What is the Biopolymer Coatings Market Size?

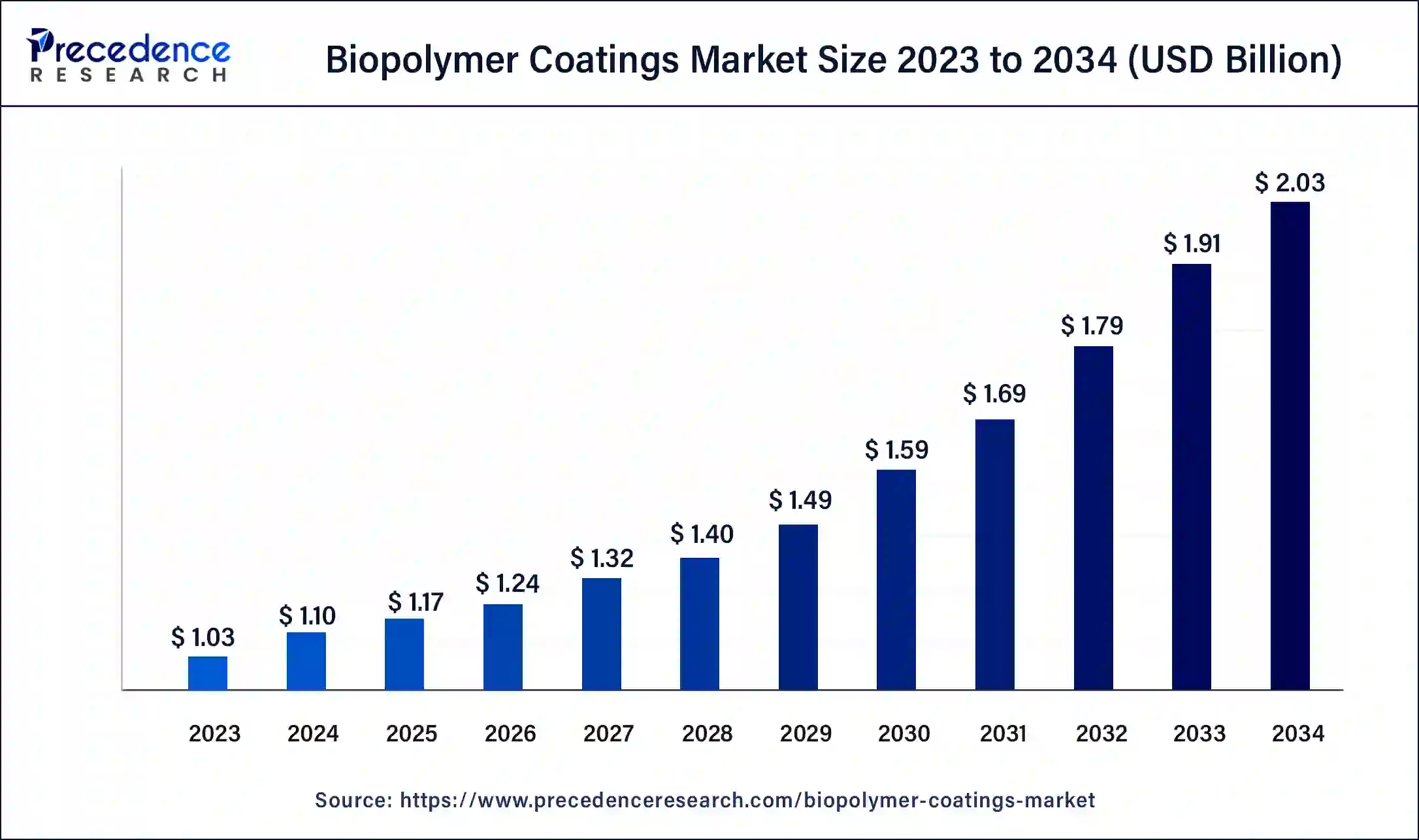

The global biopolymer coatings market size is calculated at USD 1.17 billion in 2025 and is predicted to increase from USD 1.24 billion in 2026 to approximately USD 2.15 billion by 2035, at a CAGR of 6.27% from 2025 to 2034.

Biopolymer Coatings Market Key Takeaways

- By region, Asia Pacific dominated the market in 2025.

- By region, North America is projected to grow rapidly during the forecast period.

- By product, the bio PU coatings segment led the market in 2025.

- By end-user, the packaging segment dominated the market in 2025.

Biopolymer Coatings: A Step Towards Sustainability

Biopolymer coatings are protective layers made from eco-friendly and biodegradable materials obtained from plants, microbes, and other biological sources. These coatings come in different forms, such as proteins, starch, and chitosan. They find applications in the medical, pharmaceutical, and agricultural fields. They are mainly used to prevent contamination and extend the life of products by protecting their surfaces from damage, pressure, or wear.

Biopolymer coatings offer an edge over petroleum-based materials, as they reduce the environmental impact. With the growing focus on sustainability to reduce carbon footprint, the biopolymer coatings market has witnessed significant growth over the years due to the rising popularity of these protective coatings among industries.

Biopolymer Coatings Market Growth Factors

The increasing government initiatives to promote the use of biodegradable materials in various industries, including packaging, automotive, and healthcare, to reduce carbon emissions are major factors that boost the growth of the global biopolymer coatings market. For instance, in February 2024, Danimer Scientific, a leading manufacturer and developer of biodegradable materials, announced the expansion of its business in Rochester, New York. A special biodegradable material called Rinnovo, produced at cheaper prices, is tested in this plant. This expansion has further enhanced the facility's production capacity, producing 20 tons of Rinnovo, which is 20 times more than before. Moreover, government regulation against the manufacturing of single-use plastics in several countries encouraged plastic manufacturers to ramp up their biodegradable plastic production.

The growing environmental concerns and the rising usage of biodegradable products further propel the demand for biopolymer coatings. With the rising concerns regarding environmental degradation, the use of biodegradable products, including biopolymer coatings, has increased. This also triggered the rate of research & development in the field of biopolymer coatings and bioplastics. For instance,

- In April 2023, two leading manufacturers of bioplastics, Danimer Scientific and TotalEnergies Corbion, developed a compostable coffee pod biopolymer that meets the EU packaging regulations to offer a sustainable solution over traditional single-use plastics.

Apart from notable developments in bioplastics and biopolymer coatings, the market is still emerging and has a promising future growth opportunity. To curb environmental pollution, governments and plastic manufacturing companies are collaborating or partnering to move the future towards a more renewable and greener environment. Henceforth, the aforementioned factors are likely to support the growth of the biopolymer coatings market remarkably in the coming years.

Key Dynamics Shaping the Growth of the Global Biopolymer Coatings Market

- Incorporation of Artificial Intelligence in Coating Development: The world's leading coating manufacturers are beginning to integrate artificial intelligence within their biopolymer coating production platform to optimize their formulation process, enhance consistency of finished products, increase operational efficiencies, and decrease overall production costs by minimizing waste of raw materials.

- Use of Enzymes to Create Biopolymers: Enzyme-based methods for synthesizing biopolymers have been increasingly utilized to enhance the energy efficiency and purity associated with creating both PLA and PHA biopolymers, thus providing a "greener" processing method and having a smaller carbon footprint.

- Strategic Partnerships Between Companies and Academia: Packaging and Material companies are developing next-generation coating systems using partnerships with university research laboratories to develop improved coatings with increased resistance to grease, water, and microorganisms to serve food packaging and consumer products applications.

- Adoption of Circular Economy Principles: Companies are beginning to adopt circular economy principles, such as compostable packaging and recycling programs, to support their sustainability initiatives and create differentiation in competitive environments.

- Enhanced Functional Additives: Companies are beginning to include natural antimicrobial agents, antioxidants, and intelligent indicators (such as freshness indicators) within their coating systems, in particular for food packaging, to enhance product safety and shelf life.

Biopolymer Coatings Market Outlook:

- Global Expansion: This is primarily propelled by the stringent environmental regulations and consumer demand for sustainable products.

- Sustainability Trend: The market is leveraging repurposing industrial waste and discarded materials, like agricultural byproducts like plantain peels and underutilized crops.

- Major Investor: Carapace Biopolymers, founded in 2024 in the Netherlands, which facilitates "Pomonin," a bioactive coating platform for seeds and fertilizers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.17 Billion |

| Market Size in 2026 | USD 1.24 Billion |

| Market Size by 2036 | USD 2.15 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.27% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, End-User, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, the Middle East and Africa |

Market Dynamics

Drivers

Advancements in Materials Science: The need for improved biopolymer coatings with better features prompted advancements in materials. Therefore, key market players are continuously focusing on innovation, which has resulted in improved biopolymer coatings with the best resistance properties to chemicals and moisture, making them suitable for various industrial applications.

Rising Environmental Concerns: The growing usage of plastic in several industries at a mass level has led to a rise in environmental concerns, resulting in the rising adoption of biopolymers that are eco-friendly and cause less harm to the environment. Thus, biodegradable polymers such as polylactic acid, cellulose, starch, and poly(vinyl alcohol) are in high demand in the food & beverages and pharmaceutical industries for packaging applications. This major change boosts the biopolymer coatings market.

- In June 2024, Virospack, a Spanish plastic injection molding workshop, joined Rezemo and BrightSideUp to lead the cosmetics packaging industry with eco-friendly innovations and collaborative projects.

Restraint

High Cost: While biopolymers exhibit exceptional properties over synthetic polymers, their high costs may limit their adoption. Additionally, the prices of raw materials and technologies required for producing biopolymer coatings are usually high. This may deters new entrants from investing in the market, thus hampering the market growth.

Opportunities

Government Initiatives and Expanding Area of Application: In many countries, governments have begun implementing stringent regulations to reduce the usage of plastics and minimize plastic waste generated by industries. This has forced industries to use biopolymers, as they can easily decompose and cause less harm to the environment. Moreover, the rising area of applications of biopolymer coatings further boosts their adoption to a larger extent.

- In January 2024, CJ Biomaterials Inc., a leading polyhydroxyalkanoate (PHA) biopolymers producer, announced that its patented PHA technology is being used to produce noodle cups. With CJ Biomaterials' PHA technology integrated into the inner coating of these cups, they are biodegradable, reducing plastic waste.Biopolymer Coatings Market Scope

Segment Insights

Product Insights

The bio PU coatings segment captured the largest share of the market in 2025. This is mainly due to its wide application in the automotive, architectural, furniture, and textile industries. The segment growth is also attributed to the low environmental impact, biodegradability, easy availability, and low cost of bio PU coatings. These coatings are made from renewable sources, such as biomass or plant-based oils, thus reducing reliance on fossil fuels and minimizing environmental impact.

The bio PBS coatings segment is projected to expand at a substantial growth rate in the coming future. These coatings have superior biodegradability, melt processability, thermal properties, and chemical resistance, making them suitable for food & beverage packaging, resulting in the rising demand in the food & beverages industry. On the other hand, the PLA coatings segment is also anticipated to grow rapidly during the forecast period, owing to their high use in the food & beverage industry. PLA-based biopolymer coatings are widely used for vegetable, fruit, alcohol, nut, and water packaging.

End User Insights

The packaging industry segment led the market in 2025. This is mainly due to the rising demand for sustainable packaging solutions across various industries. The growing environmental concerns worldwide increased the demand for eco-friendly packaging materials. This further encourages packaging companies to invest in biopolymers, as they are a promising alternative to chemical-based polymers.

The automotive sector is the fastest-growing end-user in the market due to its strong focus on sustainability, lightweighting, and regulatory compliance. Manufacturers are increasingly adopting biopolymer coatings to reduce vehicle weight and improve fuel efficiency, while meeting stricter environmental regulations on VOCs and toxic chemicals.

Regional Insights

Asia Pacific dominated the market with the largest share in 2025 due to rapid industrialization in developing countries, such as China and India. These countries are the fastest-growing in terms of food packaging, medical, automotive, and various other industries. Moreover, these countries are increasingly focusing on achieving sustainability goals. Other than India and China, Australia, Japan, Singapore, Malaysia, and other Asian countries are also flourishing well in the industrial growth that propels the growth of the biopolymer coatings market in the region.

The market in North America is projected to expand at a high CAGR in the coming years due to the rapid expansion of the food and packaging industries in the region, significantly boosting the demand for biopolymer coatings. Moreover, the increasing demand for sustainable packaging solutions is expected to contribute to the regional market expansion.

Wider Consumer Demand & Innovative Adoptions: Surging Chinese Market Growth

China will expand at a rapid CAGR in ASAP, due to the growing consumer demand for eco-friendly products, especially in the packaging area, which accelerates the adoption of sustainable solutions among manufacturers. Besides this, the leading companies are stepping into research activities of nanocomposite materials with improved properties, surpassing most commercial bio-based plastics.

Phenomenal Hybrid Formulations & Novel Polymers: Fostering the US Market

Specifically, the US captured the major share of the market in NA, with increased approaches in hybrid formulations, which blend various kinds of biopolymers, like starch, cellulose, chitosan, and PLA, to resolve each risk & acquire enhanced performance. However, the US leaders are actively investing in optional feedstocks, in which algae-derived [polymers are more efficient, and an alternative to describe raw material supply vulnerabilities.

A Surge in PFAS Replacement & Smart Packaging is Driving Europe

With a lucrative expansion, Europe will register a major step in PFAS replacement. The European biopolymer coatings market has been widely using innovative chitosan-carnauba wax blends and protein-based coatings, which are developing as promising, high-barrier, PFAS-free choices. Furthermore, ongoing significant advancements in smart and active coatings are encouraging the incorporation of functional additives, particularly natural antimicrobial agents, antioxidants (e.g., vanillin, essential oils), and pH-sensitive dyes to escalate shelf life, monitor food quality in real-time, and lower food waste.

Expanding Product Launches and Commercialization: Empowering the German Market

Germany is promoting significance in advanced barrier properties, antimicrobial functions, and improved recyclability/compostability. Recently, at the European Coatings Show 2025, Covestro AG presented novel bio-based polyurethane coatings (some with up to 70% renewable content) targeting automotive and industrial applications. Alongside, Evonik Industries AG unveiled the biodegradable polymer RESOMER for medical implants and drug delivery systems.

Variations Across the Industries & R&D Novelty are Impacting the Latin America Market

The possession of varied sectors, like agriculture (seed coatings), healthcare (drug delivery systems), and textiles in this region, is greatly forcing the adoption of biopolymer coatings for their functional, fruitful effects, and further widening market opportunities. However, the biopolymer coatings market in Latin America is encouraging collaborations among the prominent international companies and local academic institutions to enhance R&D activities and scale up production capabilities. Sush as NatureWorks LLC boosted its production capacity for PLA in South America and conducted different university studies on local material applications.

Accelerating Development of Edible Coatings: Transforming the Brazilian Market

Nowadays, researchers in this country are highly emphasizing the development of edible coatings coupled with abundant natural sources, including plantain peels, amaranth starch, cassava tubers, and mucilage from okra and cactus. Also, they are exploring polysaccharide-based coatings for lowering spoilage, extending shelf life, and providing a sustainable alternative to conventional packaging.

Innovative Functional Coatings are Fueling the MEA Market

The leading players in MEA are actively involved in continuous innovations in functional biopolymer coatings, especially nisin-incorporated coatings effective against microbial contamination and enzyme-embedded coatings (e.g., PLA-based). Along with the MEA, specifically government initiatives in the UAE and Saudi Arabia are increasingly leveraging sustainability to curb plastic pollution.

Adoption of High-Performance Biopolymer: Exploring the Saudi Arabia Market

Eventual rising imposition on sustainability, and the widespread adoption of high-performance biopolymer solutions, such as materials with expanded barrier properties, coupled with cellulose nanofibers and graphene nanoplatelets, are increasingly supporting the market expansion.

Biopolymer Coatings Market: Value Chain Analysis

- Feedstock Procurement

This mainly encompasses sourcing renewable, bio-based materials from various origins, like plants, animals, and microorganisms, or using industrial and agricultural waste streams. - Quality Testing and Certification

It includes an evaluation of their mechanical, thermal, barrier, chemical, and biological properties against specific international standards (ISO, ASTM). - Regulatory Compliance and Safety Monitoring

It is governed by stringent, multi-national frameworks emphasised mainly on migration limits, the use of approved ingredients, and adherence to Good Manufacturing Practices (GMP).

Biopolymer Coatings Market Companies

- BASF SE: Provides compostable and enhanced barrier properties for packaging and automotive with brands like ecovio and Ecoflex.

- NatureWorks LLC: Produces Ingeo PLA biopolymers from renewable plants for food-safe coatings and 3D printing.

- Mitsubishi Chemical Group: Manufactures BioPBS, a bio-based and biodegradable plastic for compostable coatings on paper cups and food packaging.

- Arkema S.A.: Offers PFAS-free, sustainable coatings for packaging and automotive interiors with their Rilsan Clear G range.

- Corbion: Provides Luminy PLA-based biopolymers for improved moisture resistance and durability in biodegradable food packaging.

- Novamont S.p.A. develops starch-based, biodegradable polymer materials.

- Danimer Scientific produces fully biodegradable PHA-based biopolymers.

- DuPont: Develops bio-derived specialty polymers providing flexibility and adhesion for renewable and recyclable packaging.

- Evonik Industries: Offers bio-derived additives and antimicrobial biopolymer coatings for the medical and food safety sectors.

- Archer Daniels Midland (ADM) supplies plant-derived starches and renewable ingredients.

- Cargill- It launched Incroflo P50, a novel, bio-based polymeric processing, an environmentally friendly replacement for fluorinated additives in polyolefin extrusion (used in plastic packaging films).

- AkzoNobel- In February 2025, it unveiled a new wood coating with 20% bio-based content derived from plants.

- Roquette Group- In February 2025, introduced a new platform featuring ReadiLYCOAT plant-based, ready-to-use coating systems.

Recent Developments

- In October 2023, IFF, an American corporation indulged in the manufacturing and supply of flavors and fragrances, is set to launch its new well-characterized biopolymer methanova at CPHI.

- In April 2024, BASF, a German chemicals company, expanded its certified compostable biopolymer ecovio with the launch of T 2206, an industrial compostable biopolymer for greenhouse twines.

- In October 2023, NatureWorks, a leading manufacturer of low-carbon PLA biopolymers, is constructing its new facility in Thailand to manufacture Ingeo PLA biopolymers from sugarcane to meet the demands for eco-friendly and biobased sustainable products.

- In September 2023, Saveggy, a Swedish food tech company, partnered with Odlarna.se to develop a coating for extending cucumber shelf life by 3-4 times.

- In June 2022, Greatview, a Chinese multinational aseptic processing company, joined INeos and UPM Biofuels to manufacture Greatview Planet aseptic cartons.

Segments Covered in the Report

By Product

- Bio PA Coatings

- General Industrial

- Automotive

- Exterior

- Construction

- Wire Goods

- Electrical

- Bio PU Coatings

- Deckings

- Textile

- Architectural

- Furniture

- Floorings

- Automotive

- PLA Coatings

- Food & Beverage Packaging

- General Packaging

- Bio PBS Coatings

- General Packaging

- Food & Beverage Packaging

- Cellulose Esters

- Food & Beverages

- Automotive

- Textiles

- Furniture

- Starch Coatings

- Food & Beverage Packaging

- General Packaging

- Pharmacy Bags

- Wax Coatings

- General Packaging

- Edible Coatings

- Food & Beverage Packaging

- Nitrocellulose Coatings

- Flooring

- Decking

- Furniture

- Corn Zein Protein

- Pharmaceutical

- Food & Beverage Packaging

- Soy Protein Coatings

- Food & Beverage Packaging

- General Packaging

By End User

- Packaging

- Automotive

- Food & Beverages

- Pharmaceutical

- Others

By Region

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting