Microchips Market Size and Forecast 2025 to 2034

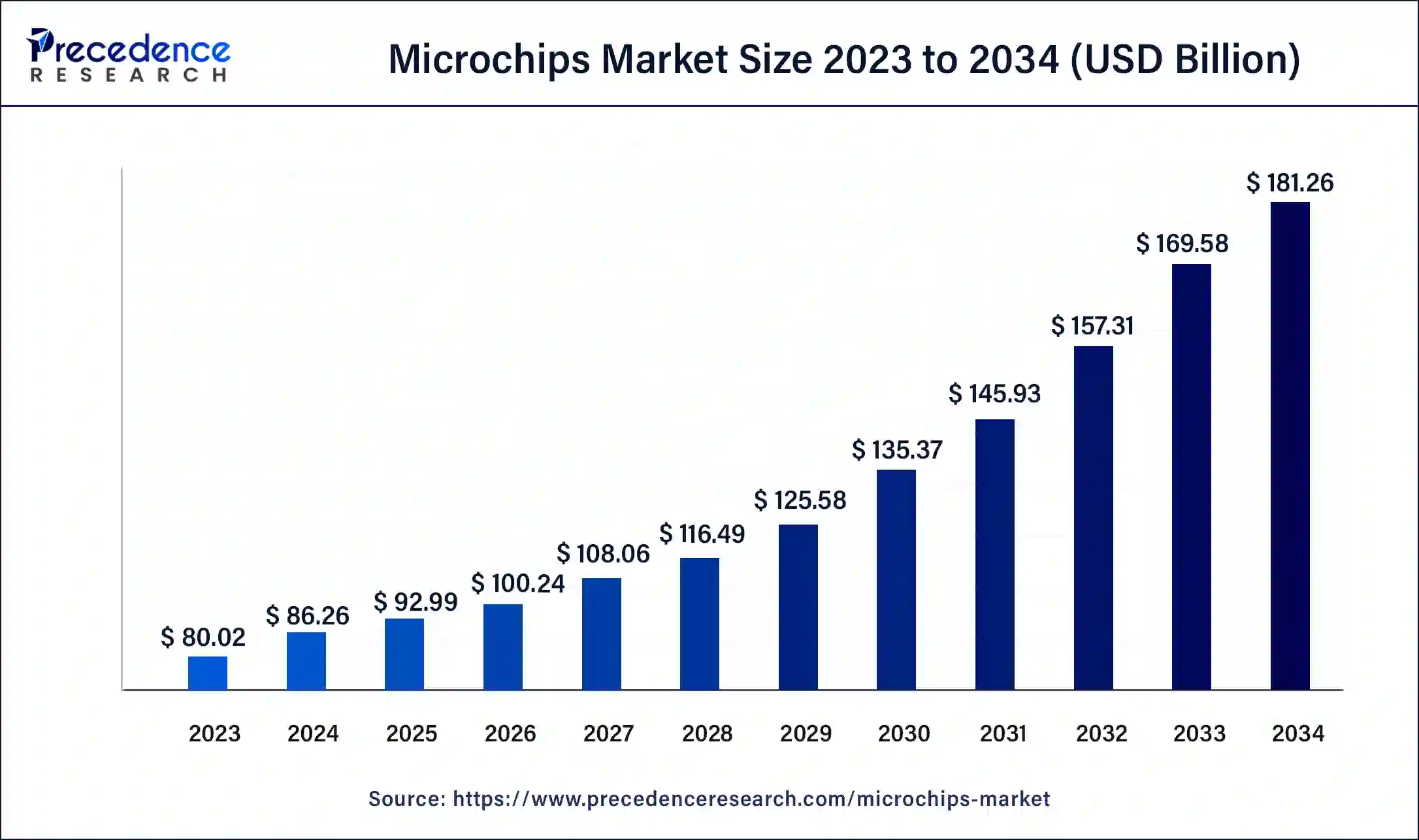

The global microchips market size accounted at USD 86.26 billion in 2024 and is predicted to reach around USD 181.26 billion by 2034, growing at a CAGR of 7.71% from 2025 to 2034.

Microchips Market Key Takeaways

- The global microchips market was valued at USD 86.26 billion in 2024.

- It is projected to reach USD 181.26 billion by 2034.

- The microchips market is expected to grow at a CAGR of 7.71% from 2025 to 2034.

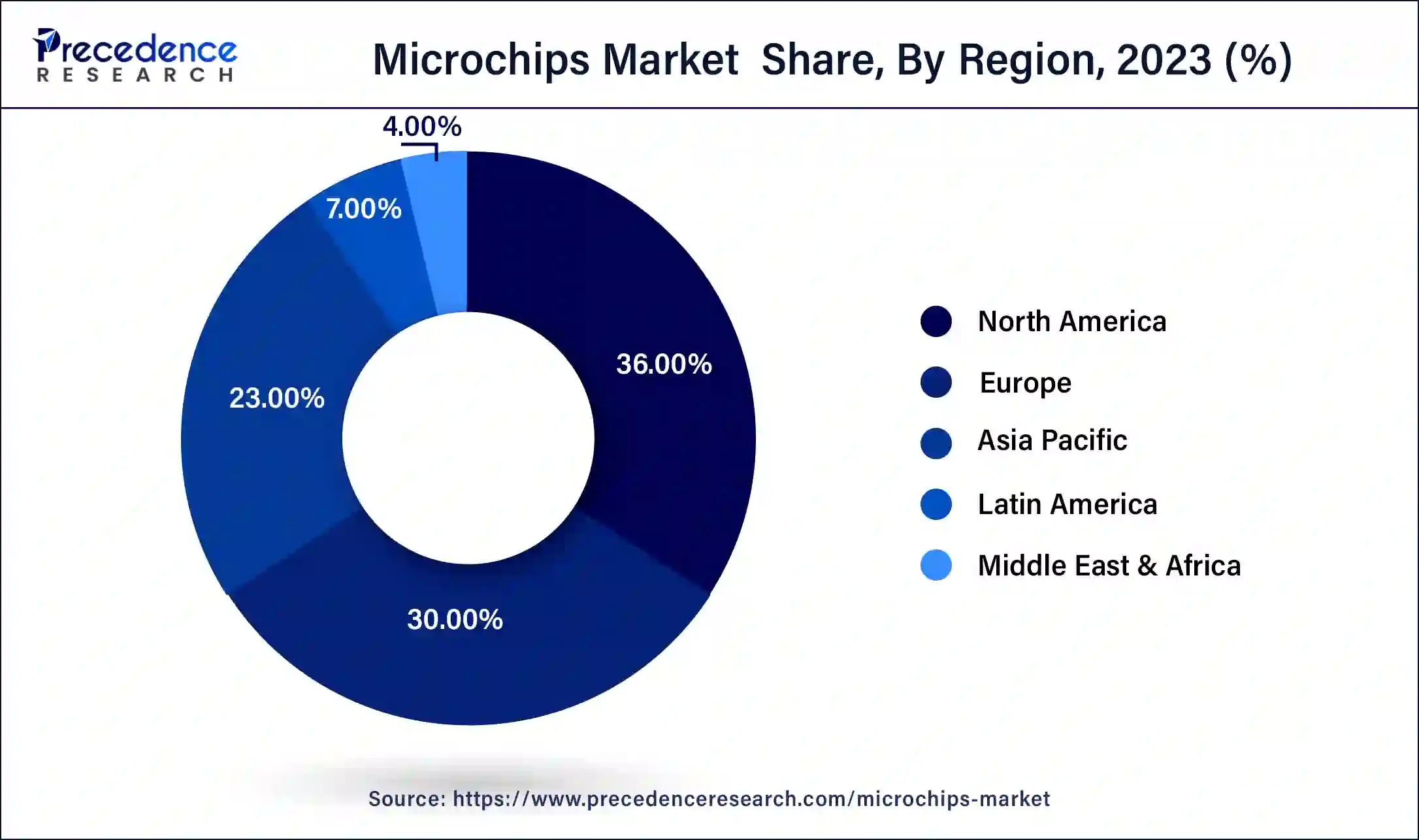

- North America contributed more than 36% market share in 2024.

- Asia-Pacific is estimated to witness the fastest CAGR between 2025 and 2034.

- By product type, the integrated device segment has held the largest market share of 42% in 2024.

- By product type, the fabless segment is anticipated to grow at a remarkable CAGR of 8.1% between 2025 and 2034.

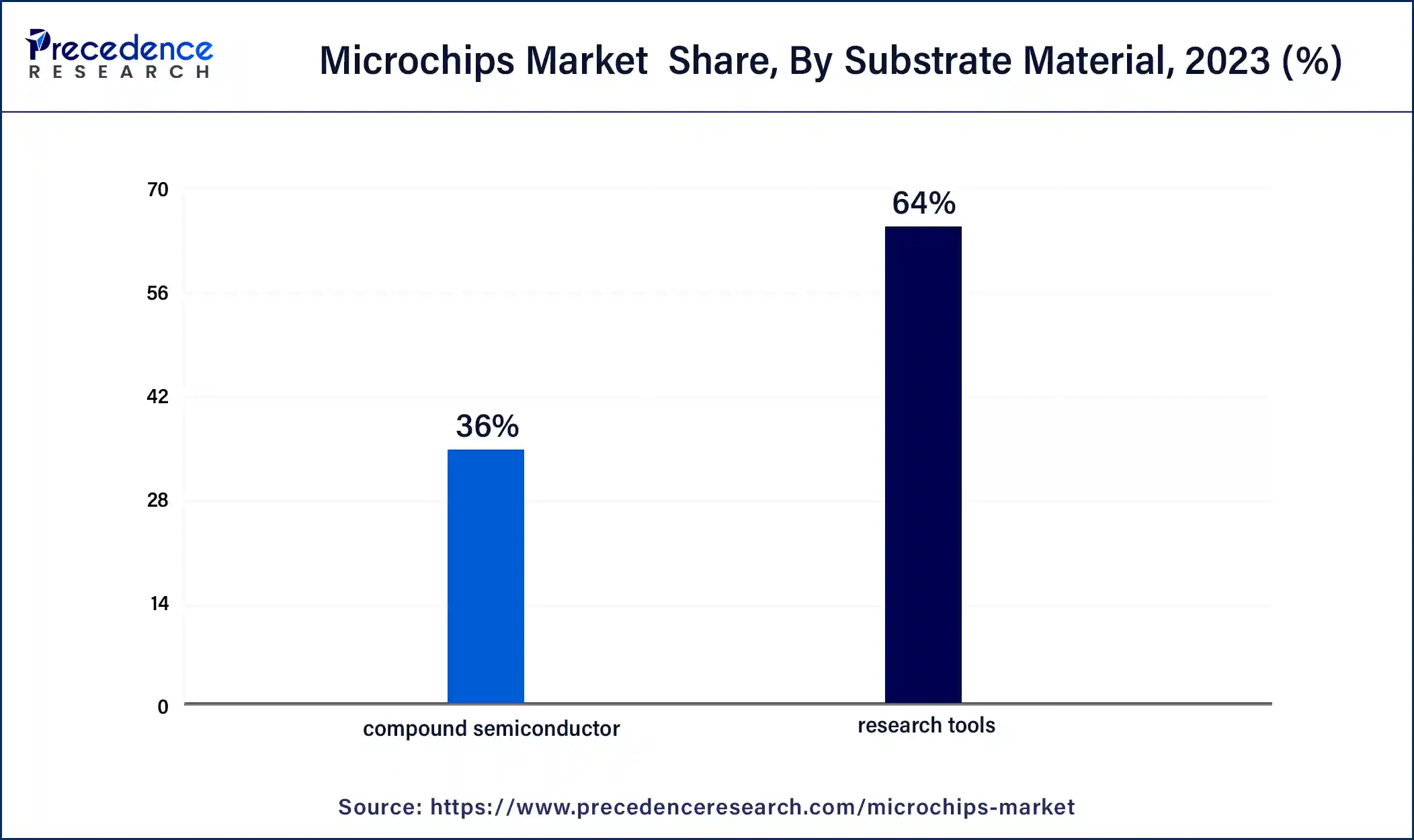

- By substrate material, the silicon segment generated over 61% of the market share in 2024.

- By substrate material, the compound semiconductor segment is expected to expand at the fastest CAGR over the projected period.

- By end-user, the consumer electronics segment had the largest market share of 39% in 2024.

- By end-user, the automotive segment is expected to expand at the fastest CAGR over the projected period.

- By manufacturing process, the planar segment generated over 64% of market share in 2024.

- By manufacturing process, the FinFET segment is expected to expand at the fastest CAGR over the projected period.

- By wafer size, the 8-inch segment generated over 41% of market share in 2024.

- By wafer size, the 12-inch segment is expected to expand at the fastest CAGR over the projected period.

U.S. Microchips Market Size and Growth 2025 To 2034

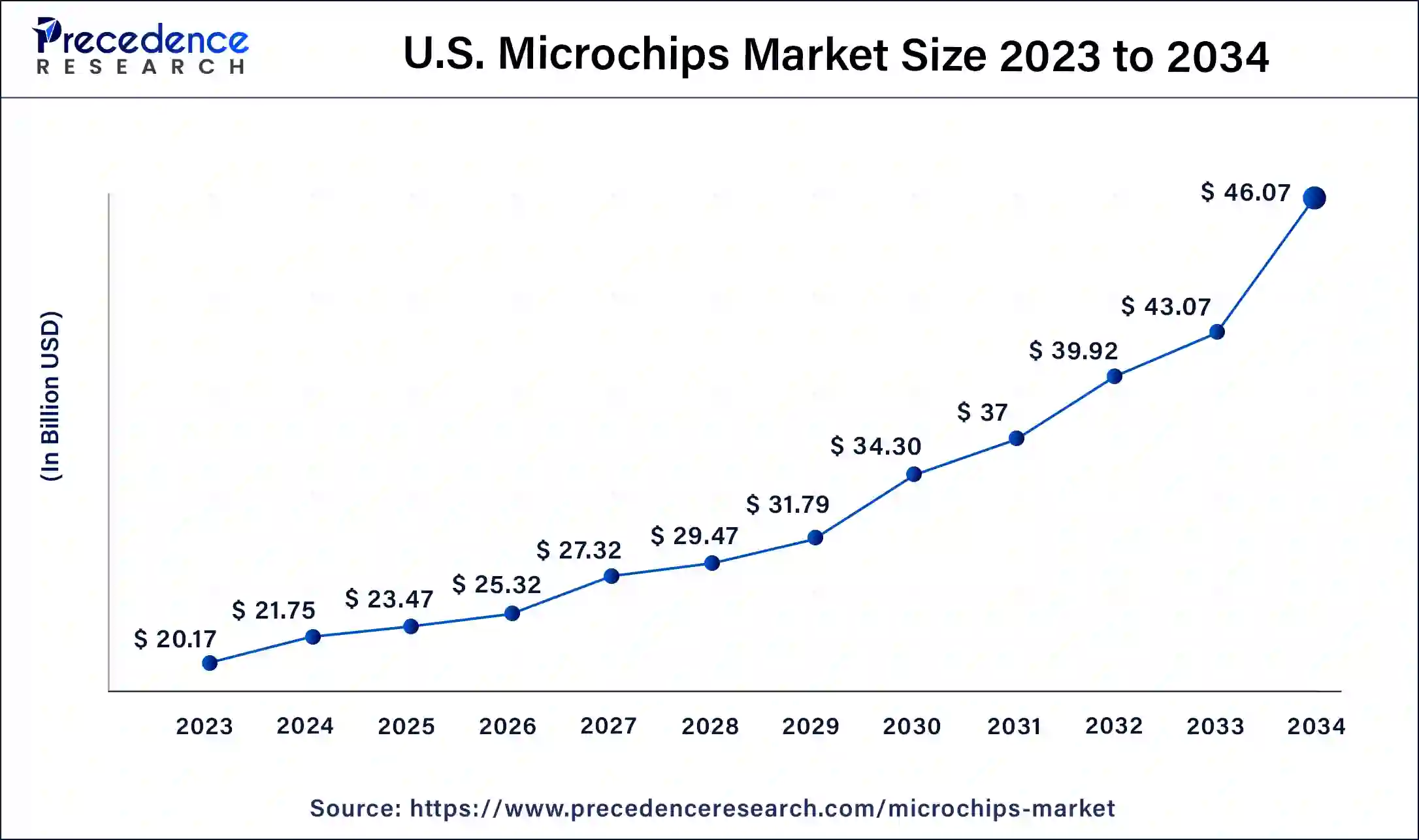

The U.S. microchips market size was valued at USD 21.74 billion in 2024 and is expected to reach USD 45.68 billion by 2034, at a CAGR of 7.86% from 2025 to 2034.

North America has held the largest market share of 36% in 2024. The microchips market in North America is driven by technological innovation and robust demand across various industries. The region hosts major semiconductor manufacturers and technology companies, contributing to a dynamic market landscape. The focus on applications like 5G, IoT, and AI, coupled with strong consumer electronics demand, positions North America as a key player in shaping the evolution of microchip technologies.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific dominates the microchips market, serving as a manufacturing hub and a significant consumer. Countries like China, South Korea, and Taiwan lead in semiconductor production, fostering a thriving ecosystem. The region's growth is propelled by expanding electronics markets, rapid industrialization, and initiatives in 5G infrastructure development, reinforcing Asia-Pacific's pivotal role in the global microchip industry.

In Europe, the microchips market is characterized by a commitment to cutting-edge semiconductor technologies and innovation. The region hosts several leading semiconductor companies and research institutions, driving advancements in microchip design and manufacturing. Europe's focus on diverse applications, including automotive technologies, industrial automation, and smart devices, positions it as a key contributor to the global microchip industry.

Market Overview

The microchips market involves the manufacturing and sale of microchips, also known as integrated circuits or ICs. These miniature electronic components consist of interconnected transistors and other circuit elements on a small semiconductor wafer. Microchips serve as the central processing unit (CPU) in electronic devices, facilitating data processing and storage. With applications spanning from consumer electronics to industrial machinery and telecommunications, the market is driven by technological advancements, increasing demand for compact and powerful computing solutions, and the pervasive integration of microchips across various industries for enhanced functionality and performance.

The microchips market is characterized by continuous innovation, addressing diverse industry needs. Ongoing technological advancements, including the development of smaller, more powerful chips, contribute to the market's growth. Increasing demand for high-performance computing solutions across various sectors further propels the expansion of the microchips market.

Microchips Market Growth Factors

- Ongoing innovations drive the development of smaller, more powerful microchips, enhancing their performance and versatility in diverse applications.

- Microchips find widespread integration across industries, serving as the backbone of electronic devices, from consumer electronics to industrial machinery.

- Growing demand for compact and powerful computing solutions fuels the expansion of the microchips market, driven by the need for enhanced functionality in electronic devices.

- Microchips play a vital role in industrial applications, contributing to the automation and efficiency of manufacturing processes, further boosting market demand.

- The telecommunications sector relies heavily on microchips for network infrastructure and devices, reflecting a substantial market opportunity.

- The rise of the Internet of Things (IoT) emphasizes the need for connected devices, propelling the demand for microchips that enable seamless connectivity.

- Industry trends favor the miniaturization of electronic components, driving the development of smaller, energy-efficient microchips for various applications.

- Microchips play a crucial role in automotive innovation, powering advanced driver assistance systems (ADAS), infotainment, and electric vehicle technologies.

- Growing concerns about cybersecurity drive the demand for microchips that provide robust security and encryption features.

- The rise of edge computing further elevates the demand for microchips that can process data efficiently at the device level, reducing reliance on centralized servers.

- Ensuring a resilient and diversified supply chain for microchip manufacturing becomes a critical consideration to address potential disruptions and meet market demand.

Microchips Market Scope

| Report Coverage | Details |

| Market Size By 2034 | USD 181.26 Billion |

| Market Size in 2025 | USD 92.99 Billion |

| Market Size in 2024 | USD 86.26 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.71% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type, By Substrate Material, By End-User, By Manufacturing Process, and By Wafer Size |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing demand for consumer electronics and rise of the Internet of Things (IoT)

The microchips market is experiencing a substantial surge in demand, driven by the expansion of artificial intelligence (AI) and automotive innovations. The proliferation of AI applications, including machine learning and neural networks, necessitates sophisticated microchips capable of handling complex computations. As AI becomes integral to industries like healthcare, finance, and manufacturing, the demand for high-performance microchips escalates, driving market growth.

Simultaneously, automotive innovations play a pivotal role in surging microchip demand. Advanced driver assistance systems (ADAS), electric vehicle technologies, and in-vehicle infotainment systems heavily rely on microchips for processing and control. The automotive industry's shift toward electric and connected vehicles amplifies the need for cutting-edge microchip solutions, emphasizing the market's role in driving technological advancements within the automotive sector. The synergistic growth fueled by AI expansion and automotive innovations positions the microchips market at the forefront of transformative technological shifts across diverse industries.

Restraint

Complex manufacturing processes and technological obsolescence

The microchips market faces challenges arising from the complexity of manufacturing processes. As microchips become more intricate and advanced, the manufacturing processes become complex and require specialized equipment and expertise. This complexity can lead to increased production costs, longer development cycles, and potential difficulties in maintaining high yields, impacting market demand. Manufacturers must continually invest in cutting-edge facilities and skilled personnel to keep pace with evolving technological requirements, contributing to a potential barrier for entry and market growth.

Additionally, technological obsolescence presents a restraint to market demand. The rapid pace of innovation in the electronics industry leads to the quick obsolescence of existing microchip technologies. As newer, more advanced chips enter the market, older versions may become outdated, reducing demand for previous generations. This constant evolution necessitates continuous research and development efforts, making it challenging for manufacturers to stay competitive and maintain sustained demand for their products, particularly when consumers and industries seek the latest technologies to enhance their devices and systems.

Opportunity

5G technology implementation and automotive electrification

The microchips market experiences a significant surge in demand propelled by the implementation of 5G technology and the trend towards automotive electrification. The rollout of 5G networks necessitates highly sophisticated and efficient microchips to power the increased data speeds, low latency, and connectivity demands. Microchips play a crucial role in the infrastructure of 5G networks, supporting base stations, antennas, and network equipment.

Simultaneously, the accelerating shift towards automotive electrification, with a focus on electric vehicles (EVs), requires advanced microchips for various applications within these vehicles. From managing battery systems to supporting sophisticated driver-assistance features, microchips contribute to the efficiency, safety, and performance of electric vehicles. The convergence of 5G technology and automotive electrification underscores the pivotal role microchips play in enabling the seamless integration of high-speed connectivity and advanced electronics, driving the market's growth in response to these transformative technological shifts.

Product Type Insights

According to the product type, the integrated devices segment has held 42% market share in 2024. Integrated devices refer to microchips where the entire manufacturing process, from designing the semiconductor to fabricating the final product, occurs within a single entity or company. This vertical integration streamlines production and ensures better control over the entire chip-making process, facilitating quicker innovation and adaptation to market needs.

The fabless segment is anticipated to expand at a significant CAGR of 8.1% during the projected period. Fabless companies, on the other hand, specialize in designing microchips but outsource the actual fabrication to external foundries. This model allows for greater flexibility in design innovation, reduced capital investment, and the ability to focus on the core competency of chip design. The fabless approach has gained prominence, enabling companies to thrive in the dynamic and competitive microchip market.

Substrate Material Insights

Based on the substrate material, the silicon segment held the largest market share of 61% in 2024. Silicon, a traditional substrate material for microchips, boasts widespread use due to its excellent semiconducting properties. It enables the creation of cost-effective and high-performance integrated circuits. Ongoing trends in silicon-based microchips focus on enhancing processing speeds, reducing energy consumption, and advancing miniaturization, ensuring silicon's continued dominance in the market.

On the other hand, the compound semiconductor segment is projected to grow at the fastest rate over the projected period. Compound semiconductors, featuring materials like gallium arsenide and silicon carbide, offer advantages in certain applications requiring higher frequencies and power capabilities. In the microchips market, trends involve the integration of compound semiconductors for specialized functionalities, such as in 5G communication devices and power electronics, showcasing their niche role in complementing silicon-based technologies.

End-user Insights

In 2024, the consumer electronics segment held the highest market share of 39% based on the end user. In the microchips market, consumer electronics drive demand with a relentless pursuit of innovation. Microchips power the latest smartphones, tablets, smart TVs, and wearables, enabling features like advanced processors, high-resolution displays, and connectivity capabilities. The trend focuses on miniaturization, energy efficiency, and enhanced performance to meet the evolving needs of tech-savvy consumers.

The automotive segment is anticipated to expand at the fastest rate over the projected period. Automotive applications in the microchips market are pivotal as vehicles embrace electrification and advanced driver assistance systems (ADAS). Microchips facilitate electric vehicle (EV) performance, battery management, and connectivity, contributing to the industry's shift towards smart, energy-efficient, and connected automobiles. The trend emphasizes the integration of microchips to enhance safety, navigation, and overall driving experience.

Manufacturing Process Insights

Based on the manufacturing process, the planar segment held the largest market share of 64% in 2024. Planar technology is a traditional microchip manufacturing process where transistors are formed on a flat surface. In this method, the transistor gate is placed directly on the silicon substrate. While widely used historically, planar technology faces challenges in achieving smaller transistor sizes, limiting its efficiency in contemporary microchip designs.

On the other hand, the compound FinFET segment is projected to grow at the fastest rate over the projected period. FinFET (Fin Field-Effect Transistor) is an advanced 3D transistor technology. It features a raised channel (fin) above the silicon substrate, enhancing control over the flow of electrical current. FinFET allows for smaller transistor sizes, improving power efficiency and performance. As a trend in the microchips market, there's a significant shift towards FinFET technology due to its superior capabilities in achieving higher transistor density and improved energy efficiency, crucial for meeting the demands of modern electronics.

Wafer Size Insights

Based on the wafer size, the 8-inch segment held the largest market share of 41% in 2024. In the microchips market, an 8-inch wafer refers to the diameter of the silicon substrate used in chip manufacturing. Historically popular, it remains in use for certain applications due to established manufacturing capabilities. However, trends indicate a gradual shift toward larger wafer sizes for increased chip production efficiency.

On the other hand, the 12-inch segment is projected to grow at the fastest rate over the projected period. A 12-inch wafer signifies a larger silicon substrate diameter, offering greater manufacturing efficiency and cost-effectiveness. The microchips market increasingly favors 12-inch wafers for advanced semiconductor production, capitalizing on economies of scale and enhancing overall semiconductor manufacturing capabilities.

Microchips Market Companies

- Intel Corporation

- Samsung Electronics Co., Ltd.

- Taiwan Semiconductor Manufacturing Company Limited (TSMC)

- Qualcomm Incorporated

- NVIDIA Corporation

- Advanced Micro Devices, Inc. (AMD)

- Texas Instruments Incorporated

- Micron Technology, Inc.

- SK hynix Inc.

- Broadcom Inc.

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- Applied Materials, Inc.

- ASML Holding N.V.

- Renesas Electronics Corporation

Recent Developments

- In 2020, Nvidia revealed its powerful Nvidia A100 artificial intelligence chip, a groundbreaking advancement in AI processing. With a staggering 54 billion transistors, this chip delivers exceptional performance, executing 5 petaflops—approximately 20 times more than its predecessor, the Volta chip. The A100 stands as a formidable force in pushing the boundaries of AI capabilities.

- In 2020, Intel has extended its 11th-generation "Core" processor chip architecture, introducing new chips tailored for high-performance gaming laptops and desktops. The Core S-series chips designed for desktops boast a notable 14% improvement in speed compared to Intel's previous top-tier gaming chips, enhancing the processing power and performance capabilities for gaming enthusiasts and desktop users.

Segments Covered in the Report

By Product Type

- Integrated Device

- Fabless

- Foundry

- Memory

- Analog

- Logic

- Microcontroller

By Substrate Material

- Silicon

- Compound Semiconductor

By End-User

- Consumer Electronics

- Automotive

- Healthcare

- Military & Civil Aerospace

- Industrial

- Telecommunications

- Data Processing

By Manufacturing Process

- Planar

- FinFET

- FD-SOI

By Wafer Size

- 6-inch

- 8-inch

- 12-inch

- 18-inch

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting