What is the High Power Graphite Electrode Market Size?

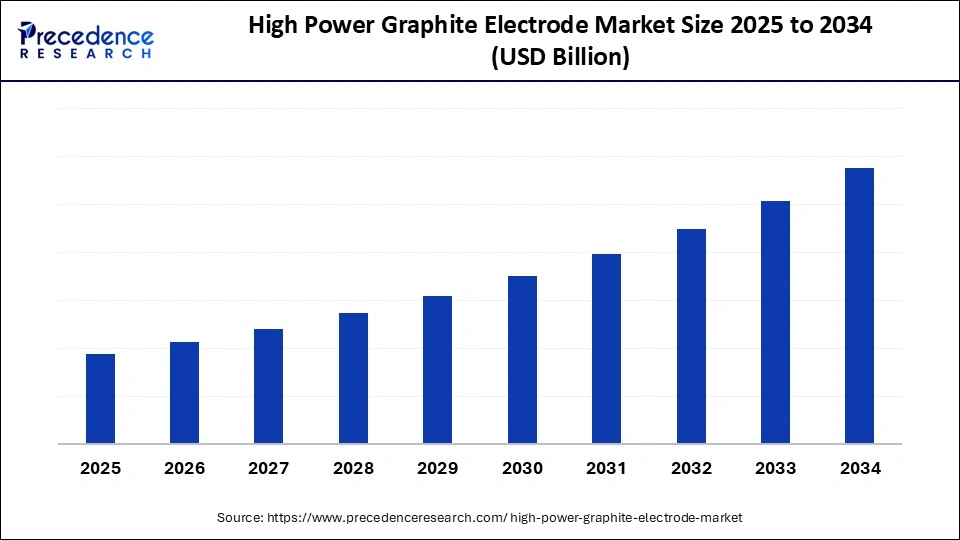

The global high power graphite electrode market is witnessing steady growth as electric arc furnaces become increasingly vital for sustainable steel production and recycling.The global high power graphite electrode market is witnessing robust growth driven by increasing steel demand from the construction and automotive sectors. This report covers market trends, production volumes, technological developments, and competitive dynamics across North America, Europe, and APAC between 2025 and 2030.

High Power Graphite Electrode Market Key Takeaways

- Asia Pacific dominated the high power graphite electrode market with the largest market share of 55% in 2025.

- North America is anticipated to grow at the fastest CAGR during the forecast period.

- By product type, the high power (HP) graphite electrode segment accounted for the significant market share of 50% in 2025.

- By product type, the ultra high power (UHP) electrodes segment is expected to witness a significant share during the forecast period.

- By electrode size, the 400–600 mm segment held the major market share of 40% in 2025.

- By electrode size, the above 600 mm segment is projected to grow at a CAGR between 2026 and 2035.

- By end user industry, the steel industry segment captured the highest market share of 65% in 2025.

- By end user industry, the non-ferrous metallurgy segment accounted for considerable growth over the forecast period.

- By distribution, the direct sales segment generated the major market share of 55% in 2025.

- By distribution, the distributors & traders stage segment is expected to grow significantly during the forecast period.

What Are High Power Graphite Electrodes?

The increasing steel production using EAF technology, especially in regions promoting sustainable steel recycling. With rising demand from the Asia Pacific, particularly China and India, HP graphite electrodes serve as a critical link in balancing cost, performance, and operational efficiency in industrial metallurgy. HP electrodes offer higher thermal and electrical conductivity compared to standard electrodes, making them suitable for medium- to high-intensity operations in both steel recycling and ferroalloy production. Their key advantage lies in energy efficiency, durability, and resistance to thermal shock.

Key Technological Shifts in the High Power Graphite Electrode Market

The high power graphite electrode market is undergoing key technological shifts. One of the most significant technological advancements includes higher electrode efficiency and durability to meet the increasing demand for high powered electrodes. Advancements in electrode technology are focused on improving the overall performance of the electric arc furnace (EAF). Technological innovations are making steel production via electric arc furnace (EAF) more efficient and environmentally friendly. Technological innovation in manufacturing processes, material composition, and application technologies is significantly accelerating the growth of the graphite electrode market. Electrode manufacturers are also increasingly incorporating automation, robotics, and process control technology, resulting in more precise manufacturing, reduced labor involvement, and higher output.

High Power Graphite Electrode Market Trends

- Industry Growth Overview: Between 2025 and 2030, the industry is expected to see accelerated growth owing to the increasing global demand for steel, propelled by rapid urbanization & industrialization, infrastructure expansion, and increasing investments in technological innovation to enhance electrode performance

- Sustainability Trends: The market is experiencing a push for sustainable and efficient manufacturing processes. Recycling of graphite electrode scraps has become a new trend to boost sustainability and reduce input costs. After extensive use, the electrodes deteriorate or become waste, which increases the need for effective recycling and disposal solutions to reduce the carbon footprint. Several industry players are increasingly seeking to reduce waste and improve sustainability.

- Global Expansion: Leading players are expanding their geographical presence. For instance, in 2024, GrafTech International Ltd., a leading manufacturer of high-quality graphite electrode products essential for electric arc furnace (EAF) steel production. The company expanded its product offerings by adding the 800-millimeter super-sized electrode to its portfolio, targeting a small but growing segment of the ultra-high power (UHP) electrode market.(Source: https://www.tradingview.com)

Trade Analysis of High Power Graphite Electrode Market: Import & Export Statistics

- Vietnam is a significant exporter. Vietnam leads the world in Graphite Electrode exports, with 94,691 shipments from October 2023 to September 2024 (TTM).

(Source: https://www.volza.com) - India is among the top exporters of UHP Graphite Electrode. India exported 253 shipments of UHP Graphite Electrode to the United States from October 2023 to September 2024 (TTM). These exports were made by 33 Indian Exporters to 77 United States Buyers, marking a growth rate of 2% compared to the preceding twelve months. India exported 3,468 shipments of Graphite Electrodes from October 2023 to September 2024 (TTM).

(Source: https://www.volza.com) - China serves as a major producer and exporter of graphite electrodes, catering to the global demand for steel. China exported 3,308 shipments of Electrode Graphite from Oct 2023 to Sep 2024 (TTM).

(Source: https://www.volza.com)

Breakthroughs made by market players in the High Power Graphite Electrode Market

| Key player | Time Period | Breakthrough |

| HEG Limited | August 2025 |

In August 2025, HEG Limited, a prominent player in the graphite electrode industry, is making a significant move to expand its production capabilities. The company recently announced plans to add 15,000 tonnes per annum (TPA) to its existing graphite electrode and related products capacity. This strategic expansion comes as the company seeks to capitalize on a structural shift in the industry, which is driving up demand for electrodes.(Source: https://marketsetup.in) |

| Graphite India Limited | August 2025 | Graphite India Limited has announced its plan to expand the capacity of its Graphite Electrodes Division by 25,000 TPA, increasing the total capacity from 80,000 TPA to 105,000 TPA. The Rs. 600 crore expansion will be implemented in two phases over a period of 36 months.(Source: https://scanx.trade) |

| POSCO Future M | January 2025 | POSCO Future M successfully localized the manufacturing technology for electrode rods, an essential material in the steel production process. The company developed manufacturing technology for high-quality synthetic graphite electrode rods with a diameter of 300mm as a national project. (Source: https://newsroom.posco.com) |

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, End User Industry, Electrode Size, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Insights

Which Segment Is Dominating the Market by Product Type in the High Power Graphite Electrode Market?

The high power (HP) electrodes segment dominated the global high power graphite electrode market in 2024. high powered electrodes are crucial for modern steel production, driven by rising global steel demand, an increasing focus on energy efficiency, and rapid technological advancements. high power (HP) electrodes offer an environmentally friendly alternative to traditional methods, thereby bolstering the segment's growth during the forecast period. On the other hand, the ultra-high power (UHP) graphite electrodes segment is expected to witness remarkable growth during the forecast period. The market is witnessing increasing demand for Ultra-High Power (UHP) graphite electrodes, owing to their ability to handle higher energy input in electric arc furnaces (EAFs), leading to faster steel production. The key players are increasingly focusing on advancements in improving Ultra-High Power (UHP) graphite electrodes to achieve greater efficiency and lifespan.

Electron Size Insights

What Causes the 400–600 mm Electrode Size Segment to Dominate the High Power Graphite Electrode Market?

The 400–600 mm electrode size segment held a dominant presence in the high power graphite electrode market in 2024. The 400–600 mm electrode Graphite allows manufacturers specializing in Ultra High Power (UHP) grades for applications in electric arc furnaces (EAFs), supported by the high steel production. On the other hand, the above 600 mm electrode size segment is expected to grow at a notable rate. The above 600 mm electrode size, such as the 700–800 mm range, significantly reduces overall melting time. The industry is shifting toward higher-power (HP) and ultra-high-power (UHP) grades to enhance production efficiency, driving the segment's expansion in the years to come.

End User Industry Insights

How Did the Steel Industry Segment Dominate the High Power Graphite Electrode Market in 2024?

The steel industry segment held the largest share in the high power graphite electrode market during 2024. The growth of the segment is driven by the increasing steel demand from industrialization, urbanization, and infrastructure development, particularly in developing nations. On the other hand, the non-ferrous metallurgy industry segment is projected to grow at a CAGR between 2025 and 2034. The growth of the segment is driven by increasing demand for high-grade and recycled non-ferrous metals, including copper and aluminum. Moreover, the increasing adoption of the circular economy model, along with increased government support for recycling programs for non-ferrous metals, is driving the segment's growth.

How Direct Sales Segment Dominate the High Power Graphite Electrode Market in 2024?

The direct sales B2B segment accounted for the largest share in the high-power graphite electrode market, highlighting its importance as a primary distribution channel. In this segment, manufacturers of graphite electrodes establish direct relationships with end-users, typically steel producers and furnace operators, without the involvement of intermediaries. This approach ensures greater control over pricing, supply reliability, and long-term partnerships.

Direct B2B sales often take the form of supply agreements or contracts with steel mills, electric arc furnace (EAF) operators, and foundries, where electrodes are a mission-critical consumable. Since the demand for graphite electrodes is closely tied to steel production cycles, these contracts help both suppliers and buyers secure stable supply chains and predictable costs in a market that can be highly volatile due to raw material price fluctuations (like petroleum coke and needle coke).

Regional Insights

Why Did Asia Pacific Lead the Global Market for High Power Graphite Electrode?

The Asia-Pacific region dominated the global high-power graphite electrode market in 2024, accounting for the largest share in both production and consumption. This regional dominance is primarily due to the robust manufacturing ecosystems in China and India, which serve as critical hubs for industries such as construction and automotive. Manufacturers in these countries have established global networks, leveraging regional players and strategic partnerships or collaborations to distribute products globally. The growth of the region is attributed to the growing demand for Ultra-High Power (UHP) graphite electrodes, rising steel production, rapid infrastructure development, increasing environmental awareness, and a supportive government framework. Rapid urbanization and industrialization have resulted in a surge in construction activities in the region, fueling the overall market's growth. The rapid technological innovations have led the steel industry to shift toward more sustainable electric arc furnace (EAF) production.

On the other hand, North America is anticipated to grow at the fastest CAGR. The region's growth is driven by the rapid expansion of the steel manufacturing industry, the increasing adoption of electric arc furnaces (EAFs), growing demand for sustainable steel manufacturing methods, heightened environmental consciousness, and a surge in construction activities. The steel industry is experiencing rapid advancements, fueled by increased demand for EAF-produced steel and a rising focus on sustainability, which is accelerating innovation in high power graphite electrodes to enhance performance and environmental compliance.

Country-Level Investments & Funding Trends for High Power Graphite Electrode Market

- Resonac manufactures and sells graphite electrodes to be used in EAF applications. Resonac estimates that by 2028, annual demand for graphite electrodes will increase by 50,000 to 70,000 tons. In the United States, where EAFs account for 70% of steel production, the number of new EAF projects is increasing. (Source: https://ap.resonac.com)

- In June 2025, British Steel secured a £500 million deal to manufacture train tracks for Network Rail. It comes two months after the UK government took control of British Steel's plant in Scunthorpe, Lincolnshire, to prevent it from closing. British Steel's Scunthorpe plant employs approximately 2,700 people, accounting for about three-quarters of the company's workforce.(Source: https://www.bbc.com)

- In November 2024, India announced its plan to invest $120 billion to reach its target steel production level of 300 million tons by 2030, according to the country's Ministry of Steel estimate.(Source: https://gmk.center)

- In August 2024, India is rising to become a major global player in steel production. India stands as the world's second-largest producer of steel. The performance of the steel sector during April-June FY'25 (Q1: FY'25) has surpassed the levels for this period in any fiscal year. In the first quarter of FY25, crude steel production reached 36.61 million tonnes (MT), finished steel production clocked 35.77 MT, and finished steel consumption hit 35.42 MT.(Source: https://www.pib.gov.in)

- According to the 2025-2026 sector plan published by the Ministry of Industry and Information Technology and other agencies in China, the government's measures also include increasing the production of high-quality steel and promoting its use in construction and transportation.

Valus Chain Analysis of the High Power Graphite Electrode Market

- Raw Material Sourcing: Primarily petroleum needle coke, needle coke derived from coal tar pitch, and coal tar pitch.

- Manufacturing: The process involves multiple stages, including baking, impregnation, re-roasting, graphitization, and machining, to achieve high electrical conductivity and mechanical strength. Technological advancements, such as high-temperature graphitization and automation, are enhancing efficiency and quality.

- Distribution: The distribution channel for high power graphite electrodes is primarily dominated by direct B2B sales directly from manufacturers to steelmakers and furnace operators through supply agreements or contracts. The online sales are present, representing a smaller portion of the market.

High Power Graphite Electrode Market Companies

- GrafTech International

- Graphite India Limited (GIL)

- Resonac

- HEG Limited

- Tokai Carbon

- Jilin Carbon Co., Ltd.

- POSCO Future M. SEC Carbon, Ltd

- Fangda Carbon New Material

- Nippon Carbon Co., Ltd.

- Kaifeng Carbon Co., Ltd.

- Zhongze Group

- SGL Carbon

- Fangda Carbon New Material

- Energoprom Group

- Kaifeng Carbon.

Recent Developments

- In January 2025, HEG announced that its wholly owned subsidiary, TACC, has entered into a Non-Binding MOU with Ceylon Graphene Technologies (CGT) to explore joint graphene manufacturing initiatives. TACC, an innovation-driven venture of the LNJ Bhilwara Group, specializes in synthetic graphite and has made significant strides in green technologies and graphene synthesis. The company continues to lead in innovation and sustainability within the advanced materials sector.(Source: https://www.business-standard.com)

Segments Covered in the Report

By Product Type

- Regular Power (RP) Electrodes

- High Power (HP) Electrodes

- Ultra High Power (UHP) Electrodes

By End User Industry

- Steel Industry

- Non-Ferrous Metallurgy Industry

- Chemical Industry

- Foundries

By Electrode Size (Diameter)

- 100–200 mm

- 200–400 mm

- 400–600 mm

- Above 600 mm

By Distribution Channel

- Direct Sales (OEM Supply Contracts)

- Distributors & Traders

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting