What is the Biosimulation Market Size?

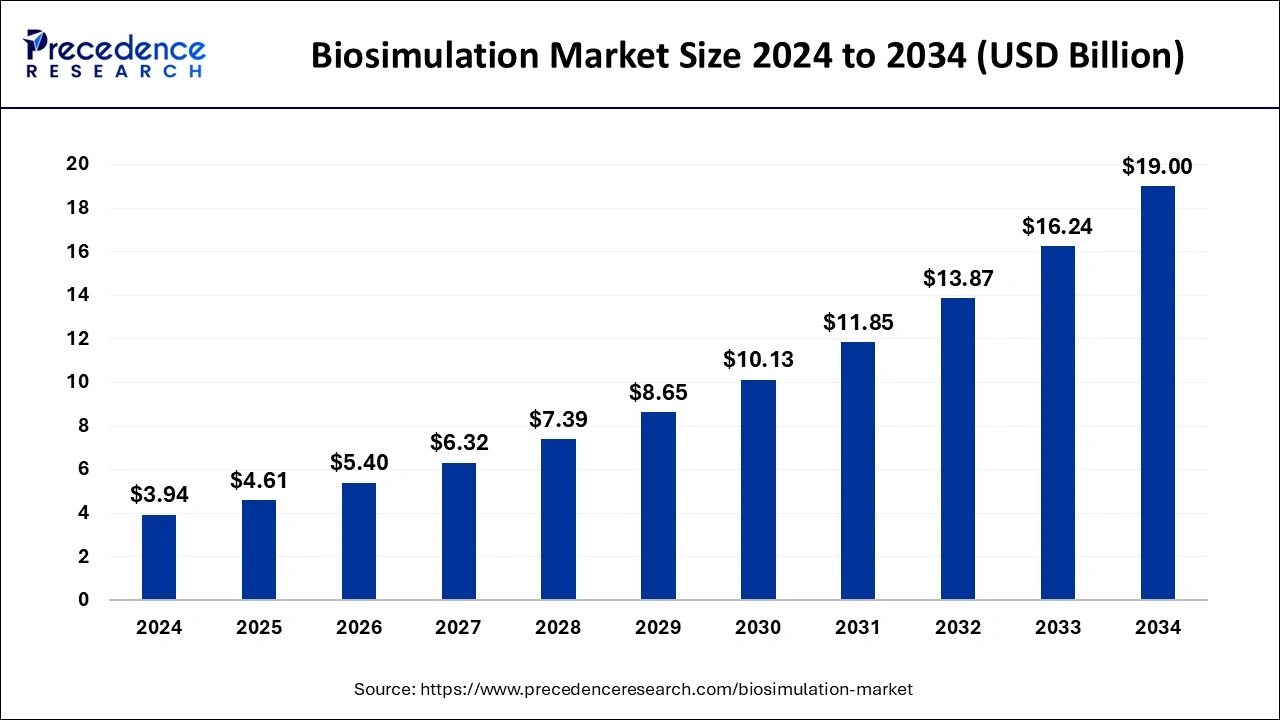

The global biosimulation market size was estimated at USD 3.94 billion in 2024 and is anticipated to reach around USD 19.00 billion by 2034, expanding at a CAGR of 17.04% from 2025 to 2034.

Biosimulation Market Key Takeaways

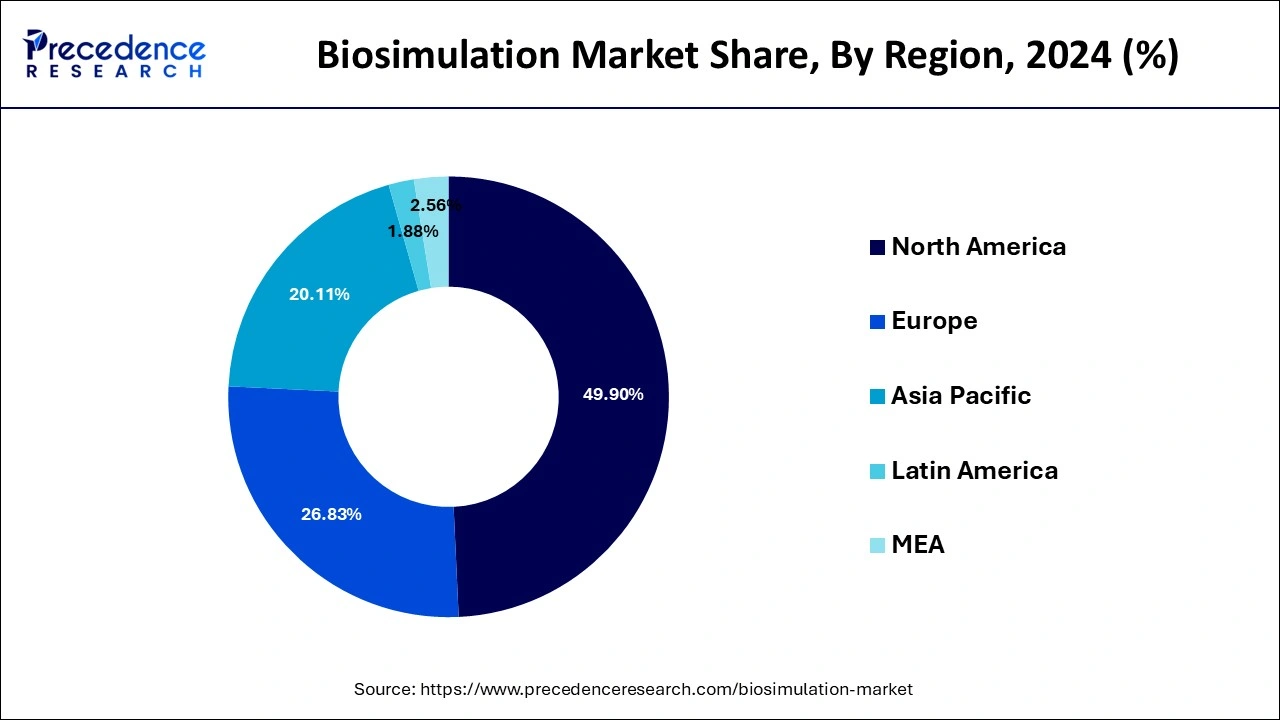

- North America dominated the biosimulation market with the highest market share of 49.90% in 2024.

- Asia Pacific is expected to expand at a double digit CAGR of 18.5% during the forecast period.

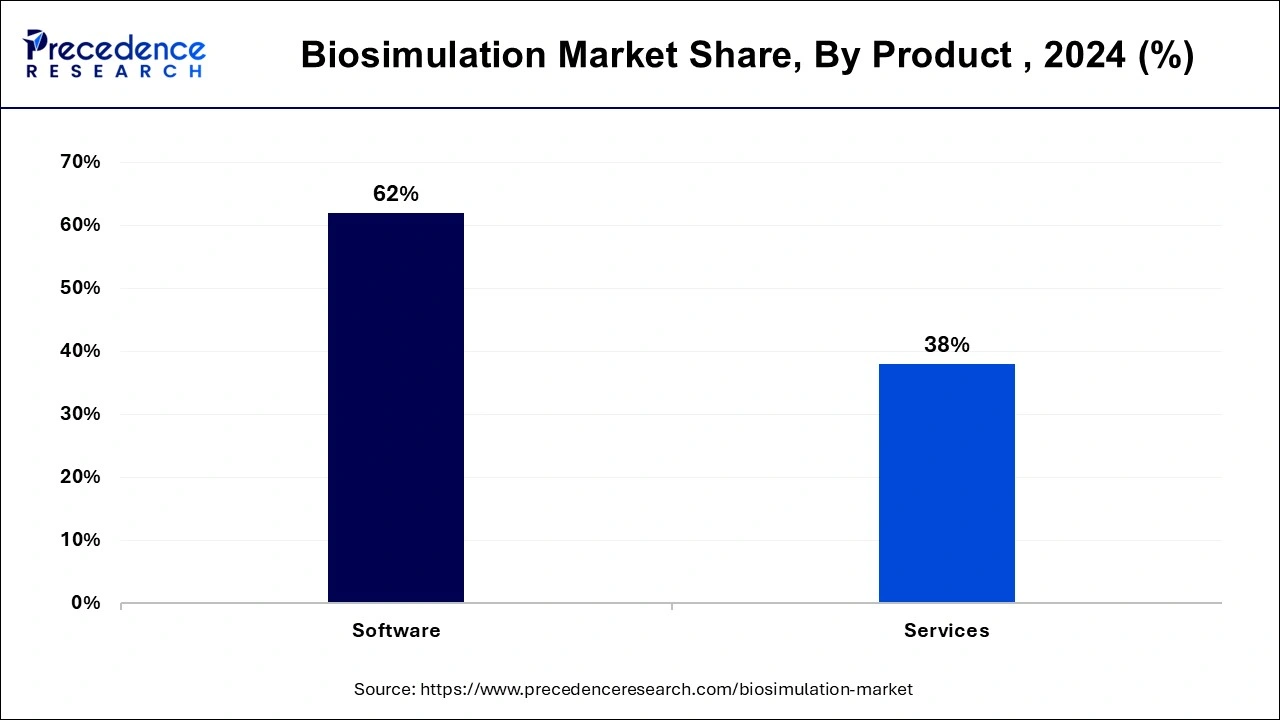

- By product, the software segment generated the largest market share of 62% in 2024.

- By product, the services segment is projected to grow at a solid CAGR during the forecast period.

- By application , the drug development segment has held a major market share of 56% in 2024.

- By therapeutic area, the oncology segment captured the biggest market share in 2024.

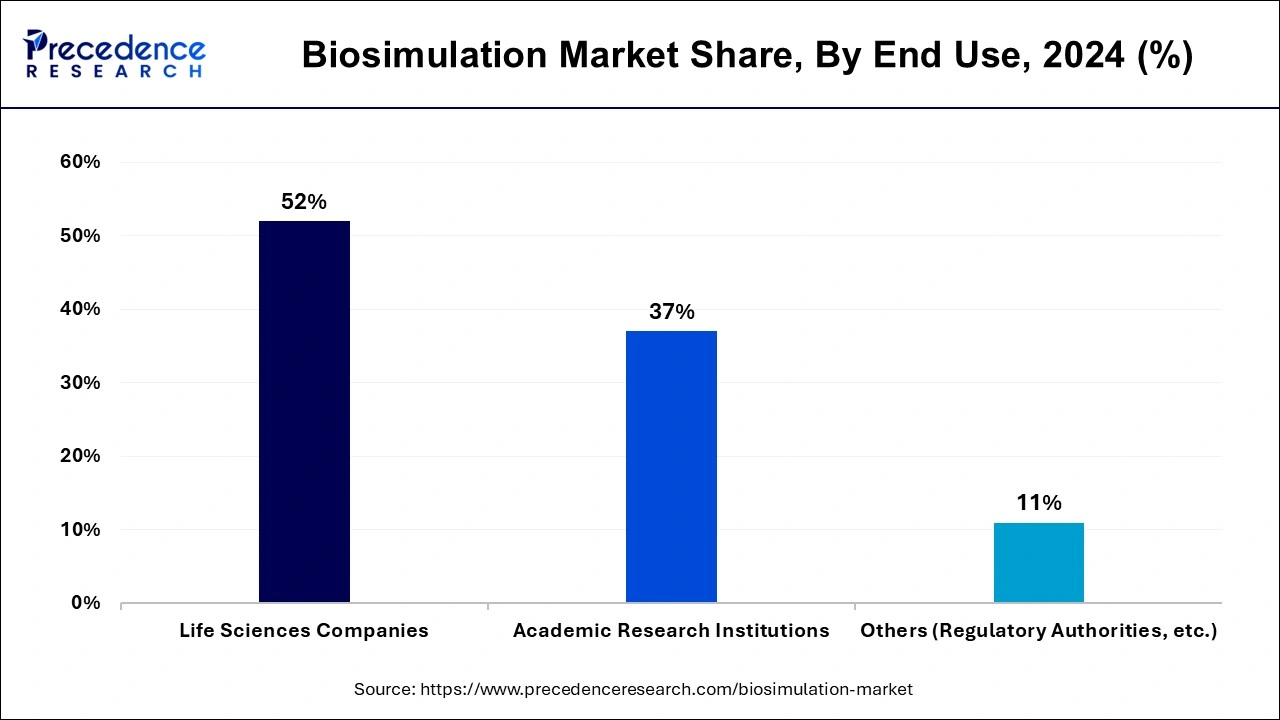

- By end use, the life science companies segment registered its dominance in the market in 2024.

- By deployment model, the cloud-based segment accounted for the highest market share of 44% in 2024.

- By pricing model, the license-based segment dominated the market in 2024.

Impact of Artificial Intelligence (AI) on the Biosimulation Market

Biosimulation models use AI to model information from clinical trials and analyze the drug-patient-population-trial relationship. These models allow researchers to explore questions about drug safety, drug interactions, and population efficacy. Biosimulation is the practice of simulating biological systems and processes on computers using mathematical models. Simulation uses AI and machine learning to create predictions based on patterns and data that researchers can use to learn more about how drugs work. Because medical information comes in many formats and levels of quality, intelligence can create new information. AI has the potential to improve clinical trials. AI can replace key steps in experimental development from study planning to execution, thus increasing the success of the trial, which is why the biosimulation market is growing.

U.S. Biosimulation Market Size and Growth 2025 to 2034

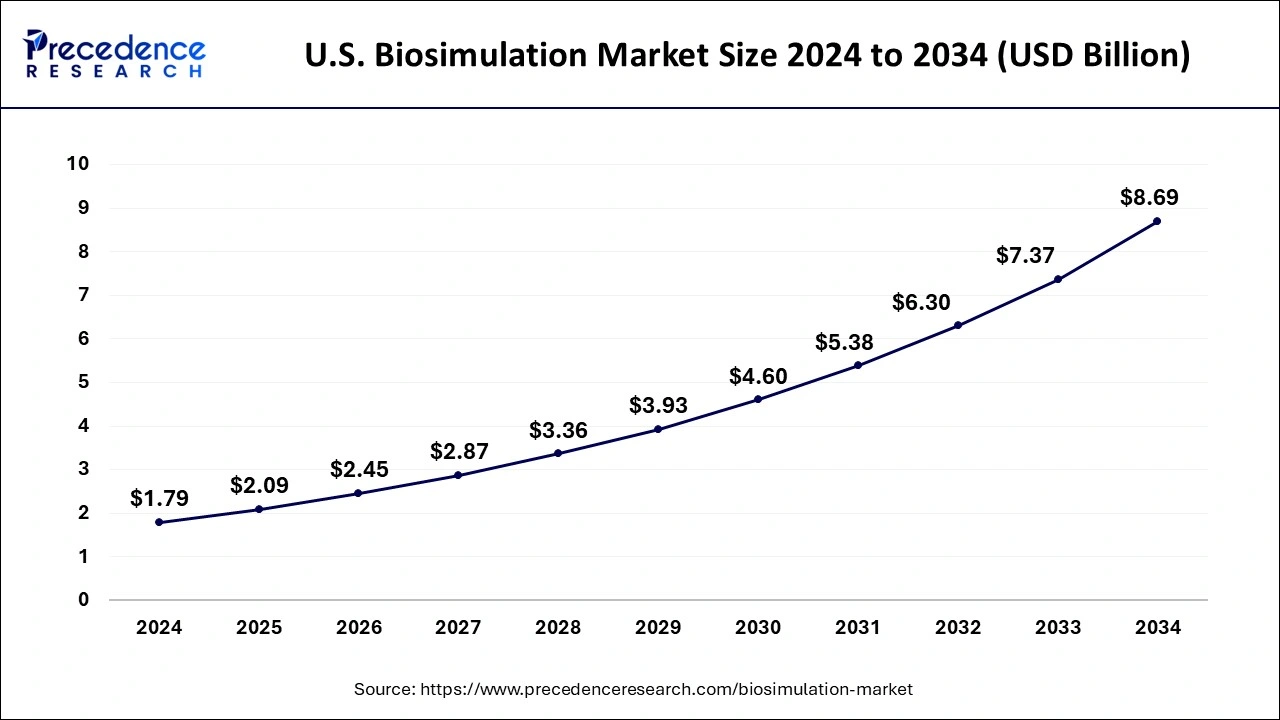

The U.S. biosimulation market size was evaluated at USD 1.79 billion in 2024 and is predicted to be worth around USD 8.69 billion by 2034, rising at a CAGR of 17.10% from 2025 to 2034.

North America held the largest share in the biosimulation market with the largest market share of 49.90% in 2024, with over 5,000 pharmaceutical companies operating in the United States. Research organizations and others are turning to biosimulation software and services to help improve drug safety and efficiency, reduce R&D costs, speed time to market, and increase productivity in North America. The United States is the clear leader among the top five countries in health research, with a share nearly four times that of China, which ranks second. Health Canada (HC) is the agency responsible for approving, monitoring, and evaluating clinical trials in Canada, which is responsible for the growth of the biosimulation market

- In February 2024, Canada's federal and provincial governments invested more than $640 million in nanotechnology research over the past decade.

Asia Pacific is expected to expand at a double digit CAGR of 18.5% during the forecast period.The region is expected to foresee a rapid growth in the investment towards the development of the healthcare and pharmaceutical industry. The presence of several top contract research organizations in the region along with the growing FDIs from the top pharmaceutical MNCs is significantly boosting the growth of the biosimulation market in Asia Pacific region. The availability of cheap factors of production and favorable government policies is supporting the development of the pharmaceutical and healthcare industries in this region, which is expected to foster the growth of the Asia Pacific biosimulation market in this region.

- The government-led nanotechnology initiative is coordinated by the Department of Science and Technology (DST) Nanoscience and Technology Mission (Nano Mission) for Asia-Pacific.

Biosimulation Market Growth Factors

- Biosimulation can help scientists test various situations and understand how the body responds in different situations, which is why the biosimulation market is growing.

- Biosimulation uses computer-based mathematical simulations to replicate biological processes, dynamics, and systems, which is why the biosimulation business is growing.

- Biosimulation software allows scientists to model and simulate complex biological systems to help predict drug behavior, which is why the biosimulation market is growing.

- Biosimulation refers to the simulation of biological processes and systems through computer programs. It is widely used in drug discovery and development, which is why the biomimicry market is growing.

- Biosimulation can help scientists test different conditions and understand how the body responds in different situations by simulating real processes in the body. This can help them develop safer and more effective new drugs and treatment and s, which is why the biosimulation market is growing.

Market Scope

| Report Coverage | Details |

| Market Size by 2024 | USD 3.94 Billion |

| Market Size by 2025 | USD 4.61 Billion |

| Market Size by 2034 | USD 19 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 17.04% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End User, Delivery Model, Geography |

Market Dynamics

Driver

Innovation in Drug Development

Biosimulation, the use of mathematical models to replicate biological processes, is revolutionizing drug discovery and development by allowing scientists to test various conditions and predict physiological responses to treatments without the need for human trials. This approach could help identify safer, more effective drugs and pave the way for new treatments. The pharmaceutical industry increasingly relies on biosimulation to understand the complexities of the human body, improve clinical outcomes, and reduce the risks and costs associated with drug development. Biosimulation plays a key role in increasing the efficiency and speed of the entire drug discovery process by providing information on drug interactions, thus enabling the rapid expansion of the biosimulation market.

Opportunity

Expanding Applications Across Multiple Industries

Advances in technology are paving the way for virtual clinical trials, providing pharmaceutical companies with a more cost-effective and time-saving alternative to traditional medical treatments. The drug development process will be simplified and made more understandable by using virtual patients and biosimulation software, such as molecular modeling, PK/PD modeling, toxicity prediction, PBPK simulation, and experimental design tools. In addition to pharmaceutical applications, the increasing use of biosimulation in industries such as defense, bioprocessing, nutraceuticals, and food manufacturing offers biomedical researchers many opportunities to design and manage complex biosimulation processes. This expansion across multiple domains is driving significant growth in the biosimulation market, creating new opportunities for innovation and collaboration.

Restraints

Challenges in Biosimulation

The biosimulation market faces many challenges that limit its growth. These include problems translating findings from preclinical animal models to human patients and the lack of biomarkers sensitive enough to accurately detect response. An incomplete understanding of disease pathology impacts the prediction of clinical outcomes. Furthermore, differences between and within patient groups (due to factors such as comorbidities, complications, and genetic differences) pose serious problems. These complexities hinder the ability of biomimetic models to precisely replicate human diseases, thus limiting their widespread use and effectiveness in drug development.

Product Insights

The software segment generated the largest market share of 62% in 2024. This is mainly due to the increased demand for biosimulation software among pharmaceutical companies and research organizations that are constantly involved in the research and development of novel drugs. Increased investments in research studies significantly bolstered the software segment. Moreover, the heightened availability of application-specific software serving particular research and development requirements contributed to segmental growth. Biosimulation software offers a complete solution to researchers, can be used for numerous applications, and enables real-time data analysis.

The services segment is projected to grow at a solid CAGR during the forecast period. Owing to the rising complexity of drug development processes. However, biosimulation services play a vital role in curtailing costs. With the growing investments in drug discovery and development, the demand for a wide array of services associated with biosimulation is expected to grow rapidly, contributing to segmental growth.

Application Insights

The drug development segment has held a major market share of 56% in 2024. This is mainly due to the strong emphasis on novel drug discovery and development. The extensive adoption of biosimulation to curtail the costs of the drug development process and the high risks associated with the failure of new drug development have fostered the growth of this segment. According to the US FDA, biosimulation is useful as a predictive tool in drug development. Moreover, biosimulation software is a crucial tool in drug development, allowing researchers to develop detailed models of biological systems.

The disease modeling segment is expected to grow rapidly during the assessment years. With the rising incidence of infectious diseases around the world, the need for disease modeling to predict infectious disease outbreaks and assess their potential impacts on healthcare systems increases. In addition, incorporating big data analytics and AI tools into disease modeling allows more accurate predictions and real-time analysis, contributing to the growth of the segment.

Therapeutic Area Insights

The oncology segment captured the biggest market share in 2024. Due to the increased prevalence of cancer worldwide. In the field of oncology, biosimulation plays an important role in comprehending tumor dynamics and treatment responses, which further enhances patient outcomes. Combining data from various sources, including clinical trials, genomic information, and pharmacokinetics, assists researchers or scientists in developing advanced models that can easily predict how the tumors are likely to respond to different therapies.

The infectious diseases segment is projected to register the highest CAGR in the biosimulation market over the studied period. Biosimulation modeling techniques enable researchers and clinicians to predict the progression of infectious diseases. These techniques further respond to various therapeutic interventions. In addition, biosimulation can assess treatment efficacy by modeling different cases. The increasing number of infectious diseases further fuels segmental growth.

End Use Insights

The life science companies segment registered its dominance in the market in 2024. This is mainly due to the increased adoption of biosimulation software among life science companies. Biosimulation software plays a crucial role in drug development and research processes. It enables companies to develop detailed models of biological systems and simulate the effects of drugs on several physiological processes. It further accelerates the drug development process.

The academic and research institutes segment is projected to expand at a rapid pace in the coming years due to the rising investment in the R&D of novel drugs. Biosimulation software allows researchers to create virtual representations of complex biological processes, including metabolic pathways, drug interactions, and cellular responses.

Pricing Model Insights

The license-based model segment dominated the biosimulation market in 2024. The segment's dominance is primarily attributed to the increased awareness of the benefits offered by this model. It provides users with access to advanced tools without requiring large investments in sophisticated infrastructure. This model offers both scalability and flexibility, allowing companies to select from numerous licensing options, such as multi-user licenses, single-user licenses, and enterprise-wide agreements, according to their specific needs and budget.

The subscription-based model segment is anticipated to grow significantly during the forecast period. The subscription-based pricing model assists companies in managing their budgets and allocating resources effectively. Additionally, the subscription model allows researchers to access sophisticated biosimulation tools without investing heavily.

Deployment Model Insights

The cloud-based segment accounted for the highest market share of 44% in 2024. The segment is mainly driven by various benefits the cloud-based deployment model offers. Cloud platforms provide biosimulation companies with the flexibility to adapt their resources, offering a more responsive approach to their operational requirements. Cloud-based platforms offer significant computational resources that are available to run complex biosimulation. Cloud models are highly cost-effective, mainly for smaller biotech firms and academic institutions that lack the sophisticated infrastructure for high-performance computing

Biosimulation Market Companies

- Biovia

- Certara

- Compugen Inc.

- Genedata

- In Silico Biosciences, Inc.

- Leadscope Inc.

- Pharmaceutical Product Development, LLC.

- Schrödinger, LLC.

- Simulations Plus, Inc.

- DassaultSystemes

- Advanced Chemistry Development

Market Leader Announcement

- In August 2024, Certara, Inc., a global leader in pharmaceutical design standards, announced the release of Phoenix version 8.5. Phoenix is the gold standard in pharmacokinetic/pharmacodynamic (PK/PD) and toxicokinetic modeling and simulation software for the pharmaceutical industry. More than 75 of the world's top 100 pharmaceutical companies use the Phoenix platform.

Recent Developments

The biosimulation market is moderately fragmented owing to the presence of several top market players. These market players are constantly involved in the various developmental strategies such as partnerships, mergers, acquisitions, collaborations, new product launches, and various others to strengthen their position and increase their market share.

- In January 2023, Biosimulation Company Cellworks Launched Precision Oncology-Focused Drug Development Business

- In June 2024, Simulations Plus, Inc., a leading provider of clinical safety and productivity simulation software and services, announced the acquisition of Pro-ficiency Holdings, Inc. and its subsidiaries. It provides simulation-enabled performance and intelligence solutions to the healthcare and pharmaceutical industries.

- In July 2024, Certara, Inc. a global leader in pharmaceutical modeling and informatics, announced that it has signed an agreement to acquire Chemaxon, an information technology software leader. The transaction is expected to close in the second half of 2024, subject to regulatory approvals and other closing conditions.

- In August 2024, Simulations Plus, Inc. a leader in biosimulation, simulation performance, and smart solutions and clinical communication for the biopharmaceutical industry, announced the quality of its business and leadership style that will support the company's future growth.

- In October 2024, Simulations Plus, Inc. a leader in biosimulation, simulation performance and problem-solving, and clinical communication for the biopharmaceutical industry, announced that it has been approved by the U.S. Food and Drug Administration (FDA) for a new grant awarded to the University of Strathclyde and InnoGI Technologies in collaboration.

Value Cain Analysis

- R&D: Utilizes biosimulation for drug-target interaction prediction, molecular structure optimization, and speeding up the drug discovery process.

Key Players: Arrowhead Pharmaceuticals, Nanobiotix, Pfizer - Clinical Trials and Regulatory Approvals: Simulations are used to design efficient trials, forecast their results, and help fast-track regulatory review on the reliable synthetic dataset.

Key Players: Insmed, Moderna, CytomX Therapeutics - Formulation and Preparing Final Dosage: Predictive modeling to interpret formulation stability, dosage form optimization, and therapeutic performance.

Key Players: Ascension Sciences, DIANT Pharma, CD Formulation - Packaging and Serialization: Focused on the design of anti-counterfeiting packaging solutions with traceable identifiers to safeguard product safety and regulatory compliance.

Key Players: Antares Vision, Avery Dennison Corporation, Kezzler - Distribution to Hospitals, Pharmacies: Deals with the distributed transport of biosimulation products to health providers while retaining definite quality amounts.

Key Players: McKesson Corporation, AmerisourceBergen, Cardinal Health - Patient Support and Services: Provides training, education, and adherence programs to aid patients in gaining a greater understanding, compliance, and even better overall health outcomes.

Key Players: NanoHealth, Pfizer

Segments Covered in the Report

By Product

- Software

- Molecular Modeling & Simulation Software

- Clinical Trial Design Software

- PK/PD Modeling and Simulation Software

- Pbpk Modeling and Simulation Software

- Toxicity Prediction Software

- Other Software

- Services

- Contract Services

- Consulting

- Other (Implementation, Training, & Support etc.)

By Application

- Drug Discovery & Development

- Disease Modeling

- Other (Precision Medicine, Toxicology, etc.)

By Therapeutic Area

- Oncology

- Cardiovascular Disease

- Infectious Disease

- Neurological Disorders

- Others

By Deployment Model

- Cloud-based

- On-premise

- Hybrid Model

By Pricing Model

- License-based Model

- Subscription-based Model

- Service-based Model

- Pay Per Use Model

By End Use

- Life Sciences Companies

- Pharmaceutical Companies

- Biopharma Companies

- Medical Device Companies

- CROs/CDMOs

- Academic Research Institutions

- Others (Regulatory Authorities, etc.)

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting