What is Biodegradable Mulch Film Market Size?

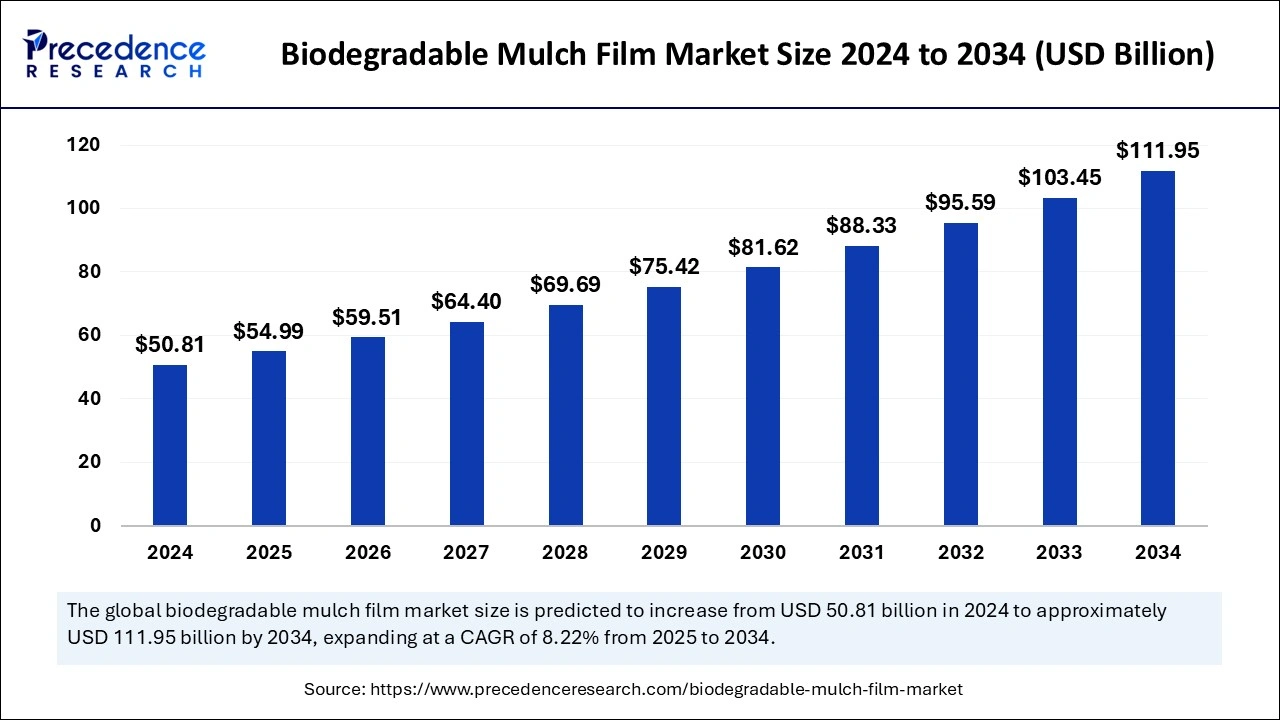

The global biodegradable mulch film market size is calculated at USD 54.99 million in 2025 and is predicted to increase from USD 59.51 million in 2026 to approximately USD 111.95 million by 2034, expanding at a CAGR of 8.22% from 2025 to 2034. Rising demand and need for food crops across the globe are the key factors driving market growth. Also, the surging demand for sustainability solutions in agricultural practices coupled with the promotion activities done by governments and other organizations to support biodegradable options can fuel market growth further.

Market Highlights

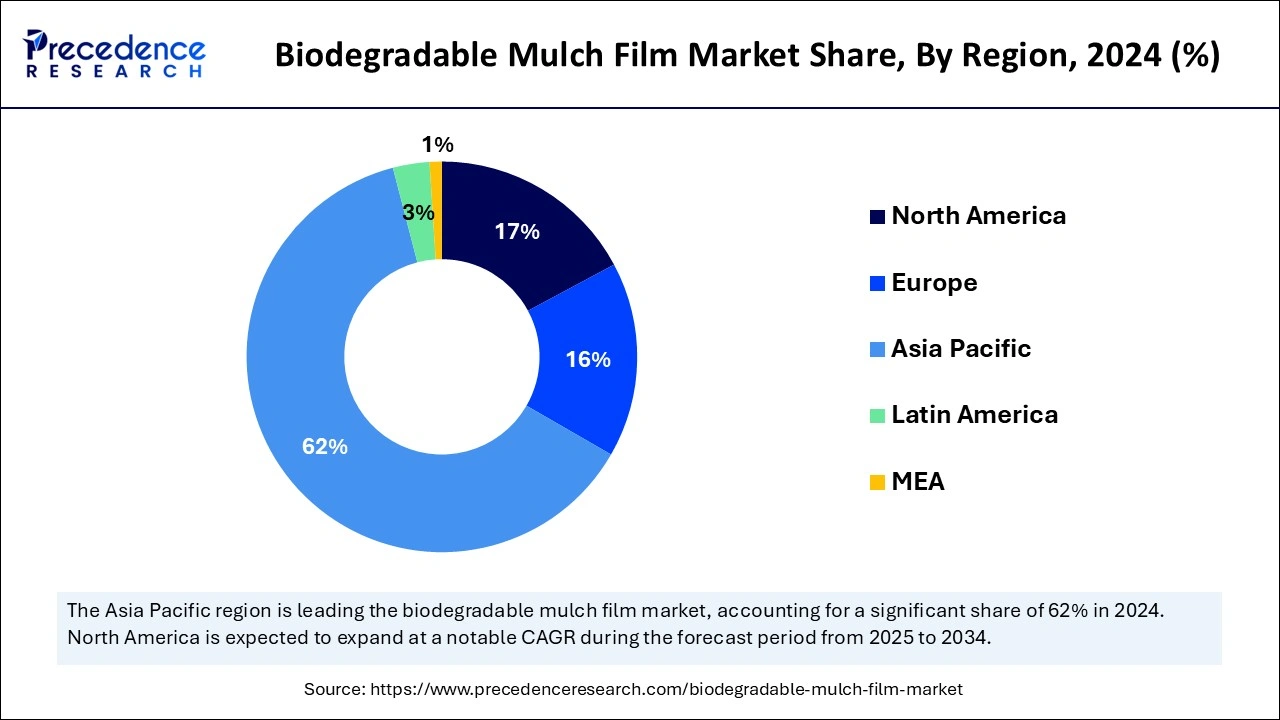

- China country led the Asia Pacific market and contributed 38% of the market share in 2024.

- Asia Pacific dominated the global biodegradable mulch film market with the largest market share of 62% in 2024.

- North America is expected to grow at the fastest CAGR of 8.12% over the studied period.

- By material composition, the starch-based films (TPS) segment has held a major market share of 36.40% in 2024.

- By material composition, the polyhydroxyalkanoates (PHA) segment segment is projecte to expand at a CAGR of 9.10% during the forecast period.

- By thickness, the 25 microns segment contributed the highest market share of 28.70% in 2024.

- By thickness, the 15 microns segment is expected to grow at a CAGR of 8.20% during the forecast period.

- By transparency, the non-transparent segment captured the biggest market share of 63.20% in 2024.

- By transparency, the transparent segment is projected to grow at a solid CAGR of 7.60% during the forecast period.

- By category, the weed barrier mulch segment generated the major market share of 31.50% in 2024.

- By category, the solarization mulch segment is expected to expand at a solid CAGR of 8.70% during the forecast period.

- By application, the agricultural applications segment contributed the largest share of 89.30% in 2024.

- By application, the non-agricultural & emerging applications segment is expected to grow at a CAGR of 9.50% during the forecast period.

Strategic Overview of the Global Biodegradable Mulch Film Industry

Biodegradable mulch films are materials derived from animals and plants, giving benefits like maintenance of soil structure, weed control, and protecting crops from soil contamination. These films are a more sustainable and convenient alternative to conventional plastic mulch, raced from decomposable raw materials. The films are mainly used in agricultural practices to improve crop yields and retain soil moisture while providing the benefit of cutting the requirement for film removal after harvest.

Role of Artificial Intelligence in Agriculture

In the biodegradable mulch film market AI-driven systems enable easy weather predictions, assess farms, and control and monitor agricultural sustainability technology using data such as precipitation, temperature, sun radiation, and wind speed in combination with photographs taken by drones and satellites. Furthermore, artificial intelligence systems can assist farmers in regulated and precision farming by offering them the correct advice on crop rotation, water management, optimal planting, pest attacks, and timely harvesting.

- In April 2024, Google launched an AI-based agricultural information tool for India to provide insights on drought preparedness and irrigation. The new AI platform will provide information at a granular level, which is essential for the Indian agricultural landscape. It will use high-resolution satellite imagery, machine learning to draw boundaries between fields, information on drought preparedness, irrigation, market access, etc.

Top 5 wheat exporters by country in 2023

| Country | Export amount |

| Russia | USD 9.5 billion |

| Australia | USD 9.33 billion |

| Canada | USD 8.8 billion |

| United States | USD 6.1 billion |

| France | USD 4 billion |

Biodegradable Mulch Film Market Growth Factors

- Governments across the globe are implementing stringent regulations on plastic use, which will boost the biodegradable mulch film market.

- The increasing trend towards organic farming is expected to propel market growth shortly.

- The integration of circular economy models will likely contribute to the market expansion over the forecast period.

Market Outlook

- Market Growth Overview: The Biodegradable Mulch Film market is expected to grow significantly between 2025 and 2034, driven by government initiatives and regulations. Demand for sustainable agriculture, and Ongoing research and innovation are improving the mechanical properties, durability, and degradation consistency of biodegradable films.

- Sustainability Trends: Sustainability trends involve fossil-based materials, strict certification and standardization, and improved film performance and durability.

- Major Investors: Major investors in the market include Eni (Versalis), BASF SE, Novamont S.p.A., and growX ventures.

- Startup Economy: The startup economy is focused on novel biomaterial developments, advanced extrusion and manufacturing techniques, and specialized and niche applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 54.99 Million |

| Market Size in 2026 | USD 59.51 Million |

| Market Size by 2034 | USD 111.95 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.22% |

| Dominating Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Composition, Thickness, Transparency, Category, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Surge in growth of the horticulture sector

The ongoing growth of the horticulture sector is the major factor driving the growth of the biodegradable mulch film market. The rising emphasis of the horticulture sector on efficient and eco-friendly production methods aligns smoothly with the advantages provided by biodegradable mulch film. In addition, increasing technological advances in farming, along with the strict government regulation on the use of biomaterials.

- In December 2024, the Horticulture Department launched the rejuvenation of old, senile orchards. The project focuses on the conversion of the nursery to a Hi-tech nursery with the latest facilities under NABARD and instructed the officer for preparation ofDPR, including infrastructure developmental works and protected cultivation structures.

Restraint

High biodegradable films cost

The high cost of these films is the primary factor hampering the biodegradable mulch film market growth. This high cost of films is due to the costly raw materials used in their manufacturing and the tedious production processes involved. Moreover, the inconsistent performance of these films because of frequently changing environmental conditions can lead to cost fluctuation and hence limit their ability, affecting their widespread application in many areas.

Opportunity

Innovations in biodegradable polymer technology

The biodegradable mulch film market is majorly influenced by substantial developments in biodegradable polymer technology. The R&D in this field is fuelling the creation of more effective, durable, and cost-effective biodegradable mulch films. Furthermore, the latest biodegradable films are created to provide the same advantages as traditional plastic films, like flexibility, strength, and water permeability, by ensuring total biodegradability. Advancements in the manufacturing process are decreasing the cost of biodegradable films.

- In December 2024, Symphony Environmental launched biodegradable resin for the plastics industry. The company says its new resin reduces the fossil content of plastic and can be recycled but biodegrades within months if it escapes into the natural environment. NbR comprises 20 percent non-fossil natural compounds and is suitable for making a wide variety of packaging, carrier bags, garbage bags, etc.

Market Concentration & Characteristics

The biodegradable mulch film market is anticipated to grow substantially due to growing environmental regulations and concerns regarding plastic use. Market concentration is expected to remain moderate, with a mixture of major market players and regional companies. Moreover, innovations in biodegradable material technology can impact this positive market growth further.

Segment Insights

Material Composition Insights

The starch-based films segment held the largest share of 36.40% in the 2024 global biodegradable mulch film market. The starch-based films include starch-PLA/PHA blends and thermoplastic starch (TPS), and a reliable component of this market. It provides alternatives to sustainable solutions, eliminating traditional plastic mulches in the agricultural sector. Its resourceful approach benefits moisture retention, improvements to soil temperature, and weed suppression. The lack of plastic in this sector demonstrates its demand in agriculture.

The polyhydroxyalkanoates (PHA) segment is expected to grow at a CAGR of 9.10% during the forecast period. The PHA is a biodegradable biopolymer immensely competing in the global biodegradable mulch film production. It is a renewable, driven alternative to the years of petroleum-based plastics. Its compatibility fitted the to the agricultural applications mainly in mulch films. PHAs hold the potential to reduce plastic waste in agriculture, which is a huge contribution to the agricultural market.

Thickness Insights

The 25-micron segment held the largest share of 28.70% in the 2024 global biodegradable mulch film market. The 25-micron thickness in the making of biodegradable mulch film is an excellent choice for balancing out equality between biodegradability and durability. Its ability to strengthen agricultural applications for a longer period of time proves its versatility in the global biodegradable mulch film industry. The quality and capacity of the biodegradable mulch film are essential for validation purposes.

The 15-micron segment is expected to peak at a CAGR of 8.20% during the forecast period. The 15-micron thickness is suitable for the short term. The prominent growth is visible in Indonesia due to its low cost and great balance between biodegradability and durability. This segment is experiencing steady growth because it is an affordable option for temporary agriculture.

Transparency Insights

The non-transparent segment held the largest growth of 63.20% in the 2024 global biodegradable mulch film market. The non-transparency bolsters effectiveness in various agricultural applications and allows soil warming. This helps weed growth in the agricultural sector. Though the transparency level highly relies on the type of crop and weather conditions. This segment contributes to the research team for discovering various ways to create opaque biodegradable films with customization in durability, degradation, and strength rates.

The transparent segment is expected to grow at a CAGR of 7.60% during the forecast period. The key focus of this segment is to balance out light transmission for crop growth that needs specific weed suppression and soil warming. It's a quick modern procedure. Researchers are discovering several possibilities to improve this segment for the main applications. It will reach a certain development on completion of the exploration period.

Category Insights

The weed barrier mulch segment covered the largest growth of 31.50% in the 2024 global biodegradable mulch film market. The biodegradable mulch film is extensively used as a weed barrier in agricultural lines. The growing development has cut out the traditional techniques progressively, with the highest demand to introduce sustainability. The beneficial aspects of this segment are being collectively worked on to reduce plastic mulch.

The solarization mulch segment is expected to grow at a CAGR of 8.70% during the forecast period. The solarization of soil is integrated with alternative non-degradable plastic films. It is a renewable solution for weed and pest control in agriculture by effectively improving the soil's life span. The traditional polyethylene (PE) plastic films are considered for solarization. The natural breakdown into the soil ensures an effective and quick result. The segment is steadily receiving acceptance from the vast agricultural sector concerned with this market.

Application Insights

The non-agricultural and emerging applications segment is expected to grow at a CAGR of 9.50% during the forecast period. Apart from the agricultural sector, home gardening and allotments, forestry, and reforestation projects are flourishing across the green businesses. The biodegradable mulch film industries have the largest portion of profit in landscaping and urban green spaces, to the home décor market. The agricultural research center has successfully addressed its target-driven research, using biodegradable mulch film as an experimental plot. It's an alternative serving several industries. This segment also contributes largely to the prevention of soil erosion by protecting it from the adverse impact of the heavy rains and winds. It is an effective, sustainable solution in erosion control as well.

Regional Insights

What is Asia Pacific Biodegradable Mulch Film Market Size?

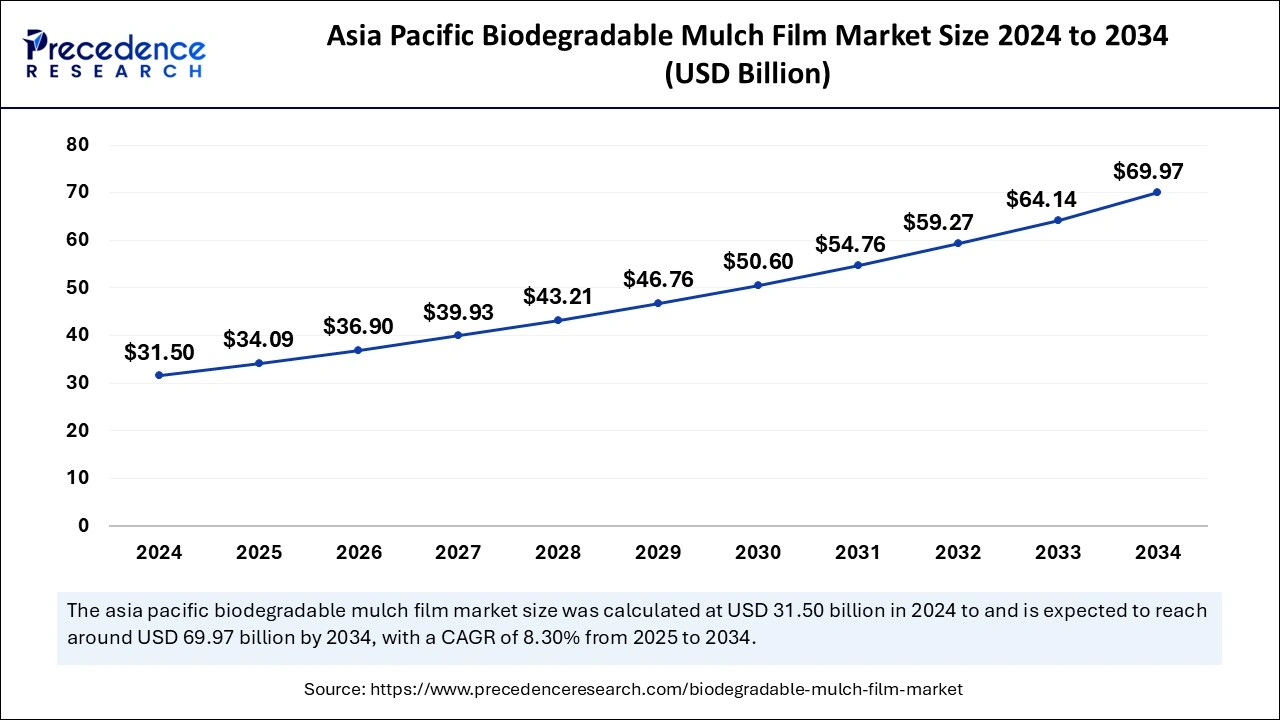

The Asia Pacific biodegradable mulch film market size is exhibited at USD 34.09 million in 2025 and is projected to be worth around USD 69.41 million by 2034, growing at a CAGR of 8.22% from 2025 to 2034.

Asia Pacific dominated the global biodegradable mulch film market in 2024. The dominance of the region can be attributed to the ongoing expansion of the agriculture industry coupled with the increasing emphasis on eco-friendly farming practices. Emerging economies in this region, such as Thailand, India, and Vietnam, are huge agricultural producers and sometimes confront hurdles with soil degradation because of wide plastic mulch use. Furthermore, the governments of major countries in the region are focusing on promoting sustainable agriculture and environmental conservation initiatives.

China Biodegradable Mulch Film Market Trends

China's an urgent need to address severe agricultural plastic pollution, which has prompted stringent government regulations like the "Agricultural Film Management Measures". Key trends include a strong push for domestic production and innovation, particularly with thermoplastic starch (TPS), to improve film performance and cost-effectiveness.

- In April 2023, BASF SE announced that it would work with AGCO Corporation to develop new features and incorporate Smart Spraying technology into Fendt Rogator sprayers for commercialization.

North America is expected to grow at the fastest rate in the biodegradable mulch film market over the studied period. The growth of the region can be credited to the strict government laws on plastic usage in the agriculture sector and increasing environmental awareness, which are the major market drivers in the region. Within North America, the U.S. led the market owing to the combination of environmental policy initiatives and demand to safeguard soil health. As a prominent player in agricultural production, the U.S. is taking steps to decrease plastic waste in farming.

- In April 2024, the U.S. Department of Agriculture (USDA) awarded a four-year, USD 744,000 grant to a team of researchers to develop new mulch films for crops that are not only sustainable and biodegradable but will also help nourish and enhance the health of soils and reduce plastic pollution.

U.S. Biodegradable Mulch Film Trends

U.S. mounting environmental concerns over microplastic pollution from conventional films. Government initiatives and grants, particularly from the USDA, are encouraging the adoption of these films, especially among high-value fruit and vegetable growers who are also responding to consumer demand for sustainable agriculture. The innovation in materials like thermoplastic starch and blends with PLA, alongside a strong focus on certification to standards like ASTM D6400 to ensure reliable performance.

Biodegradable Mulch Film Market Value Chain Analysis

- Raw Material Sourcing and Production

This initial stage involves the sourcing and synthesis of biodegradable polymers that serve as the base for the film.

Key Players: BASF SE, Novamont S.p.A., and Kingfa Technology. - Manufacturing and Extrusion

In this stage, the biodegradable polymers are extruded and processed into thin films with specific properties tailored for agricultural use, such as durability during the growing season and consistent biodegradation post-harvest.

Key Players: BioBag International AS, RKW Group, Armando Alvarez Group, and Tillak Polypack Pvt. Ltd. - Distribution and Sales

This stage involves marketing, logistics, and selling the finished biodegradable mulch films to a diverse set of customers, including wholesalers, agricultural cooperatives, and direct-to-farmer channels. - Application and End-User Adoption

The final and most crucial stage is the farmer's adoption and use of the biodegradable mulch film in agricultural practices.

Key Players: farmers and agricultural companies.

Biodegradable Mulch Film Market Companies

- BASF SE: A major chemical company, BASF contributes its advanced biopolymer ecovio, a certified compostable and soil-biodegradable material, which is a key component for manufacturing high-quality mulch films. It also invests heavily in expanding production capabilities and R&D for sustainable agricultural solutions.

- Kingfa Sci and Tech Co Ltd: As a leading Chinese player, Kingfa contributes significant production capacity for biodegradable plastics, including those used for mulch films, leveraging investments in large-scale plants and circular economy solutions to serve both domestic and export markets.

- BioBag International AS: This Norwegian firm is a major manufacturer and distributor of biodegradable mulch films, contributing to market growth by promoting eco-friendly, certified soil-biodegradable products as a solution to plastic pollution in agriculture.

- AEP Industries Inc. (now part of Berry Global): As a North American-focused film manufacturer, this company provides both traditional and biodegradable film options to the agricultural sector. Through its extensive production and distribution network, it contributes to meeting the demand for mulch films in the U.S. and beyond.

- RKW SE: This European manufacturer is a key contributor to the market by producing and supplying sustainable and high-performance films for agricultural applications, including biodegradable mulch films. It strengthens its market position through strategic acquisitions and investments in the agricultural film sector.

- British Polythene Industries PLC (now part of Berry Global): This company, like AEP, supplies both conventional and biodegradable films to the agricultural and horticultural sectors. Its contribution lies in providing a range of film solutions and leveraging its market presence to address shifting demand towards greener options.

- Armando Alvarez: As one of Europe's largest plastics processors, the Armando Alvarez Group contributes to the market with innovative biodegradable mulch options developed through decades of manufacturing experience. The company emphasizes sustainable solutions tailored for diverse crops and climates.

- Al-Pack Enterprises Ltd.: Primarily a packaging distributor and poly extruder in Canada, Al-Pack has expanded into the compostable and recyclable bag market. It contributes to the mulch film market by providing biodegradable film solutions primarily for the North American region.

- Novamont: A world leader in green chemistry, Novamont significantly contributes its innovative starch-based bioplastic, MATER-BI, for the production of fully soil-biodegradable mulch films. Its products have achieved key certifications and are widely adopted, particularly in Europe.

- AB Rani Plast OY: This Finnish film manufacturer is a player in the market by offering advanced, high-performance films for agricultural applications, including biodegradable variants. It contributes primarily to the European market with a focus on product reliability and meeting regional demand.

Latest Announcement by Industry Leaders

- In October 2024, BASF and AM Green announced the signing of MoU for opportunities in Iow-carbon chemicals. Under the MoU, BASF and AM Green intend to conduct feasibility studies on low-carbon chemical production in India, including a joint evaluation of potential technologies. The MoU was signed by Markus Kamieth, chairman of the board of executive directors of BASF SE, and Mahesh Kolli.

Recent Developments

- In April 2025, the COM4PHA project will develop new biodegradable bioplastics for cosmetics, food, and agricultural packaging. The aim is to be able to process them using conventional technologies so that they can be used in applications that are currently occupied by petroleum-derived plastics. The companies Venvirotech and ENPLAST are collaborating with the Plastics Technology Centre (AIMPLAS) in this research.

- In October 2024, the BIOENCAPSULACIÓ Project launched new algae-based hydrogels with a high capacity to retain soil moisture, along with agricultural films with biostimulant properties; both products are biodegradable and functionalized with these microorganisms, for the formulation of plasticulture products. This research project is funded by the Valencian Institute for Business Competitiveness and Innovation (IVACE+i) and the ERDF.

- In April 2023, Mitsubishi Chemical Corporation announced the commercialization of its new PBSA resin, "Ecovio™ A1000". Ecovio™ A1000 is a high-performance PBSA resin that is designed for use in demanding applications, such as food packaging and automotive components.

- In October 2023, in a collaborative effort to promote sustainability in agriculture, global packaging and paper leader Mondi partnered with Cotesi, a producer of twine, nets, and ropes for the agricultural sector. The collaboration aims to introduce a paper solution called Advantage Kraft Mulch. This innovative product aims to replace traditional plastic mulch films used by farmers.

Segments Covered in the Report

By Material Composition

- Polylactic Acid (PLA)

- Starch-Based Films

- Thermoplastic Starch (TPS)

- Starch-PLA/PHA Blends

- Poly (Butylene Adipate-co-Terephthalate) (PBAT)

- Polyhydroxyalkanoates (PHA)

- Poly (Butylene Succinate) (PBS)

- Cellulose-Based Films

- Fossil-Sourced Biodegradable Polyesters

- Poly (Butylene Succinate-co-Adipate) (PBSA)

- Others

By Thickness

- 15 Microns

- 20 Microns

- 25 Microns

- 30 Microns

- 32 Microns

- 50 Microns

- 100 Microns

- Others

By Transparency

- Transparent

- Non-Transparent

By Category

- Weed Barrier Mulch

- UV Stabilized Mulch

- Solarization Mulch

- Pesticide Barrier Mulch

- Insect Repellent Mulch

- Herbicidal Release Mulch

- Fumigation Barrier Mulch

- Others

By Application

- Agricultural Applications

- Vegetables

- Fruits

- Cereals & Grains

- Oilseeds & Pulses

- Turf & Ornamentals

- Floriculture

- Others

- Non-Agricultural & Emerging Applications

- Landscaping & Urban Green Spaces

- Forestry & Reforestation Projects

- Home Gardening & Allotments

- Agricultural Research & Experimental Plots

- Soil Stabilization & Erosion Control (select use cases)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting