What is the Thin-Film Electrode Market Size?

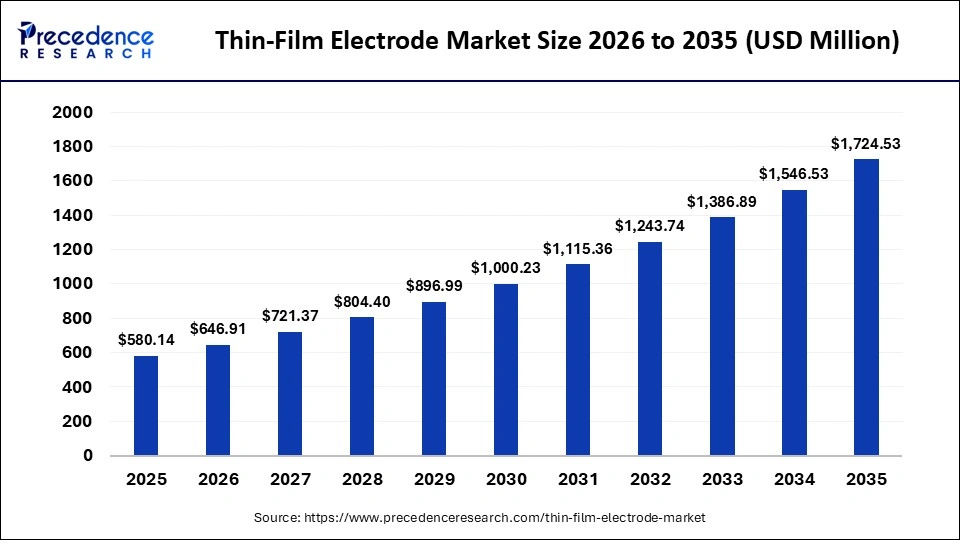

The global thin-film electrode market size accounted for USD 580.14 million in 2025 and is predicted to increase from USD 646.91 million in 2026 to approximately USD 1,724.53 million by 2035, expanding at a CAGR of 11.51% from 2026 to 2035.The thin-film electrode market is primarily driven by growing consumer demand for flexible and wearable technologies.

Market Highlights

- Asia Pacific dominated the market, holding the largest market share in 2025.

- North America is expected to grow at the fastest CAGR between 2026 and 2035.

- By material, the metal-based segment contributed the largest market share in 2025.

- By material, the carbon-based segment is growing at a remarkable CAGR between 2026 and 2035.

- By manufacturing facility, the physical vapor deposition segment generated the biggest market share in 2025.

- By manufacturing facility, the chemical vapor deposition segment is growing at a strong CAGR between 2026 and 2035.

- By end-use industry, the electronics & semiconductor segment captured the highest market share in 2025.

- By end-use industry, the healthcare & biotechnology segment is set to grow at a solid CAGR between 2026 and 2035.

Thin-Film Electrode Market Overview

A thin film electrode is an ultra-thin layer of a conductive material, typically a few nanometers to micrometers thick, deposited on a solid substrate such as glass or silicon. These electrodes are created using techniques such as physical vapor deposition, chemical vapor deposition, and sputtering, which allow precise control over thickness, surface uniformity, and material composition. Thin film electrodes are essential for modern microelectronics and electrochemical systems because they provide high sensitivity, rapid electron transfer, and stable performance at extremely small scales.

These electrodes play a crucial role in miniaturized, high-performance applications across fields such as biosensors, supercapacitors, and other electrochemical devices. They are also increasingly used in flexible electronics, neural interfaces, micro batteries, and lab-on-a-chip platforms, where compact size and high conductivity are critical for reliable operation.

How Are AI-Driven Innovations Reshaping the Thin-Film Electrode Market?

In today's rapidly evolving technological landscape, the integration of Artificial Intelligence is a transformative force and holds great potential to accelerate the growth of the thin film electrode market by optimizing manufacturing processes, materials discovery, and enhanced functionality of AI chips and smart sensors that widely use these electrodes.

AI-driven tools allow manufacturers to monitor deposition processes in real time, control film thickness with nanometer-level precision, and detect defects early, which improves production yield and reduces material waste. These capabilities are particularly important for industries that require highly uniform electrode coatings for microelectronics, biomedical sensors and energy storage devices.

AI and machine learning models are widely used to predict and optimize the properties of electrode materials, reducing the need for extensive physical experimentation. These models evaluate combinations of metal oxides, graphene, polymers and hybrids to identify materials that offer improved conductivity, stability, and surface activity.

AI-powered models can forecast the long-term performance and durability of electrodes across applications such as batteries and supercapacitors, assisting engineers in selecting optimal designs and material compositions. They also enable fast prototyping of next-generation thin film electrodes for flexible electronics, neural interfaces and high-performance semiconductor devices, supporting continuous innovation across the global market.

Thin-Film Electrode Market Outlook

Between 2025 and 2030, the industry is expected to experience accelerated growth. The market growth is driven by increasing demand for wearable devices, miniaturization and flexibility in electronics and semiconductors, rapid advancements in biosensors, and a global shift toward renewable energy systems.

Several leading players in the thin-film electrode market are increasingly focusing on expanding their geographical presence through strategic partnerships, mergers and acquisitions (M&A), and new product developments. For instance, in February 2024, Graham Partners, a private investment firm targeting advanced manufacturing and industrial technology companies, announced that one of its portfolio companies, OptConnect, LLC, a provider of managed connectivity services for Internet of Things (IoT) applications, had acquired M2M DataGlobal (M2M). M2M follows the acquisition of Premier Wireless Solutions and expanded OptConnect's scale and addressable market across additional customers and end markets in North America.

Major investments in the thin-film electrode market are being made by venture capital firms and large corporations, focusing primarily on key application areas such as semiconductors & electronics, renewable energy, and batteries. These investments drive technological advancement, expanding manufacturing capabilities, and driving innovation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 580.14 Million |

| Market Size in 2026 | USD 646.91 Million |

| Market Size by 2035 | USD 1,724.53 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.51% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material, Manufacturing Facility, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Thin-Film Electrode Market Segmental Insights

Material Insights

Metal-Based: The segment held the largest market share in 2024, because metals such as platinum, gold, silver, and titanium are widely used to form thin-film electrodes, owing to their excellent electron-transfer efficiency, corrosion resistance, and ease of fabrication via deposition techniques. The metal's superior properties make it immensely popular for electrochemical systems, including medical diagnostics, biosensors, microelectronics, and various energy storage devices.

Carbon-Based: The segment is expected to grow at a remarkable CAGR between 2026 and 2035. Carbon-based materials are valued for their cost-effectiveness, chemical stability, and versatility compared to metal-based alternatives. Carbon materials are driving innovation in biosensing, energy storage, and flexible electronics. Carbon-based electrodes are favored for implantable neural interfaces in the healthcare sector.

Polymer-Based: The segment is anticipated to grow rapidly, driven by rising demand for flexible, lightweight, and biocompatible electronic components. Polymers are characterized by their mechanical properties, which are crucial for implantable medical devices, wearable electronics, and smart textiles. Polymer-based thin-film electrodes are used across diverse industries, including healthcare & biotechnology, electronics & semiconductors, and energy storage.

Manufacturing Facility Insights

Physical Vapor Deposition: This segment contributed the highest revenue share in the thin-film electrode market. The physical vapor deposition (PVD) segment holds the dominant position as the leading manufacturing technology in the thin-film electrode market. Physical vapor deposition is highly favored, owing to its versatility, precision, and ability to produce high-quality films crucial for demanding high-performance applications. The rising demand for advanced medical devices and solar cells, along with the expanding electronics and semiconductor industries, is anticipated to fuel the growth of the segment.

Chemical Vapor Deposition: The segment is expected to grow at the fastest CAGR, as it enables the production of highly pure and uniform films with excellent conformality. The chemical vapor deposition (CVD) segment is a critical technology for producing high-quality, high-performance thin-film electrodes, especially in the semiconductor and energy sectors. Chemical vapor deposition (CVD) finds applications in semiconductors and microelectronics, renewable energy, protective coatings, and biotechnology.

Spluttering: The sputtering segment is anticipated to expand at a considerable rate. The growth of the segment is driven primarily by the rapid growth of electronics and semiconductor industries, widespread use of thin films in renewable energy applications, and rising demand for miniaturized devices. Sputtering is crucial for depositing precise metal, oxide, and nitride films in the manufacturing of integrated circuits (ICs), memory chips, transistors, and LCD or OLED displays.

End-Use Industry Insights

Electronics & Semiconductor: The segment is dominating the thin-film electrode market. The electronics & semiconductor segment is the largest end-user industry for thin-film electrodes, accounting for the majority of the market's revenue. This sector's rapid growth is fuelled by the increasing demand for miniature, faster, and more efficient electronic components.

Healthcare & Biotechnology: The segment is the fastest-growing in the thin-film electrode market. The healthcare & biotechnology segment is a rapidly growing end-user industry for thin-film electrodes, offering lucrative opportunities for innovation in diagnostics, monitoring, and treatment. The increasing demand for continuous health monitoring systems relies on thin-film technology. Thin-film electrodes play a vital role in point-of-care diagnostic devices and biosensors used in blood glucose monitors, DNA sequencers, and other rapid testing devices.

Energy & Power: The segment is anticipated to grow at a considerable rate, owing to the rapidly expanding energy & power sectors, especially in the Asia Pacific and North America regions. Thin-film technology is an essential component in thin-film solar cells and advanced energy storage systems. Moreover, continuous technological improvements in the durability, efficiency, and cost-effectiveness of thin-film solar technologies are anticipated to drive the growth of the segment during the forecast period.

Thin-Film Electrode Market Regional Insights

The Asia Pacific region dominates the thin film electrode market, as the region is a major hub of semiconductor and electronics companies, creating a strong manufacturing ecosystem for thin film electrodes. Large-scale production of smartphones, microchips, displays and sensing devices in countries such as China, South Korea, Japan and Taiwan generates consistent demand for high-performance electrode coatings that support miniaturized and energy-efficient components. The region's fast-paced industrialization fuels demand for thin film electrodes in several sectors such as healthcare, electronics and energy and power, where compact and highly conductive materials are essential.

Several countries like Japan, India, China and South Korea are major hubs, with significant investment in manufacturing electronics and semiconductors. These nations are expanding fabrication facilities, supporting advanced deposition technologies and scaling R&D for next-generation materials such as graphene films, metal oxide electrodes and nanostructured coatings. Government-backed initiatives in renewable energy, electric vehicles, and smart medical devices further accelerate adoption by creating new opportunities for thin film electrodes in batteries, supercapacitors, biosensors and implantable electronics. This combination of industrial scale, innovation capacity and strong policy support positions Asia Pacific as the global leader in the thin film electrode market.

How Is China Transforming the Thin-Film Electrode Market?

The Asia Pacific is the largest and fastest-growing region in the thin-film electrode market, driven by its strong manufacturing base, rapid industrialization, and expansion of various sectors such as electronics, semiconductors, and renewable energy. China leads the thin-film electrode market. The country is the primary contributor to this regional dominance, creating new opportunities for thin-film electrodes in various applications such as biosensors, energy storage, and electronics.

North America is the fastest-growing region in the thin-film electrode market due to strong advancements in semiconductor manufacturing, rapid adoption of AI-enabled devices, and increasing investment in next-generation energy storage technologies. The region hosts a large number of research laboratories and fabrication facilities that focus on developing ultra-thin, high-conductivity electrode coatings for microchips, medical sensors, aerospace electronics, and flexible wearables.

Federal funding programs in the United States and Canada support advanced materials research, particularly for solid-state batteries, neural interfaces and high-density energy devices, all of which rely heavily on thin film electrodes. In addition, the presence of major technology companies, strong university semiconductor programs and robust clean energy initiatives accelerates commercialization, making North America one of the most dynamic regions for thin film electrode innovation and deployment.

The United States thin-film electrode market is experiencing growth. The country's growth is supported by the increasing demand for thin-film electrodes in electronics and semiconductors, owing to their use in integrated circuits, transistors, and other miniaturized devices. The growing demand for wearable electronics and medical devices, such as SEEG electrodes for epilepsy monitoring, is expected to drive the growth of the thin-film electrode market. In addition, the surge in solar energy, particularly thin-film solar cells and supportive government initiatives like tax incentives, is anticipated to fuel the expansion of the thin-film electrode market in the coming years.

The European market is experiencing notable growth. The growth of the region is attributed to the strong demand from the electronics sector, rapid technological improvements and increasing demand for medical wearable devices. Europe has a well-established manufacturing base for sensors, microelectronics and diagnostic devices, which heavily rely on ultra-thin conductive films for lightweight, compact and energy-efficient performance. The region's expanding healthcare sector is also driving demand for thin film electrodes used in biosensors, diagnostic patches and digital health wearables that require high accuracy and stable signal detection.

The increasing adoption of thin film technologies in flexible and printed electronics in the photovoltaic industry is owing to the stringent sustainability regulations and improvements in smart thin films, boosting the region's growth during the forecast period. European climate and energy directives encourage the use of high-efficiency solar modules and next-generation photovoltaic materials, many of which incorporate thin-film electrodes for improved conductivity and durability. Strong academic research networks and public funding programs further support innovation in advanced deposition methods, nanomaterials and hybrid films, strengthening Europes position as a rapidly evolving market for thin film electrode technologies.

Germany Thin-Film Electrode Market Analysis

Germany is poised for significant growth, supported by strong government support, a robust manufacturing infrastructure, and rising advancements in nanomaterials and thin film technologies for the development of flexible and durable electrodes. The country has an established network of research institutes, semiconductor fabrication facilities and materials science laboratories that actively work on ultra-thin conductive films, metal oxide layers, and next-generation graphene-based coatings.

German companies are also investing in precision deposition technologies and automated production systems that enable high-quality, scalable thin film manufacturing for electronics, automotive, and medical applications. Supportive government policies and initiatives aimed at advancing sustainable energy solutions have increased the adoption of solar panels. Germanys national energy transition strategy has created strong demand for thin-film electrodes used in photovoltaic modules, perovskite solar cells, and energy storage solutions. The presence of large solar manufacturers, combined with government-funded projects in smart grids, hydrogen technologies, and advanced battery systems, further boosts the need for high-performance electrode films.

Thin-Film Electrode Market Companies

- BASi Research Products, Inc.

- MicruX Technologies

- Merck KGaA

- Flex Medical Solutions Ltd.

- PalmSens

- MSE Supplies LLC

- Metrohm DropSens

- First Solar, Inc.

- Hanergy Thin Film Power Group Ltd.

- Applied Materials, Inc.

Recent Developments

- In June 2025, Linxens, a global leader in the design and manufacture of component-based solutions, announced a strategic collaboration with FlexMedical Solutions (FMS), a UK-based expert in the design, development, and manufacture of functionalized biosensors and microfluidic test cartridges for point-of-care diagnostics and wearables.(Source: https://www.flexmedical-solutions.com)

- In March 2025, MicruX announced the expansion of our screen-printed dual electrodes (D2PE) line, now available in gold in addition to our high-performance carbon version. Screen-printed dual electrodes (D2PE) are designed with cutting-edge technology, offering outstanding performance for researchers and developers.(Source: https://www.micruxfluidic.com)

Thin-Film Electrode MarketSegments Covered in the Report

By Material

- Metal-Based

- Boron-Doped Diamond-Based

- Carbon-Based

- Polymer-Based

- Other Materials

By Manufacturing Facility

- Physical Vapor Deposition

- Chemical Vapor Deposition

- Sputtering

- Electrochemical Deposition/Electroplating

- Other Manufacturing Technology

By End-Use Industry

- Healthcare & Biotechnology

- Electronics & Semiconductor

- Energy & Power

- Chemical & Petrochemical

- Other End-Use Industries

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting