What is the Bakery Products Market Size?

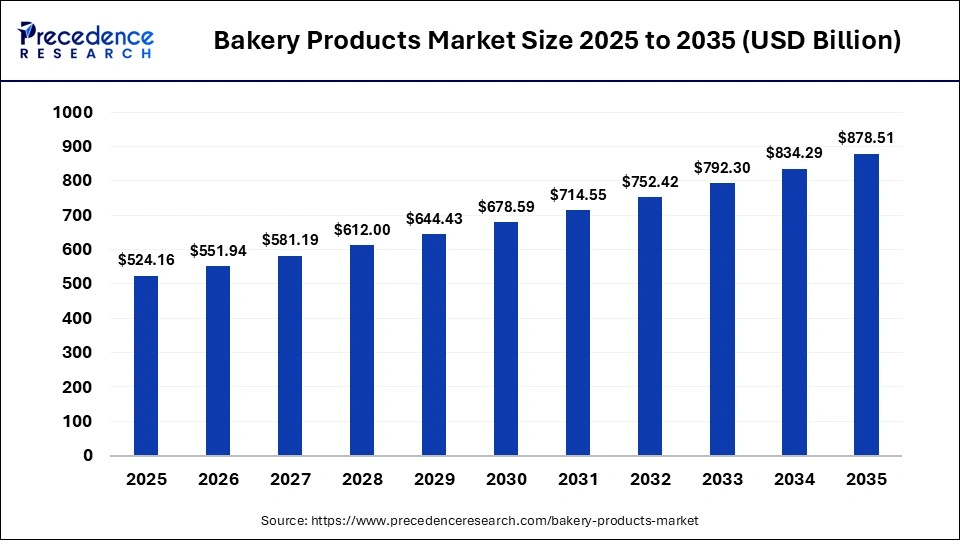

The global bakery products market size was calculated at USD 524.16 billion in 2025 and is predicted to increase from USD 551.94 billion in 2026 to approximately USD 878.51 billion by 2035, expanding at a CAGR of 5.3% from 2026 to 2035.There is a rise in preference for healthier products, which have better benefits and allow consumers to indulge in their cravings guilt-free.

Market Highlights

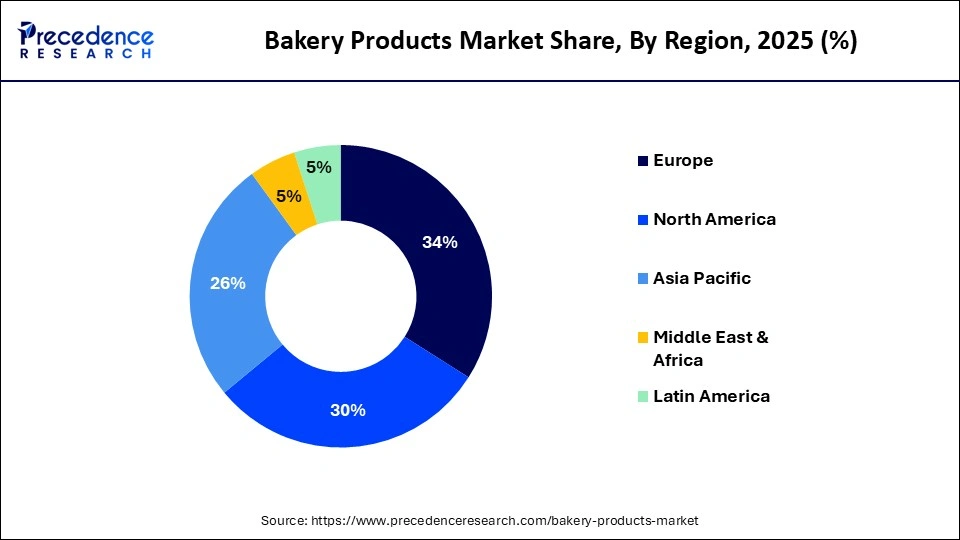

- Europe dominated the global bakery products market with a share of approximately 34% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 5.5% in the market during the forecast period.

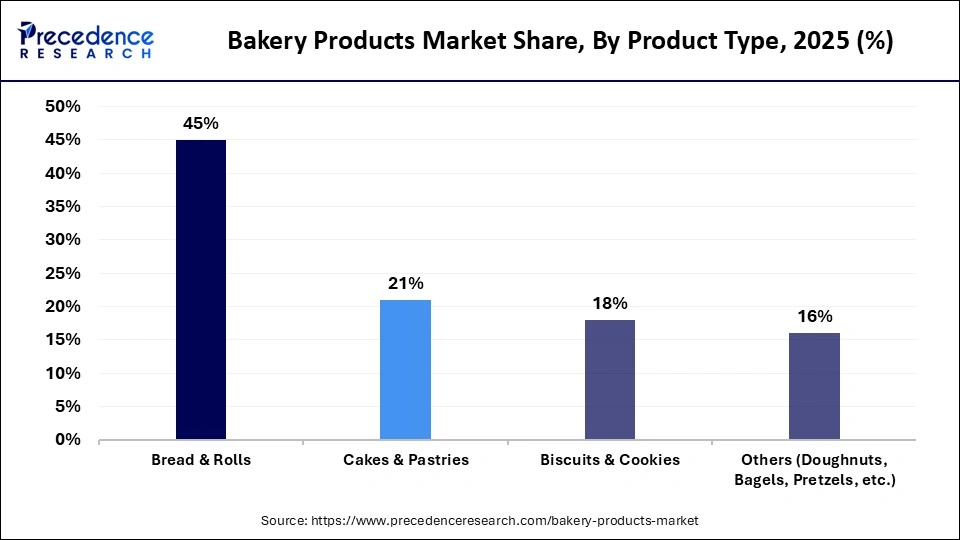

- By product, the bread & rolls segment led the market share by approximately 45% in 2025.

- By products, the biscuits & cookies segment is expected to grow at the fastest CAGR during the forecast period.

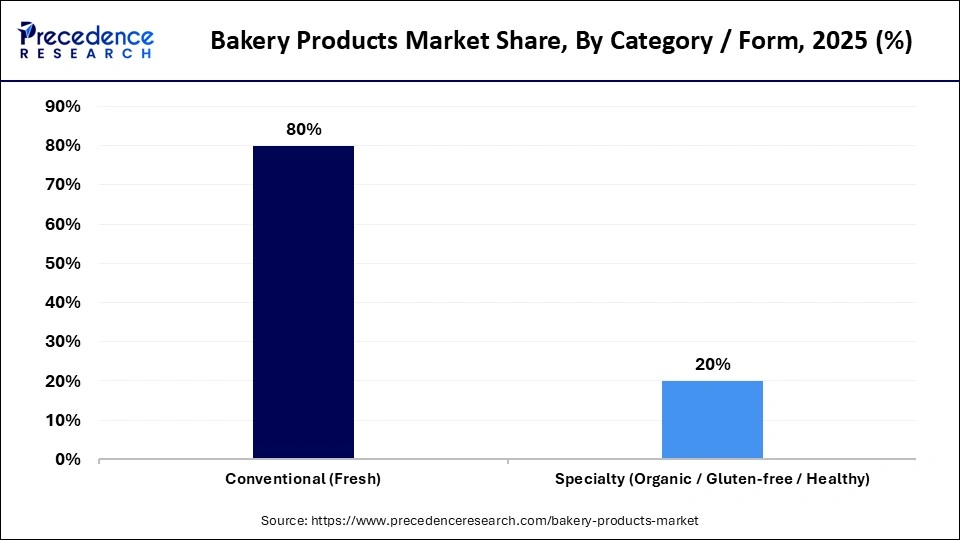

- By category, the conventional (fresh) segment dominated the market with a major share of approximately 80% in 2025.

- By category, the specialty segment is expected to be the fastest growing, with a CAGR of 4.8% during the forecast period.

- By form, the frozen segment led the bakery products market by approximately 60% share in 2025.

- By form, the fresh segment is expected to be the fastest growing with a 4.5% CAGR during 2026-2035.

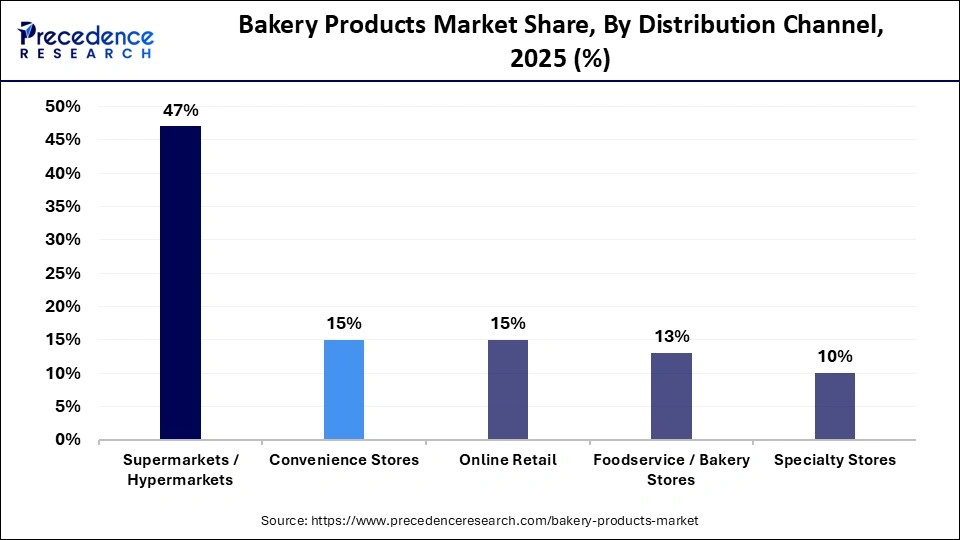

- By distributional channel, the supermarkets/hypermarkets segment dominated the market with approximately 47% share in 2025.

- By distributional channel, the online retail segment is expected to be the fastest growing with 4.7% CAGR during the forecast period.

Market Overview

The bakery products market comprises a variety of baked goods, including bread, rolls, cakes, pastries, biscuits, cookies, and other specialty items, sold through retail and food service channels. It is segmented by product type, form/category, distribution channel, and geography to capture consumption, convenience, and health-driven demand trends across global and regional markets. Bread remains a staple, while segments like biscuits and frozen/fresh specialties grow rapidly due to lifestyle shifts.

What is the role of AI in the Bakery Products Market?

AI has been transforming the bakery products world by creating even smarter and smoother things. Smart ovens manage heat and time so perfectly that it results in perfect baked goods every single time, removing the chance of errors while saving time. Behind the scenes, AI helps with predicting the demand in order to streamline supplies, spotting quality errors with cameras, and chatbots even message with customers for the custom order, which helps with time and cost efficiency. In towns such as Pune, it helps small businesses to compete by automating the routines and personalizing the offers. In conclusion, AI blends tech beautifully with the craft, increasing efficiency and bringing innovations to the market.

- For instance, in October 2025, Hovis, a UK-based baking manufacturers have partnered with the industrial AI specialist called Inelliam AI for a project with 12-months rollout of AI in its production sites, in order to increase reliability, reduce pressure on the workers, while being time efficient.

What are the Different Bakery Products Market Trends?

- The market is shifting the focus to healthy innovations such as gluten-free, vegan, low-sugar, enriched with protein products, which are now preferred by consumers.

- There is growth in plant-based baking, sourdoughs, and artisanal products in the market that it covers. .

- Protein enrichment has seen consistent growth in mainstream products across bakery products such as breads, cookies, and snacks, helping consumers meet their nutrition goals without sacrificing taste.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 524.16Billion |

| Market Size in 2026 | USD 551.94 Billion |

| Market Size by 2035 | USD 878.51Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.3% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Category/Form, Distribution Channel, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

Why did the bread & rolls segment dominate the bakery products market in 2025?

The bread & rolls segment dominated the market with approximately 45% share in 2025 because breads and rolls remain the backbone of the baking world, which is loved by everyone for their comforting simplicity and role in the daily routines, like morning toasts, or quick sandwich lunches. Healthier options like sourdough or multigrain versions of baked goods bring in health-conscious eaters who wish for nutrition without the fuss. The low prices make them easily accessible from local shops and vendors to supermarkets, leading to a steady demand throughout the year. These hold the largest share of the market, with evolving tastes, riding the wave of convenience.

The biscuits & cookies segment is anticipated to have the fastest growth with a CAGR of 4.4% in the bakery products market during the forecast period. Biscuits and cookies shine as these portable delights, which are perfect for that quick snack in between meetings, or for sharing with your loved ones during gatherings, or even perfect as a midnight snack with their crisp and ever-evolving taste. Due to their longer shelf life, these delights suit the busy lifestyles, thriving in online packs and vending machines. With experiments such as adding chocolate pieces or dry fruits like hazelnuts, these delights attract the young crowd who love to experiment with tastes and wish for something new. Bakers have started experimenting with gluten-free and protein boost products, which attract health-conscious consumers.

Category/Form Insights

What categories/forms dominated the bakery products market in 2025?

The conventional (fresh) segment dominated the market with a major share of approximately 80% in 2025. Conventional bakery items create a warm, comforting heart of everyday baking, such as warm loaves straight from the oven or soft rolls that melt in the mouth, which fills the home with its aroma that everyone loves. These classics usually thrive as a result of their simplicity, affordability, and versatile nature, whether it's breakfast, sandwiches for lunch, or a last-minute dinner without any additional requirement makes them perfect. Bakers pay special attention to the time-tested recipes that are passed down by generations, while maintaining the texture and flavor that create their signature products that customers buy without much thought, as they put their trust in the bakers.

The specialty segment is anticipated to have the fastest growth, with a CAGR of 4.8% in the bakery products market during the forecast period. The special bakery products, like gluten-free, organic, and health-boosted treats, are appealing to those who chase after wellness without necessarily sacrificing treats such as muffins packed with superseeds or cookies with natural sweeteners. These treats shine in a world where people prioritize clean eating. This niche is growing through mindful shoppers sharing the discoveries online, turning the personal health quests into a flavorful revolution that feels both indulgent and intelligent.

Form (Fresh vs Frozen) Insights

Why did the frozen segment dominate the bakery products market in 2025?

The frozen segment dominated the baking products market with approximately 60% of market share. Frozen bakery goods offer unbeatable convenience, locking in the freshness for busy lives where usually ovens wait patiently in freezers for a quick thaw and bake. These are perfect for stocking pantries or cafe prepping ahead of time. They are great in terms of consistent quality. Families rely on these frozen goods for quick last-minute desserts, while restaurants really appreciate the flexibility it allows to upscale during the peak hours. Packaging innovations have made it easy to keep the taste intact.

The fresh segment is predicted to be the fastest growing, with a CAGR of 4.5% during 2026-2035. The freshly baked delights capture the magic of the moment, straight from the oven right onto your plate, with the irresistible golden crust waiting to be torn apart. These fresh goods thrive in bustling local markets or cozy corner cafes, which draw the customer with their beautiful aroma, making them buy one more. Daily baking keeps flavors intact, with vibrance and textures just right, turning the small daily routines into small joys of life.

Distribution Channel Insights

What made supermarkets/hypermarkets dominant in the market?

The supermarkets/hypermarkets segment dominated the bakery products market by approximately 47% share in 2025. Supermarkets and hypermarkets stand as a bustling hub where magic unfurls every day, drawing the crowds with endless aisles stacked high with warm loaves, flaky croissants and pastries, or cookies that test the patience of the passerby. Families usually wander in for weekly shops, getting freshly baked bread or cakes for a little dessert with afternoon coffee. These places thrive in volume, offering variety from budget-friendly to premium or special picks, while the in-store bakery fills the air with heavenly aroma, making it impossible for customers to walk past them. Shoppers prefer the convenience of one-stop shopping, pairing groceries with the bakery hauls.

The online retail segment is anticipated to be the fastest-growing, with a 4.7% CAGR during the forecast period. Online retail transforms bakery shopping into seamless click and get happiness delivered, allowing busy people to browse through each and every item at their own convenience. Platforms showcase vibrant photos and reviews, guiding the choices towards trending desserts such as matcha pastries or vegan muffins, which are delivered fresh to your doorstep. The convenience of online platforms makes it preferred by the crowd.

Regional Insights

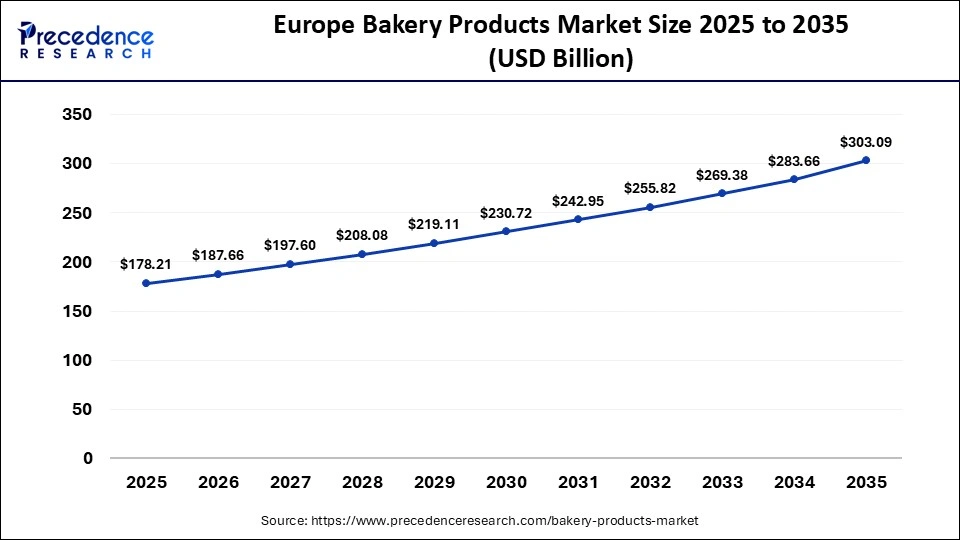

What is the Europe Bakery Products Market Size and Growth Rate?

The Europe bakery product market size has grown strongly in recent years. It will grow from USD 178.21 billion in 2025 to USD 0.00 billion in 2035, expanding at a compound annual growth rate (CAGR) of 5.45% between 2026 and 2035.

Europe's Bakery Products Market Analysis

Europe dominated the global market with a share of approximately 34% in 2025. Europe's dominance stems from deep-rooted culinary traditions and bread's status as a daily staple. Major drivers include rising demand for convenience and health-conscious shifts toward organic and gluten-free options. Future opportunities lie in premiumization, sustainable, eco-friendly packaging, and the expansion of online and direct-to-consumer sales channels.

Germany Bakery Products Market Trends

The German bakery market is expanding due to a strong cultural attachment to bread and a growing preference for artisanal, high-quality, and organic products. Consumers seek healthier options like sourdough and gluten-free items, driving innovation, while convenience trends boost demand for frozen and pre-baked goods, particularly among urban, time-conscious shoppers.

What Factors support the Asia Pacific's Market Growth?

Asia Pacific is expected to grow at the fastest CAGR of 5.5% in the market during the forecast period. The Asia-Pacific bakery market is growing rapidly due to rising disposable incomes, rapid urbanization, and a shift towards Westernized, convenient breakfast options like bread and pastries. Demand is driven by busy, on-the-go lifestyles and a preference for premium, healthier products, making it the fastest-growing region through innovative, accessible, and diverse products.

China Bakery Products Market Trends

The market in China is growing rapidly, driven by the westernization of diets and the increasing adoption of bread, cakes, and pastries as convenient breakfast or snack options. Rising disposable incomes and urbanization encourage consumers to purchase premium, branded, and health-conscious items, while e-commerce platforms expand accessibility.

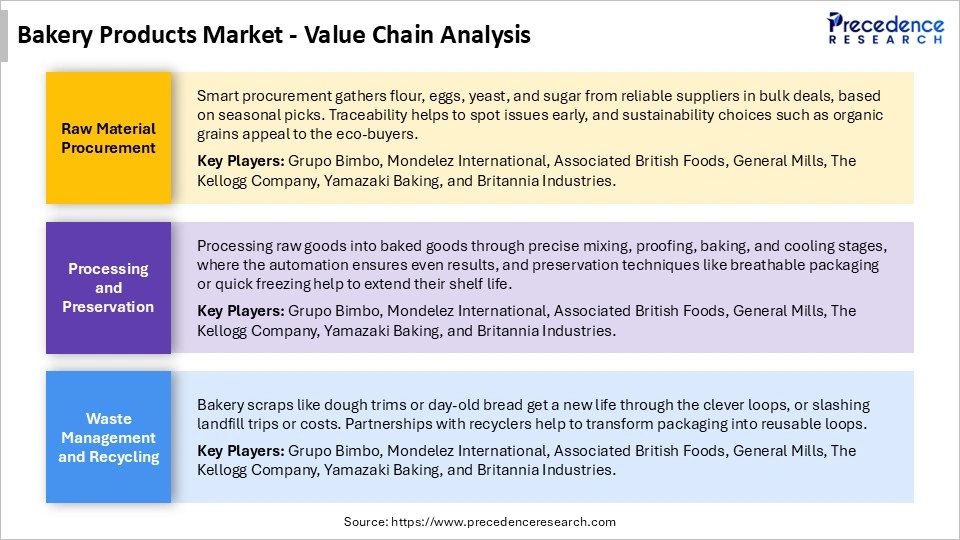

Bakery Products Market Value Chain Analysis

Who are the Major Players in the Global Bakery Products Market?

The major players in the bakery products market include Grupo Bimbo S.A.B.,Mondelez International,The Kellogg Company, Associated British Foods plc, General Mills, Inc., Nestl S.A., Britannia Industries Limited, Campbell Soup Company, Finsbury Food Group plc, Flowers Foods, Inc.,Yamazaki Baking Co., Ltd., Hostess Brands, Bimbo Bakeries USA, Bahlsen GmbH & Co. KG, Itc Limited

Recent Developments in the Bakery Products Market

- In January 2026, Pennsylvania: Puratos, a leading bakery ingredients manufacturer, took over Vr Foods, a high‑growth producer of ultra clean-label nut butters and nut‑based fillings based in Trevose, Pennsylvania. The addition of Vr helps to strengthen Puratos' U.S. manufacturing base and reinforces its commitment to leading sweet goods. Puratos Acquires Vr Foods, Accelerating Nut-Based Innovation

- In December 2025, Dehradun: Doon Basmati, millet-based new products were launched at HILANS bakery outlet, Dehradun. These products consist of Traditional Doon Basmati Rice, Wheat Flour, Maize (Makki) Flour, Multigrain Flour, and Finger Millet (Mandua) Flour, which are produced and processed by women-led institutions, such as Saksham Cluster Level Federation (CLF),Swabhiman Mahila CLF, and Udaan CLF, with support under the Rural Enterprise Acceleration Project (REAP). (Source: https://garhwalpost.in)

Segments Covered in the Report

By Product Type

- Bread & Rolls

- Biscuits & Cookies

- Cakes & Pastries

- Others (e.g., doughnuts, bagels, pretzels)

By Category/Form

- Conventional (Fresh)

- Specialty (Organic/Gluten-free/Healthy)

- By Form (Fresh vs Frozen)

- Frozen

- Fresh

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Foodservice/Bakery Stores

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content