What is the Automotive Thermal Systems Market Size?

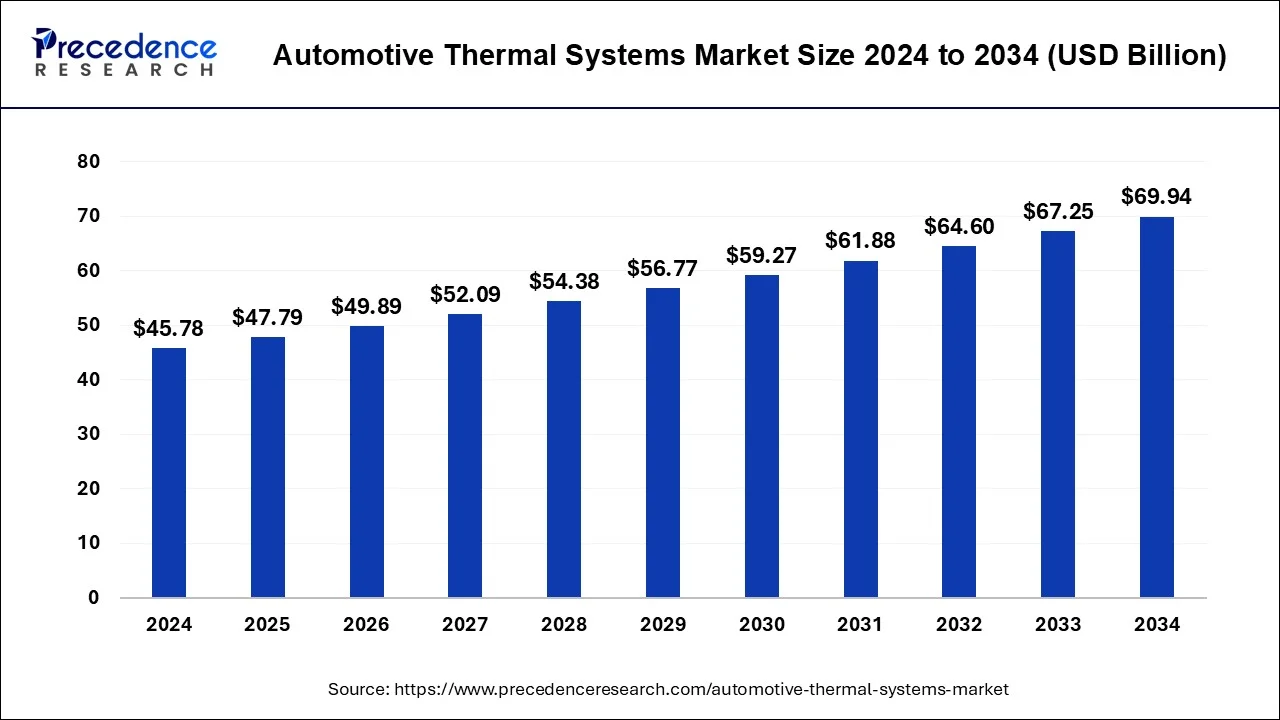

The global automotive thermal systems market size is calculated at USD 47.79 billion in 2025 and is predicted to increase from USD 49.89 billion in 2026 to approximately USD 72.60 billion by 2035, expanding at a CAGR of 4.27% from 2026 to 2035.

Automotive Thermal Systems Market Market Key Takeaways

- Asia Pacific dominated the moisture-curing adhesive market in 2025.

- By component, the compressor segment dominated the market in 2025.

- By component, the heating ventilation air conditioning segment is expected to grow rapidly in the market during the forecast period.

- By vehicle type, the passenger vehicles segment dominated the market in 2025.

- By vehicle type, the commercial vehicles simulation segment is anticipated to grow significantly in the market during the forecast period.

- By application, the waste heat recovery segment led the global market in 2025.

- By application, the seat segment is estimated to grow rapidly in the market during the fastest period.

Automotive Thermal Systems Market Growth Factors

The automotive thermal system regulates the temperature of the vehicle's primary components by using alternate engine block monitoring temperatures and reducing block monitoring temperatures and reducing temperature component variations. They improve fuel efficiency and are also utilized to give a variety of interior conveniences like as front and back air conditioning, and steering and seat warmth. These devices recycle waste heat, lowering carbon dioxide emissions in automobiles. The manufacturers of heavy automobiles or vehicles used in transportation, construction, and shipbuilding industries are among the automotive thermal system market's top purchasers.

With the advancement of automobile electronics and systems such as navigation, Heating Ventilation Air Conditioning (HVAC) systems, entertainment, and transmission, the demand for thermal systems in the automotive sector has grown dramatically during the projected period.

The automotive thermal systems market is predicted to develop due to severe emission regulations, growing demand for front and rear air conditioning, the use of turbo engines in commercial vehicles, and heated steering. In addition, the automotive thermal systems market is also predicted to rise due to the rising need for smart thermal systems in automotive and automobiles and the integration of thermal sensors in passenger cars.

On the other hand, the high cost of thermal system technology, as well as discrepancies in emission levels across nations, result in a lack of standardization, which is projected to stifle the automotive thermal system market expansion during the forecast period.

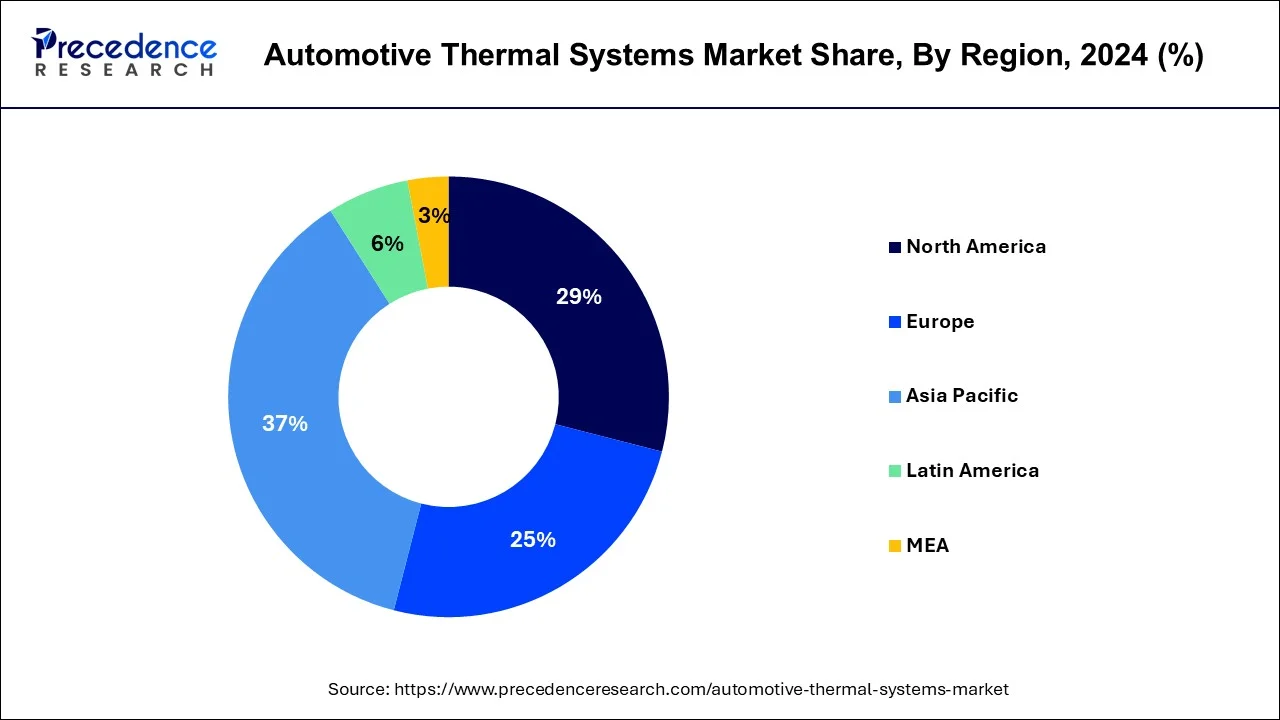

In the North America and Europe regions, where disposable income is higher, the automotive thermal systems are more often used. The Asia-Pacific region is expected to grow at a rapid pace during the forecast period. The second and third largest markets for automotive thermal systems, respectively, are the Europe and North America regions.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 72.60 Billion |

| Market Size in 2025 | USD 49.79 Billion |

| Market Size in 2026 | USD 49.89 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.33% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Vehicle, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

Based on the component, the compressor segment dominated the global automotive thermal systems market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. One of the primary factors driving the automotive thermal systems market expansion is the rising use of compressors in A/C systems to absorb the warm air inside the automobile's cabin.

The Heating Ventilation Air Conditioning (HVAC) segment is estimated to be the most opportunistic segment during the forecast period. The need for Heating Ventilation Air Conditioning (HVAC) systems has risen as customer's preferences for comfort have grown. The key market players are developing products that provide various additional benefits in addition to meeting the comfort needs of customers.

Vehicle Type Insights

Based on the vehicle type, the passenger vehicles segment accounted largest revenue share in 2024. The automotive thermal systems market is predicted to rise because to factors such as growing demand for ventilated seats, rear, and front A/C, and heated steering in passenger vehicles, as well as rising passenger vehicle sales in the Asia-Pacific region.

On the other hand, the commercial vehicles segment is estimated to be the most opportunistic segment during the forecast period. The increased per capita income and a higher standard of living are two significant factors driving the commercial vehicle sales in many countries.

Application Insights

Based on the application, the waste heat recovery segment leads the global automotive thermal systems market in 2024, in terms of revenue. The rising sales of commercial vehicles, as well as the standardization of exhaust gas recirculation and turbochargers, and the application of waste heat recovery technology in gasoline vehicles as a result of increased emission regulations, are some of the primary reasons driving the automotive thermal systems market expansion.

Moreover, the seat segment is estimated to be the most opportunistic segment during the forecast period. The increased use of passenger vehicles in the underdeveloped and developing economies is driving the growth of the seat segment during the forecast period.

Key Companies & Market Share Insights

The various developmental strategies such as new product launches, acquisition, partnerships, business expansion, investments, joint venture, and mergers fosters market growth and offers lucrative growth opportunities to the market players. The key market players have been investing in more complex thermal systems to increase vehicle efficiency and fulfil the growing demand for vehicle electrification systems in the global automotive sector, due to the growing trend of light weight and fuel-efficient automobiles.

Regional Insights

Asia Pacific Automotive Thermal Systems Market Size?

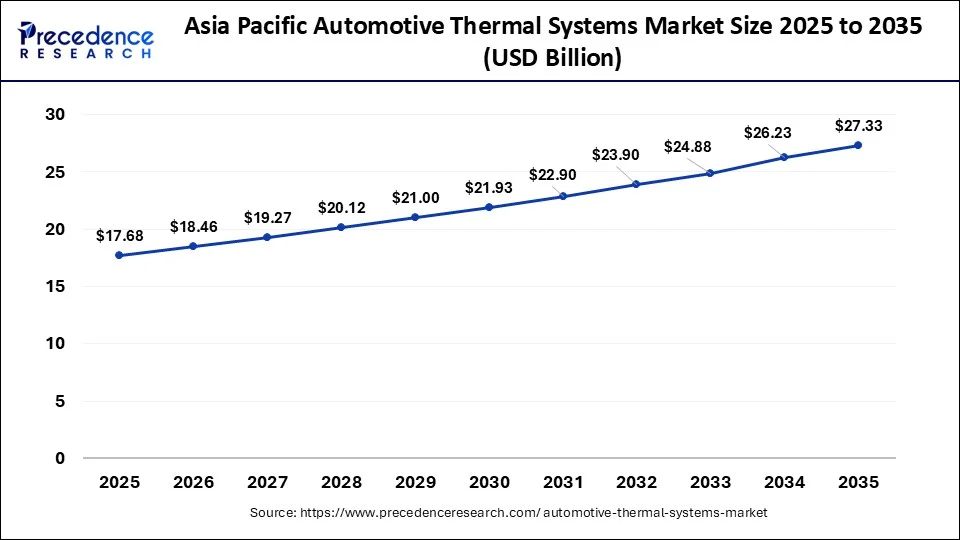

The Asia Pacific automotive thermal systems market size was valued at USD 17.68 billion in 2025 and is expected to be worth over USD 27.33 billion by 2035, at a CAGR of 4.45% between 2026 and 2035.

How did the Asia Pacific dominate the Automotive Thermal Systems Market in 2025?

Asia-Pacific segment dominated the global automotive thermal systems market in 2025. The construction equipment and heavy trucks are being driven by huge infrastructure improvements, which are fueling the growth of the automotive thermal systems market. Furthermore, the manufacturing of a large number of automobiles in Japan, South Korea, China, and India is fueling the demand in the Asia-Pacific region.

India Automotive Thermal Systems Market Trends

The Indian market is massively growing due to surging adoption and the growing popularity of electric vehicles, and stricter regulatory standards. Stringent emission norms and fuel efficiency regulations are driving automakers to adopt advanced thermal management solutions. Rapid growth of electric vehicles is boosting demand for battery thermal management systems and efficient cooling technologies.

How is the Opportunistic Rise of the Automotive Thermal Systems Market in Europe?

Europe is estimated to be the most opportunistic segment during the forecast period. With the rising demand for automobiles in nations such as the UK, France, Italy, and Germany, Europe is expected to emerge as a new market, with consumers shifting their preferences toward climate control and compact, modern Heating Ventilation Air Conditioning (HVAC) systems. Furthermore, stringent government regulations are necessitating the modification and upgradation of the automotive thermal system components, which is expected to drive the demand in this sector.

North America

Why is North America the Fastest-Growing Region in the Automotive Thermal Systems Market?

North America is expected to grow at the fastest rate in the market during the forecast period due to stringent emission standards, advanced system integration, and high demand for luxury and large vehicles. North American government programs have focused on automotive thermal management to boost the performance of electric vehicles, ensure infrastructure reliability, and promote range extension.

U.S. Automotive Thermal Systems Market Trends

The U.S. is expanding with a fast-charging infrastructure and technological innovations such as integrated thermal modules, smart systems, AI, and heat pumps. The rapid growth of electric and hybrid vehicles is significantly increasing demand for batteries, power electronics, and cabin thermal management systems. Technological advancements such as integrated thermal modules, heat pumps, and smart climate control systems are gaining traction across vehicle segments.

Latin America

What is the Potential of the Automotive Thermal Systems Market in Latin America?

Latin America is expected to experience significant growth in the market due to rising electrification, environmental regulations, localized manufacturing, and increasing consumer demand for comfort. This region is undergoing transformation due to the urgent need to expand power output, lower energy costs, decarbonize, improve grid resilience, and integrate renewable energy.

MEA

What are the Opportunities in the Automotive Thermal Systems Market in the Middle East and Africa?

MEA is expected to grow at a lucrative rate in the market, owing to production hubs, supplier collaborations, efficiency mandates, and specialized cooling needs. Saudi Arabia experiences localized EV production and achieves technological milestones. The major automotive suppliers are Denso, Valeo, Dana, and Hanon Systems, and are expanding their local presence with the launch of new products.

Value Chain Analysis of the Automotive Thermal Systems Market

- Raw Material Sourcing (Steel, Plastics, Electronics):This stage is rising through trends like high-performance polymers, sustainability, and lightweighting.

Key Players: ArcelorMittal, Thyssenkrupp Steel Europe, Nippon Steel Corporation, POSCO, BASF SE, LyondellBasell, - Continental AG, and Robert Bosch GmbH. :Retail Sales and Financing

This stage is driven by dealership service centers, vehicle financing, government incentives, and dealer/repair shop financing.

Key Players: DENSO Corporation, MAHLE GmbH, Valeo SA, Hanon Systems, Robert Bosch GmbH, BorgWarner Inc., - Gentherm Incorporated. :Aftermarket Services and Spare Parts

This stage encompasses predictive maintenance, EV-centric servicing, automated inventory and ordering, sustainable sourcing, and supply chain resilience.

Key Players: DENSO Corporation, MAHLE GmbH, Valeo, Hanon Systems, Robert Bosch GmbH, BorgWarner Inc., Gentherm Incorporated.

Automotive Thermal Systems Market Companies

- Denso Corporation

- Mahle GmbH

- Gentherm Inc.

- Valeo

- Grayson Thermal Systems

- Borgwarner Inc.

- General Motors Company

- Lennox International Inc.

- Modine Manufacturing Company Inc.

- Visteon Corporation

Recent Developments in the Automotive Thermal Systems Industry

- In August 2024, Denso Corporation and JERA collaborated to develop high-efficiency hydrogen generation technology and planned to conduct joint demonstration testing at a JERA thermal power station. Denso planned to apply the technology for hydrogen production for the automotive industry.

(Source: https://www.denso.com )

Segments Covered in the Report

By Component

- Compressor

- Heating Ventilation Air Conditioning (HVAC)

- Powertrain Cooling

- Fluid Transport

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Application

- Front and Rear A/C

- Engine and transmission

- Seat

- Battery

- Motor

- Waste Heat Recovery

- Power Electronics

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- spain

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting