What is the Biosurgery Market Size?

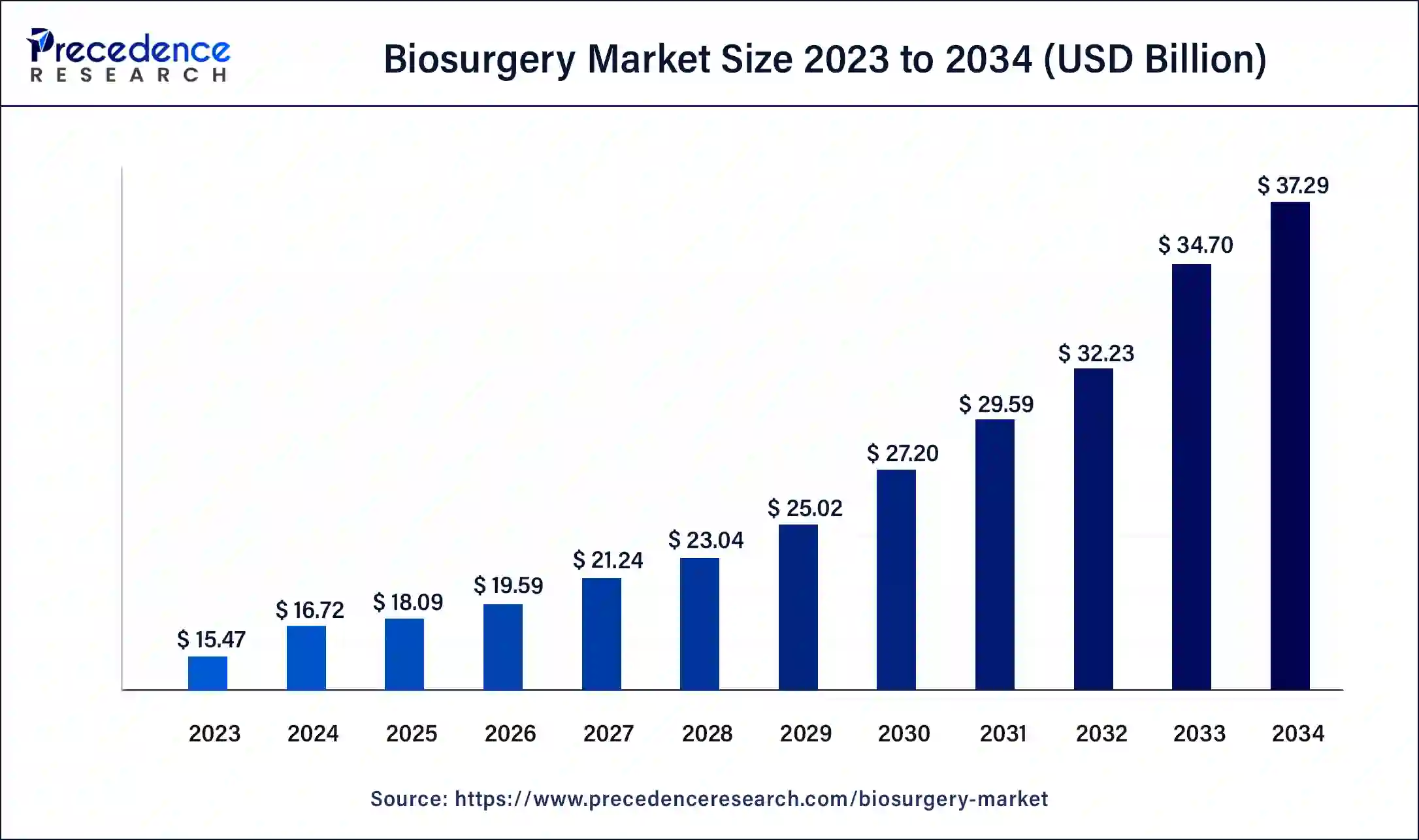

The global biosurgery market size is estimated at USD 18.09 billion in 2025 and is predicted to increase from USD 19.59 billion in 2026 to approximately USD 37.29 billion by 2034, expanding at a CAGR of 8.35% from 2025 to 2034.

Biosurgery Market Key Takeaways

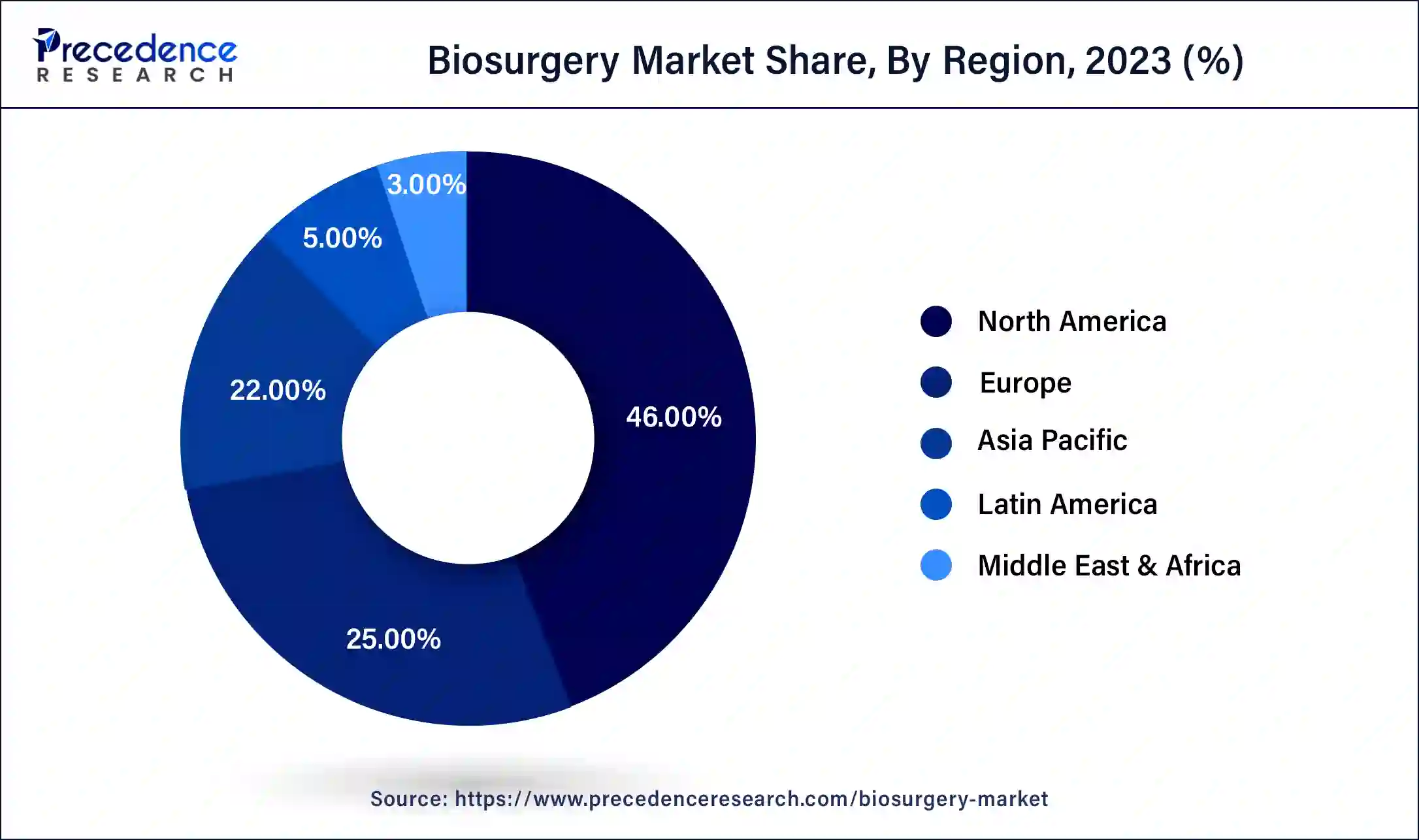

- North America contributed more than 46% of the revenue share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By product type, the bone graft substitutes segment has held the largest market share of 41% in 2024.

- By product type, the anti-adhesive agents segment is anticipated to grow at a remarkable CAGR of 12.1% between 2025 and 2034.

- By application, the neuro and spine surgery segment generated over 37% of revenue share in 2024.

- By application, the general surgery segment is expected to expand at the fastest CAGR over the projected period.

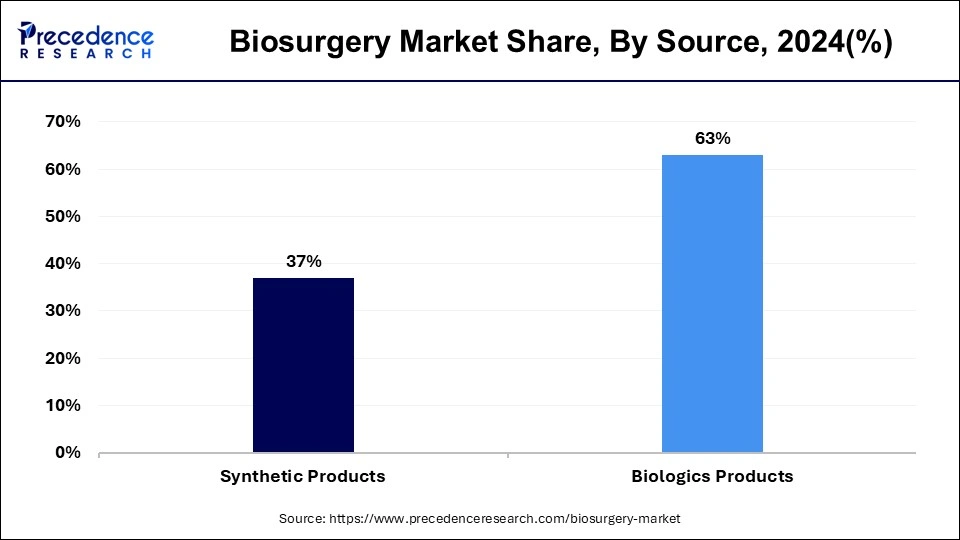

- By source, the biologics products segment had the largest market share of 63% in 2024.

- By source, the synthetic products segment is expected to expand at the fastest CAGR over the projected period.

- By end user, the hospital segment had the largest market share of 76% in 2024.

- By end-user, the clinics segment is expected to expand at the fastest CAGR over the projected period.

Strategic Overview of the Global Biosurgery Industry

The biosurgery market involves the use of biological materials, such as surgical sealants, hemostatic agents, and soft tissue grafts, to facilitate tissue repair and regeneration. It encompasses advanced medical techniques that leverage natural components to enhance the healing process. Key drivers include the rising prevalence of chronic diseases and increasing surgical procedures. Growth is also attributed to advancements in biotechnology, providing innovative solutions for wound care and tissue reconstruction.

With a focus on minimizing postoperative complications, the biosurgery market continues to evolve, offering promising prospects for medical professionals and patients alike. Market expansion is driven by the demand for minimally invasive procedures and the growing aging population. Technological advancements, such as the development of bioactive materials and personalized medicine, further propel biosurgery market growth, fostering a dynamic healthcare landscape.

How AI is Changing the Biosurgery Market?

Artificial Intelligence: The Next Growth Catalyst in Biosurgery

AI is significantly impacting the Biosurgery market by enabling advanced precision, personalization, and efficiency throughout the surgical workflow. It is integrated into robotic surgical systems to enhance the surgeon's capabilities through real-time image analysis, augmented visualization, and motion control, which reduces the risk of human error and collateral tissue damage. Machine learning algorithms analyze vast datasets to predict patient outcomes and potential complications, assisting surgeons in making more informed decisions both pre- and post-operatively. Furthermore, AI-powered analytics are optimizing operating room (OR) management and surgical training through data-driven insights and realistic simulations, which help to improve performance and address the high costs of healthcare delivery.

Market Outlook

- Market Growth Overview: The Biosurgery market is expected to grow significantly between 2025 and 2034, driven by the increasing prevalence of chronic diseases and traumatic injuries, advances in biomaterials, regenerative medicine, and the integration of AI-assisted surgical systems, and growth in minimally invasive surgeries.

- Sustainability Trends:Sustainability trends involve waste reduction and segregation, growing emphasis on utilizing durable, reusable surgical instruments and gowns over single-use disposables. Product reprocessing and refurbishment, and sustainable biomaterials and packaging.

- Major Investors: Major investors in the market include Johnson & Johnson (through Ethicon), Baxter International, Medtronic, Stryker, and B. Braun SE.

- Startup Economy:The startup economy in the market is AI and digital surgery, advanced biomaterials, and minimizing regulatory hurdles via innovation.

Biosurgery Market Growth Factors

- Increasing Chronic Diseases: The market is propelled by a surge in chronic diseases, necessitating advanced surgical interventions for effective tissue repair.

- Technological Advancements: Ongoing advancements in biotechnology, including bioactive materials and personalized medicine, contribute to the evolution of biosurgery techniques.

- Minimally Invasive Procedures: Growing demand for minimally invasive surgeries boosts the adoption of biosurgery solutions, aligning with patient preferences for reduced postoperative complications.

- Aging Population: The rising global aging population creates a substantial market opportunity, as elderly individuals often require surgical interventions for various health issues.

- Innovative Product Development: The industry thrives on innovative product development, with a focus on surgical sealants, hemostatic agents, and soft tissue grafts that cater to diverse medical needs.

- Regulatory Environment: Adherence to stringent regulatory standards ensures the safety and efficacy of biosurgery products, fostering trust among healthcare professionals and patients.

- Global Market Expansion: The biosurgery market exhibits potential for global expansion, driven by increasing awareness, healthcare infrastructure development, and accessibility to advanced medical technologies.

- Collaborations and Partnerships: Strategic collaborations and partnerships between industry players and research institutions facilitate knowledge exchange, driving research and development in biosurgery.

- Eco-friendly and Sustainable Practices: The incorporation of eco-friendly and sustainable practices in biosurgery aligns with growing environmental consciousness, presenting a niche for environmentally responsible products in the market.

- Personalized Medicine: The trend towards personalized medicine opens avenues for tailored biosurgery solutions, catering to individual patient profiles and medical requirements.

Major Key Trends in the Biosurgery Market

- Merging Digital Technologies and Robotics: The integration of artificial intelligence, machine learning, and robotics into biosurgery improves accuracy, real-time tracking, and control during operations, resulting in better patient outcomes and shorter recovery durations.

- Focus on Personalized Medicine and Tailored Solutions: The move towards personalized medicine is fueling the creation of custom biosurgical products, including 3D-printed implants and individualized tissue scaffolds, which enhance the success of surgical procedures.

- Progress in Regenerative Medicine Applications: Biosurgery is progressively being incorporated into regenerative medicine, facilitating tissue regeneration and functional recovery in a variety of surgical interventions, broadening treatment options for complex medical conditions.

- Emphasis on Outpatient Surgical Procedures: Amid a growing trend towards outpatient surgeries, biosurgery products that promote faster recoveries and minimize the necessity for prolonged hospital admissions are increasingly sought after, supporting healthcare efficiency objectives.

Biosurgery Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 37.29 Billion |

| Market Size in 2026 | USD 19.59 Billion |

| Market Size in 2025 | USD 18.09 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.35% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Source, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising incidence of chronic diseases and growing demand for minimally invasive surgeries

The rising incidence of chronic diseases and the growing demand for minimally invasive surgeries are dual catalysts propelling the biosurgery market to new heights. Chronic diseases, including cardiovascular ailments and diabetes, have witnessed a surge globally, necessitating advanced medical interventions. Biosurgery, with its emphasis on utilizing biological materials for tissue repair and regeneration, aligns perfectly with the intricate needs of these conditions. The ability of biosurgical products to facilitate efficient and targeted interventions in the treatment and management of chronic diseases has become pivotal, fostering a surge in market demand.

Moreover, the increasing preference for minimally invasive surgeries has reshaped the landscape of surgical procedures. Patients and healthcare professionals alike are drawn to these procedures due to reduced postoperative complications and quicker recovery times. Biosurgery plays a vital role in this paradigm shift by providing specialized products that complement minimally invasive techniques, driving market demand. As the healthcare industry continues to prioritize patient outcomes and recovery experiences, the biosurgery market stands at the forefront, offering innovative solutions that address the evolving landscape of medical interventions.

Restraint

High cost of biosurgical products and stringent regulatory approval processes

The high cost of biosurgical products poses a significant restraint on the market demand. The intricate processes involved in the development and manufacturing of these advanced biotechnological products contribute to elevated production costs. As a result, these higher expenses are often transferred to end-users, including healthcare providers and patients. The financial burden associated with acquiring biosurgical solutions may limit their accessibility, particularly in regions with constrained healthcare budgets. This pricing challenge hampers the widespread adoption of biosurgical products, hindering market expansion and potentially limiting their availability to a broader patient population.

Additionally, stringent regulatory approval processes act as a formidable barrier to the biosurgery market. The nature of biosurgical products, involving biological materials and innovative technologies, necessitates rigorous evaluation by regulatory authorities to ensure safety and efficacy. The lengthy and intricate approval procedures contribute to delays in product launches, restricting the timely entry of innovative biosurgical solutions into the market. This regulatory bottleneck not only prolongs the time-to-market but also requires substantial financial investments, further intensifying the challenges faced by companies operating in the biosurgery sector.

Opportunity

Rising demand for advanced wound care solutions and integration of sustainable practices

The biosurgery market experiences a surge in demand attributed to the rising need for advanced wound care solutions. With an increasing global aging population and a higher incidence of chronic wounds, there is a growing demand for innovative biosurgical products that facilitate enhanced wound healing. Biosurgery solutions, such as surgical sealants and hemostatic agents, play a crucial role in addressing complex wounds, supporting faster recovery, and reducing the risk of complications. This demand is further amplified by a shift towards minimally invasive procedures, where biosurgery products prove instrumental in achieving optimal patient outcomes.

Moreover, the integration of sustainable practices in the biosurgery market contributes to heightened demand. As environmental awareness grows, there is a preference for eco-friendly and sustainable products in healthcare. Biosurgery companies adopting green practices and developing products with reduced environmental impact find increased acceptance in the market. This alignment with sustainable values not only meets consumer expectations but also opens new avenues for market expansion, as healthcare providers increasingly seek environmentally responsible solutions in their medical practices.

Segment Insights

Product Type Insights

The bone graft substitutes segment held 41% revenue share in 2024. Bone graft substitutes in the biosurgery market are synthetic or natural materials used to replace or augment missing bone tissue. They promote bone regeneration and healing, addressing issues such as fractures or bone defects. Current trends involve the development of advanced substitutes, including bioactive ceramics and growth factor-infused matrices, enhancing their efficacy. The market is witnessing a shift towards minimally invasive procedures, driving the demand for bone graft substitutes that facilitate efficient bone repair with reduced patient morbidity.

The anti-adhesive agents segment is anticipated to expand at a significant CAGR of 12.1% during the projected period. Anti-adhesive agents in biosurgery prevent the formation of undesirable adhesions during surgeries. These agents reduce postoperative complications by preventing tissues from sticking together. Trends in the biosurgery market show a growing demand for anti-adhesive agents due to increased awareness about their benefits in minimizing complications like post-surgical adhesions. Ongoing research focuses on developing improved formulations that offer enhanced efficacy and safety, catering to the rising demand for surgical solutions with better patient outcomes.

Application Insights

The neuro & spine surgery segment is anticipated to hold the largest market share of 37% in 2024. In the biosurgery market, neuro & spine surgery involves the application of biological materials for intricate procedures related to the nervous system and spine. Trends indicate a rising demand for biosurgical products tailored to neurosurgical interventions, driven by advancements in biomaterials and a growing prevalence of neurological disorders. The focus is on innovative solutions that enhance tissue repair and regeneration in delicate neurosurgical procedures, providing improved outcomes for patients.

On the other hand, the general surgery segment is projected to grow at the fastest rate over the projected period. For general surgery, biosurgery involves the use of biological materials in a wide range of surgical procedures. A notable trend is the increasing adoption of biosurgical products in general surgery, where they contribute to hemostasis, tissue sealing, and wound management. This trend is fueled by the desire for effective and efficient solutions in diverse surgical scenarios, emphasizing the versatility and applicability of biosurgery products in the general surgical setting.

Source Insights

The biologics products segment had the highest market share of 63% in 2024 on the basis of the end user. Biologics products in the biosurgery market are derived from living organisms and include growth factors, stem cells, and tissue-based materials. Their popularity is driven by their ability to closely mimic natural biological processes, promoting effective tissue repair and regeneration. A trend in biologics involves personalized medicine, tailoring treatments to individual patient profiles.

The synthetic products segment is anticipated to expand at the fastest rate over the projected period. Synthetic products in the biosurgery market are artificially created and offer consistency in composition. The trend in synthetics centers on bioengineering advancements, producing highly functional materials for applications like wound closure and tissue augmentation.

End User Insights

The hospitals segment had the highest market share of 76% in 2024 on the basis of the end user. Hospitals, as key end-users in the biosurgery market, employ biosurgical solutions for various surgical procedures. The trend leans towards the integration of biosurgery products in routine surgeries, driven by the need for efficient wound management and reduced postoperative complications. With a focus on advanced wound care, hospitals contribute significantly to the growing demand for biosurgical interventions, enhancing patient outcomes and recovery.

The clinics segment is anticipated to expand at the fastest rate over the projected period. Clinics, encompassing outpatient and ambulatory care settings, increasingly incorporate biosurgery products in their practices. The trend emphasizes the versatility and adaptability of biosurgical solutions in addressing diverse medical conditions in a more accessible and cost-effective outpatient setting. The adoption of biosurgery in clinics reflects a broader shift towards minimally invasive procedures and personalized medicine, offering patients efficient and tailored treatment options outside traditional hospital settings.

Regional Insights

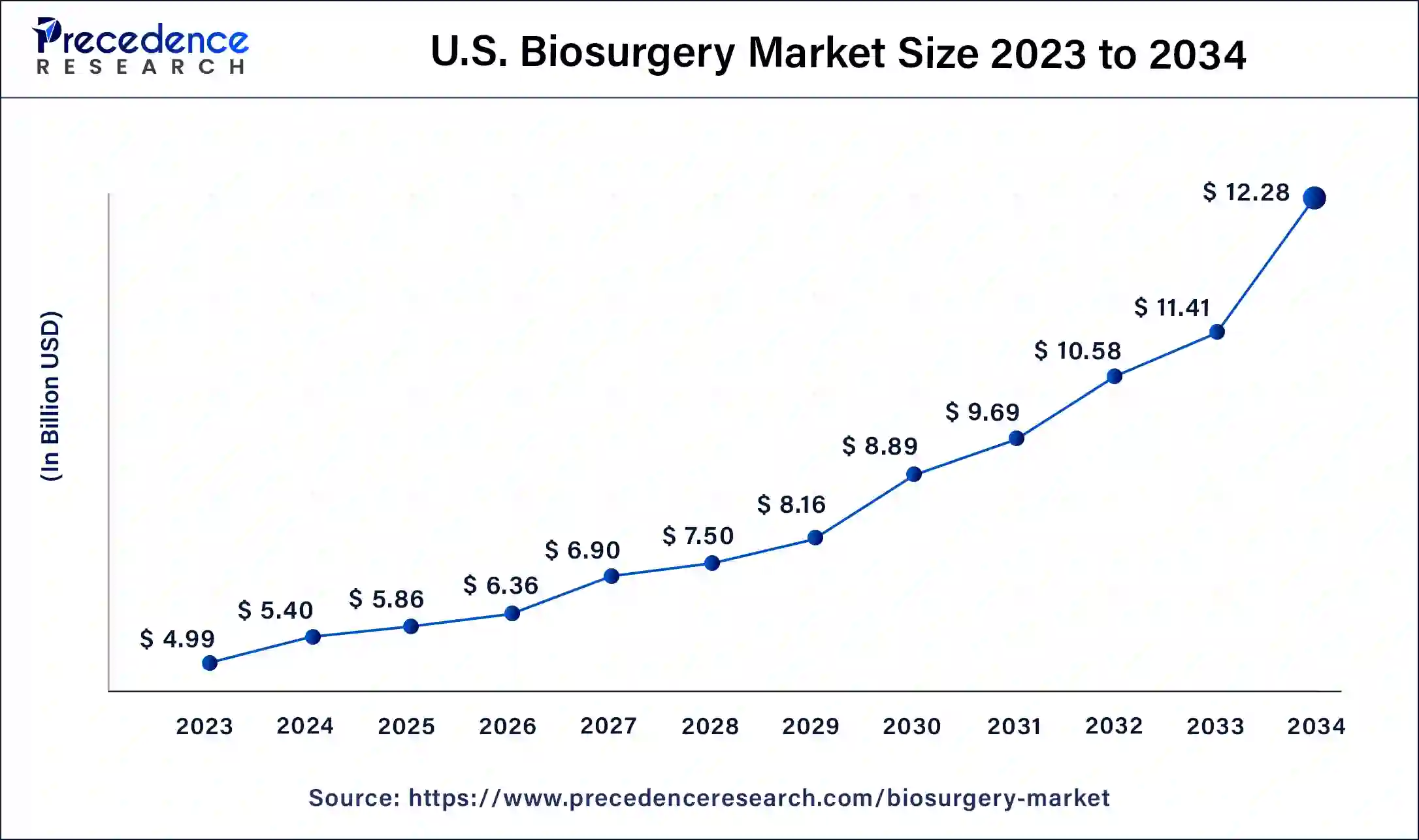

U.S. Biosurgery Market Size and Growth 2025 To 2034

The U.S. biosurgery market size is valued at USD 5.86 billion in 2025 and is projected to hit around USD 12.28 billion by 2034, growing at a CAGR of 8.56% between 2025 and 2034.

North America has held the largest revenue share 46% in 2024. In North America, the biosurgery market sees a trend towards rapid technological adoption, driven by a robust healthcare infrastructure. Advanced biotechnological innovations, coupled with a growing aging population, propel the demand for biosurgical solutions. Increasing focus on personalized medicine and a surge in minimally invasive surgeries further contribute to the market's dynamism, creating opportunities for companies to meet evolving healthcare needs.

U.S. Biosurgery Trends

The U.S. biosurgery market is driven by the growing preference for minimally invasive surgical procedures, the adoption of advanced digital technologies, such as robotic-assisted surgery and artificial intelligence, and the rising demand for advanced biological products. The high incidence of chronic conditions like cardiovascular diseases, cancer, and orthopedic disorders within the ageing U.S. population often necessitates surgical intervention.

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific biosurgery market, rapid urbanization and healthcare infrastructure development contribute to robust growth. Increasing surgical procedures, particularly in emerging economies, drive demand for advanced biosurgical solutions. The region's expanding middle-class population and rising healthcare awareness further fuel market dynamics. Additionally, strategic collaborations and investments in research and development underscore Asia-Pacific's role as a key player in shaping the future of the biosurgery market.

China Biosurgery Market Trends

China's rising demand for minimally invasive surgeries and a large, ageing population. The significant government investment in healthcare and technological innovation, particularly in domestic robotic surgery platforms, aims to boost self-sufficiency. However, this growth is moderated by challenges such as the high cost of advanced biosurgical products and intense market competition from both domestic and international players.

Europe's biosurgery market is characterized by a strong emphasis on sustainable practices. Eco-friendly biosurgical products gain traction as environmental awareness rises. Additionally, the market witnesses a trend of collaboration between research institutions and industry players, fostering innovation. Stringent regulatory standards shape product development, ensuring safety and efficacy. The diverse preferences of the skincare-conscious European population also influence the market, driving the formulation of advanced biosurgical solutions.

Germany Biosurgery Trends

Germany's Biosurgery market has a large ageing population and the high prevalence of associated chronic diseases, which necessitate advanced surgical interventions and effective biosurgical products like hemostats and sealants. The robust healthcare infrastructure, favorable regulatory environment, and strong domestic industry presence. German manufacturers are at the forefront of innovation in biomaterials and tissue engineering, with an increasing trend towards digital integration in surgical planning and care.

Biosurgery Market Value Chain Analysis

Research & Development (R&D) and Material Sourcing

This foundational stage involves deep scientific research into biomaterials, tissue engineering, and drug discovery to identify innovative biosurgical agents, such as advanced hemostats, sealants, and bone grafts.

- Key Players (R&D & Sourcing Focus): Johnson & Johnson (Ethicon), Baxter International Inc., Medtronic Plc, Integra LifeSciences, B. Braun SE.

Manufacturing & Sterilization

In this stage, raw materials are transformed into finished biosurgical products through highly specialized, often sterile, manufacturing processes that must meet stringent regulatory standards.

- Key Players: Johnson & Johnson (Ethicon), Baxter International Inc., Medtronic Plc, Stryker Corporation, B. Braun SE.

Distribution & Sales

Biosurgical products are distributed to hospitals, clinics, and surgical centres via a complex network of wholesalers, specialized distributors, and direct sales teams.

Post-Operative Care & Support

This stage involves patient recovery, follow-up care, and monitoring the long-term effectiveness of the biosurgical intervention.

Biosurgery Market Companies

- Johnson & Johnson (Ethicon) is a leader in the biosurgery market. The company offers a wide range of products, including sutures, hemostats, and sealants, with significant investment in research and development.

- Baxter International Inc. is a key player with a focus on hemostasis and tissue sealing products. Its products, such as TISSEEL fibrin sealant and Floseal hemostatic matrix, are important for controlling bleeding during complex surgeries.

- Medtronic plcprovides a broad range of surgical products that improve procedural efficiency and patient outcomes. Their offerings include the INFUSE Bone Graft and hemostatic agents, which integrate well with advanced surgical technologies.

- B. Braun Melsungen AG offers a comprehensive range of biosurgical solutions, such as sutures, hemostatic agents, and synthetic bone grafts. The company is a global provider of surgical tools and products.

- Integra LifeSciences Corporation specializes in products for neurosurgery, regenerative medicine, and soft tissue repair. They provide biomaterials and regenerative technologies that help repair and restore damaged tissue.

- C.R. Bard, Inc. (Acquired by BD) made contributions in surgical specialties, urology, and oncology. Their portfolio included vital biosurgical products, which are now integrated into BD's comprehensive medical technology offerings.

- Sanofi has contributed to the biosurgery market through its pharmaceutical expertise and specific products like surgical sealants. The company's involvement highlights the intersection of pharmaceutical science and surgical applications.

- Pfizer Inc.contributes to the market through specialized products from biopharmaceutical research. These products can have applications in surgical settings, such as hemostasis and tissue regeneration.

- Stryker Corporationis a major contributor in the orthopedic and neurosurgery sectors. They provide products including bone grafts and spinal surgery solutions, and focus on minimally invasive surgery and integration with robotic platforms.

- Cohera Medical, Inc. developed absorbable surgical adhesives for general surgical use. These products focused on leak sealing and tissue attachment.

- Kuros Biosciences AGspecializes in developing biomaterials for tissue repair and regeneration. They focus on bioactives and research and development to improve surgical outcomes.

- CryoLife, Inc.(now part of Artivion) specialized in processing and distributing implantable human tissues for cardiac and vascular surgeries. They also offered advanced hemostatic products, which are essential in cardiovascular procedures.

- Biom'up developed the hemostatic powder HEMOBLAST Bellows. This product is used to control bleeding during surgeries.

- Tissuemed Ltd. developed the tissue adhesive sealant

- TissuepatchThis is used in thoracic, general, and neurosurgery to seal air and fluid leaks [1].

- Misonix, Inc. focuses on surgical ultrasonic technology. They provide surgeons with precision, reducing surgical time and improving overall outcomes.

Recent Developments

- In May 2024, Sanofi has declared an investment surpassing USD 1.10 billion in biomanufacturing in France, building on earlier investments totaling USD 2.74 billion. This initiative emphasizes Sanofi's dedication to bolstering health sovereignty and enhancing national biomanufacturing capacities, with potential implications for the biosurgery landscape.

- In November 2023, Ethicon, part of Johnson & Johnson MedTech, has been granted approval for the ETHIZIA Hemostatic sealing patch, aimed at providing immediate management of severe and substantial bleeding during surgical operations. This addition strengthens Ethicon's biosurgery offerings, addressing urgent needs in hemorrhage control.

- In May 2023, Royal Biologics has launched BIO-REIGN 3D, a bone graft substitute based on a natural hyper-crosslinked carbohydrate polymer. This groundbreaking product is designed to improve bone grafting procedures, providing a synthetic alternative for orthopedic and musculoskeletal uses.

- In 2022, Gunze Limited has obtained medical device approval to produce and market TENALEAF, Japan's first sheet-type absorbable adhesion barrier. This milestone signifies the introduction of an innovative medical solution to prevent adhesions, enhancing surgical outcomes in the country.

- In 2022, Molecular Matrix, Inc. (MMI) introduced Osteo-P Synthetic Bone Graft Substitute (BGS) for applications in the musculoskeletal system. This innovative product offers a synthetic solution for bone grafting, catering to the needs of orthopedic and musculoskeletal procedures.

Segments Covered in the Report

By Product Type

- Anti-Adhesive Agents

- Bone Graft Substitutes

- Hemostatic and Surgical Sealant

- Mesh

- Others

By Application

- Cardiovascular and Thoracic Surgery

- Neuro and Spine Surgery

- Orthopedic Surgery

- General Surgery

By Source

- Biologics Products

- Synthetic Products

By End User

- Hospital

- Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Afric

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting