What is the Bioethanol Yeast Market Size?

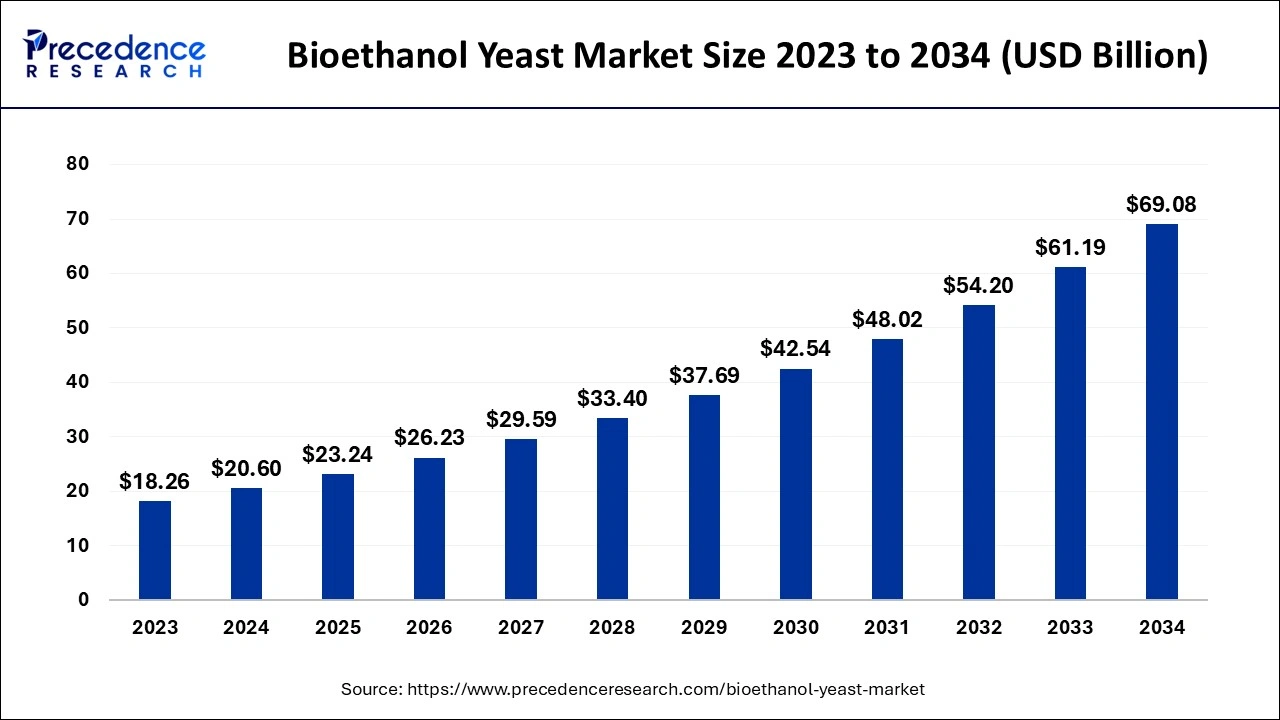

The global bioethanol yeast market size is valued at USD 23.24 billion in 2025 and is predicted to increase from USD 26.23 billion in 2026 to approximately USD 76.37 billion by 2035, expanding at a CAGR of 12.63% from 2026 to 2035. The bioethanol yeast market growth is attributed to increasing demand for renewable energy sources and government incentives promoting biofuels.

Bioethanol Yeast Market Key Takeaways

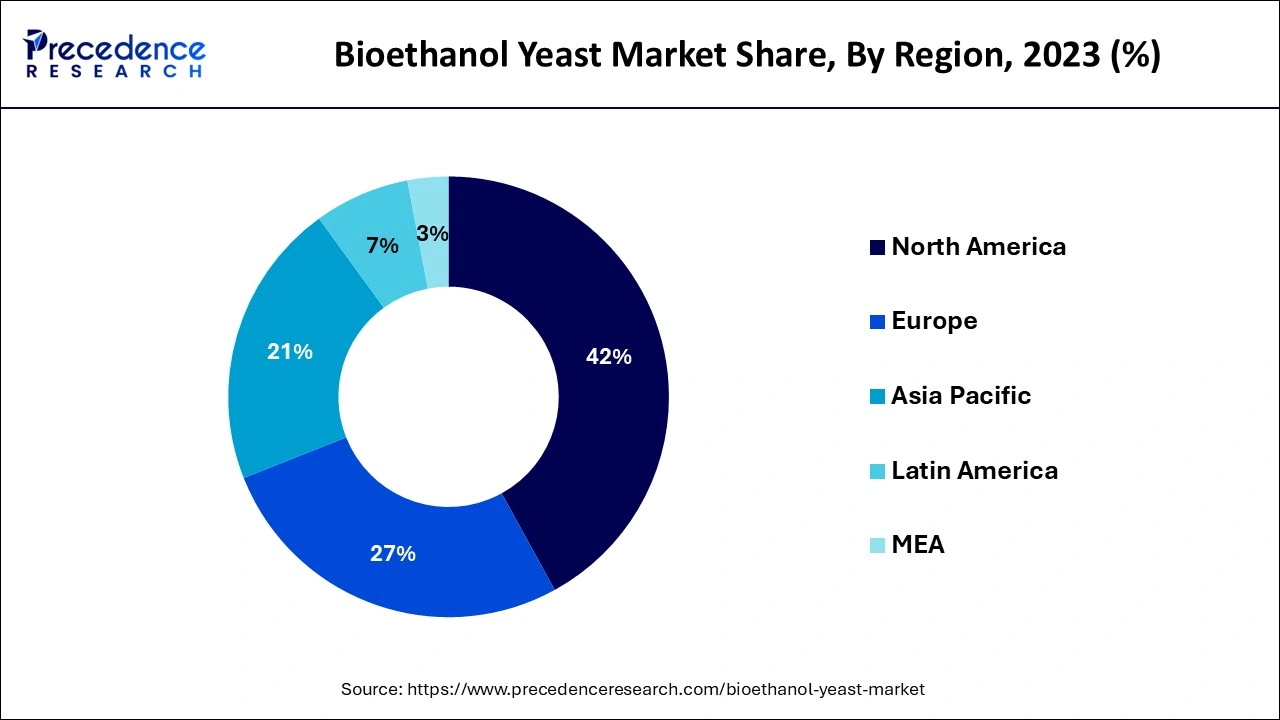

- North America dominated the global market with the largest market share of 42% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR during the projected period.

- By type, the bakers segment contributed the highest market share of 65% in 2025.

- By type, the brewer's segment is expected to grow at the fastest CAGR of 15.43% during the forecast period.

- By application, the biofuel segment captured the biggest market share of 65% in 2025.

- By application, the animal feed segment is anticipated to grow with the highest CAGR during the forecast period.

How AI is transforming the Bioethanol Yeast Market?

Artificial Intelligence (AI) improves different production processes and advances the bioethanol yeast market. Advanced mathematics and complex programming process big amounts of data and produce conclusions that are risky. This allows manufacturers to optimize the fermentation procedures and achieve increased yield results. Constant vitality is preserved, and the AI's capability for quality control and waste minimization contributes to greater ecological efficiency. Furthermore, such technological enhancement as AI allows the creation of new yeast strains and genetic research & modeling due to the increased demand for renewable energy sources.

How will the Bioethanol Yeast Market's summary reveal the industry's key potential?

Rising concern for renewable energy commodities and a global effort towards emission reduction is facilitating the bioethanol yeast market. Transportation fuel, derived predominantly from agricultural commodities, such as sugarcane, corn, and wheat, is bioethanol, a clean-burning fuel that competes directly with fossil fuels. This process is being driven by energy security issues, which will be discussed in the later sections for countries, including India, Brazil, and Indonesia, where domestic bioethanol helps cut down the import dependency on oil.

Yeast-based fermentation processes are essential in the improvement of the yield of the bioethanol. These innovations increase the conversion rate of biomass to ethanol and reduce energy utilization by the bioethanol production process, thus making bioethanol a more economically feasible and sustainable fuel.

The bioethanol yeast market is undergoing a transformative phase, propelled by the increasing demand for sustainable and renewable energy sources. A primary trend shaping the market is the shift towards second-generation bioethanol production, which uses agricultural residues and non-food biomass to create cleaner fuels. This shift is driving research into genetically modified yeast strains that can ferment complex sugars more efficiently and withstand harsh industrial environments.

There is a growing emphasis on strain specificity, where yeast depends on feedstock type- be it sugarcane, corn, wheat straw, or lignocellulosic biomass. Moreover, the rise in bio-refineries integrating circular economy principles is increasing demand for robust and adaptive yeast strains. Additionally, the collaborations between biotechnology firms and ethanol producers are strengthening, giving rise to continuous innovation in fermentation efficiency. Temperature tolerance and ethanol tolerance levels.

Bioethanol Yeast Market Growth Factors

- Increasing consumer demand for renewable energy: The global shift towards renewable energy is expected to drive bioethanol production, encouraging the adoption of yeast strains tailored for bioethanol fermentation.

- Growing awareness of environmental sustainability: Rising concerns about climate change and carbon emissions are spurring greater adoption of biofuels like bioethanol, thus supporting the demand for bioethanol yeast.

- Government incentives and subsidies: Increased governmental support through grants, tax incentives, and mandates, especially in the U.S., Brazil, and Europe, is boosting bioethanol production and yeast utilization.

- Technological advancements in yeast genetics: Innovations in genetic engineering and CRISPR technology are anticipated to enhance yeast performance, driving higher bioethanol yields and more efficient fermentation processes.

- Rising demand for bioethanol in the automotive industry: The increasing adoption of ethanol-blended fuels in vehicles worldwide is projected to spur the demand for bioethanol yeast for fuel production.

- Fluctuations in fossil fuel prices: The instability in global oil prices is expected to drive governments and industries to explore more cost-effective, renewable fuel alternatives like bioethanol.

- Expanding applications of bioethanol in non-fuel sectors: The growing use of bioethanol in industries like pharmaceuticals, cosmetics, and food preservation is likely to increase the demand for the bioethanol yeast market.

Bioethanol Yeast Market Outlook

As observed, the bioethanol yeast sector is witnessing a substantial growth characterised by the rising demand for technological advancement and renewable energy in strain development. The start-ups are smartly focusing on the innovative solutions window, especially the genetically modified (GM) yeast one, to further enter into the advanced phase of the fermentation process. This will improve the efficiency.

The industrial growth in the bioethanol yeast sector is leveraging and being strenthing grounds with its advancement in yeast technology, and alongside the rising demand for renewable energy, is also bolstering the growth factor. The improved fermentation process and beneficial government policies are the big reasons for the industrial growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 76.37 Billion |

| Market Size in 2025 | USD 23.24 Billion |

| Market Size in 2026 | USD 26.23 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 12.86% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East, and Africa |

Market Dynamics

Driver

Growing adoption of bioethanol as a sustainable fuel source

The growing adoption of bioethanol as a sustainable fuel source is anticipated to drive demand for efficient production in the bioethanol yeast market. An increasing interest in the use of blends as fuel is thus promoting further research on qualities of yeast that are most suitable for bioethanol production. Biofuels are being pushed by governments globally to reduce possible emissions and reliance on fossil fuels.

- In 2023, the U.S. adopted policies on clean fuels for advanced biofuel generation. Meanwhile, Brazil stated policies concerning the sustainable development of bioethanol. Furthermore, India has put off its biomass program up to 2026 with an emphasis on popularising biogas and biofuels, thus boosting the market in the coming years. Bioenergy from waste and residues is also projected to double to 30 EJ in 2030 under the IEA Net Zero Emissions (NZE) case.

Restraint

Availability of diverse feedstocks

The limited availability of diverse and sustainable feedstocks is anticipated to restrain the growth of the bioethanol yeast market. Particularly in those areas that have specialized crops, such as sugarcane or corn, most of them experience fluctuations since they are seasonal crops that affect the supply chains. Bioethanol production is limited by this constraint since large-scale production requires considerable investments in agricultural sectors that may not be well developed in some regions. Additionally, a conflict of interest has been observed between the food and fuel industries as they struggle to access the same food crops.

Opportunity

High investments in research and development activities

High investments in research and development activities are likely to advance the capabilities of yeast strains tailored for the bioethanol yeast market. New innovative technologies, including gene editing tools CRISPR-Cas9, are being considered to develop better and stronger yeast with difficulties associated with yeast slower fermentation and contamination.

The U.S. Department of Energy has invested a lot of funds towards the BETO Bioenergy Technologies Office. Such measures have ensured that bioethanol production costs have been cut by up to 40% over the last decade, pulling the industry forward. Furthermore, international multilateral agreements between the governments and the private sector, along with universities and research institutions, stress realizing the gap between experimental and industrial-scale production of bioethanol.

Bioethanol Yeast Market Segment Insights

Type Insights

The baker's segment held a dominant presence in the bioethanol yeast market in 2024 due to its applicability to large-scale bioethanol production and lower costs. The segment proved to be competitive, and it effectively catalyzed first-generation bioethanol feedstock, such as corn and sugarcane. USDOE, in its annual report to Congress in 2023, described the importance of baker's yeast in the attainment of bioethanol production, especially under the Renewable Fuel Standard regulation of blending biofuels into transportation fuel. Additionally, the research projects funded by the European Commission in 2023 were aimed at improving baker's yeast.

The brewer's segment is expected to grow at the fastest rate in the bioethanol yeast market during the forecast period of 2025 to 2034, owing to its upgraded ability to transform second-generation bioethanol feedstocks, such as the lignocellulosic biomass. Renewable energy report of 2024 by IRENA states that investments in second-generation bioethanol plants are on the rise in regions such as Europe and Asia-Pacific. In this, brewer's yeast is instrumental in harnessing agricultural residues for bioenergy production. The USDA 2024 has also identified brewer's yeast as critical in decreasing the usage of fossil fuels through the effective conversion of non-food biomass.

Application Insights

The biofuel segment accounted for a considerable share of the bioethanol yeast market in 2024 due to the increasing trend among countries regarding the use of renewable energy to curb greenhouse gas emissions. Bioethanol is one of the most popular bio-products mixed with transportation fuel, which is produced from various developed yeast strains, with profound bioethanol manufacturers including America, Brazil, and China. Additionally, the growing need for the use of biofuels as a way of eliminating greenhouse gas emissions and the provision of renewable energy further fuel the segment.

- According to BETO, in the United States of America, in 2023, bioethanol made up more than 10% of the total fuel use, proving a significant role of bioethanol in the fuel matrix.

The animal feed segment is anticipated to grow with the highest CAGR in the bioethanol yeast market during the studied years, owing to the need to meet the ever-increasing demand for quality, healthy feeding to livestock and poultry. Bioethanol yeast has then been adopted as a protein source in animal feed, as it is a more sustainable means of protein production than soybean meal production. Furthermore, yeast helps enhance digestion and the immune system of animals taking feed, and this has promoted the uptake of yeast in animal feeds.

Bioethanol Yeast Market Regional Insights

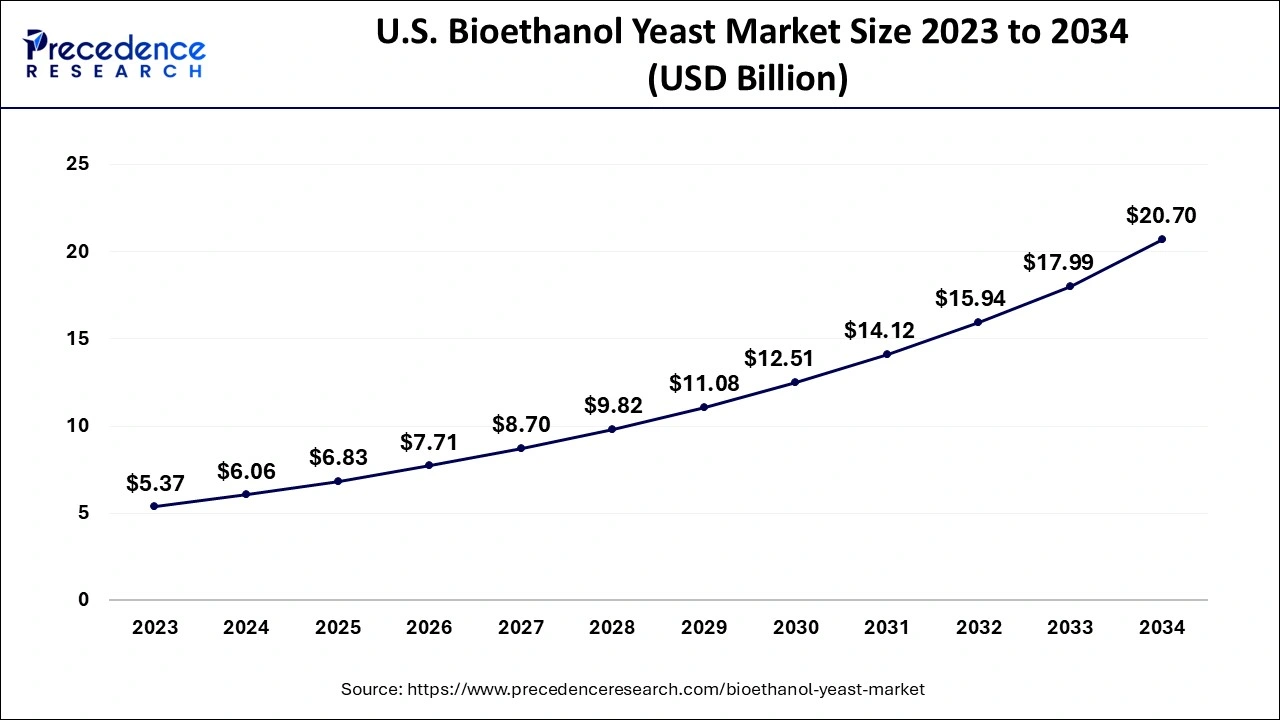

The U.S. bioethanol yeast market size is exhibited at USD 6.83 billion in 2025 and is expected to be worth around USD 22.97 billion by 2035, growing at a CAGR of 12.89% from 2026 to 2035.

North America held the largest share of the bioethanol yeast market in 2025 due to the high government support in terms of policies and regulations towards bioethanol. The principal supporter of the bioethanol industry in America has been the U.S. EPA through policies such as the Renewable Fuel Standard RFS, which provides blending requirements for renewable fuels, including ethanol. U.S. bioethanol production in 2023 was 16.5 billion gallons for about 10% of the domestic consumption of gasoline, as EIA data shows. Furthermore, the increasing pressure towards finding environmentally friendly fuel sources and the steady improvements in yeast production have increased the demand for bioethanol yeast.

North America remains a global leader in the bioethanol yeast market, driven by strong government backing, advanced fermentation technologies, and an expansive bioethanol production infrastructure. In particular, the United States and Canada play pivotal roles. The U.S., through its Renewable Fuel Standard (RFS) policy, mandates the blending of renewable biofuels into transportation fuels, directly fueling the demand for high-performance yeast strains in ethanol production.

Government grants and funding, such as those from the Department of Energy (DOE), support R&D in genetically engineered yeast capable of maximizing ethanol output while reducing carbon emissions. Canada, too, is promoting low-carbon fuel initiatives, especially under the Clean Fuel Regulations, creating incentives for yeast innovation and cleaner fuel solutions. Both countries benefit from a robust academic and industrial research network, which facilitates continuous advancement and commercialization of novel yeast strains.

Asia Pacific is projected to host the fastest-growing bioethanol yeast market in the coming years, owing to the rapid industrialization, population growth, and consequently rising demands for energy. China and India are among the countries that are focusing on spearheading the enhancement of bioethanol production as countries work towards reducing their dependence on fossil fuels. India is also expected to scale up its bioethanol generation under the National Biofuels Policy, which promotes biofuels in the transportation industry.

Asia Pacific is emerging as the fastest-growing bioethanol yeast market, bolstered by a rising population, increasing energy needs, and a proactive shift towards sustainable alternatives. Countries like China, India, Thailand, and Indonesia are leading the charge, driven by government mandates and growing environmental consciousness. In India, the Ethanol Blended Petrol (EBP) programme, which aims to reach a 20% blending rate by 2025, is spurring bioethanol production, prompting a surge in demand for resilient and cost-effective yeast strains.

Europe's advancement in this market is specifically measured and centralised to the need to accomplish the renewable energy targets and aim for non-food-based feedstocks that closely refer to the second-generation bioethanol. European research and development are closely targeting the utilisation of lignocellulosic biomass by replacing food crops such as sugarcane or corn.

This idea has discovered the ‘food versus fuel' debate, significant for the bioethanol yeast sector. The main progress is establishing designed yeast strains with a precision level of efficiency and tolerance, and further modernising the fermentation technologies.

Latin America's contribution by far in this market has been noteworthy, mainly via Brazil's best of all development of a large-scale scale efficient sugarcane-related ethanol industry and the genetically driven co-option of the affordable adoption of the comprehensive Saccharomyces cerevisiae strains. This region is a champion in bioethanol production due to its accurate genetic characterisation with the help of valuable scientific research through educational grounds for in-depth insights.

Recent updates on bioethanol yeast-2025

Sustainable fuel demand accelerates yeast innovation

- On 12 March, the growing demand for renewable fuels and clean energy alternatives worldwide is driving significant growth in the bioethanol yeast market. There is a great need for yeast strains that are suited to extreme fermentation conditions and produce large amounts of ethanol. New prospects for yeast suppliers are being created by governments in North America, Europe, and Asia, tightening their requirements for ethanol blending. Additionally, businesses are investigating second-generation feedstocks such as lignocellulosic biomass, which need sophisticated yeast strains to convert effectively.

Genetically engineered strains improve conversion efficiency

- On 9 April 2025, the developments in metabolic engineering and synthetic biology have created yeast strains that can ferment mixed sugars like xylose and glucose at the same time have been created. Since traditional yeast performance is limited in the production of cellulosic ethanol, these innovations are especially important to increase productivity and process stability. Researchers are strengthening yeast resistance to inhibitors present in pretreated biomass.

Bioethanol Yeast Market Value Chain Analysis

The upstream analysis involves yeast strain development and selection, and feedstock sourcing and logistics. The accurate examination of the cost-effectiveness and sustainability of various feedstocks and refining supply chains is essential. Whereas the analysis of the adoption and development of genetically designed yeast strains improves ethanol yields.

The midstream analysis is the bridge that processes the activities and required segments between manufacturing and production. The analysis of several production process technologies, like simultaneous saccharification and fermentation (SSF), is helpful to mitigate energy consumption. The examination of the commercial and recovery use of products produced during fermentation is also essential to accomplish the economic viability of the operation.

The downstream analysis involves market access and distribution that further covers the logistics, policy analysis, market, distribution, purification and product separation. This assessment is essential to refine the dehydration and distillation process. Overall, the market dynamics awareness and the suitable infrastructure setting for distribution and logistics strengthen the presence of the bioethanol yeast sector.

Bioethanol Yeast Market Companies

- AB Mauri

- AngelYeast Co., Ltd.

- Associated British Foods plc

- Cargill, Inc.

- DSM

- Foodchem International Corporation

- LALLEMAND Inc.

- Leiber GmbH

- Lesaffre

- Novozymes

- Omega Yeast Labs, LLC.

- Oriental Yeast Co., Ltd

- Pacific Ethanol, Inc.

Recent updates on bioethanol yeast

Sustainable fuel demand accelerates yeast innovation

- On 12 March, the growing demand for renewable fuels and clean energy alternatives worldwide is driving significant growth in the bioethanol yeast market. There is a great need for yeast strains that are suited to extreme fermentation conditions and produce large amounts of ethanol. New prospects for yeast suppliers are being created by governments in North America, Europe, and Asia, tightening their requirements for ethanol blending. Additionally, businesses are investigating second-generation feedstocks such as lignocellulosic biomass, which need sophisticated yeast strains to convert effectively.

Genetically engineered strains improve conversion efficiency

- On 9 April 2025, the developments in metabolic engineering and synthetic biology have created yeast strains that can ferment mixed sugars like xylose and glucose at the same time have been created. Since traditional yeast performance is limited in the production of cellulosic ethanol, these innovations are especially important to increase productivity and process stability. Researchers are strengthening yeast resistance to inhibitors present in pretreated biomass.

Latest Announcements by Industry Leaders

- October 29, 2024 - CTE Global Inc

- President and CEO - Alex Shifman

- Announcement - CTE Global, known for its effective yeast and enzymatic solutions in biofuel production, proudly introduces Innova Eclipse yeast to its lineup. “We're excited to bring this groundbreaking yeast to the biofuel sector,” said Alex Shifman, the president and CEO of CTE Global. “Innova Eclipse not only boosts bioethanol production but also aligns perfectly with our mission to deliver innovative products and services for our clients. Our team is eager to help biorefineries unlock the potential this yeast can add to their operations and profitability.”

Recent Developments

- On 8 August 2024, this acquisition strengthens AB Mauris' capabilities in fermentation science and innovation, particularly within the bioethanol and brewing sectors. The integration of Omega Yeast expands its product diversity and supports the company's strategic goal of offering specialized yeast solutions for fuel-grade ethanol production. The move also brings advanced research facilities and a broader strain library into AB Mauri's network.

- On 15 June 2024, by integrating BASF's spartec product line, Lallemand enhances its fermentation performance portfolio tailored for the biofuels industry. This acquisition supports its mission to offer yeast and enzyme combinations that optimize yield and process stability. The company aims to serve emerging and established ethanol markets with comprehensive high performance microbial solutions.

- On 12 March 2024, Innova Delta is a next-generation non-GMO yeast engineered for robustness and efficiency in high-stress fermentation conditions. The product helps improve ethanol yields and reduces fermentation time, offering significant economic advantages for producers. The collaboration leverages Novonesis' distribution network and MicroBioGen yeast engineering expertise.

- In March 2024, MicroBioGen, an Australian company specializing in industrial biotechnology and known for offering 'yeast innovation as a service,' announced a major breakthrough in partnership with global biotech leader Novonesis (formerly Novozymes). Launched just last month, Innova Delta represents the most advanced non-genetically modified (non-GM) yeast innovation in ethanol production, significantly enhancing reliability, efficiency, and overall performance.

- In February 2024, IFF (NYSE: IFF), a prominent leader in food, beverage, health, biosciences, and scent, celebrated a landmark approval from the Argentine Secretary of Agriculture, Livestock and Fisheries within the Ministry of Economy. This green light has opened the door for the commercialization of genetically modified (GM) yeasts for grain-based bioethanol production in Argentina.

- In June 2024, BASF completed the sale of its bioenergy enzymes business based in San Diego to Lallemand's subsidiaries, Danstar Ferment AG and Lallemand Specialties Inc. This acquisition includes the Spartec product portfolio and related technologies currently under development. Lallemand is set to incorporate the business and its employees into its Lallemand Biofuels & Distilled Spirits (LBDS) business unit. As of June 1, all related business activities have officially transitioned to Lallemand.

- In June 2024, Neogen Corporation (NASDAQ: NEOG), an innovative leader in food safety solutions, announced the launch of CelluSmart technology from Megazyme by Neogen, designed for the measurement of cellulosic ethanol in biofuel production.

Bioethanol Yeast Market Segments Covered in the Report

By Type

- Brewers

- Bakers

By Application

- Animal Feed

- Biofuel

- Food

- Cleaning and Disinfection

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting