking vehicles that deliver not only transportation but alsoEnhanced infotainment, personalized comfort settings, and advanced driver assistance systems. Automakers are responding by embedding sophisticated software solutions that enable over-the-air updates, predictive maintenance, and real time navigation. Additionally, the growing popularity of electric passenger cars is further boosting software demand, as these vehicles rely heavily on integrated control systems for battery management, energy optimization and performance enhancement.

Global Automotive Software Market Revenue, By Vehicle Type, 2022-2024 (USD Billion)

| By Vehicle Type | 2022 | 2023 | 2024 |

| Passenger car | 13.66 | 18.73 | 23.83 |

| LCV | 4.29 | 5.97 | 7.72 |

| HCV | 7.05 | 9.46 | 11.77 |

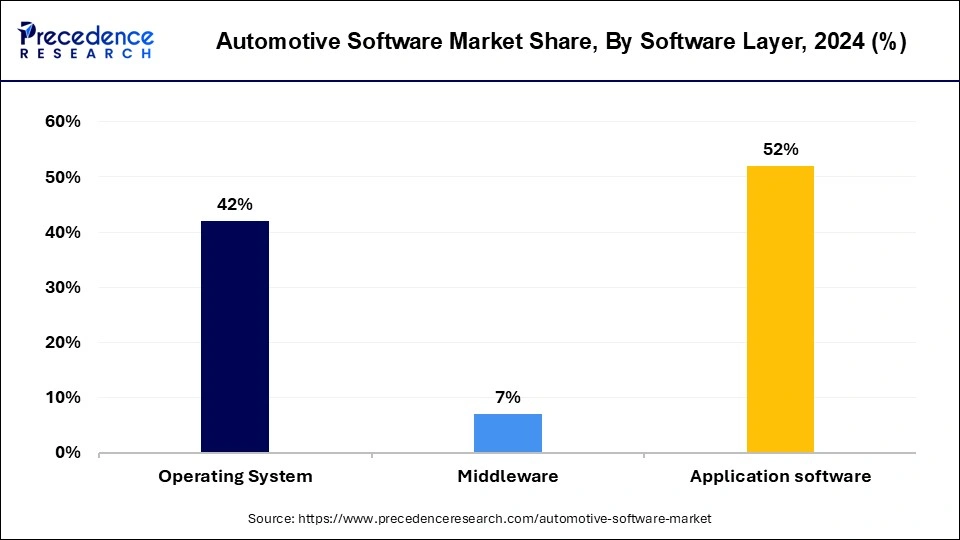

Software Layer Insights

The autonomous driving software segment is experience rapid momentum as automakers and technology companies push towards higher levels of vehicle autonomy. Advances in artificial intelligence, machine learning, sensor fusion, and high definition mapping are enabling safer and more reliable driver assistance systems. Governments in various regions are encouraging innovation through supportive policies and infrastructures investment, while consumers are increasingly receptive to features that reduce driver workload and enhance safety.

This combination of regulatory support, technological readiness and consumer demand is accelerating adoption, making autonomous driving software a focal point for future automotive innovation.

Global Automotive Software Market Revenue, By Software Layer, 2022-2024 (USD Billion)

| By Software layer | 2022 | 2023 | 2024 |

| Operating System | 10.52 | 14.30 | 18.03 |

| Middleware | 1.54 | 2.20 | 2.92 |

| Application Software | 12.94 | 17.66 | 22.37 |

Regional Insights

Automotive Software Market Size and Growth 2026 to 2035

The Asia Pacific automotive software market size was exhibited at USD 19.68 billion in 2025 and is projected to be worth around USD 56.14 billion by 2035, growing at a CAGR of 11.05% from 2026 to 2035.

On the basis of geography, the region of the Asia Pacific has emerged as the largest market up till now due to the increasing demand for advanced software and systems among the people. The rapid technological advancements that have been observed in this region are a major factor for the growing demand of automotive software. Increasing acceptance among the people for technological advancement has also boosted the demand for automotive software.

The region of North America has also emerged as a potential opportunity for the growth of the automotive software market. a huge demand is expected from the region of North America during the forecast period. The existence of the key market players and the rapid research and development programs carried out by them have emerged as a major growth factor for the growth of the automotive software market during the forecast period.

Europe's Core Advancements in the Automotive Software Industry

Europe's noteworthy advancements in this industry to date are solo European leaders, the supportive commission head, and popular automakers. The core potential of automotive software is tested and advanced at the giant companies. The regions ‘Vehicle of the Future' initiative involved massive investment to upgrade hardware and form quality software construction to befit in real time control and AI.

Alongside the European leaders are building their exclusive platforms, such as Neue Klasse, CARIAD, and MB.OS. Each of the automotive software promotes valuable updates and data alteration. With the transition into electronic/electrical infrastructure and choices, the demand for electronic control units (ECUs), along with robust computer are rising to achieve a systematic middleware.

How is Latin America contributing to the Automotive Software Sector?

Latin America's grip on connectivity, safe software, virtual testing, and convincing role in EV battery management. The region contributes largely to the largest segmental part of the sector, covering ADAS and connectivity. Following this, Brazil announced billion-dollar initiatives to regulate the unification of Head-Up Displays (HUD) and Advanced Driver Assistance Systems (ADAS).

Alongside, it also held software development courses to bolster connectivity to aim at smart navigation systems, Internet of Things (IoT) unification, and real-time data exchange. Latin America is growing into a leader in the virtual testing software industry, supporting R&D and startups with its AI model approach. This indirectly leverages the vehicle's safety measures and nature, promoting the performance of apt automotive software selection.

Recent Developments

- In August 2025, Tesla officially shuttered its in house Dojo supercomputer initiative, marking a notable shift in its autonomous driving AI strategy. The move, which included disbanding the Dojo team and losing several key executives, indicates a pivot away from building proprietary AI infrastructure toward relying more on external technology partners. This strategic decision comes challenges tied to Tesla's self-driving development.(Source: https://timesofindia.indiatimes.com)

- In August 2025, Lyft announced a strategic partnership with Baidu to roll out robotics across Europe, starting in the U.K. and Germany. The collaboration plans to bring Biadu's Apollo Go autonomous vehicle onto Lyft's platform, pending regulatory approvals. This move represents a significant expansion of robotaxi services beyond China and the U.S., signalling growing confidence in autonomous mobility across European markets. (Source: https://www.businessinsider.com)

Automotive Software MarketCompanies

- ATEGO SYSTEMS INC. (PTC)

- AUTONET MOBILE, INC.

- ADOBE

- AIRBIQUITY INC

- BLACKBERRY LIMITED

- GOOGLE (ALPHABET INC.)

- MONTAVISTA SOFTWARE, LLC

- GREEN HILLS SOFTWARE

- MICROSOFT CORPORATION

- WIND RIVER SYSTEMS, INC

Segments Covered in the Report

By Application

- ADAS & Safety Systems

- Body Control & Comfort System

- Powertrain System

- Infotainment System

- Communication System

- Vehicle Management & Telematics

- Connected Services

- Autonomous Driving

- HMI Application

- Biometrics

- Remote Monitoring

- V2X System

By Vehicle Type

- Passenger car

- LCV

- HCV

By Software Layer

- Operating System

- Middleware

- Application software

By EV Application

- Charging Management

- Battery Management

- V2G

By Offering

- Solutions

- Services

By Organization Size

- Large Scale Organizations

- Medium Scale Organization

- Small Scale Organization

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting