What is the Architecture Window Film Market Size?

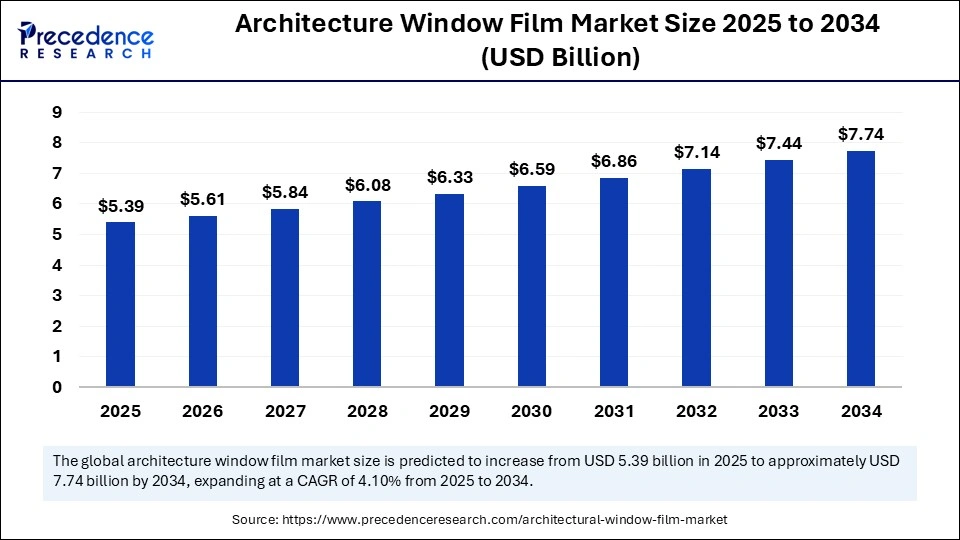

The global architecture window film market size accounted for USD 5.39 billion in 2025 and is predicted to increase from USD 5.61 billion in 2026 to approximately USD 8.04 billion by 2035, expanding at a CAGR of 3.70% from 2026 to 2035. The market is growing due to increasing demand for energy-efficient buildings, UV protection, and enhanced interior comfort.

Market Highlights

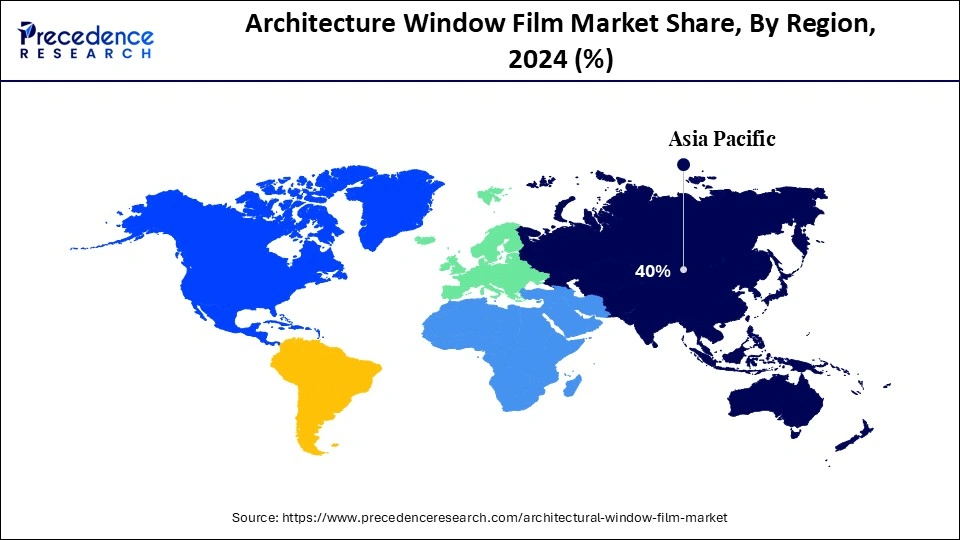

- Asia Pacific dominated the market, holding the largest market share of 40% in 2025.

- North America is expected to grow at a notable CAGR Between 2026 and 2035.

- By product type, the solar control films-metalized type segment held the largest market share of 30% in 2025.

- By product type, the solar control films-metalized type segment is expected to grow at the fastest rate during the forecast period.

- By application (building type), the commercial buildings segment held the largest share at 35% in 2025.

- By application (building type), the hospitality segment is expected to grow at the fastest CAGR from 2026 to 2035.

- By functionality (primary benefit), the energy/heat reduction segment is expected to grow at the CAGR from 2026 to 2035.

- By functionality (primary benefit), the small light/privacy control films segment held the largest share of in 2025.

- By material/construction, the polyester (PET) films segment contributed the highest market share at 40% in 2025.

- By material/construction, the ceramic/nano-ceramic films segment is growing at the significant CAGR Between 2026 and 2035.

- By thickness, the medium films (50�150 �m) segment contributed the highest market share of 55% in 2025.

- By thickness, the thick films (>150 �m) segment is expected to grow at the fastest CAGR from 2026 to 2035.

Architecture Window Film Market Market Overview

The architecture window film market is witnessing strong growth as building owners and developers increasingly seek solutions to improve energy efficiency, reduce heat and glare, and protect interiors from harmful UV rays. Adoption is being fueled by growing demand for improved occupant comfort and aesthetic appeal, as well as increased awareness of sustainable building practices. Adico Inc., Saint Gobain, 3M Company, and Eastman Chemical Company are important market participants. To satisfy changing consumer demands, Johnson Window Films and others are continually developing cutting-edge technologies such as heat-rejecting films and ceramic coatings.

- In June 2024, Onyx Coating launched Vunyx ceramic window films, utilizing advanced sputtering technology to achieve up to 98% infrared rejection, enhancing heat rejection and UV protection.

How is digitization and IoT integration shaping the architectural window film market?

Digitization and IoT are enabling window films to evolve from passive solar-control products into smart, connected systems that respond in real time to environmental conditions and user commands. These days, films can change their tint or opacity, dynamically integrate with building management systems, and be controlled by voice apps or sensors. These developments enhance energy efficiency, comfort, privacy, and aesthetic adaptability in both new and existing buildings.

- In June 2024, Research Frontiers & AIT Group introduced the thermolite retroWAL SPD-SmartGlass window, a retrofittable SPD smart glass system allowing users to instantly change tint from clear to dark or any state in between.

Major Trends of the Architecture Window Film Market

- As companies look for more ways to enhance the energy efficiency of commercial properties and urban residential towers, companies have increasingly started to adopt spectrally selective films. Spectrally selective films block heat from infrared radiation while still providing a larger amount of natural daylight.

- Also helping to drive growth in the use of window films is the demand for retrofits in older commercial buildings and the increase in the number of urban residential towers. Additionally, privacy and decorative films are becoming more popular for new co-working spaces, hospitals, and high-end residential projects.

- Smart glazing technology has made it possible for window films to work in conjunction with automated building systems, and the increased number of cities and municipalities implementing housing safety regulations (urban safety) and insurance compliance requirements has increased the number of security and safety films in these markets.

Architecture Window Film Market-Trade Analysis:

- There are over 6,500 global shipments of architectural window films shipped every year globally, and almost 38% of that total volume comes from China, followed by 17% from South Korea, and 14% from the US. India, UAE, and Vietnam collectively import over 2,800 shipments of window film every year due to the need for retrofit under the construction code.

- Nearly 65% of the traded volume is made up of commercial-grade solar control films, and the average price of an architectural window film shipment varies between $18,000-$45,000, depending on the type of coating and thickness of the film.

Architecture Window Film Market Growth Factors

- Increasing demand for energy-efficient solutions to reduce cooling and heating costs.

- Rising awareness about UV protection, glare reduction, and improved indoor comfort.

- Rapid urbanization and construction growth, especially in developing economies.

- Technological advancements such as smart films, spectrally selective films, and advanced coatings.

- Growing trend of retrofitting older buildings to meet modern sustainability standards.

- Supportive government policies and green building certifications encouraging energy-efficient materials.

- Increasing adoption in commercial spaces such as offices, retail outlets, and hospitals to enhance comfort and reduce operational costs.

- Expanding residential applications as homeowners seek affordable alternatives to window replacement.

- Growing preference for decorative and privacy films in interior design applications.

- Rising focus on sustainability and reducing carbon footprints in the construction industry.

Market Outlook:

- Industry Growth Overview: The global growth of this sector is being driven by increased urbanization around the world, as well as by increased focus on green building certification, along with increased awareness about thermal comfort and optimizing energy use in all types of residential and commercial buildings.

- Sustainability Trends: A focus on low VOC adhesives, recyclable polyester substrates, and solar heat rejection technologies has been the main focus of manufacturers, and they are continuing to evolve their products to align with sustainable building practices as well as with the global ESG compliance framework.

- Global Expansion: Rapid growth in emerging economies such as those found throughout the Asia-Pacific, Middle East, and Africa is being fueled by new investments in infrastructure, the development of smart city initiatives, as well as the growth of the commercial real estate sector, all of which are contributing to higher levels of penetration into other global markets.

- Startup Ecosystem: The start-up ecosystem is innovating in several areas, including creating self-healing films, utilizing AI-assisted heat control coatings, and developing decorative films that can be customized based on unique climate and aesthetic requirements.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.39 Billion |

| Market Size in 2026 | USD 5.61 Billion |

| Market Size by 2035 | USD 8.04 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 3.70% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application, Functionality, Material / Construction, Thickness, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Energy Efficiency & Cost Savings

As global energy prices continue to rise, building owners are looking for economical ways to reduce their electricity costs. Window films enhance insulation and offer a cost-effective substitute for window replacement. They reduce HVAC loads and help maintain steady indoor temperatures. Adoption is especially high in areas with harsh climates, where heating or cooling is in high demand. In commercial real estate energy energy-efficient structures are also becoming more popular for sustainability certifications.

- In April 2025, Window Film Depot announced its participation in Glass TEXpo 25, showcasing 3M Sun Control Films and DI-NOC Architectural Surface Finishes to help glazing contractors expand their service offering without increasing overhead.

Sustainability & Green Building Regulations

Energy codes and sustainability guidelines for new and renovated buildings have been implemented in numerous countries. The adoption of energy-saving films is promoted through incentives, subsidies, and green building certifications. Commercial adoption is driven by regulatory compliance, whereas awareness campaigns are more effective for residential projects. Policies that emphasize energy efficiency and lowering carbon emissions also fuel market expansion.

Restraints

High Initial Cost of Advanced Films

The higher initial costs of premium films, such as nanoceramic and smart films, may prevent their widespread use, particularly in small-scale, price-sensitive residential projects. Despite the long-term energy savings these films provide, small businesses and homeowners may be put off by the initial outlay. Cost concerns are especially acute in developing nations, where several financial constraints exist. For commercial projects, the cost of bulk procurement and installation can also be substantial. Price remains a barrier despite manufacturers' efforts to release more affordable versions.

Lack of Skilled Labor and Improper Installation

Customer satisfaction may suffer from poor film performance due to issues such as peeling, hunting, or reduced energy efficiency caused by improper installation. Specialized training is necessary for many installers, especially for thick or smart films. Inexperience can also compromise safety features such as shatter resistance. Inadequate installation could lead to higher maintenance costs. Adoption is slowed in some areas by the lack of training initiatives and awareness campaigns.

Opportunities

Energy Efficient and Sustainable Building Film Solutions

Architectural window films offer an affordable way to improve building energy efficiency amid the growing global emphasis on sustainability. These films help reduce HVAC costs, improve insulation, and reduce heat gain. Their application aligns with green building standards and can contribute to LEED certification.

- In March 2024, Eastman Chemical Company launched a new line of high-performance ceramic window films, branded as Ceramic Shield Pro, aimed at providing advanced heat rejection and UV protection.

Advanced Technologies in Window Films

Technological advancements in window film, including decorative films, electrochromic films, and nano ceramic coatings, are creating new markets. These cutting-edge films meet the requirements of contemporary architecture and smart buildings by providing dynamic light control, improved functionality, and enhanced aesthetics.

- In January 2025, Saint-Gobain stated that in certain jurisdictions, regulatory limits on reflective films impacted the deployment of their Sage Glass electronic solutions.

Architecture Window Film MarketSegmental Insights

The solar control films-metalized type dominated the market because of their affordability, robustness, and potent ability to block glare and heat from the sun. Because of their reflective qualities, they are particularly well-liked in large-scale residential and commercial settings where comfort and energy efficiency are top concerns. These films are also comparatively simple to produce and install, which lowers expenses and increases adoption rates. In areas with strong sunlight and significant cooling needs, they remain the preferred option. Solar control films-nano-ceramic films fastest growing segment, motivated by their cutting-edge technology which provides exceptional heat rejection without sacrificing aesthetics or natural light. Because they are nonmetallic, they prevent signal interference, which makes them increasingly appealing for contemporary smart buildings. They enhance the overall building experience by offering superior clarity and durability compared to conventional films. These high-performance films are becoming more in demand as luxury homes and high-end construction projects expand.

Commercial buildings dominated the market owing to workplaces, shopping centers, hospitals, and educational institutions, which have a strong need for added comfort and UV protection, and energy efficiency. Commercial buildings with large glass facades have a great need for window film in order to improve energy efficiency and adhere to green building regulations. Businesses are also putting more emphasis on the health of their workers, which is encouraging the use of glare-reducing and temperature-maintaining films. Window films' place in this industry is further cemented by their incorporated into sustainability initiatives. Hospitality is the fastest-growing application segment, as more hotels, resorts, and eateries use solar control and decorative films to lower cooling expenses, increase guest comfort, and create aesthetically pleasing interiors. A major requirement in guest-centric spaces is the ability of films to improve privacy while preserving the flow of natural light in hospitality settings. Growing awareness of eco-friendly building techniques and sustainable tourism accelerates adoption as the hospitality industry becomes more competitive. These films are emerging as a cost-effective means of setting spaces apart.

The energy/heat reduction segment dominated the market since improving thermal comfort and reducing cooling loads continue to be the main goals of both residential and commercial buildings. Given the increased focus on environmentally friendly building practices, these films offer a useful and affordable energy management option. Additionally, they support government programs that encourage the design of energy-efficient buildings, which increases their applicability in both developed and developing nations. Demand is further driven by rising electricity prices as consumers look for long-term savings. Small light/privacy control films are the fastest growing, driven by growing consumer demand for privacy, aesthetic appeal, and personal comfort. They are becoming increasingly popular in office and residential settings because they offer flexibility without requiring structural changes. To preserve aesthetics and guarantee privacy, these films are also being used in medical and educational settings. Their market presence has increased due to the increased demand for such solutions brought about by the trend toward open space layouts.

Polyester (PET) films dominated the market due to their low-cost adaptability and simplicity of installation. They provide dependable performance in solar control, safety, and decorative applications, making them popular in both residential and commercial projects. PET films are also very versatile due to their durability, light weight, and compatibility with a variety of coatings. Their availability in a variety of finishes and colors guarantees their continued popularity for both large-scale and low-budget projects. Ceramic/nano-ceramic films are the fastest-growing segment, driven by their exceptional ability to block infrared rays and enhance comfort levels without obstructing vision. They are more appropriate for smart homes and connected offices because, in contrast to metallic films, they do not obstruct electronic signals. These films are an investment worth making over time because they don't fade or discolor over time. Their growth is being driven by their increasing use in upscale renovations and luxury building projects.

Medium films (50�150 �m) dominated the market since they offer the best possible balance between affordability, performance, and durability. For solar control and safety, they are widely utilized in both residential and commercial settings. In addition to providing good protection from heat and UV rays, their moderate thickness guarantees simple installation. They are the best option for projects with high performance standards and a tight budget because of this balance. Thick films (>150 �m) are the fastest growing due to their increased strength and capacity to offer better security and safety. They are extensively utilized in high security commercial buildings, government buildings, and defense facilitates where films are more valuable for their use because they enhance soundproofing and insulation in addition to safety. The growing demand for protective and disaster-resistant building materials fuels their expansion.Product Type Insights

Application (Building Type) Insights

Functionality (Primary Benefit) Insights

Material/Construction Insights

Thickness Insights

Architecture Window Film MarketRegional Insights

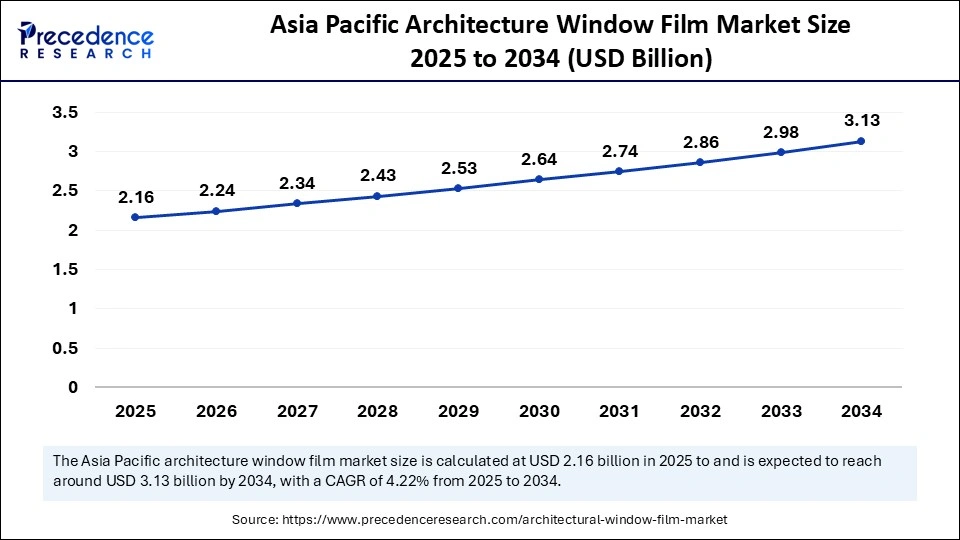

The Asia Pacific architecture window film market size is exhibited at USD 2.16 billion in 2025 and is projected to be worth around USD 3.13 billion by 2034, growing at a CAGR of 4.22% from 2025 to 2034. Why Did Asia Pacific Dominate the Architectural Window Film Architecture Window Film Market in 2024? Asia Pacific dominated the market due to the growing use of energy-efficient building solutions, extensive construction projects, and fast urbanization. The region's countries are seeing a surge in demand for window films for both residential and commercial projects. Additionally, solar control films are crucial for lowering cooling expenses due to the hot climate in many Asia countries. Its leadership position is further supported by the presence of important manufacturers in the area. North America is the fastest-growing region, motivated by the growing focus on sustainable building practices, green building certifications, and cutting-edge smart film technologies. Adoption has accelerated due to strict building energy codes and growing awareness of energy conservation. The market also gains from the high rate of older buildings being retrofitted to meet contemporary energy efficiency standards. The region's growth is accelerated by consumers' growing preference for decorative and private films.

Architecture Window Film Market Value Chain

The value chain begins with sourcing polyester (PET) films, UV-curable coatings, metalized layers (aluminum, nickel, or titanium), and pressure-sensitive adhesives. Suppliers are typically chemical and specialty material producers who ensure optical clarity, thermal stability, and durability. The performance of the final film depends on raw material purity and coating uniformity. Upstream value capture lies with advanced polymer and coating suppliers that develop proprietary formulations enabling infrared rejection, UV blocking, and scratch resistance.

This is the core value-creation stage, where raw films are converted into high-performance architectural window films through multi-layer extrusion, sputtering, metallization, and lamination. Manufacturers focus on optical performance, heat rejection, glare reduction, and aesthetic design. Automation, cleanroom environments, and precision coating technologies are critical to ensure product consistency. Value capture is strongest among film producers with R&D capability and patented technologies, such as Eastman Chemical (LLumar), 3M, and Saint-Gobain Solar Gard, which leverage material science innovation and brand trust.

Finished films are distributed through regional distributors, construction firms, and certified installers to serve commercial, residential, and institutional buildings. Proper installation determines long-term performance and warranty validity, making installer training and certification a key downstream value driver. Marketing emphasizes energy savings, UV protection, and sustainability benefits aligned with green building standards (LEED, BREEAM). Downstream value capture is achieved by brands and service networks offering bundled installation, warranties, and customized film solutions for architects and developers.

Architecture Window Film Market Companies

Eastman is a global leader in performance materials and specialty chemicals, and the market leader in window films through its well-known brands such as LLumar�, Vista�, and SunTek�. The company offers a comprehensive portfolio including solar control, safety & security, and decorative films for residential and commercial buildings. Its strong distribution network and continuous innovation in energy-efficient and UV-protective films drive its market leadership.

Madico specializes in the development and manufacturing of window films, coatings, and laminates for architectural, automotive, and safety applications. The company is known for its energy-saving and security-focused architectural films, providing solutions that improve comfort, privacy, and building sustainability. Madico�s commitment to sustainability and film recycling initiatives enhances its competitive positioning.

3M is a diversified technology company with a strong presence in the architectural window film segment through its 3M� Window Films line. Its films combine nanotechnology and multi-layer optical innovations to reduce heat, glare, and UV radiation while enhancing aesthetics. 3M�s brand strength, global reach, and focus on commercial building efficiency make it a key player in the market.

A brand under Eastman Performance Films, SunTek offers a broad range of residential and commercial architectural films, including reflective, dual-reflective, and neutral solar films. The brand emphasizes affordable performance and quality, supported by Eastman�s manufacturing expertise and research capabilities.

Saint-Gobain, a global building materials leader, manufactures architectural films through its Solar Gard� brand. Solar Gard�s portfolio includes solar control, safety, and decorative window films designed to enhance energy efficiency and occupant comfort. Saint-Gobain�s sustainability focus and strong position in the construction ecosystem make it a key influencer in the green building segment.

Huper Optik is renowned for its nanoceramic and spectrally selective window films, which provide superior heat rejection and UV protection without compromising visibility. The company is recognized for introducing the world�s first multi-layer nano-ceramic window film, making it a pioneer in advanced coating technologies for architectural applications.

LLumar, another flagship brand of Eastman Performance Films, offers a diverse portfolio of architectural window films focused on solar control, decorative enhancement, and safety. LLumar is known for its aesthetic appeal and high performance, catering to both residential and commercial markets globally.

Recent Developments

- In April 2024, Hyundai Motor Company unveiled the Nano Cooling Film, a vehicle window tint designed to enhance interior cooling efficiency significantly over traditional tint films. This innovative film utilizes a nanostructure that optimizes heat dissipation, making it particularly effective in hot, dry climates. It can reduce interior temperatures by up to 12�C (22�F), contributing to energy efficiency and passenger comfort.(Source: https://www.marklines.com)

- In July 2025, Lintec Corporation launched the BR-50UH RECYCLE 100, a solar control window film made from 100% recycled PET resin. This eco-friendly film reduces solar heat penetration by approximately 57%, blocks over 99% of UV rays, and helps prevent glass shard scattering. It is designed for use in offices, residences, and commercial buildings, maintaining high transparency while cutting interior heat.(Source: https://www.lintec-global.com)

Architecture Window Film MarketSegments Covered in the Report

By Product Type

By Application

By Functionality

By Material / Construction

By Thickness

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting