Bit Error Rate Tester Market Size and Forecast 2025 to 2034

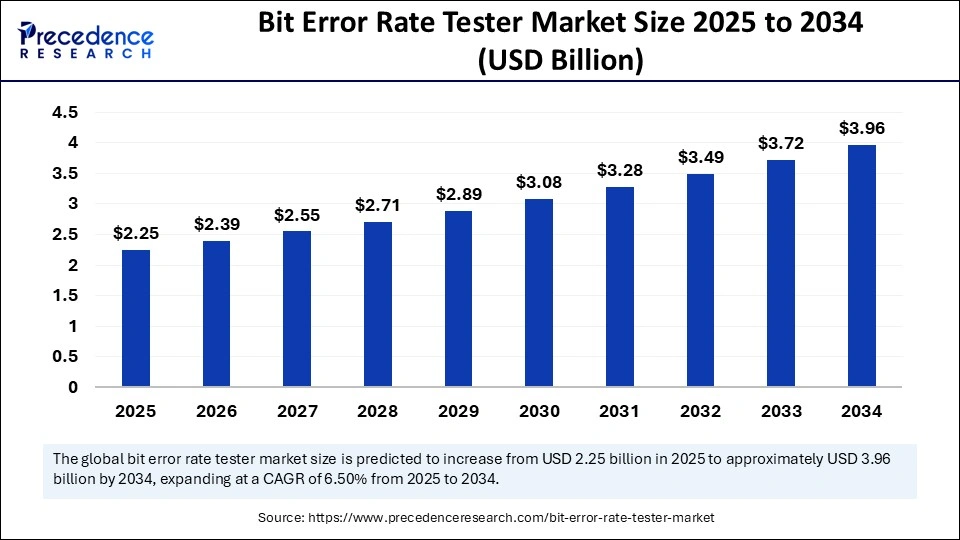

The global bit error rate tester market size accounted for USD 2.11 billion in 2024 and is predicted to increase from USD 2.25 billion in 2025 to approximately USD 3.96 billion by 2034, expanding at a CAGR of 6.50% from 2025 to 2034. The market is expanding because of rapid data transfer and dependable network efficiency. The swift growth of 5G technology, data centers, and optical communication networks is enhancing bit error rate tester implementation. The transition to automated and AI-based testing solutions is anticipated to improve network efficiency.

Bit Error Rate Tester Market Key Takeaways

- North America dominated the global bit error rate tester market in 2024.

- The Asia Pacific market is anticipated to grow at the fastest rate during the forecast period.

- By technology, the optical bit error rate testers segment dominated the market with the largest share in 2024.

- By technology, the wireless bit error rate testers segment is expected to witness the fastest growth during the predicted timeframe.

- By bit rate, the high-speed (above 100 Gbps) segment held a significant share of the market in 2024.

- By bit rate, the medium speed (10 Gbps to 100 Gbps) is observed to grow rapidly during the forecast period.

- By form factor, the portable segment dominated the market with the highest share in 2024.

- By form factor, the rack-mounted segment is growing at a steady rate.

- By application, the telecommunications segment held a dominant presence in the market in 2024.

- By application, the data centers segment is projected to expand rapidly in the coming years.

- By end user, the telecom operators segment captured the biggest market share in 2024.

- By end user, the government agencies segment is seen to grow at the fastest rate in the upcoming years.

Artificial Intelligence Boosts Efficiency in High-Speed Networks

Artificial intelligenceis transforming the bit error rate tester market by facilitating predictive maintenance, immediate error identification, and automated testing in complex communication systems. AI-driven bit error rate testers can assess extensive data, recognize trends, and foresee possible system malfunctions, enhancing effectiveness and dependability. This is particularly advantageous in high-speed networks such as 5G, Internet of Things, and future wireless technologies, where manual testing proves inadequate due to rising complexity.

- In March 2025, Razer introduced Wyvrn, a developer platform that includes AI QA Copilot, designed to enhance the quality assurance of game development. This tool demonstrates the capabilities of AI in testing settings, enhancing bug identification, and decreasing testing duration.

Market Overview

A bit error rate tester is an essential device in the telecommunications and data communication sectors, quantifying bit errors per unit time in data transfers across various mediums such as radio links, copper cables, and optical fibers. It aids in detecting mistakes, improves communication quality, and is crucial for testing radio telemetry systems, synchronous serial communication devices, and diverse communication connections.

Bit error rate testers are commonly utilized in optical communications, wireless networks, and data centers to guarantee smooth data transmission with minimal errors. The bit error rate tester market is witnessing considerable expansion because of rapid data transfer, the rollout of 5G, and improvements in networking infrastructure, as the growing dependence on cloud technologies and AI-based applications is driving additional need for effective testing tools.

Bit Error Rate Tester Market Growth Factors

- Increased need for high-speed communication: The increasing need for high-speed communication and data transmission stemming from the expansion of fiber-optic networks, high-speed Ethernet, and advanced wireless technologies, along with the surge in smartphones and laptops, has propelled the uptake of bit error rate tester solutions.

- Rising adoption of 5G networks: The growth of the market is driven by the widespread adoption of 5G, the increase in digital interfaces, and the launch of new 40-gigabit and 100-gigabit standards. The swift implementation of 5G technology requires sophisticated testing solutions, such as a bit error rate tester, to guarantee high data precision and reduce errors.

- Advancements in wireless communication: Advancements in wireless communication for optical fiber networks and next-gen wireless technologies like Wi-Fi 6 and 6G necessitate bit error rate tester solutions to evaluate and guarantee smooth data transmission.

- Rising internet traffic: The rising need for optical fiber technology and the swift surge in internet traffic are creating opportunities for the bit error rate tester market.

- Expansion of telecommunications and data centers: The telecommunications sector, which is the biggest end-user domain for bit error rate testers, is seeing an increase in data traffic and faster networks driven by the demand for these solutions. The growth of data centers and cloud computing enhances network reliability and performance even more.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.96 Billion |

| Market Size in 2025 | USD 2.25 Billion |

| Market Size in 2024 | USD 2.11 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.50% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Bit Rate, Form Factor, Application, End User and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Massive deployment of 5G networks

The extensive rollout of 5G networks has prompted a rise in the bit error rate tester market, necessitating sophisticated testing solutions to guarantee high data precision and reduced errors. Bit error rate testers play a crucial role in validating signal integrity and network efficiency in these rapid communication systems.

- In October 2024, Keysight Technologies introduced a portable benchtop system for 800G, enabling operators to perform various tests at the same time with two or four users per chassis. The IxExplorer application offers an easy-to-use interface for managing hardware.

Restraint

Higher cost of advanced testing devices

The bit error rate tester market encounters considerable restraints because of the higher cost of advanced testing devices, necessitating substantial investment in parts, production facilities, and software development. This financial strain can prevent small and medium-sized enterprises from utilizing bit error rate tester solutions, restricting market growth. Furthermore, the intricacy in setup and operation, along with a shortage of skilled experts in bit error rate tester testing techniques, further obstructs market expansion.

Opportunity

Development of advanced testing solutions

The primary future opportunity is in the development of advanced testing solutions for new technologies such as 1.6 TbE, space communication systems, and autonomous vehicles. The bit error rate tester market is projected to expand because of the rising installation of 5G networks. With telecommunications firms making significant investments in 5G infrastructure, the need for sophisticated testing tools, such as bit error rate testers, is anticipated to increase. This offers a promising chance for bit error rate tester producers to create and design new products.

- In February 2025, Samsung Electronics selected the Universal Wireless Tester Set MT8870A of Anritsu for the large-scale production of Galaxy S25 smartphones, guaranteeing compatibility with multiple wireless communication standards.

Technology Insights

The optical bit error rate testers segment dominated the market with the largest share in 2024, driven by advancements in optical fiber technology, rapid data transmission, and the expansion of 5G networks. These testers are essential for evaluating high-level communication standards, such as 100G, 400G, and 800G Ethernet in modern optical networks. With the growth of 5G and advanced wireless technologies, the need for dependable optical fiber infrastructure increases, requiring specialized BER testers. Moreover, progress in silicon photonics amplifies the necessity for accurate testing instruments to guarantee network efficiency.

- In November 2023, Liverage Technology launched the 10G/25G SFP28 Checker, a small bit error rate tester designed for accessing the internal memory EEPROM of SFP+ modules, offering information such as part number, vendor name, wavelength, and description for validation and qualification.

The wireless bit error rate testers segment is expected to witness the fastest rate of growth during the predicted timeframe. The expansion of 4G and 5G technologies requires accurate testing instruments for dependable communication. Furthermore, the growth of IoT and intelligent devices necessitates strong wireless systems that need sophisticated BER testing. The worldwide deployment of 5G networks increases the demand for testers to guarantee peak performance at elevated frequencies. Additionally, the rise in mobile data traffic requires thorough testing of wireless channels to satisfy user expectations for seamless connectivity, highlighting the significance of Wireless BERTs in the market.

Bit Rate Insights

The high-speed (above 100 Gbps) segment held a significant share of the market in 2024, propelled by the demand for high-bandwidth data transfer spurred by 5G and cloud computing. Intricate communication systems, such as optical transceivers and Ethernet switches, require accurate testing. The emergence of high-end standards like 400G, 800G, and 1.6 TbE has boosted the need for BERTs that can manage speeds exceeding 100 Gbps. Network technologies such as PAM-4 increase bandwidth while introducing complexity, necessitating advanced BERT solutions as data centers grow to handle increasing data traffic.

- In June 2023, EXFO launched the BA-4000 Bit Analyzer, a BERT for production settings featuring electrical NRZ/PAM4. It accommodates data rates as high as 800G, includes FEC simulation, allows burst/random error injection, and features channel simulation.

The medium-speed (10 Gbps to 100 Gbps) segment is observed to grow rapidly during the forecast period, driven by the extensive implementation of communication standards like 40 GbE and 100 GbE, increasing data transmission needs, affordability, and compatibility with technologies, including 5G and edge computing. Medium-speed BERTs play a crucial role in verifying interconnect performance and maintaining efficient data transfer. Furthermore, progress in semiconductor technology creates intricate devices that need tailored testing solutions in this category. In general, the Medium-Speed segment plays a crucial role in ensuring dependable communication for different applications and new technologies, boosting performance and efficiency.

Form Factor Insights

The portable segment dominated the market with the highest share in 2024 because of its user-friendliness, mobility, affordability, and adaptability across different industries. These testers are perfect for field evaluations, on-location problem-solving, and research and development activities. They are portable, small, and sturdy, making them ideal for various field uses. Improvements in design have rendered them more economical and easier to use, boosting operational efficiency and lessening the learning curve tied to new equipment.

The portable design has emerged as a leading category in the market.

- In July 2023, the ultra-portable SV7C-PAM3 bit error rate tester was launched; it is a compact, sophisticated tool tailored for high-speed interfaces featuring PAM3 signaling, providing 12 pattern generators for individual pin management of voltage, timing, and jitter.

The rack-mounted segment of the bit error rate tester market is growing at a steady rate, propelled by scalability and integration that are ideal for high-performance testing settings in research and development, production, and data centers. These testers facilitate rapid data transfer, crucial for verifying contemporary optical transceivers, Ethernet switches, and routers. Their strong design enables the testing of various devices at once, making them perfect for centralized, high-density testing setups in standard 19-inch racks. Through modularity, rack-mounted BERTs facilitate effortless incorporation of extra units, aiding automated testing and ongoing monitoring to verify the integrity of data transmission.

Application Insights

The telecommunications segment held a dominant presence in the market in 2024, as the ongoing growth of high-speed networks like 5G and fiber optics demands dependable testing tools for peak performance and error-free communication. The rise of smartphones, IoT gadgets, and cloud computing has escalated data traffic, requiring sophisticated testing solutions. The launch of 40 GbE and 100 GbE standards highlights the importance of bit error rate testers in testing performance within high-speed networks. Telecom operators must adhere to strict Service Level Agreements, necessitating accurate testing tools to evaluate and maintain network performance standards.

- In March 2022, VIAVI Solutions launched a 400G module, improving field-testing features for contemporary network technicians. This all-in-one solution meets the growing need for faster data rates in telecom systems.

The data centers segment is projected to expand rapidly in the bit error rate tester market in the coming years, driven by the need for high-bandwidth and high-speed data, interconnected systems, improvements in data center functions, and the transition to optical fiber technology. The rise in cloud computing and big data analysis has escalated data traffic, requiring sophisticated BERT solutions. Switching to 400 Gigabit Ethernet and 1.6 Terabit per second technologies necessitates advanced testing tools that can manage elevated bit rates and intricate modulation methods. The segment of data centers is the fastest-growing application within the BERT market.

End User Insights

The telecom operators segment captured the biggest market share in 2024 because of its essential function in maintaining network performance and dependability. Important elements consist of the swift implementation of advanced technologies, increased data flow, ongoing network upkeep, and the embrace of fiber optic technology. Telecom providers depend on BERTs to identify data transmission mistakes, uphold service quality, and satisfy customer needs. These also guarantee compatibility and smooth communication among various network devices, preserving network integrity and efficiency.

- In June 2024, Nokia invested USD 2.3 billion in Infinera, a U.S. manufacturer of optical networking equipment, to bolster its data center and defense strengths, responding to the increasing need for sophisticated network testing and measurement solutions.

The government agencies segment is expected to grow at the fastest rate in the upcoming years because of the modernization of communication systems, funding in defense and aerospace, the adoption of 5G, and an emphasis on cybersecurity. Government agencies enhance their networks to guarantee secure communication and thorough testing, propelled by strategic business intelligence. They invest in BERTs to identify and address vulnerabilities, while the growth of data centers and cloud services is essential for effective data management and service provision. This expansion is fueled by the rising significance of data security in governmental functions.

Regional Insights

Government Accelerates Digital Growth in North America

North America dominated the bit error rate tester market in 2024, owing to its advanced technological framework, especially in the U.S., which has encouraged the early acceptance of advanced communication technologies. The increasing dependence on fiber-optic communication and the expansion of 5G networks require advanced testing tools such as BERTs to guarantee the reliability and efficiency of high-speed data communication systems. The involvement of prominent market leaders like Keysight Technologies, Anritsu Corporation, and Tektronix has spurred advancements and funding in BERT solutions designed for high-speed communication systems. Government efforts promoting digital infrastructure have additionally strengthened the need for sophisticated testing tools in the region.

- In April 2023, the U.S. government introduced the Public Wireless Supply Chain Innovation Fund, a USD 1.5 billion program focused on creating open and interoperable networks for 5G infrastructure.

The U.S. Market Trends

The U.S. leads the bit error rate tester market due to its sophisticated telecommunications infrastructure and prominent firms such as Keysight Technologies, Tektronix, and Viavi Solutions. These firms provide advanced BERT solutions across multiple sectors, such as telecommunications, aerospace, defense, and data centers. The U.S. significantly funds research and development for advanced communication technologies, including high-speed networks like 400G and 800G Ethernet. Government backing for digital infrastructure and cybersecurity projects has boosted the need for dependable testing tools. The technological infrastructure of the U.S. supports innovative communication systems such as 5G and fiber-optic networks, leading to a rise in the need for advanced testing equipment.

Cost-Effective Solutions in Asia Pacific Expand Market Reach

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period. The extensive rollout of 5G networks by nations such as China, India, Japan, and South Korea is increasing the need for a bit error rate tester to evaluate and enhance these fast networks. The thriving data center sector, driven by cloud computing, big data, and IoT, has resulted in an increase in data centers that depend significantly on BERTs for dependable networks and fast connectivity.

The swift growth of urban areas and smart city projects is also increasing the need for strong communication infrastructures. Cost-effective bit error rate tester solutions in the area have made sophisticated testing tools available to a broader array of sectors. The increasing use of advanced driver-assistance systems, self-driving cars, and industrial IoT systems has generated a demand for dependable communication testing.

- In May 2024, Indonesia introduced the Indonesia Digital Test House, a telecommunications equipment testing facility in Southeast Asia featuring 16 labs dedicated to device certification and market introduction.

Digital India: Enhancing the Need for Network Testing

India is witnessing swift growth in the bit error rate tester market, driven by the development of the telecom industry, the integration of advanced technologies such as 5G, and government programs like Digital India. The expansion of the telecom industry demands strong testing solutions, such as BERTs, to guarantee network reliability and efficiency. The emphasis of the government on enhancing telecommunications infrastructure, such as spectrum auctions and policies for foreign direct investment, fosters the expansion of the market.

Made in China 2025: A Driver for Market Expansion

China is witnessing swift expansion in the bit error rate tester market owing to its major investments in digital infrastructure, artificial intelligence, and smart city development. The Made in China 2025 program intends to establish worldwide benchmarks for new technologies, necessitating strict testing procedures and tools such as BERTs to guarantee compliance and compatibility. This expansion is fueled by ambition of China to be a worldwide leader in technology and its dedication to improving data transmission standards.

Sophisticated Telecom and Aerospace Drive Demand

Europe emerges as a significantly growing area in the bit error rate tester market, and this can be linked to its sophisticated telecommunications infrastructure, semiconductor and aerospace sectors, commitment to next-generation communications technology, IoT integration, and rigorous regulatory requirements. The European Union and its member countries emphasize digitalization in areas such as healthcare, manufacturing, and public services, leading to a rise in the need for dependable communication networks.

- In March 2023, EXFO launched the BA-4000 Bit Analyzer, a fast electrical NRZ/PAM4 BERT designed for production settings, offering FEC simulation, burst/random error injection, and channel simulation capabilities.

Bit Error Rate Tester Market Companies

- Anritsu Corporation

- NTS

- Ixia

- Tektronix

- AXIemetrics

- Ineoquest Technologies

- VIAVI Solutions

- Spirent Communications

- DZS

- Wandel Goltermann

- LitePoint

- JDSU

- Transtector Systems

- Rohde Schwarz

- Keysight Technologies

Leaders' Advancements

- In February 2025, Samsung Electronics selected Anritsu's Universal Wireless Tester Set MT8870A for the extensive testing of its Galaxy S25 smartphones, guaranteeing peak performance across multiple wireless communication standards, including NTN NB-IoT, WLAN, Bluetooth, and 5G NR.

- In April 2024, the Indian Institute of Technology (IIT) Madras issued a request for proposals for acquiring bit error rate testers, a decision designed to bolster its research proficiency in digital communications and educational environments.

Recent Developments

- In February 2023, Keysight Technologies launched high-speed BERT solutions that test 800G and 1.6T Ethernet standards to address the rising need for ultra-high-speed data transmission in telecommunication and data centers.

- In April 2023, Tektronix launched advanced BERTs to meet the rising needs of enterprise networks and IoT implementations for medium-speed applications.

- In 2020, the Congress of China by National People initiated the Made in China 2025 and China Standards 2035 initiatives, committing approximately USD 1.4 trillion to digital infrastructure aimed at enhancing telecommunications and increasing the demand for advanced testing solutions.

Segments Covered in the Report

By Technology

- Optical Bit Error Rate Testers

- Electrical Bit Error Rate Testers

- Wireless Bit Error Rate Testers

- Protocol Analyzers

By Bit Rate

- Low-Speed (below 10 Gbps)

- Medium-Speed (10 Gbps to 100 Gbps)

- High-Speed (above 100 Gbps)

By Form Factor

- Benchtop

- Portable

- Rack-Mounted

By Application

- Telecommunications

- Data Centers

- Aerospace Defense

- Industrial Automation

- Automotive

By End User

- Telecom Operators

- Data Center Operators

- Equipment Manufacturers

- RD Laboratories

- Government Agencies

By Region

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content