What is Biodegradable Nanomaterials Market Size?

The global biodegradable nanomaterials market is expanding as industries adopt sustainable nanomaterials for environmental safety, healthcare, and smart material design. The market growth is attributed to rising environmental regulations, increasing consumer demand for sustainable solutions, and rapid advancements in biodegradable nanomaterial technologies.

Market Highlights

- By region, the Europe segment held a dominant presence in the market in 2024, accounting for an estimated 40% market share.

- By region, the Asia Pacific segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By material type, the poly(lactic acid) (PLA) segment accounted for a considerable share of the market in 2024, holding a market share of about 35%.

- By material type, the nanocellulose composite segment is projected to experience the highest growth rate in the market between 2025 and 2034.

- By nanomaterial form, the nanoparticles segment led the market, accounting for an estimated 40% market share.

- By nanomaterial form, the nanofibers segment is set to experience the fastest rate of market growth from 2025 to 2034.

- By degradation mechanism, the hydrolytic degradation segment registered its dominance over the market in 2024, which held a market share of about 30%.

- By degradation mechanism, the enzymatic degradation segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By application, the packaging segment dominated the market, accounting for an estimated 50% market share.

- By application, the medicine segment is projected to expand rapidly in the market in the coming years.

- By end-user, the food & beverage segment maintained a leading position in the market in 2024 that holding a market share of about 45%.

- By end-user, the healthcare & pharmaceuticals segment is predicted to witness significant growth in the market over the forecast period.

Market Overview

What Is the Biodegradable Nanomaterials Market?

The biodegradable nanomaterials market is also in a positive phase of growth, which can be explained by growing environmental issues and strict regulations. In 2024, the United Nations Environment Program (UNEP) reported that single-use plastic packaging makes up more than 36% of the total plastic waste in the world. This is why it is crucial to find alternatives that are both sustainable and environmentally friendly. It has also led to a shift towards using biodegradable nanomaterials in packaging because they offer higher barriers and have less environmental impact than conventional plastics.

Biodegradable nanomaterials include nanoscale materials based on renewable sources, which are engineered to decompose in nature without forming residual toxins. Cellulose nanofibers and chitin-based composites are materials designed to deliver mechanical strength and performance while being environmentally compatible. They are used in a wide range of industries like food packaging, healthcare, and agriculture, and can be applied in the context of sustainability, reducing the need for petrochemical-based plastics. Furthermore, the growth of the market in Europe is also backed by measures such as the European Commission's Sustainability of the Chemicals Strategy, which aims to enhance the safety and sustainability of chemicals.(Source: https://www.unep.org/plastic-pollution)

Impact of Artificial Intelligence on the Biodegradable Nanomaterials Market

The biodegradable nanomaterials market is transformed by artificial intelligence (AI), which improves the effectiveness of development, scaling, and commercialization. Scholars use AI-based modeling technologies to create nanoparticles that can degrade accurately and possess specific functionalities to use in the field of medicine, agriculture, and packaging. Furthermore, the manufacturers use AI-based automation to optimize the use of raw materials, reduce energy use, and improve the consistency of products, thereby reducing the cost of operations and minimizing waste.

Key Upcoming Launches and Pioneering Studies Shaping the Biodegradable Nanomaterials Market

- September 2025, University of Cambridge Launches Advanced Biodegradable Nanocomposite

The University of Cambridge unveiled a novel biodegradable nanocomposite designed for packaging applications. This material integrates cellulose nanocrystals with polylactic acid (PLA), achieving enhanced mechanical strength and oxygen barrier performance under varied environmental conditions. Researchers estimate the material could extend food shelf life significantly while reducing plastic waste. - June 2025— Fraunhofer Society Reports on Industrial-Scale PLA Biodegradation

Fraunhofer researchers demonstrated the scalability of PLA-based biodegradable nanomaterials for packaging at pilot facilities in Germany. The study shows that this technology could substantially lower industrial plastic waste when integrated into existing packaging production processes. - May 2025— Indian Institute of Science Develops Brain-Targeting Biodegradable Nanomaterial

IISc researchers engineered a novel biodegradable nanocarrier capable of crossing the blood-brain barrier for potential applications in neurodegenerative disease treatment. Laboratory testing showed enhanced neuronal uptake and reduced cytotoxicity, opening promising therapeutic pathways. - July 2025 – Polylactic Acid (PLA) Nanocomposite Films Enhanced with Nanoclay and Zinc Oxide

A study published in Plastics Engineering demonstrates that incorporating nanoclay and zinc oxide nanoparticles into PLA films significantly improves their strength and heat resistance. This advancement positions these films as promising alternatives for industrial packaging, aligning with the growing demand for eco-friendly materials. - June 2025– Development of Biodegradable Nanocomposite Scaffolds for Biomedical Applications

Research featured in Scientific Reports focuses on creating nanocomposite scaffolds using natural polymers like carboxymethyl cellulose and alginate, combined with synthetic polymers. The incorporation of magnetic clay nanoparticles modified with graphene oxide enhances the mechanical properties of these scaffolds, making them suitable for tissue engineering applications. - May 2025– Fabrication of Biodegradable Nanocomposite Films for Food Packaging

An article in MDPI Polymers explores the development of functional and biodegradable films using biopolymer blends and nanoclay suspensions. These films exhibit potential in sustainable food packaging applications, offering an alternative to traditional plastic materials. (Source:https://www.np.phy.cam.ac.uk)

(Source: https://www.fraunhofer.de)

(Source: https://ddnews.gov.in)

(Source: https://www.nature.com)

(Source: https://www.mdpi.com)

Growth Factors

- Rising Demand for Eco-Friendly Packaging Solutions: Growing environmental awareness is driving the adoption of biodegradable nanomaterials in packaging, boosting sustainable material innovation.

- Advancements in Biomedical Applications: Breakthroughs in biodegradable nanomaterials for targeted drug delivery and tissue engineering are propelling growth in the healthcare sector.

- Increasing Adoption in Agricultural Practices: Rising use of biodegradable nanocomposites for controlled-release fertilizers and crop protection is fuelling innovation in sustainable agriculture.

- Growing Government Support and Incentives: Expanding environmental policies and subsidies for sustainable materials are boosting research and commercial adoption of biodegradable nanomaterials.

Market Scope

| Report Coverage | Details |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

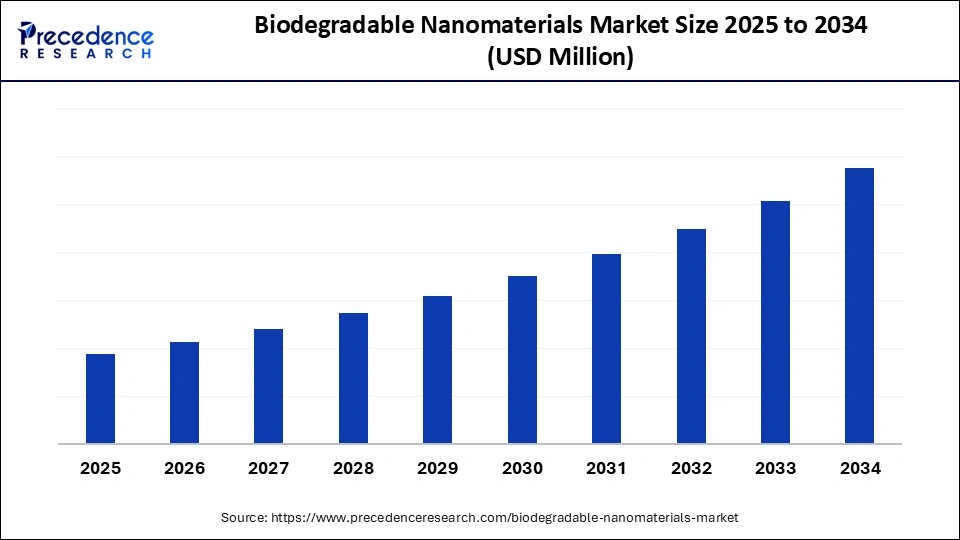

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Nanomaterial Form, Degradation Mechanism, Application, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is the increasing demand for sustainable packaging solutions driving growth in the biodegradable nanomaterials market?

Increasing demand for sustainable packaging solutions is expected to drive the market in the coming years. The growth in the use of biodegradable nanomaterials should also be propelled by increasing demand for sustainable solutions in packaging. These advanced materials are adopted in the packaging industries to substitute petroleum plastics, which are a major source of environmental pollution.

European Bioplastics in 2024 claimed a global bioplastics production capacity of approximately 2.47 million tonnes. This production capacity in packaging for 2024 highlights the importance of packaging demand in driving the adoption of nanocomposites based on biodegradable polymers. Moreover, the growing applications in the biomedical and healthcare sectors are anticipated to accelerate market expansion.(Source: https://www.european-bioplastics.org)

Restraint

How Are High Production Costs and Scalability Issues Restricting Growth in the Market for Biodegradable Nanomaterials?

Complex synthesis processes and the use of specialized equipment, leading to elevated manufacturing costs, further hamper the market in the coming years. Development of polyhydroxyalkanoate (PHA)-based nanocomposites requires fine-tuning processing conditions to achieve the desired properties, which may be resource-intensive. Additionally, the lack of standardization hinders the development of universally accepted benchmarks, slowing down the adoption of biodegradable nanomaterials across various industries.

Opportunity

Why Are Surging Investments in Nanotechnology Research Projected to Strengthen the Biodegradable Nanomaterials Market?

Surging investments in nanotechnology research are projected to create immense opportunities for the players competing in the market. Governments in the United States, the European Union, China, and Japan are spending huge amounts of money on developing sophisticated biodegradable materials. Universities and national laboratories use these grants to investigate molecular-level modifications that enhance strength, flexibility, and biodegradation rates.

In 2024, the U.S. National Science Foundation presented major grants to initiatives that incorporate biodegradable nanomaterials into sustainable production systems. This especially emphasizes scaling production methods that improve environmental safety. Furthermore, the high consumer awareness regarding eco-friendly materials is estimated to accelerate adoption across industries.

Segment Insights

Material Type Insights

Why Did Poly(lactic Acid) (PLA) Dominate the Biodegradable Nanomaterials Market in 2024?

The Poly(lactic acid) (PLA) segment dominated the biodegradable nanomaterials market in 2024, holding a market share of about 35%. This dominance is due to their sourcing through plant-based feedstocks, aligning with environmentally sustainable trends.

According to the European Environment Agency in 2024, PLA packaging materials reduced plastic waste in some European regions by an estimated 10% annually. This has played a significant role in achieving the targets of the circular economy. Moreover, the advancements make PLA a dominant force as a sustainable material solution, thus facilitating the demand.

The nanocellulose composites segment is expected to grow at the fastest rate in the coming years, owing to their high mechanical properties, biodegradability, and flexibility in various industries. A study by the National University of Singapore in 2024 revealed that biomedical scaffolds were prepared using nanocellulose composites.

This enhanced mechanical stability by between 18 and 20% and hastened biodegradation. Furthermore, the adoption rates in Europe increased sharply due to rigid sustainability regulations, and the research institutes of Asia-Pacific are also contributing to segment growth in the coming years. (Source: https://materials.international)

Nanomaterial Form Insights

What Factors Drove Nanoparticles to Lead the Biodegradable Nanomaterials Market in the Past Year?

The nanoparticles segment held the largest revenue share in the biodegradable nanomaterials market in 2024, accounting for an estimated 40% market share, as they have a high surface-area-to-volume ratio and are thus more reactive and in contact with the biological systems. Additionally, the nanoparticles are versatile in packaging, where they are made into films to enhance moisture and gas barrier properties, thus lengthening shelf life and decreasing food waste.

The nanofibers segment is expected to grow at the fastest CAGR in the coming years, owing to their characteristic features, namely high surface area, porosity, and mechanical strength. This makes them the perfect agents when used in the fields of filtration, wound healing, and tissue engineering. Moreover, the increasing industrial applications and favorable government policies are expected to make the Asia-Pacific region the most active region in nanofiber applications.

Degradation Mechanism Insights

Why Was Hydrolytic Degradation the Leading Mechanism in the Biodegradable Nanomaterials Market in 2024?

The hydrolytic degradation segment dominated the biodegradable nanomaterials market in 2024, which held a market share of about 30%, as it's a popular mechanism in biodegradable nanomaterials. Additionally, this mechanism does not require specialized enzymes, enhancing its flexibility in various environmental conditions and further strengthening its dominance.

The enzymatic degradation segment is expected to grow at the fastest rate in the coming years, owing to the high degree of control over breakdown processes. Additionally, the increase in environmental regulations and the amount of research funding going to enzyme-based degradation further drives further growth of this sub-segment.

Application Insights

What Caused Packaging to Become the Dominant Application in the Biodegradable Nanomaterials Market in 2024?

The packaging segment held the largest revenue share in the biodegradable nanomaterials market in 2024, accounting for an estimated 50% market share, due to the growing demand for a sustainable substitute to traditional plastics. In 2025, IIT Hyderabad developed a biodegradable packaging film made from sewage sludge and chicken eggshells, which achieved a 79.9% water barrier enhancement.

In 2024, the European Commission JRC found that biodegradable polymer nanocomposites reduced the average 120-day decomposition of packaging waste to less than 45 days when packaged in industrial compost. Furthermore, the increase in the oxygen barrier properties of biodegradable films is expected to enhance packaging applications in the coming years.(Source: https://materials.international)

The medicine segment is expected to grow at the fastest CAGR in the coming years, owing to the growing application of biodegradable nanomaterials. In 2024, researchers at the National University of Singapore reported that such nanoparticles led to up to 60% uptake by cancer cells, which improves therapeutic outcomes.

Research by Kyoto University demonstrated that biodegradable nanofibers allowed the release of drugs to be regulated and the delivery duration to be controlled. Moreover, the Chinese Academy of Sciences recognized that bioengineered biodegradable nanocarriers enhanced bone tissue regeneration rates, which was a major development in regenerative medicine.

End-User Industry Insights

Why Did the Food & Beverage Sector Lead the Biodegradable Nanomaterials Market in 2024?

The food & Beverage segment dominated the biodegradable nanomaterials market in 2024, holding a market share of about 45% due to increasing environmental regulations and consumer demand for sustainable packaging across the industry. Furthermore, companies like Nestlé and PepsiCo have already tested packaging with biodegradable nanomaterials to meet consumer demands for greener products.

The healthcare & pharmaceuticals segment is expected to grow at the fastest rate in the coming years, owing to the use of biodegradable nanomaterials. The University of Tokyo found that nanofiber scaffolds enhance tissue regeneration rates by more than 30%, making them appealing for medical implantation and wound healing.

By 2024, the American Chemical Society reported that biodegradable nanomaterials would reduce the risks of long-term toxicity associated with implanted devices. Moreover, partnerships with research institutions to accelerate the incorporation of these materials into the next generation of medical products further boost the market. (Source:https://pmc.ncbi.nlm.nih.gov)

Regional Insights

Why Did Europe Dominate the Biodegradable Nanomaterials Market in 2024?

Europe led the biodegradable nanomaterials market, capturing the largest revenue share in 2024 with an estimated 40% market share, due to harsh environmental policies and a high regard for sustainability in diverse sectors. The Green Deal and the Circular Economy Action Plan of the European Union have played a major role in advancing the use of eco-friendly materials, such as biodegradable nanomaterials.

Institutions, including ETH Zurich and the Fraunhofer Society, have been on the frontline, developing superior biodegradable nanocomposites. That improves the material properties like strength, resistance to barriers, and thermal stability. Furthermore, the public-private funding programs like Horizon Europe support these developments, with 2024 allocating huge grants to sustainable materials research, thus fuelling the market in this region.

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, as countries are investing significantly in research and development. This enhances the application of nanotechnology in fields like healthcare, packaging, and agriculture. Moreover, the increasing environmental awareness and government assurance tend to promote an unparalleled rise in the Asia-Pacific market of biodegradable nanomaterials.

Value Chain Analysis - Biodegradable Nanomaterials Market

Raw Material Procurement (Biopolymers, Natural Precursors & Feedstocks)

The value chain begins with sourcing renewable, bio-based feedstocks such as cellulose, chitosan, starch, lignin, PLA, and other natural polymers. Purity, molecular weight control, and sustainable sourcing (non-GMO, low-carbon footprint) are critical to ensure consistency in nanoscale performance. Suppliers increasingly integrate biorefineries and circular biomass sourcing to meet environmental standards and reduce dependency on petrochemicals. Upstream value capture lies in owning low-cost, high-quality bio-feedstock streams and efficient extraction technologies.

Nanomaterial Synthesis & Functionalization

This is the core value creation stage, involving mechanical, chemical, and biological synthesis techniques such as electrospinning, self-assembly, green chemistry reduction, and enzymatic modification, to produce nanocellulose, nanoclays, or biodegradable nano-composites. Functionalization (adding antimicrobial, barrier, or mechanical properties) differentiates products for industries like biomedicine, packaging, and coatings. This stage is R&D-intensive and capital-heavy, with IP in processing methods and nano-dispersion stability providing a strong competitive advantage.

Application Development & Commercial Integration

Biodegradable nanomaterials are supplied to pharma, food packaging, cosmetics, textiles, and electronics sectors for use in drug delivery systems, smart films, and green composites. Successful commercialization depends on scaling up lab-grade materials to industrial production, regulatory approval (especially for medical or food-contact uses), and lifecycle testing. Collaboration between material scientists, OEMs, and end-user industries ensures customization and adoption. Value capture is highest among firms that offer turnkey, application-specific nano solutions with proven biodegradability and performance data.

Biodegradable Nanomaterials Market Companies

- BASF SE: BASF leads in the development of biodegradable nanopolymers and nanocomposites that merge high performance with environmental responsibility. Through its ecovio and Ecovio FS product lines, BASF integrates PLA and PBAT-based nanomaterials for sustainable packaging, agriculture films, and food service applications, driving circular economy adoption.

- Dow Chemical Company: Dow pioneers nanostructured biodegradable plastics and coatings, combining renewable monomers and nano-engineered polymers for durability and flexibility. Its R&D focuses on biodegradable nanocomposite formulations that maintain mechanical integrity while enhancing degradation rates, supporting sustainable packaging and industrial uses.

- Evonik Industries AG: Evonik specializes in biodegradable polymer nanoparticles used in pharmaceuticals, cosmetics, and functional coatings. The company's RESOMER platform produces biodegradable nanocarriers for targeted drug delivery and tissue engineering, emphasizing advanced bio-performance and precision biodegradation control.

- Mitsubishi Chemical Corporation: Mitsubishi Chemical develops biodegradable nanocomposites under its BioPBS™ and BioPE brands, engineered for strength, processability, and compostability. Through its integration of nanotechnology and bio-based chemistry, the company enables scalable solutions for packaging, automotive, and agricultural markets.

- NatureWorks LLC: NatureWorks is a global leader in PLA-based nanomaterials through its Ingeo™ biopolymer platform, enhancing functionality via nanoclay and nanocellulose reinforcement. The company's focus on renewable feedstocks and compostable materials supports circular design principles across packaging, textiles, and 3D printing industries.

Other Companies in the Market

- Green Dot Bioplastics: A pioneer in plant-based biodegradable nanocomposites, Green Dot combines starch-based polymers with nanofillers to improve biodegradability and mechanical strength in consumer and industrial products.

- Metabolix, Inc. (now Yield10 Bioscience): Develops PHA (polyhydroxyalkanoate)-based nanomaterials, offering biodegradable alternatives to conventional plastics for packaging, agriculture, and 3D printing applications.

- Novamont S.p.A.: Develops Mater-Bi bioplastics reinforced with natural nanofillers, focusing on biodegradable and compostable materials for agriculture, packaging, and consumer goods.

- Stora Enso: A renewable materials company advancing nano-cellulose-based biodegradable composites, providing sustainable alternatives to fossil-based plastics and coatings.

- U.S. Department of Energy (DOE): Supports research in biodegradable nanomaterials and green nanotechnology, funding public-private collaborations to accelerate innovation in sustainable materials and clean manufacturing.

Recent Developments

- In September 2025, Researchers in South Korea developed a novel class of polymer–carbon nanotube (CNT) hybrid microelectrode arrays designed to advance neuroscience technologies. These electrodes combine exceptional electrical conductivity with mechanical softness, enabling stable brain signal recordings while minimizing inflammation and tissue damage. This innovation marks a significant step toward safer and more efficient brain–computer interfaces, offering potential applications in neural prosthetics, neurological research, and precision neuromodulation.

- In September 2025,an Australian research team achieved a breakthrough in advanced nanomaterials, paving the way for a new generation of nanodrug applications. This innovation has broad implications for drug delivery, diagnostics, and gene editing, offering the potential to significantly improve patient outcomes worldwide significantly. The research is expected to accelerate progress in personalized medicine and transformative therapies over the coming decades.

- In September 2025the Zhiyuan announced that it had made significant advancements in nanotechnology. Starting with machinery and equipment producing 800 nm and 500 nm materials, the company has now achieved mass production of nano-fertilizers below 100 nm. Remarkably, Zhiyuan has scaled its production capacity from 30 kg to 750 kg within just eight hours — an industry-first milestone described as a breakthrough "nano-barrier." In 2025, the company officially announced its expansion into semiconductor and new energy nanomaterials, strengthening its position as a leader in the field.(Source: https://www.azonano.com)

(Source: https://finance.yahoo.com)

(Source: https://www.digitalhealthnews.com)

Segments Covered in the Report

By Material Type

- Natural Polymers (Chitosan, Alginate, Starch, Cellulose)

- Synthetic Polymers (PLA, PCL, PHA)

- Nanocellulose (Nanofibrillated Cellulose, Nanocrystalline Cellulose)

- Biopolymer Composites (Blends of natural & synthetic polymers)

By Nanomaterial Form

- Nanoparticles (Spherical, Rod-like, Platelet)

- Nanofibers (Electrospun, Self-assembled)

- Nanocomposites (Polymer-clay, Polymer-carbon nanotube)

- Nanocoatings (Surface-modified biodegradable films)

By Degradation Mechanism

- Enzymatic Degradation

- Hydrolytic Degradation

- Oxidative Degradation

- Photodegradation

By Application

- Packaging (Food, Pharmaceuticals, Electronics)

- Agriculture (Controlled-release fertilizers, Biodegradable mulches)

- Medicine (Drug delivery systems, Tissue engineering scaffolds)

- Environmental Remediation (Water treatment, Soil decontamination)

- Consumer Goods (Biodegradable textiles, Personal care products)

By End-User Industry

- Food & Beverage

- Healthcare & Pharmaceuticals

- Agriculture & Horticulture

- Consumer Electronics

- Textiles & Apparel

- Environmental Services

- Automotive & Aerospace

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content