Biopolymer Films Market Size and Forecast 2025 to 2034

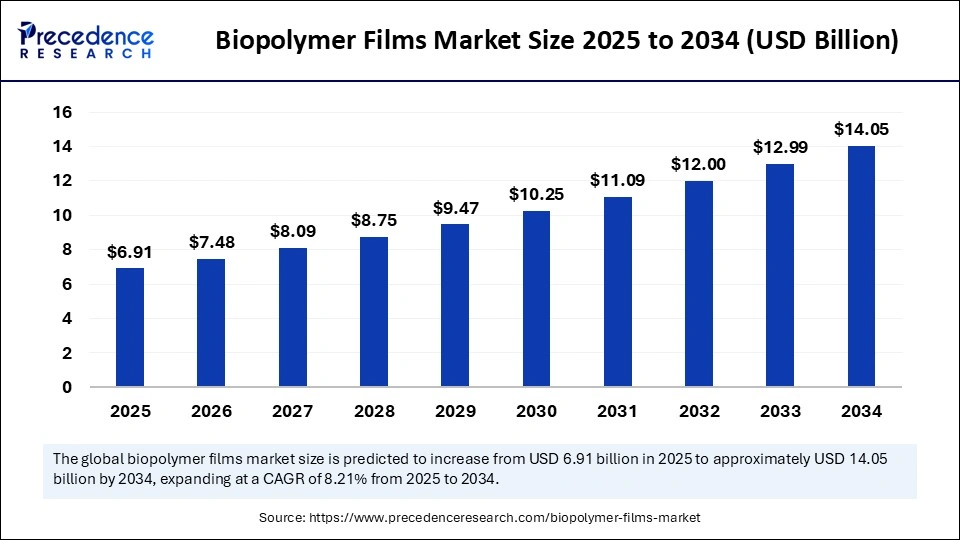

The global biopolymer films market size was calculated at USD 6.38 billion in 2024 and is predicted to increase from USD 6.91 billion in 2025 to approximately USD 14.05 billion by 2034, expanding at a CAGR of 8.21% from 2025 to 2034. The biopolymer films market is experiencing growth, with sustainability demand and packaging innovation continue to support market acceptance and adoption of eco-friendly materials.

Biopolymer Films Market Key Takeaways

- In terms of revenue, the global biopolymer films market was valued at USD 6.38 billion in 2024.

- It is projected to reach USD 14.05 billion by 2034.

- The market is expected to grow at a CAGR of 8.21% from 2025 to 2034.

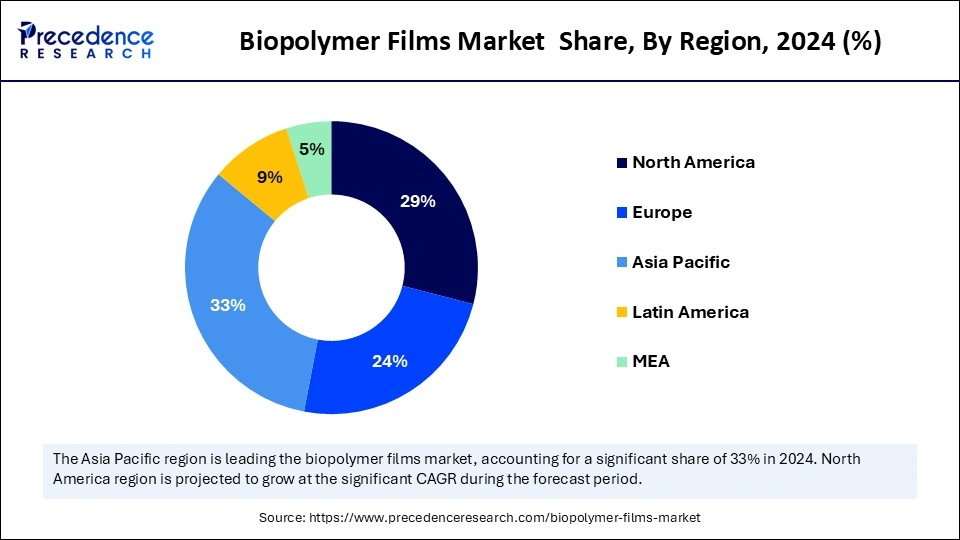

- Asia Pacific dominated the biopolymer films market with the largest market share of 33% in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By material type, the polylactic acid (PLA) films segment held the biggest market share of 30% in 2024.

- By material type, the polyhydroxyalkanoates (PHA) films segment is expected to expand at a notable CAGR over the projected period.

- By film type, the biodegradable films segment captured the highest market share of 40% in 2024.

- By film type, the edible films segment is expected to expand at a notable CAGR over the projected period.

- By technology, the extrusion segment contributed the maximum market share of 35% in 2024.

- By technology, the solvent casting is expected to expand at a notable CAGR over the projected period.

- By application, the packaging segment accounted for the significant market share of 45% in 2024.

- By application, the medical & healthcare segment is expected to expand at a notable CAGR over the projected period.

- By end user industry, the food & beverage segment held the largest market share of 38% in 2024.

- By end user industry, the pharmaceuticals & healthcare segment is expected to expand at a notable CAGR over the projected period.

- By distribution channel, the direct sales segment generated the major market share of 42% in 2024.

- By distribution channel, the online retail segment is expected to expand at a notable CAGR over the projected period.

How Is Artificial Intelligence Impacting biopolymer films market?

Artificial intelligence is emerging as a game changer in biopolymer films, allowing companies to manufacture sustainable, high performance materials faster and more accurately than ever. In August 2025, the University of Maryland launched an AI platform supported by the NSF, created to hasten innovation of biodegradable polymer film development, capitalizing on surging interest from industry in scalable eco-packaging. At the industry level, reports have surfaced describing films being optimized through the use of AI, which provide extended shelf life, multi-objective features, and decreased experimental waste, to help connect discoveries made in labs with scalable, greener packaging solutions.

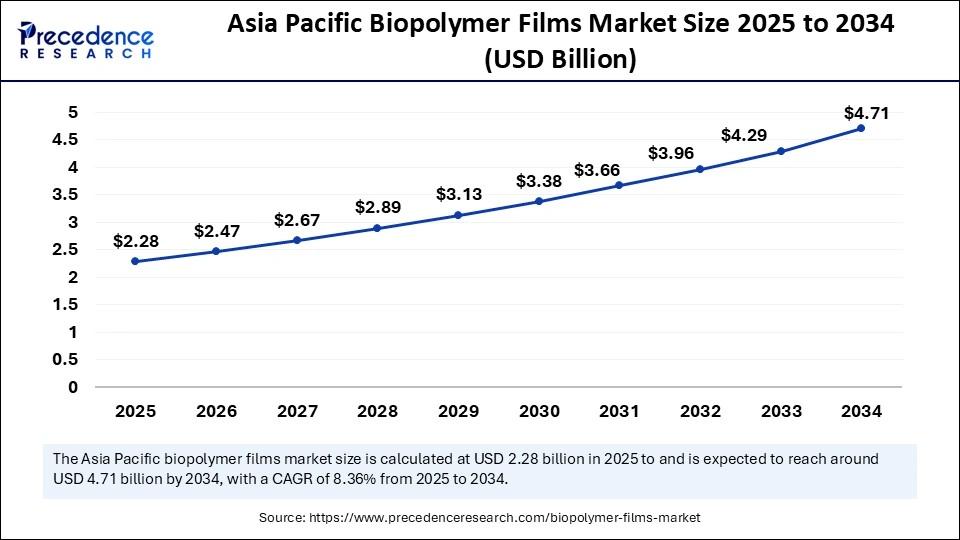

Asia Pacific Biopolymer Films Market Size and Growth 2025 to 2034

The Asia Pacific biopolymer films market size is exhibited at USD 2.28 billion in 2025 and is projected to be worth around USD 4.71 billion by 2034, growing at a CAGR of 8.36% from 2025 to 2034.

Asia Pacific Biopolymer Films Market Trends

Asia Pacific commands the biopolymer films market due to swift enforcement of policies, consumer pressure for sustainable packaging, and high-volume manufacturing capabilities. Regulations with tightened restrictions in India and China threaten the traditional plastic industry and are forcing sectors to adopt biodegradable or compostable films. For instance, India mandated that all compostable products be CPCB certified as meeting ISO 17088 standards, while Japan cities in 2021 expanded their bioplastic roadmap with targets for mass bioplastic approximately 2 million tons flourishing in packaging, and other areas, by 2030. These announcements deliver predictable demand while tightening supply chain knitting together Asia Pacific to become the number one biopolymer films market.(Source: https://www.env.go.jp)

Japan is the pivot in the region and the focal point by which Japan's governments bioplastic roadmap refers to has potential to advance bioplastic's in packaging other supply chains and FMCG. Japan is advancing quickly and pushing adoption of bio-based and biodegradable films in for example cellulose growing media, etc., and multilayer films through new technology next generation multilayer innovative film. Policy incentives promoting compostable packaging combined with major retailers and FMCG brands commitment to sustainability, has pushed the needle actionable be compostable.

North America Biopolymer Films Market Trends

North America is on the verge of becoming the fastest-growing region for biopolymer films based on regulatory momentum and innovation. California's Extended Producer Responsibility (EPR) (SB 54) law and compostable labeling (AB 1201) rules are creating de facto thresholds and inspiring converters and brands to implement compatible packaging film. Furthermore, contributions towards establishing the performance capabilities of the existing product mix through investments into polyhydroxyalkanoate (PHA) based materials and compostable film blends is shifting marketplace, meanwhile creating more robust regional growth for sustainable film.

- In March 2025, Oman Investment Authority announced a strategic investment into a prominent biopolymers company based in the U.S., adding to its sustainability portfolio and fueling global advancement of renewable and eco-friendly material solutions.(Source: https://www.zawya.com)

Market Overview

The Biopolymer Films Market refers to the industry focused on the production and utilization of films derived from renewable biological sources such as starch, cellulose, proteins, polylactic acid (PLA), and polyhydroxyalkanoates (PHA). These films serve as sustainable alternatives to conventional petroleum-based plastics and are widely applied in packaging, agriculture, food & beverage, pharmaceuticals, and consumer goods. Characterized by biodegradability, compostability, and reduced carbon footprint, biopolymer films are gaining traction due to growing environmental concerns, regulatory support for sustainable packaging, and demand for eco-friendly products across industries.

Biopolymer Films Market Growth Factors

- Increasing Environmental Regulation: Worldwide bans and reduction of single-use plastics are forcing manufacturers to research and develop biodegradable products as alternatives. These regulations make biopolymer films a natural fit for sustainable materials in flexible packaging, agriculture and consumer goods.

- Rising Consumer Demand for Eco-conscious Products: Consumers increasingly select eco-friendly and compostable products, leading brand to offer biopolymer films in food and beverage packaging to support their sustainability goals, and appeal to the eco-conscious customer.

- Development of Circular Economy Models:Industries is looking at closed-loop solutions and compostable packaging. Biopolymer films are recyclable and/or biodegradable, and maximize a great opportunity with developing sustainable packaging and waste reduction initiatives globally.

- Demand from Larger End-user Industries: Food packaging, agriculture, and pharmaceuticals, use of biopolymer films is growing for safety, biodegradability, and functional characteristics. Demand across all sectors promotes and accelerates large growth in the biopolymer marketplace, and supports consistent adoption.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 14.05 Billion |

| Market Size in 2025 | USD 6.91 Billion |

| Market Size in 2024 | USD 6.38 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.21% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Film Type, Technology, Application, End User Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

What is Behind the Growth of Biopolymer Films Globally?

The primary driver behind the growth of the biopolymer films sector is the global obsession with single-use plastic and sustainability. While regulatory authorities and governments are implementing laws and mandates to reduce plastic pollution e.g. the EU's new Packaging and Packaging Waste Regulation requires compostable packaging for tea bags, fruit stickers and similar products by 2028 and California's SB 54 requires all single-use packaging to be recyclable or compostable by 2032 to me these policies are a drop in the bucket.Major food and beverage brands are implementing biodegradable films for all of their wrapping and labeling. They do this not just out of environmental necessity, but consumer preference. For all of these reasons, biopolymer films are squarely in the crosshairs of the global packaging sectors sustainability shift.

Restraint

What Is Holding Back the Biopolymer Films Market?

A chief constraint for the biopolymer films market has been high production costs and the limited availability of raw materials compared to conventional plastics. Unlike petroleum-based films, biopolymer films use high-cost feedstocks, such as starch, cellulose, or polylactic acid, and the processing can be high in energy use and may even require specialized equipment.

As a result, biopolymer films are often 3-4 times the price of conventional plastic films which can make adoption difficult for price-sensitive industries such as food packaging. Moreover, recent reports have indicated that supply chain disruptions in agricultural feedstocks for biopolymers, such as corn and sugarcane, have added additional costs and limited scalability. Although the demand for sustainable materials is increasing, affordability remains the primary barrier to wider uptake of biopolymer films.

Opportunity

Can Biodegradable Agricultural Mulch Films Revolutionize Sustainable Farming Practices?

The main opportunity for the global biopolymer films market is the increase in biodegradable mulch films, which are biodegradable mulching films that decompose naturally and therefore provide a traditional plastic based mulch sustainability option. These films provide better vegetables by improving soil health, soil temperature, and soil moisture while at the same time, reducing farmers' problems with disposal and clean-up. Recent research has focused on starch and cellulose based films that break down quickly without leaving harmful residues as well.

- In 2024, several countries in Europe increased the testing of biodegradable mulch films on vegetable crops to support green transition goals, demonstrating their acceptance in states with the most politicized acceptance of biodegradable mulch films. Furthermore, as governments promote sustainable farming practices and continue to ban single-use plastics, the growth opportunities for biodegradable agricultural films continue to expand for the biopolymer films industry.

Material Type Insights

How did Polylactic Acid (PLA) films dominate the biopolymer films market in 2024?

Polylactic Acid (PLA) is the leading material type for films in 2024, due to its very good biodegradability, low relative cost, and broad compostable availability through renewable sources such as corn starch and sugarcane. They will see significant use in the food packaging market, disposable products, and agriculture where a strong mechanical property and compostable material are required. PLA's legislation-driven and growing replacement of petroleum-based plastics in the economy will further solidify its dominance.

Polyhydroxyalkanoates (PHA) films are the fastest-growing material type as they can fully biodegrade in soil and marine environments. PHA films are gaining traction in specialty packaging, biomedical applications, and single-use products. Investment in sustainable materials and improvements in production technology have further facilitated the growth of PHA films, especially in regions with stringent regulations on plastic waste management.

Film Type Insights

How did biodegradable films dominate the biopolymers films market?

Biodegradable films segment continued to dominate the Biopolymer Films Market in 2024. The biodegradable process, when used appropriately, adds less on the environmental concern scale than a conventional plastic. Legislation on single use plastics is increasing and continues to drive consumer behaviour towards environmentally consciously alternatives and, as a result, more industries are using these films, promoting them as the leading film type.

Edible films are exhibiting the fastest growth, particularly in food and pharmaceutical applications. They provide the same barrier properties, are designed to be consumed thus packaging can be wasted. As the number of innovations with natural polymers such as starch, proteins, and polysaccharides increase, edible films are becoming a solid option for more sustainable alternatives with ready-to-eat food, confectionary, and drug delivery systems.

Technology Insights

What Makes Extrusion a Dominant Clinical Trial Phases?

Extrusion holds the leading position in the technology segment in 2024, being the most well-established and cost-effective means of rolling out biopolymer films at scale, allowing manufacturers to achieve uniform thickness, strength, and flexibility useful for packaging applications. The extrusion is done with several biopolymers, such as PLA and starch-based blends makes it an even surer bet for mass production.

Solvent casting has emerged as the fastest growing technology, especially for high value applications in the pharmaceuticals and healthcare sector. It is also the best technology to customize and control film structure, porosity, and thickness for applications requiring film to drug delivery films and biodegradable coatings. The demand for specialty films requiring some enhanced performance properties are contributing to the rapid implementation of solvent casting into the marketplace.

Application Insights

Which is the largest application segment in biopolymer films market?

The packaging segment dominated the biopolymer films market in 2024, Food packaging is leading applications where biopolymer films are extensively used for bags, pouches, coatings, and preserving the shelf life of food products. Increased consumer demand for sustainable packaging alternatives and pervasive legislation surrounding plastic waste are further increasing their use in packaging bakery, dairy, fresh produce, and ready-to-eat food products, as well as providing stability to the food packaging segment.

Drug delivery films are the fastest growing application in terms of their value in controlled drug release, wound healing, and biomedical coatings. Biopolymer films allow for biocompatibility, non-toxicity, and degradability that are desirable properties for these types of sensitive healthcare uses. A growing body of research in bio-based polymers for personalized medicine and drug delivery, as well as pharmaceutical packaging is contributing to faster growth in this high value medical segment.

End User Industry Insights

How did food and beverage segment lead the biopolymer films market in 2024?

Food & Beverage segment dominated the end-user Industry in biopolymer films market in 2024, as biopolymer films are widely used in food, beverage and dairy packaging, labels, and protective coatings. Increased consumer awareness of eco-friendly packaging alongside the necessity of food and beverage product safety and shelf life are primary drivers, while being compostable is an important benefit for packaging in the home, including for snacks, beverages, dairy, and fresh produce.

Pharmaceuticals & healthcare is the fastest-growing major end user segment as general biopolymer films are used in drug delivery systems, protective and functional wound dressings and medical packaging. Biocompatibility and biodegradability makes biopolymer films suitable for very sensitive medical applications. Increased investment in bio-based healthcare materials and the regulatory landscape to support sustainable materials in medical packaging will continue to grow this segment.

Distribution Channel Insights

What made direct sales dominate the biopolymer films market in 2024?

Direct sales dominate the distribution channel segment, because manufacturers prefer supplying biopolymer films directly to large industries such as food packaging, agricultural, and healthcare industries. Direct sales provide better pricing, customization, and solid relationships with bulk buyers. Even larger companies prefer direct distribution because it allows them to maintain efficient supply chains and fulfill client demands when they request specific customizations.

Online retail distribution is currently experiencing the fastest growth, as an increase in digital platforms expands the ability for biopolymer films to reach small businesses and individual consumers. Now that e-commerce channels allow for easy access, provide a wider range of products, and provide competitive prices; the large adoption of sustainable packaging among start-ups and growing demand by consumers who are environmentally conscious have all caused rapid growth of the online distribution channel.

Value Chain Analysis for Biopolymer Films Market

- Feedstock Procurement

This stage use renewable feedstocks such as starches, cellulose, and polylactide, that were derived from agriculture or forestry to be utilized to produce sustainable biopolymers.

Key Players: NatureWorks LLC, Novamont S.p.A, Braskem, Corbion.

- Compound Formulation and Blending

Biopolymer resins are blended with additives, plasticizers, and functional agents to enhance resistance and flexibility, for specific properties and functions.

Key Players: BASF SE, Arkema, Mitsubishi Chemical Group, Danimer Scientific.

Distribution to Industrial Users

Producers and suppliers to sticks biopolymer films developed to packaging; agriculture; and consumer goods industries, whether by distribution channels or direct sales.

Key Players: Taghleef Industries, Futamura Group, Toray Industries, Avery Dennison.

- Waste Management and Recycling

Used films go to composting, biodegradation, or potential recycling streams, which help to alleviate landfill flows and support circular economy perspectives.

Key Players: Loop Industries, BioBag International, TotalEnergies Corbion.

- Regulatory Compliance and Safety traceability

Producers help to ensure that biopolymer films are certified sustainable, food safe, biodegradable, etc. through various regulations around the world, with entry by certification authorities.

Key Players: TÜV Austria, SGS SA, Bureau Veritas, Intertek Group.

Biopolymer Films Market Companies

- NatureWorks LLC

- BASF SE

- Novamont S.p.A

- Braskem S.A.

- Mitsubishi Chemical Corporation

- Toray Industries Inc.

- Danimer Scientific

- Plantic Technologies Ltd.

- BioBag International AS

- FKuR Kunststoff GmbH

- Innovia Films Ltd.

- Avery Dennison Corporation

- Cortec Corporation

- TIPA Corp Ltd.

- Vegware Ltd.

- EarthFirst Films

- Treofan Group

- GreenDot Bioplastics

- Biome Bioplastics Ltd.

- Amcor plc

Recent Developments

- In June 2025, On World Environment Day, UKHI launched its EcoGran, a revolutionary Indian biopolymer that is designed to be used as a substitute for plastics and will biodegrade. UKHI's aim is to support the circular economy in the context of sustainability and initiate eco-friendly manufacturing processes.

(Source: https://ukhi.org) - In March 2025, NatureWorks has launched a new BOPLA film solution, called Ingeo™ biopolymers. The new film excels due to production efficiencies, improved mechanical strength, and faster biodegradability and allows packaging companies to introduce greener materials into their product offerings, without sacrificing performance.(Source:https://www.businesswire.com)

Segments Covered in the Report

By Material Type

- Polylactic Acid (PLA) Films

- Polyhydroxyalkanoates (PHA) Films

- Starch-Based Films

- Cellulose-Based Films

- Protein-Based Films (Soy, Gelatin, Whey, Others)

- Lipid-Based Films

- Chitosan Films

- Blended/Composite Biopolymer Films

- Others

By Film Type

- Biodegradable Films

- Compostable Films

- Edible Films

- Water-Soluble Films

- Barrier Films

- Others

By Technology

- Solvent Casting

- Extrusion

- Blown Film

- Injection Molding

- Coating & Layering Techniques

- Others

By Application

- Packaging

- Food Packaging

- Beverage Packaging

- Pharmaceutical Packaging

- Personal Care Packaging

- Industrial Packaging

- Others

- Agriculture

- Mulch Films

- Greenhouse Films

- Silage Films

- Seed Coating Films

- Others

- Medical & Healthcare

- Drug Delivery Films

- Wound Dressing Films

- Biodegradable Medical Device Films

- Others

- Consumer Goods

- Shopping Bags

- Household Products

- Stationery Products

- Others

- Industrial Applications

- Coatings & Adhesives

- Textile Films

- Electronics Films

- Others

By End User Industry

- Food & Beverage

- Agriculture

- Pharmaceuticals & Healthcare

- Personal Care & Cosmetics

- Industrial Manufacturing

- Consumer Goods

- Textiles

- Electronics

- Others

By Distribution Channel

- Direct Sales

- Distributors/Wholesalers

- Online Retail

- Specialty Stores

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting