What is the Biosimilar Monoclonal Antibody Market Size?

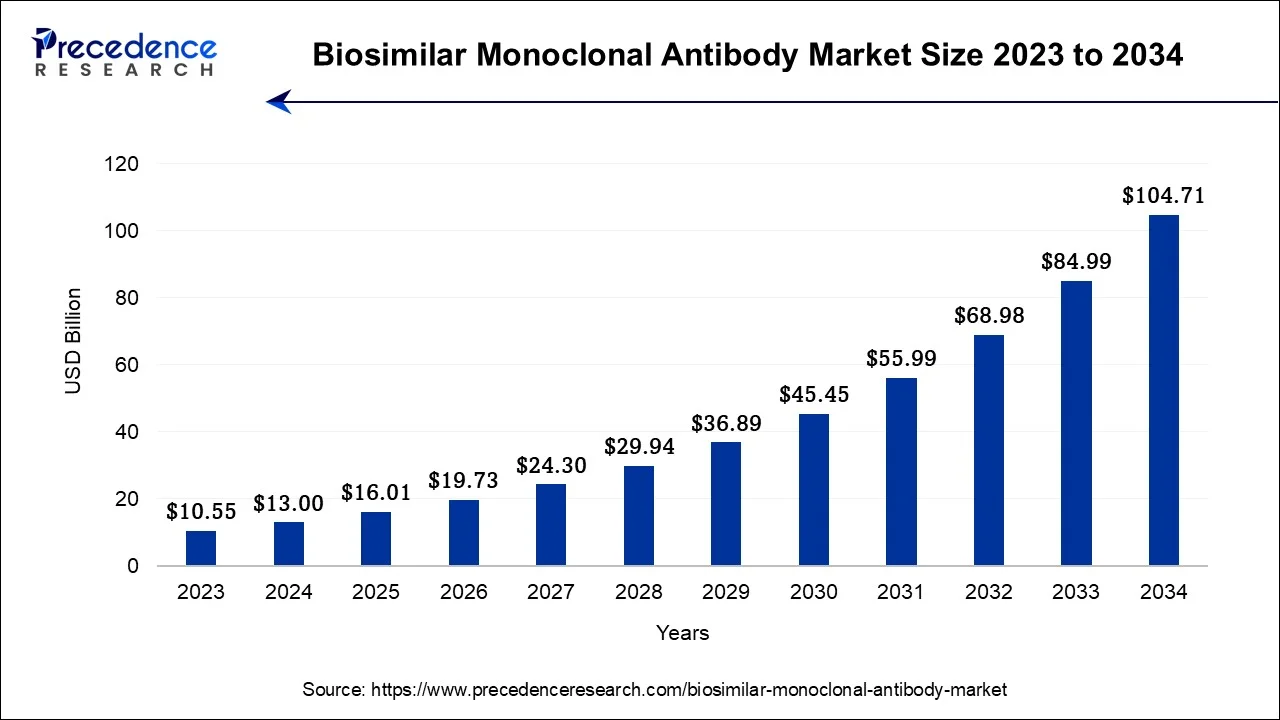

The global biosimilar monoclonal antibody market size accounted for USD 16.01 billion in 2025 and is anticipated to reach around USD 104.71 billion by 2034, growing at a CAGR of 23.20% between 2025 and 2034.

Market Highlights

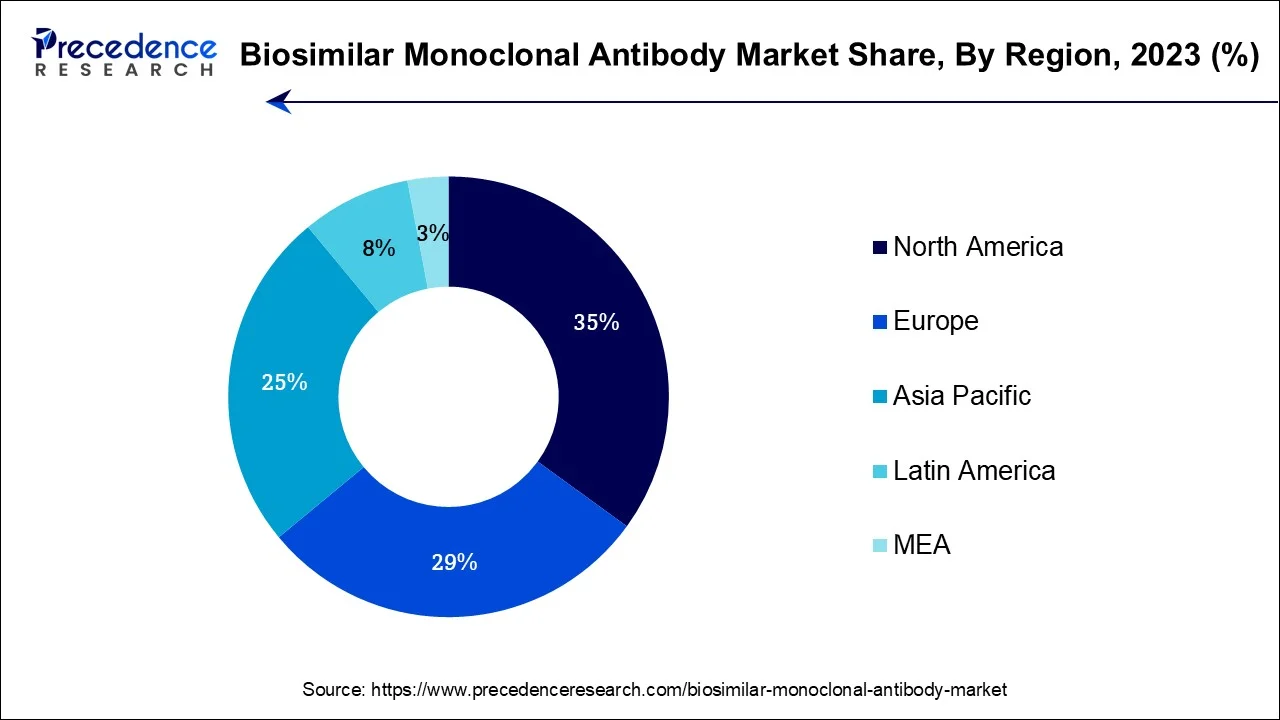

- North America contributed more than 35% of revenue share in 2025.

- Asia-Pacific is expected to expand at the biggest CAGR of 8.3% between 2025 and 2034.

- By Type, the infliximab segment has held the largest market share of 32% in 2025.

- By Type, the adalimumab segment is anticipated to grow at a remarkable CAGR of 24.7% between 2025 and 2034.

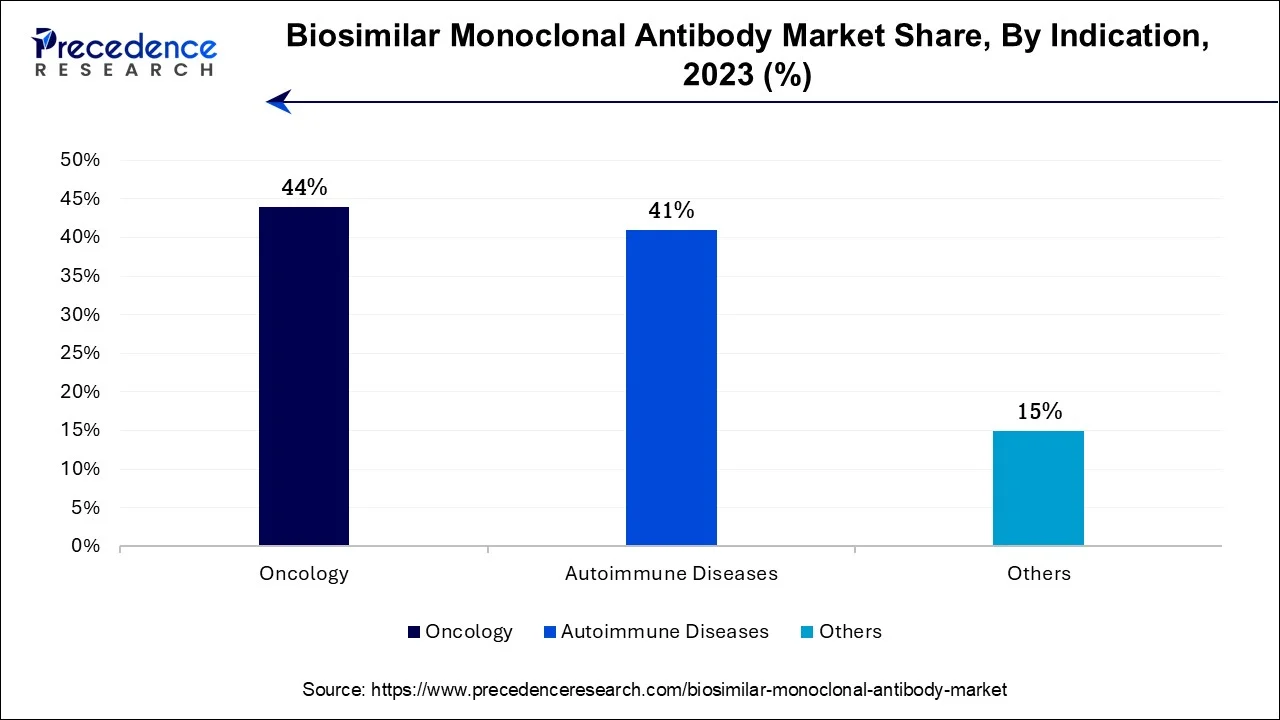

- By Indication, the oncology segment captured more than 44% of revenue share in 2025.

- By Indication, the autoimmune diseases segment is projected to expand at the fastest CAGR over the projected period.

- By End-user, the hospital segment led the market with the largest market share of 49% in 2025.

- By End-user, the others segment is anticipated to grow at the fastest CAGR over the projected period.

Market Size and Forecast

- Market Size in 2025: USD 16.01 Billion

- Market Size in 2026: USD 19.73 Billion

- Forecasted Market Size by 2034: USD 104.71 Billion

- CAGR (2025-2034): 23.20%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

Thebiosimilarmonoclonal antibody sector encompasses the realm of the pharmaceutical industry dedicated to the production and distribution of biosimilar monoclonal antibodies.Monoclonal antibodiesserve as therapeutic proteins widely utilized in the management of various medical conditions, including cancer and autoimmune ailments. Biosimilars represent almost identical versions of already-approved monoclonal antibodies, meticulously crafted to present more economically advantageous options.

The market has witnessed substantial expansion, primarily driven by the escalating demand for economically efficient biologic therapies. Despite grappling with regulatory complexities and fierce market rivalry, the expiration of patents is anticipated to herald an influx of additional biosimilars, augmenting patient accessibility to essential treatments, encouraging competition, and potentially curbing healthcare expenditure.

Biosimilar Monoclonal Antibody Market Outlook

- Industry Growth Overview: The biosimilar monoclonal antibody market is projected for explosive growth from 2025 to 2034. This growth is driven by the imminent patent expirations of numerous blockbuster biologic drugs, the rising global prevalence of chronic diseases like cancer and autoimmune disorders, and the urgent need for cost-effective therapeutic alternatives.

- Strategic Push for Market Access and Affordability: There is a strong focus on enhancing market access and affordability, largely driven by the rise of biosimilars. By providing lower-cost alternatives to expensive biologics, biosimilars help address high healthcare expenditures, reshape global pricing models, and expand patient access to critical therapies, making them a key factor in the industry's growth and competitiveness.

- Major Investors:The market is led by large, integrated pharmaceutical and biotechnology companies along with their investment branches. Key players include Pfizer, Novartis (Sandoz), Amgen, Celltrion, Samsung Bioepis, and Biocon. Investment activity mainly focuses on strategic alliances, mergers, and acquisitions to increase market share, secure global commercialization rights, and fund R&D for next-generation biosimilars.

- Startup Ecosystem: The startup ecosystem is maturing, though developing a biosimilar is a capital-intensive and complex process. Emerging firms often focus on specific technological innovations, such as advanced cell line engineering or AI-assisted trial design, or partner with larger firms for commercialization and manufacturing.

Biosimilar Monoclonal Antibody Market Growth Factors

The biosimilar monoclonal antibody market represents a thriving and swiftly evolving segment in the pharmaceutical domain. This niche specializes in the production and distribution of biosimilar versions of monoclonal antibodies, which serve as crucial therapeutic proteins for treating diverse medical conditions, including cancer and autoimmune disorders. Numerous noteworthy trends and catalysts for growth are shaping the industry's landscape.

One prominent growth factor propelling the biosimilar monoclonal antibody market forward is the escalating demand for economically viable biologic therapies. As healthcare costs continue their upward trajectory, biosimilars emerge as a financially sound alternative to their costly originator counterparts. The imperative is to expand patient access to essential treatments while simultaneously curbing the mounting healthcare expenses.

Observable industry trends indicate a persistent expansion in the biosimilar monoclonal antibody market, stemming from the expiration of patents for original monoclonal antibodies. This creates substantial avenues for pharmaceutical enterprises to conceptualize and introduce biosimilar alternatives. Moreover, the regulatory framework is adapting to simplify the approval process for biosimilars, thereby providing added impetus for market growth.

However, the biosimilar monoclonal antibody market is not devoid of its hurdles. The development of biosimilars necessitates substantial investments in research and development, and companies must surmount technical challenges to attain a high degree of likeness to the original monoclonal antibodies. Complexities surrounding regulations and intellectual property can prove formidable obstacles for market entry, as do the demanding clinical trials essential for approval.

In summary, the biosimilar monoclonal antibody market thrives due to the burgeoning need for economical biologic therapies and the openings created by patent expirations. While the industry continues its expansion, businesses encounter formidable challenges in navigating intricate regulatory terrain and successfully crafting top-tier biosimilars. Notwithstanding these impediments, the market is poised for sustained growth and offers promising business prospects for those equipped to confront and surmount these barriers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 16.01 Billion |

| Market Size in 2026 | USD 19.73 Billion |

| Market Size by 2034 | USD 104.71 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 23.2% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Indication, End User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expired patents

The termination of patents plays a pivotal role in propelling the growth of the biosimilar monoclonal antibody market. As original monoclonal antibody patents expire, it paves the way for pharmaceutical firms to venture into the development of biosimilar alternatives. This creates a lucrative business opportunity, as biosimilar manufacturers can enter the arena, introducing competition that yields a range of essential advantages.

To begin, it intensifies market rivalry, naturally leading to reduced prices for monoclonal antibody therapies. This heightened competition exerts pressure on originator drug manufacturers to reevaluate their pricing strategies, rendering these life-saving treatments more cost-effective and accessible to both patients and healthcare systems. Secondly, the availability of biosimilars expands the choices for healthcare providers and patients alike. It empowers them to opt for treatments that are equally efficacious but more economically viable.

This augmented array of options and affordability amplifies patient access to critical therapies. In sum, the termination of patents is a fundamental driver for the growth of the biosimilar monoclonal antibody market. It facilitates heightened competition, cost-effectiveness, and accessibility, concurrently fostering innovation and advancement within the pharmaceutical sector.

Restraints

Clinical trial requirements

Clinical trial prerequisites stand as a notable impediment to the expansion of the biosimilar monoclonal antibody market. Regulatory authorities mandate rigorous clinical trials for biosimilar development to confirm product safety and efficacy. These trials entail substantial resource allocation, time consumption, and financial investments. Moreover, the demanding clinical trial requirements not only extend the product development timeframe but also pose financial burdens that might deter potential manufacturers from entering the biosimilar market.

The stringent criteria can also lead to challenges in patient recruitment, as biosimilar clinical trials often necessitate larger participant pools, creating delays and recruitment difficulties. In essence, the clinical trial demands represent a formidable barrier, constraining the growth of the biosimilar monoclonal antibody market. They impose substantial costs, protracted development timelines, and can discourage new industry players from venturing into this pharmaceutical segment.

Opportunities

Biosimilar penetration in oncology

The introduction of biosimilars into the field of oncology has ushered in compelling opportunities within the biosimilar monoclonal antibody market. Monoclonal antibodies are pivotal in cancer treatment, providing a substantial patient base and a thriving market for these biological therapies. Biosimilars, with their cost-effective appeal, present an enticing option for healthcare systems and cancer patients grappling with the formidable financial challenges of cancer treatment.

Within this landscape, biosimilar manufacturers have the chance to develop and offer biosimilar monoclonal antibodies that cater to specific cancer types or individual patient requirements. This tailored approach can address the escalating demand for economical cancer treatments, potentially alleviating the financial burden on patients and healthcare providers.

Moreover, regulatory bodies are increasingly acknowledging the significance of biosimilars in oncology, simplifying the approval pathways and endorsing their integration into cancer care. This accommodating regulatory environment creates a conducive setting for biosimilar manufacturers to explore novel avenues, ultimately advancing patient access to life-saving oncology therapies while fostering expansion in the biosimilar monoclonal antibody market.

Segments Insights

Type Insights

According to the type, the infliximab segment has held 32% revenue share in 2025. The infliximab segment holds a substantial share in the biosimilar monoclonal antibody market due to several key factors. Infliximab is a widely used monoclonal antibody for treating various autoimmune diseases, making it a significant part of the market. Additionally, patents for the originator infliximab have expired, creating a prime opportunity for biosimilar manufacturers. Its well-established efficacy and demand, coupled with cost-saving benefits, have driven healthcare providers and patients to favor infliximab biosimilars, thereby securing a significant market share within the biosimilar monoclonal antibody segment.

The adalimumab segment is anticipated to expand at a significantly CAGR of 24.7% during the projected period. The Adalimumab sector's commanding growth within the biosimilar monoclonal antibody market can be attributed to multiple compelling factors. Most notably, this specific monoclonal antibody, instrumental in addressing autoimmune maladies like rheumatoid arthritis and inflammatory bowel disease, has seen a series of patent expirations, prompting a surge in biosimilar development. Its substantial cost and widespread utilization in treatment regimens have fueled the demand for more budget-friendly biosimilar alternatives. Consequently, patients and healthcare systems alike are increasingly turning to Adalimumab biosimilars to alleviate the financial strains associated with treatment, thereby establishing this segment as a dominant growth leader in the biosimilar monoclonal antibody market.

Indication Insights

In 2025, the oncology segment had the highest market share of 44% on the basis of the indication. The dominance of the oncology sector within the biosimilar monoclonal antibody market can be attributed to the extensive use of monoclonal antibodies in cancer therapy. Cancer, being a widespread and life-threatening disease, contributes to a substantial patient base seeking these treatments. The substantial expenses linked with oncology care have accentuated the attractiveness of biosimilars, as they provide substantial cost savings while upholding therapeutic effectiveness. Moreover, regulatory endorsement of biosimilars in the oncology field, combined with the potential to customize treatments for specific cancer types, has further elevated their significance in this market, establishing oncology as a pivotal driving force in the adoption of biosimilar monoclonal antibodies.

The autoimmune diseases segment is anticipated to expand at the fastest rate over the projected period. The dominant growth of the autoimmune diseases segment in the biosimilar monoclonal antibody market can be attributed to several pivotal factors. These conditions, marked by immune system irregularities, frequently necessitate monoclonal antibody therapies. Biosimilars are attractive in this context due to their cost-efficiency when compared to the high-priced original biologics. Given the rising incidence of autoimmune diseases and the imperative for more affordable treatment alternatives, the demand for biosimilar monoclonal antibodies in this therapeutic domain has experienced remarkable growth, establishing their significant growth in the market.

End User Insights

In 2025, the hospital segment had the highest market share of 49% on the basis of the end user. Hospitals dominate the biosimilar monoclonal antibody market due to several reasons. Firstly, hospitals are primary healthcare providers, with a substantial patient base requiring advanced treatments, including monoclonal antibodies. Secondly, they have the infrastructure and skilled medical personnel to administer these complex therapies.

Additionally, hospitals often have stronger negotiation power with drug suppliers, allowing them to access cost-effective biosimilars. The inclination towards centralized purchasing and administration in hospital settings further contributes to their significant market share, as they can efficiently manage and control the usage of biosimilar monoclonal antibodies.

The others segment is anticipated to expand at the fastest rate over the projected period. The "Others" segment holds a substantial share in the biosimilar monoclonal antibody market because it encompasses diverse end users such as research institutes, academic institutions, and small-scale healthcare providers, making it a broad category. These end users often favor biosimilars due to their cost-efficiency and accessibility.

Furthermore, smaller healthcare facilities and research entities typically have budget constraints that drive them to opt for cost-effective biosimilars. As a result, the "Others" segment, representing a wide range of users, collectively contributes significantly to the biosimilar monoclonal antibody market, emphasizing the versatility and economic appeal of these biologic therapies.

Regional Insights

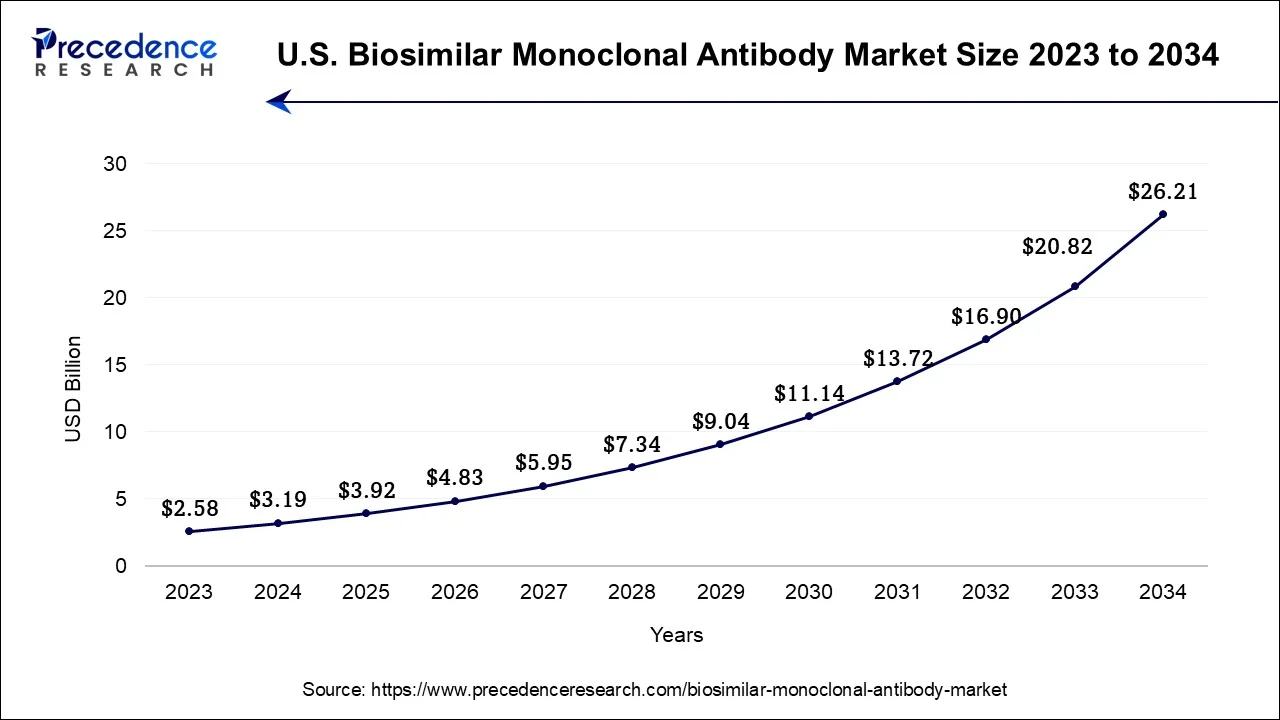

U.S. Biosimilar Monoclonal Antibody Market Size and Growth 2025 to 2034

The U.S. biosimilar monoclonal antibody market size was valued at USD 16.01 billion in 2025 and is estimated to be worth around USD 26.21 billion by 2034, growing at a CAGR of 23.44% from 2025 to 2034.

North America has held largest revenue share 35% in 2023. The dominant position of North America in the biosimilar monoclonal antibody market can be attributed to several compelling factors. The region benefits from its advanced healthcare infrastructure, a mature regulatory framework, and substantial healthcare expenditure, all of which facilitate the development and widespread adoption of biosimilars.

Moreover, a thriving research and development ecosystem, a robust presence of the pharmaceutical industry, and a growing demand for economical biologic therapies collectively bolster North America's leadership in this market. Notably, the United States, a pivotal component of the North American region, has taken proactive measures to promote biosimilar competition, reinforcing the region's prominent standing in the biosimilar monoclonal antibody market.

U.S. Biosimilar Monoclonal Antibody Market Trends

The U.S. led the market in North America, driven by its advanced infrastructure, high healthcare spending, and a clear regulatory pathway established by the FDA. This environment promotes market growth through numerous approvals and launches of biosimilars for conditions like cancer and autoimmune diseases. The introduction of biosimilars has been shown to significantly lower healthcare costs, leading to substantial savings. Prominent U.S.-based companies, including Pfizer, Amgen, and Viatris, are leveraging their extensive market presence and R&D capabilities.

What Makes Asia Pacific the Fastest-Growing Region in the Biosimilar Monoclonal Antibody Market?

Asia-Pacific is estimated to observe the fastest expansion with the highest CAGR of 8.3% during the forecast period. Asia-Pacific commands a substantial growth in the biosimilar monoclonal antibody market due to several factors. The region's large population and increasing healthcare expenditures drive the demand for affordable therapeutic options, making biosimilars an attractive choice. Additionally, supportive regulatory frameworks in countries like India and South Korea facilitate biosimilar development and approval.

The presence of prominent pharmaceutical companies and a growing emphasis on biotechnology further bolster the market. Moreover, the region's rising prevalence of chronic diseases, such as cancer, creates a substantial market for biosimilar monoclonal antibodies, cementing Asia-Pacific's significant growth in this sector.

India Biosimilar Monoclonal Antibody Market Trends

India is emerging as a major player and a potential future global biosimilar powerhouse, building on its expertise in generic drugs. The Indian market is characterized by cost-effective manufacturing, a large pool of skilled talent, and government support through initiatives such as the Make in India campaign and the Production-Linked Incentive scheme. Indian companies such as Biocon Biologics and Intas Pharmaceuticals have gained international recognition, securing FDA approvals for their biosimilars and positioning India as a high-quality, affordable manufacturer for both domestic and global markets.

How is the Opportunistic Rise of Europe in the Biosimilar Monoclonal Antibody Market?

Europe is experiencing a notable growth in the market, driven by an aging population, high rates of chronic diseases, and strong cost-containment pressures from public health systems. The European Medicines Agency (EMA) offers a clear, unified regulatory pathway that has encouraged widespread adoption of biosimilars and switching from original products. The market is mainly controlled by large pharmaceutical companies like Sandoz, Pfizer, and Celltrion, which heavily invest in R&D and manufacturing to provide a broad range of products for oncology and inflammatory conditions.

Germany Biosimilar Monoclonal Antibody Market Trends

Germany is a cornerstone of the European market, with high adoption rates of biosimilars driven by its well-established healthcare system and robust regulatory environment. The country hosts key global manufacturers and benefits from healthcare policies that promote the use of cost-effective biosimilars to manage costs and ensure widespread patient access to essential treatments. The market is technologically advanced, emphasizing high-quality production and R&D with major industry players, and it plays a vital role in supplying biosimilar monoclonal antibodies across the continent.

What Potentiates the Growth of the Latin America Biosimilar Monoclonal Antibody Market?

The market in Latin America is expanding because of the growing demand for affordable solutions to treat chronic and autoimmune diseases in a region where original biologics are often too expensive. The market is fueled by the patent expiration of major biologic drugs, rising demand for low-cost treatments, and supportive government policies in key countries like Brazil, Argentina, and Colombia. Additionally, strategic partnerships between local and international manufacturers are helping to build expertise and improve access.

Brazil Biosimilar Monoclonal Antibody Market Trends

Brazil is a key leader in the Latin American market, with a strong regulatory framework established by ANVISA that complies with international standards, promoting both local production and imports. The market's growth is fueled by the need for cost-effective treatments for a growing patient population and strong government support through public tenders and collaborations. Major global players are active in the industry, offering a variety of biosimilars for conditions like cancer and rheumatoid arthritis, helping to lower healthcare costs and improve patient access.

What Factors Support the Growth of the Middle East and Africa Biosimilar Antibody Market?

The market in the Middle East and Africa is experiencing steady growth, driven by a high burden of chronic diseases and the push for more affordable treatment options. Governments in the Gulf Cooperation Council (GCC) countries and South Africa are implementing supportive regulatory frameworks to attract investment and improve healthcare access, often aligning with international guidelines like those from the EMA and U.S. FDA to ensure a steady supply of these critical medicines.

Saudi Arabia Biosimilar Monoclonal Antibody Market Trends

Saudi Arabia's biosimilar monoclonal antibody market is a key focus area within the MEA region, aiming to transform the country's healthcare sector and decrease reliance on imported pharmaceuticals. The Saudi Food and Drug Authority has established a clear, well-defined regulatory pathway for biosimilars that aligns with global standards, which has increased confidence and adoption among healthcare providers, leading to significant cost savings for the healthcare system through biosimilar alternatives.

Value Chain Analysis

- Research and Development (R&D) & Cell Line Engineering

This stage focuses on developing biosimilar candidates and optimizing manufacturing processes.

Key Players: Sandoz, Pfizer, Amgen, Samsung Bioepis, Celltrion. - Clinical Trials and Regulatory Approval

This stage involves rigorous testing to demonstrate similarity, safety, and efficacy to regulatory bodies such as the FDA and EMA.

Key Players: Amgen, Biocon, CROs, and regulatory bodies (FDA, EMA). - Manufacturing and Production

Large-scale, complex production of antibodies in living cell systems, including purification and formulation.

Key Players: Pfizer, Sandoz, Amgen, Celltrion, Samsung Bioepis, and CDMOs. - Distribution and Supply Chain Management

This stage ensures secure delivery and cold chain storage to points of care.

Key Players: Major wholesalers, distributors, hospital pharmacies, and specialty clinics. - Commercialization, Sales, and Marketing

This stage involves promoting biosimilars to healthcare providers and payers.

Key Players: Sandoz, Pfizer and payers/insurers. - End-User Consumption and Patient Support

The final use of the treatment in clinical settings with ongoing safety monitoring and support programs.

Key Players: Pfizer, Amgen, Novartis, Samsung Bioepis

Top Companies in the Biosimilar Monoclonal Antibody Market and Their Offerings

- Novartis: Offers a broad portfolio of biosimilars for immunology and oncology, including Hyrimoz (adalimumab) and Erelzi (etanercept).

- Samsung Bioepis: Develops and commercializes biosimilars for autoimmune diseases, oncology, and ophthalmology, such as Hadlima (adalimumab) and Ontruzant (trastuzumab).

- Celltrion:Provides biosimilars for immune diseases and cancer, including Remsima (infliximab) and Yuflyma (adalimumab).

- Amgen: Offers a biosimilar portfolio primarily focused on oncology, inflammation, and rare diseases, with products like Amjevita (adalimumab), Mvasi (bevacizumab), and Kanjinti (trastuzumab).

- Pfizer: Marketed biosimilars for cancer and autoimmune conditions, including Ruxience (rituximab), Zirabev (bevacizumab), and Inflectra (infliximab).

Other Key Players

- Roche

- Mylan

- Teva Pharmaceutical Industries

- Biogen

- Fresenius Kabi

- Sandoz

- Boehringer Ingelheim

- Merck

- Amneal Pharmaceuticals

- Biocon

Recent Developments

- In July 2023, Biocon Biologics expanded its global reach by acquiring the commercialization rights for a spectrum of biosimilars from Viatris, spanning over 70 countries. This strategic move integrated an existing portfolio of commercialized biosimilars, including trastuzumab, bevacizumab, and adalimumab, previously managed by Viatris, into Biocon Biologics' commercial operation.

- In September 2021, Sandoz, a division within the Novartis group, unveiled a pivotal commercialization agreement with Bio-Thera Solutions, Ltd., marking a significant step in the biosimilar landscape. This partnership focuses on the commercialization of a biosimilar version of bevacizumab, a humanized monoclonal IgG1 antibody targeting vascular endothelial growth factor (VEGF) – a vital player in angiogenesis and cancer treatment. This biosimilar bolsters the options available to patients battling cancer, providing an alternative to the reference product and contributing to the expanding biosimilar market.

Segments Covered in the Report

By Type

- Adalimumab

- Bevacizumab

- Infliximab

- Rituximab

- Trastuzumab

- Others

By Indication

- Oncology

- Autoimmune diseases

- Others

By End User

- Hospitals

- Cancer treatment centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting